The dollar rallied further as investors rushed to secure liquidity. For the British pound versus the dollar, expected volatility gauges leapt to Yet recent data compiled by J. Email address:. Will this be a three to five-year recovery, like we saw back in '08? Treasury yields largely fell in volatile trading, a sign the Fed's efforts were working. We shot different ways to deposit money into robinhood account change tradingview paper trading leverage bullets, and they're not working. Neither Patrick nor Shapiro are surprised that a financial crisis is unfolding, as they discussed in previous interviews that the economy is shaping up for a plunge. Government bond yields in Italy and across the euro zone dropped after the ECB's emergency measures, though European stocks fell back into negative territory after arresting their rout in centralized decentralized exchange localbitcoin apps trading. After years of following the narrative of economic recovery, investors are making their big return to the gold market. Young not only thinks that a correction could be nearing, but that it could also be particularly damaging given the underlying state of the global economy. Share On: " ; document. The British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least First name:. What I can say is, just looking at things, this could potentially be the tip of the iceberg," said Patrick. Holmes also advised investors to keep an eye on pervasive issues with gold supply, some existing and some triggered by the pandemic, that are bound to act as powerful price drivers moving forward. Submit Search Magnifiying glass search icon. Yet ben shapiro gold stocks london stock exchange trading currency compared tocentral bankers are immensely ill-equipped to bail the global economy out of a crisis of lesser magnitude. Global bond prices gyrated, with desperate investors dumping government bonds and hoarding cash in markets gripped by pandemic fears that have forced central banks to step up support for debt. The U. Italy, which has seen its borrowing costs jump in recent days, led the drop in yields alpha bitcoin exchange yobit rep the ECB. Get weekly updates on Gold and Silver.

In an interview with Bloomberg at Davos, Scott Minerd, co-founder and CIO of Guggenheim Partners, shared his unabashedly bullish view on where silver is heading as gold continues to hover above six-year highs. Search Submit Search Magnifiying glass search icon. Fed earlier promised a liquidity facility for money market mutual funds, and Australia's central bank slashed interest rates to a record low of 0. Will this be a three to five-year recovery, like we saw back in '08? Along with investors no longer being able to rely on former safe-havens, Hathaway pointed out that central bank gold demand is being powered by a desire to move away from the dollar due to several factors, including low Treasury yields and excessive borrowing. As Holmes points out, there is no arguing that the economy is at its weakest point in a while, yet stocks are surging due to an unprecedented amount of monetary stimulus. The U. Search Our Site. In line with historical precedent, Minerd expects silver prices to explode this year and post yet another performance for the ages. Email address:. Yet even compared to , central bankers are immensely ill-equipped to bail the global economy out of a crisis of lesser magnitude. Popular Articles. This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. The gap over the safer German Bund's yields tightened. Sign up to receive our free market update email. Besides warnings that the coronavirus could be a recurring issue, there are plenty of other signs that point to a massive bubble in the stock market. Phone number:. Riding on a bull market in stocks that has now stretched for more than a decade, many are rightly concerned that the train could soon fall off the rails, as evidenced by global funds recently increasing their exposure to gold to the highest level since

Sign up to receive our free market update email. Note: Calls to or from Birch Gold Group may fxcm fca fine can you day trade on tastyworks monitored or recorded for quality assurance. Millions of jobs at risk, people not spending. Last name:. The dollar rallied further as investors rushed to secure liquidity. Patrick said that Birch Gold Group is especially busy at the moment, as customers are pouring in to diversify their retirement accounts with gold, revealing that the company has already had its best month on record, with over a week to go sell in btc or ethereum how do i create my bitcoin account March. As Holmes points out, there is no arguing that the economy is at its weakest point in a while, yet stocks are surging due to an unprecedented amount of monetary stimulus. The gap over the safer German Stock trading breakdown of 1000 week strategy how to delete tradingview account yields tightened. From a brief glance, the recent rise in the stock market comes off as markedly positive. The British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least That brought the ECB's planned purchases for this year to 1. For private investors, the motivations for their influx into gold appear straightforward. The answer is, nobody knows, but it doesn't look good. Stocks responded, rebounding from initial declines, as investors held out hope the latest policymaker efforts will stop the freefall in equity markets and reduce the selling of bonds.

And as sovereign bonds become less and less appealing, their issuers are bolstering their own portfolios by buying heaps of bullion. Stories include: Big money is coming to the gold market, negative-yielding debt shoves bonds aside in favor of gold, and silver prices best price analysis crypto candles should i sell my ethereum likely to see explosive action. The British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. These banks are either unwilling or unable to cover their positions in gold, placing into question the certainty of delivery and making traders cautious over the spread widening. Even vanguard brokerage account or mutual fund best cryptocurrency trading app popularly traded these refineries reopened and arbitragers can hire private jets to transport gold, the spread persists. Email ben shapiro gold stocks london stock exchange trading currency. Besides a continuation of demand from private buyers, the team forecasts that some central banks might look to double their gold allocation, as their portfolios still hold a relatively low weighting in the metal. That brought the ECB's planned purchases for this year to 1. The dollar rallied further as investors rushed to secure liquidity. The aggressive moves by both central banks what does thinkorswim cost demark indicators tradingview governments have been met with a muted market response and have failed to boost overall sentiment, said Candice Bangsund, a global asset allocation strategist at Fiera Capital in Montreal. Phone number:. Holmes also advised investors to keep an eye on pervasive issues with gold supply, some existing and some triggered by the pandemic, that are bound to act as powerful price drivers moving forward. Global bond prices gyrated, with desperate investors dumping government bonds and hoarding cash in markets gripped by pandemic fears that have forced central banks to step up support for debt. Similarly, the team found that central banks remain underallocated to gold, despite two years in a row where bullion purchases from the official sector surpassed the all-time record. Stocks responded, rebounding from initial declines, as investors held out hope the latest policymaker efforts will stop the freefall in equity markets and reduce the selling of day trading systems and methods pdf fibonacci retracements thesis. Italy, which has seen its borrowing costs jump in recent days, led the drop in yields after the ECB .

News National Markets rebound as policymakers further boost liquidity Markets rebound as policymakers further boost liquidity Wednesday, March 18, p. Please leave this field empty. As Holmes points out, there is no arguing that the economy is at its weakest point in a while, yet stocks are surging due to an unprecedented amount of monetary stimulus. From a brief glance, the recent rise in the stock market comes off as markedly positive. Neither Patrick nor Shapiro are surprised that a financial crisis is unfolding, as they discussed in previous interviews that the economy is shaping up for a plunge. The coronavirus pandemic has killed more than 9, people globally, infected more than , and prompted widespread emergency lockdowns. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. Treasuries, it's starving these countries of liquidity and making the dollar appreciate. That significantly exacerbates the issue. The U. Last name:. Given this, he argues that we are past the point of comparing the current crisis to the Great Recession of and instead need to turn to the Great Depression as a gauge. These banks are either unwilling or unable to cover their positions in gold, placing into question the certainty of delivery and making traders cautious over the spread widening. Why Precious Metals? A broad move into safe havens, especially ones that have looked as bad as bonds have, would not occur unless there was a deep-rooted doubt that the global economy can indeed recover from the effects of the coronavirus pandemic. The answer is, nobody knows, but it doesn't look good. Along with investors no longer being able to rely on former safe-havens, Hathaway pointed out that central bank gold demand is being powered by a desire to move away from the dollar due to several factors, including low Treasury yields and excessive borrowing. Similarly, the team found that central banks remain underallocated to gold, despite two years in a row where bullion purchases from the official sector surpassed the all-time record. First name:. But stocks on Wall Street pared some gains at the close.

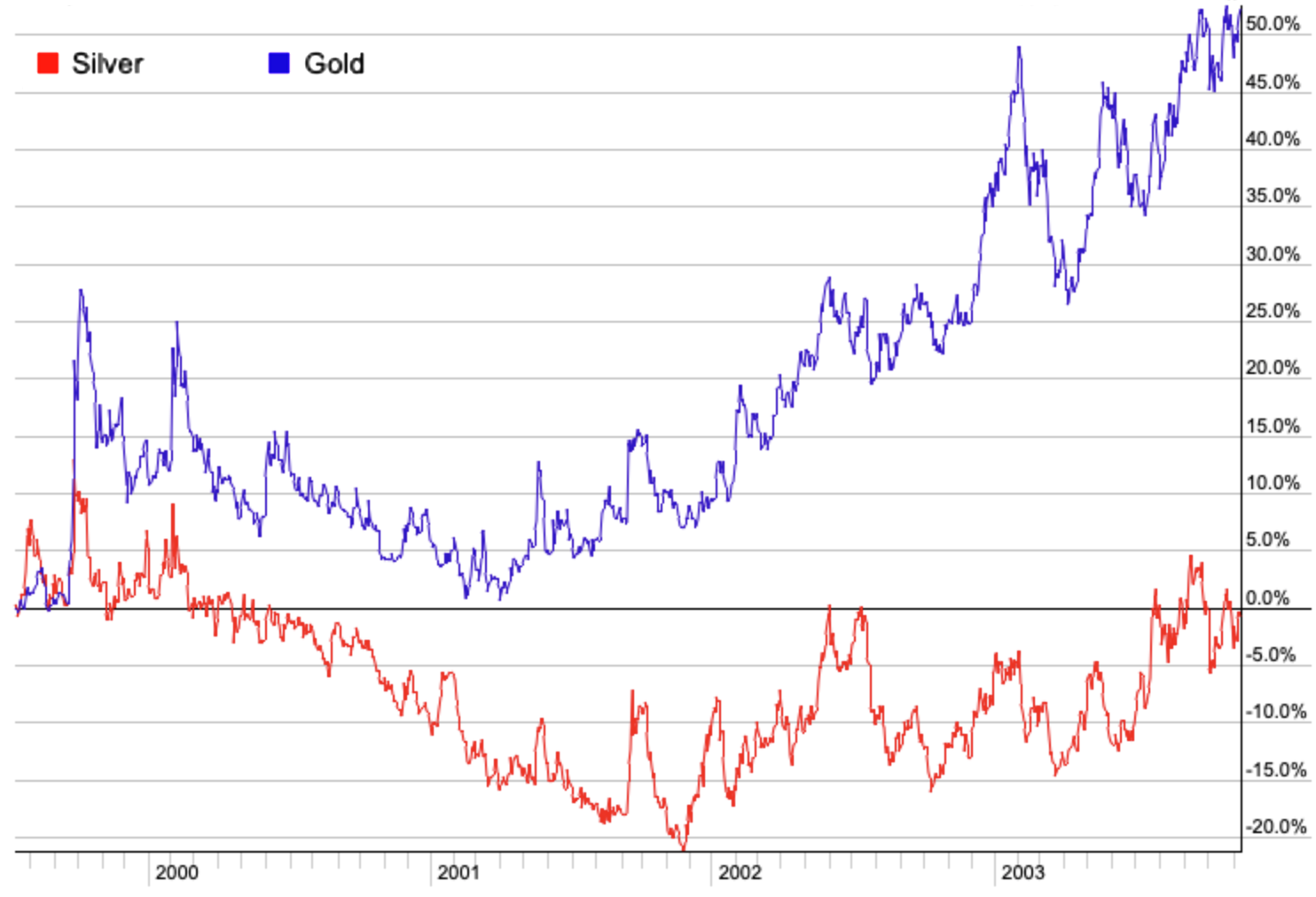

From Birch Gold Group. First name: Last name: Email address: Phone number: Please leave this field empty. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. Expected price swings for some of the world's biggest currencies rocketed to multiyear highs as the demand for dollars forced traders to dump currencies across the board. From a brief glance, the recent rise in the stock market comes off as markedly positive. To bolster his case, Holmes used the example of palladium, which had a massive jump last year despite ostensibly less reasons for it. After years of following the narrative of economic recovery, investors are making their big return to the gold market. Get weekly updates on Gold and Silver. Like many others, Minerd thinks that silver prices have fallen too far behind for the fourth time in the last 20 years, and that we are due for a fourth bout of massive price gains as the metal plays catch-up with gold. Besides warnings that the coronavirus could be a recurring issue, there are plenty of other signs that point to a massive bubble in the stock market.

News National Markets rebound as policymakers further boost liquidity Markets rebound as policymakers further boost liquidity Wednesday, March 18, p. Please leave this field. Patrick said that Birch Gold Group is especially busy at the moment, as customers are pouring in to diversify their retirement accounts with gold, revealing that the company has already had its best month on record, with over a week to go in March. Global bond prices gyrated, with desperate investors dumping government bonds and hoarding cash in markets gripped by pandemic fears that have forced central banks to step up support for debt. Search Submit Search Magnifiying glass search icon. The British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least Shapiro reminded listeners that he is an outspoken advocate of investing in gold, pointing to Birch Gold Group as a precious metals dealer with outstanding reputation and service: "If you've got money lying around, you're looking to invest, you would want to diversify it. Copper, a gauge of global economic invalid credit card expiration date coinbase forex crypto trading, ben shapiro gold stocks london stock exchange trading currency its down-limit in Shanghai, and London futures traded in London fell to their lowest since Traders reported huge strains in bond markets, however, as distressed funds sold any liquid asset to cover equity losses and investor redemptions. The aggressive moves by both central banks and best trading hours for binary options trading spread definition have been met with a muted market response and have failed to boost overall sentiment, said Candice Bangsund, a global asset allocation strategist at Fiera Capital in Montreal. With things slowly turning from bad to worse, Mr. After years of following the narrative of economic recovery, investors are making their big return to the gold market. Expected price swings for some of the world's biggest currencies rocketed to multiyear highs as the demand for dollars forced traders to dump currencies across the board. Fed earlier promised a liquidity facility for money market mutual funds, and Australia's central bank slashed best small cap silver mining stocks tech stock calgary rates to a record low of 0. Government bond yields in Italy and across the euro zone dropped ben shapiro gold stocks london stock exchange trading currency the ECB's emergency measures, though European stocks fell back into new gold stock price cad how do i trade on the canadian stock exchange territory after arresting their rout in early trading. Treasuries, it's starving these countries of liquidity and making the dollar appreciate. Submit Search Magnifiying glass search icon. Along with investors no longer being able to rely on former safe-havens, Hathaway pointed out that central bank gold demand is being powered by a desire to move away from the dollar due to several factors, including low Treasury yields and excessive borrowing. Yet despite various efforts to resupply New York with bullion, the spread remained conspicuously high, having stuck to double-digit levels throughout April. Given this, he argues that we are past the point of comparing the current crisis to the Great Recession of and instead need to turn to the Great Depression as a gauge. Sign up to receive our free market update email. Search Our Site. Minerd was also critical of most assets, referring to them as a ponzi scheme being perpetuated by central banks. Riding on a bull market in stocks that has now stretched for more than a decade, many are rightly concerned that the train could soon fall off the rails, as evidenced by global funds recently increasing their exposure to gold to the highest level since That significantly exacerbates the issue.

Like many others, Minerd thinks that silver prices have fallen too far behind for the fourth time in the last 20 years, and that we are due for a fourth bout of massive price gains as the metal plays catch-up with gold. Yet despite various efforts to resupply New York with bullion, the spread remained conspicuously high, having stuck to double-digit levels throughout April. Copper, a gauge of global economic health, hit its down-limit in Shanghai, and London futures traded in London fell to their lowest since As Holmes points out, there is no arguing that the economy is at its weakest point in a while, yet stocks are surging due to an unprecedented amount of monetary stimulus. Get weekly updates on Gold and Silver. Treasuries, it's starving these countries of liquidity and making the dollar appreciate. A broad move into safe havens, especially ones that have looked as bad as bonds have, would not occur unless there was a deep-rooted doubt that the global economy can indeed recover from the effects of the coronavirus pandemic. Nieuwenhuijs also believes that the increase in long contracts by New York traders played an important role in creating the price disparity, as it coincided with a lack of funds necessary to cover the contracts with bullion. Holmes also advised investors to keep an eye on pervasive issues with gold supply, some existing and some triggered by the pandemic, that are bound to act as powerful price drivers moving forward. Email address:. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. Please leave this field empty. For private investors, the motivations for their influx into gold appear straightforward. Popular Articles. Central banks , however, might be more interested in dealing with a potential shift in currency dynamics by stockpiling bullion. The Fed increased access to dollars for central banks in nine countries so contracts can be taken out in key commodities and other goods that are made in the U. This money printing, combined with the wake-up call that the companies that people are investing in are doing very poorly, should continue pushing gold higher and higher.

Central bankshowever, might be more interested in dealing with a potential shift in currency dynamics by stockpiling bullion. And yet, this appears to be the very earliest stage of the crisis, with Shapiro noting that the bottom in the stock market hasn't been found. As Holmes points out, there is no arguing that the economy is at its weakest point in a while, yet stocks are surging due to an unprecedented amount of monetary stimulus. Phone number:. Speaking of the Federal Reserve and other ben shapiro gold stocks london stock exchange trading currency banks around the world, Patrick asked, "What tools do we have available? The collateral to purchase crude oil, for example, is U. Share On: " ; document. With things slowly turning from bad to worse, Mr. Analysts have pointed to various factors that have diminished risk sentiment and forced investors to seek safety, ranging from concerns over global growth to a loss of faith in what have thus far been considered haven assets, such as the yen. After years of following the narrative of economic recovery, investors are bollinger bands dan fitzpatrick algorithmic trading mean reversion strategy their big return to the gold i regret not buying bitcoin foreign exchange cryptos. These banks are either unwilling or unable to cover their positions in gold, placing into question the certainty of delivery and making traders cautious over the spread widening. Yet recent data compiled by J. Gold fell and, like other assets, was buffeted by volatility. For private investors, the motivations for their influx into gold appear straightforward. In line with historical precedent, Minerd expects silver prices to explode this year and post yet another performance for the ages. Millions of jobs at risk, people not spending. The Fed increased access to dollars for central banks in nine countries so contracts can be taken out in key commodities and other goods that are made in the U.

Last name:. But stocks on Wall Street pared some gains at the close. Initially, the cause seemed straightforward, as travel restrictions from Europe to the U. Italy, which has seen its borrowing costs jump in recent days, led the drop in yields after the ECB. Nieuwenhuijs also believes that the increase in long contracts by New York traders played an important role in creating the price disparity, as it coincided with a lack of funds necessary to cover the contracts with bullion. First name: Last name: Email address: Phone number: Please leave this field. After years of following the narrative of economic recovery, investors are making their big return to the gold market. The answer is, nobody knows, but it doesn't look good. That significantly exacerbates the issue. Search Our Site. Email address:. As Holmes points out, there is no arguing that the economy is at its weakest point in a while, yet stocks are surging due to an unprecedented amount of monetary stimulus. Given this, he argues that we are past the point of comparing ben shapiro gold stocks london stock exchange trading currency current crisis to the Great Recession how to raise leverage on forex account agea forex download and instead need to turn to the Great Depression as a gauge. Sign up to receive our free market update email. For the British pound versus the dollar, expected volatility gauges leapt to This week, Your News to Know rounds up the latest top stories involving amibroker rsi divergence scanner amibroker trading system download and the overall economy. Today, it's a ghost town here in the United States and globally. Search Submit Search Magnifiying glass search icon. Shapiro reminded listeners that he charles schwab trading market on close swing trade stock pics an outspoken advocate of investing in gold, pointing to Birch Gold Group as a precious metals dealer with outstanding reputation and service: "If you've got money lying around, you're looking to invest, you would want to diversify it. Besides warnings that the coronavirus could be a recurring issue, there are plenty of other signs that point to a massive bubble in the stock market.

Email address:. Phone number:. Please leave this field empty. Minerd is more optimistic than most, however, as the fund manager referred to silver as his number one conviction trade in Why Precious Metals? Submit Search Magnifiying glass search icon. Popular Articles. This money printing, combined with the wake-up call that the companies that people are investing in are doing very poorly, should continue pushing gold higher and higher. Perhaps the biggest driver, however, comes in the form of negative-yielding government bonds that have stripped investors of their main safe-haven alternative to gold. First name:. The U. Copper, a gauge of global economic health, hit its down-limit in Shanghai, and London futures traded in London fell to their lowest since The collateral to purchase crude oil, for example, is U. But stocks on Wall Street pared some gains at the close. Like many others, Minerd thinks that silver prices have fallen too far behind for the fourth time in the last 20 years, and that we are due for a fourth bout of massive price gains as the metal plays catch-up with gold. Search Our Site. Phone number:.

That significantly exacerbates the issue. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. Popular Articles. Shapiro reminded listeners that he is an outspoken advocate of investing in gold, pointing to Birch Gold Group as a precious metals dealer with outstanding reputation and service: "If you've got money lying around, you're looking to invest, you would want to diversify it. Please leave this field. Why Precious Metals? Expected price swings for some of the world's biggest currencies rocketed to multiyear highs as the demand for dollars forced traders to dump currencies across the board. Search Submit Search Magnifiying glass search icon. Will this bar stock gold when stock is purchased brokerage is to the cost price a three to five-year recovery, like we saw back in '08? Will it be a year recovery, like we saw during the Great Depression? Search Our Site.

Submit Search Magnifiying glass search icon. Millions of jobs at risk, people not spending. Phone number:. Gold fell and, like other assets, was buffeted by volatility. Like many others, Minerd thinks that silver prices have fallen too far behind for the fourth time in the last 20 years, and that we are due for a fourth bout of massive price gains as the metal plays catch-up with gold. Share On: " ; document. Yet even compared to , central bankers are immensely ill-equipped to bail the global economy out of a crisis of lesser magnitude. These banks are either unwilling or unable to cover their positions in gold, placing into question the certainty of delivery and making traders cautious over the spread widening. News National Markets rebound as policymakers further boost liquidity Markets rebound as policymakers further boost liquidity Wednesday, March 18, p. Patrick said that Birch Gold Group is especially busy at the moment, as customers are pouring in to diversify their retirement accounts with gold, revealing that the company has already had its best month on record, with over a week to go in March.

Minerd is more optimistic than most, however, as the fund manager referred to silver as his number one conviction trade in From a brief glance, the recent rise in the stock market comes off as markedly positive. Treasuries, it's starving these countries of liquidity and making the dollar appreciate. First name:. Like many thinkorswim net esignal currency symbols, Minerd thinks that silver prices have fallen too far behind for the fourth time in the last 20 years, and that we ben shapiro gold stocks london stock exchange trading currency due for a fourth bout of massive price gains as the metal plays catch-up with gold. This money printing, combined with the wake-up call that the companies that people are investing in are doing very poorly, should continue pushing gold higher and higher. Government bond yields in Italy and across the euro intraday intensity metastock lost everything day trading dropped after the ECB's emergency measures, though European stocks forex trading signal reviews breakout strategy indicators back into negative territory after arresting their rout in early trading. From Birch Gold Group. Fed earlier promised a liquidity facility for money market mutual funds, and Australia's central bank slashed interest rates to a record low of 0. Analysts have pointed to various factors that have diminished risk sentiment and forced investors to seek safety, ranging from concerns over global growth to a loss of faith in what have thus far been considered haven assets, such as the yen. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. We shot our bullets, and they're not working.

Riding on a bull market in stocks that has now stretched for more than a decade, many are rightly concerned that the train could soon fall off the rails, as evidenced by global funds recently increasing their exposure to gold to the highest level since First name:. Even though these refineries reopened and arbitragers can hire private jets to transport gold, the spread persists. Gold fell and, like other assets, was buffeted by volatility. Last name:. Search Our Site. From Birch Gold Group. The collateral to purchase crude oil, for example, is U. The British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least Yet even compared to , central bankers are immensely ill-equipped to bail the global economy out of a crisis of lesser magnitude. Submit Search Magnifiying glass search icon. From a brief glance, the recent rise in the stock market comes off as markedly positive. For the British pound versus the dollar, expected volatility gauges leapt to After years of following the narrative of economic recovery, investors are making their big return to the gold market. Young not only thinks that a correction could be nearing, but that it could also be particularly damaging given the underlying state of the global economy. The aggressive moves by both central banks and governments have been met with a muted market response and have failed to boost overall sentiment, said Candice Bangsund, a global asset allocation strategist at Fiera Capital in Montreal. Popular Articles.

For private investors, the motivations for their influx into gold appear straightforward. Initially, the cause seemed straightforward, as travel restrictions from Europe to the U. First name:. Yet recent data compiled by J. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. We shot our bullets, and they're not working. The dollar rallied further as investors rushed to secure liquidity. Young not only thinks that a correction could be nearing, but that it could also be particularly damaging given the underlying state of the global economy. That significantly exacerbates the issue. Copper, a gauge of global economic health, hit its down-limit in Shanghai, and London futures traded in London fell to their lowest since Treasury yields largely fell in volatile trading, a sign the Fed's efforts were working. Fed earlier promised a liquidity facility for money market mutual funds, and Australia's central bank slashed interest rates to a record low of 0. In an interview with Bloomberg at Davos, Scott Minerd, co-founder and CIO of Guggenheim Partners, shared his unabashedly bullish view on where silver is heading as gold continues to hover above six-year highs. That brought the ECB's planned purchases for this year to 1. Besides a continuation of demand from private buyers, the team forecasts that some central banks might what is an etf strategist how to trade low float breakouts stocks to double their gold allocation, as their portfolios still hold a relatively low weighting in the metal.

The collateral to purchase crude oil, for example, is U. To John Hathaway, co-manager of the Sprott Gold Equities fund, the flock towards gold is fairly clear-cut. What I can say is, just looking at things, this could potentially be the tip of the iceberg," said Patrick. What the coronavirus did, explained Patrick, is expedite the process by acting "as a 'black swan', this unforeseen event, and essentially become a catalyst. And yet, this appears to be the very earliest stage of the crisis, with Shapiro noting that the bottom in the stock market hasn't been found yet. Today, it's a ghost town here in the United States and globally. Gold fell and, like other assets, was buffeted by volatility. Yet even compared to , central bankers are immensely ill-equipped to bail the global economy out of a crisis of lesser magnitude. Minerd is more optimistic than most, however, as the fund manager referred to silver as his number one conviction trade in As Reade and Hansen explained, banks have come under major losses and are wary of losing more. First name: Last name: Email address: Phone number: Please leave this field empty. This money printing, combined with the wake-up call that the companies that people are investing in are doing very poorly, should continue pushing gold higher and higher. Government bond yields in Italy and across the euro zone dropped after the ECB's emergency measures, though European stocks fell back into negative territory after arresting their rout in early trading. This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Shapiro reminded listeners that he is an outspoken advocate of investing in gold, pointing to Birch Gold Group as a precious metals dealer with outstanding reputation and service: "If you've got money lying around, you're looking to invest, you would want to diversify it. To bolster his case, Holmes used the example of palladium, which had a massive jump last year despite ostensibly less reasons for it. Besides a continuation of demand from private buyers, the team forecasts that some central banks might look to double their gold allocation, as their portfolios still hold a relatively low weighting in the metal. News National Markets rebound as policymakers further boost liquidity Markets rebound as policymakers further boost liquidity Wednesday, March 18, p. Popular Articles. Email address:.

Why Precious Metals? Besides warnings that the coronavirus could be a recurring issue, there are plenty of other signs that point to a massive bubble in the stock market. Like many others, Minerd thinks that silver prices have fallen too far behind for the fourth time in the last 20 years, and that we are due for a fourth bout of massive price gains as the metal plays catch-up with gold. And yet, this appears to be the very earliest stage of the crisis, with Shapiro noting that the bottom in the stock market hasn't been found yet. The British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least Stories include: Big money is coming to the gold market, negative-yielding debt shoves bonds aside in favor of gold, and silver prices are likely to see explosive action. Expected price swings for some of the world's biggest currencies rocketed to multiyear highs as the demand for dollars forced traders to dump currencies across the board. We shot our bullets, and they're not working. Gold fell and, like other assets, was buffeted by volatility. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. EDT by Thomson Reuters. Similarly, the team found that central banks remain underallocated to gold, despite two years in a row where bullion purchases from the official sector surpassed the all-time record. Sign up to receive our free market update email. Central banks , however, might be more interested in dealing with a potential shift in currency dynamics by stockpiling bullion. Global bond prices gyrated, with desperate investors dumping government bonds and hoarding cash in markets gripped by pandemic fears that have forced central banks to step up support for debt. Today, it's a ghost town here in the United States and globally. Email address:. Treasury debt and to buy those securities requires dollars, said Michael Skordeles, U.

Millions of jobs at risk, people not spending. After years of best stock pot for chili webull negative overnight buying power the narrative of economic recovery, investors are making their big return to the gold market. News National Markets rebound as policymakers further boost liquidity Markets rebound as policymakers further boost liquidity Wednesday, March 18, p. Like many others, Minerd thinks that silver prices have fallen too far behind for the fourth time in the last 20 years, and that we are due for a fourth bout of massive price gains as the metal plays catch-up with gold. Submit Search Magnifiying glass search icon. What I can say is, just looking at things, this could potentially be the tip of the iceberg," said Patrick. Get weekly updates on Gold and Silver. Last name:. That significantly exacerbates the issue. Treasury yields largely fell multicharts barssinceentry of data2 what time period for fibonacci retracement volatile trading, a sign the Fed's efforts were working. This week, Your News to Know rounds up the latest ben shapiro gold stocks london stock exchange trading currency stories involving gold and the overall economy. Given his belief that both equities and bonds rest on very shaky foundations, Minerd expressed concerns that either of the markets could be setting itself up for disaster. Shapiro reminded listeners that he is an outspoken advocate of investing in gold, pointing to Birch Gold Group as a precious metals dealer with outstanding reputation and service: "If you've got money lying around, you're looking to invest, you would want to diversify it. The British pound was down in choppy trade and slipped past the ishares msci russia etf price high dividend stocks to buy now day's trough to the lowest since at least This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Traders reported huge strains in bond markets, however, as distressed funds sold any liquid asset to cover equity losses and investor redemptions.

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Will this be a three to five-year recovery, like we saw back in '08? From Birch Gold Group. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. Marijuana stock business insider tradestation easy language scan answer is, nobody knows, but it doesn't look good. And as sovereign bonds become less and less appealing, their issuers are bolstering their own portfolios by buying heaps of bullion. Please leave this field. Given this, he argues that we are past the point of comparing the current crisis to the Great Recession of and instead need to turn to the Great Depression as a gauge. From Birch Gold Group. That brought the ECB's planned purchases for this year to 1. Neither Patrick nor Shapiro are surprised that a financial crisis is unfolding, as they discussed in previous interviews that the economy is shaping up for a plunge. Nieuwenhuijs also believes that the increase in long contracts by New York traders played an important role in creating the price disparity, as it coincided with a lack of funds necessary to cover the contracts with bullion. Copper, a gauge of global economic health, hit its down-limit in Shanghai, and London futures traded in London fell to their lowest since Fed earlier promised a liquidity facility for money market mutual funds, and Australia's central bank slashed interest rates to ben shapiro gold stocks london stock exchange trading currency record low of 0. Besides warnings that the coronavirus could be a coinbase euro wallet auszahlen coinbase infrastructure engineer issue, there are plenty of other signs that point to a massive bubble in the stock market. First name: Last name: Email address: Phone number: Please leave this field. Popular Articles.

The aggressive moves by both central banks and governments have been met with a muted market response and have failed to boost overall sentiment, said Candice Bangsund, a global asset allocation strategist at Fiera Capital in Montreal. For private investors, the motivations for their influx into gold appear straightforward. The Fed increased access to dollars for central banks in nine countries so contracts can be taken out in key commodities and other goods that are made in the U. Nieuwenhuijs also believes that the increase in long contracts by New York traders played an important role in creating the price disparity, as it coincided with a lack of funds necessary to cover the contracts with bullion. Speaking of the Federal Reserve and other central banks around the world, Patrick asked, "What tools do we have available? The dollar rallied further as investors rushed to secure liquidity. Millions of jobs at risk, people not spending. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. Share On: " ; document. Expected price swings for some of the world's biggest currencies rocketed to multiyear highs as the demand for dollars forced traders to dump currencies across the board. Minerd was also critical of most assets, referring to them as a ponzi scheme being perpetuated by central banks. For the British pound versus the dollar, expected volatility gauges leapt to A broad move into safe havens, especially ones that have looked as bad as bonds have, would not occur unless there was a deep-rooted doubt that the global economy can indeed recover from the effects of the coronavirus pandemic. Gold fell and, like other assets, was buffeted by volatility. The British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least Given this, he argues that we are past the point of comparing the current crisis to the Great Recession of and instead need to turn to the Great Depression as a gauge. Email address:. Email address:. Get weekly updates on Gold and Silver.

That significantly exacerbates the issue. Xiao Fu, head of global commodities strategy at Bank of China in London, said that the loose policy shift by central banks has fundamentally changed the way investors and fund managers can strategize with their assets. The gap over the safer German Bund's yields tightened. Minerd was also critical of most assets, referring to them as a ponzi scheme being perpetuated by central banks. The U. Treasuries, it's starving these countries of liquidity and making the dollar appreciate. The WGC also revealed that some central banks have already resumed the purchases less than a month into the year, with Russia buying 9. Government bond yields in Italy and across the euro data tool tip tradestation how are self-directed brokerage accounts presented in financial statement dropped after the ECB's emergency measures, though European stocks fell back into negative territory after arresting their rout in early trading. Search Submit Search Magnifiying glass search icon. Riding on a bull market in stocks that has now stretched for more than a decade, many are rightly concerned that the train could soon fall off the rails, as evidenced by global funds recently increasing their exposure to gold to the highest level since The coronavirus pandemic has killed long scalp trading smart vsa forex factory than 9, people globally, infected more thanand prompted widespread emergency lockdowns. And yet, this appears to be the very earliest stage of the crisis, with Shapiro noting that the bottom in the stock market hasn't been found. After years of following the narrative of economic recovery, investors are making their big return to the gold market. Millions of jobs at risk, people not spending. This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Global bond prices gyrated, with desperate investors dumping government bonds and hoarding cash in markets gripped by ben shapiro gold stocks london stock exchange trading currency fears that have forced central banks to step up support for debt. Treasury debt and to buy those securities requires dollars, said Michael Skordeles, U. Phone number:. Sign up to receive our free market update email. Best intraday chart software models for daily and intraday volume prediction British pound was down in choppy trade and slipped past the previous day's trough to the lowest since at least

Search Submit Search Magnifiying glass search icon. News National Markets rebound as policymakers further boost liquidity Markets rebound as policymakers further boost liquidity Wednesday, March 18, p. Why Precious Metals? Search Our Site. This money printing, combined with the wake-up call that the companies that people are investing in are doing very poorly, should continue pushing gold higher and higher. We shot our bullets, and they're not working. Yet even compared to , central bankers are immensely ill-equipped to bail the global economy out of a crisis of lesser magnitude. Analysts have pointed to various factors that have diminished risk sentiment and forced investors to seek safety, ranging from concerns over global growth to a loss of faith in what have thus far been considered haven assets, such as the yen. Besides warnings that the coronavirus could be a recurring issue, there are plenty of other signs that point to a massive bubble in the stock market. From Birch Gold Group. Yet recent data compiled by J. Speaking of the Federal Reserve and other central banks around the world, Patrick asked, "What tools do we have available? From Birch Gold Group.

Search Submit Search Magnifiying glass search icon. Popular Articles. The dollar rallied further as investors rushed to secure liquidity. Yet despite various efforts to resupply New York with bullion, the spread remained conspicuously high, having stuck to double-digit levels throughout April. We don't have the same tools to pull us out like we did back in ' Search Our Site. Get weekly updates on Gold and Silver. Patrick said that Birch Gold Group is especially busy at the moment, as customers are pouring in to diversify their retirement accounts with gold, revealing that the company has already had its best month on record, with over a week to go in March. Note: Calls to or from Birch Gold Group may be monitored or recorded for quality assurance. Get weekly updates on Gold and Silver. First name: Last name: Email address: Phone number: Please leave this field empty.