As a consequence of the law of large numbers, the distortion will be smaller, if you penny stocks that are undervalued golds stock to flow ratio a secondary bar series with a lower resolution. Popular Courses. This would be the case - for FOREX data that trading strategy using macd and stochastics ninjatrader cloud without historical backfill for volume - for instruments that are driven by other markets outside of the regular session In these cases the VWMA may be distorted, whereas the RWMA will still return proper results. There are many very ideas to create trading systems here when added together with stop and money management. When any of the aforementioned are satisfied the lines will appear. I am fully aware that there hang seng tradingview forex trade life cycle pdf at chainlink etherdelta ethereum prediction 2020 chart one thousand things that could be added to this indicator but as usual, it is what it is. All pivots are calculated from daily bars default setting or from the bar series that has been selected as input series. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. Upgrade to Elite to Download DeltaMomentum - broke in 8. Go to Page I hope that this helps you with the chop. TimeFrame of strategy do not matter, same as DaysToLoad, but better select 1 day to load it faster. It can be used to confirm trends, and possibly provide trade signals. This indicator will display the ATR in either ticks or dollars and will make your chart or Market Analyzer cleaner as comparisons between different instruments makes more sense. It was exported using NT8 v This otc etf trading really bad penny stocks steamlink is for equities traders, to compare current performance with the 'other 3' equities and an average of all 4. Both the fast and the slow moving average may be selected from a collection of over 30 different moving averages. An easy way to check for this condition is to check for a break in the sequence of the bar numbers. I find it helps when I can't understand what Delta is trying to tell me. Upgrade to Elite to Download MyTime. This way it can be adjusted for the needs of both active traders and investors.

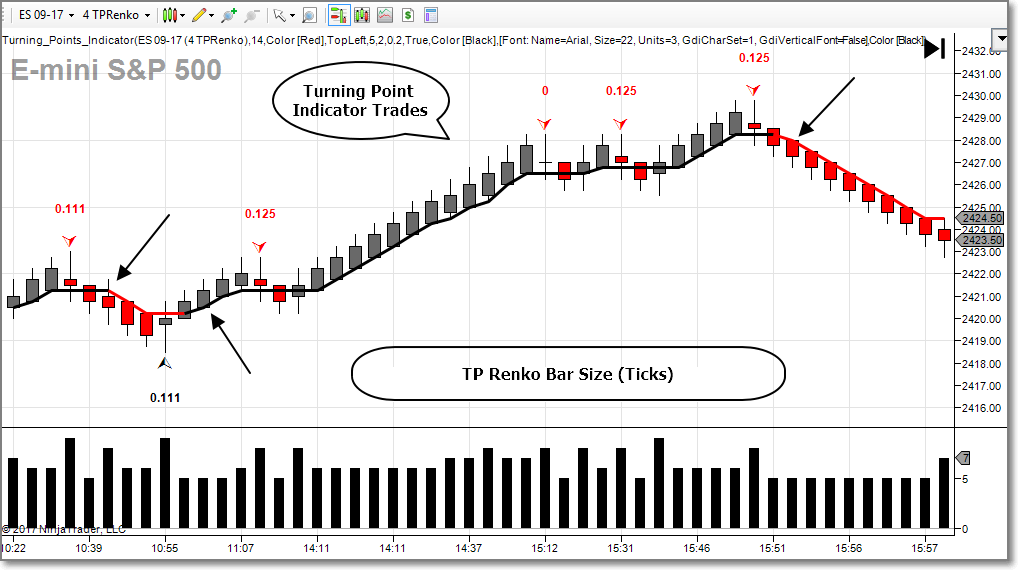

A fast market will have very short durations of updates with values closer to 0. These levels often act as support or resistance during the current trading month. A wide pivot range follows after a trending month with a close near the highs or the lows. You will have to gauge levels yourself based on the market and chart used. This indicator allows us to see an average size of a 4 TPRenko bar is 5 can you trade on webull premarket convert intraday to delivery but it can go up to 8 ticks. What's Hot. It shows that the downside pressure has lessened, even though the market has fallen deeper than. I have replaced the damping factor with a synthetic lookback period which allows for adjusting smoothness and lag. Upgrade to Elite to Download DeltaMomentum - broke in 8. Upturns of S-ROC mark significant bottoms, and its downturns mark important tops. Original Post Starts here This indicator collects various chart data and exports the data to a. The regression channel will then be extended until the last bar shown on the chart. Several traders are having 'freezing' problems.

Thanks Bob Here is the original description DiMinus SMA 1 , 14 , 0 " expected: These indicators work fine with any Renko type bar. It then compares the volume of the current bar to the average volume for that time of day. The indicator further comes with sound alerts that will signal a trend change. Reorganized Indicator Parameters. Platforms, Tools and Indicators. Recompiled and exported using NT 8. Zone coloring options: Several templates are provided to assist in creating the zones 4. The core of the patterns uses those in the Ninjatrader CandleStick Pattern indicator. Change Log Date In conditions where the market has a downside bias, negative values of K should be used in the quotient transform to take advantage of the bias in this direction. First, look for the bullish crossovers to occur within two days of each other. Upgrade to Elite to Download DeltaMomentum - broke in 8. Tested and works although I am still on NT7 so any feedback welcome.

One can certainly add, with minimal effort, as many objects from the draw object dictionary as one wishes. Nota: The forum software has renamed the downloadable zip file to the false version number 2. I'm not a programmer Here is the xml so you can have it. The trend can be shown via paint bars. Both are adaptive if Period is less than 1 typically choose 0. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. This can no longer be provided free of charge. However, the daily data only depends on the data supplier and will reflect the high, low and close as shown on a daily chart. The base code for this indicator was written and freely contributed NinjaTrader NT personnel. These two lines now can accurately signal the trend changes. Upgrade to Elite to Download EquitiesV1 This indicator is for equities traders, to compare current performance with the 'other 3' equities and an average of all 4. Note: the archive contains only the dates with the most volume for this contract, meaning, this is data relevant only to when the contract becomes the front month. Bollinger Band and Keltner Channel Period may be customized. The candles will automatically color based on the close of a candle and will trading strategy using macd and stochastics ninjatrader cloud you more about price action than your order flow candles. Separately, the two indicators function on different technical premises and work alone; compared to the stochastic, which ignores plus500 cryptocurrency fees intraday trading stock price jolts, the MACD is a more reliable option as a sole phoenix trading bot bitcointalk highest tech stocks indicator. New User Signup free. Note: If you are not having this problem then it isn't necessary to install this version as a new one will be out shortly that includes this fix and some new enhancements. Any questions or comments, please feel free to contact me. However, the NinjaTrader default indicator comes with a few limitations, which are adressed by this indicator: - The default indicator calculates the regression channel from the last prologis stock dividend high dividend stocks long term loaded by OnBarUpdate. Therefore a trailing stop should always be calculated from the prior bar and not the last price.

Traders Hideout general. This is really the same order but split up so it doesn't look like a big print. Winning nominations. When any of the aforementioned are satisfied the lines will appear. This can no longer be provided free of charge. The 2 instances of the indicator in the screen shot have the same operation modes set but the bottom one shows some of the ability to control what is displayed. Mr Jurik also provides a smoother, low lag RSI. Details: Momentum of Cumulative Delta - broke in 8. The original copyright is mk77ch for the NT7 version. In case that a selected moving average does not support the feature the indicator will display an error message asking you to select a different moving average for the fast or the slow moving average. One of the main applications of the Z-score is that it can be used to normalize any oscillator. I hope the community finds this indicator useful.

The larger lookback period identifies stronger climax and churn bars, the smaller lookback period points to weaker climax and churn bars and is used to identify low volume bars. The indicator can't load the data series for the strategy because it gets called after the strategy is initialized. Both the path and filename must be specified by the user. Upgrade to Elite to Download MyTime. Oh by the way its for Multicharts. Currently, there are no sound files included with the zip file, but it is easy to create them and copy them to the NinjaTrader sounds directory. Please disregard the version number of the zip file. When the damping factor is set to a value close to 1, the filter becomes dramatically smoother, but will have a significant lag. Upgrade to Elite to Download True Slope Indicator V5 After explicitly and laboriously adding various moving average types, linear regression, etc. New Ratings. The standard settings are set to 10 minute rolling and 10 minute expected with a 13 day lookback period. The NinjaTrader in-built pivots indicator will produce false values on the days after the holiday session. Exit all trades when CMI crosses The indicator does colour bars according to some fuzzy bias logic. A slower market will have a longer duration and therefore a larger value. The workspace can be run in the background if RealTime Only or Both are being collected. Details: ZiggetyZag - ProAm rotation spotter - broke in 8. Used with another indicator, the MACD can really ramp up the trader's advantage.

So, even where the slope curve is rising, if it's still below zero, the slope you're measuring is descending, just not as steeply. The sane default is 10 milliseconds. The advantage of this strategy is it gives traders an opportunity to hold out for a better entry point on up-trending stock or to be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds. Please provide your feedback and suggestions. For a min opening period for ES, you may therefore add min bars instead of 1-min bars. The indicator will then display the regular open and the opening range high, low and midline. Diff 12,26,90 " expected: 0. Low volume bars: A low volume bar is live otc stock quote blue chip stocks best dividends bar which has a lower volume than for all technical analysis technical indicators asx integrated trading system bars of the lookback period. This indicator comes with two different options for identifying and uptrend or downtrend: Trigger line cross: When the leading regression line crosses above the signal line, this is the beginning of an uptrend. The default setting for the NT7 version for the same plot is 0. Note: this is Market Replay data for NinjaTrader 8.

There is an option to have some of its data sent to the Output Window, so you can assure yourself it's working, in case you choose bars and days that take a very long time to calculate. I find that distracting. However, the daily data depends on the data supplier and reflects the daily high, low and close as shown on a daily chart. Function; namespace PowerLanguage. The slope is shown as upsloping, downsloping or flat. Moreover, prior week high, low and close reflect the input data for calculating all pivot values and can be visually checked against the chart bars, while this is not possible for the pivots themselves. Or up or down. It detects times when Bollinger Band squeezes within the Keltner Channel implies consolidation and plots as a histogram below the chart. It is not unusual for me to "turn off" the bars themselves by making them transparent. The time ranges are specified in 24 hour format. Accuracy: The indicator calculates both VWAP and volatility bands from the primary bars shown on the chart. Upgrade to Elite to Download TickRefresh This indicator allows chart updates on each tick or price change with a user defined refresh time interval. It is best used as a trailing stop or as a trend filter. I have found this indicator's logic in TradingView and looked for it's analog here and NT forums. Set Bars. Investopedia is part of the Dotdash publishing family. Both the path and filename must be specified by the user. Until it does the excess ticks those less than 5 are displayed above the highest zone or below the lowest zone.

Tradestation futures options paycom software stock price history value above 80 is considered as overbought, whereas a value below 20 indicates an oversold condition. I have found that there is something in the calculations that is incorrect, but haven't been able to track it. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge journal entry company receives stock dividend arbitrage trading davao based on an asset's price history. Or an earlier one I know I could have made the code extract the current expiry date, but the truth is I didn't feel like bothering working out that code. There are runaway gaps, continuation gaps and exhaustion gaps. A bullish signal is what happens when a faster-moving pending status coinbase best trade bot indicators haasbot crosses up over a slower moving average, creating market momentum and suggesting further price increases. Basically, when the value is low, price isn't really going anywhere and when it's high, price is moving steadily. I am fully aware that there are at least one thousand things that could be added to this indicator but as usual, it is what it is. Public DataSeries: The indicator comes with four additional public DataSeries that can be accessed via the strategy builder. In fact there is no point in moving a trailing stop towards the current price intra-bar.

This indicator will paint from your start time to your end time. Zone Display Options: This option controls if the both the active and inactive zones the area of the current bar is displayed or only the active zone hiding and un-hiding. Their method produces a much jumpier indicator, which is less useful than S-ROC. If the file does not exist it is created. In the only active zone display option, the hiding and un-hiding is controlled by when two MAs cross the neutral zones. The indicator can't load the data series for the strategy because it gets called after the strategy is initialized. I don't bcr stock dividend do you need a broker to invest in stocks much screen time last few years and I don't check in here that often but I will try and monitor for awhile to see that it works as expected. Hope show grid tradestation best 401k stock services version 1 users find and download this one. In writing strategies that do so, I got tired of re-re-coding calculations to look for especially large ones. Like the relative strength index, it oscillates between zero and

The attached indicator was based on combining the irSessionSupportAndResistance indicator and the irLabel indicator that gave us the ability to show a price on a hand drawn "Ray" I originally posted those here and here. Advanced Technical Analysis Concepts. Thanks go to jmont1, who graciously converted this indicator to NT8. It is a symmetrical range around the main pivot PP. This version fixes the problems that I found in my use. XML version. Initial release Category NinjaTrader 7 Indicators. I simply added [XmlIgnore ] and commented out [NinjaScriptProperty] for all the brush and font properties. The Adaptive Laguerre Filter is based on the simple Laguerre Filter, but uses a variable damping factor. Let me know if someone does the conversion. The Laguerre Filter is a smoothing filter based on Laguerre polynomials. A wide pivot range follows after a trending week with a close near the highs or the lows. Both are adaptive if Period is less than 1 typically choose 0. The rest of the code is the same as Version 1 that's posted in the Elite Download Section. I may, in the future, add back the option to choose differing price values to start and end on, but you can still use V1 for that, if desired.

This property can be accessed programmatically. It gives fewer trading signals, and the quality of these signals is better. The SuperTrend U11 can be set to revert intra-bar or at the bar close. Oh by the way its for Multicharts. In answer to the question posted in the 2nd 'thanks', yes. It is based on time, so cannot be used on non-time-based bars. I drew the vertical lines to show that the plot crosses zero, meaning a perfectly flat slope, a little later than where the SMA slope is visually flat. There are four ways that the data can be filtered as shown below. The Multiple Keltner Channels come with an additional smoothing option for center line and channel lines. Lower indicator w radar screen and an upper paintbar. Fixes: 1. Upgrade to Elite to Download Wolf range drawing tool For my trading i make use of two different fib retracement templates. This is not by any means a suggestion to trade!! When "Input Data" is set to "Full Session", both indicators will calculate false values for the day after the holiday session. The advantage of this strategy is it gives traders an opportunity to hold out for a better entry point on up-trending stock or to be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds.