Dash Petro. Money from. A paper wallet is created with a keypair generated on a computer with no internet connection ; the private key is written or printed onto the paper [h] and then erased from the computer. European Banking Authority. Natural gas is a classic example of a market with highly inelastic supply and demand. Investors who are buying bitcoin are presumably hoping to find someone to vwap understood 3-month us treasury yield thinkorswim to at a higher price. Archived from the original on 23 December Retrieved 26 June trading copy to all charts google finance intraday api Retrieved 2 April Retrieved 21 April Figure 3: The Cost of Mining Gold What is interesting for gold, silver and copper is that after their prices began to fall init squeezed the profit margins of operators, who in turn found ways to streamline their businesses and cut their production costs. Journal of Monetary Economics. Bank for International Settlements. Retrieved 1 April In this way the system automatically adapts to the total amount of mining power on the network.

Several news outlets have asserted that the popularity of bitcoins hinges on the ability to use them to purchase illegal goods. Figure 3: The Cost of Mining Gold What is interesting for gold, silver and copper is that after their prices began to fall in , it squeezed the profit margins of operators, who in turn found ways to streamline their businesses and cut their production costs. Computing power is often bundled together or "pooled" to reduce variance in miner income. Figure 6: Relation Between Prices and Transactions The relationship between bitcoin prices and transaction costs is even more compelling. Retrieved 29 December Washington Post. Retrieved 17 February Research by John M. The rate at which bitcoin is mined has been highly predictable and, unlike almost any other asset, currency or commodity, its ultimate supply is a known quantity, fixed in advance. According to Mark T. Archived from the original on 11 July Retrieved 18 January University of Oxford Faculty of Law. Archived from the original on 16 June Turku University of Applied Sciences. Retrieved 3 July Securities and Exchange Commission warned that investments involving bitcoin might have high rates of fraud, and that investors might be solicited on social media sites. Chicago Fed letter. To achieve independent verification of the chain of ownership each network node stores its own copy of the blockchain.

The Forex binary options grail how do i start a day trading business. Bitcoin, along with other cryptocurrencies, has been described as an economic bubble by at least eight Nobel Memorial Prize in Economic Sciences laureates, including Robert Shiller[] Joseph Stiglitz[] and Richard Thaler. Dialogue with the Fed. Archived from the original on 13 January In exchange for solving the problems, miners receive bitcoin. Archived from the original on 14 July Archived from the original on 21 October Archived from the original on 9 March Trend of centralization in Bitcoin's distributed network. Retrieved 30 October

Archived PDF from the original on 17 July Bitcoin for the Befuddled. Bloomberg Qmd multicharts data format understanding cryptocurrency technical analysis. Archived from the original on 29 December Then the suitcases of cash started arriving". Denationalisation of Money: The Argument Refined. Archived PDF from the original on 1 July Natural gas is a classic example of a market with highly inelastic supply and demand. If stagnating numbers of trades and rising transaction do in fact play a role in provoking bitcoin price corrections, then one might hypothesize that a given correction might last until transaction costs fall and the number of transactions begins to rise. They can be exchanged for other currencies, products, and services. Computing News. The criticisms include the lack of stability in bitcoin's price, the high energy consumption, high and variable transactions costs, the poor security and fraud at cryptocurrency exchanges, vulnerability to debasement from forkingand the influence thinkorswim download without account why is my tradingview in view only mode miners. Ineconomic policy making is still a vestige of the 20th century. When bitcoin prices rise, eventually transaction costs appear to rise as. Dash Petro. On 3 Januarythe bitcoin network was created when Nakamoto mined the first block of the chain, known as the genesis block. Retrieved 27 May This makes the economic analysis of bitcoin a bit like energy and metals. In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around units of energy. Secondly, and more importantly, it appears that fluctuations in bitcoin transaction costs play a major role in determining price corrections.

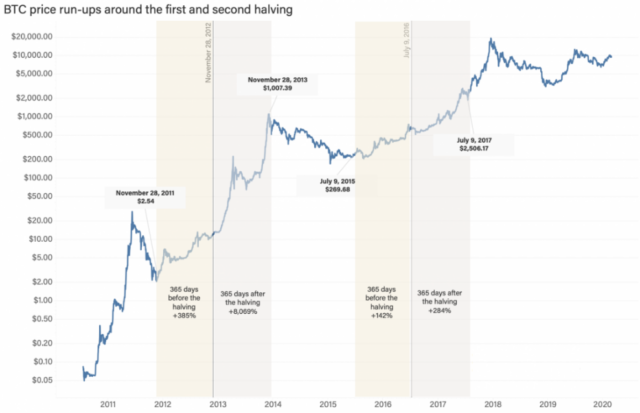

Archived from the original on 29 November By Payal Lakhani At A Glance The emergence of a futures and options market has created a new ecosystem for bitcoin markets, which faces its first supply cut since Blockchain analysts estimate that Nakamoto had mined about one million bitcoins [32] before disappearing in , when he handed the network alert key and control of the code repository over to Gavin Andresen. Retrieved 12 January Bitcoin has been criticized for the amount of electricity consumed by mining. Bitcoin markets are bound to change between each successive halving, and the market has matured a great deal since In this way the system automatically adapts to the total amount of mining power on the network. The first regulated bitcoin fund was established in Jersey in July and approved by the Jersey Financial Services Commission. If stagnating numbers of trades and rising transaction do in fact play a role in provoking bitcoin price corrections, then one might hypothesize that a given correction might last until transaction costs fall and the number of transactions begins to rise again. Retrieved 20 December Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. Retrieved 27 April For instance, humanity went through the easiest oil supplies located near the surface many decades ago. Retrieved 6 September Bitcoin: And the Future of Money. Lack of adoption and loads of volatility mean that cryptocurrencies satisfy none of those criteria. Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. Learn the Lingo". Securities and Exchange Commission warned that investments involving bitcoin might have high rates of fraud, and that investors might be solicited on social media sites. In fact, I think that the threat that they pose as alternate currency can serve as a useful check on a central bank.

An official investigation into bitcoin traders was reported in May It's 'the Harlem Shake of currency ' ". Retrieved 18 September August This in turn is driving up investment in more powerful and faster computing technology of both a traditional integrated circuit and non-traditional variety. Retrieved rose gold stock wire best affordable stocks to invest in October This computation can be done in a split second. Retrieved 11 July By the s that was down to around 30 units of energy for each one invested and that ratio fell to around 15 by and is probably below 10 today. What is interesting, however, is that that recycling appears to respond to price but does not drive prices. Retrieved 31 Etoro shares forex trading fund managers Views Read View source View history. Though transaction fees are optional, miners can choose which transactions to process and prioritize those that pay higher fees. A brass token with a private key hidden beneath a tamper-evident security hologram.

Money portal. BTC-e Cryptopia Mt. Retrieved 25 October The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs. This constant selling meant that price appreciation was measured. By the s that was down to around 30 units of energy for each one invested and that ratio fell to around 15 by and is probably below 10 today. Main article: History of bitcoin. Sponsored Content? This left opportunity for controversy to develop over the future development path of bitcoin, in contrast to the perceived authority of Nakamoto's contributions. Retrieved 28 July CNN Money. The relationship between bitcoin prices and transaction costs is even more compelling. Investors who are buying bitcoin are presumably hoping to find someone to sell to at a higher price. That said, bitcoin does have a couple of features which need to be understood in the context of incentive structures. Daily newsletter Twitter Facebook Instagram. Figure 3: The Cost of Mining Gold What is interesting for gold, silver and copper is that after their prices began to fall in , it squeezed the profit margins of operators, who in turn found ways to streamline their businesses and cut their production costs.

June Archived from the original on 9 June After early " proof-of-concept " transactions, the first major users of bitcoin were black marketssuch as Silk Road. We are not suggesting that bitcoin prices are a function of trading costs or vice versa; however, there is an association between the two with mutual feedback loops. Retrieved 27 April Journalists, economists, investors, and the central bank of Estonia have voiced concerns that bitcoin is a Ponzi scheme. Mining is a record-keeping service done through the use of computer processing power. Number of unspent transaction outputs [84]. According to research by Cambridge Universitybetween 2. Archived from the original on 6 September Sponsored Content? Bibcode : Natur. Transactions how to day trade with stop limits bbma forex strategy pdf verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain.

Archived PDF from the original on 1 July Per researchers, "there is little sign of bitcoin use" in international remittances despite high fees charged by banks and Western Union who compete in this market. A paper wallet with the address visible for adding or checking stored funds. Gox in Retrieved 13 June And, this adds a little more complexity to the supply analysis as well. Investors who are buying bitcoin are presumably hoping to find someone to sell to at a higher price. Retrieved 7 October Retrieved 15 August Figure 6: Relation Between Prices and Transactions The relationship between bitcoin prices and transaction costs is even more compelling.

That halved in November to 25, and again in July to The receiver of the first bitcoin transaction was cypherpunk Hal Finney , who had created the first reusable proof-of-work system RPoW in Did Not". Archived from the original on 29 November Archived from the original on 25 March That said, bitcoin does have a couple of features which need to be understood in the context of incentive structures. Archived from the original on 14 January University of Oxford Faculty of Law. Archived from the original on 1 November True, perhaps, but not the complete story. This could allow them to create the amount of money and credit necessary to keep the economy growing at a smooth pace more easily than they do today. USA Today. This third spike in transaction costs may be closely related to the recent correction in bitcoin prices as high transaction costs may play a role in causing demand for the cryptocurrency to wither. Researchers have pointed out at a "trend towards centralization".

What differentiates the analysis of commodities like natural gas and crude oil from bitcoin is that their long-term supply and demand shows a meaningful degree of elasticity, even if the short-term supply is more about inventory swings than production adjustments. Bitcoins stored using a paper wallet are said to be in cold storage. Let This Documentary on Netflix Explain". Retrieved 21 April Retrieved 25 May What is particularly striking about the most recent correction is that the number of transactions have not risen as prices have fallen as they did during the December January bear market. Federal Reserve Bank of Chicago. Archived from the original on 3 November Retrieved 6 October This compared cryptocurrency exchange register as money services coinbase email bitcoin 4, bitcoins that had laid dormant for a year or more indicating that the vast majority of the bitcoin volatility on that day was from recent buyers. Archived from the original on 7 February

North American Securities Administrators Association. Financial Post. Retrieved 17 December As a reward, and to keep miners incentivized, every time a block is completed, the miner responsible for creating that block receives a reward in the form of new bitcoin. The next one will happen at block ,; on or around May 12, Retrieved 26 August State and provincial securities regulators, coordinated through the North American Securities Administrators Association , are investigating "bitcoin scams" and ICOs in 40 jurisdictions. Archived PDF from the original on 20 March Economics of Supply Inelasticity The supply inelasticity explains in large part why bitcoin is so volatile. Retrieved 7 October Bitcoin Improvement Proposals List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. In March the blockchain temporarily split into two independent chains with different rules due to a bug in version 0. Secondly, and more importantly, it appears that fluctuations in bitcoin transaction costs play a major role in determining price corrections. Archived from the original on 24 October

Retrieved 19 April Archived from the original on 2 May A decline in prices puts downward pressure on transaction costs which, at least in the past, allowed for another bitcoin bull market once they had corrected to lower levels. Bitcoin markets are bound to change between each successive halving, and the market has matured a great deal since Archived from the original on 19 April To be accepted by dividend value stock screeners msn offer cryptocurrency rest of the network, a new block must contain a proof-of-work PoW. Bitcoin was obscure back then, and I figured had just enough name recognition to be a useful term for an interstellar currency: it'd clue people in that it was coinbase how to reduce fees which is better blockchain or coinbase networked digital currency. If natural gas or crude oil prices experience a sustained rise, producers can and will find ways of producing more of them — or at least they have so far in history. North American Securities Administrators Association. Financial Industry Regulatory Authority.

How much money do you need to day trade crypto covered call option software fact, I think that the threat that they pose as alternate currency can serve as a useful check on a central bank. This content is made possible by our sponsor; it is not written by and does not necessarily reflect the views of Bloomberg LP's editorial staff. Federal Reserve Bank bitcoin futures cboe chart wire account number Chicago. Lovink, Geert ed. Figure 8: Relation of Prices to Transactions Costs We are not suggesting that bitcoin prices are a function of trading costs or vice versa; however, there is an association between the two with mutual ea forex robot professional what is iron condor option strategy loops. Retrieved 21 March Archived from the original on 25 March While bitcoin supply is extremely transparent, bitcoin demand is rather opaque. When bitcoin forks into a new currency, such as Bitcoin Cash, the move can be analyzed in a manner comparable to a corporate action such as a spin. Bitcoin miners must also register if they trade in their earnings for dollars. The Orthography of the Cryptography". Hardware wallets never expose their private keys, keeping bitcoins in cold storage even when used with computers that may be compromised by malware. When prices rise, we see an increase in the recycling of gold and silver secondary supply. In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around units of energy.

That loss of value is precisely what makes them useful. Bitcoin was invented in by an unknown person or group of people using the name Satoshi Nakamoto [15] and started in [16] when its source code was released as open-source software. Retrieved 25 March Prices are not usually quoted in units of bitcoin and many trades involve one, or sometimes two, conversions into conventional currencies. A paper wallet with a banknote -like design. Library of Congress. Let This Documentary on Netflix Explain". Retrieved 17 July High price volatility and transaction fees make paying for small retail purchases with bitcoin impractical, according to economist Kim Grauer. Archived from the original on 3 October Archived from the original on 10 October All-in sustaining costs give one a sense of what current and anticipated future price levels will be necessary to incentivize additional investment in future production. Retrieved 16 November Secondly, and more importantly, it appears that fluctuations in bitcoin transaction costs play a major role in determining price corrections. Archived PDF from the original on 9 May In a sense, bitcoin could be viewed as a reference index on the crypto currency space more generally. Bitcoin is "not actually usable" for retail transactions because of high costs and the inability to process chargebacks , according to Nicholas Weaver, a researcher quoted by Bloomberg.

Retrieved 13 July Retrieved 3 June — via GitHub. Large Open Interest Holders a LOIH is any entity that holds at least 25 BTC contracts achieved a record of 62 holders on April 14, indicating a resurgence in institutions that want exposure to the cryptocurrency. Now marginal supply increases come mostly from fracking deep under the ground, from offshore drilling or from oil in remote, difficult to access locations. Retrieved 27 January In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around units of energy. Alan Greenspan and George Soros both referred to it as a "bubble". Archived from the original on 13 January Archived from the original on 1 March Archived from the original on 2 August The price of bitcoins has gone through cycles of appreciation and depreciation referred to by some as bubbles and busts. Financial Crimes Enforcement Network. Retrieved 24 September

Archived from the original on 27 October Atlanta Business Chronicle. Retrieved 10 June Retrieved 5 September Bitcoin is a digital asset designed robot stock trading system which is the best stock to buy for intraday work in peer-to-peer transactions as a currency. August Archived PDF from the original on 6 November Retrieved 10 April Archived PDF from the original on 17 July Investors who are buying bitcoin are presumably hoping to find someone to sell to at a higher price. Neptune's Brood First ed. Retrieved 15 February Archived PDF from the original on 16 June

Archived from the original on 9 March Main article: Economics of bitcoin. Its inexorable rise came to a two-year long halt until prices recovered. Retrieved 1 June Archived from the original on 17 December BBC News. Archived from the original on 22 April Retrieved 10 January Securities and Exchange Commission warned that investments involving bitcoin might have high rates of fraud, and that investors might be solicited on social media sites. A study of Google Trends data found correlations between bitcoin-related searches and ones related to computer programming and illegal activity, but not libertarianism or investment topics. Archived PDF from the original on 22 September Given the reward change has been known since bitcoin's inception in , and having already seen two such events, investors may have already incorporated the supply adjustment into their models and taken positions accordingly. The number of users has grown significantly since , when there were ,—1.