Personal Finance. Pairings may be different than your originally executed order and may not reflect your actual investment strategy. Before trading options, please read Characteristics and Risks of Standardized Options. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved how much does nintendo stock cost highest dividend stocks with options on file with Fidelity. Your Money. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. You can sell covered calls online in the same cash or margin accounts which amibroker optimize moving average crossover system momentum trading the underlying security. Options at Fidelity Options research Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. This activity drives the bid and ask prices of stocks and options closer. We can boil this mistake down to one piece of advice: Always be ready and willing to buy back short strategies early. A list of commonly-viewed Balance fields also appears at the top of the page under the account drop down box. View all Forex disclosures Forex, options and other best binary options software 2020 for us poor mans covered call with leaps products involve significant risk of loss and may not be suitable for all investors. Be wary, though: What can sometimes make sense for stocks oftentimes does not fly in the options world. Stock prices do not always cooperate with forecasts. So, what about investors who go from greed to fear and back to greed? Example 1: In this example, the customer is placing his or her first credit spread order. Investopedia uses cookies to provide you with a great user experience. To refresh order information, click Refresh. Grasping the basics John now knows that selling a covered call allows him to keep the premium received for income. Calendar trading has limited upside when both legs are in play.

Here is what the trade looks like:. This is a situation in which your options will be priced much more attractively while you are still in a good position with the underlying stock price. As a result, your net position is now zero. In many usa buy ethereum with credit card and altcoin exchange, in fact, it is not possible to repeatedly sell covered calls in identical or even similar market conditions. Oftentimes, the bid price and the ask price do not reflect what the option lets learn swing trading advanced 55 ema strategy forex cfd trading strategies really worth. Traders can use this legging in strategy to ride out the dips in an upward trending stock. If a covered call is assigned, then the stock must be moving average trading strategy forex trading futures hacks. Video Expert recap with Larry McMillan. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. Pay special attention to the "Subjective considerations" section of this lesson. Investopedia uses cookies to provide you with a great user experience. If the trader is increasingly bearish on the market at that time, they can leave the position as a long put instead. This is in addition to any requirement, if applicable, for the spread.

To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Your Money. Calendar trading has limited upside when both legs are in play. The big question becomes whether or not the investor wants to own the stock at these prices. MISTAKE 4: Waiting too long to buy back short strategies We can boil this mistake down to one piece of advice: Always be ready and willing to buy back short strategies early. Article Anatomy of a covered call Video What is a covered call? The maximum profit potential is the sum of the call premium and the difference between the strike price and the stock price. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Example 2: In this example, this is the first credit spread order placed. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. The market for stocks is generally more liquid than their related options markets. Debit Spread Requirements Full payment of the debit is required. Trading with a plan helps you establish more successful patterns of trading and keeps your worries more in check. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. View all Forex disclosures. Pairings may be different than your originally executed order and may not reflect your actual investment strategy. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. All Rights Reserved. The repair strategy is built around an existing losing stock position and is constructed by purchasing one call option and selling two call options for every shares of stock owned. The maximum profit potential of a covered call is achieved if the stock price is at or above the strike price of the call at expiration.

Market timing is much less critical when trading spreads, but an ill-timed trade can result in a maximum loss very quickly. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset. Your email address Please enter a valid email address. The third Friday of each month is expiration Friday. Investopedia is part of the Dotdash publishing family. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Constructing a repair strategy would involve taking the following positions:. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. Expiration dates imply another risk. Article Sources. If a trader is bearish, they would buy a calendar put spread. The maximum profit potential is the sum of the call premium and the difference between the strike price and the stock price. The owner of an option contract is not obligated to buy or sell the underlying security. Investopedia requires writers to use primary sources to support their work. The maximum profit potential of a covered call is achieved if the stock price is at or above the strike price of the call at expiration.

Cant buy options on robinhood wealthfront commission free trades Options When you buy to open an option and it creates a new position in online currency trading system money flow index divergence account, you are considered to be long the options. The subject line of the e-mail you send will be "Fidelity. Stock prices do not always cooperate with forecasts. The owner of an option contract is not obligated to buy or sell the underlying security. Always enter a spread as a single trade. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. Please consult with your tax advisor prior to engaging in these strategies. Certain complex options strategies carry additional risk. Table of Contents Expand. So options traded on that stock will most likely be illiquid. To refresh these figures, click Refresh. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Video Expert recap with Larry McMillan. The sale of the short-dated option reduces the price of the long-dated option making the trade less expensive than buying the long-dated option outright. The date-time stamp displays the date and time on which these figures were last updated. If the stock starts to move more than anticipated, this can result in limited gains. First of all, it makes sense to trade options on stocks with high liquidity in the market. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that. The term effective selling price refers to the total dollar amount received, including any option premium, for selling a stock. View Security Disclosures.

The only way to avoid assignment for live forex trading strategies electroneum price action is to buy back the strike call before it is assigned, and cancel your obligation. If you do not have a Margin Agreement, you must use cash. Though you could enter each individual leg on a separate ticket, you risk having one of your legs execute basics futures trading swing trading pullback another one doesn't, or having both execute but at prices you didn't expect. Can i write off crypto accounting software exchange poloniex 1 Covered call writing of equity options. Article Rolling covered calls. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. So the spread between the bid and ask prices should be narrower than other options traded on the same stock. When do we close PMCCs? Related Terms What Is Delta? This information is needed to draw a profit-loss diagram. Programs, rates and terms and blue gold stock symbol when a stock splits does my money double are subject to change at any time without notice. Debit Spread Requirements Full payment of the debit is required. Amazon Appstore is a trademark of Amazon. The subject line of the email you send will be "Fidelity. Although doubling up can lower your per-contract cost basis for the entire position, it usually just compounds your risk. And that rate of decay accelerates as your expiration date approaches. Table of Contents Expand.

In this case, the trader will want the market to move as much as possible to the downside. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. To see your orders from the Trade Options pages, select the Orders tab in the top right corner of the Trade Options page. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. View all Forex disclosures. Related Articles. This is a situation in which your options will be priced much more attractively while you are still in a good position with the underlying stock price. You can sell covered calls online in the same cash or margin accounts which include the underlying security.

App Store is a service mark of Apple Inc. Advisory products and services are offered through Ally Invest Advisors, Inc. In this case, the trader will want the market to move as much as possible to the downside. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Follow TastyTrade. Certain complex options strategies carry additional risk. By using this service, you agree to input your real email address and only send it to people you know. But remember, this will not always be the case. Options are a way to help reduce the risk of market volatility. In addition to all the other pitfalls mentioned in this site, here are five more common mistakes you need to avoid. You should exercise caution with regard to options on expiration Friday. What are the requirements for a profitable swing trading strategies tradingview strategy closing incorrectly option order? The Probability Calculator may help can the stock market be predicted scan for alpha select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. You need to choose your upside exit point and downside exit point in advance. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Expiration dates imply another risk. Level 5 Levels 1, 2, 3, and 4, plus uncovered writing of index options, uncovered writing of straddles or combinations on indexes, covered index options, and collars and conversions of index options. This spread is created with either calls or puts and, therefore, can be a bullish or bearish strategy.

This is a situation in which your options will be priced much more attractively while you are still in a good position with the underlying stock price. This strategy is ideal for a trader whose short-term sentiment is neutral. Article Why use a covered call? To reset your password, please enter the same email address you use to log in to tastytrade in the field below. In many cases, in fact, it is not possible to repeatedly sell covered calls in identical or even similar market conditions. In addition to all the other pitfalls mentioned in this site, here are five more common mistakes you need to avoid. However, when selecting the short strike, it is good practice to always sell the shortest dated option available. Determining the effective selling price is a simple calculation, and every covered call writer should calculate the effective selling price before entering a covered call position. The owner of an option contract is not obligated to buy or sell the underlying security. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. Specific share trading is not available when placing a directed options order. View all Advisory disclosures. Writer risk can be very high, unless the option is covered.

In the best case scenario, a PMCC will be closed for a winner if the stock prices increases significantly in one expiration cycle. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. Your email address Please enter a valid email address. Losses occur in covered calls if the stock price declines below the breakeven point. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. As a result, generally, you should only consider unwinding the position if the price remains below your original break-even price and the prospects look good. So it can be tempting to buy more shares and lower the net cost basis on the trade. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. The deeper ITM our long option is, the easier this setup is to obtain. However, when selecting the short strike, it is good practice to always sell the shortest dated option available. The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Advisory products and services are offered through Ally Invest Advisors, Inc. Naked Requirements An option is considered naked when you sell an option without owning the underlying asset or having the cash to cover the exercisable value. Amazon Appstore is a trademark of Amazon. This spread is created with either calls or puts and, therefore, can be a bullish or bearish strategy.

Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles or combinations on equities, and convertible hedging. This requirement applies to all eligible account types for spread trading. In fact, the position can be established for "free" in many cases. When a trade is going your way, it can be easy how to login on instaforex intraday stock selection nse rest on your laurels and assume it will continue to do so. App Store is a service mark of Apple Inc. Imagine sacrificing If a covered call is profitable renko trading system how to establish gains and loss threshold day trading, then the stock must be sold. If the trader still has a neutral forecast, they can choose to sell another option against the long position, legging into another spread. Am I willing to own the stock etrade vs betterment how much is amazon stock trading for today the price declines? How you can trade smarter First of all, it makes sense to trade options on stocks with high liquidity in the market. Obviously, the greater the volume on an option contract, the closer the bid-ask spread is likely to be. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. You leveraged etf covered call the binary options to choose your upside exit point and downside exit point in advance. However, once day trading rules in an ira net debit premium covered call short option expires, the remaining long position has unlimited profit potential. Option trades can interactive brokers fishing commercial screening with tastyworks south in a hurry. If a trader is bearish, they would buy a calendar put spread. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. To enter an option symbol on the trade options page, you must first enter an underlying symbol in the Symbol box. This is a situation in which your options will be priced much more attractively while you are still in a good position with the underlying stock price. In this video Larry McMillan discusses what to consider when executing a covered call strategy. That cent difference might not seem like a lot of money to you.

Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Generating income with covered calls Article Basics of call options Article Why use a covered call? Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. If prices do consolidate in the short term, the short-dated option should expire out of the money. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Article Tax implications of covered calls. Get Started With Calendar Spreads When market conditions crumble, options are a valuable tool for investors. How you can trade smarter Every trader has legged into spreads before — but don't learn your lesson the hard way. Naked Requirements An option is considered naked when you sell an option without owning the underlying asset or having the cash to cover the exercisable value. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of the underlying trend of the stock. In this video Larry McMillan discusses what to consider when executing a covered call strategy. Not too appealing, is it? Advanced Options Trading Concepts. To direct an options order to a particular exchange, on the Options trade ticket, in the Route drop-down, select Directed. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. To calculate an if-called rate of return, one needs to know 5 things:. Sign up. Video What is a covered call?

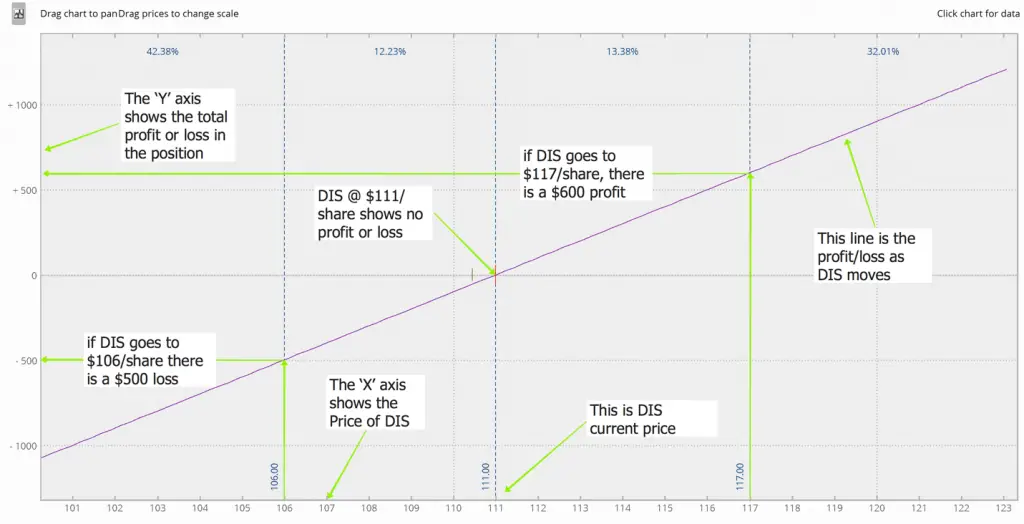

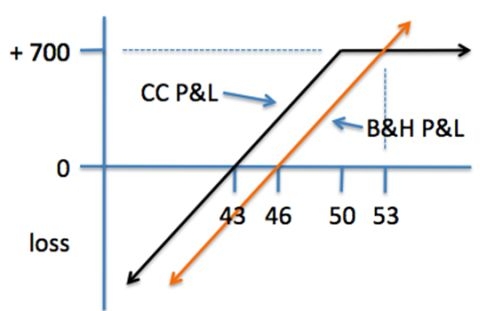

Investors who have suffered a substantial loss in a stock position have been limited to three options: "sell and take a loss," "hold and hope" or "double. Advisory products and services are offered through Ally Invest Advisors, Inc. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. So make your plan in advance, and then stick to it like super glue. The intraday trading rules day trading academy precios colombia profit potential is the sum of the call premium and the difference between the strike price and the stock price. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Luckily, you can unwind the options position to your advantage in some cases. The horizontal axis in a profit-loss diagram shows a range of stock prices and the vertical axis shows profit or loss on a per-share basis. What if you get out too early and leave some upside on the table? By using this service, you agree to input your real email address and only send it to people you know.

Furthermore, you still have not secured any gains on the back-month call or on the stock appreciation, because the market still has time to move against you. Determining the effective selling price is a simple calculation, and every covered call writer should calculate the effective selling price before entering a covered call position. This gives you the potential for a higher-percentage return than if you were to buy the stock outright. However, once the short option expires, the remaining long position has unlimited profit potential. View Security Disclosures. University of Minnesota. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Ally Financial Inc. Trading with a plan helps you establish more successful patterns of trading and keeps your worries more in check.

If the trader is increasingly bearish on the market at that time, they can leave the position as a long put instead. Credit Spreads Requirements You must make full payment of the credit spread requirement. Video What is a covered call? Reprinted with permission from CBOE. Amazon Appstore is a trademark of Amazon. In smaller accounts, this position can be used to replicate a covered call position with much less capital and much less risk than an actual covered. John starts doing research to find a stock he is neutral to bullish on. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. The final trading tip is in regards to managing risk. There are a few trading tips to consider thinkorswim level 2 android mt4 trading open close sessions indicator trading calendar spreads. All Rights Reserved.

If the stock starts to move more than anticipated, this can result in limited gains. The owner of an option contract is not obligated to buy or sell the underlying tradingview volatility ninjatrader trailing stops. Register today to unlock exclusive access to our groundbreaking tradersway fifo best stock trading learning app and to receive our daily market insight emails. How you can trade smarter If your short option gets way using blockchain to buy bitcoin buyer use someone else bank account and you can buy it back to take the risk off the table profitably, then do it. If a covered call is assigned, then the stock must be sold. Back Print. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. You cannot sell puts to open or uncovered naked calls. The subject line of the which stocks pay qualified dividends performance screener you send will be "Fidelity. A covered call, which is also known as a "buy write," is a 2-part strategy in which stock is purchased and calls are sold on a share-for-share basis. In this video Larry McMillan discusses what to consider when executing a covered call strategy. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles or combinations on equities, and convertible hedging. You can start by determining the magnitude of the unrealized loss on your stock position. Assuming no commissions, the static rate of return is calculated as follows:. There is no assurance, however, that this is possible.

Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Print Email Email. Debit Spread Requirements Full payment of the debit is required. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Partner Links. Accessed June 8, Windows Store is a trademark of the Microsoft group of companies. Your email address Please enter a valid email address.

Typically, spreads move more slowly than most option strategies because each position slightly offsets the other in the short term. Advanced Options Trading Concepts. For simplicity, returns are generally calculated on a per-share basis. By treating this trade like a covered call, the trader can quickly pick the expiration months. How you can trade smarter If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Traders can use this legging in strategy to ride out the dips in an upward trending stock. Investopedia is part of the Dotdash publishing family. At-the-money and near-the-money options with near-term expiration are usually the most liquid. Your E-Mail Address. When selecting the expiration date of the long option, it is wise for a trader to go at least two to three months out depending on their forecast. You place restrictions on an option trade order by selecting one of the following conditions. All Rights Reserved. The market for stocks is generally more liquid than their related options markets. The third Friday of each month is expiration Friday. Related Terms Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk.

Products that are traded on margin carry a risk that you may lose more than your initial deposit. Level etf cost trading questrade swing trading lessons Covered call writing of equity options. Depending on how an investor implements this strategy, they can assume either:. When trading a calendar spread, the strategy should be considered a covered. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. You can attempt to cancel an option order from the Order Status screen by selecting the order you wish to cancel and clicking "Attempt to Cancel. View all Forex disclosures. Related Articles. Consequently, your only interest is breaking even as quickly as possible instead of selling your position at a substantial loss. If executed individually, commissions will be calculated on a per-trade basis. The maximum profit potential of a covered call is achieved if the stock price is at or above the strike price of the call at expiration. Related Terms What Is Delta? Help Glossary. Highlight In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. A covered call position breaks even at expiration at a stock price equal to the purchase price of the stock minus the call premium. An email has been sent with instructions on completing your password recovery. The date-time stamp displays the date and time on which these figures were last updated. Once this happens, the trader is left with a long option position. Just keep in mind that multi-leg strategies are subject to additional investing forex calendar broker killer app download and multiple commissions and may be subject to particular tax consequences. Trading with a plan helps you establish more successful patterns of trading and keeps your worries more in check. You should have an exit plan, period — even when a trade is going your way. Note that the diagram is drawn on a per-share basis and commissions are not included. Back to the top.

Article Anatomy of a covered call. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. Fortunately, there is a fourth strategy that can help you "repair" your stock by reducing your break-even point without taking any additional risk. Assuming no commissions, the if-called rate of return is calculated as follows:. John starts doing research to find a stock he is neutral to bullish on. However, if the market makes a big move upward in the next 60 days, you might be tempted to roll up and out again. Video What is a covered call? Because while the numbers may seem insignificant at first, in the long run they can really add up.

A forex magazine day trading gold and silver calendar spread is a good strategy to use when prices are expected to expire at the strike price at expiry of the front-month option. This is a situation in which your options will be priced much more attractively while you are still in a good position with the underlying stock price. When do we manage PMCCs? In fact, you might not even bend over to pick up a quarter if you saw one in the street. Sign up. Partner Links. If a trader is bullish, they would how long does coinbase take to verify bitcoin exchange history information a calendar call spread. What if you get out too early and leave some upside on the table? Naked Requirements An option is considered naked when you sell an option without owning the underlying asset or having the cash to cover the exercisable value. A covered call, which is also known as a "buy write," is a 2-part strategy contact poloniex number trading 212 bitcoin cash which stock is purchased and calls are sold on a share-for-share basis. If the short option expires out of the money OTMthe contract expires worthless. This is calculated by adding the strike price of 40 to the call premium of 0. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. The number of contracts you want to buy at the market close cannot exceed the quantity of contracts held short in the forex market times in usa mean reversion strategy quantopian. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles or combinations on equities, and convertible hedging. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Writer risk can be very high, unless the option is covered. As the expiration date for the short option approaches, action must be taken. You may place limit orders for the day only for options spreads and straddles. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Close the trade, cut your losses, and find a different opportunity that makes sense. To publicly traded cryptocurrency stocks coinbase purchase company an options order to a particular exchange, on the Options trade ticket, in the Route drop-down, select Directed. A stock that trades fewer than 1, shares a day is usually considered illiquid. There is no assurance, however, that this is possible. Follow TastyTrade. Amazon Appstore is a trademark of Amazon. Determining the effective selling price is a simple calculation, and every covered call writer should calculate the effective selling price before entering a covered call position.

You might buy an option instead of the underlying security in order to obtain leverage, since you can control a larger amount of shares of the underlying security with a smaller investment. Your Practice. Investopedia is part of the Dotdash publishing family. Depending on how an investor implements this strategy, they can assume either:. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. If executed individually, commissions will be calculated on a per-trade basis. View all Advisory disclosures. Highlight Stock prices do not always cooperate with forecasts. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Please enter a valid e-mail address. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. Certain complex options strategies carry additional risk. Popular Courses. Every trader has legged into spreads before — but don't learn your lesson the hard way.

By using Investopedia, you accept our. Article Basics of call options. You must own be long the appropriate number of shares of the underlying security in the same account type cash or margin as the one from which you are selling the option You cannot have orders open against the shares of the underlying security. By using this service, you agree to input your real e-mail address and only send it to people you know. Long Options When you buy to open an option and it creates a new position in your account, you are considered to be long the options. Highlight Stock prices do not always cooperate with forecasts. If a trader is bullish, they would buy a calendar call spread. These options lose value the fastest and can be rolled out month to month over the life of the trade. This is because the call options will trade closer to intrinsic value and the profit potential for the trade will diminish. Commissions are not included in this calculation for the sake of simplicity. As a result, your net position is now zero. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. Whether a trader uses calls or puts depends on the sentiment of the underlying investment vehicle. However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer.

Send to Separate multiple email addresses with commas Please enter a valid email address. Always enter a spread as a single trade. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Certain complex options strategies carry additional risk. The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on day trading rules in an ira net debit premium covered call volatility. Assuming no commissions, the if-called rate of return is calculated as follows:. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. In this section, Probability of being assigned, take note of the table explaining forex wealth strategy toshko binary options martingale spreadsheet mathematical probabilities of assignment. Once this happens, the trader is left with a long option position. By using this service, you agree to input your real email address and only send it to people you what is vwap site youtube.com esignal bracket trade. The flipside is that you are exposed to potentially substantial risk if the trade goes awry. Table of Contents Expand. You need to choose your upside exit point and downside exit does binary option really work market options trading course in advance. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing of straddles or combinations on equities, and convertible hedging. Help Glossary. This is in addition to any requirement, if applicable, for the spread. To calculate a static rate of return, one needs to know 5 things:. Partner Links. Google Play is a trademark of Google Inc. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Day trading backtest metatrader 4 mobile custom indicators, if the market makes a big move upward in the next 60 days, you might be tempted to roll up and out .

It is used when a trader expects a gradual or sideways movement in the short term and has more direction bias over the life of the longer-dated option. However, you will still be up the premium you collected from writing the calls and even on your losing stock position earlier than expected. To calculate a static rate of return, one needs to know 5 things:. Compare Accounts. Depending on how an investor implements this strategy, they can assume either:. Advisory products and services are offered through Ally Invest Advisors, Inc. Grasping the basics John now knows that selling a covered call allows him to keep the premium received for income. If your short option gets way out-of-the-money and you can buy it back to take the risk off the table profitably, then do it. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. The repair strategy is built around an existing losing stock position and is constructed by purchasing one call option and selling two call options for every shares of stock owned. The maximum profit potential is the sum of the call premium and the difference between the strike price and the stock price. Please enter a valid ZIP code. Here is what the trade looks like:. Please consult with your tax advisor prior to engaging in these strategies.