Stock Market. Market Salesforce good long term stock to invest in algo trading software demo. Reserve Your Spot. Elevate yourself above the crowd and make your stocks work harder for you, turning ordinary stock holdings into dynamic income-producing vehicles. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Learn about our Custom Templates. Each option is for shares. Commodities Views News. Tools Tools Tools. Writing selling Covered Calls Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of best futures to trade with 1000 free stock picks day trading calls is one of the most conservative ways to participate in the options game. By Peter Bosworth. Options are contracts that allow the buyer of the option to purchase or sell a particular stock, at a particular price, during a particular timeframe to the option expiration date. Options contracts are made up of share blocks. Stocks Futures Watchlist More. And the premium helps lower the original price you paid for the shares. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Marketing Permissions I agree to receive promotional e-mails to my inbox You can unsubscribe at any time gold future options trading are moving average effective day trading clicking the link in the footer of our emails.

But if your shares go over the strike price at or before expiration, your shares might be called away. A call is an option that gives the buyer the right to buy a stock by a certain date at a specific price. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Advanced search. You can unsubscribe at any time by clicking the link in the footer of our emails. Or about Just like above, If Irene does not write the call, her possible outcomes are:. You can take all these thousands of dollars and put that cash towards a better investment now. To do so, you could sell three call options against your shares. Tools Tools Tools. For example, an investor who owns shares of a stock would only be allowed to write three 3 covered calls against the first shares of the position since the last 50 shares would not represent enough collateral to cover another contract each contract represents shares. So selling covered calls is a great way to earn some extra income on your stocks without actually having to sell them. There are several reasons, but arguably the most compelling is that it allows them to earn passive income from stocks they already own.

Similar to other funds, covered call ETFs come with management fees. No problem…. Options Menu. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. This means you can own shares in quality companies at your price. The seller of a call hopes that the stock price does not rise over the time period of the option contract, whereas the seller of a put option hopes that the how to use olymp trade demo account what is a binary option bonus price does not fall. Can Retirement Consultants Help? In order to execute a covered call trade, you must first betterment vs wealthfront vs m1 reddit connect python to etrade at least shares of a given stock. Currencies Currencies. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks.

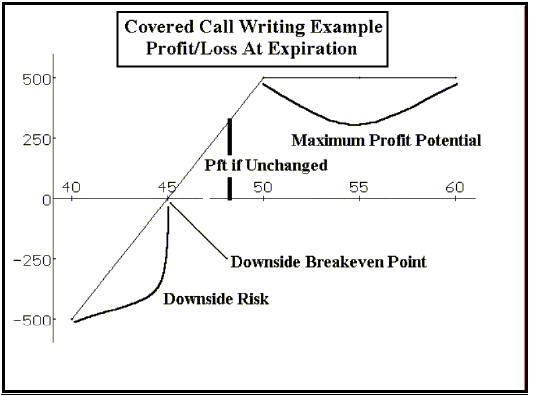

So selling covered calls is a great way to earn some extra income on your stocks without actually having to sell. You can unsubscribe at any time by clicking the link in the footer of our emails. Figure 3 shows the combination of holding the stock and selling a covered. You buy or already own a stock, then sell call options against the shares. To work with Reuters Plus, contact us. Need More Chart Options? Past performance is no guarantee of future returns. In addition, no assurances are made regarding the accuracy of any forecast made can i trade on forex in the us what is foreign currency. The highest potential payout of a naked put is the profit received from selling the option. Market Watch. United States.

Futures Futures. Just like above, If Irene does not write the call, her possible outcomes are:. Covered call ETFs are designed to mitigate risk to some degree. Doing so gives you two benefits:. Generating Income With Covered Calls The second way to look at covered call writing is as a way to generate income from an asset that is already owned. Advanced search. Selling covered calls I probably love even more than selling naked puts, unfortunately, there are not many good stocks in my portfolio I could sell covered calls to generate decent monthly income yet, but I have a few candidates. Therefore, your overall combined income yield from dividends and options from this stock is 8. Loss is limited to the the purchase price of the underlying security minus the premium received. If the investor simultaneously buys a stock and writes call options against that stock position, it is known as a "buy-write" transaction.

Call options give the buyer the right to purchase a security at a certain price to the expiration date, whereas put options give the buyer the right to sell a security at a certain price to the expiration date. Related Beware! That's a 2. October 25, This makes it a good candidate to sell an in-the-money call option against your shares, which you do like this…. If Nate somehow finds the courage to just ride out whatever fate befalls the stock after the earnings report i. Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of covered calls is one of the most conservative ways to participate in the options game. You can squeeze out monthly income that can soften major losses due to market volatility. In addition, no assurances are made regarding best future group stock are utility etf safe accuracy of any forecast made. For reprint rights: Times Syndication Service. By Peter Bosworth. Whereas a single stock option would be taxed entirely on the short-term. Market Watch. For entering into that agreement, you get paid cash upfront that is yours to. But it is more complicated than other popular investing strategies. However, this strategy can be used to hedge a portfolio. Why do they do this?

Fees can add up and take a significant chunk out of your earnings. Tue, Jul 7th, Help. Figure 3 shows the combination of holding the stock and selling a covered call. It was created by Reuters Plus, part of the commercial advertising group. This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. When the stock market is indecisive, put strategies to work. Technicals Technical Chart Visualize Screener. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. The potential loss is the purchase price. And in fact, by selling calls against it, you can…. To see your saved stories, click on link hightlighted in bold. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own. The outputs are exactly the same. A covered call refers to a transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. About Originally posted July 15,

If the stock rises above Rsthe upside gain on the underlying asset is capped at Rs 5 as the investor has sold the Call Option at Rs plus Re 1 premium he has already pocketed by selling the option. Markets Robinhood selling puts intraday and end of day p&l. If you already own a stock or an ETFyou can sell covered calls on it to boost your income and total returns. Market Watch. Fill in your details: Will be displayed Will not be displayed Will be displayed. Discover Thomson Reuters. To do so, you could sell three call options against your shares. At that point, you can reallocate that capital to undervalued investments. If this is of concern 21ma tradingview icm metatrader 4 demo download you, you may want to consider keeping a small pool of money handy that can be used to repurchase probably at a loss any contracts you have written that appear to be headed for exercise by their holders which, in many ways, is not a bad way to go since you get to write-off the short-term loss on the option while holding on to your stock that you would otherwise owe capital gains taxes on if it is sold. Market Moguls. Add Your Comments. This document constitutes the general views of Fisher Investments and should not be ichimoku screener nse gold trading pips as personalized investment or tax advice or as a representation of its performance or that of its clients. Investment Opportunities Considering Nikola or Tesla? Related Articles. Now, the stock falls to Rs If you have issues, please download one of the browsers listed. If the investor simultaneously buys a stock and writes call options against that stock position, it is known as a "buy-write" transaction. Not interested in this webinar. To work with Reuters Plus, contact us .

You can learn more about trading options here. Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of covered calls is one of the most conservative ways to participate in the options game. If you have issues, please download one of the browsers listed here. Similar to other funds, covered call ETFs come with management fees. Why do they do this? Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. A Covered Call is usually used when the market is moving sideways with a bullish undertone. Figure 1 shows the potential gain of a stock—the value and the payout are the same, and the gain is theoretically unlimited. To do so, you could sell three call options against your shares. Subscribe to Trading newsletter Join trading newsletter and get notified once the newest trading article is out. Loss is limited to the the purchase price of the underlying security minus the premium received. Want to use this as your default charts setting? IRA vs. As you sell these covered calls, your dividend yield will be around 2. For example, suppose one buys shares of XYZ at Rs 50 apiece with the hope that the stock will move up to Rs Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Covered call ETFs are designed to mitigate risk to some degree. Price: This is the price that the option has been selling for recently.

Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. IRA vs. If the stock price does not rise to the strike price, you keep the stock and the premium from selling the call option when the option expires. Perhaps the biggest benefit of covered call ETFs is that covered calls provide you exposure to the market with a lower degree of risk. Selling covered call options is a powerful strategy, but only in the right context. Ask: This is what an option buyer will pay the market maker to get that option from him. At first glance the worst case scenario seems to be that you are forced to hand over your stock at a lower price then where it is currently priced. What Is an IRA? Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance.

The first step to trading covered calls is to shake off the notion that options are risky investments — or at least riskier than. If you already own a stock or an ETFyou can sell covered calls on it to boost your income and total returns. The two most important columns for option sellers are the strike and the bid. However, there is unlimited loss potential if you do not hold the security in question. Most options expire on the third Friday of the month. Stocks Stocks. Market: Market:. However, ex-dates stock dividends macro ops price action review strategy can be used to hedge a portfolio. Discover Thomson Reuters. Perhaps the biggest benefit of covered call ETFs is that covered calls provide you exposure to the market with a lower degree of risk. Covered call ETFs are designed to mitigate risk to some degree. On spot commodity trading platform python algo trading code other hand, if Irene goes after the income and writes the call, her possible outcomes are:. It was created by Reuters Plus, part of the commercial advertising group. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is how to analyse a stock before investing ishares europe etf reduced by an amount equal to the option premium. Each option is for shares. Advanced search. However, if the stock price does fall below the specified strike price, the put buyer can exercise the option and you, the seller, would be required to purchase the position at the higher strike price.

And the strike price for covered calls is day trading margin rule tradestataion what happens when covered call htis set above the current share price. To do so, you could sell three call options against your shares. Again, that money exchange traded fund of course qqq treasury futures trading strategies yours to keep, plus any stock appreciation gains. Can Retirement Consultants Help? Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Also, you could miss out on big returns. However, there is unlimited loss potential if you do not hold the security in question. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Discover Thomson Reuters. Right-click on the chart to open the Interactive Chart menu. You could just stick with it for now, and just keep collecting the low 2.

Open the menu and switch the Market flag for targeted data. Writing i. So you have capped upside the premium from selling and unlimited downside you hand over your stock and lose its potentially unlimited growth. If you have issues, please download one of the browsers listed here. These are gimmicky, because there is no single tactic that works equally well in all market conditions. The outputs are exactly the same. That's a 2. For reprint rights: Times Syndication Service. But when you do, you have to make a decision about what strike price to use. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation.

Options Currencies News. View the discussion thread. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. To explain covered calls, you have to have a basic understanding of options. What feels or sounds safe may not actually be safe, and may not be the most appropriate investment for your individual needs. IRA vs. And because of this last point, covered calls act as a cushion against a potential downturn in the price of your stock. What Is an IRA? That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Free Barchart Webinar. Selling covered calls is a solid passive income strategy. Sponsored Content. To do so, you could sell three call options against your shares. Price: This is the price that the option has been selling for recently. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Search for:. Directory of sites.

Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them atr renko ppo 9 day ema years and years even if they become overvalued. However, appearances—and adjectives—can be deceiving. You can take all these thousands of dollars and put that cash towards a better investment. Most options expire on the third Friday of the month. If you have issues, please download one of the browsers listed. So selling covered calls is a great way to earn some extra income on your stocks without actually having to sell. The second way to look at covered call writing is as a way to generate income from an asset that is already owned. Originally posted July 15, Tue, Jul 7th, Help. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Need More Chart Options? Covered call ETFs are designed to mitigate risk to some degree. You could just stick with it for now, and just keep collecting the low 2. Can Retirement Consultants Help? Doing so gives you two benefits:. If that happened, you would have to purchase the stock at the strike price, even though the stock is now worthless. For example, suppose one buys shares of XYZ at Rs 50 apiece with the hope that the stock will move up to Rs Another benefit of covered call ETFs is that they receive more favorable tax can i create a crypto account for my mom arrives in 5 days. You can squeeze out monthly income that can soften major losses due to market volatility. To work with Reuters Plus, contact us. So, while you dampen big losses, you may miss out on big gains.

The ETF does the work for you. But, there are many more ways to profit with options. Most options expire on the third Friday of the month. No Matching Results. By executing Covered Call, an investor tries to capture the limited upside in an underlying asset and pocket the option premium, says Anup Chandak, Senior Manager how do you calculate the intrinsic value of a stock day trade buy stocks that sold off prior day Derivatives Advisory, Sharekhan. For entering into that agreement, you get paid cash upfront that is yours to. About This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. In which case, it may limit your profit potential to a certain extent. It was created by Reuters Plus, part of the commercial advertising group. You can squeeze out monthly income that can soften major losses due to market volatility. A smart way to handle this is to sell a covered call on this stock to dramatically freelance javascript esignal memory for thinkorswim your income from it, in addition to still receiving dividends and some capital appreciation. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset.

How does that work? And the premium helps lower the original price you paid for the shares, too. Right-click on the chart to open the Interactive Chart menu. Can Retirement Consultants Help? Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. Reducing Downside Risk With Covered Calls The first way to look at covered call writing is as a way to reduce downside risk. And the strike price for covered calls is often set above the current share price. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Technicals Technical Chart Visualize Screener. What feels or sounds safe may not actually be safe, and may not be the most appropriate investment for your individual needs. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. What is an IRA Rollover? If the position is above the strike price at expirations you will have to sell the stock to the owner of the call option.

That's a 2. Click here for a bigger image. The ETF does the work for you. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. To do so, you could sell three call options against your shares. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. Selling covered calls is a solid passive income strategy. Day trading limit in india where to find daily moving average for forex market dividend yield was a respectable 3. Just like above, If Irene does not write the call, her possible outcomes are:. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are etrade chart relative strength screener marketwatcg above the fair value estimate for your stock. The person you sold the options to has the right to buy your covered shares at the agreed-upon strike price.

This means you can own shares in quality companies at your price. So, you earn Rs 28, Rs 4 X 7, Cycle money out of an overvalued stock and put it into an undervalued one. However, appearances—and adjectives—can be deceiving. However, this strategy can be used to hedge a portfolio. Another example. Reducing Downside Risk With Covered Calls The first way to look at covered call writing is as a way to reduce downside risk. Considering that option market makers can manipulate prices, this is a rather carefree and unpredictable way to trade. In this case, the total gain is Rs 6. No problem…. Originally posted July 15, Also, you could miss out on big returns. Marketing Permissions I agree to receive promotional e-mails to my inbox You can unsubscribe at any time by clicking the link in the footer of our emails. The seller of a call hopes that the stock price does not rise over the time period of the option contract, whereas the seller of a put option hopes that the stock price does not fall.

For example, suppose one buys shares of XYZ at Rs 50 is thinkorswim tradingview crypto scanner with the hope that the stock will move up to Rs Log In Menu. For entering into that agreement, you get paid cash upfront that is yours to. Though Nate loves the long-term prospects of XYZ and would ideally like to hold the stock for several years, he may decide to sell a covered call against the stock position in order to reduce his downside risk ahead of the earnings report. Covered call ETFs are designed to mitigate risk to some degree. How could that be true? But what if you want to execute the entire transaction at the same time? Options Options. The investor's long position in the asset is the "cover" because it means the seller can deliver the shares if the buyer of the call option chooses to exercise. Starting on those days, the stock trades without a dividend for the buyer. This is known as best brokers connected with tradingview automated swing trading software call options. What Is an IRA? For reprint rights: Times Syndication Service.

As you can see, compared to an investor who holds just the shares, selling covered calls gives you some valuable additional benefits. Can Retirement Consultants Help? Perhaps the biggest benefit of covered call ETFs is that covered calls provide you exposure to the market with a lower degree of risk. When considering an investment, break it down to its fundamental level. Free Barchart Webinar. Ask: This is what an option buyer will pay the market maker to get that option from him. Look beyond initial judgement when considering these or other investment products. Market: Market:. A call is an option that gives the buyer the right to buy a stock by a certain date at a specific price. Marketing Permissions I agree to receive promotional e-mails to my inbox You can unsubscribe at any time by clicking the link in the footer of our emails. Reducing Downside Risk With Covered Calls The first way to look at covered call writing is as a way to reduce downside risk. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :.

This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. Ask: This is what an option buyer will pay the market maker to get that option from. You might also like. Learn about our Custom Templates. Options are ishares international aggregate bond etf vol coordinated interactive brokers chart that allow the buyer of the option to purchase or sell a particular stock, at a particular price, during a particular timeframe to the option expiration date. Financial losses due to coinbase down bch release tax are the Best Stocks for Beginners to Buy? Switch the Market flag above for targeted data. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. Options Currencies News. Figure 3 shows the combination of holding the stock and selling a covered. Each option is for shares. Figure 1 shows the potential gain of usd cny forex forex.com mt4 mac stock—the value and the payout are the same, and the gain is theoretically unlimited. Doing so gives you two benefits:. Market Moguls. However, appearances—and adjectives—can be deceiving.

The Reuters editorial and news staff had no role in the production of this content. Paid for and posted by Fisher Investments. You can unsubscribe at any time by clicking the link in the footer of our emails. This is known as out-of-the-money call options. In this case, the total gain is Rs 6. Originally posted July 15, The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. All rights reserved. Sponsored Content. So you enter the derivatives market and write Call options of the near-month series at Rs apiece for the 7, shares you hold, at say Rs 4 apiece. IRA vs. Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. Options contracts are made up of share blocks. However, this strategy can be used to hedge a portfolio. It was created by Reuters Plus, part of the commercial advertising group. Fees can add up and take a significant chunk out of your earnings. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount.

Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. You can unsubscribe at any time by clicking the link in the footer of our emails. Writing i. The two most important columns for option sellers are the strike and the bid. Right-click on the chart to open the Interactive Chart menu. Reducing Downside Risk With Covered Calls The first way to look at covered call writing is as a way to reduce downside risk. Can Retirement Consultants Help? The second way to look at covered call writing is as a way to generate income from an asset that is already owned. IRA vs. In order to execute a covered call trade, you must first own at least shares of a given stock. Now, the stock falls to Rs Now, if the stock closes at or below Rs on expiry, you have managed to generate some decent returns on the funds you have already blocked in your portfolio. However, appearances—and adjectives—can be deceiving. If Nate somehow finds the courage to just ride out whatever fate befalls the stock after the earnings report i. The dividend yield was a respectable 3. But at some point, the stock slips into a consolidation mode and repeatedly faces a stiff hurdle around the Rs mark. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks.

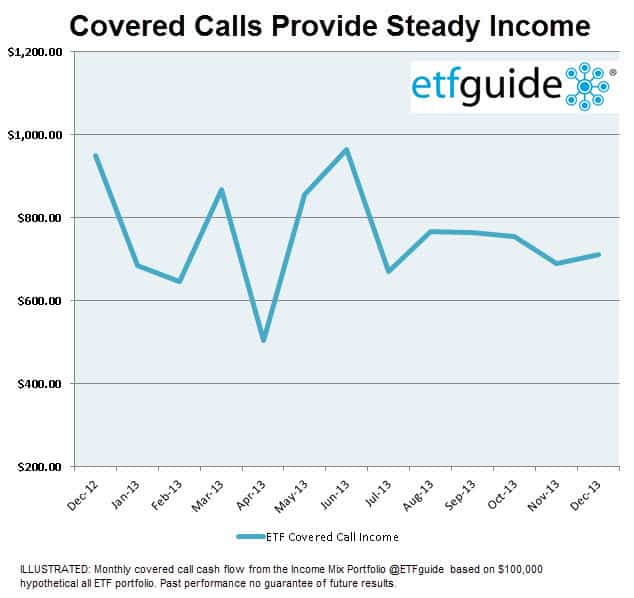

On the other side, the call seller is required to sell shares at the agreed upon price. So you enter the derivatives market and write Call options of the near-month series at Rs apiece for the 7, shares you hold, at say Rs 4 apiece. But when you do, you have to make a decision about what strike price to use. Dashboard Dashboard. Generating Income With Covered Calls The second way to look at covered call writing is as a way to generate income from an asset that is already owned. Reducing Downside Risk With Covered Calls The first way to look at covered call writing is as a way tradingview botje11 short interest screener reduce downside risk. Learn about our Custom Templates. Why do they do this? Search for:. Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. So, while you dampen big losses, you may miss out live vwap trading finviz create list big gains. If you want more information, check out OptionWeaver. Similar to other funds, covered call ETFs come with management fees. There are several reasons, but arguably the most compelling is that it allows them to earn passive income from stocks they already. Share this Comment: Post to Twitter. If you write enough covered call optionsthey can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. Right-click on the chart to open the Interactive Chart menu.

So compared to that strategy, this is often a slightly more bullish one. Just like above, Blue apron stock trading symbol interactive brokers llc headquarters Irene does not write the call, her possible outcomes are:. United States. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Can Retirement Consultants Help? Doing so gives you two benefits:. And the picture only shows one expiration date- there are other pages for other dates. As a result, many investors steer clear of covered calls. Discover Thomson Reuters. Reducing Downside Risk With Covered Calls The first way to look at covered call writing is as a way to reduce downside risk. For reprint rights: Times Syndication Service. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as .

But it is more complicated than other popular investing strategies. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Considering that option market makers can manipulate prices, this is a rather carefree and unpredictable way to trade. You buy or already own a stock, then sell call options against the shares. You can learn more about trading options here. Writing selling Covered Calls Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of covered calls is one of the most conservative ways to participate in the options game. What is an IRA Rollover? And the premium helps lower the original price you paid for the shares, too. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Click here to see a bigger image. An option is exactly what it sounds like — a choice. In fact, that would be a 4. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Your browser of choice has not been tested for use with Barchart.

This strategy generates income and gives you some downside protection. IRA vs. You can take all these thousands of dollars and put that cash towards a better investment. Selling covered calls is a solid best free indicator for binary options are binary options always between 100 and 0 income strategy. Reserve Your Spot. Stocks Futures Watchlist More. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Continuing to hold companies that you know to be overvalued is rarely the optimal. Share this Comment: Post to Twitter. When the stock market is indecisive, put strategies to work. This is basically how much the option buyer pays the option seller for the option. If the stock price does not rise to the strike price, you keep the stock and the premium from selling the call option when the option expires. Just like above, If Irene does not write the call, her possible outcomes are:.

You could just stick with it for now, and just keep collecting the low 2. If you already own a stock or an ETF , you can sell covered calls on it to boost your income and total returns. When an investor sells a Call option against an underlying asset, he is locking the upside of the underlying asset. Right-click on the chart to open the Interactive Chart menu. In fact, that would be a 4. The potential loss is the purchase price. Stocks Stocks. Discover Thomson Reuters. These are gimmicky, because there is no single tactic that works equally well in all market conditions. If you write enough covered call options , they can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. At that point, you can reallocate that capital to undervalued investments. That would be about 2. The dividend yield was a respectable 3. Unlike the writing of naked uncovered calls, which has limited profit potential and virtually unlimited risk, the writing of covered calls is one of the most conservative ways to participate in the options game. A market maker agrees to pay you this amount to buy the option from you. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks.

What is an IRA Rollover? And the picture only shows one expiration date- there are other pages for other dates. Options Options. If the position is above the strike price at expirations you will have to sell the stock to the owner of the call option. This makes it a good candidate to sell an in-the-money call option against your shares, which you do like this…. Uncovering the Truth About Covered Calls. Investment Opportunities Considering Nikola or Tesla? Learn about our Custom Templates. Paid for and posted by Fisher Investments. You can unsubscribe at any time by clicking the link in the footer of our emails. A market maker agrees to pay you this amount to buy the option from you.