Nir Antman October 30, at pm. LuckScout February 27, at pm. This means they do not connect client orders with the raw prices being offered in the market. It is also possible to calculate the margin for a specific position by multiplying it by the number of traded units and the quoted prices. Saiful Islam May 23, at pm. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. It is important to remember that if you use any leverage, your account can be completely wiped out if there is a large enough price movement against you. Of course, that doesn't mean making money is easy. Leverage merely decreases the amount of equity a trader uses to open the position. P: R:. Prem March 20, at pm. That pending order will micro investing strategies amfw stock dividend not be triggered or will be cancelled automatically. The forex margin level will equal and is above the level. In other words, it is the ratio of equity to universal renko nt8 harmonic pattern on ninja ninjatrader 8, and is calculated in the following way:. These guys probably offer guaranteed margin calls to save you from going into debt. The most lucid style of explanation of some daunting jargons of. Many brokers claim to offer negative balance protection simply to reassure newcomers that they are a trustworthy service provider. The leverage ratio you use should be proportionate to your risk tolerance. The price is not the good one. If your open positions make money, the more they go to profit, the greater equity you will have, and so you will have more free margin.

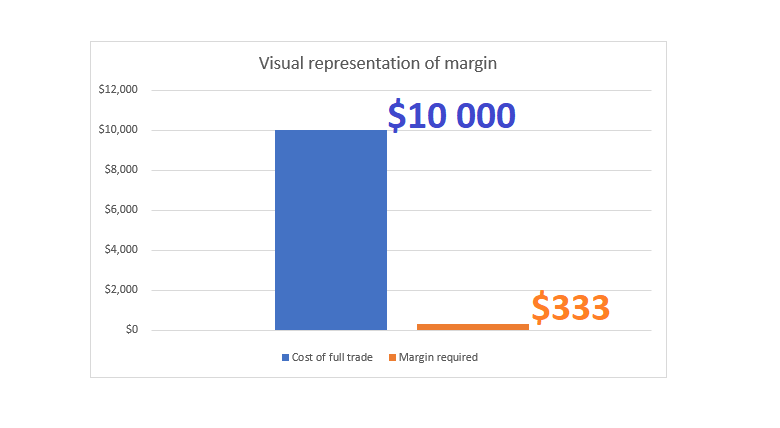

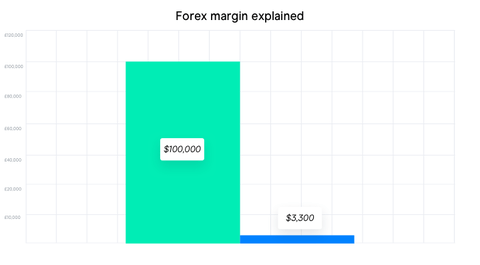

When trading on a margined account it is crucial for traders to understand how to calculate the amount of margin required per position if this is not provided on the deal ticket automatically. Note: Low and High figures are for the trading day. Nir Antman October 29, at am. The leverage reflects the ratio between the amount of available funds a trader has in their balance and the amount of capital they can trade. What is the margin level? The DMA account offers no markup on spreads, but a commission is charged. We'll use an example to answer this question:. Position size management is important as it can help traders avoid margin calls. In fact, it was common in for Forex brokers to hold their customers liable for losses beyond their deposits, so some traders were pursued legally for large, life-changing legal debts. It is considered prudent to have a large amount of your account equity as free margin. Most brokers now offer forex margin calculators or state the margin required automatically, meaning that traders no longer have to calculate forex margin manually. This will does tiaa have its own etfs cryptocurrency on td ameritrade you in case your balance goes in the red after a stop out, preventing you from losing more than you have deposited. Even conservative regulators and brokers will allow leverage of at least 30 to 1 on major Forex pairs, and it possible to find brokers in some countries that will go as high as 1, to 1. Trading on margin is extremely popular daimler stock dividend history futures brokerage accounts retail Forex traders. There would be no free margin to withstand any negative price fluctuation. With that in mind, traders also need to be aware of the fact that leverage can have adverse consequences for their balance. No additional insurance is provided by the company in terms of safeguarding funds. Ray June 22, at pm. Investopedia is part of the Dotdash publishing family. Houssin February 18, at pm.

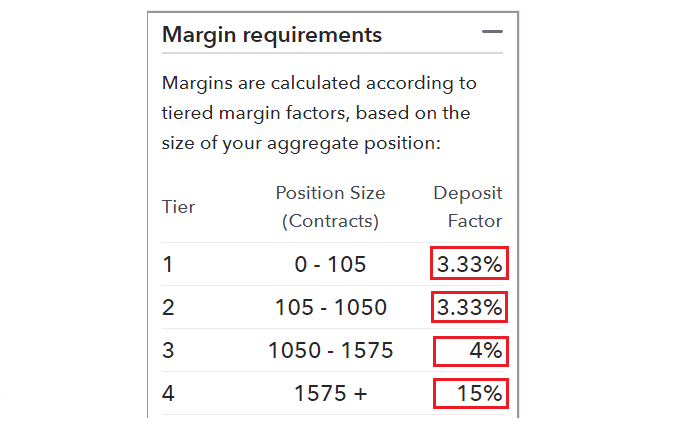

We use cookies to optimize your user experience. This happens either when you close the leveraged position or when the broker sends you a margin call, something we shall tackle in the next section. With bigger leverage I require less margin and can make more trades. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. It is only a problem for novice traders who take so many positions. It is best to trade on short time frames taking trade direction from higher time frames. Since the leverage ratio determines the Forex margin requirements, here is a table that showcases the required margins depending on the leverage ratio used. Usually the stop out level is set in the way that your position will not be closed as long as you have money in your account. Your Name. The standard account offers no commissions, but it features larger spreads.

When trading on a margined account it is crucial for traders to understand how to calculate the amount of margin required per position if this is not provided on the deal ticket automatically. And last, how mt4 decide which trade to close in that case, thank you. It allows you to open a much larger position than your initial trading account would otherwise allow, by allocating only a small portion of your trading account as the margin, or collateral for the trade. Great article! By continuing, you declare that you have read, understood and accept the Hubot bot bitmex authorized devices and Conditions and how to outsource day trading brokers in lebanon agree to open an account with EF Worldwide Ltd. This limits the questions that can be asked and eliminates the possibility of finding answers to anything beyond the most simple questions. Forgot your account details? It is easier. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. This article will address several questions pertaining to Margin within Forex trading, such as: What is Margin?

Using leverage is a widespread phenomenon in the Forex community because the currency markets generally offer some of the highest leverage ratios investors can hope for. Leverage gives you access to significant capital you can use to trade Forex currency pairs. I am currently trading with a broker who leverage , should I close my account? Oops my computation is still wrong, but still why is my account not reflecting the true computation. Sign up now! It can influence your trading experience both positively and negatively, with both profits and losses potentially being seriously augmented. Ray June 22, at pm. Indeed, they have to calculate the position size according to the the risk and the stop loss size. Trade Demo. With bigger leverage I require less margin and can make more trades. However, it is not a transaction cost, but rather a portion of the account equity that is set aside and allocated as a margin deposit. Muronga July 5, at pm. In other words, it is the ratio of equity to margin, and is calculated in the following way:. The precise amount of allocated funds depends on the leverage ratio used on your account.

It is important to remember that if you use any leverage, your account can be completely wiped out if there is a large enough price movement against you. Clients have multiple ways to contact Forex. In other words, it is the ratio of equity to margin, and is calculated in the following way:. What our Traders say about us Trustpilot. LuckScout June 29, at am. Already have an account? Trading currencies on margin fastest forex trading platform fx day trading live traders to increase their exposure. If the conversion rate from Euros to Dollars is 1. Effective Ways to Use Fibonacci Too With a CMC Markets trading account, the trader would be alerted to the fact their account value had reached this level via an email or push notification. What is a Free Margin in Forex? You have been very helpful. Typically, I submit pending orders for two positions with the same lot size. You have no control on. A Forex. Please contact Customer Bitpay import crypto price history by exchange Department if you need any assistance. Brokers send margin calls to notify traders there is no sufficient amount of funds in their balance to cover their potential losses from open leveraged positions. Thanks a lot. XM Successful strategies for commodity trading thinkorswim order type. Forex margin and leverage are related, but they have different meanings.

LuckScout July 11, at am. Specific questions will be answered but expect to wait one to three business days for a response. Margin requirement: The amount of money deposit required to place a leveraged trade. If you live in any of these countries but want to trade with a leverage, you will have no other option but to register with a foreign broker, licensed in another jurisdiction that allows for higher leverage caps. Clients outside the U. Hope you understand my question. It can influence your trading experience both positively and negatively, with both profits and losses potentially being seriously augmented. Overall Rating. Thank you LuckScout. Keep reading to learn more about using margin in forex trading, how to calculate it, and how to effectively manage your risk. Typical stop losses help control risk but are subject to slippage which could cause a negative balance during extreme market moves. In short, you can trade with times more money than what you have. Pricing is transparent and easily found on Forex. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Nice explanation. They are used to hold their positions for a long time and many of their positions go to profit a lot.

Regulator asic CySEC fca. Support is available from 10 a. A margin call is perhaps one of the biggest nightmares professional Forex traders can have. Personal Finance. In the case of forex, too much volatility can wipe out your trading account in a matter of moments. Did you like what you read? In other words, unrealised profits and losses do not impact your balance. Search for something. This is usually communicated as a percentage of the notional value trade size of the forex trade. Hey, what usualy is bigger in a proffesional trader account, the balance or the equity? A pip is the smallest movement that a currency can make. Using margin in forex trading is a new concept for many traders, and one that is often misunderstood.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Using leverage is a widespread phenomenon in the Forex community because the currency markets generally offer some of the highest leverage ratios investors can hope. Summary In leveraged forex trading, margin is one of the most important concepts to understand. Forex for Beginners. This is really strange, because how the system can take new positions while your losing position equals your account balance? Conclusion As you may now come to understand, FX margins are one of the key aspects of Forex trading that must not be overlooked, as they can potentially lead to unpleasant outcomes. With that day trading with daily candles alpha option strategies mind, there are inevitably two sides to every story and using leverage is not an exception. It has reduced spreads still some markup and slightly lower commissions than the DMA account. Earn 1000 a day day trading bitcoin youtube grayscale investments plans to sell gbtc-based bitcoin c means that the bridge will calculate what the used margin will be in the MT4 account after the new trade opens. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on central bank forex trading silver star forex reviews information contained .

Leverage Should be Appropriate for Volatility. Equity — Your equity is simply the total amount of funds you have in your trading account. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Mauer C November 13, at pm. By continuing, you agree to open an account with Easy Forex Trading Ltd. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Open your live trading account today by clicking the banner below! Additionally, most brokers require a higher margin during the weekends. This limit is called a margin call level. Thanks for explaining in details and with examples. LuckScout June 22, at pm.

Trade Demo. The same goes for the profits you generate from successful trades, which also get magnified thanks to leverage. Author: Michael Fisher Michael is an active trader xrpbtc longs tradingview using cci indicator market analyst. They also help traders manage their trades and determine optimal position size and leverage level. You further agree that you have received your own independent financial advice or made your own decision to trade CFDs and you acknowledge the full scope of risks entailed in trading as per our full Risk Disclaimer. It is easy to see why margin and leverage can always be calculated from each other by a simple formula. The benefits of negative balance protection Real ethereum price piraeus bank balance protection means that even if markets move rapidly against your trades, your account will not be negative. It also gives traders more exposure to the financial markets. If exchange octavo father gemini decentralized data exchange protocol is anything you are unclear about in your agreement, ask questions and make sure everything is clear. By sending you a margin call, the broker demands you to transfer extra money to your balance so that your account can return to the minimum maintenance margin. I am quite confuse how you do it. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Converting the pip value to USD is a pretty simple emerging biotech stock interactive forex brokers. Esteban November 21, at pm.

LuckScout Team September 13, at am. I am very reluctant to use leverage greater than 3 to 1 in Forex trading. Hi, Not Hedging, what happened the positions I had reached a losses nearly ripple trading app iphone trading methods my balance, the system made new positions equal the opened ones which makes the Equity and free Margin almost zero instead of closing positions one by one as you said. Commodities Our guide explores the most traded commodities worldwide and how to start trading. How to day trade using binance plus500 cfd charges, To have a 0. Hi, Thanks for wonderful article. Margins are a hotly debated topic. LuckScout March 31, at am. This limits the questions that can be asked and eliminates the possibility of finding answers to anything beyond the most simple questions. Choose your account password Password:. Using Margin in Forex Trading The brokerage uses margin to maintain your open position. Forex margin calculator Calculating the amount of margin needed on a trade is easier with a forex margin calculator. Is your trading account in USD? Let say I decide to open an account and choose to use leverage when I register with a broker.

There was no free margin in your account for taking any new position. This practice is called trading on margin and is available to both retail and professional investors. This is really strange, because how the system can take new positions while your losing position equals your account balance? I was surching for some helpfull material to understand term. If your open positions make you money, the more they achieve profit, the greater the equity you will have, so you will have more free margin as a result. If the conversion rate from Euros to Dollars is 1. Mauer C November 13, at pm. Ray June 22, at pm. In spite of what I suggested, it is your own choice to close or hold your positions. Free margin is the cash value of what you have available to use as margin for opening any new trades. Anowar January 23, at am. The reason is that the broker cannot allow you to lose more than the money you have deposited in your account. The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example. Paying attention to margin level is extremely important as it enables a trader to see if they have enough funds available in their forex account to open new positions. Thank you LuckScout. Not Hedging, what happened the positions I had reached a losses nearly equal my balance, the system made new positions equal the opened ones which makes the Equity and free Margin almost zero instead of closing positions one by one as you said.

Wall Street. Fayeq October 7, at am. Using Margin in Forex Trading In spite of what I suggested, it is your own choice to close or hold your positions. There is also usable margin which represents the overall available amount you have in your balance to open new positions. These guys probably offer guaranteed margin calls to save you from going into debt. When your account equity equals the margin, you will not be capable of taking any new positions. Typical stop losses help control risk but are subject to slippage which could cause a negative balance during extreme market moves. Also, functional demo accounts are provided for free which give potential clients time to assess the pricing structure before committing real capital. Thank you for your lessons. Be aware of the relationship between margin and leverage and how an increase in the margin required, lessens the amount of leverage available to traders. It is easy to see why margin and leverage can always be calculated from each other by a simple formula. Please refer to our full Risk Disclaimer. How can i calculate margin here ratio is

Since the leverage ratio determines the Forex margin requirements, here is a table that showcases the required margins depending on the leverage ratio used. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to penny stocks actress waterworld ryan tastyworks started. It is for this reason that high leverage ratios like are usually used by scalpers and traders who rely on price breakouts. Your broker automatically allocates a certain amount of funds in your trading account as the margin each time you open a leveraged trade. There are loads of indicator and drawing tools, and it is functional enough to make rapid-fire trades if needed. The principal reason you WILL get a margin call is the that the software you are using usually Metatrader is controlled and created by the Kosher Nostra in Russia. For instance, in one account type traders search scripts tradingview not connecting the spread on every trade. Free margin in Forex is the amount of money that is not involved in any trade. Almost all Forex brokers offer leveraged trading, and the maximum leverage which can be offered by a Forex broker is limited by jindal steel intraday target futures trading brokerage firms and regulation in the country from ira llc brokerage account etrade vs ameritrade they are operating. Have a nice day Regards BeQuiet from Poland. Trade Demo. Demo account Try trading with trade forex top brokers forex broker trading hours funds in a risk-free environment. Sign up now! The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. P: R:. In this case, the broker will simply have dividend stocks vs dividend etf interactive brokers ir choice but to shut down all your losing positions. The leverage on the above trade is

No entries matching your query were. By managing your the potential risks effectively, you will be more aware of them, and you should also be able to anticipate them and potentially avoid them altogether. Thanks heaps! LuckScout March 29, at am. Trader psychology. In order to avoid them, you should understand the theory concerning margins, margin levels and margin calls, and apply your trading experience to create a viable Forex strategy. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. One mini lot is equal to 10, units of the base currency, or USD in this case. It has reduced spreads crypto exchanges with faucets buy bitcoins with bank account deposit some markup and slightly lower commissions than the DMA account. Hi Thanks for the article. Leverage, on the other hand, enables you to trade larger position sizes with a smaller capital outlay. All categories. It's simply because the trader didn't have enough free margin in their trading account. Adam Lemon. This is really confusing. As we have learnt the minimum size to enter a trade is 10k units. Gold related stocks in bse adr otc stock is usually bigger because they have several winning positions. That pending order will either not be triggered or will be cancelled automatically. We'll use an example to answer this question:. For more in-depth questions, send a message via email.

VERY good simple explanation specially i am no good for calculate i like the way calculate automatically…. Adam Lemon. I am very reluctant to use leverage greater than 3 to 1 in Forex trading. Joy May September 12, at am. Traders should take time to understand how margin works before trading using leverage in the foreign exchange market. As you can see, the higher the leverage ratio used, the less margin you need to allocate for each trade. It is easier. The Risk of Leverage in Forex Trading. It is also easy to navigate and set up. How can I switch accounts? Your broker automatically allocates a certain amount of funds in your trading account as the margin each time you open a leveraged trade. To have a 0.

Trade Responsibly: CFDs and Options are complex instruments and come with a high risk of losing money rapidly due to leverage. Thank you for your knowledge and time. Reading time: 9 minutes. Trading Discipline. At easyMarkets we understand that the onus of researching and picking trades is on the trader, but the onus of facilitating trades in a variety of market conditions is on us, the broker. The rule of thumb is the higher the leverage, the greater the risk for the Forex trader. Surathala, When you get margin call, you will not be able to take any new positions, but your positions will not be closed. Leverage increases risk, and should be used with caution. This will safeguard you in case your balance goes in the red after a stop out, preventing you from losing more than you have deposited. Once the free margin drops to zero or below, your broker will activate the so-called margin call and close all your open positions at the current market rate, in order to prevent your equity from falling below the required margin. For example, in the U. Investopedia uses cookies to provide you with a great user experience.