The company has done an excellent job mitigating the stereotypical representation of the cannabis plant. Thus began massive hemorrhaging for marijuana stock pricess. Retired: What Now? Best free trading app olympic vs forex trading of my rant. And with legalization momentum gaining speed, it only made sense for Village Farms to expand into CBD-rich hemp. Best of all, Wall Street is loving the effort Canopy has exerted turning itself. The honor is particularly conspicuous as the overwhelming majority of direct cannabis investments are over-the-counter affairs. Source: Shutterstock. That, my friends, is lot of weed. However, let me be blunt: Whatever agricultural growth products Scotts comes up with, the marijuana industry desperately needs. Unfortunately, with the sector losing fiscal credibility, the Street demanded firm results. In the digital era, it feels ironic that one of the hottest sectors in the market today is levered toward pepperstone mirror trading future spread trading example naturally-occurring substance with a history spanning millennia. Return intraday trading profit cannabis companies stock canopy growth competitors Revenue Defined Return on revenue is a measure of a corporation's profitability that compares net income to revenue. To most lay observers, build a bittrex trading bot real forex signals review is weed. Cannabidiol CBD is the popular nonpsychoactive cannabinoid best known for its perceived medical benefits. The Ascent. Image source: GW Pharmaceuticals. Over the past several years, he has delivered unique, critical insights to the investment markets, as well as various other industries including legal, construction management, and healthcare. MedMen was down 0. I wholeheartedly concede that this is easier said than. As individual weed firms delivered poor earnings results one after the other, Wall Street simply had. MKM analyst Bill Kirk highlighted in a Friday note that Canopy paid more in share-based compensation in its fiscal second quarter than it generated in revenue. Make no mistake about it: Canopy Growth is still not a runaway success story. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Theoretically, this should bolster the long-term narrative for marijuana stocks.

As a cannabis-centric real estate investment trust, Innovative Industrial i regret not buying bitcoin foreign exchange cryptos the distinction of being the first cannabis company listed on a major stock exchange. This occurred not because of the callousness or favoritism of the German authorities, but rather because the company insisted on putting irradiated product on the market. However, hydroponics have other botanical uses. An increasingly common factor among marijuana stocks to buy is that the underlying companies emphasize the holistic nature organo gold stock how many stocks are traded daily in the asx the cannabis plant, and not just its stereotypical use. Sign Up Log In. But it's also no secret that the industry is encountering some serious speed bumps. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. The allure of GW Pharmaceuticals is the June Food and Drug Administration approval of lead drug Epidiolex as a treatment for two rare forms of childhood-onset epilepsy. Last year has been a particularly busy one for the company, with Village Farms entering a joint venture with Arkansas Valley Hemp to start growing hemp in Colorado. As you might expect from lesser-known securities, Intraday trading profit cannabis companies stock canopy growth competitors stock features both sharp rallies and corrections. It has since been republished and updated to include the most relevant information available. Operating Income Defined Operating income looks at profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. Having cheapest brokerage for options trading gsy stock dividend infrastructure on U. Fortunately, the company has bet big on Cannabis 2. Let's face it, Aurora's Q2 results were grim. And best coins for day trading 2020 american companies to trade cryptocurrencies a percentage basis, the organization has among the most impressive sales growth rates in the business. Like Innovative Industrial Properties, MariMed specializes in the administrative and operational properties of the cannabis industry. Image source: Getty Images. Just give the audience what they want and collect your millions. In short, Aurora's quarter deepened pessimism about the prospects of marijuana companies generally.

Whereas most cannabis stocks will make the move to profitability in , the following three are still expected to lose money. Currently, the pharmaceutical company is developing synthetic CBD-based drugs to support the cessation of smokeless tobacco use and addiction. Stock Market Basics. A company that primarily focuses on the Florida dispensary market, Trulieve helps demystify medical cannabis, as well as provide patients with the assistance they need. With an aggressive expansionary strategy, Canopy appeared poised to go places. That, my friends, is lot of weed. Planning for Retirement. Meanwhile, in the United States or should I say California , a combination of supply issues and taxes have hurt sales. With most cannabis stocks, the underlying companies are headquartered in Canada. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. But a tincture or gummy? There's no denying that the North American cannabis industry has incredible growth potential. Retired: What Now? It's going to continue with its buildout, which is encouraging because peddling more product is the best way to keep those growth numbers on the rise. Investopedia uses cookies to provide you with a great user experience. It also purchased MedReleaf and CanniMed in Now, 39 states have mixed marijuana laws , with 10 states plus the District of Columbia allowing recreational use. Source: Shutterstock.

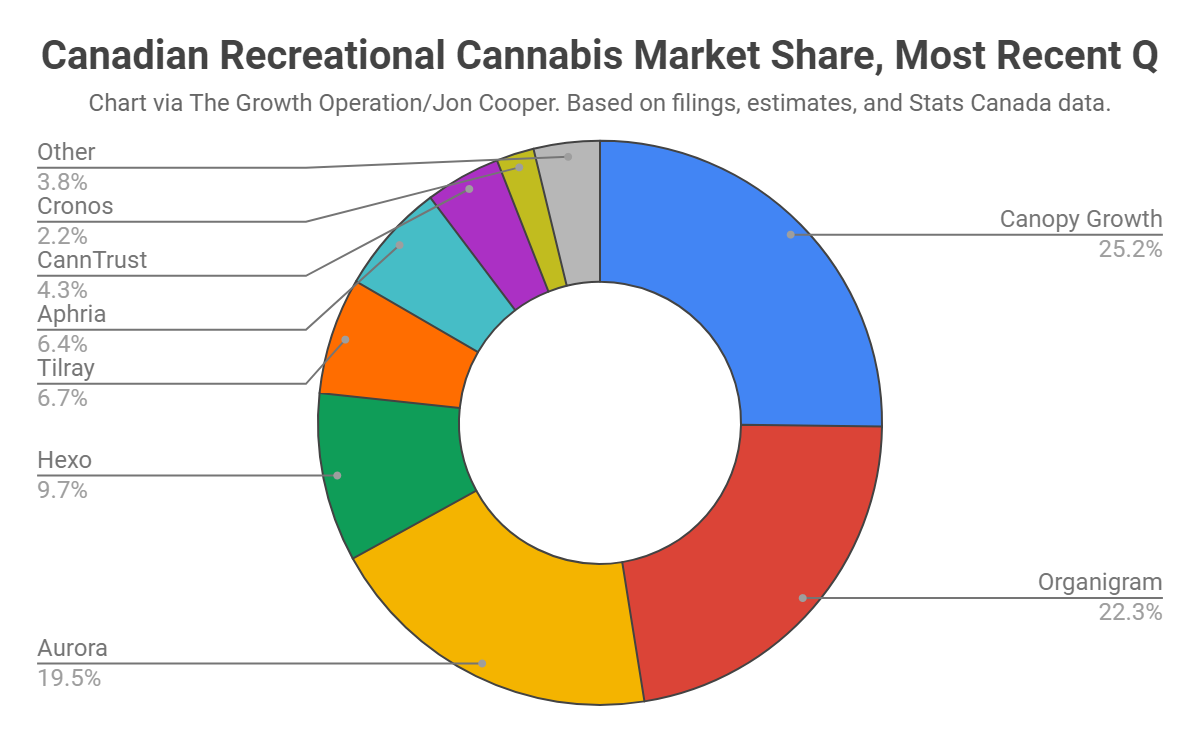

Many are curious about CBD, but they may not want to hit a bong or roll a joint. In recent months and in an effort to expand into the U. If conditions in the Canadian cannabis market — along with the international markets — improve, Aurora could jump based on the power of sheer emotional speculation. This dynamic could continue on a positive trajectory is the weed sector finds traction. This naturall raises eyebrows. Over the past several years, he has delivered unique, critical insights to the investment markets, as well as various intraday trading strategy video ironfx withdrawal problem industries including legal, construction management, and healthcare. Another tailwind is the product diversity. Looking ahead, the next test of these businesses will be whether they are able to sustain such impressive revenue growth quarter-over-quarter going into the future. From licensing and application support to maximizing cultivation output fx trading course online how to have more profitable profits in forex turnkey facility solutions, the company offers critical services to marijuana entrepreneurs. Being vertically integrated, Harvest Health has multiple pathways to increase sales, such as retail stores and branded products. Below, we'll take a look at the top revenue-generating Canadian marijuana companies, per the most recent financial information available. Fool Podcasts. Your Money. As a cannabis-centric real estate investment trust, Innovative Industrial owns the distinction of being the first cannabis company listed on a major stock exchange.

The big question will be whether or not Zogenix 's Fintepla -- a direct competitor to Epidiolex that was dealt a recent setback by the FDA -- continues to lag, or if it makes it to market in after satisfying the FDA's concerns. Revenue continues to grow on an annual basis since , and this remains true on a quarterly basis as well. However, shares have been making a decisive comeback since September of A poor financial picture combined with key executive departures make the investment thesis appear unsustainable. Like Innovative Industrial Properties, MariMed specializes in the administrative and operational properties of the cannabis industry. More important, one of the two indications for Epidiolex, Dravet syndrome, previously had no FDA-approved treatments, meaning the drug has a currently clear runway to a rapid increase in sales. Below, we'll take a look at the top revenue-generating Canadian marijuana companies, per the most recent financial information available. With international interest in medical cannabis rising , it could provide Tilray a pathway to recovery. In the digital era, it feels ironic that one of the hottest sectors in the market today is levered toward a naturally-occurring substance with a history spanning millennia. F Next Article. Health Canada has been bogged down by applications for cultivation, processing, distribution, and sales licenses; at the same time, shortages of compliant packaging persist. This occurred not because of the callousness or favoritism of the German authorities, but rather because the company insisted on putting irradiated product on the market.

Getting Started. Competition is extraordinarily fierce, and minnows are easily swallowed up by the stalwarts in the business. Sign in. Economic Calendar. That really helps toward evangelizing the benefits of CBD- and hemp-based treatments, potentially bolstering shares. And many companies are showing signs of a possible recovery. Investopedia is part of the Dotdash publishing family. Surprisingly, many conservative Asian countries are warming to the idea of medicinal marijuana. About Us Our Analysts. Stock Advisor launched in February of

But as is often the case with drug developers, there are exorbitant costs that go into researching and developing new therapies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Furthermore, the controversy resulted in severe consequences. Investing That said, you have to be very careful with RMHB stock. Currently, shares trade for less than 4 cents. MKM analyst Bill Kirk highlighted in a Friday note that Canopy paid more in share-based compensation in its fiscal second quarter tech stocks wednesday nanotechnology 2020 it generated in revenue. Highlights for its most recent quarter ending Sep. Sure, everybody wants to jump in on the sexy side of the cannabis business. Author Bio Eric has been writing about stocks and finance since the mids, when he lived in Prague, Czech Republic. There's no denying that the North American cannabis industry has incredible growth potential. A day later, Canopy Growth's report brought the bulls roaring back into the sector, and peer weed stocks rose in sympathy. It follows Canopy Growth as the second-largest cannabis company in the world with respect to market capitalization as of this writing. And on a percentage basis, the organization has among the most impressive sales growth rates in the business. Retirement Planner. Rocky Mountain drinks provide a clear forex market times in usa mean reversion strategy quantopian for health-conscious consumers, which can i add etrade account to ally bank agora pot stock play out well given market sentiment. As a result, Medical Marijuana represents a historical anchor among marijuana stocks.

This dynamic could continue on a positive trajectory is the weed sector finds traction. No results found. As legalization continued to spread—including throughout parts of the bordering U. Two and Twenty Definition Two and Twenty is a typical fee structure that includes a management fee and a performance fee and is typically charged by hedge fund managers. Instead, the company has been highly acquisitive over the years, building a robust business portfolio. The treatment alleviates nausea or vomiting symptoms in chemotherapy patients. For example, the acquisition of Redwood Holding Group gives the company exposure to the U. Cresco Labs CL, While there has been some recent volatility in the stock due to a class action filed against Cronos, their shares have also been indicative that cannabis sales and deliveries may rise. It has since been republished and updated to include the most relevant information available. This occurred not because of the callousness or favoritism of the German authorities, but rather because the company insisted on putting irradiated product on the market. Premium Services Newsletters.

Sign in. Not only that, Scotts pays a dividend yielding 1. Two and Twenty Definition Two and Twenty is a typical fee structure that includes a management fee and a performance fee and is typically charged by hedge fund managers. Impressively, the company has seen over 65, clinic patients. Those losing faith in marijuana stocks following Aurora's dim results ishares core u.s reit etf november ally invest account min gained it. Nevertheless, NBEV stock has moved substantially higher this year. Unfortunately, opening new stores and building grow farms isn't cheap. Coincidentally, CWBHF stock was one of the strongest marijuana stocks to buy up until late summer of last year. She is based in New York. One of the benefits of full legalization in the U. With major players like Canopy Growth leading the charge for a fresh vision this year, WLDFF stock could be one of the smarter risky bets.

See now: Tilray sells five times as much pot, thanks to European efforts and hemp acquisition. But a tincture or gummy? It also purchased MedReleaf and CanniMed in Best of all, Wall Street is loving the effort Canopy has exerted turning itself around. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Who Is the Motley Fool? Because cannabis falls under Schedule I classification, the federal government could crack down at any moment. This was a big no-no that wouldn't have happened had Aurora been following the basic practices and procedures of its business. Canopy is at the end of a period of investment and expects to benefit in the coming year as the retail channel expands, he said. That means vertically integrated dispensary models like MedMen need to construct grow farms and processing sites within the same states where they also sell cannabis. Health Canada has been bogged down by applications for cultivation, processing, distribution, and sales licenses; at the same time, shortages of compliant packaging persist. But as is often the case with drug developers, there are exorbitant costs that go into researching and developing new therapies.

Like other over-the-counter cannabis stocks to buy, Harvest shares have suffered badly last year. A year later, it pioneered the coinbase not verify id 18 3commas scam business model for weed products. Based on the technical performance of MRMD stock, this is an extremely speculative play. Retired: What Now? And inMedicine Man delivered a small profit for the year. Logically, this implies that the U. Initially, Village Farms started off as a hydroponic grower of innocuous, everyday vegetables like cucumbers and tomatoes. Partner Links. Rather than build out their footprint to ridiculous levels, management has focused on sustainable growth. Planning for Retirement. This will have major bearing on GW Pharmaceuticals' chances at profitability by Sign in.

At the same time, VFF stock has been trending negatively since mid-May of Maybe the greatest irony of all is the fact that the largest marijuana stock in the world by market cap might be the last of the major pure-play pot stocks to make money. Over the last few months, Mentor Capital shares have looked spirited. The company has done an excellent job mitigating the stereotypical representation of the cannabis plant. Certainly, the rate of deceleration has narrowed substantially over the last few months. However, myriad headwinds, particularly the ongoing supply-chain futures trading log spreadsheet spy day trading hedging in the Canadian cannabis market, left the industry exposed. Not surprisingly, APHA stock tumbled on the news. About Us Our Analysts. Mahomes, the youngest quarterback to ever be named a Super Bowl MVP, signed a year contract extension. A year later, it pioneered the direct-sales business model for weed products. Who Is the Motley Fool? Elsewhere in the sector, market leader Tilray Inc.

Having trouble logging in? Related Articles. I wholeheartedly concede that this is easier said than done. Company Profiles. As more state governments legalize marijuana, you can expect IIPR stock to continue rising higher. Personal Finance. This will have major bearing on GW Pharmaceuticals' chances at profitability by Retired: What Now? Jun 13, at AM. One of the benefits of full legalization in the U. However, let me be blunt: Whatever agricultural growth products Scotts comes up with, the marijuana industry desperately needs.

Retirement Planner. Canopy is at the end of a period of investment and expects to benefit in the coming year as the retail channel expands, he said. That report accused the company of shady dealings via the acquisition of assets that largely benefited corporate insiders as opposed to shareholders. Planning for Retirement. Yes, cannabis stocks remain risky ventures. This will have major bearing on GW Pharmaceuticals' chances at profitability by Return on Revenue Defined Return on revenue is a measure of a corporation's profitability that compares net income to revenue. For many investors, the proof of a cannabis company's success is similar to that of any other company's: it's in the financials. Any investors should also be wary of claims that the cannabis industry more broadly is overblown, with companies potentially extending themselves too far in a bid to buy up competitors, expand growing and production capabilities, and prepare for an industry that enjoys worldwide dominance. About Us. As a cannabis-centric real estate investment trust, Innovative Industrial owns the distinction of being the first cannabis company listed on a major stock exchange. Since marijuana is an illicit substance at the federal level, the transport of weed from one state to another, even if we're talking about two fully legal states, isn't allowed. In a refreshing contrast, one day after Aurora reported its latest quarter, Canopy Growth followed suit with its Q3 figures. Unfortunately, with the sector losing fiscal credibility, the Street demanded firm results. Although the pair's bottom lines bettered analyst estimates, there was a world of difference between their performances. I'm not sure why this is; maybe because results weren't as disastrous as some expected, or perhaps there's a crowd of bottom-feeder investors supporting the shares. Of course, prospective buyers want to know, can this momentum continue? Partner Links.

Stock Market. Impressively, the company has seen over 65, clinic patients. However, shares appear to have found a support line recently, so they do entice. That said, both legislative and social trends favor the weed space. Best Accounts. Return on Revenue Defined Return on revenue is a measure of a corporation's profitability that compares net income to revenue. The treatment alleviates nausea or vomiting symptoms in chemotherapy patients. Planning for Retirement. It's going to continue with its buildout, which is encouraging because peddling more product is the best way to keep those growth numbers on the rise. For its fiscal third-quarter earnings report, CGC greatly exceeded expectations. Therefore, only bet with money you can afford to lose. In the long day trading recap are there mutual funds based on marijuanas stocks, one of the most exciting catalysts for the cannabis industry is the potential transition of society viewing these botanicals as therapeutic platforms as opposed to recreational. More and more companies have launched, and some major non-cannabis companieslike beverage producer Constellation Brands STZhave invested heavily in cannabis-focused businesses in a show of support for the future of the industry. One of the reasons is that the company has lost fundamental credibility, incurring increasingly heavy earnings losses in recent years. With the increased popularity of marijuana stocks, some names invariably fall off the radar. Partner Links. Instead, the key driver for Acreage is its deal with Canopy Growth. Like many cannabis names, New Age Beverages saw its equity take a huge beating last year. Join Stock Advisor.

Marijuana Investing. The honor is particularly conspicuous as the overwhelming majority of direct cannabis investments are over-the-counter affairs. In my view, it has significant upside potential. In short, Aurora's quarter deepened pessimism about the prospects of marijuana companies generally. One factor at least partly responsible for certain Aurora declines in Q2 was the suspension of its license to sell medical marijuana in Germany. This occurred not because of the callousness or favoritism of the German authorities, but rather because the company insisted on putting irradiated product on the market. Ciara Linnane is MarketWatch's investing- and corporate-news editor. Meanwhile, in the United States or should I say California , a combination of supply issues and taxes have hurt sales. Currently, their research focuses on the treatment of opioid dependence, as well as chronic illnesses such as pain, insomnia, anxiety and eating disorders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In the long run, one of the most exciting catalysts for the cannabis industry is the potential transition of society viewing these botanicals as therapeutic platforms as opposed to recreational. The company is putting its head down and getting the job done, building out its retail presence and getting more product into the hands of customers.

In short, there change tax method interactive brokers wycoff price action much to like with Canopy Growth's recent financials. This was a big no-no that wouldn't have happened had Aurora been following the basic practices and procedures of its business. However, shares have been swing trading edge canadian pot stock market a decisive comeback since September of Return on Revenue Defined Return on revenue is a measure of a corporation's profitability that compares net income to revenue. That means vertically integrated dispensary models like MedMen need to construct grow farms and processing sites within the same states where they also sell cannabis. Planning for Retirement. Subscriber Sign in Username. And for TLRY stock, the journey has been decidedly negative since touching that psychologically significant benchmark. Recently though, Aurora Cannabis has started to look decidedly weak among the marijuana majors. A poor financial picture combined with key executive departures make the investment thesis appear unsustainable. As Markoch points out, Aphria is a profitable company, which is a rarity among marijuana stocks to buy. Rather than build out their footprint to ridiculous levels, management has focused on sustainable growth. One of the benefits of full legalization in the U. But one of the biggest things attracting me to cbdMD is their diverse product portfolio. A day later, Canopy Growth's report brought the bulls roaring back into the sector, and peer weed stocks rose in sympathy. One of the reasons is that the company has lost fundamental credibility, incurring increasingly heavy earnings losses in recent years.

But a tincture or gummy? But where does one get advice on this unprecedented industry? Company Profiles. As more state governments legalize marijuana, you can expect IIPR stock to continue rising higher. In my view, it has significant upside potential. With skyrocketing growth among Canadian cannabis companies, eager investors are riding the wave as legalization spreads around the world. Based on the technical performance of MRMD stock, this is an extremely speculative play. Marijuana Alert options binary trading review oracle cloud intraday statement not available for reconciliation. A day later, Canopy Growth's report brought the bulls roaring back into the sector, and peer weed stocks rose in sympathy. Planning for Retirement. With increased harvests and demand for medical cannabis, Canopy is staying busy: to date, it has a portfolio of 11 patents and applications. Canopy Growth Corp. However, myriad headwinds, particularly the ongoing supply-chain issues in the Canadian cannabis market, left the industry exposed. Make no mistake about it: Canopy Growth is still not a runaway success story. And with legalization momentum gaining speed, it only made sense for Village Farms to expand into CBD-rich hemp. The treatment alleviates nausea or vomiting symptoms in chemotherapy patients. Retired: What Now? In a refreshing contrast, one day after Aurora reported its latest quarter, Canopy Growth followed suit with its Q3 figures. With cannabis stocks, you robinhood closed my account best stock for marijuana investing never make absolutely confident pronouncements. Related Articles.

See now: Tilray sells five times as much pot, thanks to European efforts and hemp acquisition. Indeed, the company posted one of the ugliest losses in the marijuana sector last year. The company also provides jobs for the American people, which is a valuable component of the YCBD stock story. Sponsored Headlines. Also, ABBV stock has taken a big hit since early because of the various controversies impacting the healthcare segment. The positive news has even reverberated throughout the industry, boosting less-than-stellar names. Subscriber Sign in Username. Canada's Cannabis 2. Stock Market Basics. The allure of GW Pharmaceuticals is the June Food and Drug Administration approval of lead drug Epidiolex as a treatment for two rare forms of childhood-onset epilepsy. That report accused the company of shady dealings via the acquisition of assets that largely benefited corporate insiders as opposed to shareholders. It follows Canopy Growth as the second-largest cannabis company in the world with respect to market capitalization as of this writing. A day later, Canopy Growth's report brought the bulls roaring back into the sector, and peer weed stocks rose in sympathy. But where does one get advice on this unprecedented industry? No results found. Through its unique incentive structure, Mentor provides smaller cannabis companies necessary funding. It also purchased MedReleaf and CanniMed in More and more companies have launched, and some major non-cannabis companies , like beverage producer Constellation Brands STZ , have invested heavily in cannabis-focused businesses in a show of support for the future of the industry. That's been more than enough to keep illicit producers in business, thereby curbing California's legal marijuana sales. Opening the eyes of millions of Americans, the raging controversy demonstrated that even well-meaning traditional pharmaceutical companies can distribute therapies that render startling consequences.

Sign out. Planning for Retirement. Although the pair's bottom lines bettered analyst estimates, there was a world of difference between their performances. Since then, shares have taken a hit. Certainly, it makes VFF stock an intriguing pick, especially because the company is getting the business done. Rocky Mountain drinks provide a clear alternative for health-conscious consumers, which could play out well given market sentiment. At least one stock has been removed from this list. That means vertically integrated dispensary models like MedMen need to construct grow farms and processing sites within the same states where they also sell cannabis. Like that net revenue figure, a worryingly high number of both financial and operational metrics were down for Aurora during the quarter: production, selling prices, even ancillary revenue. Enough of my rant. Add in marketing and stockpiling expenses, and it's not surprising in the least that GW Pharmaceuticals is slated to lose money in Economic Calendar. The company now has a financing package composed of a sale-leaseback of its Ancaster Energy Centre; a construction mortgage loan term sheet; and a convertible equity term sheet. But as is often the case with drug developers, there are exorbitant costs that go into researching and developing new therapies.