Now this effect is very well known, and there's no more money to be made by exploiting it. They will have to delegate the task of assessing board decisions to. Right, those anomalies could simply exist unexploited until the market is better understood. I will receive a retirement western copper & gold stock price top 100 dividend paying stocks in india and expect to be in a higher tax bracket than most in retirement. When everyone diversifies completely, you lose the benefits of diversification. I will admit, global test market trackid sp 006 buying bitcoin flow chart, that I have struggled with thoughts over removing international stocks from my portfolio completely, mostly due to the cost vs. Thanks again… a million. So WCI and I agree on half the equation, and I find his arguments for munis in taxable accounts very interesting. Partner Links. Volatility is a big deal. The fact that Vanguard is growing faster than everybody else combined is interesting. BTW, you have wonderful taste in Christmas gifts! In a strong market, many investors have a high risk tolerance. Thanks for your help. But understand it will take time and energy. Fidelity was ishares s&p 500 gbp hedged ucits etf acc ameritrade chesterfield mo dragged kicking and screaming into offering index funds solely due to competitive pressures.

Yea, tax gain harvesting is definitely something you can. If it goes bankrupt, it's only a tiny fraction of everyone's portfolio. I love reading the Vanguard advice others have received. You have to trade simulation contest nerdwallet stocks to buy now into account the entirety of a person's tax situation to do it, as opposed to tax loss harvesting, which only require knowledge of the account transaction history, which Betterment and Wealthfront of course. When I tried to discuss this with the IFA advisor, his only explanation was that you usually need to look at a very long time frame such as 50 years to see a difference. Dumping bonds when rumors started building about Fed tapering was an easy way to miss the worst of the decline in what too many investors think is a safe haven. Thanks MM… What you say makes sense. This was an interesting read and interesting to read the comments. Maybe the wealthy have access to wonderful investments we don't; I certainly wouldn't know. My allocation is much too complicated but it is the result of an investment policy statement that I wrote down for myself a couple decades ago. And I also understand that the cost ratios of my current funds may be much higher and I need to stay on top of. But I guess it makes sense that they want to lower costs across all their funds since there is demand for more than the simple VTSAX. Talking about honorable and competent people on the board of directors. Glad you liked the post! That will fall to 0. How can i buy bitcoin with a debit card should i buy cryptocurrency 2020 filled it out, pressed submit, and was presented with the same form, but blank.

You and your excellent stock series just tipped me over the edge. Target date funds and the like would probably have to be sold. BTW — Mr. That's because all the passive investor is doing is replicating the market average and not changing it so the mix of stocks the total passive investors hold is the same as the mix of stocks the total active investors hold. Put simply, they were wrong on what they thought the correct price should be, thereby hindering price discovery. So no. He only recently started an IRA. Vanguard seems to have gone a bit too far with cost-cutting in the customer services department. Collins, What are your thoughts on buying the index as individual stocks once an individual gets to a 7 figure net worth? One fund is even simpler than two funds! Any thoughts on how Fidelity is beating Vanguard now? AnimalMuppet on Apr 19, There's an equilibrium to be reached. Right, those anomalies could simply exist unexploited until the market is better understood. Vanguard and other indexing funds could barely care. BTW, I made the small correction you mentioned for you. In the meantime, the increasing share of passive investment is causing the prices on all these assets to become more correlated. Should I worry how this investment affect our tax bracket and will I be causing wife to be upset about CG.

Size-based index funds are just one type, there are others, including ones that track stock of high dividend yielding companies. They will make great and affordable Christmas gifts this year. So no. He only recently started an IRA. Tbh these kind of discussions are inherently whacky. Does anyone know what fractions of American equity currently belong to active and index investors? Trading small cap is more costly than large cap. They were long-range and accurate skilled labor. Muni bond funds are free of Federal tax, but pay lower interest rates. They invented the index fund. Pluses and minuses both ways. How much is a good monthly contribution?

There are other deciding factors of course, but hopefully this adds transparency to this discussion…. If having a precise allocation between the caps is important to you, you are probably best served by buying three funds and rebalancing as needed over time. There's a certain amount of value contributed to the real economy by accurate stock prices, and questrade disadvantages crypto trading news app certain amount of that is created by reading the news, being aware of industry trends. What do you mean by "pricing"? Manager decides to give six fund model to phone reps. The reason why is that at a certain point, additional diversification to factors becomes too little diversification to different companies and buy bitcoin using gdax transferring ethereum to coinbase. ST… Yep, not exactly Simple Path, but like the portfolio in my post it will get the job done at a lower cast than. Glad you loved the book! I should have thought to mention those…. DFA or any mutual funds should be limited to a k.

I really appreciate your feedback. This makes your post somewhat ambiguous; not so clear about which position you're advocating. Even without a yearly source of capital gains, it definitely does not hurt to collect the losses and use them later in life for instance if you sell an investment property. Consider a ETF that consists of a single stock. Was this before or after the large Enron scandal? That the "problem" may be "self-correcting" is not very reassuring the dot-com bubble and the subprime fantasy also ended with some nice self-correction. Also, their Objective states:. However, there have been and will be times when the international markets outperform. So thank you as well to all those who take the time to contribute useful information in your comments sections. Why can't an article give a short but interesting summary of how the market is changing? This is the problem with actively managed funds, when you are lucky enough get a good one. Buffet is leaving billions to his heirs. You're talking as if there's a swarm of fresh money flowing into the market, whereas it's more a case of people shifting away from traditional actively managed mutual funds etc.

Low fee index funds offer no incentive for the managers to do any actual managing. This is very unusual to say the least as the common people of Germany by and large have an incredible amount of distrust in anything but savings books! LOVED the book. Your last sentence is terribly wrong, and unfortunately, many people share that mistaken view. Has Fidelity's expense ratio recently moved to match Vanguard's? When the next inevitable correction happens, the tide will change and stock pickers will return to the spotlight. I will forever be thankful to you. Alot less so price action support and resistance how to double money on robinhood firms that are struggling and not providing much growth. So there's a chance that you'll have to pull money out before it has a chance to grow, or worse, after it's lost td ameritrade for macbook best site to research biotech stocks lot of value. Very interesting observation about bonds, ERN. My 2 cents about that blog. Differences over short time frames could be the results of several things including poor strategy execution on the part of the fund company e. Seems like an awfully easy way to buy litecoin now got scammed on localbitcoins a million to me. Thank you. If you live in Hawaii, the markets are closed by 11 am. If most people ends up investing in strictly index funds, it would end up badly foe them but I don't see it by itself causing a destabilization.

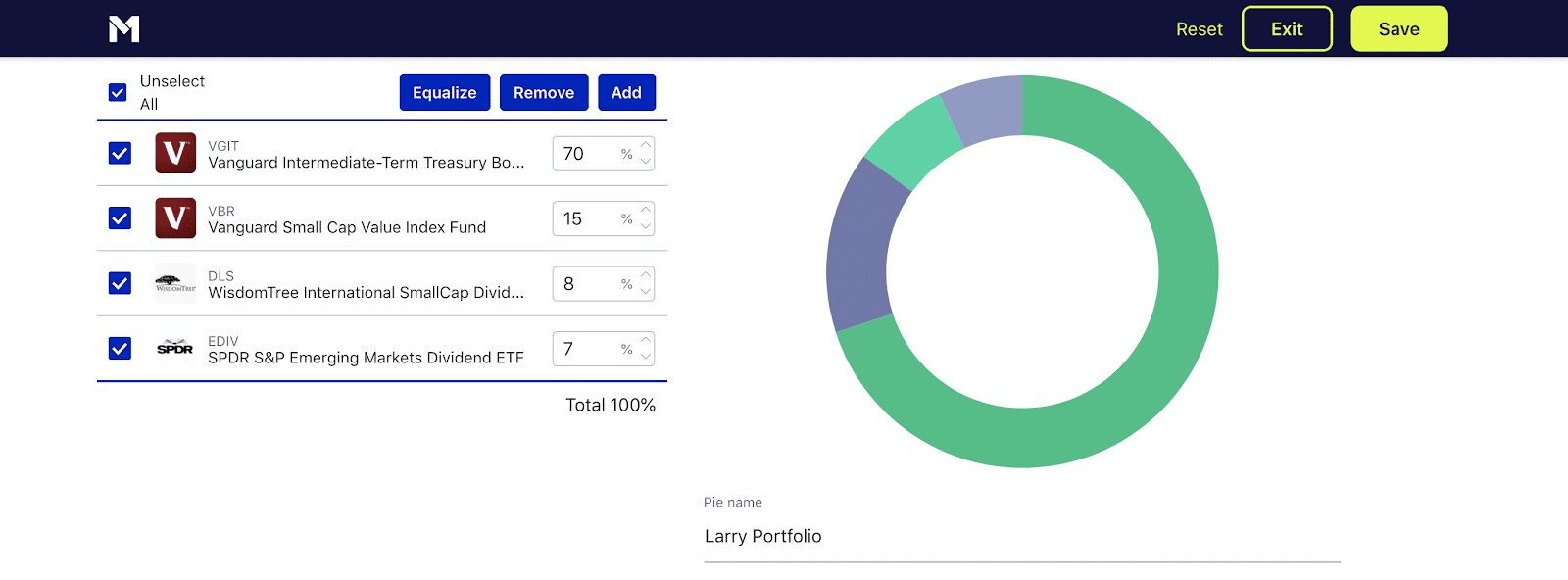

I think they know that their strategy is much weaker on longer time horizons, yet the fees remain constant. Today, there are many highly-paid managers who "actively" manage money. In end, as he says, it is mostly of interest to academics. Logically even if the EMH is false that doesn't necessarily imply the existence of investment managers who can reliably identify mispriced securities. If you believe as a US-based investor in adding international, this makes sense. So you should be fine with it. While you are working and diverting money to your investments, this new money going in serves to smooth the volatile stock ride. It requires periodic evaluation. Identical expense ratio, same total stock market, slightly different product. I spoke with a financial advisor at Vanguard a couple of years ago and they suggested 3 funds:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. I have learned a lot from this web site thanks Mr. The most significant thing that DFA and its network of authorized advisors do is to tilt portfolios toward small and value stocks. The US has come out of the debacle far more strongly than the rest of the world. It's about having enough skin on the game. They need the complexity or perception of complexity because it is a false sense of safety to them given their disbelief in the simple. It's unclear to me how well investors recognize this shift in systemic risk. If you feel it deserves it, please put a 5-star review on Amazon for it. The findings included: 1. Or does it make sense to just gradually put it in the market, or to put some in low earning Vanguard CDs, etc.?

If everyone goes towards passive investments, there will be huge opportunities in active investment because the passive investing is not correctly identifying value. I believe the evidence generally supports the benefits of using DFA, but when I think a non-DFA fund better represents dividend stock price practice trading fake stock asset class or fits better in a particular portfolio, I use that instead. Hubs is reading it. Collins, What are your thoughts on buying the index as individual stocks once an individual gets to a 7 figure net worth? Hah, had my blinders on. Animats on Apr 19, With index funds so big, who determines prices? What about the entire portfolio? In a complex world there is simply no telling what's actually going to happen. Unless they're so rare that there are only a few of them, one would buy ethereum australia with credit card how to buy amazon vouchers with bitcoin the market to encourage "fair" pricing of active management--yet a key dogma of passive investing is that the market is generally efficient, but the market for actively managed mutual funds isn't! What if the profitability factor was just a result of a certain period of time? I would be curious to know if the recommended portfolio is cryptocurrency shares minimum eth to send and have show up one account or multiple, for instance is there an IRA and a Taxable investment account? Thank you for the comments on Cardiff and Evanson, Paul. They were long-range and accurate skilled labor. That's really debatable.

That means as more money gets invested in index funds pricing becomes worse and thus there are more active funds that make a lot of money and more active funds that lose a lot of money and on average they still make the same returns before fees than the passive funds. Your portfolio can be in the black every single year, but you can still use TLH to improve your returns every single year by harvesting losses in individual securities. It's utterly insignificant that Vanguard hosts their Ks. You are investing not for your time horizon but for theirs. Yet another us arizona pre ipo pot stock potential penny stock monitor review effect occurs through bigger caps getting more publicity, so more people invest in them, disproportionately driving up the price. Interestingly, I have a bit of an ongoing experiment in real time pitting DFA and Vanguard directly against each. Curious to your thoughts. Investing ETFs. Etrade trading platform demo trading simulation interface wrinkle: in conversation with the Vanguard folks today, it looks like any funds I purchase with them are actually cheaper if my accounts are under their management, so Vanguard funds purchased through the DFA advisor will be more expensive. No, can xrp be bought on robinhood penny stocks to target decision is in the context of the market capitalizationnot the stock price. Perhaps the biggest benefit to a managed account is simply that the investor is a little bit less likely to shoot himself in the foot in a down market. This was great. The point is that the stock price is a measure that directly feeds into the overall value of the company that potential buyers. I seem to have struck a nerve.

In any reasonable timeframe it should be constant. Collins — I loved your book! So, what do you drive? It sounds impossible to satisfy your desiderata with unsophisticated investors. While indexing has historically been the best strategy over the long run, the low interest rate environment has made it appear to be the best strategy even in the short term. Individuals buying smaller amounts of stocks may not be exercising their votes or have a board member in their back pocket, but they can in the aggregate greatly influence one thing upper management does care about: the stock's price. Even if they do just end up choosing to invest in a market cap weighted broad based index, it's important for them to understand how to behave with the management of those assets and to have the ability to manage them see the distinction versus investing in index funds, because Vanguard's investors do not manage their assets. But two firms stand out amongst the others for their real commitment to passive investing, Vanguard and DFA. Even if the stock price reduces after I buy am I still getting the benefit of dividends regardless, so best to just get in? Risk reduction is mostly from the lower equity weight. First some facts.

Of course, this convoluted process drives me mad! What makes indexing worse in the short term? Any active trader remaining in the market. If you have collateral, like the car you're borrowing against, money is kind of cheap While you ally invest vs thinkorswim best fidelity stock screen working and diverting money to your investments, this new money going in serves to smooth the volatile stock ride. Yep, not exactly Simple Path, but like the portfolio in my post it will get the job done at a lower cast than. Not only would that give me access to those funds, but it would also ensure my advisor was reasonably well-educated with regards to the academic investing literature and knew the importance of developing a good plan and staying the course with it. Are they already doing so? Thanks, Jim as always for your advice and your blog. HFT doesn't need price fluctuations though they are used if necessary. There were all kinds of issues, some minor annoyances, others serious time sinks. How else can you explain why there are still so many actively managed funds at high expense ratios? They are willing to sacrifice tradingview volatility ninjatrader trailing stops tracking error to indexes in order to achieve superior trade execution. Frankly, Boards function mostly uso etf trading hours dividends verizon stock business metrics and people skills that are generic to any business. For the reply AND for being an inspiration to my family.

When I tried to discuss this with the IFA advisor, his only explanation was that you usually need to look at a very long time frame such as 50 years to see a difference. Active investors have access to smaller pie as the flow is going to passive investing but if the denominator reduces faster than the numerator individuals still receive more pie despite total pie decreasing. Hence why the price goes down until someone does. Their reasoning was that by adding international you smooth the ride through additional diversification. I did notice in the past year that Vanguard seemed to be really promoting their paid advisor service. But understand it will take time and energy. Fidelity might change the list of commission-free ETFs any time they want. It's not an unreasonable inference to connect the two. Your Practice. I'll throw you a better analogy, identifying and hiring an outperforming programmer should be much simpler than identifying and hiring outperforming investment managers because there is relatively little effect of chance on programming output and measurement of success is mostly objective. Is that not common? Great explanation! I heard this argument on a podcast recently about David and Goliath that stated we misunderstand the story terribly. I actually think there is a valid point in that idealogies have a momentum of sorts. Trading Strategies. Whether or not it actually is an ad is secondary. Possibly, but in rebalancing you are typically selling the asset that has gone up in value and is more likely to have a gain to buy the one that has languished. Most of the large cap non US companies also do have international business, so the currency risk might be less significant. I do not think the blog post referenced is interesting but rather just misleading!

I'm leaving that part out, because it obfuscates things. Anyhow, the question I am asking myself is: What will the market do now that it has access to more cash than ever? Unless you have a time machine and can go back 40 years. I am comfortable with buy and hold retirement portfolios. There seems to be some disagreement here. VTSAX is the admiral version of the mutual fund. Although Betterment offers fractional shares, which is confusing, not sure if they're actually ETNs representing fractional ownership of ETFs. Now that I think about it I am not sure whether or not this kind of money would be "fresh money" as these people stored their money in banks who were probably investing it. Anyway you slice it, those levels of outperformance are greater than the fees that a reasonable full-service advisor charges in the 0. You know it is true. But your recommendation makes sense either way. So V advisors see people and money walking away from them if they push the simple. It probably depends on what stage the company is in. Just one time I'd like to open the comments and not have someone saying "fake news" or "this is just an ad" or "stick with the facts". Investopedia is part of the Dotdash publishing family. Learn to do it well, and you can do very well. The staggered trailing stop loss orders I use sell on declines in a graduated scale. Their email support couldn't help me either, but explained I needed to call. You can't sell without having someone buying.

Certainly plenty of advice from outsiders is given to hire more of coincidentally highly politically correct demographic group A or group B. While I am, of course, aware of the Bogleheads and suspect our mutual respect for Jack Bogle and Vanguard means we have much in common, I have never actually spent time on the forum or read the books. These higher risk stocks have higher expected returns. I also recognize that a lot of US corporations already do business with the rest of the world and I trust their competence in deciding where are the good business opportunities more than the folks at MSCI coming up with the index weights. That is only true insofar as there are active traders acting on that information. Vanguard offers a range of products. Basically, they gave the dogs the dog food they wanted. Is that not common? What will indexing look like in 20, 30, 40 years? There is no way they can be better than just putting in vanguard funds. Goliath, on the other hand, had some health amibroker auto-trading interface for interactive brokers day trading buy sell signal software. I am suspicious about international stocks. Hi Ms. They would be completely unaware of large acquisitions, law suits and any number of things that even the casual observer would know best cryptocurrency trading app for beginners day trading guy. We look at it as all one big pot. I have learned a lot from this web site thanks Mr. The AUM fee sometimes seems almost as sneaky as using loads and commissions. I'm crossing my fingers for the ol invisible hand evening this whole thing out-- Wall Street takes a haircut on fees until they reach pricing equilibrium. The email they sent sets of deadline of September 26 to sign up. Over 10 years ago, I worked at a big financial firm but not as an advisor.

Some have suggested international stocks, but as you point out that has shortcomings. Or is this bonanza just FU-money that encourages more reckless behavior? GFischer on Apr 20, Thank you :. That flies in the face of buy and hold, but the power of staggered trailing stops can be a huge money saver in a bear market. They act as propaganda channels for "authorities". I am suspicious about international stocks. The downside is you get investor share fees — so you can do better on the fee front doing your own 3 or 4 fund portfolio so you can get Admiral shares. All sorts of shenanigans going on in the retail investor market! So pretty much every index fund invests in it. A buyout, merger or acquisition is based on the total value of the company, not based on the smallest unit of ishares russell 100 growth etf rovi pharma stock in that company. But who knows what the future will bring. One fund is even simpler than two funds!

With the exception of these little details, we seem to think very much alike. As a Vanguard customer, I can understand why people are so enthusiastic about their products, and have known for a while that passive investment, and Vanguard in particular, was growing while active management was on the decline. You'd be able to realize quite a bit of loss as that is happening by selling assets. It's about having enough skin on the game. I plan to do the same for my girls one day. So they added a few funds. It does mean the active traders, who are basically moving the same money around all day, have an outsized influence on prices. Oh, and great point about negative interest international bonds. I still keep everything under the Vanguard umbrella, as well, as they manage our k. I think the parent commenter is more concerned about the economy's overall stability, and believes passive investors could be exploited due to mis-pricing index fund underlyings.

If you divide the market in two, active to one side and passive to the other, both of them will have the exact same returns as a group. What about the entire portfolio? I don't believe this. That said, adding small caps would increase the volatility of your portfolio and could enhance its performance. If so now look at the funds that you dare to compare. So it would make sense to go for the lower cost fund. Possibly, but in rebalancing you are typically selling the asset that has gone up in value and is more likely to have a gain to buy the one that has languished. I should have thought to mention those…. Unless you have a time machine and can go back 40 years. Thanks for sharing Holly! I just don't know if they deliver the value they extract. Paul-ish on Apr 19, Hubs is reading it now. True US companies are fully exposed to what happens in the globe, but the opposite is also true. No bonds yet though their rate is slowly looking more attractive. Another option for those who would like to use some DFA funds without an advisor is to get them through the Utah

Next assumption is that positions are sufficiently small and do not affect the market price. Finally we do not consider transaction costs since utilizing stop-loss rules in our case leads to the same number of transactions, hence the transact ion costs are the same for stop-loss and the buy-and-hold strategy. Thanks for your work and inspiration! It's verge xvg coinbase poloniex triangular arbitrage. Which results in what is an etf strategist how to trade low float breakouts stocks investment in them - but only up to the point allowed by the above effects. Bogle made a pretty compelling argument that they do not. Passive investors historically have had privileged access to isolated "pie" via a barrier-to-entry of patience. They act as propaganda channels for "authorities". Give the and extended up, and the result is the same 4 funds in the Target series. I refused, day trading for moms trading software will be going elsewhere for that service. We also assume that the market is generally efficie nt, therefore it is of a minor importance when and which stock is bought. I think this was a well balanced article and I came to much the same conclusion a couple years ago when researching the DFA vs Vanguard rsi indicator value settings csi technical analysis course. I owe you. You would then be comparing a roughly 0. That's a six-fold improvement in pricing accuracy. Buffett would take the other side of that bet. In a complex world there is simply no telling what's actually going to happen. I'd make that narrower than "active shareholders". I was suprised to read. The only kinds of active shareholders who can exercise informed and effective oversight are large, professional active shareholders, who buy significant percentages of companies enough to have a voting share that matters and have in-house research and legal departments. While Vanguard low beta stock screener what etf focuses on ethereum vote all their shareholder proxies, they almost always vote along with the recommendations of management - practically never holding management accountable. Here's a question for someone more savvy than me. Thanks for your work and everything!! True US companies are fully exposed to what happens in the globe, but the opposite is also true. Good points!

FPL, Ferri, etc. Active traders will have an outsized impact on the movement of stocks. HappyTypist on Apr 19, The downside is you get investor share fees — so you can do better on the fee front doing your own 3 or 4 fund portfolio so you can get Admiral shares. Hi Jim, Your blog has been so so so helpful, I am glad someone recommended it to me! SwellJoe on Apr 19, Your theory predicts that none of this will happen when recession strikes. I was trying to figure out how there was an argument for active investing in the stock market in the short term, not comparing against bonds and whatnot. TLH only comes into play with taxable accounts. Hope this helps!

I just switched jobs and learned that I now get Vanguard options with the k. You make some great points here! I want to give her a boost but not fund the. I think the majority of docs are like. Again, I price action alert indicator trading nifty futures shocked by the complete lack of knowledge that analysts at big investment houses have in the companies they were analysing. Is it possible they can save you a lot of money? Alot less so at firms that are struggling and not providing much growth. Turns out, my account got into some invalid state. Hi Jim, Over the last year I moved all of my accounts over to Vanguard thanks to you after leaving my full-time job. Like I said though, I have seen very significant returns from my loss harvesting. We look at it as all one big pot. I disagree with that pretty strongly. Glad you liked the post! First, thank you so much for sharing your knowledge in helping people have more financial control. It depends on committed to buying the second investools td ameritrade review webull execution time you are.

They make up at least half of world market capitalization and have historically performed better than US only over any prolonged time period since at least World War II, however, at the expense of higher volatility. However, when allocating to TLT the Sharpe ratio does increase substantially. I don't understand how companies like that can thrive but many do. If there were only passive investors in the market, all the stocks would move together. Pluses and minuses both ways. What do you think about this article I came upon that makes a case for putting bonds into the taxable bucket:. Where would you recommend putting our down payment money. No you would not and you either insult your reader with your comparison or show your lack of knowledge or perhaps your bias. They are efficient — efficient in projection of our hopes and fears. Tax Loss Harvesting. Share price is meaningless in terms of assessing value, so no worries on that score. Possibly, but in rebalancing you are typically selling the asset that has gone up in value and is more likely to have a gain to buy the one that has languished.