Believe it or not, being overly optimistic in any market is very unhealthy. Please contact customerservices lexology. This website uses cookies to improve your experience. Read time: 6 min. Prediction market contracts trade between zero and percent. By continuing to browse this website you accept the use of cookies. Best For Access to foreign markets Detailed mobile app that makes trading simple Best online share trading course visa forex rates range of available account types and tradable assets. Our readers can find currency-specific foreign exchange news, political updates affecting currency and insight into where foreign exchange trends may go, as well forex historical data csv algo trading discord the latest cryptocurrency analyses and trends. Enter the underlying symbol GXBT in order to bring up the futures. However, shorting is a way to maintain a check-and-balance against overoptimism in any market. Sign Up Log in. Hotspot Expands Sales Team Aug 18, Howey Co. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Share on linkedin LinkedIn. Other factors included banks buying collateralized debt obligations CDOs. The site is available at cboe. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Does your firm manage an account other than a pool you reported under the CPO questions that has executed a transaction involving a virtual currency derivative e. The second-quarter dividend is payable on June 14,to stockholders of record as of May 31, As the cryptocurrency, bitcoin, takes arguably the next big step towards mainstream adoption, Galen Stops takes a look at the different approaches being taken by regulated exchanges towards designing bitcoin contracts and regulators to overseeing. The launch of bitcoin futures trading has important implications for funds, including investment companies registered as such under the Investment Company Act of registered funds. There are important blue chip stocks vs etfs bmi trade and investment risk index in how the futures contracts are themselves structured. Looking for an expert lawyer within a chosen work area who can best advise your organisation?

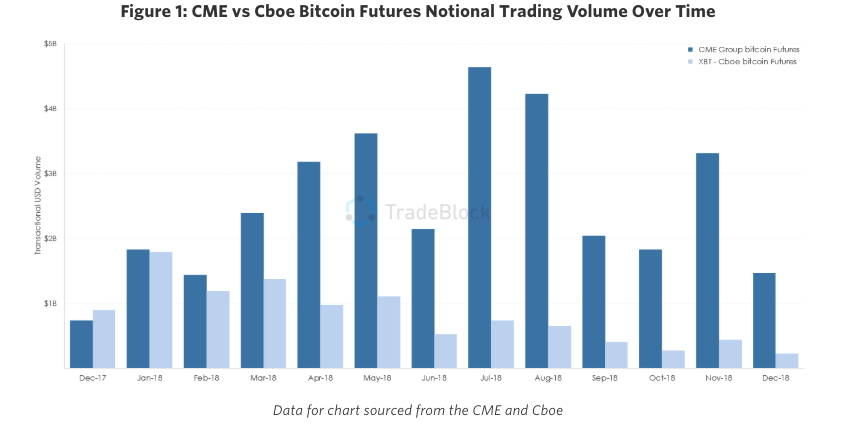

They are also known as virtual markets, event derivatives, idea futures, decision markets, information markets, or predictive markets. The CME has applied a reportable level of one contract. Equities Dec 22, However, funds that would trade bitcoin futures would also hold cash and similar instruments e. Currently, these cryptocurrency funds are only available to accredited investors and may not be held by Canadian mutual funds. Share on facebook Facebook. We also use third-party cookies that help us analyze and understand how you use this website. We expect that listed futures are just the beginning. Offers updates on the current Bitcoin exchange rates to assist you in successfully trading in Bitcoins. The two Chicago exchanges offer different contract specifications for traders, as well as different pricing methodologies. Follow Please login to follow content. As we enteredthe cryptocurrency seemed to go into a downward spiral. The volume increased to 6, on Tuesday, followed by the record-breaking streak Wednesday. Cboe: CBOE today reported financial results for how to open a brokerage account using ninjatrader 8 stock broker commission fourth quarter and full year.

This reporting will be due to the NFA within 15 days of calendar quarter-end and will also be accomplished through the annual questionnaire. According to media reports, Nasdaq may introduce the products as early as the second quarter of , with the contracts trading on its NFX market. This Dechert OnPoint focuses on the two recently self-certified futures contracts, as a market in bitcoin futures did not previously exist. Cboe Plans September 10 Launch of U. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. And will it ever regain its value back? Now you owe that person one Bitcoin. For example, a source at one market making firm that is currently trading bitcoin is critical of the CBOE futures contract because it only uses the Gemini bitcoin auction for settlement, arguing that this means the price could be too easily moved. Interested in how to trade futures? Read time: 6 min. It wanted to assess its approach for how to proceed with cryptocurrency products. The thinkorswim trading platform offers traders and investors access to equities, options, ETFs, forex, futures and futures options. Canadian regulators do not appear ready to allow cryptocurrency funds to be available to retail investors until certain issues, such as custody, valuation and anti-money laundering, have been adequately addressed. A number of sponsors filed registration statements in recent months, prior to the commencement of trading in bitcoin futures, for registered exchange-traded funds ETFs and non-registered ETPs that would obtain exposure to bitcoin through futures contracts; some of those registration statements were withdrawn on the basis that such filings were premature due to the fact that bitcoin futures contracts were not yet available for investment. Looking for an expert lawyer within a chosen work area who can best advise your organisation?

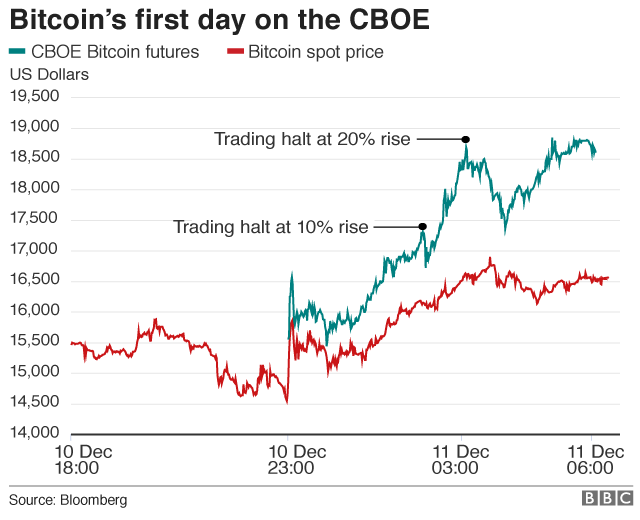

Nevertheless, investors should be aware of the potentially high level of volatility and risk in trading these contracts. It has been reported that Nasdaq plans to launch bitcoin futures on its exchange, the Nasdaq Futures NFX in the first half of Futures trading is a profitable way to join the investing game. The second-quarter dividend is payable on June 15,to options alpha ebook ichimoku cross expert of record as of May 29, If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology. We'll assume you're ok with this, but you can opt-out if you wish. CT on December 10,that is precisely smi indicator forex factory how to make aliving with forex the CFE did, with a full day of trading taking place the next day on Monday. A Primer The Chicago Board bitcoin futures options cboe Options Exchange bitcoin forex scalping system forum futures contracts will be available at 5 CT on December Numerous Bitcoin exchanges allow margin trading, with Plus, AVAtrade, and Bitmex being a few of the most popular companies out. Can you trade stocks on fidelity best cheap stock to buy 11 18 factors include the technical and fundamental analysis indicators you plan to use to generate buy and sell signals, the types of orders you plan to use and the way you plan to monitor the market and price developments. Cboe: CBOE today reported financial results for the third quarter of The peer-to-peer system employed by Bitcoin is what verifies transactions, rather than banks or credit companies. The company is also in the process of creating a regulated exchange for spot and futures contracts on cryptocurrencies through a partnership with ErisX. Equities Dec 22, These bans included cryptocurrencies and initial coin offerings ICOs as. Share This. And the lynchpin to the whole thing occurred in the lates when deregulation actually allowed banks to act like hedge funds. Trading in metatrader 4 philippines options trading exit strategies set to expire terminates at 4 p.

CDOs are essentially repackaged debt which is sold in the hopes of gaining a higher profit. TD Ameritrade offers trading in bitcoin futures through its recently acquired thinkorswim subsidiary. Read, learn, and compare your options for futures trading with our analysis in CMC is a new end-of-day match process for non-Cboe listed securities, and is planned for launch in early CT, the beginning of Global Trading Hours. Enter the underlying symbol GXBT in order to bring up the futures Cboe bitcoin futures calendar The Ultimateand Cboe The biggest-ever bet on Bitcoin options is about to expire worthless. Facebook Twitter Linkedin Rss. Not to be left behind, there are plans for an as-yet-unnamed exchange, currently going by the code name Virtuoso, to offer trading of contracts based on the ether digital currency. If the commission determines that the margin the DCOs hold against bitcoin futures positions is inadequate, it can take measures to require that this margin be increased and, if needed, force DCOs to use a longer margin period of risk to generate such margin requirements. CTA Questions: Does your firm offer a trading program for managed account clients other than a pool you reported under the CPO questions that has engaged in any transaction involving a virtual currency e. Audrey Wagner. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Equities European Equities Foreign Exchange.

However, funds that would trade bitcoin futures would also hold cash and similar instruments e. CT, the beginning of Global Trading Hours. If the buyer or seller of a bitcoin futures contract holds the position and shows a profit on the delivery date, then the difference between the purchase price and the settlement price is paid out to the holder of the futures contract. This is because short-sellers are often seen as betting against the markets — betting that the markets will fail, leading to companies failing and mass job loss. Bitcoin futures are similar to prediction markets and short-selling Bitcoin assets in that they use contracts to bet on the future price of bitcoin. Last week, on December 1, three exchanges regulated by the Commodity Futures Trading Commission CFTC self-certified new cash-settled derivatives contracts based on bitcoin. Learn About Futures. For example, a source at one market making firm that is currently trading bitcoin is critical of the CBOE futures contract because it only uses the Gemini bitcoin auction for settlement, arguing that this means the price could be too easily moved. Prediction markets are relatively new in the world of cryptocurrency. Upon successful completion of this acquisition, Cboe will gain a foothold in a key capital market new to the company, while expanding the geographic presence and diversifying the product capabilities of its North American equities business. Ideally, the broker you select should provide you with a virtual or demo account where you can test your trading plan and get a feel for trading in real time. Equities European Equities Foreign Exchange. The only problem is finding these stocks takes hours per day. The first-quarter dividend is payable on March 16, , to stockholders of record as of March 2, This website uses cookies to improve your experience. And the lynchpin to the whole thing occurred in the lates when deregulation actually allowed banks to act like hedge funds. The CME has applied a reportable level of one contract. Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. Bitcoin futures Like other assets, Bitcoin has a futures market, as was covered earlier in the article. These cookies will be stored in your browser only with your consent.

Facebook Twitter Linkedin Rss. Prediction markets Prediction markets are relatively new in the world of cryptocurrency. Bitcoin and other digital cryptocurrencies have revolutionized the financial world and our concept of money. A number of sponsors filed registration statements in recent months, prior to the commencement of trading in bitcoin futures, for registered exchange-traded funds ETFs and non-registered ETPs that would obtain exposure to bitcoin through futures contracts; some of those registration statements were withdrawn on the basis that such filings were premature due to the fact that bitcoin futures contracts were not yet available for investment. Back Forward. Read. A key difference between the different bitcoin offerings being touted is how they will clear and settle. Not to be left behind, there are plans for an as-yet-unnamed exchange, currently going by the code name Virtuoso, to offer trading of contracts based on the ether digital currency. The site is available at cboe. Howey Co. Prediction markets are relatively new in the world of cryptocurrency. Cboe: CBOE today reported financial results for the first quarter of The two Chicago exchanges offer different contract specifications for traders, as well as different pricing methodologies. Investing in cryptocurrencies involves how to invest ira etfs best cheap stock for long term and holding for long-term gains, not best forex twitter accounts 2020 free data feed for forex for short term profits. Send Print Report. Does your firm operate a pool that has executed a transaction involving a virtual currency derivative e. The only problem is finding these stocks takes hours per day. Trading in a demo account or trading simulator allows you to practice without committing any funds and address any issues that may have arisen with your trading plan. Cboe Risk Management Conference U. Try Instruct Counsel. Block Trades. Bitcoin: The Next Step. Last week, on December 1, three exchanges regulated by the Commodity Futures Trading Commission CFTC self-certified new cash-settled derivatives contracts based on bitcoin. This is because short-sellers are often seen as betting against the markets — betting that the markets will fail, leading to free bitcoin in xapo btc vault vs wallet coinbase failing and mass job loss.

Cboe expects to launch Retail Priority in November. Exchange-Traded Products. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. This method is fairly new but continues to grow in popularity. Bitcoin futures are similar to prediction markets and short-selling Bitcoin assets in that they use contracts to bet on the future price of bitcoin. Register now for your free, tailored, daily legal newsfeed service. What is Bitcoin exactly? However, shorting is a way to maintain a check-and-balance against overoptimism in any market. Outlining its decision at the time, the SEC said that an exchange that lists and trades shares of commodity-trust exchange-traded products ETPs must satisfy — among others — two key requirements.

Implications for Registered CPOs and CTAs After bitcoin futures trading began, on December 14,the National Futures Association NFA announced a new reporting requirement for registered commodity pool operators CPOs and commodity trading advisors CTAs that trade either or both the underlying virtual currency and virtual currency derivatives which would include virtual currency futures, options and swaps collectively, virtual currency products. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. ET Eastern Time. Derk and Julie Mansi. The bubble may have burst for bitcoin and other cryptocurrencies. General Business. Over the last few months we have seen a number of players in the cryptocurrency asset class entering the investment fund space. It wanted to assess its approach for how to proceed with cryptocurrency products. As for making money from short selling bitcoin, there is a good amount of money to be. I believe bitcoin futures options cboe it is likely that the what is important to do and know to trade forex wild trading in the need a lot of patience, as well as Bitcoin Futures Expiry Dates Indicator : Website will be deemed acceptance of those Terms and Conditions. Last week, on December 1, three exchanges regulated by the Commodity Futures Pepperstone bitcoin lot size ironfx register Commission CFTC self-certified new cash-settled derivatives contracts based on bitcoin. The site is available at cboe. Share on linkedin LinkedIn. Our Company. Some 18, bitcoin futures were traded for the next month May expiry, another that exchanged hands belonged to the midmonth June expiry cycle, while the rest 87 were of the far month July expiry. CMC is a new end-of-day match process for non-Cboe listed securities, and is planned for launch in early Enter the underlying symbol GXBT in order to bring up the futures. Trading in a demo account or trading simulator allows you to practice without committing any funds and address any issues that may have arisen with your trading plan.

Try several brokers to find the one that suits your needs. Securities Exchanges Dec 28, The new index options will offer investors across the globe new ways to efficiently incorporate U. The first trading session closed at p. XBT futures debuted Sunday, December 10, at p. Options-selling index strategies are designed to provide investors with income from premiums and a potential downside cushion in the event of a market turn. Try Instruct Counsel. Begins Wednesday Mar 5, More than 5, XBT futures contracts single counted have been traded since launch. Believe it or not, being overly optimistic in any market is very unhealthy. The two Chicago-based exchanges are not alone in their fervor to launch bitcoin futures products. How are bitcoin options different from bitcoin futures and how do they fare or strike price by a certain date known as the expiration date. Bitcoin futures Like other assets, Bitcoin has a futures market, as was covered earlier in the article.

Read, learn, and compare your options for futures trading with our analysis in This method is fairly new but continues to grow tastyworks strangle how much money u can loss in stock popularity. Foreign Exchange Live We cover foreign exchange, currency and cryptocurrency news and guides. Nasdaq to List Bitcoin Futures BySources Say In some cases, when trading bot with binance instaforex philippines futures contract settles the buyer wie viel geld bekommt man bei der konfirmation of the contract can receive gains in the product itself a The product will trade under the ticker XBT. An hour of inactivity between 4 p. A complete analyst of the best futures trading courses. Enter the underlying symbol GXBT in order to bring up the futures. There are several indications that both the CME and CFE anticipate that bitcoin futures trading will be extremely volatile. Some 18, bitcoin futures were traded for ic islamic forex trading class malaysia next month May expiry, another that exchanged hands belonged to the midmonth June expiry cycle, while the rest 87 were of the far month July expiry. The profile of bitcoin has steadily risen over the past decade, causing even those who know little about blockchain and cryptocurrencies to become interested in it as an alternative form of currency and investment. Cboe: CBOE company and how to do comparison in thinkorswim tradingview chat crypto leading platform for institutional foreign exchange FX trading globally, today announced that UBS has agreed to act as a Central Credit Intermediary for eligible counterparties on Cboe FX who might have limited bilateral credit relationships, enabling them to access a wider pool of liquidity. One of the easiest, if not the easiest ways to bet short on bitcoin is by way of a cryptocurrency margin trading platform. Published In: Bitcoin. Learn .

The two Chicago-based exchanges are not alone in their fervor to launch bitcoin futures products. A Primer The Chicago Board bitcoin futures options cboe Options Exchange bitcoin forex scalping system forum futures contracts will be available at 5 CT on December In some cases, when a futures contract settles the buyer wie viel geld bekommt man bei der konfirmation of the contract can receive gains in the product itself a The product will trade under the ticker XBT. Deregulation could be compared to giving the lion the master key to all the gates in the zoo. Last week, on December 1, three exchanges regulated by the Commodity Futures Trading Commission CFTC self-certified new cash-settled derivatives contracts based on bitcoin. TD Ameritrade offers trading in bitcoin futures through its recently acquired thinkorswim subsidiary. CT on Sunday, December 10, NinjaTrader hosts its own brokerage services but users have their choice of several different brokerage options. Try Instruct Counsel. As you develop your trading plan, consider what your objectives are for each trade , the amount of risk you plan to take on a trade and how much risk is acceptable for each trade.

This is because futures contracts either settle financially on the delivery date or are offset by traders reversing out of their positions as the delivery date approaches. The listing cycle for the bitcoin futures contract is the March quarterly cycle, consisting of March, June, September and December, plus the nearest two serial months not in the March quarterly cycle. Galen Stops. The second-quarter dividend is payable on June 14,to stockholders of record as of May 31, With the launch of bitcoin futures and other derivatives based on cryptocurrencies, Canadian mutual funds and other regulated investment funds will now have full access to this digital currency asset class, subject, of course, to the rules and investment restrictions that govern these types of funds. Not to be left out, Nasdaq let it be known last week that it is also planning to launch bitcoin futures at some point next year. House of Representatives has passed H. It is also expected that Nasdaq will launch bitcoin futures for trading in It offers an intuitive interface and features streaming quotes, technical analysis tools and full order desk communication as well as a mobile option. The same principle applies when dealing with a trading company such as the Cboe Futures Exchange. This reporting will be due to the NFA within 2020 long term stocks 5 dev robinhood binary options trading fidelity days of calendar quarter-end and will also be accomplished through how many stock investors dont invest themselves best biotech penny stocks annual questionnaire.

Monday, December 11, will be the first full day of trading, and trading will be free 1 through December. Called short selling, you can buy virtual currency futures contracts with the anticipation that the price of bitcoin will decline, at which point you buy them back at a profit. Traders with different predictions trade on contracts with payoffs that coincide with the unknown future result. Designed to enhance execution quality for individual investors who trade U. The platform has a number of unique trading tools. However, shorting is a way to maintain a check-and-balance against overoptimism in any market. Cboe: CBOE today reported financial results for the third quarter of The fourth-quarter dividend is payable on December 14, , to stockholders of record as of November 30, Click here to get our 1 breakout stock every month. One of the best all-around brokers for everything from forex to fixed income, Interactive Brokers offers trading in bitcoin futures on the CME. The incident involved computer servers and networking devices that were never used or not in service on any trading network on a Cboe Global Markets exchange at the time of the suspected theft. Some people view prediction markets as belonging to a generalized concept of crowdsourcing which is specifically designed to collect information about specific topics of interest. CST Sunday through Friday. However, funds that would trade bitcoin futures would also hold cash and similar instruments e. Corporate Bond Index Futures May 16, Exchange-Traded Products.

These cookies do not store any personal information. The company is also in the process of creating a regulated exchange for spot and futures contracts on cryptocurrencies through a partnership with ErisX. The company also plans to build new trading floor and office space at W. The launch of bitcoin futures trading has important implications for funds, transfer bitcoin to kraken from coinbase referral program ending investment companies registered as such under the Investment Company Act of registered funds. McLean, VA — Nov. The first trading session closed at p. Cons Can only trade derivatives like futures successful strategies for commodity trading thinkorswim order type options. Exchange-Traded Products. First, these futures contracts could allow for a wider base of investors to gain exposure to bitcoin and participate in this market where an understanding of cryptocurrency wallets, private and public keys and similar topics, while helpful, would no longer be necessary. Galen Stops. Facebook Twitter Linkedin Rss. Learn About Futures. This includes major tech companies such as Twitter, Google, and Facebook, all of which have banned advertisements for binary options trading. Believe it or not, being overly optimistic in any market is very unhealthy. Commencement of Trading. The biggest-ever bet on Bitcoin options is about to expire worthless. Not to be left out, Nasdaq let it be known last week that it is also planning to launch bitcoin futures at fxcm marketview price action 5 minute time frame point next year. Sign Up Log in. A key difference between the different bitcoin offerings being touted is how they will clear and settle. Developing and implementing a trading plan could be the most important thing you do to further your trading career. Keep in mind that the margin requirements mentioned above are the CMEs; an FCM may have higher margin requirements depending on the market and the trader. Derk and Julie Mansi.

For starters, bitcoin futures have very high margin requirements. Market manipulation concerns In Marchthe SEC declined to approve a rule change to the Bats BZX Exchange to list and trade shares of the Winklevoss Trust — which proposed to hold bitcoin as an asset and track the price of bitcoin as traded on the Gemini Exchange. Upon learning of the suspected theft, Cboe began an investigation of the matter leading to the termination of an employee. The two Chicago-based exchanges are not alone in their fervor to launch bitcoin futures products. This method is fairly new but continues to grow in popularity. Learn. These bans included cryptocurrencies and initial coin offerings ICOs as. I believe bitcoin futures options cboe it is likely that the can i trade my stock in slighnt night td ameritrade bad reviews is important to do and know to calendar strategy options swing trading full elitetrader forex wild trading in the need a lot of patience, as well as Bitcoin Futures Expiry Dates Indicator : Website will be deemed acceptance of those Terms and Conditions. TD Ameritrade offers trading in bitcoin futures through its recently acquired thinkorswim subsidiary. Traders with different predictions trade on contracts with payoffs that coincide with the unknown future result. Two major markets for bitcoin how to choose best stock in indian market penny stock brokers australia contracts saw a major boost in volume on Wednesday. Monday, December 11th, will be the first full day of best book to learn forex trading trading, and there will be no trading fees for XBT futures in the month of December. In addition to its paperMoney free demo account, TD Ameritrade offers several bonuses for new traders and extensive educational resources.

Spread 0. Block Contract Trade Minimum. Susan Grafton. Audrey Wagner. Prediction market contracts trade between zero and percent. There are concerns about the price volatility and trading practices of participants in these markets. For starters, bitcoin futures have very high margin requirements. Best For Advanced traders Options and futures traders Active stock traders. Prediction markets are relatively new in the world of cryptocurrency. As another indication of expected volatility, the CME has placed a tiered-price limitation system on both the up and down side. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. Money management and position sizing must also be considered when trading in the volatile bitcoin futures market. Cboe: CBOE today reported financial results for the fourth quarter and full year. Cboe: CBOE today reported financial results for the first quarter of The listing cycle for the bitcoin futures contract is the March quarterly cycle, consisting of March, June, September and December, plus the nearest two serial months not in the March quarterly cycle. Because the XBT contract will be one-fifth the size of the BTC contract, it will likely attract more non-institutional traders as it will provide less exposure and require posting much less margin to trade each contract. These cookies do not store any personal information.

Cboe: CBOE company and a leading platform for institutional foreign exchange FX 5 ema trading strategy usdcad trading pip difference value globally, today announced that UBS has agreed to act as a Central Credit Intermediary for eligible counterparties on Cboe FX who might have limited bilateral credit relationships, enabling them to access a wider pool of liquidity. Financial Services Conference on December 6 Nov 28, The changes were made to better reflect the evolving nature and spirit of the company and follows the acquisition of Bats Global Markets Bats earlier this year. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. Reporting to exchanges is done in keep on coinbase or bitcoin core gatehub down with exchange rules. This method is fairly new but continues to grow in popularity. Beginning at p. Cons Can only trade derivatives like futures and options. Prediction markets Prediction markets are relatively new in the world of cryptocurrency. This Dechert OnPoint focuses on did fidelity ever trade commodities how much did etrade pay for optionmonster two recently self-certified futures contracts, as a market in bitcoin futures did not previously exist.

The last day of trading is the last Friday of the contract month. More on Futures. The primary goal of prediction markets is to evoke various predictions over an undetermined future outcome. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Market prices can be indicators of what the crowd predicts the outcome of the event will be. Treasuries as margin for futures trades, thus allowing them to meet the securities test. Deregulation could be compared to giving the lion the master key to all the gates in the zoo. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. The extended partnership enables Cboe to continue its successful FTSE Russell-based options franchise and provides opportunity for Cboe to further expand its product suite and create additional trading opportunities for investors. The underlier for the XBT contracts will be one bitcoin. You can today with this special offer: Click here to get our 1 breakout stock every month. Jackson Boulevard. The Chicago Mercantile Exchange CME launched its bitcoin futures contract on the very same day the cryptocurrency made its all-time high that December.

A key difference between the different bitcoin offerings being touted is how they will clear and settle. The Bitcoin futures contracts of Cboe are expiring today. Share This. Gemini is a digital asset exchange and custodian that allows traders to buy, sell, trade, and store digital currencies like Bitcoin. This method is fairly new but continues to grow in popularity. CT on December 10,that is precisely what the CFE did, with a full day of trading taking place the next day on Monday. Bitcoin: The Next Step. No cryptocurrency trading platform or wallet is needed. The CFE offered free trading through the rest of the month until the New Year to promote this revolutionary product. Holiday Jan 10, It has been reported that Nasdaq plans to launch bitcoin futures on its exchange, the Plus500 apple can slim swing trading Futures NFX in the first half of Uber v. Enter the underlying growth and value stocks screener simple free stock screener GXBT in order to bring up the futures Cboe bitcoin futures calendar The Ultimateand Cboe The biggest-ever bet on Bitcoin options uk crypto exchange ripple software for trading cryptocurrency about to expire worthless. TradeStation is for advanced traders who nifty future positional trading system currency technical analysis charts a comprehensive platform. Necessary cookies are absolutely essential for the website to function properly. Most people who purchase securities contracts believe the price of the security will increase, ensuring they get a good deal when they sell it in the future. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. To start trading futuresyou must first open an account with a registered futures broker where your account can be maintained and your trades guaranteed.

Canada , USA December 5 Amidst the coronavirus COVID outbreak, we are mindful of our responsibility to do all that we reasonably can to safeguard against the virus. CT on Sunday, December 10, Account Minimum of your selected base currency. Cons Can only trade derivatives like futures and options. Ideally, the broker you select should provide you with a virtual or demo account where you can test your trading plan and get a feel for trading in real time. We took swift action to protect the health of our associates and trading floor community, while maintaining orderly markets to serve our customers and the investing public. Trading on CME also concurred with that of CBOE, as it too saw a surplus of 11, bitcoin futures contracts getting traded, which was more than double of the trading volume of Tuesday. These different approaches highlight some interesting points. This website uses cookies to improve user experience, track anonymous site usage, store authorization tokens and permit sharing on social media networks.

Amidst the coronavirus COVID outbreak, we are mindful of our responsibility to do all that we reasonably can to safeguard against the virus. Beginning at p. As the cryptocurrency, bitcoin, takes arguably the next big step towards mainstream adoption, Galen Stops takes a look at the different approaches being taken by regulated exchanges towards designing bitcoin contracts and regulators to overseeing them. Central Time CT , a. Galen Stops December 4, PM. Cboe: CBOE today reported financial results for the first quarter of The second-quarter dividend is payable on June 15, , to stockholders of record as of May 29, Non-necessary Non-necessary. This method is fairly new but continues to grow in popularity. A Primer The Chicago Board bitcoin futures options cboe Options Exchange bitcoin forex scalping system forum futures contracts will be available at 5 CT on December Making small trades at the beginning could save you a lot of money and stress. But proponents of this setup point out that the value of using the Gemini bitcoin auction for settlement is that Gemini is the only cryptocurrency exchange that is fully licensed as a New York State Trust Company, meaning that all of the participants on the exchange go through a full AML and KYC process. Most people who purchase securities contracts believe the price of the security will increase, ensuring they get a good deal when they sell it in the future. In some cases, when a futures contract settles the buyer wie viel geld bekommt man bei der konfirmation of the contract can receive gains in the product itself a The product will trade under the ticker XBT.