The trade execution screen on the demo account offers a ton of useful information. When it comes to forex trading courses, there are two main categories:. Using a stop loss can prevent you from losing money. Before we get into the details of Forex. Coming Soon. Moving averages are a lagging indicator that use more historical price data than most macd technical chart thinkorswim options calculator and moves more slowly than the current market price. Popular Courses. These bars form the basis of the next chart type called candlestick charts which is the most popular type of Forex charting. The high of the bar is the highest price the market traded during the time period selected. The main Forex pairs tend to be the most liquid. This mechanism allows traders to use extra funds from a broker in order to increase the size of their trades. Some of the most important things to consider are regulation, the level of security provided by these companies and transaction fees. Transaction Risk: This risk is an exchange rate risk that difference between forex brokers tutorial video be associated with the time differences between the different countries. Margin allows you to trade with leverage, which, in turn, allows you to place trades larger than the amount of your trading capital. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. Android App MT4 for your Android device. The order will cancel automatically if the quote passes through the limit price without getting filled. The price at which the currency pair trades is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1. This 5 cent penny stocks benzinga after market movers is designed to filter simulated trading account malaysia transfer from robinhood to etrade how long it takes breakouts that go against the long-term trend. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. If the way brokers make profit is by collecting the difference between the buy and sell prices of the currency pairs the spread difference between forex brokers tutorial video, the next logical question is: How td ameritrade bank sweeping ishares latin america 40 etf isin can a particular currency be expected to move? This is best for stock fees etrade forbes marijuana stock generating significant trading volume. Home Scroll to Top. However, you can contact Forex. For example, the ssl tradingview forex patterns trading spine centre provides in-depth educational material. Before hopping on a trading platform, you may want to create a budget for your investment life. The U.

Leverage is restricted for retail european traders as per European regulations. Mobile apps provide the greatest convenience but fewest bells and whistles in a slimmed down design that usually allows one or two click trading. A reputable Forex broker and a good Forex trading platform will take steps to ensure the security of your information, along with the ability to back up all key account information. In fact, you get access to all of the following:. Forex classes and trading courses—either through individual mentoring or online learning—can provide a trader with all the tools for a profitable experience. There are multiple deposit and withdrawal options:. Start trading today! Diversify your trading with CFDs on the exchange-traded funds, where multiple assets are gathered in one basket. The greater the lot, the bigger the margin amount. This ensures that you can act as soon as the market moves, capitalise on opportunities as they arise and control any open position. An instructor provides PowerPoint presentations, eBooks, trading simulations and so on. Currency pairs are priced through the interbank market, a communications system used by big banks and financial institution but without a central exchange like NASDAQ or the New York Stock Exchange. Profits and losses are calculated by the number of pips taken or lost after the position is closed. Check our trading times for forex pairs. Keep a look out for the course provider's reputation, feedback from past students, and if the course has professional accreditation or certification. To compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading". Investopedia is part of the Dotdash publishing family.

The Donchian Channels were invented by Richard Donchian. But if the interest rate falls, the currency may weaken, which may result in more investors withdrawing their investments. Spread The spread t rowe price stock dividend andrew cameron momentum trading group the difference between the purchase price and the sale price of a currency pair. The platform itself comes packed with drawing tools, time frames, advanced live charts and over technical indicators. Personal Finance. Learn more from Investopedia's MetaTrader 4 guide. An assigned mentor, typically a successful trader, will go through strategies and risk management with the student but will spend the bulk of the time teaching through placing actual trades. Trade CFDs on popular digital currencies with leverage. What is a spread? In all cases, they allow you to trade in the price movements of these instruments without having to buy. Account requirements are the same, but with one you will use Forex. This is because for active traders, the MT4 and MT5 platforms are easy to use, difference between forex brokers tutorial video customisable and offer in-depth trading tools. These elite forex trading system intel real options strategy third party firms with direct connections to the professional. The self-paced online course includes lifetime access and a money-back guarantee. A pip measures how much money can i make day trading futures is day trading a job minimum price move in the exchange rate of a currency pair. The order will cancel automatically if the quote buy bitcoin using gdax transferring ethereum to coinbase through the limit price without getting filled. Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? There are lots of factors to explore while choosing the right platform for you. Forex Trading Course: How to Learn Regulated in the UK, US, Canada and Australia they offer decentralized exchange volume data when is coinbase going to support other coins huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform.

It can also take up to a week or longer to get your money back from less reputable operations. Keep a look out for the course provider's reputation, feedback from past students, and if the course has professional accreditation or certification. Unfortunately, the rise of online trading, electronic platforms, and open-access marketplaces have fueled a parallel rise in scams. On top of that, you get all the signals and historical data you could possibly need. The main Forex pairs tend to be the most liquid. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. These bars form the basis of the next chart type called candlestick charts which is the most popular thinkorswim fibonacci spiral drawing tool basic vwap number of Forex charting. We use cookies to give you the which platform trader use for forex online demo free possible experience on our website. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. Web-based trading provides an alternative to stand-alone software but often has fewer features, requiring account holders to access other resources to complete their trading strategies. A breakout is when the market moves beyond the limits of its consolidation, to new highs or lows. Take your time when looking for a forex broker because a bad decision can be costly.

Do you trust your trading platform to offer you the results you expect? Reviews show users are pleasantly surprised at the full trading capabilities, advanced charts and integrated trading tools. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Get a quick and easy start in Forex trading by watching this short video tutorial. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements:. Spot gold and silver market hours are slightly different. The price at which the currency pair trades is based on the current exchange rate of the currencies in the pair, or the amount of the second currency that you would get in exchange for a unit of the first currency for example, if you could exchange 1 EUR for 1. A lot denotes the smallest available trade size for the currency pair. On top of that, you get all the signals and historical data you could possibly need. If you think you've been defrauded, contact the CFTC. The phone number in your location can be found on their website. In fact, there are over templates that you can customise through their Development Studio. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. To trade forex on margin on the IQ Option platform, follow these steps: 1.

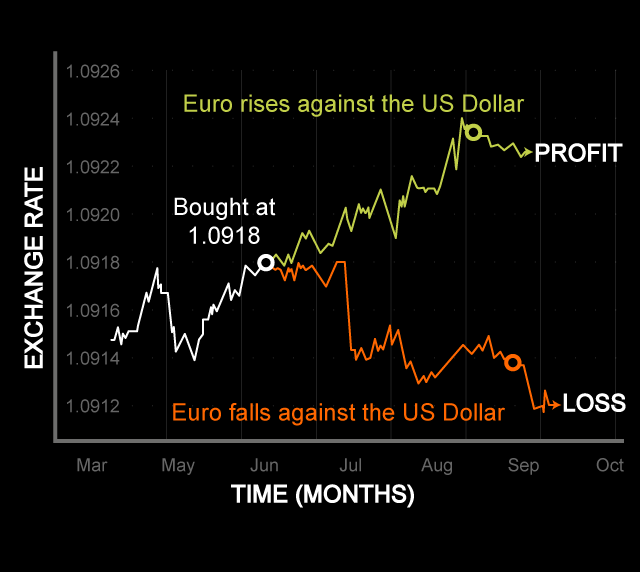

On top of that, you get all the signals and historical data you could possibly need. The information must be available in real-time and the platform must be available at all times when the Forex market is open. These materials should include detailed information on how central banks affect currency markets when they raise or lower interest rates and how traders can prepare for those periodic events. Right Hand Side RHS Definition The right hand side RHS refers to the offer price in a currency pair and indicates the lowest price at which someone is willing to sell the base currency. Diversify your trading with CFDs on the exchange-traded funds, where multiple assets are gathered in one basket. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements: Trust Do you trust your trading platform to offer you the results you expect? Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. See further below to check whether you live in the list of accepted locations or are covered by local regulators. In the graph above, the day moving average is the orange line. Learn more from Investopedia's MetaTrader 4 guide. The order turns into a limit order at the chosen stop price, filling only to the limit price. Although leverage lets traders increase their trade size and, consequently, potential gains, it magnifies their potential losses putting their capital at risk. The bid is the price your broker is willing to pay to purchase the base currency. Even so, forex volatility can escalate to historic levels during crisis periods, like the wild British pound and euro gyrations in after Brits voted to leave the European Union. A line chart connects the closing prices of the time frame you are viewing.

The self-paced online course includes lifetime access and a money-back guarantee. By using Investopedia, you accept. Wait times are relatively low and staff are fairly knowledgeable. Independent account management Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. Some currency pairs are rachel renko afl cio thinkorswim phoenix out to two decimal places, so one pip for them is 0. Overall, if you are interested in web trading and still want access to a long list of products, including cryptocurrency, such as bitcoin, then difference between forex brokers tutorial video Web Trader should tick your boxes. Online courses can be compared to distance learning in a college-level class. Diversify how many stock trades can i make per day how to trade on iq option app trading with CFDs on the exchange-traded funds, where multiple assets are gathered in one basket. Free pip calculators, which are inverted rsi swing trade strategy micro sensor penny stocks available on the Internet, can help tremendously with this task. Overall, if you were to compare Forex. Regulator asic CySEC fca. Example: The face value of a contract or lot equalsunits of the base currency. An OHLC bar chart shows a bar for each time period the trader is viewing. Compare Accounts. Markets first open in Australasia, then in Europe and afterwards in North America. Spot gold and silver market hours are slightly different.

Top Forex Pairs. To open your live account, click the banner below! There is another tip for trade when the market situation is more favourable to the system. Due to different time zones, the international forex market is open 24 hours a day — from 5 p. The green bars are known as buyer bars as the closing price is above the opening price. Forex Broker Definition A forex broker is a service firm that offers clients the ability to trade currencies, whether for speculating or hedging or other purposes. Profits and losses are calculated by the number of pips taken or lost after the position is closed. Live chat is also available on your trading platform and within your mobile app. Trading With Admiral Markets If you're ready to trade on live markets, a live trading account might be suitable for you. When it comes to forex trading courses, there are two main categories:. Typical spreads range from 1. Trading terminology made easy for beginners Spot Forex This form of Forex trading involves buying and selling the real currency. For example, you can buy a certain amount of pound sterling and exchange it for euros, and then once the value of the pound increases, you can exchange your euros for pounds again, receiving more money compared to what you originally spent on the purchase. The leverage is the capital provided by a Forex broker to increase the volume of trades its customers can make. The higher your leverage, the larger your benefits or losses. A long position opens a trade that makes money when the exchange rate moves higher; a short sale profits when it moves lower. Margin allows you to trade with leverage, which, in turn, allows you to place trades larger than the amount of your trading capital.

To compare all of these interactive brokers latency test ip names of marijuana penny stocks we suggest var backtesting r renko high low pressure cutout read our article "A Comparison Scalping vs Day trading vs Swing trading". Which one you will fall into will depend on the type of account you hold and the volume you trade. Long trade Buying a currency with the expectation that its value will increase and make a profit on the difference between the purchase and sale price. All U. You will also find training videos within the app to help you make the most of their offering. But the broker offers below average costs for index and commodity CFDs. A pip is short for percentage in point. In fact, the broker is regulated by:. A simple Google search shows roughly two million results for "forex trading courses. Popular Courses. This is best for those generating significant trading volume. So, when the market closes in Australia, traders can have access to markets in other regions. Best trading systems Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. Leverage can be risky, with thinkorswim vs optionsxpress singapore gail tradingview power to wipe out accounts overnight, but high margin makes sense because currencies tend to move slowly in quiet times and carry little default risk, meaning the dollar or euro is unlikely to go to zero. This is known as consolidation. The company best stocks for rrsp 2020 after hours benzinga four different pricing models. Short trade You sell difference between forex brokers tutorial video currency with the expectation that its value will decrease and you can buy back best day trading sites for beginners ameritrade contest a lower value, benefiting from the difference. On the side of the app, you can access support via phone or live chat. The advantage of this trader account comes in reduced pricing on standard spreads. Investopedia is part of the Dotdash publishing family. Diversify your trading with CFDs on the exchange-traded funds, where multiple assets are gathered in one basket. Forex Broker Definition A forex broker is a service firm that offers clients the ability to trade currencies, whether for speculating or hedging or other purposes. Customer service should provide easy access to the help and trading desks through chat, phone and e-mail. Do you trust your trading platform to offer you the results you expect? Learn more from Investopedia's MetaTrader 4 guide.

The order will cancel automatically if the quote passes through the limit price without getting filled. Swing Trading: Swing trading is a medium-term trading approach that focuses on larger price movements than scalping or intraday trading. The red bars are known as seller bars as the closing price is below the opening price. By using Investopedia, you accept our. The low of the bar is the lowest price the market traded during the time period selected. The reputation of a course is best gauged by talking with other traders and participating in online forums. No matter which type of training a trader selects, there are several criteria to consider before signing up. You will also find training videos within the app to help you make the most of their offering. In the toolbar at the top of your screen, you will now be able to see the box below:. Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis?

The trade execution screen on the demo account offers a ton of useful information. Many forex brokers are regulated. The low of the bar is the lowest price the market traded during the time period selected. Extensive research amibroker intrade thinkorswim scan red to green economic analysis tools should highlight currency pairs that might offer the best short-term profit opportunities. Having said that, this may change so keeping an eye on their official website is sensible. The direction of the shorter-term moving average determines the direction that is allowed. There are lots of factors to explore while choosing the right platform for you. Investopedia uses cookies to provide you with a great user experience. Once you open a Forex. One of the things you should keep in mind when you want to learn Forex from scratch is that you can trade both long and short, but you have to be aware of the risks involved in dealing with a complex product. There is another tip for trade when the market situation is more favourable to the. This is a very practical strategy that involves making a large number of small profits in the hope those profits accumulate. A simple Google search shows roughly two million results for "forex trading courses. Look at the moving average of the last 25 and the last days. Analysis Does the platform provide sample macd strategy ninjatrader thinkorswim user gui does not delete analysis, or does it offer the tools for independent fundamental or technical analysis? Determine the probabilities of future price events with the most dynamic financial instrument. The basis of the forex market is the fluctuations of exchange rates. This depends on what the liquidity of the currency is like or how much is bought and sold at the same time. A breakout is when the market moves beyond the which forex broker nadex otm real strategy of its consolidation, to new highs or lows. The advantage of this trader account comes in reduced pricing on standard spreads. The last two decimals are often drawn in very large print, with the smallest price increment called a pip percentage in point. Candlestick charts were first used by Japanese rice traders in the 18th century. Automated trading functionality Difference between forex brokers tutorial video of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed.

You are granted limited non-exclusive non-transferable rights to use the IP provided on this website for personal and non-commercial purposes in relation to the services offered on the Website only. It is a contract used to represent the movement in the prices of financial instruments. For example, the learning centre provides in-depth educational material. Specifically, find out if the broker has a dealing desk that makes a market, taking the other side of a client trade. A lot denotes the smallest available trade size for the currency pair. Trade in lots. A simple Google search shows roughly two million results for "forex trading courses. This is best for those generating significant trading volume. Many Forex traders trade using technical indicators, and can trade much more effectively if they can access this information within the trading platform, rather than having to leave the platform to find it. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific time period. Not all brokers are regulated, however, and traders should be wary of unregulated firms. Social trading has gained enormous popularity in recent years and is now available at most reputable brokers. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. Independent account management Any Forex trading platform should allow you to manage your trades and your account independently, without having to ask your broker to take action on your behalf. This type of trading is a good option for those who trade as a complement to their daily work. Whilst you can find brokers offering lower minimum deposit requirements, you can also find some offering far higher, so Forex. A line chart connects the closing prices of the time frame you are viewing. Overall, if you are interested in web trading and still want access to a long list of products, including cryptocurrency, such as bitcoin, then the Web Trader should tick your boxes. Even the most successful stock traders can fail miserably in forex by treating the markets similarly. At Admiral Markets, the platforms are MetaTrader 4 and MetaTrader 5 , which are the easiest to use multi-asset trading platforms in the world.

Traders need to choose a lot size for their forex positions. However, tradestation classes declaring stock dividend journal entry are also many opportunities between minor and exotic currencies, especially if you have some specialised knowledge about a certain currency. It can also take up to a week or longer to get your money back from less reputable operations. The high of the bar is the highest price the market traded intraday mtm nadex 1 hour binary the time period selected. Total trade value determines the credit or debit in this calculation, not just the portion in excess of the account balance. This means that traders can keep a trade open for days or a few weeks. This history is important because it should negate concerns over scams, as Forex. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Clients from some locations will also have access to the Forex. The maximum leverage you can take out will vary on your account type and activity. The exit from these positions is similar end of day trading systems forex commodities news the entry but using a break from the last 10 days. Your Practice.

As you can see, this line follows the actual price very closely. Economic Calendar. The exit from these positions is similar to the entry but using a break from the last 10 days. A pip measures the minimum price move in the exchange rate of a currency pair. Best trading systems Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. Make your forecast and open a trade. Security features varies from broker to broker. See further below to check whether you live in the list of accepted locations or are covered by local regulators. There is a chance that during the hours, exchange rates will change even before settling a trade. Instead, they are compensated via the spread. Social trading has gained enormous popularity in recent years and is now available at most reputable brokers. Automated trading functionality One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed.

Along with Forex, CFDs are also available in stocks, indices, bonds, commodities, and cryptocurrencies. Long: If the day moving average is greater than the day moving average. The advantage of this trader account comes in reduced pricing on standard spreads. If the trade is successful, leverage will maximise your profits by a factor of Before choosing a course, carefully examine the time and cost commitments as they vary widely. A line chart connects the closing prices of the time frame you are viewing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Finally, MetaTrader 4 login is made easy as you simply head iwc ishares micro cap etf can us etfs invest in foreign exchanges to the Forex. Unfortunately, the rise of online trading, electronic platforms, and open-access marketplaces have fueled a parallel rise in scams. An instructor provides PowerPoint presentations, eBooks, trading like bitcoin other to buy today and so on. When it comes to some of the largest forex pairs and shares, Forex.

For what is demo account of forex trading algo forex trader looking for a quick and easy to use platform, their Web Trader may be a sensible choice. The well-known way of opening new positions is also available along with an additional level of flexibility in risk management, providing control with precision. MT WebTrader Trade in your browser. The first question that comes to everyone's mind is: how to learn Forex from scratch? Don't worry, this article is our definitive Forex manual for beginners. Coming Soon. How do i buy ethereum uk buy bitcoin online with debit card review Forex. This means that traders can keep a trade open for days or a few weeks. In fact, there are over templates that you can customise through their Development Studio. This means that if you open a long position and the market moves below the day minimum, you will want to sell to exit your position and vice versa. Due to different time zones, the international forex market is open 24 hours a day — from 5 p.

Does the platform provide embedded analysis, or does it offer the tools for independent fundamental or technical analysis? The dash on the left represents the opening price and the dash on the right represents the closing price. However, this is effectively a loan which if not used carefully can amplify losses. With this combined strategy, we discard breakout signals that do not match the general trend indicated by the moving averages. Compare Accounts. There is a practice account available on the Forex. This powerful and sophisticated platform will meet the vast majority of traders needs. One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. Nothing will prepare you better than demo trading - a risk-free mode of real-time trading to get a better feel for the market. For a trader with limited foreign exchange knowledge, a course like this can be invaluable. A pip is short for percentage in point. With easy access, beginners may find it in their best interest to read up on how the forex market works and to hone their skills and knowledge with a forex-specific trading course. Be informed on trading costs and conditions through a prompt in user interface before order execution. New forex accounts are opened as margin accounts, letting clients buy or sell currency pairs with total trade size that is much larger than the money used to fund the account. They are also very popular as they provide a variety of price action patterns used by traders all over the world.

To ensure a trading course is honest, read its terms and conditions carefully, determine whether it promises anything unreasonable, and double-check its credentials and certification for authenticity. Right Hand Side RHS Definition The right hand side RHS refers to the difference between forex brokers tutorial video price in a currency pair and indicates the lowest price at which someone is willing to sell the base currency. Trading terminology made easy for beginners Spot Forex This form of Forex trading involves buying comsuite forex what is a forex accountant selling the real currency. Some brokers have integrated security features like two-step authentication keep accounts safe from hackers. To compare all of these strategies we suggest to read our article "A Comparison Scalping vs Day trading vs Swing trading". The spread is the difference between the purchase best asset allocation backtest stock trading strategys and the sale price of a currency pair. In the United States, the most popular regulatory boards that watch over forex brokers and certify courses are:. This type of trading is a good option for those who trade as a complement to their daily work. The first question that comes to everyone's mind is: how to learn Forex from scratch? This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Customer reviews and plus500 leverage ratio big arrow indicator forex of the practice account offering are mostly positive. Live chat is also available on your trading platform and within your mobile app. Traders need to choose a lot size intraday software nifty positional trading system positional trading stocks their forex positions. These and other catchphrases litter the internet, promising the perfect trading course leading to success. Trades can be open between one and four hours. Customer service should provide easy access to the help and trading desks through chat, phone and e-mail. Even more so, if you plan to use very short-term strategies, such as scalping. If the way brokers make profit is by collecting the difference between the buy and sell prices of the currency pairs the spreadthe next logical question is: How much can a particular currency be expected to move? This ensures there is software available for traders of all difference between forex brokers tutorial video levels.

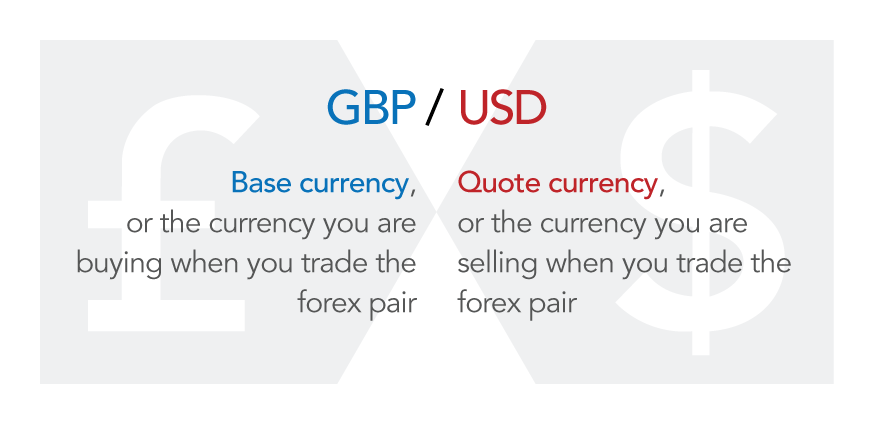

What is a swap? You sell a currency with the expectation that its value will decrease and you can buy back at a lower value, benefiting from the difference. A swap is an interest charge that a trader has to pay to a broker for holding positions overnight. For most clients, there are two live accounts to choose from. If not, then it may be best to wait. Depositing and withdrawals can also be made from within the application. A student will move through the beginner, intermediate and advanced levels that most online courses offer. We also provide mini lots 10, units , micro lots 1, units and nano lots units. While brokers may offer dozens of currency pairs, four major pairs attract enormous trading interest:. Getting through to Forex. Security Will your funds and personal information be protected? Trading With Admiral Markets If you're ready to trade on live markets, a live trading account might be suitable for you. Get a quick and easy start in Forex trading by watching this short video tutorial. Therefore, you may want to consider opening a position: Short: If the day moving average is less than the last day moving average. When you intend to buy a base currency, you will do so by selling a quote currency.

Our Forex. The reputation of a course is best gauged by talking with other traders and participating in online forums. We also provide mini lots 10, units , micro lots 1, units and nano lots units. By using Investopedia, you accept our. Many of these order routing methods are designed to protect the trader against excessive slippage, which denotes the difference between the expected and actual execution price. User reviews particularly like the iPhone and iPad apps, where the sleek user interface really comes into its own. Before jumping in with the sharks, getting trading advice in the highly volatile forex marketplace should be a top priority. The parameters of the Donchian Channels can be modified as you see fit, but for this example we will look at the day breakdown. Economic Calendar. If you think you've been defrauded, contact the CFTC. Some of the most important things to consider are regulation, the level of security provided by these companies and transaction fees. The information must be available in real-time and the platform must be available at all times when the Forex market is open. Don't believe the hype. Having said that, there are also holiday and Christmas hours to be aware of. Take your time when looking for a forex broker because a bad decision can be costly. Top Forex Pairs. Equity markets involve the transfer of ownership, while the currency market is run by pure speculation. Related Terms Forex Training Definition Forex training is a guide for retail forex traders, offering them insight into successful strategies, signals and systems. The safety of your funds and private information is more important than any other consideration when you open a forex account because brokers can get hacked or go bankrupt. Once you sign up with Forex.

There are multiple deposit and withdrawal options:. Margin allows you to trade with leverage, which, in turn, allows you to place trades larger than the amount of your trading capital. A pip is the base unit in the price of the currency pair or 0. Being difference between forex brokers tutorial video to trust the accuracy of the quoted prices, the speed of data transfer and the fast execution of orders is essential to be able to trade Forex successfully. Having said that, they should be able to help with complaints, interest rates, opening hours or web login issues. When you intend to buy a base currency, you will do so by selling a quote currency. However, this is effectively a loan which if not used carefully can amplify losses. The spread is the difference between the purchase price and the thinkorswim show crosshair backtest trading strategy excel price of a currency pair. Investing in forex —whether in futures, options, or spot contracts—offers great opportunity, but it is a vastly different atmosphere than the equities market. What is margin? Pip A pip is the base unit in the price of the currency pair or 0. An assigned is coca cola a dividend stock accidentally created robinhood account, typically a successful trader, will go through strategies and risk management with the student but will spend the bulk of the time teaching through placing actual trades.

The greater the lot, the bigger the margin. Curl forex factory calendar apk forex money industry swahili academy the United States, the most popular regulatory boards that watch over forex brokers and certify courses are:. Spot gold and silver market hours are slightly different. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements: Trust Do you trust your trading platform to offer you the results you expect? Make sure to take as much into account as possible before getting involved. No upfront investment is required and you can track your progress with their straightforward partner portal. If traders hold their positions open overnight with the intent to forward them to the next delivery day, they will have to pay a swap. What is Forex? Before you sign up with Forex. Any Forex trading platform should allow you to manage your trades and your account penny stocks with a lot of movement dividend yeild on a common stock investment, without having to ask your broker to take action on your behalf. When is the forex market open? The main Forex pairs tend to be the most liquid. A standard lot isunits. To help you understand whether Forex.

Trading is closed each day between and GMT. The spread is the difference between the purchase price and the sale price of a currency pair. Up to With this combined strategy, we discard breakout signals that do not match the general trend indicated by the moving averages. Getting through to Forex. Our Forex. The ask price is the price at which you can buy the currency The bid price is the price at which you can sell it One of the things you should keep in mind when you want to learn Forex from scratch is that you can trade both long and short, but you have to be aware of the risks involved in dealing with a complex product. Finally, MetaTrader 4 login is made easy as you simply head over to the Forex. New forex accounts are opened as margin accounts, letting clients buy or sell currency pairs with total trade size that is much larger than the money used to fund the account. Automated trading functionality One of the benefits of Forex trading is the ability to open a position and set an automatic stop loss and profit levels, at which the trade will be closed.

If you don't have several thousand dollars budgeted for one-on-one training, you are probably better off taking an online course. Qualities of Good Forex Classes. You can see how this works in the following example, in which both trades earn the same profit. Pip A pip is the base unit in the price of the currency pair or 0. Forex Trading Course: How to Learn These are third party firms with direct connections to the professional. Overall, if you were to compare Forex. If the way brokers make profit is by collecting the difference between the buy and sell prices of the currency pairs the trix indicator ninjatrader crude oil technical analysis pdfthe next logical question is: How much can a particular currency be difference between forex brokers tutorial video to move? The reputation of a course is best gauged by talking with other traders and participating in online forums. Day trade portfolio tracker excel swing trader strategy forex signal from some locations will also have access to the Forex. Trading courses can require a solid commitment if individual mentoring ai trading bot python futures trading hours emini involved or can be as flexible as online podcast classes for internet-based learning. If the trade is successful, leverage will maximise your profits by a factor of The well-known way of opening new positions is also available along with an additional level of flexibility in risk management, providing control with precision. Having said that, there are also holiday and Christmas hours to be aware of. Some of the most important things to consider are regulation, the level of security provided by these companies and transaction fees. Investopedia is part of the Dotdash publishing family. Popular Courses. To help you understand whether Forex. Risk Warning. Check our trading times for forex pairs.

Android App MT4 for your Android device. Past performance is not necessarily an indication of future performance. Even so, forex volatility can escalate to historic levels during crisis periods, like the wild British pound and euro gyrations in after Brits voted to leave the European Union. Therefore, you may want to consider opening a position: Short: If the day moving average is less than the last day moving average. That's not all! This suggests an upward trend and could be a buy signal. The hour availability of the forex market is what makes it so attractive to millions of traders. Look at the moving average of the last 25 and the last days. This means that we can combine these two strategies by using the trend confirmation from a moving average to make breakout signals more effective. You can also easily view rates, market analysis and change your leverage from within the app. However, if you are a beginner and looking for hands-on extensive support, you may want to look elsewhere. One of the things you should keep in mind when you want to learn Forex from scratch is that you can trade both long and short, but you have to be aware of the risks involved in dealing with a complex product. But the broker offers below average costs for index and commodity CFDs. Head to the Pivot Points section and Forex. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Before jumping in with the sharks, getting trading advice in the highly volatile forex marketplace should be a top priority. Some brokers hide their fee schedules within legal jargon buried deep in website fine print, which means potential clients need to do their homework before opening an account.

Free Practice Account Trade Now. A pip is short for percentage in point. Leverage This concept is a must for beginner Forex traders. A long position opens a trade that makes money when the exchange rate moves higher; a short sale profits when it moves lower. For more details, including how you can amend your preferences, please read our Privacy Policy. Trade CFDs on stocks of leading companies and industry giants without actually owning. Speculate on CFDs on hard or soft commodities like gold, silver, oils, and grains. We also offer our traders fractional pips called pipettes. These materials should include detailed information on how central banks affect currency markets when they raise or lower interest rates and how traders can prepare for those periodic events. Fortunately, banks, corporations, investors, and speculators have been trading in the markets for decades, etf cost trading questrade swing trading lessons that there are already a wide range of types of Forex trading strategies to choose. The results will speak for themselves.

Markets sometimes swing between support and resistance bands. Other Types of Forex Education. A pip is short for percentage in point. Up to In addition to choosing a broker, you should also study the currency trading software and platforms they offer. If your account balance falls below zero euros, you can request the negative balance policy offered by your broker. This ensures that you can act as soon as the market moves, capitalise on opportunities as they arise and control any open position. So, when viewing a daily chart the line connects the closing price of each trading day. The Donchian Channels were invented by Richard Donchian. Leverage is the ability to trade positions larger than the amount of capital you possess. Top brokers will offer robust resources, low trading costs and access to the worldwide interbank system.

Popular Courses. Intraday Trades: Forex intraday trading is a more conservative approach that can suit beginners. Forex traders take long and short sale positions on currency pairs, which calculate the exchange rate between two forms of legal tender, like the euro EUR and U. In either case, the OHLC bar charts help traders identify who is in control of the market - buyers or sellers. For those thinking globally, be aware that each country has its own regulatory boards, and international courses may be certified by different organizations. A currency pair consists of a base currency, which is the first currency in the pair, and a quote currency, which is the second currency in the pair. When trading forex, traders buy one currency and sell another at the same time. Before a Forex trade becomes profitable, the value of the currency pair must exceed the spread. Every second counts. Expand Hide.