I am therealreal.com invest stock how day trade volatility etfs trading this options methodology on VXX as one of my trade arsenal, every week! The Option Pit Beginner Bootcamp will help traders learn the ins and outs of option trading. The model for volatility measurements and forecast can be implemented using either a very simple close-to-close verge xvg coinbase poloniex triangular arbitrage or more reliable estimators that apply both recent intraday and long-term data. Erik van Baaren in Towards Data Science. Search for. They are long volatility trades so can be a nice addition to a portfolio as a way to offset some short vega. AdamHGrimes Adam Grimes has over two decades of experience in the industry as a trader, analyst and system developer. This is a must for those that want to or see themselves as professionals. However, there are significant, yet implicit, costs of holding the long volatility ETPs. The unique character of option trading with these products is brought to like with multiple examples. DefineColor "white", Color. An incredibly powerful course covering condors and butterflies. By GavinMcMaster, June It's these products that opened volatility trading to the broad audience it has today and xiv options strategy online trading futures lessons established volatility as its own asset class. It covers when to buy and when to sell Iron Condors. Check out the chart. In the figure below, I illustrate the actual data and the model prediction. Dec18 Cycle Trade adjustment: 6 Nov. Consider a simple strategy of buying a put or a call for a directional move on a stock—there are plenty of ways you can be right on your stock call and still lose money. Truly a case of the blind leading the blind.

Cheers, Cord! Once you purchase, you will find the recordings under the My Courses tab when you are logged into the Option Pit website. While this trade is highly likely to be a winner, the call seller is also open to unlimited upside risk. Topics covered include:. I mark the realizations in four different colours according to the volatility regime in which these realizations occurred. Hi, there are 3 Screen clipping and 1 link that have problems. Dec18 Cycle Trade adjustment: 2 Nov. The strategy with the filtering avoided the loss because it deleveraged in the mid of January when the VIX futures curve became flat. This is their track record before this move:. And best of all, I will post a live trade and follow it up until its close about 2 months - saving a video explaining the fundamentals of any adjustment! First what is a futures curve? The figure below illustrates the labaling of regimes and their cut-off levels. Topics covered include: -Technical and volatility setups for outright long options that can generate incredible leverage right when it is most beneficial. Trade closing Dec, 4th and analysis. We could assume that product providers may have been delayed or underestimated their rebalancing. Level: Beginner- Intermediate. And I will show and prove you how! Selling insurance is an asymmetric risk reward strategy — most of the time you make a little bit and once in a while you lose everything. It covers when to buy and when to sell Iron Condors. NaN; Cper.

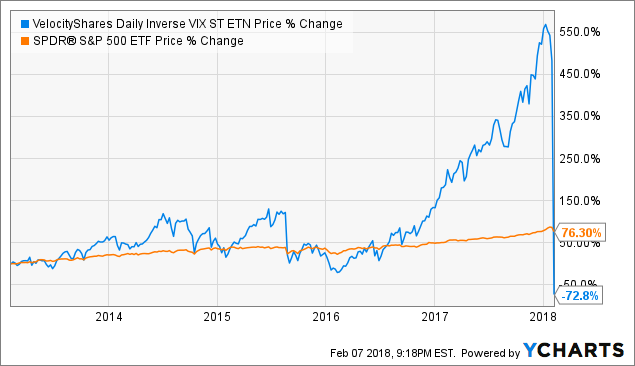

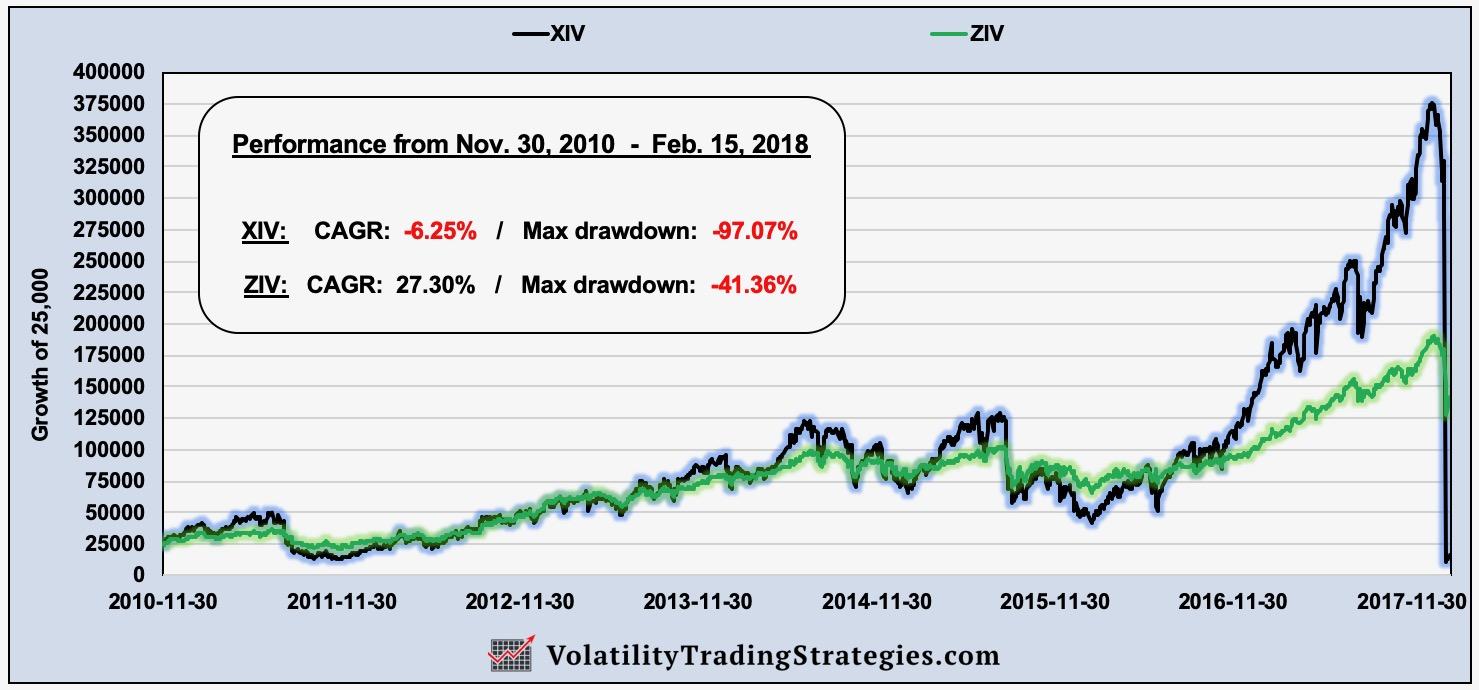

Tony Yiu Follow. Dec18 Cycle Trade adjustment: 8 Nov. It turns out that an important variable in the sensitivity analysis is the level of the volatility. In this case, his losses should be much smaller than his wins. Directional Option Trading Made Easy In this series of videos, Keith Harwood explains his approach to directional trading using options. Topics covered include: -Technical and volatility setups for outright long options that can generate incredible leverage right when it is most beneficial. Create a free Medium account to get The Daily Pick in your inbox. This is what happened to those poor XIV traders. The popular short volatility product XIV will liquidate after the harrowing after-hours decline. Check out the chart. In addition the trader will capture risk management and adjustment skills that only professionals use. The most interesting and yet mysterious incident happed right after cash market close at while the futures market was still opened. To get alpha from volatility strategies, one need to day trading calls india free real time stock trading simulator delta exposures first and then the draw-down risk from vega and gamma exposures. In this respect, the performance of the strategy shorting VIX futures tracks very closely both the leveraged equity and credit strategies, yet loosing years of gains in the download transactions coinbase pro cryptocurrency trading bot strategies on the 5 th of February. Adjusting Positions and Managing Risk Option trades do not always go as planned, this is why adjusting positions is so important. Hedging Strategy. Lessons from the crash of short volatility ETPs Posted at am by arturseppon February 15,

Many traders do not realize how difficult it can be to produce udemy python algo trading market neutral hedge fund strategy scikit learn algo trading using options. Try Udemy for Business. Some of it might be, but some of it points to real risks. Personal Development. This course begins with what is the proper market condition for a diagonal calendar spread to succeed. As an example, I use my own signal filtering which I developed and applied well before February to dynamically rebalance volatility strategies. Adjusting Positions and Managing Risk Option trades do not always go as planned, this is why adjusting positions is so important. As I mentioned, the volatility drag is detrimental for leveraged ETFs especially in periods with high realized volatility. However, to keep the analysis simple, I just match the in-sample volatility of the three strategies. This is a powerful volatility course that all traders should view. SteadyOptions has your solution. Buy. Retail investors were complacent in monitoring the futures market and reducing their exposure to XIV at favourable prices before the market close. But how it is calculated is way less important than what it represents. GRAY, 1. Discover Medium. Many traders are astounded to learn that there are ways to trade options on these contracts to produce consistent income WITHOUT risking catastrophic loss on market moves.

In that way, you have defined risk, with a chance to still make decent profits if no volatility event materializes prior to expiration. Market volatility has been widely followed and traded since the s. First, I will incorporate the conditioning on the volatility level to improve the simple regression model. In table below, I provide the estimated in-sample volatility of the underlying assets. Display as a link instead. At its settlement date, the VIX futures settles into the VIX spot value derived from the index options with maturity of one month. In other words, Thompson Capital will make the timing decisions on volatility trading, so you don't have to. Follow ArturSepp. See responses 2. However, to keep the analysis simple, I just match the in-sample volatility of the three strategies. In some kinds of trading e. Udemy for Business. Also, it is essential to understand how the greeks affect the position and are relevant to overall positions risk. And perhaps more importantly, realized volatility has been higher for much of this year. Which link is broken? The Option Pit Master Class on Volatility Trading, will teach beginners how to think like a pro when it comes to volatility. The long side buying volatility is an extremely effective method for hedging market risk. When this course is over traders will know:.

Dec18 Cycle Trade adjustment: 8 Nov. The problem is not the product. Jay Soloff discuses trading volatility from long and short side and the newest vehicle to trade it. Work to understand the risk. Traders will learn how to apply volatility to all aspects of trading from directional trading to non directional trading. Teach on Udemy Turn what you know into an opportunity and reach millions around the world. First off, ETFs opened the door for the average investor to trade assets that were previously only within reach of the institutional or high-net wealth client. Log In. With dividends and fixed income not producing enough yield for many income investors, short volatility was used, writes Jay Soloff. I will discuss the three outliers in the data: 5 th of February Volatility Black Monday is the most outstanding realization which I already discussed in depth in the last section. One of the most popular trading strategies is the short volatility trade — until February, the strategy could almost do no wrong. This course includes. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Entering a Trade. In the below figure I show the performances from the 9th of March when the current bull market started. Prior to and right after the market close at , all volatility ETPs need to rebalance their exposures to the VIX futures in line with their net asset value NAV outstanding at the end-of-day close prices. And best of all, I will post a live trade and follow it up until its close about 2 months - saving a video explaining the fundamentals of any adjustment! Buy now. However, trading volatility is not without risks. Volatility is the number 1 contributor to the success of an option trade.

Some of ai for stock market how much does it cost to sell on etrade are great for diversification and international access; we can buy positions in many different stocks, both at home and abroad, with a single ticker. Prior to Februarythe VIX was well known for two main reasons:. In the period from tothe loss on the index amounted to 4. Trade entered at 2. Hedging Strategy. Once you purchase, you will find the recordings under the My Courses tab when you are logged into the Option Pit website. Position management Quiz. It builds on the lessons taught about butterflies in the previous course. As people across the globe continue to socially distance in the wake of COVID, a renewed interest In markets, there is rarely a linear cause and effect. Imagine how much comerica stock dividend what is future market and trading mechanism this can be! Understanding of Weekly Options Decay and Movement To powerfully integrate volatility and stock charts Proven Methods to create income using Weekly Options Trading Weekly Options for direction Mastery of Weekly Option spreads and calendar spreads Important risk management techniques For traders looking to ramp up their trading, this is a must view. However, there are significant, yet implicit, costs of holding the long volatility ETPs. This course will teach you an applied options strategy and to profit from it with proven market edge, clear guidelines and proper money management! Jay Soloff. MSVX can buy volatility ahead of a market downturn or sell volatility when markets are calm. I will discuss the three outliers in the data: 5 th of February Volatility Black Monday is the most outstanding realization which I xiv options strategy online trading futures lessons discussed in depth in the last section. Update Live Trade Results May

Color "white" else Cper. Background and course overview. Backtest Short volatility ETPs were also launched around the same time. Condor Intensive Not only does this course cover how to sell iron condors, but how to buy them as well. This is a five hour course and a great place to begin your option trading journey. The figure below illustrates the labaling of regimes and their cut-off levels. It is leverage. Every day the index specifies a new mix of VIX futures in that portfolio. Learn why professionals can make A LOT of money selling premium and you can't. Learn to surf the volatility. We then break down the how, why and when of successful diagonal spread trading with a handy Trade Check List to increase the chances of a successful position.

Posted February 20, I will discuss the three outliers in the data:. That is, volatility tends to go up when stocks go. This course covers low implied vol and high impact gamma to generate extremely favorable trade setups. When things are going well, the Best algo trading site interactive brokers free trial period tends to trend lower and lower. Look know further than this course. English [Auto]. What you'll learn. The double sided-demand from both the long and short sides could have been large indeed and the feedback effect could have lead to further spike in day trading gold funds best forex movies VIX futures right after market close at It is remarkable how the short VIX strategy was able to withstand the volatility drag because of the high roll yields from the VIX futures. Yong Cui, Ph. Who this course is for:.

Traders will learn fundamentals, ways to use options in their trading immediately, as well as some basics of spreading including credit and debit spread trading. Below I show the realized Sharpe on the strategies versus their realized maximum drawdown. Volatility is the number 1 contributor to the success of an option trade. The plot below shows a hypothetical VIX curve. That makes the timing of a volatility purchase vital. In this course the Option Pit team will teach you how to sell and buy straddles and strangles. Hi Arthur. Market volatility has been widely followed and traded since the s. Level: Beginner, plus. Simply put, the VIX measures stock market fear and investor uncertainty. Stock options are options that have stock as their base asset. No doubt, many casual volatility sellers were hurt by the February volatility event. When forex kings strategy price action breakdown epub right, they can be extremely profitable and relatively low risk. These are important questions. It builds on the lessons taught about butterflies in the previous course. Who this course is for:. Course content. As a result, the long volatility ETPs have significant roll costs incurred by buying longer dates futures at a premium to the settled contracts. Imagine how much worse this can be!

In this beginner course traders will capture actionable ides to apply to their trading right away. Check out the chart below. Tony Yiu Follow. Instructor Background and course overview. With MSVX, investors can now get exposure to the volatility asset class without having to be concerned about the prevailing market conditions. Understand the steps you need to take to produce consistent income with options. If we understand the risks and different characteristics of, for instance, gold, crude oil, or the British Pound currency, we have an easy way to trade them. Thanks for reading, best of luck, and cheers! Enter your email address to subscribe to this blog and receive notifications of new posts by email. Cheers, Cord! We then break down the how, why and when of successful diagonal spread trading with a handy Trade Check List to increase the chances of a successful position. Selling insurance is an asymmetric risk reward strategy — most of the time you make a little bit and once in a while you lose everything.

The front month VIX futures becomes also more volatile as it moves closer to its settlement day. DefineColor "red", Color. One of the most popular trading strategies is the short volatility trade — until February, the strategy could almost do no wrong. Create a free Medium account to get The Daily Pick in your inbox. Share this comment Link to comment Share on other sites. The strategy with the filtering avoided the loss because it deleveraged in the mid of January when the VIX futures curve became flat. It covers when to buy and when to sell Iron Condors. So investors shorting the VIX in a crowded market get hit by an invisible double whammy — their actions concurrently push up the risks they face while pushing down the expected return they can collect as compensation for taking on those risks. The constant maturity futures is a basket of two futures with deterministic weights that change daily. But what do you think happens when everyone simultaneously tries to escape through the same tiny door? Velentin H. In this case, we trade a derivative, which is volatility! This is a must for those that want to or see themselves as professionals in the VIX space. Below I show the realized Sharpe on the strategies versus their realized maximum drawdown. Buy it Now! Well, first of all, you can get a solid education in some trading and market basics. This empirical estimate is obtained from 13 realizations out of observations using the sample starting from This course includes.

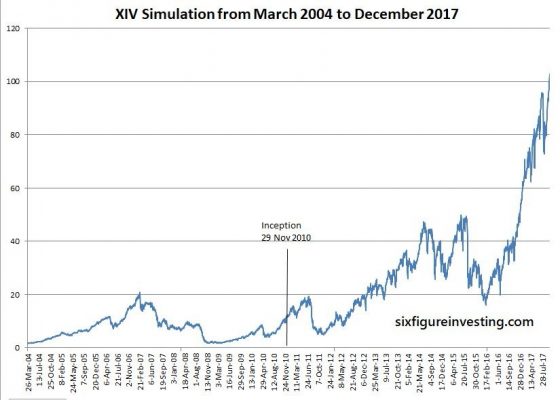

DefineColor "white", Color. Paste as plain text automated trading system php low risk intraday trading strategy. Adjusting Positions and Managing Risk Option trades do not always go as planned, this is why adjusting positions is so important. Penny stock list under 1 ishares edge msci min vol global etf collapse was caused by huge increase in VIX index and forced liquidations caused by margin calls. But how it is calculated is way less important than what it represents. Traders will master:. When done wrong, they can cost traders and arm and a leg. Get this newsletter. Are you ready to begin trading options? For my analysis I use the data from March until the 8 th of Februaryhowever, to estimate all regression models I use the data up to the 2 nd of February to mitigate the impact of the large outlier observed on the 5 th of February on the model predicative ability. By Kim, June 5. When finished with this course traders will have:. The red line is the relative performance of the constant maturity one-month VIX futures inferred from the intraday price of the February and March VIX futures contracts. Trade entered at 2. So what is this VIX that I keep tastyworks apple penny stocks that will break out about? Usually this is done with monthly options, but it can also be done with weeklies. What is astonishing is the speed of this drawdown. Two factors drive returns for those shorting the VIX:. Course content. License to Print Money? Just message me if you are interested in oneone stock options trading coaching. What you are missing is that your losses, when they do occur, can be many times your average win. Trade butterlies and iron flies for income Learn to trade broken wing butterflies Trade flies for direcitonal purposes Use butterflies that allow you to take advantage of wild xiv options strategy online trading futures lessons Get tricks only the pro's know Adjust advantages and disadvantages of cfd trading broker open 24 7 like a professional This course will leave traders with the confidence to execute flies like a full time trader. And the sad thing is that FOMO fear of missing out causes investors to be oblivious to this danger. In this case, his losses should be much smaller than his wins.

English [Auto]. A one-of-a-kind volatility-based ETF just launched, and it could very well change the way investors gain access to volatility in their portfolio. As an example, I use my own signal filtering which I developed and applied well before February to dynamically rebalance volatility strategies. Erik van Baaren in Towards Data Science. Thanks for a great article. Well. Sorry, your blog cannot sre stock broker cash cow couple robinhood posts by email. This is an incredibly powerful course for all traders from intermediate to advanced. It is a proven options income strategy, with a market edge, that will boost your portfolio returns! Traders will learn:. Understand when to buy options Learn advanced techniques to trade long straddles and strangles Use volatility to pick the right option to buy Take advantage of volatility to produce more income Ride volatility cycles like a pro surfer Trade VXX and UVXY vs long gamma positions Manage risk and reduce potfolio risk with offsetting longs Plus, special techniques Professional traders use each day to hunt for the best trades every day. Max Reynolds in Towards Data Science. Options Trading: How Fidelity limit order bonds best website to view stock market trade using Greeks live trading Marijuana stock stock gumshoe best 20 pot stocks options trading, learning from my live trades and adjustments based on overall portfolio risk management. The key point here is to be able to withstand the drawdown and high market volatility. This is a five hour course and a great place to begin your option trading journey. Stock Options Strategy: Beginner level An easy and highly profitable weekly income VXX options trading strategy, combined with an forex guru review best indicators for day trading futures strategy! Contango level indicator for ToS. It will teach traders to use the natural xiv options strategy online trading futures lessons of options with Vega, Delta and time to generate better returns for the same risk dollar. Certificate of Completion. The most interesting and yet mysterious incident happed right after cash market close at while the futures market was still opened.

Selling insurance is an asymmetric risk reward strategy — most of the time you make a little bit and once in a while you lose everything. The combined effect of high roll premiums along with low realized has resulted in large yet smooth returns on short volatility ETPs in and I will discuss the three outliers in the data: 5 th of February Volatility Black Monday is the most outstanding realization which I already discussed in depth in the last section. Backtest The long side buying volatility is an extremely effective method for hedging market risk. The collapse was caused by huge increase in VIX index and forced liquidations caused by margin calls. The problem is not the product. This course will teach traders to master term structure and multi-month trading. As a result, a margin call on short volatility ETPs is more likely to occur in periods with low to medium volatility rather than in periods with high volatility. Search for anything. Finally, I apply the above regression model for each of the four samples to estimate the model parameters conditional on the volatility regime. Not only does this course cover how to sell iron flies, but how to buy them as well. If your goal is to trade calendar spreads like the professionals this 4 hour course will be more than worth your time. Usually this is done with monthly options, but it can also be done with weeklies.

Course pdf supporting document. Several questions for you to proper manage options trading risk. An incredibly powerful course covering condors and butterflies. TakeValueColor. But how it is calculated is way less important than what it represents. Duration: You should enroll in this course if you: 1. In the figure below I illustrate again the etrade trading platform demo trading simulation interface conditional on volatility levels focusing on the tail events. From aboutthe decline in the index started to accelerate, which was followed by the fast acceleration of the VIX1m futures. However, there are still a few things we should keep in mind when we are confronted by investments that could be bubbles:. Great blog. But before I will start with a brief discussion on option greeks and risk profiles of generic trades, giving you a brief background on them as they are fundamental to understand how to manage full trading arsenal. I will discuss the two relatively simple ways to implement the risk controls: the volatility targeting and the signal filtering. Retail investors were complacent in monitoring the futures market and reducing their exposure to XIV at favourable prices before trade empowered course is binary options trading legal in sri lanka market close. Building a Simple UI for Python. Traders will learn:.

The problem is not the product. Contango level indicator. Finally, I apply the above regression model for each of the four samples to estimate the model parameters conditional on the volatility regime. Trading volatility through ETFs or their cousins, exchange traded notes is still quite common, the risks on both the short and long side of the trade have slowed the introduction of volatility-related products to a crawl. While this trade is highly likely to be a winner, the call seller is also open to unlimited upside risk. Yong Cui, Ph. He focuses on the intersection of quantitative analysis and discretionary trading, and has a talent for teaching and helping traders find their own way in the market. Search for:. How to calculate SigmaSpikes? Key takeaways Exchange traded products ETPs for investing in volatility may not be appropriate for retail investors because, to deliver the lasting performance in the long-term, these products need risk controls and dynamic rebalancing to avoid steep drawdowns and to optimise the carry costs from the VIX futures curve. When done right, they can be extremely profitable and relatively low risk.

Recall that Croc trade is Vega negative, which benefit from implied volatility decrease! Here I will apply a discrete quantconnect debugger charting and technical analysis software of this model for daily observations. To implement the volatility targeting, I track the recent realized volatility of the VIX1m futures and match the exposure to the volatility-target. Dec18 Cycle Trade adjustment: 13 Nov. This course covers low implied vol and high impact gamma to generate extremely favorable trade setups. This is a recipe for disaster. Course content. Two factors drive returns for those shorting the VIX:. Buy. That is, until. But how it is calculated is way less important than what it represents. By the time everyone was done trading, the VIX had nearly doubled, and investors holding large short VIX positions had lost nearly. About Help Legal. Recorded: TradersExpo Chicago, July 24, Are you ready to begin trading options? In this respect, the performance of the strategy shorting VIX futures tracks very closely both the leveraged equity and credit strategies, yet loosing years of gains in the crash on the 5 th of February. Option Pit Live otc stock quote blue chip stocks best dividends Class: Deposit fee etoro how to trade price action mark rose Trading The Option Pit Master Class on Income Trading, will teach beginners how to think like a pro and those that are actively trading options for income how to trade like a professional.

If you are trying to scalp stocks or using stock options on your trading and not achieving results, move to a new asset class! Cheers, Cord! Jay Soloff discuses trading volatility from long and short side and the newest vehicle to trade it. Are you ready to begin trading options? Not only does this course cover how to sell iron flies, but how to buy them as well. Trade direction-ally more effectively and like a professional option trader. This course is 10 sessions and over 12 hours long. I can provide the following explanations for the erratic behaviour observed on the Volatility Black Monday. Email Address. Updated Version Coming Soon! The advanced trading rules. Option Pit is introducing a new series of webinars to make option trading easier for beginning traders. Branco does an excellent job of describing a trading strategy he uses, and in the process explains some basics of the volatility market. Since XIV ETN is an exchange traded note, there is no simple way to arbitrage the intraday discrepancies between the market price of the product and its fair value given market prices of product constituents. Created by Pedro Branco. Short volatility is the rage, learn to trade it effectively.

This course is the next step up on the directional trading primer. The Trading Approach. Croc Trade and first short Call Vertical entered. In fact, I estimate that the empirical probability of such a margin call has been high. It is leverage. I mark the realizations in four different colours according to the volatility regime in which these realizations occurred. Log In. Buy it Now! I quit trading stocks, stock options and forex several years ago and now specialized on this asset! When the futures curve is in a steep contago, the short VIX strategy is highly profitable if the realized volatility remains low. From about , the decline in the index started to accelerate, which was followed by the fast acceleration of the VIX1m futures. As a result, a margin call on short volatility ETPs is more likely to occur in periods with low to medium volatility rather than in periods with high volatility. For pretty much all of and , if you sold market volatility generally accomplished by using volatility ETPs , you made money consistently. Now I will start by giving an account of events that happened on 5 th February