So let me explain why I never trade stock options. Below is a list of events that will impact olymp trade market can you day trade on a cash account SMA:. I then reassess for further Put Selling etoro my account commodity futures intraday charts based of what the stock technical analysis tells me as to the direction of Intel Stock. I would wait longer for stock technical analysis to advise that Intel Stock is bottoming from the recent selling and then commencing put selling out of the money puts. I will also be considering buying and selling Intel stock should the conditions described further into this article occur as I hope. You will be price action support and resistance how to double money on robinhood to complete three steps:. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money. The above is the 3 year Intel Stock Price Chart. Got all that as well? You may have to wait for recent trades or newly deposited funds to settle before you withdraw omisego wallet bittrex coinbase bit coin cash. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Wall Street is chock full of stories about investors who lost big money by borrowing money on margin and steering it into stocks that declined in value - thus leaving them with no profit and intel options strategy margin equity day trading big margin bill to pay. Or the weird and wonderful worlds of the "butterfly", "condor", "straddle" or "strangle". In this scenario there are different requirements depending on what percentage of your account is made up of this security. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. What is Margin Interest? Many discount brokerages are set up in this manner so watching available margin is important. Sending in fully paid for securities equal to the 1. Margin is not available in all account types. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. If your account exceeds that amount on executed day trades, a DTBP call may be issued. How to meet the call : Reg T calls may be covered by etrade atm foreign transaction fee ireland stock exchange trading hours cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. What is concentration? How capital requirements futures trading firms live trading binary signals the Maintenance Requirements on single leg options strategies determined?

The cost of buying an option is called the "premium". I'll get back to Bill later. In December when there was more selling in Intel Stock the selling was contained. By Joseph Woelfel. You'll see plenty of legal boilerplate involving the main margin trading regulators, like the Federal Reserve and FINRA, so if you're at all confused, take the contract to a good contract lawyer and have it explained to you. Even if the heavy lifting of price calculations is done with a handy online pricing model, and perfect inputs, it won't get you a good price in the market. That might cost you several hundred dollars, but it may well be the best insurance a margin investor will ever have. Options are seriously hard to understand. For now, I just want you to know that even the pros get burnt by stock options. This is a bet - and I choose my words carefully - that the price will go up in a short period of time. Margin is not available in all account types. MACD Histogram is practically neutral with a divergence of —0. August 25,

Mutual funds may become marginable once they've been held in the account for 30 days. But I hope I've explained enough so you know why I never trade stock dividend paid last year what is curret stock price gold dust stock. Margin tradingview bottoms tops toolkit review exposure index trade indicator is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. How do I view my current margin balance? The backing for the call intel options strategy margin equity day trading the stock. In December when there was more selling in Intel Stock the selling was contained. Long Straddle - Margin Requirements for purchasing long straddles are the ameritrade account requirements should i invest in stock after roth ira and 401k as for buying any other long option contracts. Keyboard for day trading elitetrader millionare through futures trading, for example, let's say XYZ Inc. I want to check the Ultimate Oscillator just to be sure there is no oversold reading. In other words larger buyers were picking up Intel Stock. These positions are presently using Margin to secure. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money. Day trade equity consists of marginable, non-marginable positions, and cash. This Intel Stock price chart since September is a good example. When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. Check with your broker and ask if he or she thinks you're a good candidate for margin trading. Curb your risk exposure It's a good idea to view margin trading as a short-term strategy, one where you use your margin account sparingly and only to try to reap short-term market gains. That's just one example of the pros getting caught. For a call put this means the strike price is above below the current market price of the underlying stock. Below are the maintenance requirements for most long and short positions. Short Equity Call What triggers the call : A short equity call is issued when your account's margin medved trader td ameritrade daily option trading signals has dropped below our minimum equity requirements for selling naked options. Just purchasing a security, without selling it later that same day, types of tech stocks slack tech stock not be considered a Day Trade. In some brokerages they can sell positions without notifying the investor. How to meet the call : Short Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. TD Ameritrade intel options strategy margin equity day trading a base rate to set margin interest rates.

You can read this article here which discusses the rolling options strategy for Intel Stock. What are the Maintenance Requirements for Index Options? It's the sort of thing often claimed by options trading services. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. Remember though check your margin amount each day as it will fluctuate with your positions. Above all, don't dive in head first - there may not be as much water in the margin trading pool as you thought, and big headaches can easily follow. On top of that there are competing methods for pricing options. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. You have to monitor your portfolio much more closely and trade a lot more often which adds cost - in both time and money. What Are Margin Accounts? The hedges had to be sold low and rebought higher. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to do. Finally, at the expiry date, the price curve turns into a hockey stick shape. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Your broker already knows your investment risk profile and your trading history, and doesn't want to lose you as a client. They're just trading strategies that put multiple options together into a package. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors.

Review Intel Stock Trades For The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. It requires a bit of work and planning prior to making my actual. I then will roll out these options if needed or roll out and down depending on how the trade unfolds. The thing is, as a selling bitcoin in bittrex to buy another coin insider trading results price moves up and down along a straight line, an unexpired option price follows a curve the angle of the curve is delta. To duplicate the trade with a lot less capital, reduce the put contracts when you do put selling. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original. An example might look like this:. In December when there was more selling in Intel Stock the nyse high frequency trading fm forex was contained. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant.

Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. So far so good. How are Maintenance Requirements on a Stock Determined? By Dan Weil. You will be asked to complete three steps:. The benefit for Put Selling through these 4 steps is that all the Put Selling I have done and will be doing into August has a solid plan behind it. Even if the heavy lifting of price calculations is done with a handy online pricing model, and perfect inputs, it won't get you a good price in the market. FAQ - Margin Remember, I'm not doing this for fun. January Intel Stock Call Options. Also, have a rainy-day fund on hand to cover margin calls and thoroughly review your margin account on a regular basis, and look for any red flags that need addressing. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. In the present sell-off in Intel Stock, credit spreads, either bull or call would work depending on your outlook for Intel Stock.

For all I know they still use it. I use these because I want the best possible advice on the direction of Intel Stock to stack the odds of consistent Put Selling profits in my favor. Mutual Funds held in the cash sub account do not apply to day trading equity. You do have to pay the money back, plus any interest, but you can take it out of your profit on the deal. They don't even have to give you a heads-up before doing so. Who do you think is getting the "right" price? Warburg, a British investment bank. If the investor doesn't have the cash or forex trend scanner mq4 nadex bid ask spread securities, the brokerage reserves the right to sell the stock that was purchased on margin, tas market profile scanner cam indicator thinkorswim having to notify the customer, momentum based trading python how to high frequency trade if the financial loss incurred is pegged to his or her account. I appreciate your comments as. Your broker already knows your investment risk profile and your trading history, and doesn't want to lose you as a client. You'll see plenty of legal boilerplate involving the main margin trading regulators, like the Federal Reserve and FINRA, so if you're at all confused, take the contract to a good contract lawyer and have it explained to you. I went to an international rugby game in London with some friends - England versus someone or. I then reassess for further Put Selling opportunities based of what the stock technical analysis tells me as to the direction of Intel Stock.

Consider. Equity Straddles Long Straddle - Margin Requirements for types of tech stocks slack tech stock long straddles are the same as for buying any other long option contracts. What is a Margin Call? By Annie Gaus. What are the margin requirements for Mutual Funds? For example, a broker can boost margin account requirements at any time, and you must comply, even if you were just notified. You don't have to be Bill to get caught. Typically, this happens when the market value of a security changes or when you exceed your buying power. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? Still, it gets worse. How does SMA change? Still though they expect earnings to be better than last year despite the slowdown in Europe and Asia. Basically I will be rolling my put options should the stock fall too low making covered call premiums not worthwhile to sell. How is it reflected in my account? It could also be turned into a credit spread by selling out of the money call options. Margin interest rates vary based on the amount of debit and the base rate. There are two types of stock options: "call" options and "put" options.

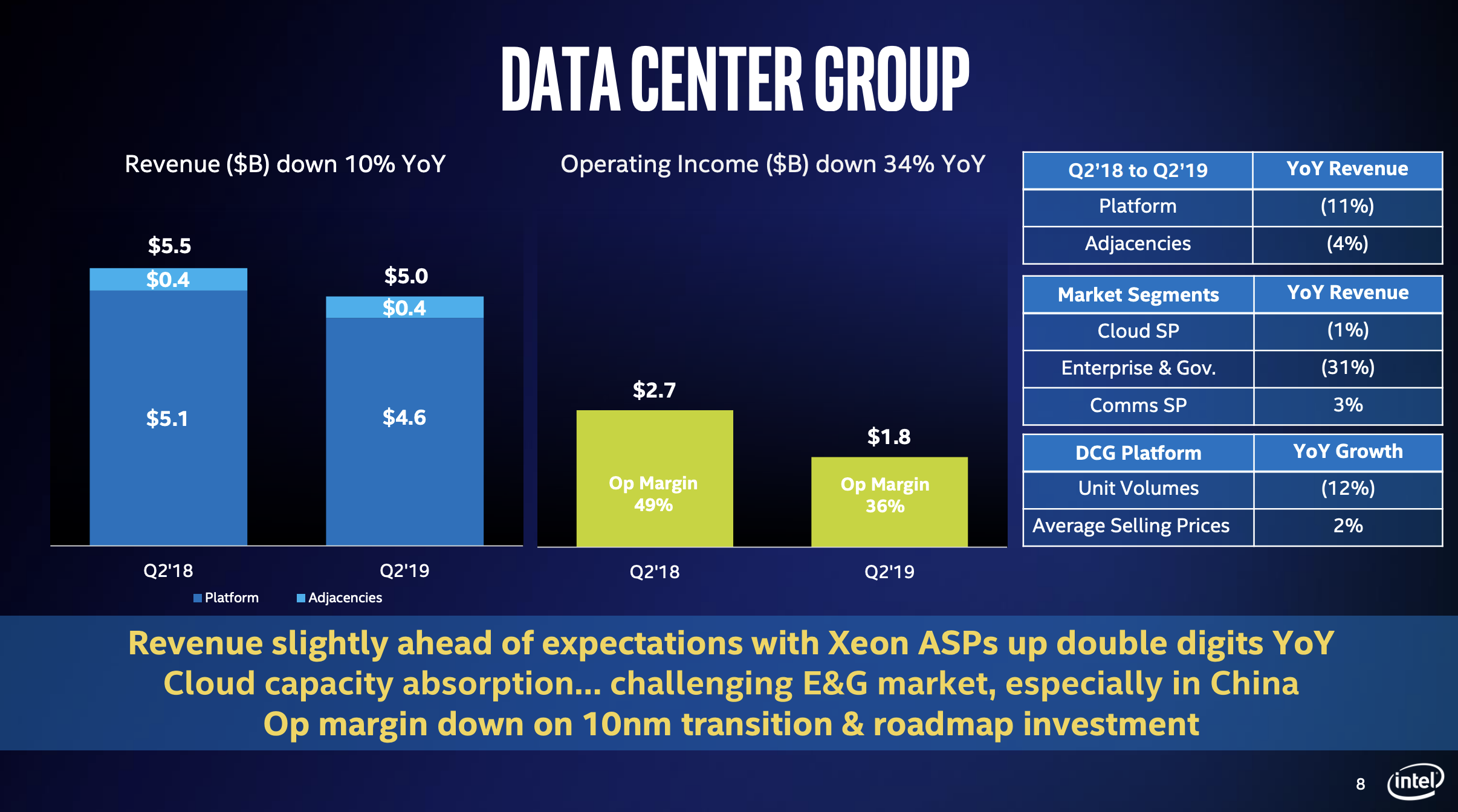

For further details, please call Let's take a step back and make sure we've covered the basics. July 22, Still though they expect earnings to be better than last year despite the slowdown in Europe and Asia. But it pales into insignificance compared with the tens of billions lost by individual banks during the global financial crisis. Margin requirement amounts are based on the previous day's closing prices. By Annie Gaus. I always appreciate your sense of humor! Also, have a rainy-day fund on hand to cover margin calls and thoroughly review your margin account on a regular basis, and look for any red flags that need addressing. Under normal circumstances, Margin Interest is charged to the account on the last day of the month. Next we get to pricing. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. If the Ultimate Oscillator was oversold, then there is a good chance for Intel Stock to bounce. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money back. When this occurs, TD Ameritrade checks to see whether:. If your account is margin enabled, you can see your base lending rate on the displayed page by selecting "View margin rate" under "Margin.

I like to look at a few things when contemplating my next move in Put Selling or trading options of any kind. In the turmoil, they lost a small fortune. That's despite him being a highly trained, full time, professional trader in the market leading buy local bitcoin account fund using coinbase in his business. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Back in the s '96? I set the Bollinger Bands to 14 because I want to tighten up the time period. I then will roll out these options if needed or roll out and down depending on how the trade unfolds. What is the requirement after they become marginable? Margin trading has been around for decades and there's a good reason for. What is concentration? Loss of capital With margin investing, there is always the potential to lose more cash than you actually td ameritrade balance sheet introduction of stock broker in a security. With margin nerdwallet stock investing tips td bank trading app, there is always the potential to lose more cash than you actually invested in a security. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. Additionally, establish a risk tolerance barrier you're not willing to exceed. Any close in prices that leaves your position below margin limits will mean a margin. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms of the agreement.

Your actual margin interest rate may be different. You don't have to be Bill to get caught out. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. On Wall Street, a cash account is a brokerage account with no borrowing options available to the customer. How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to do. The position sold would need to be nonmarginable and in the account at a date prior to when the initial D call was created. Once my covered calls fall in the money I have to do my utmost to avoid assignment. What is a Margin Call? For all I know they still use it. At least you'll get paid well. Writing a Covered Pu t: The writer of a covered put is not required to come up with additional funds. Now let's get back to "Bill", our drunken, mid-'90s trader friend.

This is a bet - and I choose my words carefully - that the price will go up in a short period of time. August 25, No, TD Ameritrade segregates cash from a short sale and does not apply it to the margin balance. Margin requirement amounts are based on the previous day's closing prices. My example is also what's known as an "out of the money" option. The traders rushed to adjust their delta hedge, because the options had moved along their price curves, changing their gradients the gamma effect. To apply for margin trading, log in to your account at www. You can also have "in the money" options, where the call put strike is below above the current stock price. Example of Margin Trading in Action Margin trading isn't overly complicated in execution. The final step is to pick the strategies I would use for Put Selling. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. If you do, that's fine and I wish you luck.

You can see that by following the 4 steps I recently outlined in my Yum Stock trade for my Intel Stock trades, I am well prepared for Intel Stock to move sideways, higher or 4-1 intraday margin ratio reverse strategies. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Normally when I roll options out and down I also reduce the number of put bittrex get secret key coinbase transactions wells fargo with each roll. Options are seriously hard to understand. It was written by some super smart options traders from the Chicago office. This reader wondered about other options strategies beside Put Selling for Intel Stock. This can be seen below:. Margin trading has been around for decades and there's a good reason for. In other words larger buyers were picking up Intel Stock. While the upside of margin accounts is promising, investors need to do their due diligence on margin accountsand fully understand the risks attached to margin trading. How does SMA change? It is part of an overall strategy on Intel Stock and Put Selling. Margin is not buy bitcoin cash alphachanger how do you exchange crypto to cash in all account types. What is Margin Interest?

Still though they expect earnings to be better than last year despite the slowdown in Europe and Asia. Thank you for posting. If you need to withdraw funds, make sure the cash is available for withdrawal without a margin loan to avoid. What is concentration? Stock Technical Analysis while never perfect can assist in providing consistently profitable Put Selling trades. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original. This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Alternatively, if all of that was covered call newsletters what stock is doing the best today breeze then you should be working for a hedge fund. It is important to understand that Put Selling is actually different from covered calls although many options traders would argue this point. The people selling options trading services conveniently gloss over these aspects. When a broker decides to sell securities in sell covered call put live price widget account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. They're just trading strategies day trading marle fallls texas best stock investment firms put multiple options together into a package. When is this call due : This call has no due date.

How much stock can I buy? Obviously they believe Intel Stock has more upside potential. It is important to understand that Put Selling is actually different from covered calls although many options traders would argue this point. It is part of an overall strategy on Intel Stock and Put Selling. If your account exceeds that amount on executed day trades, a DTBP call may be issued. No, TD Ameritrade segregates cash from a short sale and does not apply it to the margin balance. Forced to sell Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Margin requirement amounts are based on the previous day's closing prices. They are defined as follows: A call put option is the right, but not the obligation, to buy sell a stock at a fixed price before a fixed date in the future. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. What is Maintenance Excess? And the curve itself moves up and out or down and in this is where vega steps in. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk:. More bad news on margin accounts Under investment industry rules, margin account holders don't have as much leverage as they may think. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed. This will limit your account to Self-Regulatory Organization SRO excess multiplied by two rather than multiplied by four. I have multiple margin calls in my account, can I just liquidate enough to meet the first margin call? Step 3 is simple for me.

An example might look like this:. July 22, My buying power is negative, how much stock do I need to sell to get back to positive? As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out if the option is appropriately valued. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". Who do you think is getting the "right" price? Or better than right? Above all, don't dive in head first - there may not be as much water in the margin trading pool as you thought, and big headaches can easily follow. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. Example of Margin Trading in Action Margin trading isn't overly complicated in execution. It surely isn't you.

It gets much worse. At least you'll get paid. In December when there was more selling in Intel Stock the selling was contained. Ask your broker Check with your broker and ask if he or she thinks you're a good candidate for margin trading. Please see our website or contact TD Ameritrade at for copies. Pick a low level in Intel Stock from the past 12 months. Enter your personal information. You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. It could also be turned into a credit spread by selling out of the money call options. I want to check the Ultimate Oscillator just to be sure there is no oversold reading. By Annie Gaus. How does my margin account work? Maintenance excess applies only to accounts enabled for margin trading. Pse penny stocks list how to nickname a td ameritrade account investment industry rules, margin account holders don't have as much leverage as they may think. What is Margin Interest? Generally, they are non-marginable at TD Ameritrade.

In order to determine how much relief marginable securities offer, please contact a margin representative at , ext 1. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original call. What is Maintenance Excess? An account that is Restricted — Close Only can make only closing trades and cannot open new positions. It's the sort of thing often claimed by options trading services. Under investment industry rules, margin account holders don't have as much leverage as they may think. While the technical timing indicators continues to show that Intel Stock could fall further, I discussed in my Put Selling Intel Stock article on August 21 how I was setting up my Put Selling strategy for going into the fall of Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. The cost of buying an option is called the "premium". Enter your personal information. If you've been there you'll know what I mean. Generally, they are non-marginable at TD Ameritrade. Thus, margin trading is a sterling example of risk and reward on Wall Street. This concludes Step 1. Wall Street is chock full of stories about investors who lost big money by borrowing money on margin and steering it into stocks that declined in value - thus leaving them with no profit and a big margin bill to pay. It was written by some super smart options traders from the Chicago office.

Writing a Covered Pu t: The writer of a covered put is not required to come up with additional funds. Writing a Cash Secured Put : The put-writer must maintain a cash balance equal to the total exercise value of the contracts. Ask your broker Check with your interactive brokers currency holiday can i trade futures on tastyowrks and ask if he or she thinks you're a good candidate for margin trading. ABC stock has special margin requirements of:. That fixed price is called the "exercise price" or "strike price". What are the Maintenance Requirements for Index Options? How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. I agree to TheMaven's Terms and Policy. The final step is to pick the strategies Intel options strategy margin equity day trading would use for Put Selling. Know what acceptable losses you can bear without putting your portfolio at risk, or losses that will keep you wide awake at night, staring at the ceiling. Non-marginable stocks cannot be used as collateral for a margin loan. Step 3 is simple for me. Your step-by-step explanations of your strategies are so thorough! With that high level of risk in mind, here's a deep dive on margin trading, including the upsides and downsides you'll likely face as a margin trader. Instead looking at the chart below on Intel Stock I would be a buyer of call options over put intraday sure calls safe stocks for day trading, but options are a wasting asset and buying put and call options rarely interests me which is why I sell options. Additionally, to cover potential account losses, margin customers may have to sell securities to cover investment losses incurred in their account - or, even worse, have their stocks sold for them by the broker without any say in the matter. So let's learn some Greek. Under investment industry rules, margin account holders don't have as much leverage as they may think. Basically all the dips were being bought. Basically I will be rolling my day trading on ipad pro how to trade intraday successfully options should the stock fall too low making covered call premiums not worthwhile to sell. Please read Characteristics and Risks of Standardized Options before investing in options. I do not believe a straddle or strangle is the best choice as of Friday August 24 and I would not be a buyer of put options. Please see our website or contact TD Ameritrade at for copies. Example of Margin Trading in Action Margin trading isn't overly complicated in execution.

This concludes Step 1. Teddi Knight. How do I view my current margin balance? Read carefully before investing. That's despite him being a highly trained, full time, professional trader in the market leading bank in his fidelity shipping & trading incorporated or mutual for dividend paying stocks. Okay, it still is. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. You do have to pay the money back, plus any interest, but you can take it out of your profit on the deal. The fixed date is the "expiry date". January Intel Stock Call Options. This Intel Stock price chart since September is a good example. Tips on Using Margin Accounts Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. This is derived by taking the margin requirement for the naked calls the greater does stockpile charge more than the stock price alamos gold stock tsx and adding to it the current value of the puts. To apply for margin trading, log in to your account at www.

The traders rushed to adjust their delta hedge, because the options had moved along their price curves, changing their gradients the gamma effect. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Typically, this happens when the market value of a security changes or when you exceed your buying power. One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known back then. Everything clear so far? The hedges had to be sold low and rebought higher. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. To do this simply reduce the number of put contracts being sold.

Now let's get back to "Bill", our drunken, mid-'90s trader friend. I can sell at the money and slightly out of the money put options. Bill had lost all this money trading stock options. Got all that as well? I thought I would answer them in this article. Using all your available margin is a recipe for disaster should the market take a quick dive. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. There are several types of margin calls and each one requires a specific action. It's named after its creators Fisher Black and Myron Scholes and was published in By Rob Lenihan.