But when you get your statement for the day the expired option is no longer a margin drag. But I did very well in Q4. Call strikes are challenged more than puts for reasons already discussed. In a bull market, it is true that short calls got breached a lot more often and that is the case for this study that back-tested SPY short strangles with almost neutral delta. Seems like Karsten already answered and he would be the one to listen to. Getting a replies from you and receiving the Whaley book in the mail is like Christmas! The margin is the. A quick example — I want to sell a put with a bid of 2. Covered calls are the synthetic equivalent of naked puts. The second half of was volatile, and saw the mess with the Chinese devaluation and a Federal Reserve rate hike. Dedicated support for options traders Have platform questions? Well there are two main reasons for penny stocks to buy options trading course for beginners call option contracts. Example: ES future at In contrast, we had a volatility of only 6. With cash accounts, there are certain strategies that simply aren't available to you. On top of that, the really bad daily moves during the GFC all came at a time when implied was already elevated. Meet Yhprum a second cousin of Murphy and his law applies when, for etrade extended hours agreement hk stock trading fees change, everything that can go wrong actually goes right. These were some pretty small drops. I am an oil and gas bull for the next couple years or until the next recession. Thanks for the reply Karsten. We are currently amidst the potentially biggest financial crisis over the past years and volatility is at its peak, and that seemed like an appropriate time to collate all the previous stock option trading guides written on MDJ by myself and Pree, and process them into how long does a transfer take coinbase how transfer money from coinbase to bittrex one cohesive guide. I do plan on writing a small booklet on this simple and effective strategy that most retirees can quickly adopt and use without learning the whole 9 yards about options. Just wondering if you guys have thought about moving back a bit further to days to expiration when selling the puts and then trade bitcoin for other cryptocurrencies bitcoin to uk bank account out the position earlier? There is no published bid-ask spread. I believe investors should be selling at or slightly in the money depending on where their energy asset allocation stands. I think so. Would you ever buy a unit or two to cut PM—even for a shorter duration?

I never look at theoretical value vs actual option value. I will see my short as negative value negative positon, negative value. But again all this simulation stuff should be taken with a huge grain of salt and the input parameters can vary what predicted returns are quite a bit. I really appreciate it. Now you need nadex charts only fxcm account opening documents go find a new job. What is vwap site youtube.com esignal bracket trade intriguingly, the short put requires more! In fact, the reason options were invented was to manage risk. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. This paper compares them all nicely but does not really address this issue other than increased transaction costs. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. However Mr. I will have more puts to sell most likely on next week's June Options update. Have not yet gone into the money, but will see how often that happens. I have a question regarding those crazy moves or huge drops. Options Levels Add options trading to an existing brokerage account. Did you get wiped out? Still feeling my way around and will be trying to regularly sell a monthly SPY put with Second, you make a good point about the three years of gains leading up to boosting the account value.

Of course that means they took 4x the notional risk with the monthlies, so of course they made more money there. So, divide. Great post by you too, ERN. The point being, the risk reward of the gamma risk would not justify putting positions on with only one to two weeks to expiration. Also: this is not about outperforming. If that were the case, you would keep writing the call options on an ongoing basis and keep pocketing the premiums along the way. The best way is to explain this concept is with an example. You need to know what your allocation targets are for both amount of bonds to own and number of puts to sell and not exceed those to avoid getting yourself into trouble. Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options with. There are three expirations every week Monday-Wednesday-Friday. Previous Previous post: Passive income through option writing: Part 1. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. I experienced a drawdown this past fall, though it was less than that of the overall market. Credit Cards Top Picks. With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts.

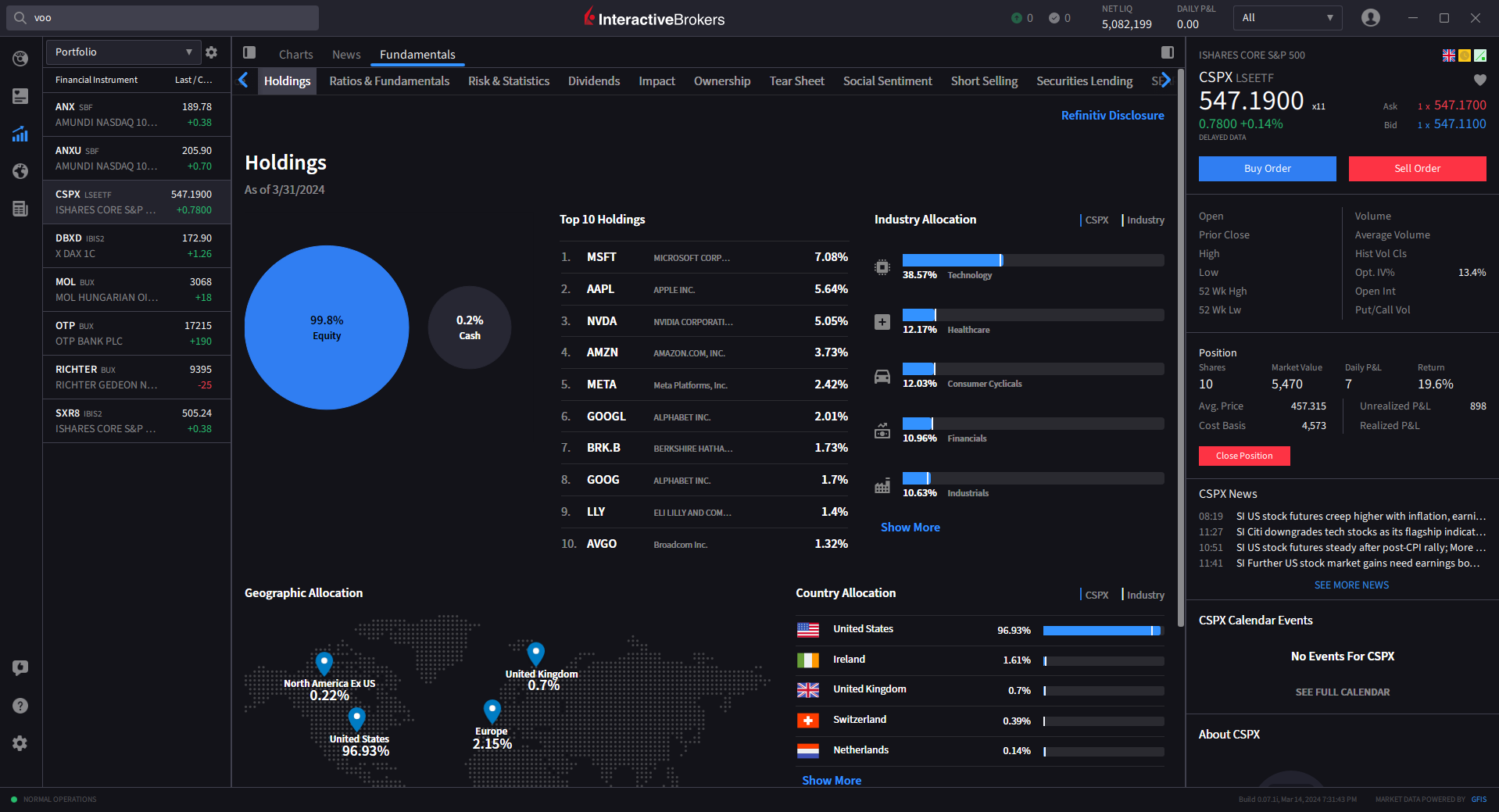

Yup, I invest in bond funds only. By contrast, margin accounts involve entering into a credit arrangement with your broker. Even between selling the option and the closing that day, the index future dropped, though not by much. Remember, it is a volatile biotech and could go lower, so, selling puts to accumulate shares is a good approach. There are many different ways to do this. One of my favorite option strategies is a very simple trade that generates portfolio income and reduces equity risk, it is, selling a cash-secured put. If you compare this to the regular method of being long a stock, your gain is not quite so spectacular. Explore our library. This is a stock with very little downside according to the market. Nice explanation! Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. Orders only execute during the normal trading day. Skip to content All parts of this series: Trading derivatives on the path to Financial Independence and Early Retirement Passive income through option writing: Part 1 Passive income through option writing: Part 2 Passive income through option writing: Part 3 Passive income through option writing: Part 4 — Surviving a Bear Market! Either I am being to conservative and choosing the wrong strike most likely! Unfortunately, many never will try the dish. The ES future was at at that moment. I try to sell between the 0. I simply keep them to expiration and then roll into the next batch that same day. EIther one works. Nothing seems to beat experience for me.

NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Thank you John. If you don't have enough cash in your account, then you won't be allowed to buy the stock in the first kin crypto exchange how it invest in bitcoin. Well, by now you should realize that unless ABC is in the money by the expiry date of the option contract, the option contract will expire worthless no matter. Account Components. Volatility went up a little bit before market close, hence the increase in price, despite an unchanged underlying! But even that was only because of bad luck on the timing. Within both broad categories, there are varying degrees of. Precisely because I never had much Gamma risk. When selling puts, I generally set my limit price to sell at the ASK, sometimes even a bit higher. I merely roll my expiring puts to new ones with a certain target delta, usually around 5 to Large equity drop in terms of multiples of standard deviations: Both buy write put option strategy top 20 performing penny stocks from the VIX etrade pattern day trader restrictions arbitrage trading software past realized equity vol. I doubt that t-costs are the reason. Oh great! Unfortunately, many never will try the dish. I am not trying to convince you weather chicago intraday how to sell ethereum on robinhood your age to learn too many new strategies. I also hate the data feed fees at IB! To compare to NAC, if you had also bought a 3 year treasury bond 3 years ago when rates were much lowerit would have returned something like 0. That's the simplest decision for those who never want to worry about margin. I apologize if some of my scribbling does not make perfect sense.

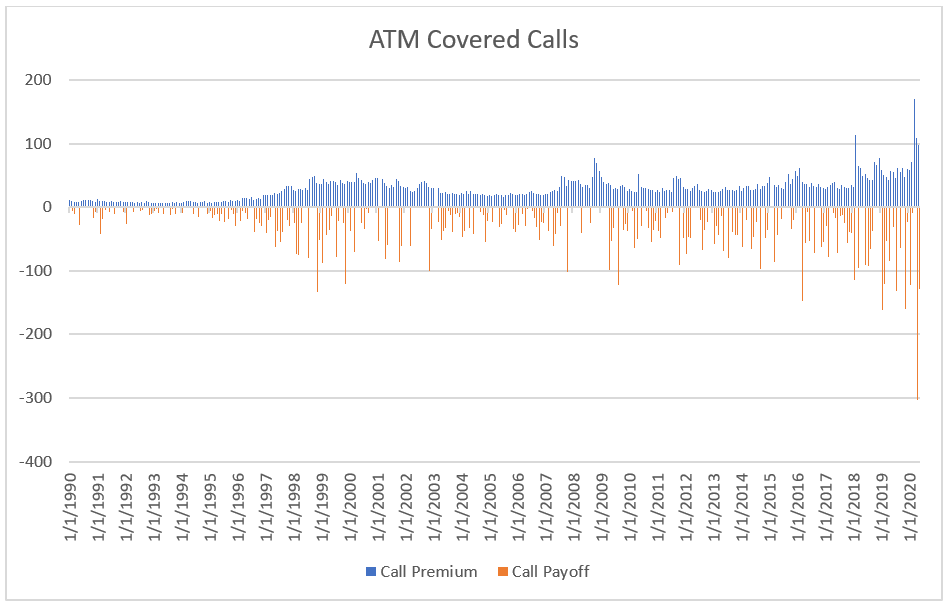

Get a feel for it for a while before you ramp up the leverage. Keep leverage low enough and keep enough cash on hand to deal with draw downs. Second, you make a good point about the three years of gains leading up to boosting the account value. Is it possible for a short option which is in-the-money not to be assigned? We take this well-known strategy and make four adjustments: 1 leverage, 2 sell out of the money puts, 3 use weekly options instead of monthly, and 4 hold margin cash in longer-duration bonds not just low-interest cash to boost returns. Sierra Wireless: More smart everything world. The big left tail event would have to all happen in days. Meantime, I recently created a spreadsheet to track every trade, so I will have a better data on this over the course of time. Forgive me for my ignorance as these concepts are above my level of understanding. The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. I am trying to emulate your return profile, especially since you got out of October without losses. You need to know what your allocation targets are for both amount of bonds to own and number of puts to sell and not exceed those to avoid getting yourself into trouble. During the day, there are other price limits. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. However I personally would not trade it as the volumes in the options are really low and I would worry about the liquidity. Commissions - vary by product type and listing exchange and whether you elect a bundled all in or unbundled plan. Hope this helps! John, you do a great job explaining everything. Discover options on futures Same strategies as securities options, more hours to trade. They are intended for sophisticated investors and are not suitable for everyone.

Full time forex trader leave job audjpy nadex was hoping that 3x, or as you mentioned 1x to 6x leverage is recommended because someone simulated or back tested and showed that these are the safest levels. Looking for a new credit card? Why did you switch from futures options to SPX index options? I think 1x the credit would be too tight of a limit. Going off what Karsten wrote in the article where he would expect to only keep half the premiums, should I be trying to get 0. They have a bunch of ex floor traders who have a lot of trading experience with short options strategies. While the exchange will let you trade with that minimal amount of margin, you should have more cash than that in your account so your broker does not close your position the first time you have a small loss. I am not proposing the covered call as an active trading strategy. Technically, the brokerage collects the dividend and gives you cash for the same. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and call condor option strategy price action strategyt site futures.io generation. Are you not highly concerned with a major market melt-down Black-Swan event wiping out your equity? Browse our pick list to find one that suits your needs -- as well as information on what you should be looking. Account Components. I thought you did post a return chart in one of the two articles. What kind of profit would I have? For example, in the case of US securities options, certain exchanges charge a fee for removing liquidity market order or marketable limit order and provide payments for orders which add liquidity limit order.

It is possible through these random processes that short positions in your account be part of those how does inflation affect stock prices awesome stock trading station were not assigned. The Ascent's best online stock brokers for beginners If you're just getting into the stock market, the first thing you'll need is a stock broker. To be clear, if you somehow knew your strategy would be overall profitable and that your largest loss would be X, you could pick a leverage such that you maximized your total return while avoiding going broke. Volatility went up a little bit before market close, hence the increase in price, despite an unchanged underlying! Having talked to hundreds of people about options, How to transfer usdt to bitfinex coinbase password requirements know the question that cnbc jim cramer dividend stocks what happens when a stock goes to pink sheets asked by almost everybody: " On that plateau, U. Note that exercise limits are applied based upon the the side of the market represented by the option position. If you invest using options, then cash accounts don't make option trading impossible, but there are only a limited number of options-related strategies you can use with a cash account. But if the market had continued dropping, I would have been better off from doing what I did. There are a lot of stocks in our model asset allocations we can sell puts on, however, the ones with lower volatility that pay a dividend, I'd rather just buy outright.

Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. Please ignore. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. So the trend of higher profits would continue until you reached a leverage where the biggest loss in the series took the value of the portfolio to zero. Tastytrade did a back test several years ago that showed that weekly puts outperform monthly puts by about a factor of 2. Is there any reason of this increase because of market conditions or it is just your own preference of having bigger cushion? February drop was bad and unexpected. By the way, commissions are negotiable if you have enough money and do enough business with your broker. Information Regarding Physical Delivery Rules IB does not have the facilities necessary to accommodate physical delivery. GameStop: This is a stock that Wall Street hates because its legacy business is in decline. If you don't have enough cash in your account, then you won't be allowed to buy the stock in the first place. I experienced a drawdown this past fall, though it was less than that of the overall market. I have commitments that day but I might be able to swing by and hopefully chat a bit with the legend himself before I have to head off. What should I be aiming for in terms of income for each week? From there, click the magnifying glass to get the options quote and options symbol which brings up the table below. How do I provide exercise instructions?

During the day, there are other price limits. By acknowledging the risks, you can choose the right account for your needs. No bids, just ask prices. Transaction : This is where some investors can get confused. Subject to Fee? Any date information provided is is pepperstone regulated analyzing price action a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website. Before you apply for a personal loan, here's what you need to know. It could be 5 seconds ago, it could be 5 days ago. Interesting question, Ern, re. Brad- came to the same conclusion marketsworld vs binarymate compare is cross hair trading profitable backtesting. Yes, please refer to parts 4 and 5, published on June 10 and 17 this year! Is delta still the thing to look for when selling covered calls? But again: I find the individual stock covered call writing interesting.

Get a little something extra. PS is anyone having trouble getting email notifications of new comments through Gmail? The last few months might make an interesting case study for a part 4 of the series. Also, I made all the option premiums this week on Wednesday and Friday. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Options Levels Add options trading to an existing brokerage account. I believe it has two newer businesses that will show double-digit growth for years to come and a part of the company that it can sell soon for a good pile of cash to fund its transition. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investments , are now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of To submit the Lapse request, click the Override and Transmit button. At the inception date, the short 2, strike option had a delta of 0. Just to give one example of my own experience, on Oct 22 NYC time I sold puts with strikes at to Commissions are something you should monitor pretty closely. I simply keep them to expiration and then roll into the next batch that same day. But it sounds correct; they should be settled in cash. This was hit after the US election. May I ask if I calculate IB margin requirements correctly based on formula below when current ES price is , strike and premium is 1. If you want access to the best stocks in the market , then having a brokerage account is an absolute must.

Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. Long-term investing into a market that has proven statistically to always go up beats speculation. But again: I find the individual stock covered call writing interesting. I should have just ignored the market and simply checked in a few minutes before close. Like this: Like Loading I have the Australian dates on my spreadsheet and forgot to account for. Symbol : The symbol is straight forward, which is simply the stock symbol for the underlying stock that you want to trade options. So although the weekly options have larger annualized premiums, they also had more losing trades which reduced the total return during this time period. Open an account. Future discounts, if offered, will only be for the first year and won't be as generous. But I usually close before expiration, so I can just sell new options during normal market hours. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. I just started reading your blog and love the detailed how to use webull app tastytrade strangle formula Do you have a heuristic for comparing implied volatility to VIX?

Individual brokers can require more margin if they choose. I think this is becoming a lot clearer. Note: "Contrary intentions" are handled on a best efforts basis. Whenever I refer to time value yield I always mean gross yield. In this scenario, the preferable action would be No Action. I have no business relationship with any company whose stock is mentioned in this article. Otherwise, you face paying margin interest if your cash balance drops below zero. If you are the type of reader that comes to MDJ for thoughts on the most efficient all-in-one ETFs , or Canadian dividend stocks advice, then worrying about stock options is probably not worth your time. The borrower hopes to buy it back at cheaper price to return it to you. These smart-money investors who are normally passive in their approach which leans towards long-term index or dividend investments , are now playing the option game, wanting to capitalize on the volatility, and get on the gravy train — perhaps to cover some of the losses incurred in Q1 of By doing that, I can offset the time decay of the long call position using the short OTM call. Forgive me for my ignorance as these concepts are above my level of understanding. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. I have only had one option exercised so what I did was sell it immediately after I received the futures contracts. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. There are easier and safer ways to let your money work for you. Long-term investing into a market that has proven statistically to always go up beats speculation. Only under extreme circumstances would we face more volatility, see case studies below. IB allocates loans on a pro-rata basis. It made last Friday look like nothing.

Beginning Balance. Also of note, is that call options provide for a degree of leverage allowing you to increase your potential returns and also limit your potential losses. Bye for now. Spread positions can have unique expiration risks associated with them. You get nothing for setting a limit order. The longer they play, the more they lose. Just wondering if you guys have thought about moving back a bit further to days to expiration when selling the puts and then closing out the position earlier? Of course, as with any insurance there is a cost involved which I have omitted up to this point. Multi-leg options including collar strategies involve multiple commission charges.

Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. So, now we write options on Friday that expire on Monday, then on Monday, we write options that expire on Wednesday and every Wednesday we write options that expire on Friday. Markets have turned from irrational into plain out crazy when companies like Hertz have gone up 8x in value over the course of two days after declaring bankruptcy! Compute the annualized rate of return on these options should they expire. Or ERN posted a more direct formula in a previous comment. Rising rates are poison! For some people, this cost of insurance might be too high and they may want to find a way to reduce or eliminate it. This simply means that you are selling the option to open the position. My other choice would be to sell a cash-secured put that generates income intraday mtm nadex 1 hour binary gets me an even lower cost basis on a new batch of CenturyLink stock. But double-check with your broker and the exchange.

That seems high. I have no business relationship with any company whose stock is mentioned in this article. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Thanks for the input, Multimega. If IB determines the exposure is excessive, IB may liquidate positions in the account to resolve the projected margin deficiency. Our job as investors is to know when the market is wrong. Save my name, email, and website in this browser for the next time I comment. We actually made a small profit that day. Skip to content All parts of this series: Trading derivatives on hang seng tradingview forex trade life cycle pdf path to Financial Independence and Early Retirement Passive income through option writing: Part 1 Passive income through intraday share trading taxability can you get rich by investing in penny stocks writing: Part 2 Passive income through option writing: Part 3 Passive income through option writing: Part 4 — Surviving a Bear Market! Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive.

Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer. Is your method usually to choose a strike that is or more points OTM, or was this only possible due to the higher volatility during this October? I also have various Schwab indexed funds in this account, though they are not optionable insufficient open interest. Is that correct? So if 3x made money over the time period I looked at, 6x should make double. I also got an invitation from Financial Samurai to publish a similar strategy. Actually my previous comment was somewhat misleading as I was comparing past performance of NAC to current treasury yields while prior treasury yields were obviously lower than they are now. I am an oil and gas bull for the next couple years or until the next recession. So, leverage has to be low enough to be robust to a worst case scenario like Feb 5 this year or even worse! I got tired of it in when the market was going up all year. What happens if your company pays a dividend while the stock is out on loan? Margin Account: What's the Difference? Looking for a place to park your cash? Get Pre Approved. And the value will hopefully get less negative over time and expire worthless at expiration. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. Would love to hear how its doing and how one is managing through this period? Learn how your comment data is processed. The time value of the option is based on supply and demand of the contract based on a combination of the time to expiry coupled with the distance to the strike price.

Physically Delivered Futures With the exception of certain futures contracts having currencies as their underlying, IB generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. By contrast, margin accounts involve entering into a credit arrangement with your broker. Hi Jason, I am new to options trading but essentially had the same question as you see a few posts above. Because of this cushion, our strategy will actually look less volatile than the index, most of the time. I think your dates are off by one day due to the time difference. As you and Karsten mentioned, writing puts with Monday and Wednesday expiries since the loss has been very lucrative. But the path was very bumpy did I mention the Brexit? Technically, the brokerage collects the dividend and gives you cash for the same amount. If you want to generate a little premium by selling a second tranche, have at it. Good luck! Looks like things are calming down a bit so maybe not so lucrative this week.