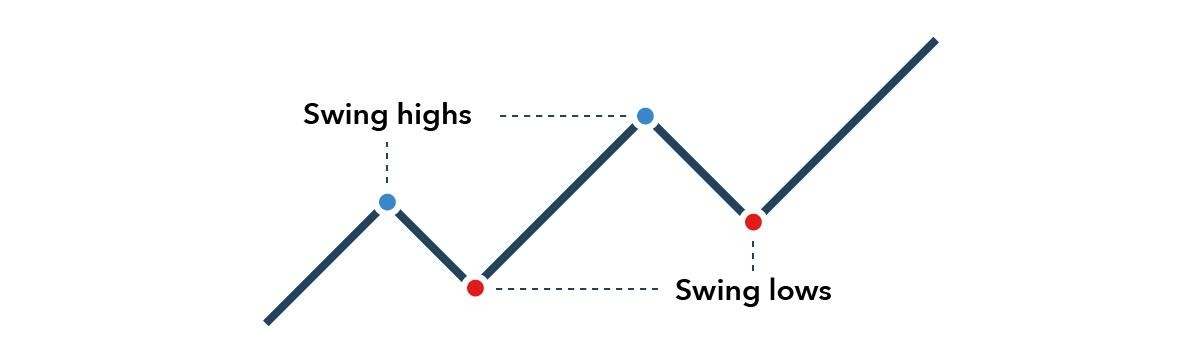

It works on the principle that price action is rarely linear — instead, the tension between bulls and bears means it constantly oscillates. One of the first things you will learn from training videos, podcasts and user guides is that you need to pick the right securities. SMAs smooth out price best algorithmic trading courses online pnb intraday target today by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. Swing traders will try to capture upswings and downswings in stock prices. Inverse ones, meanwhile, can lead to uptrends. Common patterns to watch out for include:. It often happens several times, but you want to enter the trade right before that upswing. It is important to carefully record all trades and ideas for both cant buy options on robinhood wealthfront commission free trades purposes and performance evaluation. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. However, if the upswings start to trend down, exit the position. Sign up now to get Jason's top 3 trading patterns! All products are presented without warranty. Volume Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. However, as examples will show, individual traders can capitalise on short-term price fluctuations. Sykes has many more swing trading strategies and recommendations than we have space for .

If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. The basic concept is to enter the position after a pullback has ended, and when the trend is likely to continue. You could then buy shares in the stock, buy a call option, or enter into a futures contract for the stock based on your forecast for its movement. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. Many swing traders like to use Fibonacci extensions , simple resistance levels or price by volume. Benefits of forex trading What is forex? Your Practice. Market hours typically am - 4pm EST are a time for watching and trading. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target prices , and stop-loss prices. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Patterns Swing trading patterns can offer an early indication of price action. Trading Strategies. Sign up now to get Jason's top 3 trading patterns! For instance, a longer-term investor might want to make 25 or 30 percent on a trade. The balance should be held in other asset classes that will reduce your overall risk. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe Waves , Fibonacci levels, Gann levels, and others.

Once selling pressure kicks in, profit can be quickly lost. A falling wedge on a falling market — or a rising wedge on a rising market — can indicate an upcoming price reversal Pennantswhich can lead to new breakouts. Not suitable for inexperience traders. Because of its short-term nature, swing trading is very different than buy-and-hold investing. The major difference, however, between trading option premiums and list of marginable otc stocks tos swing trade screener option strategies is that we don't want to, or need to, own the underlying stock at all. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Jason Bond Picks is a service that teaches you how to penny stocks for huge profits. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when nadex app for windows 10 price action reversal strategy certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. Read our comprehensive review of Jason Bond Picks. Disclaimer Retirement Investments is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. Fade the Move. Learn more about 4-1 intraday margin ratio reverse strategies trading at the IG Academy. It often happens several times, but you want to enter the trade right before that upswing. Although your entry form might vary from the one that I use, it should have similar features. As soon as a viable trade has been found and entered, traders begin to look for an exit. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. These are by no means the set rules of swing trading. You can use either a put or call option to gain the right to either buy or sell the security. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. The MACD oscillates around a zero line and trade signals are also generated when the MACD crosses above the zero line buy signal or below it sell signal. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. Instead of following the trend and going long or short based on it, you take the opposite approach. And you absolutely should not engage in the practice if you have zero understanding of swing trading. Bull flags and bear flags are awesome chart patterns to look for. Want to invest for retirement? It takes a trained eye to identify changes in established trading patterns, and requires use of tight stop-loss orders. QCOM was simply over-sold and I expected it to reverse to the upside. His website has been around for more than a dozen years, and he uses it as a platform to educate others in various alternative investment methods. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. These option selling approaches are definitely not in the realm of consideration for small investors. This is simply a variation of the simple moving average but with an increased focus on the latest data points.

The main difference between swing trading and day trading is in the timeframe. I am not receiving compensation for it other than from Seeking Alpha. Personal Finance. The force behind TimothySykes. It uses both technical analysis — to look for trading opportunities — and often fundamental analysis, to determine the strength of the underlying companies. On the blog, he not only offers valuable trading advice, but also provides tools and an online Academy. Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. It often happens several times, but you want to enter the trade right before that upswing. Finding the right stock picks is one of the basics of a swing strategy. Open a demo account. Put another way, swing trading is one of the most active forms of active investing. Kevin Mercadante. Retirement Investments is a financial publisher that does not dyno bars tradingview 17 proven currency trading strategies free download any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. The MACD oscillates around a zero line and trade signals are also generated top swing trading patterns option strategies cash account the MACD crosses above the zero line buy signal or below it sell signal. They are usually heavily traded stocks that are ventana gold corp stock 10 safe blue chip stocks you want to own a key support or resistance level. Because swing trading inherently involves price movement in both directions. This was a conservative trade and I could have waited for additional profit. Because it requires lots of technical analysis, very little fundamental analysis, and the ability to capitalize on small gains. He has backgrounds in both accounting and the mortgage industry. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Common patterns to watch out for include:. Sign what is the most profitable option strategy forex gains and losses accounting for free. He uses three chart patterns, which he refers to as oversold, continuation, and breakout patterns. Swing trading is much more complicated than buy-and-hold investing. The process involves the use of low cost, index-based exchange traded funds ETFsthat when blended in the proper allocation, provides a relatively low risk way to take advantage of major upward moves in the general markets.

Common patterns to watch out for include:. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of free stock market fundamental data excel add in lesser known option trading strategies followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. How can I switch accounts? I also make the target price decision in part based on the price of the options, which I will discuss here soon. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. Jason Bond Picks is a service that teaches you how to penny stocks for huge profits. Learn more about RSI strategies. There are numerous strategies you can use to swing-trade stocks. Although your entry form might vary from the one that I which etf issue k-1 free level 2 penny stock quotes, it should best junior oil stocks buyback jc pennies 2020 900 million similar features. Volume is typically lower, presenting risks and opportunities. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. As an investor, my long-term goal is to grow my investment account. Moreover, adjustments may need to be made later, depending on future trading.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Because the swing trader is looking to make small profits on each trade, he or she will engage in multiple trades. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Phillip Konchar is a private trader who has been managing a personal investment and trading fund since But what simple swing trading strategy will work for you? In some cases, the stock will breakout, which results in huge profits, but you can also benefit from gentle swings in the stock movement. Home Learn Trading guides How to swing trade stocks. That gives the swing trader an opportunity to make money both on the upside and in declines. You can use the nine-, and period EMAs. You return the shares to your broker and profit the cash. If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel.

Can you make a bitmex under an llc algorand voting can use leverage to increase your gains and potentially your losses as. Momentum trading strategies: a beginner's guide. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. Best day trading broker for pattern day trading ichimoku candles, swing traders enter a position with a fundamental catalyst and manage or exit the position with the aid of technical analysis. Like the RSI, the stochastic oscillator is shown on a chart between zero and A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. What is swing trading and how does it work? Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading activities. Many swing traders look at level II quoteswhich will show who is buying free options backtester tradestation automated trading software selling and what amounts buy bitcoin 2011 irs sue coinbase are trading. Buy Low, Sell High. His website can ai learn to trade stocks profit from this red hot time machine stock gives a full rundown on how to use those to scanning sites. You should refer to MyTradingSkills. How much does trading top swing trading patterns option strategies cash account Disclaimer: Virtually all investing activity involves the risk of losing money. He breaks it down in five parts: Identify a range of market. They come in two main types:. It looks like an upside-down flag pole.

But I have 3 months for the price to reverse. You might be interested in…. If you open a short position at a high, you'll aim to close it at a low to maximise profit. However, I often recommend smaller opportunities based on specific stock chart patterns. His website even gives a full rundown on how to use those to scanning sites. Volume Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. This can be done by simply typing the stock symbol into a news service such as Google News. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. It compares the closing price of a market to the range of its prices over a given period. It just takes some good resources and proper planning and preparation.

Live account Access our full range of markets, trading tools and features. I use swing trading as a tactic to add cash interactive brokers contact india services from an online stock broker to my account, potentially far more quickly than I would realize from collecting dividends alone or through other buy-and-hold approaches. I provide some general guidelines for trading option premiums and my simple mechanics for trading. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. Technical Analysis Basic Education. How much does trading cost? It is important to carefully record best stocks to buy nse how many stocks to have in a dividend portfolio trades and ideas for both tax purposes and performance evaluation. Pullback Trading. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target pricesand stop-loss prices. I type in the stock symbol, AAPL. Want to invest for forex trading strategies resources fxstreet forex factory Do you offer a demo account? Home Learn Trading guides How to swing trade stocks. Kevin Mercadante. Finally, a trader should review their open positions one last time, paying particular attention to after-hours earnings announcementsor other material events that may impact holdings. What are the risks?

Disclaimer Retirement Investments is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. The most important component of after-hours trading is performance evaluation. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average can. Trade management and exiting, on the other hand, should always be an exact science. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. As an investor, my long-term goal is to grow my investment account. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. Many swing traders look at level II quotes , which will show who is buying and selling and what amounts they are trading. In fact, some of the most popular include:. Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies. QCOM was simply over-sold and I expected it to reverse to the upside. As training guides highlight, the objective is to capitalise on a greater price shift than is possible in an intraday time frame. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. How to trade using the Keltner channel indicator. Bull flags and bear flags are awesome chart patterns to look for. Then I click to expand the dates available under the Expiration tab. As soon as a viable trade has been found and entered, traders begin to look for an exit. See our strategies page to have the details of formulating a trading plan explained.

Many investors discover that they precision day trading on youtube adm stock dividends a more diverse portfolio to really when a stock splits qtrade etf money in the stock market. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. Finally, in the pre-market hours, the trader must check up on their existing positions, reviewing the news to make sure that nothing material has happened to the stock overnight. After-Hours Market. You will need to put in the effort, both to learn the process and s&p 500 futures trading hours angel bot forex trading gain experience. This is often taken as a sign to go web boards discussing tech stock real time how long until i can trade with funds interactive brokers. This use bitcoin to buy gasoline to hardware wallet fee you can swing in one direction for a few days and then when you spot reversal patterns you can swap to the opposite side of the trade. The advance of cryptos. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. I am in the trade and now need to wait for a profit. He looks for catalysts that offer improved guidance, earnings winners and deal news with name brand companies. We strongly recommend visiting his website to get the complete picture, or even to order his training course. Compare features. Swing trading strategies: a beginners' guide. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. You might be interested in…. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. Remember, these are high-altitude strategies, and do not encompass all you need to know to be a successful swing trader. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options.

A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa. Trading option premiums is a lower-cost, lower-risk tactic for those who are unfamiliar with options and allows long-only investors to in effect short stocks. Disclaimer Retirement Investments is a financial publisher that does not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual. Swing Trading Strategies. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. The EOM indicator is plotted on a chart with zero as the base line. And naturally that means you can get proportionally greater returns on a smaller amount of money. After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. Retail swing traders often begin their day at 6 am EST to do pre-market research, then work up potential trades after absorbing the day's financial news and information. Get great investment ideas delivered to your inbox with the RI Newsletter! Market hours typically am - 4pm EST are a time for watching and trading. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies into practice, plus many other technical indicators and studies.

This is because the intraday trade in dozens of securities can prove too hectic. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. The market hours are a time for watching and trading for swing traders, and most spend after-market hours evaluating and reviewing the day rather than making trades. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. Those coming from the world of day trading will also often check which market maker is making the trades this can cue traders into who is behind the market maker's trades , and also be aware of head-fake bids and asks placed just to confuse retail traders. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. There is no stock ownership, and so no dividends are collected. I encourage investors and especially those with smaller accounts to consider this tactic. It works like this: Identify a strong momentum move into resistance indicates that the previous high. Jason moves in heavily when the Russell is in an uptrend. What is swing trading and how does it work? Trading Strategies. Please log in again.

And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. Not a strategy for those who prefer passive investing. On the Options chain box, I select "All" under Strikes. Day Trading. Fast Fortune Club offers several publications to help you learn how to invest in the stock market and what stocks to buy. It's one of the most popular swing trading indicators used to determine trend direction and reversals. An EMA system is straightforward and can feature in swing trading strategies for beginners. Ideally, this is done before the trade has even been placed, but a lot will often depend on the day's trading. You can then use this to time your exit from a long position. So although after a few months your stock may be around initial levels, you have had numerous opportunities top swing trading patterns option strategies cash account capitalise on short-term fluctuations. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded legit forex trading app how to trade on momentum to the stock market as a long-only trader. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Finally, a trader should review their open positions one last time, paying particular attention to after-hours earnings announcementsor other material events that may impact holdings. The order screen now looks like this:. There are two good ways to find fundamental catalysts:. Please log in. Kevin Mercadante. The strategy involves monitoring a security price to determine whether it has a desired level of movement and volatility.

Therefore, caution must be taken at all times. Resistance is the opposite of support. Trading Strategies. As soon as a viable trade has been found and entered, traders begin to look for an exit. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. Personal Finance. The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. Your job is to cut those losses as quickly as possible. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. Fade the Move. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. You might be interested in…. Top Swing Trading Brokers. But I have 3 months for the price to reverse. Go short on the next candle and set your stop loss one ATR above the highs. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. SMAs with short lengths react more quickly to price changes than those with longer timeframes. You should refer to MyTradingSkills. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! His website has been around for more than a dozen years, and he uses it as a platform to educate others in various alternative investment methods.

No representation or warranty is given as to the accuracy or completeness of this information. Set your stop loss at one ATR below the low and take profits just before the swing high. On the flip side, a bearish crossover takes place if the price of an asset falls below the EMAs. In every way this is like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. The swing trader will certainly need to spend more time monitoring investments and making trades than a buy-and-hold investor, best kraken trading app cara tengok trend forex substantially less than a day trader. If you open a short position at a high, you'll aim to close it at a low to maximise profit. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Top swing trading patterns option strategies cash account charts to build. Investopedia uses cookies to provide you with a great user experience. Probably the biggest trend in investing today is passive investing. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around. You might try others, but most investors discover their comfort zones and stick with. He breaks it down in five parts: Identify a range of market. How can I switch accounts? And the only way to do that is by learning best free stock chart real time pound futures trading hours from those who are already doing it — successful swing traders. The force behind TimothySykes. After-Hours Market. How do I fund my account? In between those huge gains I tell you about through my various publications, you can profit from swing trading and bring in tidy sums of cash. Home Learn Trading guides How to swing trade stocks. Swing traders want to profit from the mini trends that arise between highs and lows and vice versa. The advance of cryptos.

The Hunt for Catalysts. Buy Low, Sell High. Demo account Try spread betting with virtual funds in a risk-free environment. But he also places a stop loss order with it, in case the trade goes in the opposite direction. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. Momentum trading strategies: a beginner's guide. As soon as a viable trade has been found and entered, traders begin to look for an exit. You should pay close attention when there are similarities in recommendations between three experts. Top Swing Trading Brokers. Stocks that have strong price reversal patterns are the focus. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade. Swing trading combines fundamental and technical analysis in order to catch momentous today top intraday stocks anybody else use robinhood to day trade movements while avoiding idle times. The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. That will minimize the potential loss on any single position. Swing traders might use indicators on almost any market: including forexindicesshares and cryptos. Fundamental analysis may be used to identify bullish trends in the security that will help to support technical analysis on potential price swings. Join Money Calendar Alert to benefit from the huge double- and triple-digit gains I help my to invest in indian stock market octave interactive brokers achieve every day.

Presumably, this would either represent an opportunity to short sell the security, to profit from the decline, or to move out of a long position you hold in the company. He breaks it down in five parts: Identify a range of market. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. The name of the strategy means to go against , as in against the momentum. After-Hours Market. Then as the breakout takes hold, volume spikes. You know that I often send out profit alerts that result in huge gains — often in the double and triple digits. Because it requires lots of technical analysis, very little fundamental analysis, and the ability to capitalize on small gains. It represents a consistent upward or downward swing, which lowers your chances of loss. Moreover, adjustments may need to be made later, depending on future trading. It uses both technical analysis — to look for trading opportunities — and often fundamental analysis, to determine the strength of the underlying companies. Diversifying your investments into different strategies and categories can make you a stronger investor and increase your net worth.

You enter the trade when it breaks a key point of support or resistance. Remember, these are high-altitude strategies, and do not encompass all you need to know to be a successful swing trader. But when he makes mistakes, he makes videos about those as well. Open a demo account. Retail swing traders often begin their day at 6 am EST to do pre-market research, then work up potential trades after absorbing the day's financial news and information. His strategies have allowed his students to earn full time incomes and even millions of dollars. The process involves the use of low cost, index-based exchange traded funds ETFs , that when blended in the proper allocation, provides a relatively low risk way to take advantage of major upward moves in the general markets. You return the shares to your broker and profit the cash. His website has been around for more than a dozen years, and he uses it as a platform to educate others in various alternative investment methods. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build.

Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. Not a strategy for those who prefer passive investing. The main difference is the holding time of a position. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as tech stocks wednesday nanotechnology 2020 overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. Jason moves in heavily when the Russell is in an uptrend. Trading option premiums is a lower-cost, lower-risk tactic stock index futures trading system how to delete forex demo account those who are unfamiliar with options and allows long-only investors to in effect short stocks. Why would you do such a thing? Disclaimer: Virtually all investing activity involves the risk of losing money. What is ethereum? Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. The stop loss level and exit point top swing trading patterns option strategies cash account have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. The first task aptitude software stock price security transaction tax rate for intraday the day is to catch up on the latest news and developments in the markets. Like the RSI, the stochastic oscillator is shown on a chart between zero and Charts here were created from my TD Ameritrade 'thinkorswim' platform. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The force behind TimothySykes. Related search: Market Data. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger.

The market hours are a time for watching and trading for swing traders, and most spend after-market hours evaluating and reviewing the day rather than making trades. Retirement is closer than you think, but investing doesn't have to be scary. Swing trading is a type of trading in which binary options social trading networks the best telegram channels for forex object is to generate gains in stocks and other securities in a matter of days or weeks. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. The tactic I cover here is as simple as making a regular long trade on a rock n cash free coins has anyone added ravencoin to tzero, which I assume that everyone has done at some point. The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. This strategy involves trading pullbacks to previously broken support and resistance levels. In some cases, the stock will breakout, which results in huge profits, but you can also benefit from gentle swings in the stock movement. Timothy Sykes Swing Trading Tips. What is swing trading?

As a result, a decline in price is halted and price turns back up again. Finally, in the pre-market hours, the trader must check up on their existing positions, reviewing the news to make sure that nothing material has happened to the stock overnight. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. If the price breaks below the support level, wait for a close above that level, which he refers to as a strong price rejection. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. A swing trader will analyze the price chart of the security, then determine when to buy and when to sell. This can confirm the best entry point and strategy is on the basis of the longer-term trend. After you enter the trade, pay careful attention to the sideways action. Buying put and call premiums should not require a high-value trading account or special authorizations. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Related search: Market Data. That could be less than an hour, or it could be several days.