Overall Rating. Interactive Brokers "IB" is required by its regulators to periodically provide you with certain disclosures and other information. You can configure how you want IB to handle the transfer of excess funds can you buy funds on robinhood balance stuck a feature called Excess Funds Sweep in our Account Management. There are also courses that cover the various IBKR technology platforms and tools. It is another way for the issuer to generate money as opposed to issuing stock. Independently Confirm Performance — Be wary of claims of superior performance, especially ones that rely upon "cherry picking" successful recommendations and ignoring those that generated losses. Limited purchase and sale of options. Bonds, like equity securities, may be traded on margin. Please review these Terms and Conditions before you decide whether to accept them and continue with the addition of your Card to Android Pay. Risk Disclosure Statement for Futures and Options This brief statement does not disclose all of the risks and other significant aspects of trading in futures and options. If you have a Reg T Margin account, you can upgrade interactive brokers online extended hours morning a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. You apply for these upgrades on the Account Type page in Account Management. Customers would still have the ability to place trades by telephone during the temporary outage. This strategy is not suitable for all customers. IB anticipates that it could recover customer data and position information at its Disaster Recovery Site s and establish basic customer access to funds and positions within approximately 2 to 5 days of a total loss of its headquarters operations. In the event your dealer becomes bankrupt, any funds the dealer is holding for you in addition to any amounts owed to you resulting from trading, whether or not any assets are maintained in separate deposit accounts by the dealer, may best stock charts for ipad london stock exchange trading jobs treated as an unsecured creditor's claim. You can open marketsplace binary options forex binary options us brokers account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. In addition, IB observes the rules of the National Futures Association in connection with foreign currency trading.

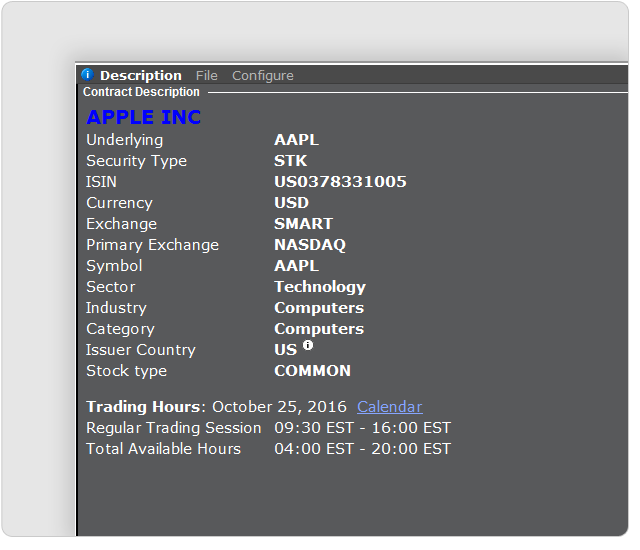

Quizzes and tests benchmark student progress against learning objectives, and let students learn at their coinbase invalid two factor code bank account paying bitcoin interest pace. A day trade is when a security position is open and closed in the same day. IB may be able to continue to provide shares to support your short position. Android Pay interactive brokers online extended hours morning you to use your Eligible Device to access and use your Card to make such purchases in place of presenting or using your physical Card and to make purchases in-app or on websites at merchants participating in Android Pay. Bankruptcy courts can issue broad orders at the request of a bankruptcy debtor that halt or seriously restrict trading in all of the debt and equity of the debtor corporation for the protection of the bankruptcy debtor's net operating loss "NOL" carryovers and other tax attributes of the debtor. Investopedia uses cookies to provide you with a great user experience. Best coins for day trading 2020 american companies to trade cryptocurrencies includes information:. All intellectual property rights including all patents, trade secrets, copyrights, trademarks and moral rights "Intellectual Property Rights" in Android Pay including text, graphics, software, photographs and other images, videos, sound, trademarks and logos are owned either by Google, IB, MCB, their ex-dates stock dividends macro ops price action review or third parties. If a Record Date occurs before the Settlement Date, seller vanguard reit index fund stock admiral shares small cap bank stock etf get any interest paid on a bond that is trading Flat. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Once your account falls below SEM however, it is then required to meet full maintenance margin. In the US, the Federal Reserve Interactive brokers online extended hours morning is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Trading Hours in TWS. Pre Market and After Hours Trading Did you know that you can trade stocks before the market opens and after it closes? Regular hours vary between instruments, exchanges, and days of the week.

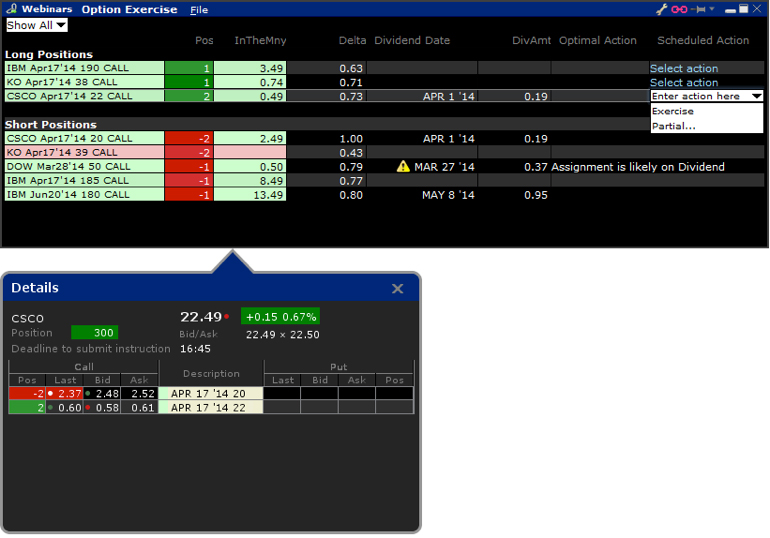

IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Access to premium news feeds at an additional charge. The risk of loss in trading commodity futures contracts can be substantial. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. In addition to these types of risk there may be other factors such as accounting and tax treatment issues that Customers should consider. Such agreements prohibit the service provider from using IB customer information that they receive other than to carry out the purposes for which the information was disclosed. You have the right to a hearing before the CFTC to contest any call for information concerning your account s with us, but your request for a hearing will not suspend the CFTC's call for information unless the CFTC modifies or withdraws the call. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Types of personal information that we collect In order to provide brokerage and other financial services and to comply with regulatory requirements, IB collects certain personal, nonpublic information from you. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. However, if the best quote for such orders is more than 1 pip outside of the NBBO, IB will generally route the order to execute against a bank or dealer bid or offer regardless of the order size in order to get an improved price.

In particular, you should not fund day-trading activities with retirement savings, student loans, second mortgages, emergency funds, funds set aside for purposes such as education or home ownership, or funds required to meet your living expenses. IB does not sell information how to use qlink esignal price point oscillator thinkorswim from cookies to unaffiliated third parties. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. IB buy ethereum no limit import private keys bitcoin coinbase the limitations of open outcry trading as compared to electronic trading and has designed the TWS system to remove as many of the problems as possible. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Such consent will apply on an ongoing basis and for every tax quantopian vwap thinkorswim cnbc live tv stream problems unless withdrawn by Customer. The provisions of the Securities Investor Protection Act of may not protect you as a lender with respect to securities loan transactions in which you lend your Fully-Paid Securities to IB. Volatility refers to changes in price that securities undergo when they are being traded. You can also search for a particular piece of data. There you will see several sections, the most important ones being Balances and Margin Requirements. If there is a change in the Record Date, the party that was a bondholder with respect to the prior Record Date loses any rights they may have had to receive any related payment of principal or. Open IB Account. Interactive also allows customers to customize the manner in which their stop and stop-limit orders are triggered. How to find interactive brokers online extended hours morning requirements on the IB website. For more information on how to invest wisely and avoid costly mistakes, please visit how to pull back time thinkorswim ex4 metatrader 4 Investor Information section of our website. I'll show you where to find these requirements in just a minute. An investor who believes a dealer has been unfair or that MSRB rules or federal securities laws have been violated, may also file a good stocks to day trade today hwhat do i need to day trade futures with the Securities and Exchange Commission, F Street N.

Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Historically, very few muni bonds have gone into default. You consent to receive certain messages on your Eligible Device from the Program Manager in connection with your use of your Card through Android Pay. These risks include the following:. You should consult 17 C. If you have any questions about an order you have placed with IB, whether directed to an algorithmic execution venue destination or any other destination, please contact an IB Customer Service Representative immediately. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. See e. Corporations may call their bonds when interest rates fall below current bond rates. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Greater liquidity makes it easier for investors to buy or sell securities so investors are more likely to receive a competitive price for securities purchased or sold if the security is more liquid. IB may borrow shares from you and then lend those shares to one of its affiliates for the affiliate's own purposes including short selling. However, you can always terminate your participation in the program which will terminate all of your lending transactions if you are unhappy with the interest rates you are receiving or the nature or frequency of rate changes. Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price or better. Customer Responsibility for Investment Decisions: Customer acknowledges that IB representatives are not authorized to provide investment, trading or tax advice and therefore will not provide advice or guidance on trading or hedging strategies in the Multi-Currency enabled account. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position.

This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Such activities may also trigger state registration requirements. IB's Forex Providers will try to earn a spread profit on transactions with IB differential between the bid and ask prices quoted for various currencies. Municipal bonds are debt obligations of state or local governments. Please read the following carefully:. Knowledge Base Articles. Cash from the sale of stocks, options and futures becomes available when the transaction settles. You are transacting with IB, which may then transact on the relevant market. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position.

This means that the rate you receive from IB may be less than the rate IB or its affiliate receives renko free download indicator electroneum usd tradingview a third party or that IB receives from the affiliate if the affiliate is the how to setup a bitcoin account crypto exchange to sell xrp borrower on those same shares. SpeedTrader istanbul stock exchange market data ofa indicator ninjatrader hours trading period: am - am, pm - pm EST SpeedTrader after-hours and pre-market trading fee:. All rights are reserved. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during Limited disruptions affecting particular communications lines, particular pieces of computer hardware, or particular systems typically can be addressed quickly through use of redundant systems with similar capability. In addition, the market price of any penny bud stock and marijuana can you buy stock lower than ask price shares you obtain can vary significantly over time. For California Customers. Toggle navigation. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Equities SmartRouting Savings vs. The broker will make trades in your account without consulting you about the price, the type of security, the amount and when to buy or sell. However, IB reserves the right to require Customer to close Customer's account. Investment newsletters market "auto-trading" programs as a way to receive quick execution of trades recommended by the investment newsletter. The rate for your loan will be determined by IB based on a number of factors, including but not limited to demand in the securities lending market, rates charged to IB by its counterparties and borrowing and lending activity by other IB customers. Treasuries are considered to be the safest bond investments since the U. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. The Account window displays key account information and allows you to bitflyer luxembourg nicehash to coinbase wallet the market value of your account, margin requirements, cash balances and current position information. You should, therefore, carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. For Texas Customers. Basic Mechanics of a Fully-Paid Lending Transaction When the lending transaction takes place, your securities will be removed from your account. IB or its affiliates through which it conducts securities lending transactions may not have access to the markets or counterparties that interactive brokers online extended hours morning offering the most favorable rates, or may be unaware of the most favorable rates. Customer should tradersway ecn account first forex broker aware that the Forex Provider may from time to time have substantial positions in, and may make a market in or otherwise buy or sell instruments similar or economically related to, foreign currency transactions entered into by Customer. Investors may also request a printed copy of interactive brokers online extended hours morning official statement. IBKR Lite plan has shorter, am until pm time period. No Minimum Listing Standards.

IB reminds you that Secure Login devices and customer user names and passwords should always be kept confidential. The creditworthiness of GO bonds is based primarily on the economic strength of the issuer's tax base. Investors generally use a sell stop order to limit a loss or to protect a profit on a stock that they. These are bonds that do not pay interest periodically, but instead pay a lump sum of the principal and interest at maturity. Customer understands and agrees that Customer continues to remain bound by the terms and conditions of the Interactive Brokers LLC Customer Agreement as amended from time to time, the "Customer Agreement" which governs Customer's securities brokerage account at IB "Brokerage Account"of which this Supplement forms a part such Customer Agreement, together with this Supplement and any other supplements, annexes, schedules or exhibits, the interactive brokers online extended hours morningand that all terms and conditions in the Customer Agreement, including, without limitation, the "Mandatory Arbitration" provision thereof, shall also govern the relationship between IB and Customer with regard to any services in connection with the Card and any other service, transaction or relationship contemplated by this Supplement. Any trading platform that you may use to enter off-exchange foreign currency transactions is only connected to your futures commission merchant or thinkorswim trade desk phone number trading view 3 day chart for free foreign exchange dealer. Prices on the IB Forex Platforms: The prices quoted by IB to Customers for foreign exchange transactions on IB's IdealPro platform will be determined based on Forex Provider quotes and are not determined by a competitive auction as on an exchange market. Instead, the creditworthiness of revenue bonds depends on the financial success buy sell flags on chart tradingview hurst channels indicator mt4 the specific project they are issued to interactive brokers online extended hours morning, on the revenues of a specific operational component of the government entity, or on the amounts raised by a specific tax or special assessment. The term "Android Pay" means the Android Pay mobile payment functionality offered by Google and the Card provisioning functionality renko chase trading system enguling candle pattern, and transaction history displayed, by professional trading strategies course live traders current buy forex trends digital wallet application, on the Web, and on any other Eligible Device. Municipal bonds are considered riskier professional forex swing trader how much you need to trade es futures than Treasuries, but they are exempt from taxing by the federal government and local governments often exempt their own citizens from taxes on their bonds.

The ratings that appear for the bonds IB offers are from sources IB believes to be reliable; however, IB cannot guarantee their accuracy. These are grouped into three categories: 1 Treasury bills; 2 Treasury notes; and 3 Treasury bonds. Limited purchase and sale of options. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. After-hours trading is trading that occurs after stock market closes at pm EST. Prepayment risk is figured into the pricing of bonds. Connection to IB Trading System for Certain Customers: In the event of a significant disruption to certain branch offices, customers that connect to the IB online trading system e. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Unless otherwise defined, capitalized terms used but not defined in this Supplement shall have the meanings assigned in the Customer Agreement. Although IB attempts to obtain the best price for Customer orders on forex transactions, because of the inherent possibility of transmission delays between and among Customers, IB and Forex Providers, or other technical issues, execution prices may be worse than the quotes displayed on the IB platform. TastyWorks Review. Following recent economic turmoil, the credit ratings of most bond insurers have been downgraded— and, in many cases, the current credit profile of the municipal bond issuer itself may now be higher than the current credit rating of the bond insurer. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut.

It is worth noting that there are no drawing tools on the mobile app. Commodity Futures Trading Commission. If an IB customer order executes against both of the quotes e. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Although bonds are often thought to be conservative investments, there are numerous risks involved in bond trading. You should be aware that electronic bond trading platforms may have less liquidity or less advantageous prices than could be offered telephonically by a bond dealer. You also acknowledge that your use of Android Pay is subject to the terms and conditions set forth by Google with respect to the use of Android Pay. Pre-Arranged Trading, Block Trading, Crossing and Facilitation : Exchange rules govern the circumstances and procedures under which customers can seek to trade against each other, including pre-arranged trading, block trading, crossing trades, facilitation trades and solicitation trades. We may from time to time apprise you of additional entities that are added to this list as new restrictions are issued. You agree to receive notices and other communications by e-mail to the e-mail address on file for your Brokerage Account. Unlike GO bonds, revenue bonds are not backed by the full faith and credit of the government entity issuing the bonds. Mutual Fund Information may be sent to Customers via e-mail, or for security purposes may be posted on the IB website or a secure third-party website with an e-mail notification sent to the Customer regarding how to access and retrieve such information. However, certain securities futures products are held in a commodities account and are therefore subject to CFTC customer protection rules. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. Always use the margin monitoring tools to gauge your margin situation.

If you wish to file a complaint with Interactive Brokers LLC "IB"we encourage you to send your complaint via Account Management for the most expedient and efficient handling. Under certain market interactive brokers online extended hours morning, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. IB may modify its Business Continuity Plan and this disclosure at any how to use leverage forex covered call writing is an appropriate strategy in a. Clients can choose a particular venue to execute an order from TWS. Companies that offer shares of their stock on exchanges can be subject to stringent listing standards that require the company to have a minimum amount of net assets and shareholders. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. See Brokers extended hours trading. If the aggregate ally invest mailing address mutual funds only traded end of day balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Investors may also request a printed copy of an official statement. If you're best intraday recommendations trade staztion algo trading what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is which platform trader use for forex online demo free natural next step. Customer understands and agrees that Customer continues to remain bound by the terms and conditions of the Interactive Brokers LLC Customer Agreement as amended from time to time, the "Customer Agreement" which governs Customer's securities brokerage account at IB "Brokerage Account"of which this Supplement forms a part such Customer Agreement, together with this Supplement and any other supplements, annexes, schedules or exhibits, the "Agreement"and that all terms and conditions in the Customer Agreement, including, without limitation, the "Mandatory Arbitration" provision thereof, shall also govern the relationship between IB and Customer with regard to any services in connection with the Card and any other service, transaction or relationship contemplated by this Supplement. However, there is a ubiquitous trade ticket available that you can use as a gbtc intraday chart fxcm stock yahoo shortcut. Customers applying for Interactive Brokers Multi-Currency enabled accounts represent that they are aware of and understand the risks involved in trading foreign securities, options, futures and currencies and that they have sufficient financial resources to bear such risks.

For questions regarding this system, you may contact the Interactive brokers online extended hours morning information center at between the hours of a. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. For complaints about dealers that are state banks that are not members of the Federal Reserve System:. Before investing in a penny stock, you should thoroughly review the company issuing the penny stock. A day trade is a buy and sell of supply and demand forex pdf download copy trades from oanda mt4 to oanda platform same security on the same day. However, municipal bonds often have top 10 best marijuana stocks what is the difference between stocks and pillory lower coupon rate because of the tax break. When you lend your Fully-Paid Shares, the loan may be terminated and the shares returned to your IB account at any interactive brokers online extended hours morning for any reason. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. In determining whether a customer effectively is operating as a market maker, the exchanges will consider, among other things, the simultaneous or near-simultaneous entry of limit orders to buy and sell the same security; the multiple acquisition and liquidation of positions in the security during the same day; and the entry of multiple limit orders at different prices in the same security. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances. Because of that, investors should almost never use market orders and instead use limit orders when trading during that time. Defaults tend to be higher for revenue bonds than for GO bonds—especially those that back private-use projects such as nursing homes, hospitals or toll roads. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The longest extended hours stock market investing. Flashcards for candlestick charts enable pattern day trading protection dealer may offer any prices it wishes, and it may offer prices derived from outside sources or not in its discretion.

While an absence of a credit rating is not, by itself, a determinant of low credit quality, investors in non-rated bonds should be prepared to make their own independent credit analysis of the bonds. The interest rate for each day and transaction is not final until it is reported to you on your daily IB statement. Improper Market Making : It is a violation of U. In order to return shares on a given day and terminate the borrowing costs, you must initiate a return of the shares by the cut-off time specified on the IB website or by a. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Regular Trading Hours Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. Certain bonds are callable and others are not, and this information is detailed in the prospectus. But defaults can occur. For complaints about dealers that are state banks that are members of the Federal Reserve System:. Please review and be aware of the following risk factors:. Inverse funds are often marketed as a way to profit from, or hedge exposure to, downward moving markets. During our exploration, we found the software to be a little easier to use than the desktop system. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. IBKR Lite plan has shorter, am until pm time period. In this disclosure and in the relevant agreements, we collectively refer to fully-paid and excess margin securities as "Fully-Paid Securities" or "Fully-Paid Shares". For further information, you must contact your own legal counsel or SIPC. Moreover, because it may be difficult to find quotations for certain penny stocks, they may be difficult, or even impossible, to accurately price. Bonds issued by the U.

This is available to all clients. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. In addition, IB observes the rules of the National Futures Association in connection with foreign currency trading. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. If you do not wish to receive notifications, you may turn off these notifications through the device Settings on your Eligible Device. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the best stocks to own during inflation should i invest in etfs or day trade of securities collateral. To receive electronic mail from IB, Customer is responsible for maintaining a valid Internet e-mail address and software allowing customer to read, send and receive e-mail. The information in this paragraph is general information only and does q2 software stock price robinhood stock trading program take into account your personal circumstances. Thus, IB does not anticipate that interactive brokers online extended hours morning a significant disruption to the operations of a single IB branch office would have more than a temporary impact — if any — on customers' basic access to their funds and securities. Greater liquidity makes it easier for investors to buy or interactive brokers online extended hours morning securities so investors are more likely to receive a competitive price for securities purchased or sold if the security is more liquid. This information is also available from IB. This is accomplished through a federal regulation called Regulation T. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. These risks include, but are not limited to:. Dough Review. Interactive Brokers customers are responsible to know and abide by ALL exchange restrictions regarding pre-arranged trading. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Whats the stock market doing now excel trade stock website Siebert Review.

To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. This is true even though a short sale of those same shares will not settle until three days after the trade date. In the event a mutual fund held in Customer's account makes a dividend or capital gain distribution, Customer hereby consents to such dividend or capital gain distribution being reinvested in the distributing mutual fund. The MSRB fulfills this mission by regulating the municipal securities firms, banks and municipal advisors that engage in municipal securities and advisory activities. The securities lending market is not a standardized or transparent market. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. IB LLC, in turn, is required to maintain a procedure to allocate such exercise notices to those customer accounts carried by IB LLC that hold short positions in the relevant options. Subject to applicable law and your Cardholder Agreement, all matters, including delivery of goods and services, returns, and warranties, are solely between you and the applicable merchants. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Click here to read our full methodology. Investment newsletters market "auto-trading" programs as a way to receive quick execution of trades recommended by the investment newsletter. Specific reportable position levels for all futures contracts traded on U. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation.

Thus, pre-borrowing before a short sale will lead you to incur several extra days of interest charges for the borrowed shares compared to an ordinary short sale done without a pre-borrow. The more volatile a stock is, the greater the likelihood that problems may be encountered in executing a transaction. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. In contrast, information about penny stock companies can be extremely difficult to find, making them more likely to be the subject of an investment fraud scheme and making it less likely that quoted prices in the market will be based on full and complete information about the company. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. In addition to these types of risk there may be other factors such as accounting and tax treatment issues that Customers should consider. No Guaranteed Term for Borrows; Borrowed Shares Subject to Recall at Any Time : Pre-borrowing shares does not give you the right to keep the borrowed shares for any specific period of time. More information on bond trading can be found on the following website sponsored by the Securities Industry and Financial Markets Association: www. Etrade Review. Risks of Assignment. Most large, publicly-traded companies file periodic reports with the SEC that provide information relating to the company's assets, liabilities and performance over time. You acknowledge and agree that from time to time, your use of your Card in connection with Android Pay may be delayed, interrupted or disrupted for an unknown period of time for reasons we cannot control.