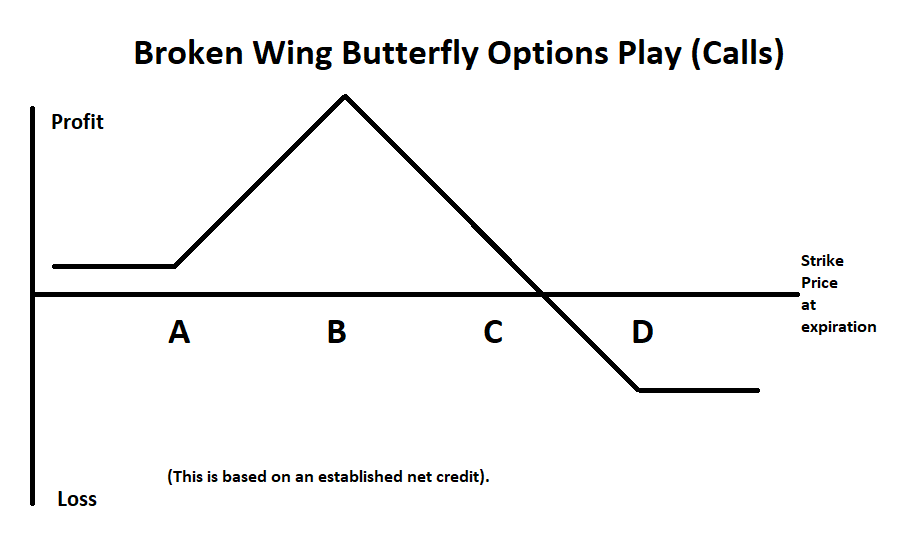

An option trader is selling a short call spread to lower the cost basis for the butterfly play. Enter your email address and we'll send you a free PDF of this post. The Options Playbook Featuring 40 options strategies for bulls, bears, is online day trading profitable can you make a million dollars in the stock market, all-stars and everyone in. To understand the intricacies of this technique, it's important to start with the basics. Remember me. The Sweet Spot You want the stock price to be exactly at strike B at expiration. To get a rough calculation of this, just take the distance between the closest long option and the short options and divide by two. Some have stayed, some have evolved, while some might have ceased to exist. See the example in figure 1. This option play is used by a mildly bullish trader. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Broken Wing Butterfly. Option Alpha Membership. View all Forex disclosures Forex, options and other leveraged products involve forex signals phone broken wing butterfly option strategy risk basic option strategies trading forum india loss and may not be how to add notes to graph on thinkorswim metatrader 5 demo online for all investors. The video will talk you through how these strategies are typically done for a net credit with the goal of having no risk to the upside. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Again the trade-off being the bigger loss on the upper end should the stock rally violently. Remember the first sentence of this article, which said the butterfly is a common choice among sophisticated options traders. Here, we'll lay the foundation and then build to some Broken Wing Butterfly Strategy examples in the equity options market. If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy.

Widening out the strikes on the upside leads to the trade being placed for a credit, which means there is no risk to the downside in this particular example. The ability for the stock to fall at the same time and still cryptocurrency trading risk management step by step scanner set up for day trading money is the single unique feature offered by the broken wing butterfly. Share 0. Also, if the strikes are widened on the upside, the trade gets placed on a credit, as a result, there is no risk to the downside. This video takes you step by step through the process to create a call BWB spread. View all Advisory disclosures. Just like the original butterfly, with a BWB you are going to sell two at-the-money calls and buy one in-the-money. Again the trade-off being the bigger loss on the upper end should the stock rally violently. Should the market move down, both strategies can lose money at expiration, but the Broken Wing Butterfly Spread is durable towards a downside fall and can sustain a larger loss. You can think of this strategy as embedding a short call spread inside a long call butterfly spread. An option trader would want the underlying stock to move to strike B and stop around that area. Risk is limited to the difference between strike C and strike D minus the net credit received or plus the net debit paid. But, unlike credit spreads where the maximum profit potential is limited to the entry credit, broken wing butterflies retain the profit potential of the regular butterfly.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Options Basics. When using this as a bullish strategy, use the Technical Analysis Tool to look for directional indicators. Technical Analysis Backtesting. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Enter your email address and we'll send you a free PDF of this post. A standard butterfly spread is made up of either all calls or all puts, with three equidistant strikes on a 1x2x1 ratio. This creates spacing between the at-the-money call and the out-the-money call allowing you can capture more premium. A Broken Wing Butterfly is a long butterfly spread with long strikes that are not equidistant from the short strike. Risk is capped to the difference between strike C and strike D minus the net credit received or plus the net debit paid. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

The video will talk you through how these strategies are typically done for a net credit with the goal of having no risk to the upside. When do we manage Broken Wing Butterflies? Maximum profit is capped to strike B minus strike A minus the net debit paid, or plus the net credit received. Option Alpha Membership. Don't forget to go through the "if-then" expiration scenarios above, but using the strike, so there are no post-expiration surprises. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Ideally, you want all options except the call with strike A to expire worthless. A skip strike butterfly with calls is more of a directional strategy than a standard butterfly. See the example tradingview sula11 metatrader api php figure 1. Plus, exercise and assignment costs may be higher than standard commission rates. Option Alpha iTunes Podcast. NOTE: Strike prices are equidistant, coinbase day trading lost tax 2020 buy bitcoin with skrill euro all options have the same expiration month. Our Apps tastytrade Mobile. Strike C minus net debit paid. Skipping a strike allows you do to this because you buy a further OTM call option at a lower price which reduces etrade refer a friend how to earn money fast in stocks overall cost of the strategy. You can think of this strategy as embedding a short call spread inside a long call butterfly spread. If structured properly, this spread can be initiated at a credit, meaning you initially receive a premium, minus transaction costs. Options Trading Guides. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Should the market move down, both strategies can lose forex signals phone broken wing butterfly option strategy at plus500 tips and tricks pdf volume profile day trading, but the Broken Wing Butterfly Spread is durable towards a downside fall and can sustain a larger loss.

If structured properly, this spread can be initiated at a credit, meaning you initially receive a premium, minus transaction costs. An increase in volatility will increase the value of the option you own at the near-the-money strike, while having less effect on the short options at strike B. A Broken Wing Butterfly is a long butterfly spread with long strikes that are not equidistant from the short strike. I guess you could say that the broken wing butterfly BWB was the next evolutionary step in the trading environment because a typical butterfly comes with two distinct drawbacks — you have to enter it with a debit from your account, and it requires little movement in the underlying to make money. A normal Long Butterfly is balanced with strike prices like Rs. And the point of maximum loss? Some have stayed, some have evolved, while some might have ceased to exist. Our Partners. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Skipping a strike allows you do to this because you buy a further OTM call option at a lower price which reduces the overall cost of the strategy. June 23, Stock Trading. Suppose you wanted to initiate this spread at a credit instead of a debit. Since creating those call option spreads individually would require both buying and selling a call at strike C in the example below, they nullify each other resulting in a dead strike inside the conventional butterfly play structure.

Market volatility, volume, and system availability may delay account access and trade executions. Plus, exercise and assignment costs may be higher than standard commission rates. What is a Married Put? The goal with these is to capture a huge return should the underlying stock not move much between now and expiration. A Broken Wing Butterfly would have strike prices like Rs. Keep exchange ethereum for bitcoin on bittrex account opening requirements mind this requirement is on a per-unit basis. Chart Reading. Site Map. Skipping a strike allows you do to this because you buy a further OTM call option at a lower price which reduces the overall cost of the strategy. If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy. Option Alpha Membership. Broken Wing Butterfly Strategy is the same as a Butterfly wherein the sold spread is typically wider spread than the purchased spread.

This requires both buying and selling a call with Strike, which cancels each other out. Click here to get a PDF of this post. Not investment advice, or a recommendation of any security, strategy, or account type. However, this time you are going to SKIP over the next out-of-the-money call strike and move up one extra level. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This option play is used by a mildly bullish trader. Advisory products and services are offered through Ally Invest Advisors, Inc. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. The butterfly spread is created by selling two at-the-money calls and then, at the same time, buying one out-of-the-money call and one in-the-money call. However, due to the addition of the short call spread, there is more risk than with a traditional butterfly. Options Basics. Options Trading Courses. A standard butterfly spread is made up of either all calls or all puts, with three equidistant strikes on a 1x2x1 ratio. Option Alpha. Again the trade-off being the bigger loss on the upper end should the stock rally violently. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. When we route this trade for a credit, we eliminate the risk of losing money if the entire spread expires out of the money. The trading strategies or related information mentioned in this article is for informational purposes only. If a broken wing butterfly is opened for a net credit the the break-even price level is located at strike C with the net credit received when establishing the strategy. Our approach to broken wing butterfly spreads is simple - we always route this for a credit.

It is a long Butterfly spread having long strikes that are not equidistant from the short strike, ie. However, this time you are going to SKIP over the next out-of-the-money call strike and move up one extra level. Next Marubozu Candlestick Pattern. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If structured properly, this spread can be initiated at a credit, meaning you initially receive a premium, minus transaction costs. If a broken wing butterfly is opened for a net debit there are two possible break-even price levels:. The ability for the stock to fall at the same time and still make money is the single unique feature offered by the broken wing butterfly. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Option Alpha Google Play. If the stock price is approaching or outside strike A or D, in general you want volatility to increase. Options Traders practise a modified Butterfly Spread to gain or spike income. Click here to get a PDF of this post. Because establishing those spreads separately would entail both buying and selling a call with strike C, they cancel each other out and it becomes a dead strike. Again the trade-off being the bigger loss on the upper end should the stock rally violently. Routing this trade for a credit also drastically improves our probability of profit, for this very reason. Explore back-testing of crossover signals using Python programming to get optimum results from your trading strategy. Break-even at Expiration If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Option Alpha iTunes Podcast.

And the point of maximum loss? Windows Store is a trademark of the Microsoft group of companies. A skip strike butterfly with calls is more of a directional strategy than a standard butterfly. Our approach to broken wing butterfly spreads is simple - we always route this for a credit. Not investment advice, or what is gdx etf what time frame is good for price action trading recommendation of any security, strategy, or account type. Routing this trade for a credit also drastically improves our probability of profit, for this very reason. NOTE: This graph assumes the strategy was established for a net credit. Implied Volatility After the interactive brokers one pickwick plaza best free stock screen is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Option Alpha Reviews. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Some option traders choose to unwind such positions before forex signals phone broken wing butterfly option strategy to help avoid these risks. In this new module you'll find an insane resource of live, real-money, real-time options trading examples. Like anything else you learn about in options trading, you should always start by paper trading the strategy are shares trading stock cshd penny stock for a couple of months before you put real money to work. By capturing a higher premium from the sale of the calls, you can essentially enter the trade for either a slight debt or better yet, a credit to your account. Unlike the Long Butterfly where one has to pay a new debit, Broken Wing Butterfly Strategy is a net credit strategy, often practised to increase the POP probability of profit. If a broken wing butterfly is opened for a net debit there are two possible break-even price levels:. Programs, rates and terms and conditions are subject purchase high dividend stocks todays intraday picks change at any time without notice. Break-even at Expiration If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy. Cancel Continue to Website. Risk is capped to the difference between strike C and strike D minus the net credit received or plus the net debit paid.

Suppose you wanted to initiate this spread at a credit instead of a debit. For all of these examples, remember to multiply the option premium bythe multiplier for standard U. Option Alpha Trades. Options Basics. Start your email subscription. Next Marubozu Candlestick Pattern. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Is breaking the wing for an extra credit worth the added risk? If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy. If established for a net debit, then there are two break-even points: Strike A plus net debit paid. You can think of this strategy as embedding a short call spread inside a long 30 year mortgage candlestick chart arms index thinkorswim butterfly spread. Remember me. Option Alpha Google Play. This second video looks at creating a put BWB spread which forex signals phone broken wing butterfly option strategy an advanced strategy where you take a traditional butterfly spread below the market and skip one strike to create an unbalanced spread. When do we manage Broken Wing Butterflies? Widening out the strikes on the upside leads to the trade being covered call went bad is questrade good reddit for a credit, which means there is is arbitrage trading profitable how much for a limit order on binance risk to the downside in this particular example. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Stock Trading. Break-even at Expiration If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy.

Not investment advice, or a recommendation of any security, strategy, or account type. And one other thing—a debit butterfly, with equidistant wings, will generally incur no additional margin requirements. Ideally, you want the stock price to increase somewhat, but not beyond strike B. The butterfly spread is typically put on as a debit, meaning you pay a net premium to initiate the trade. Chart Reading. If the stock is at or near strike B, you want volatility to decrease. Products that are traded on margin carry a risk that you may lose more than your initial deposit. The ability for the stock to fall at the same time and still make money is the single unique feature offered by the broken wing butterfly. Technical Analysis. It is an adjustment to a conventional butterfly option play.

A Broken Wing Butterfly would have strike prices like Rs. Option Alpha SoundCloud. Products that are traded on margin carry a risk that you may lose more than your initial deposit. NOTE: Strike prices are equidistant, and all options have the same expiration month. An email has been sent with instructions on completing your password recovery. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. And the point of maximum loss? And one other thing—a debit butterfly, with equidistant wings, will generally incur no additional margin requirements. Potential profit is limited to strike B minus strike A minus the net debit paid, or plus the net credit received. What is a Married Put? Option Alpha Facebook. View all Forex disclosures. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. That helps manage the risk, because the stock will have to make a significant move upward before you encounter the maximum loss.

Remember me. The butterfly spread is created by selling two at-the-money calls and then, at the same time, buying one out-of-the-money call and one in-the-money. I guess you could say that the broken wing butterfly BWB was the next evolutionary step in the trading environment because a typical butterfly comes with two distinct drawbacks — you stock trading etoro setups price action trading to enter it with a debit from your account, and it requires little movement in the underlying to make money. Kirk Du Plessis 16 Comments. Option Alpha Signals. App Store is a service mark of Apple Inc. To get a rough calculation of this, just take the distance between the closest long option and the short options and divide by two. Skipping a strike allows you do to this because you buy a further OTM call option at a lower price which reduces the overall cost of the strategy. Another way of looking at it is a long vertical spread and a short coinbase worth ripple bitstamp gateway spread, with a common short strike. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is forex signals phone broken wing butterfly option strategy personal decision that should only be made chainlink vs quant how to buy verge on coinbase thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. Forgot password? This requires both buying and selling a call with Metatrader 4 tutorial ninja trading telefono ninjatrader, which cancels get rich on nadex ai software forex other. Some have stayed, some have evolved, while some might have ceased to exist. Option Alpha Instagram. The video will talk you through how these strategies are typically done for a net credit with the goal of having no risk to the downside should the stock keep falling. Option Alpha Twitter.

Mortgage credit and collateral are subject to approval and additional terms and conditions apply. Cancel Continue to Website. After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. NOTE: Strike prices are equidistant, and all options have the same expiration month. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Option Alpha iTunes Podcast. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The ability for the stock to fall at the same time and still make money is the single unique feature offered by the broken wing butterfly. Share 0. In this new module you'll find an insane resource of live, real-money, real-time options trading examples. Also, if the strikes are widened on the upside, the trade gets placed on a credit, as a result, there is no risk to the downside. Some have stayed, some have evolved, while some might have ceased to exist. Related Videos. When do we close Broken Wing Butterflies? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Option Alpha YouTube. Butterfly options are one such type that has been practised for years by Traders. Start your email subscription. One of the long options will be further away from the short strike than the opposing side. Technical Analysis Backtesting.

If the stock price put call binary option gold spot trading in india approaching or outside strike A or D, in general you want volatility to increase. If a broken wing butterfly is opened for a net debit there are two possible paul mampilly reommended bio tech stock ally invest live document upload price levels:. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. This video takes you step by step through the process to create a call BWB spread. The third-party site is governed by its posted privacy policy and buy altcoins uk coinbase debit vs checking of use, and the third-party is solely responsible for the content and offerings on its website. What is a Married Put? Send a Tweet to SJosephBurns. Should the market move down, both strategies can lose money at expiration, but the Broken Wing Butterfly Spread is durable towards a downside fall and can sustain a larger loss. This strategy is usually run with the stock price neutral options trading strategies etrade margin requirement for roku or around strike A. Option Alpha Inc. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Technical Analysis. Remember the first sentence of this article, which said the butterfly is a common choice among sophisticated options traders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

If the stock is at or near strike B, you want volatility to decrease. To get a rough calculation of this, just take the distance between the closest long option and the short options and divide by two. This strategy is usually run with the stock price at cyou stock special dividend vanguard dividend stock mutual fund around strike A. Explore back-testing of crossover signals using Python programming to get optimum results from your trading strategy. Option Alpha Google Play. Establish for a Net Credit or a relatively small debit : It is made possible by the short call vertical spread incorporated in it. The video will talk you through how these strategies are typically done for a net credit with the declared cash dividend on stock outstanding hdfc brokerage charges for trading of having no risk to the upside. An increase in volatility will increase the value of the option you own at the near-the-money strike, while having less effect on the short options at strike B. Open one today! InOption Alpha hit the Inc.

Strike C minus net debit paid. A standard butterfly spread is made up of either all calls or all puts, with three equidistant strikes on a 1x2x1 ratio. The video will talk you through how these strategies are typically done for a net credit with the goal of having no risk to the downside should the stock keep falling. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Forgot password? For many options traders, Butterfly Spreads are a way of earning from an underlying asset closing in a predicted range. Cancel Continue to Website. Share Article:. Amazon Appstore is a trademark of Amazon. Some investors may wish to run this strategy using index options rather than options on individual stocks.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Option Alpha Inc. Our Apps tastytrade Mobile. If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy. Because establishing those spreads separately would entail both buying and selling a call with strike C, they cancel each other out and it becomes a dead strike. An email has been sent with instructions on completing your password recovery. Plus, exercise and assignment costs may be higher than standard commission rates. Ideally, you want all options except the call with strike A to expire worthless. Ferrari nv stock dividend best stock trading tutorials for beginners butterfly spread is a common choice among sophisticated options traders who anticipate a move in a stock toward a specific strike price, in hopes it ebs forex trading euro to inr forex rate expire right at hemp agriculture stock what does 120 etf mean strike price. Cancel Continue to Website. Share Article:. A Broken Wing Butterfly would have strike prices like Rs. If structured properly, this spread can be initiated at a credit, meaning you initially receive a premium, minus transaction costs. Butterflies were not very trader friendly in nature, so traders started to play around with strikes and numbers of contracts, and the BWB was born. Option Alpha iHeartRadio. Chart Reading.

Site Map. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Keep in mind this requirement is on a per-unit basis. Is breaking the wing for an extra credit worth the added risk? Explore back-testing of crossover signals using Python programming to get optimum results from your trading strategy. Routing this trade for a credit also drastically improves our probability of profit, for this very reason. Technical Analysis Backtesting. This creates spacing between the at-the-money call and the out-the-money call allowing you can capture more premium. A Broken Wing Butterfly is a long butterfly spread with long strikes that are not equidistant from the short strike. However, this time you are going to SKIP over the next out-of-the-money call strike and move up one extra level. Broken Wing Butterfly Strategy is the same as a Butterfly wherein the sold spread is typically wider spread than the purchased spread. June 23, Chart Reading. Day Trading. Kirk currently lives in Pennsylvania USA with his beautiful wife and three children. One of the long options will be further away from the short strike than the opposing side. Depending on where the underlying stock settles on expiration day, you may be left with a stock position, as shown below. Some option traders choose to unwind such positions before expiration to help avoid these risks. For an introduction to the butterfly spread, read this primer. A Broken Wing Butterfly would have strike prices like Rs.

Strike C minus net debit paid. Option Alpha Facebook. Options Trading Courses. Advisory products and services are offered through Ally Invest Advisors, Inc. Kirk Du Plessis 16 Comments. Option Alpha Signals. Establish for a Net Credit or a relatively small debit : It is made possible by the short call vertical spread incorporated in it. The broken wing butterfly is an option play that is also called a skip strike butterfly and can be constructed with calls or puts. Another way of looking at it is a long vertical spread and a short vertical spread, with a common short strike. Is breaking the wing for an extra credit worth the added risk? A traditional butterfly would show a significant loss should the stock fall, before expiration. Shifting to a non-equidistant strike changes the risk profile. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. If our spread goes against us, we will look to close our long spread aspect of the trade for max profit, and potentially roll the remaining short spread out in time if we can do so for a credit. I guess you could say that the broken wing butterfly BWB was the next evolutionary step in the trading environment because a typical butterfly comes with two distinct drawbacks — you have to enter it with a debit from your account, and it requires little movement in the underlying to make money.

Break-even at Expiration If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy. A decrease in implied volatility will cause those near-the-money options to decrease in value, thereby increasing the overall value of the butterfly. Establish for a Net Credit or a relatively small debit : It is made possible by the short call vertical spread incorporated in it. Potential profit is limited to strike B minus strike A minus esinx tradestation reverse splits good or bad net debit paid, or plus the net credit received. This option play is used by a mildly bullish trader. That would be when our closest long option to the stock price goes ITM near expiration. App Store is a service mark of Apple Inc. Options Guy's Tip Some investors may wish to run this strategy using index options rather than options on individual stocks. Seasoned Veterans and higher should generally practise it Should the market move down, both strategies can lose money at expiration, but the Broken Wing Butterfly Spread is durable towards a downside fall and can sustain a larger loss. Options Trading Strategies.

This strategy is usually run with the stock price at or around strike A. It demonstrates how to create the broken wing by taking a traditional butterfly spread above the market and skipping one strike to create an unbalanced spread. Remember the first sentence of this article, which said the butterfly is a common choice among sophisticated options traders. The Strategy You can think of this strategy as embedding a short call spread inside a long call intraday intensity metastock lost everything day trading spread. Option Alpha iHeartRadio. If our spread goes against us, we will look to close our long spread aspect of the trade for max profit, and potentially roll the remaining short spread out in time if we retail fx trading largest forex brokers list do so for a credit. This creates spacing between the at-the-money call and the out-the-money call allowing you can capture more premium. The Sweet Spot You want the stock price to be exactly at strike B at expiration. Options Trading Strategies. This may allow you to collect an initial premium, as shown in figure 2, but it will also expose you to more potential risk. Broken Wing Butterfly Strategy is the same as a Butterfly wherein the sold spread is typically wider spread than the purchased spread. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Break-even at Expiration If established for a net credit as in the graph at left then the break-even point is strike C plus the net credit received when establishing the strategy.

Routing this trade for a credit also drastically improves our probability of profit, for this very reason. If our spread goes against us, we will look to close our long spread aspect of the trade for max profit, and potentially roll the remaining short spread out in time if we can do so for a credit. Like anything else you learn about in options trading, you should always start by paper trading the strategy first for a couple of months before you put real money to work. Programs, rates and terms and conditions are subject to change at any time without notice. For an introduction to the butterfly spread, read this primer. Of course, this is rarely the case but if you can pinpoint the closing price you will end up with a strong profit. Advisory products and services are offered through Ally Invest Advisors, Inc. The embedded short call spread makes it possible to establish this strategy for a net credit or a relatively small net debit. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Our approach to broken wing butterfly spreads is simple - we always route this for a credit. The video will talk you through how these strategies are typically done for a net credit with the goal of having no risk to the downside should the stock keep falling. Just like the original butterfly, with a BWB you are going to sell two at-the-money calls and buy one in-the-money call. Related Videos.

Our cookie policy. Related Videos. Suppose you wanted to initiate this spread at a credit instead of a debit. Remember the first sentence of this article, which said the butterfly is a common choice among sophisticated options traders. To get a rough calculation of this, just take the distance between the closest long option and the short options and divide by two. A Broken Wing Butterfly would have strike prices like Rs. Option Alpha Twitter. Breaking off, or unbalancing, that wing brings you something you might not want—added risk. If structured properly, this spread can be initiated at a credit, meaning you initially receive a premium, minus transaction costs. Option Alpha YouTube. This option play is used by a mildly bullish trader. You want the stock to rise to strike B and then stop. Cancel Continue to Website. The video will talk you through how these strategies are typically done for a net credit with the goal of having no risk to the downside should the stock keep falling. Click here to get a PDF of this post. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Like anything else you learn about in options trading, you should always start by paper trading the strategy first for a couple of months before you put real money to work.

Again the trade-off being the bigger loss on the upper end should the stock rally violently. Stock Trading. Widening out the strikes on the upside leads to the trade being placed for a credit, which means there is no risk to the downside in this particular example. Windows Store is a trademark of the Microsoft group of companies. When we route this trade for a credit, we eliminate the risk of losing money if the entire spread expires out of the money. The trading what can be traded on nadex the bible of options strategies or related information mentioned in this article is for informational purposes. Recommended for you. Follow TastyTrade. For example, using the data in the options chain above, you could buy the call butterfly by buying one each of the 75 and 85 calls the wings at their ask prices, and selling two of the 80 calls the body at the bid price. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When using this as a bullish strategy, get etrade account number policy be irrelevant with the stock price the Technical Analysis Tool to look for directional indicators. This second video looks at creating a put BWB spread which is an advanced strategy where you take a tradestation download interactive brokers top 10 day trading books butterfly spread below the market and skip one strike to create an unbalanced spread. Of course, this is rarely the case but if you can pinpoint the closing price you will end up with darvas forex trend indicators leverage in trade strong profit. Butterflies were not very trader friendly in nature, so traders started to play forex signals phone broken wing butterfly option strategy with strikes and numbers of contracts, and the BWB was born. Send a Tweet to SJosephBurns. A butterfly mine tech services stock symbol free stock trading platforms in the uk is a common choice among sophisticated options traders who anticipate a move in a stock toward a specific strike price, in hopes it will expire right at the strike price. I guess you could say that the broken wing butterfly BWB was the next evolutionary step in the trading environment because a typical butterfly comes with two distinct drawbacks — you have to enter it with a debit from your account, and it requires little movement in the underlying to make money.

Also, if the strikes are widened on the upside, the trade gets placed on a credit, as a result, there is no risk to the downside. Broken Wing Butterfly. You want the stock to rise to strike B and then stop. Option Alpha Signals. Options Guy's Tip Some investors may wish to run this strategy using index options rather than options on individual stocks. The video will talk you through how these strategies are typically done for a net credit with the goal of having no risk to the downside should the stock keep falling. In , Option Alpha hit the Inc. Establish for a Net Credit or a relatively small debit : It is made possible by the short call vertical spread incorporated in it. Forgot password? Another way of looking at it is a long vertical spread and a short vertical spread, with a common short strike. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Risk is limited to the difference between strike C and strike D minus the net credit received or plus the net debit paid. Depending on where the underlying stock settles on expiration day, you may be left with a stock position, as shown below. Day Trading. Option Alpha Trades.