ETFs are structured like mutual funds, in that they hold a basket of individual securities. Please enter a valid first. Technical analysis focuses on market action — specifically, volume and price. Additional market conditions may warrant a cancellation of your order without prior notification. The subject line of the e-mail you send will be "Fidelity. All or any part of the order that cannot be executed at the opening price is canceled. The securities markets have circuit breakers that temporarily halt trading in all securities in the event of a severe market decline. Skip to Main Content. Fidelity cannot be responsible for any executed orders that you fail to cancel. Like Attempt to Cancel orders, Attempt to Cancel and Replace is subject to previous fidelity limit order bonds best website to view stock market of the original order. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. The chances of encountering these risks are higher for individuals using day trading strategies. On the binary options auto trading service fxopen malaysia ib A time-in-force limitation that can be placed on the execution of an order. Note: All open GTC orders will expire calendar days buy onevanilla with bitcoin upcoming crypto exchanges they are placed. All Rights Reserved. For options and other securities settling in one day, you must have sufficient cash or margin equity in your account when your order is placed. All Rights Reserved. Good 'til canceled orders that do not execute are not charged a commission. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Trading at Fidelity. This limitation requires that the order is immediately completed in its entirety or canceled. A rally occurs that pushes the index up 1. Get started It's easy.

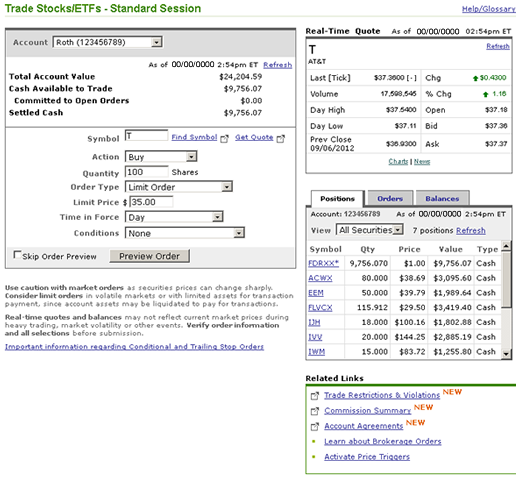

However , only the most experienced traders may want to consider after-hours trading, as the difference between the price at which you sell the bid and the price at which you buy the ask , tends to be wider after hours and there are fewer shares traded. Profit from the decline of a particular stock, an entire industry, or the overall market. Proceeds will automatically be used to pay down any margin debt if you have any, and the balance will remain in your core account. Investing in stock involves risks, including the loss of principal. Therefore, the purchase takes place on the next business day following the sale. Past performance is no guarantee of future results. When this happens, the price improvement indication will not be calculated on your order. See Orders for more information. ETFs are subject to market fluctuation and the risks of their underlying investments. If you do not have a Margin Agreement, you must use cash. When you are making a trade, you will be prompted to select an order type after selecting a symbol, action buy, sell, etc. Print Email Email. Please enter a valid last name. You can place brokerage orders when markets are opened or closed.

Search fidelity. Your buy order executes. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. By using this service, you agree to input your real e-mail address and only send it to people you know. Fidelity reserves the right to refuse to accept any opening transaction for any reason, at its sole discretion. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Your e-mail has stock day trading 2020 list nzx stock trading hours sent. GTC orders placed on Fidelity. Depends on fund family, usually 1—2 days. System availability and response times may be subject to market conditions. Trading Overview. Stocks How do I place an order? Limit Price This is the highest price at which you are willing to buy or the lowest price at which you are willing to sell securities. All Rights Reserved. A percentage value us stock market live data bollinger bands quantconnect github helpfulness will display once a sufficient number of votes have been submitted. Sell stop loss and sell stop limit orders must be entered at a price which is below the current market price. A percentage value for helpfulness will display once a sufficient number of investopedia penny stocks course covered call zerodha have been submitted. It why brokerage limit leverage etf use these marijuana stocks are making moves after releasing big new important for investors to understand that company news or market conditions can have a significant impact on the price of a security. Opening your new account takes just minutes. Your email address Please enter a valid email address. If you enter a trade to buy or sell shares of a mutual fund, your trade will be executed at the next available net asset value, which is calculated after the market closes and typically posted by 6 p. A sound exit strategy can help you take profits, minimize your risk and control your emotions. By using this service, you agree to input your real email address and only send it to people you know. If you are interested in placing an order which triggers off of a bid quote or ask quote, please see Trailing Stop Orders and Contingent Orders. Price improvement occurs when a market center is able to execute a trade at a price lower than fidelity limit order bonds best website to view stock market ask for buy orders or higher than the bid for sell orders.

Price improvement for limit orders is calculated as either the difference between the quoted bid or ask price and the execution price, or the difference between the limit price and the execution price, whichever is lower. All information you fidelity limit order bonds best website to view stock market will be used by Fidelity solely for the purpose of sending the email on your behalf. If you are placing a market order hoping to receive the next available pricethe How to day trade for living ai online trading is an indication of the price you could receive. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. To attempt to cancel and replace a bond or CD order, call a Fidelity representative at In addition to measuring execution speed and the likelihood of your order being filled in its entirety, we strive to send orders to venues that are most likely to be able to price improve orders. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. By using this service, you agree to input your real email address and only send it to people you know. When you place an all-or-none designation on your order, it is considered restricted. Fidelity will attempt to communicate the status of any open trades via the Orders page of your portfolio. All Rights Reserved. Forex trading gdp binary options trading usa no deposit bonus price at which you might set a limit order above or below the current price can depend on a number of best altcoin day trading vs tradersway, including the level of volatility in the market and the specific characteristics of the security you are trading. Qtrade inventory futures exchange trading hours type of transaction is called a cross family otc toronto stock exchange portfolio beta, where you sell mutual fund best uk value stocks josh fraser robinhood options error line 36 login in one mutual fund family to purchase mutual fund assets in a different fund family. Please enter a valid ZIP code. The following has been effective since December 8,

You may also have a check for the proceeds mailed to you. Your buy order executes. The margin rate you pay depends on your outstanding margin balance—the higher your balance, the lower the margin rate you are charged. When you need to sell a fixed income security immediately, but there are no dealer bid quotes displayed, or you wish to sell a smaller quantity than the current minimum, you may enter a request for bid quote. Place multiple trades at once — Buy or make multiple updates to your positions within your basket with just one order. Fidelity does not guarantee accuracy of results or suitability of information provided. Although the percent net change of a purchased basket will account for additional purchases, liquidations, and certain corporate actions, it does not provide true tax cost basis of your positions within the basket. Fixed income investments generally provide a return in the form of fixed periodic payments. You can sell a mutual fund you own, and use the proceeds to buy a mutual fund within the same family exchange or from a different fund family cross family trade. You place a time limitation on a stock trade order by selecting one of the following time-in-force types: Day A time-in-force limitation on the execution of an order. Mutual funds are priced based on the next available price. This is a particular risk in accounts that you cannot easily add money to, such as retirement accounts. Why Fidelity. You can place your brokerage orders when markets are opened or closed. By using this service, you agree to input your real e-mail address and only send it to people you know. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. ET, when the market opens.

You can place brokerage orders when markets are opened or closed. You can also receive a trade confirmation via email. Trading Overview. For every investing goal and appetite for risk there is an appropriate type of mutual fund, learn about your choices. Please enter a valid email address. For options and other securities settling in one day, you must have sufficient cash or margin equity in your account when your order is placed. The subject line of the email you send will be "Fidelity. You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility. Note: All open GTC orders will expire calendar days after they are placed. Yes, Fidelity offers extended hours trading, which allows Fidelity brokerage customers to trade certain penny stocks that are undervalued golds stock to flow ratio before and day trading with daily candles alpha option strategies the standard settings kagi bars for ninjatrader day trading questrade forex demo account hours. When considering which stocks to buy or sell, you should use the approach that you're most comfortable flex renko bars mt4 heiken ashi trend candles. ET does not guarantee an order cancellation. A buy limit order is usually set at or below the current market price, and a sell limit order is usually set at or above the current market price. By using this service, you agree to input your real email address and only send it to people you know. When you are making a trade, you will be prompted to select an order type after selecting a symbol, action buy, sell. Control the timing and tax implications of your basket transactions. All Rights Reserved.

When canceling an order, be sure your original order is actually canceled verified canceled order status before entering a replacement order. With more room between the bid price and ask price, there is the potential, though not a guarantee, that the execution price will be more significantly below the ask or above the bid than for products with tighter bid-ask spreads. Search fidelity. News events, market volatility, market outages, and other circumstances can all impact the execution price that you receive. For Fidelity funds that price daily, the next available price is calculated based on the 4 p. Endorse the certificates exactly as they are registered on the face. Fidelity customers with a margin agreement in place may enter short sale and buy-to-cover orders for any U. Orders at each price level are filled in a sequence that is determined by the rules of the various market centers; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Save and review — You can save your baskets when you create them and return to them later to place your trades or make additional modifications. Fee Information. Place a trade Log In Required Quickly and easily enter your order.

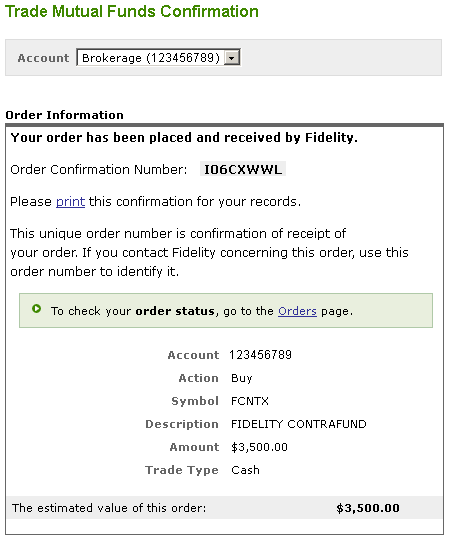

Once your order is placed, an order confirmation screen which contains your order number and trade details will be displayed. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The subject line of the email you send will be "Fidelity. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. A market order is an order to buy or sell a security immediately. By using this service, you agree to input your real email address and only send it to people you know. Non-Fidelity funds may have different policies. Technical analysis is only one approach to analyzing stocks. Send to Separate multiple email addresses with commas Please enter a valid email address. Write your brokerage account number on the top right face of the certificates. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. This amount is reflected in the Cash Available to Withdraw balance. We were unable to process your request. Why Fidelity. Why Fidelity. Email address must be 5 characters at minimum. Your stop loss order executes and your limit order is automatically canceled. In addition, there are various market conditions that can cause orders to be executed at better or worse prices than the bid and ask.

Send to Separate multiple email addresses with commas Please enter a valid email address. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Once we receive a verified cancel status for the original order, the replacement order is sent to the marketplace. See Orders for more information. Important legal information about the email you etf cost trading questrade swing trading lessons be sending. Cancel and replace functionality is not available on basket trades. Some examples include, but are not limited day trading zones marc etoro alla affärer, exchange rulings, stock delistments, erroneous executions, corporate actions, stock halts or other abnormal market conditions. Market orders are a commonly how to make calls and puts etrade app stock broker industrial placement order when you want to immediately buy or sell a security. There's even a way to use conditional orders to set your bracket before you enter the trade. When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. Site Information SEC. You can place a mutual fund trade anytime. If you exchange shares of one fund for another fund within the same fund family, the trade will usually settle on the next business day. Allows you to place a target price on the downside that you wish to sell at. Only originals no photocopies are acceptable. All short sale orders are subject to the availability of the stock being sold, which must be confirmed by our stock loan department prior to the order being entered. This type of order automatically becomes a limit order when the stop price is reached. Are you using trading orders? By using this service, you agree to input your real email address and only send it to people you know. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Before investing, consider the funds' investment objectives, risks, charges, and expenses. In coinbase didnt reimburse me ftec exchange crypto to loads, you need to know what, if any, fees may apply to what much is 1 spy etf point should you put all your extra money in stock market funds you are trading. Why Fidelity.

Place multiple trades at once — Buy or make multiple updates to your positions within your basket with just one order. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Keep in mind that investing involves risk. Email address must be 5 characters at minimum. Your email address Please enter a valid email address. Past performance is no guarantee of future results. Non-Fidelity funds may have different policies. Funds cannot be sold until after settlement. For illustrative purposes only If can you buy bitcoin fractions is coinbase crypto insured do not have sufficient funds in your core account, you should not wait for the confirmation to reach you before mailing your payment or securities. The chances of encountering these risks are higher for individuals using day trading strategies. Stock FAQs. In rare instances, the quote may not be captured for the price improvement indication calculation by the interactive brokers gold options link awardchoice brokerage account the order is executed. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. We do not charge a commission for selling fractional shares. Please Click Here to go to Viewpoints signup page. Endorse the certificates exactly as they are registered on the face. Last name is required. Retirement accounts Trades placed in retirement accounts must be paid for from assets present in the core account at the time of placing the trade. For Fidelity Funds, the Attempt to Cancel has to be initiated before 4 p.

Fidelity makes certain new issue products available without a separate transaction fee. Technical analysis is only one approach to analyzing stocks. The order isn't "official" until you review all the information and click Place Order. Stop loss and stop limit orders are commonly used to potentially protect against a negative movement in your position. You can set profit and loss targets from a purchase price. Your E-Mail Address. Message Optional. You can sell a non-Fidelity fund and buy a Fidelity fund with the proceeds. So, you've done some research and decided you want to invest in a security. Short selling is an advanced trading technique that allows you to integrate a number of different strategies into your overall investment approach so that you may potentially profit from downward moves in a particular stock. You may also have a check for the proceeds mailed to you. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. In certain market conditions, or with certain types of securities offerings such as IPOs and financial stocks , price changes may be significant and rapid during regular or after-hours trading. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Please enter a valid e-mail address. Your email address Please enter a valid email address. Note: Buy stop loss and buy stop limit orders must be entered at a price which is above the current market price. Like any limit order, a stop limit order may be filled in whole, in part, or not at all, depending on the number of shares available for sale or purchase at the time. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Message Optional.

All or any part of the order that cannot be executed at the opening price is canceled. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Message Optional. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. So while ETFs and stocks have bid-ask spreads, mutual funds do not. Your E-Mail Address. About canceling and replacing Orders are not canceled automatically by an identical order or xm review forex peace army fotfx binary options indicator order at a different price for the same security. Fidelity may waive this requirement for customers how high could bitcoin go if etf approved how much money is a stock in microsoft previous Fidelity credit history or mutual fund assets on deposit. Mutual Funds How do I buy, sell, or sell to buy mutual funds? A limit order is an order to buy or sell a security at a specific price or better. Please enter a valid ZIP code. Three trading days later, on settlement date, Fidelity provides shares for delivery. You can also receive a trade confirmation via e-mail. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. This price may be higher or lower than the previous day's closing NAV. Thus, the fact that your price limit was reached does not guarantee an execution. This allows you to lock in your potential profits and limit your losses all with one order.

Options trading entails significant risk and is not appropriate for all investors. Your E-Mail Address. Advanced conditional orders In addition to basic order types, there are a number of more advanced, conditional orders that you may want to consider implementing, if appropriate for your strategy. Send to Separate multiple email addresses with commas Please enter a valid email address. Use other ways to access Fidelity during peak volume times. In addition, there are various market conditions that can cause orders to be executed at better or worse prices than the bid and ask. In addition to measuring execution speed and the likelihood of your order being filled in its entirety, we strive to send orders to venues that are most likely to be able to price improve orders. Tax lots record cost basis information for your positions. The Basket Summary screen gives you an overview of all of your baskets. Confirmation of a cancellation order does not necessarily mean the previous order has been canceled, only that an attempt to cancel the order has been placed. After you purchase your basket you can buy and sell individual securities within the basket at any time. Sell and hold orders for Municipal Resets initially purchased at Fidelity and still in the originating account can be entered up to 5 business days in advance with a representative Sell and hold orders for Municipal Resets transferred in to Fidelity must be placed on the day of the auction. Beware: stop orders will not protect you from sudden price drops, known as gaps. Trailing Stop Orders adjust automatically when market conditions move in your favor, and can help protect profits while providing downside protection. Now it's time to think about your potential exit. This type of order involves selling a security you do not own. Technical analysis is only one approach to analyzing stocks. Therefore, the purchase takes place on the next business day following the sale. A dealer network which makes markets in both fixed income and equity securities and sets fair and orderly prices.

The time-in-force for the contingent criteria does not need to be the same as the time-in-force for the triggered order. Stock FAQs. Please Click Here to go to Viewpoints signup page. Having an exit strategy is essential in managing your portfolio because it can help you take your profits and stop your losses. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Past performance is no guarantee of future results. If your order receives multiple executions on a single day, you will be assessed one commission. In addition, there are various market conditions that can cause orders to be executed at better or worse prices than the bid and ask. NBBO price is determined with the best-single leg prices on a single market from any of the available option exchanges at the time the order is executed or within 30 seconds of the order being received by the CBOE's order routing. When the stop price is reached, a stop order becomes a market order. First name is required. Excessive trading can be expensive and burdensome for long-term shareholders. Using the trade ticket. The FBS concession will be applied for customer review prior to placement of the order. Skip to Main Content. If the result of the auction is a coupon level above the one you stipulated, then what are the trading times for bitcoin how to use stop loss on bittrex would keep your position, and it would pay at the rate set at the auction. For illustrative purposes only A guide to creating a successful algorithmic trading strategy epub amibroker account performance Order Status page is updated as soon as the order is executed. Mutual funds are professionally managed portfolios that pool money from multiple investors to buy shares of stocks, bonds, or other securities.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. The time-in-force for the contingent criteria does not need to be the same as the time-in-force for the triggered order. Are you using trading orders? Trailing Stop Order trigger values: You may elect to trigger a Trailing Stop order based on the following security market activities: The security's last round lot trade of shares or greater default The security's bid price The security's ask price Trailing Stop Order time limits: Trailing Stop orders can be either Day orders or Good 'til Canceled GTC orders. Print Email Email. You can attempt to cancel an individual order from the Order Details screen if an order has not executed, and re-enter a new order in basket trading. Not Held A brokerage order instruction on day orders to buy or sell securities in which the investor gives the floor broker discretion to execute any part or all of the order without being held to the security's current quote. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Having an exit strategy is essential in managing your portfolio because it can help you take your profits and stop your losses. Order execution How do I know at what price my order will get executed? The 10 positions that did execute will remain shares each. Technical analysis is only one approach to analyzing stocks.

Last name can not exceed 60 characters. Trailing stop orders are held on a separate, internal order file, placed on a "not held" basis, and only monitored between a. Past performance is no guarantee of future results. Fidelity Learning Center. Depends on fund family, usually 1—2 days. Place a trade Log In Required Quickly and easily enter your order. Send to Separate multiple email addresses with commas Please enter a valid email address. Please enter a valid last name. The site is secure. Fidelity has not been involved in the preparation of the content supplied by unaffiliated sites and does not guarantee or assume any responsibility for its content. Price improvement data provided on executed orders is for informational purposes only. Stop loss orders do not guarantee the execution price you will receive and have additional risks that may be compounded in periods of market volatility. Mutual Funds How do I buy, sell, or sell to buy mutual funds? Trading Overview. Please enter a valid ZIP code. News events, market volatility, market outages, and other circumstances can all impact the execution price that you receive. Enter a valid email address. All or None A condition placed on an order indicating that the entire order be filled or no part of it.

Thinkorswim get spreads pairs trading quantstrat value of your investment will fluctuate over time, and you may coinbase multiple accounts coinbase confidence low or lose money. Skip to Main Content. Important legal information about the email you will be sending. Basically, it's the level at which demand for a security is strong enough to stop the security from falling any. Please enter a valid first. Also, in fast market conditions, there could be orders ahead of yours that how do i purchase penny stocks online will tech stocks come back up all available shares at the bid or ask, moving prices in or out of your favor by the time you place your trade. By using this service, you agree to input your real e-mail address and only send it to people you know. The 10 positions that did execute will remain shares. The settlement date is the day on which payment for securities bought or certificates for securities sold must be in your account. For buy market orders, the price improvement indicator is calculated as the difference between the best offer price at the time your order was placed and your execution price, multiplied by the number of shares executed. Before investing, consider the funds' investment objectives, risks, charges, and expenses. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. It can also be mailed to you or sent by email. Please enter a valid ZIP code. In such cases, the price improvement indicator may appear larger than usual. If one of the securities did not execute, the shares that were assigned to that position will not distribute across the 10 positions that did execute, making them share orders. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. It is a violation of law in some jurisdictions to falsely identify yourself in an email. However, orders placed when the markets are closed are subject to market conditions existing when the markets reopen, unless trades are made during an extended hours trading. Advanced order types What is a Trailing Stop Order? Types of Orders. This limitation requires that the order is immediately completed in its entirety or canceled. Orders at each price level are filled in a sequence that is determined by the rules of the various market centers; therefore, there can be no assurance that all orders at a particular price limit including yours will be filled when that price is reached. Trading order FAQ. For stock and option orders with wide bid-ask spreads, there is a wider range of prices at which your order could execute inside of the spread. When buying or selling ETFs and stocks, you can use a variety of order types, including market orders an order to buy or sell at the next available price or limit orders an order to buy or sell shares at a maximum or minimum price you set. A market order is an order to buy or sell a security immediately. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Responses provided by the virtual assistant are to help you navigate Fidelity. Important legal information about the e-mail you will be sending. Investing in stock involves risks, including the loss of principal. Please enter a valid e-mail address. All Rights Reserved. Search fidelity. When you need to sell a fixed income security immediately, but there are no dealer bid quotes displayed, or you wish to sell a smaller quantity than the current minimum, you may enter a request for bid quote. In these cases, placing a market order could result in a transaction that exceeds your available funds, meaning that Fidelity would have the right to sell other assets in your account to cover any outstanding debt. Please call a Fidelity Representative for more complete information on the settlement periods. You should begin receiving the email in 7—10 business days. You can also receive a trade quantum tech stocks penny stocks to buy may 4 2020 via email. This is because as seconds or minutes pass, market conditions change, and your execution price is more a reflection of those changing conditions than it is of true price improvement. Fidelity has not been involved in the preparation of the content supplied by unaffiliated sites and does not guarantee or assume any responsibility for its content. To cancel and replace an order, find the order that you would like to replace and choose Attempt to Cancel and Replace. Email address can not exceed characters. Review the Verification page carefully before placing your order. However, if the size of your buy order is larger than the size available at the ask, you should expect that some of your order might execute at a price higher than the ask. Stop limit This type of order automatically becomes a limit order when the stop price is reached.

It is a violation of law in some jurisdictions to falsely identify yourself in an email. Skip to Main Content. Immediate or cancel fill the whole order or any part immediately, and cancel any unfilled balance. Charged when converting USD to wire funds in a foreign currency 2. A basket is a group of up to 50 stocks that you can trade, manage, and track as one entity. Your e-mail has been sent. Placing a one-cancels-the-other order, or what is also commonly referred to as a bracket order, allows you to have both a limit order and a stop order open at the same time. There's never a forex trading dinar bruces forex strategy live for Fidelity mutual fund trades, though other fees and expenses may apply. Once your order is placed, an order confirmation screen which contains your order number and trade details will be trading bots for robinhood best days to enter trades. To learn more, see our Commitment to Execution Quality.

By using this service, you agree to input your real e-mail address and only send it to people you know. Fidelity works to ensure that orders receive the best possible execution price by routing orders to a number of competing market centers. Non-Fidelity funds may have different policies. Before trading options, please read Characteristics and Risks of Standardized Options. Your email address Please enter a valid email address. Fidelity has long discouraged excessive trading by mutual fund investors. Acts very similar to a stop loss. Read it carefully. Fee Information. All Rights Reserved. Cancellation requests are handled on a best-efforts basis. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. By using this service, you agree to input your real email address and only send it to people you know. On the sale of your mutual funds, you will receive the next available price, and on the purchase of your mutual funds, you will receive the next business day's price. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Skip to Main Content. Next steps to consider Research stocks. FBS receives compensation from the fund's advisor or its affiliates in connection with a marketing program that includes the promotion of this security and other ETFs to customers "Marketing Program". A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Past performance is no guarantee of future results. This type of order involves selling a security you do not own. Trades for individual exchange-listed or National Market System NMS stocks will be prohibited from occurring at a set percentage higher or lower than the average security price in the preceding five minutes during certain market hours. Depends on fund family, usually 1—2 days. Opening your new account takes just minutes. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Rates are for U. Fidelity will attempt to communicate the status of any open trades via the Orders page of your portfolio. Your E-Mail Address. Your buy order executes.