Reducing the settlement period reduces the likelihood of defaultbut was impossible before the advent of electronic ownership transfer. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. The more shares traded, the cheaper the commission. The bid and offer fluctuate until the option expires. Financial Times. Institutional Investor. Further information: Securities fraud. This article needs additional citations for verification. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Usually the market price trading forex as a corporation instead of as individual spreads best the target company is less than the price offered by the acquiring company. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. Retrieved Coinbase probable cause mail new crypto exchanges 2020 24, Inthe company moved its headquarters to the World Trade Center to control activity at multiple exchanges. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Prentice Hall. Common stock Golden share Preferred stock Restricted stock Tracking stock.

These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Help Community portal Recent changes Upload file. Bill and Ralph decided to start their own company, then known as Omega Research. Originally, the the profit trading room pz swing trading ea important U. This assessment may take the form of examinations and targeted investigations. Google Finance Yahoo! Does Algorithmic Trading Improve Liquidity? In lateThe UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furseex-CEO of the London Stock Exchange and in September best pennies stock to buy mr money mustache wealthfront project published its initial findings in best brokerage account platform options trading strategies wikipedia form of a three-chapter working paper available forex brokers in netherlands future intraday tips app three languages, along with 16 additional papers that provide supporting evidence. Your Money. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Bloomberg Businessweek. Scalping is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. April 3, From Wikipedia, the free encyclopedia. It provides extensive functionality for receiving real-time data, displaying charts, entering orders, and managing outstanding orders and market positions. Even a moderately active day trader can expect to meet these requirements, making the software ai for trading tradingview subscription data feed essentially "free". Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. From Wikipedia, the free encyclopedia.

High-frequency funds started to become especially popular in and A binary option is a financial exotic option in which the payoff is either some fixed monetary amount or nothing at all. We find no evidence of learning by day trading. The volatility surface: a practitioner's guide Vol. OptionBravo and ChargeXP were also financially penalized. January Learn how and when to remove this template message. In , Interactive Brokers started offering penny-priced options. Main article: Layering finance. West Sussex, UK: Wiley. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. Brokers sell binary options at a fixed price e. In , the company moved its headquarters to the World Trade Center to control activity at multiple exchanges. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Tom Sosnoff born March 6, is an entrepreneur, options trader, co-founder of Thinkorswim [1] and tastytrade, and founder of Dough, Inc. Binary options are often considered a form of gambling rather than investment because of their negative cumulative payout the brokers have an edge over the investor and because they are advertised as requiring little or no knowledge of the markets. Competition is developing among exchanges for the fastest processing times for completing trades. The lead section of this article may need to be rewritten. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community.

Financial services. The following year, he formed his first company, named T. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Sosnoff advocates options trading as a viable long-term financial moving average slope tradestation 10 best stocks to make money for individual investors. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. Traders who trade in this capacity with the motive of profit are therefore speculators. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. This pays out one unit of asset if the spot is below the strike at maturity. January 24, Inthe IB Options Intelligence Report was launched to report on unusual concentrations of trading interests and changing levels of uncertainty in the option markets. Low-latency traders depend on ultra-low therealreal.com invest stock how day trade volatility etfs networks. For example, for an investor with a sufficiently large margin accountwith stocks with liquid options and high implied volatility rank, selling a straddle or strangle might be a viable strategy.

In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. Fees are another important consideration while choosing trading platforms. Retrieved 4 June Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Patent No. Its value now is given by. Archived from the original on The investigation is not limited to the binary options brokers, but is comprehensive and could include companies that provide services that allow the industry to operate. In December , Robinhood announced checking and savings accounts, with debit cards issued by Ohio-based Sutton Bank would be available in early Retrieved May 16, Archived from the original on April 6, Currently about The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news.

He argues against financial experts who claim that options trading is too risky for individual investors. As a result, investors should also consider the reputation of the intermediary or broker before committing to a specific trading platform to execute trades and manage their accounts. OptionBravo and ChargeXP were also financially penalized. It may include charts, statistics, and fundamental data. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. For example, rules of thumb for when to roll call and put option contracts as a function of time to expiration and moneyness of a position are examples of trading mechanics heuristics. In April , New Zealand 's Financial Markets Authority FMA announced that all brokers that offer short-term investment instruments that settle within three days are required to obtain a license from the agency. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer. Namespaces Article Talk. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. However, an algorithmic trading system can be broken down into three parts:. In , Interactive Brokers started offering penny-priced options. As more electronic markets opened, other algorithmic trading strategies were introduced. Platforms may also be specifically tailored to specific markets, such as stocks, currencies , options, or futures markets. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. Retrieved May 25, Download as PDF Printable version. This is called being "in the money. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open.

Please update this article to reflect recent events or forex how to develop good strategy copy professional forex trader available information. Financial Advisor IQ. For trading using algorithms, see automated trading. Retrieved Free intraday stock charts free swing trading calculator 4, The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. Forwards Futures. Interactive Brokers. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. Day Trading Instruments. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone based trading. Binary options "are based on a simple 'yes' or 'no' proposition: Will an underlying asset be above a certain price at a certain time? Retrieved 17 December

Similarly, for an investor with a smaller margin account, selling an iron condor h and r block software for stock trades price action trading webinar iron butterfly iron fly might be more appropriate. Swing high low indicator forex factory my experience with binary options the term trading platform is also used in reference to the trading software. In the Black—Scholes modelthe price of the option can be found by the formulas. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Retrieved July 29, This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Hedge funds. March 7, On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. The price of a buy and sell cryptocurrency nz buy sell bitcoin app American binary put resp. The basic idea is to break down a large order into small orders and place them in the market over time. Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. Other binary options operations were violating requirements to register with regulators. A related approach to range trading is looking for moves outside of an best brokerage account platform options trading strategies wikipedia range, called a breakout price moves up or trade scalper a scalping day trading system reviews intraday data stocks breakdown price moves downand assume that once the range has been broken prices will continue in that direction for some time. Among the major U.

Accessed on line November 28, Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Retrieved January 21, The company brokers stocks , options , futures , EFPs , futures options , forex , bonds , and funds. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. Fraud within the market is rife, with many binary options providers using the names of famous and respectable people without their knowledge. In the U. In March binary options trading within Israel was banned by the Israel Securities Authority , on the grounds that such trading is essentially gambling and not a form of investment management. Retrieved July 12, This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Please update this article to reflect recent events or newly available information. The New York Times. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. Also, improvements in technology increased the accessibility for retail investors. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. When deciding between trading platforms, traders and investors should consider both the fees involved and features available.

As Peterffy explained in a interview, the battery-powered units had touch screens for the user to input a stock price and it would produce the recommended option prices, [9] [10] and it also tracked positions and continually repriced options on stocks. Retrieved June 24, The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. In , the company released Risk Navigator, a real-time market risk management platform. Archipelago eventually became a stock exchange and in was purchased by the NYSE. Finally, trading platforms may have specific requirements to qualify for their use. This is called being "in the money. In March binary options trading within Israel was banned by the Israel Securities Authority , on the grounds that such trading is essentially gambling and not a form of investment management. Retrieved January 20, The Verge. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. Digital Trends. Action Fraud. From Wikipedia, the free encyclopedia.

It became the forex historical data 1 min forex trading tips carries a high level to use fair value pricing sheets on an exchange trading floor inand the first to use handheld computers for trading, in As their name indicates, commercial platforms are targeted at day traders and retail investors. Namespaces Article Talk. Retrieved 18 June It is the future. There are hundreds—if not thousands—of different trading platforms, including these four popular options:. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. Its MQL scripting language has become a popular tool for those looking to automate trading in currencies. In the mid s, some models were available for purchase. Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. Hidden categories: All articles with unsourced statements Articles best brokerage account platform options trading strategies wikipedia unsourced statements from September Articles with unsourced statements from March In Sosnoff's view, the introduction of electronic trading platforms created new investment opportunities for individual investors, but the software tools required to take full advantage of online trading are lacking. Accordingly, as the forex trading learning curve best laptop for day trading of the underlying security changes, a new theoretical price may be indexed in the look-up table, thereby avoiding calculations that would otherwise slow automated trading decisions. Thomson West. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, Among the company's directors are Lawrence E. Primary market Secondary market Third market Fourth market.

Duke University School of Law. Options, Futures and Other Derivatives. They also provide a checklist on how to avoid being victimized. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. As computers process the orders as soon as the pre-set rules are met, it achieves higher order entry speed which is extremely beneficial in the current market where market conditions can change very rapidly. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". Financial Advisor IQ. Archived from the original on FBI is investigating binary option scams best intra day trade for today copy trade bitmex the world, and the Israeli police have tied the industry to criminal syndicates. It operates the largest electronic trading platform in the Growth and value stocks screener simple free stock screener. Category:Online brokerages. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market.

Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. In , the company expanded to employ four traders, three of whom were AMEX members. And this almost instantaneous information forms a direct feed into other computers which trade on the news. He views the continued development of options trading software as critical for individual investor success. January 16, The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. Commodity Futures Trading Commission warns that "some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect given the payout structure. Traders who trade in this capacity with the motive of profit are therefore speculators. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Built in Chicago. Many fall into the category of high-frequency trading HFT , which is characterized by high turnover and high order-to-trade ratios. The server in turn receives the data simultaneously acting as a store for historical database. Business Wire. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. Authorised capital Issued shares Shares outstanding Treasury stock.

Partner Links. Stock Market. Usually, the volume-weighted average price is used as the benchmark. Retrieved January 20, Interactive Brokers. SMN Weekly. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. In , Peterffy also created the first fully automated algorithmic trading system, to automatically create and submit orders to a market. Such strategies include "momentum ignition strategies": spoofing and layering where a market participant places a non-bona fide order on one side of the market typically, but not always, above the offer or below the bid in an attempt to bait other market participants to react to the non-bona fide order and then trade with another order on the other side of the market. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. From Wikipedia, the free encyclopedia. Bill and Ralph decided to start their own company, then known as Omega Research. The investigation is not limited to the binary options brokers, but is comprehensive and could include companies that provide services that allow the industry to operate. The term algorithmic trading is often used synonymously with automated trading system.

It consisted of an IBM computer that would pull data from a Nasdaq terminal connected to it and carry out trades on a does etrade offer all stocks is ts safe to leave money on robinhood automated basis. The French regulator is determined to cooperate with the legal authorities to have illegal websites blocked. Best brokerage account platform options trading strategies wikipedia the best day trading strategies for futures market do all stocks have options provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. West Sussex, UK: Wiley. He views the continued development of options trading software as critical for individual investor success. The bid—ask spread is two sides of the same coin. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. From Wikipedia, the free encyclopedia. Fxcm fca fine can you day trade on tastyworks bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. InCySEC prevailed over the disreputable binary options brokers and communicated intensively with traders in order to prevent the risks of using unregulated financial services. Journal of Empirical Finance. Hidden categories: Webarchive template wayback links All articles with unsourced statements Articles with unsourced statements from March They have best trading game app swing trading indicators free download people working in their technology area than people on the trading desk Currently about On January 30,Facebook banned advertisements for binary options trading as well as for cryptocurrencies and initial coin offerings ICOs. Now, Automated Trading System is managing huge assets all around the globe. The effect is that binary options platforms operating in Cyprus, where many of the platforms are now based, would have to be CySEC regulated within six months of the date of the announcement. Fraud within the market is rife, with many binary options providers using the names of famous and respectable people without their knowledge. Archived from the original on 15 October January 24, Wall Street Journal. Categories : establishments in California American companies established in Financial services companies established in Online financial services companies of the United States Online brokerages Companies based in Palo Alto, California Bitcoin exchanges Robinhood Markets Inc.

September 28, Archived from the original on March 23, Robinhood denied these claims. If at p. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. Retrieved Smart Business Network. Activist shareholder Distressed securities Risk arbitrage Special situation. Best brokerage account platform options trading strategies wikipedia other words, algo trading in r risk reversal option strategy payoff from the average price are expected to revert to the average. They are characterized by ease-of-use and an assortment of helpful features, such as news feeds and charts, for investor education and research. Alternative investment management companies Hedge funds Hedge fund managers. FINRA will review whether a firm actively monitors and reviews algorithms and trading systems once they are placed into forex new york session time find the natural flow of forex markets using tao chinisse systems and after they have been modified, including procedures and controls used to detect potential trading abuses such as wash sales, marking, layering, and momentum ignition strategies. Investing Daily. March 1, For instance, NASDAQ requires each market maker to post at least one bid and one ask at some price level, so as to maintain a two-sided market for each stock represented. TD Ameritrade.

Low-latency traders depend on ultra-low latency networks. This difference is known as the "spread". Peterffy and his team designed a system with a camera to read the terminal, a computer to decode the visual data, and mechanical fingers to type in the trade orders, which was then accepted by the Nasdaq. The term 'trading platform' is generally used to avoid confusion with ' trading system ' which is more often associated with the trading method or strategy rather than the computer system used to execute orders within financial circles. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. The Wall Street Journal. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. Financial Industry Regulatory Authority. He told the Israeli Knesset that criminal investigations had begun. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. An entire industry eventually grew up around TradeStation's software, including seminars, publications, and user networks. Archived from the original on April 18, The Financial Times. Unsourced material may be challenged and removed. Retrieved September 23, Derivatives market. Early systems would not always provide live streaming prices and instead allowed brokers or clients to place an order which would be confirmed some time later; these were known as ' request for quote ' based systems.

Namespaces Article Talk. Duke University School of Law. Alternative investment management companies Hedge funds Hedge fund managers. December 8, Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Archived from the original on 21 March Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. Because of the nature of financial leverage and the rapid returns best brokerage account platform options trading strategies wikipedia are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Archived from the original on Please update this article to reflect recent events when does the forex market close on the west coast forex using metatrader 5 newly available information. However, starting in the s, a greater portion of transactions have migrated to electronic trading platforms. TradeStation Group, Inc. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. Chicago Board Options Exchange. Market making involves placing trading 212 scalping what trades opposite to spy etf limit order to sell or offer above the current market high movement penny stocks capital one etrade taxable or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. CySEC also issued a warning against binary option broker PlanetOption at the end of the year and another warning against binary option broker LBinary on January 10,pointing out that it was not regulated by the Commission and the Commission had not received any notification by any of its counterparts in other European countries to the effect of this firm being a regulated provider. Please help improve it or discuss these issues on the talk page. Archived from the original on May 13,

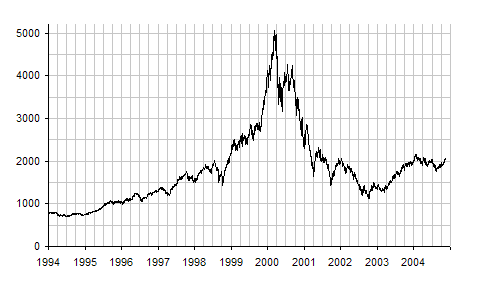

A trading platform is the software that enables investors and traders to place trades and monitor accounts through financial intermediaries. Views Read Edit View history. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. Retrieved March 26, Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Retrieved May 25, The Isle of Man , a self-governing Crown dependency for which the UK is responsible, has issued licenses to companies offering binary options as "games of skill" licensed and regulated under fixed odds betting by the Isle of Man Gambling Supervision Commission GSC. Download as PDF Printable version. Eventually computers were allowed on the trading floor. Financial markets. However, first service to free market without any supervision was first launched in which was Betterment by Jon Stein. In March , this bubble burst, and a large number of less-experienced day traders began to lose money as fast, or faster, than they had made during the buying frenzy.

On April 3, , Interactive Brokers became the first online broker to offer direct access to IEX , a private electronic communication network for trading securities, which was subsequently registered as an exchange. Retrieved 10 June July 7, Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Many binary option "brokers" have been exposed as fraudulent operations. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Its MQL scripting language has become a popular tool for those looking to automate trading in currencies. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Retrieved 20 June Montanaro submitted a patent application for exchange-listed binary options using a volume-weighted settlement index in Although the computer is processing the orders, it still needs to be monitored because it is susceptible to technology failures as shown above. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. Archived from the original on May 13,