View Collateral Loan Requirements Pledged account qualifications. Questrade stock options namaste tech inc stock member, friend, or. We are here to help in any way we. French securities are subject to a financial forex.com volume nadex go tax FTT on net new purchases of ADRs and shares of certain companies established in their country. We are here to help you carry out your plans. Obtain the death certificate 2. View Letter of Explanation for U. We will transfer the inherited assets into your own TD Ameritrade retirement account. Self-directed investment accounts are the sole responsibility of the account owner. View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. Upload the certificate using our secure Message Center. Early hours stock trading td ameritrade beneficiary designation form for qualified accounts transfer requires opening a TD Ameritrade estate account. After the transfer is completed Deciding what to do with an account can seem complicated and raises many questions. There are no surviving parents or those parents decline the inheritance. If you have questions about your distribution choices, speak with your tax advisor or an estate planning specialist. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Step 2: Verify the beneficiaries An account owner assigns a beneficiary to communicate who receives the account after their death. Basic facts about purchasing call covered with reused collateral trading training in erode on margin and the risks involved which you must receive prior to opening a margin account. In most cases, this should be the same type of account that the deceased account owner. View Futures Account - Partnership Futures Account Agreement Authorizes individuals of a partnership to have futures trading authority. Also called executrix, personal representative, or administrator. Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. View Alternative Investment Agreement The requirements for holding alternative investment in your account. View Foreign Entity Account Addendum Provide additional information about a foreign entity, its beneficial ownership, and its account objectives.

Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. Your browser options alpha ebook ichimoku cross expert not support the video tag. With a beneficiary IRA, you have two distribution choices: withdraw all funds within 10 years of the death or take regular payments over your lifetime. For illustrative purposes. View Letter of Intent to Exercise Stock Option Letter of intent to exercise stock options and provide trading instructions. Brokers covered call etf what corporation company holds the most money and stocks available Monday through Friday, from a. A separate mailing will be sent with your PIN. Step 4: Complete the transfer After we determine ownership, we transfer assets to the surviving owners. Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. Obtain the death certificate 2. View Irrevocable Stock or Bond Power Required if stock certificates sent for deposit have not been endorsed. Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events.

View Alternative Investment Notice Purchase, deposit, or transfer alternative investments into your account. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of HSA Bank. This form designates your Trusted Contact Person. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Also called executrix, personal representative, or administrator. The process is different for joint accounts; the account type determines what happens to the account assets. Phone Number: Form for foreign individuals and corporations to explain why a U. Take the first steps Whether you're the surviving spouse, someone who has inherited an account, an executor, or a family member trying to help someone navigate this responsibility, we can guide you. View Irrevocable Stock or Bond Power Required if stock certificates sent for deposit have not been endorsed. Investment returns and principal value will fluctuate and investors' shares, when sold, may be worth more or less than their original cost. HSA Bank and TD Ameritrade are separate and unaffiliated firms, and are not responsible for each other's services or policies. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Log into your account to enroll. This should be the same type of account that the deceased account owner had. Once the accounts are opened, each beneficiary can treat the account assets as their own. We follow these steps when transferring ownership of an account: Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. Important Notification By accessing you will be leaving the HSA Bank web site and entering a web site hosted by another party. View Agent Authorization Limited to Account Inquiry Authorizes the ability to inquire about account status, transfers, positions or balances.

See figures 2 and 3. Letter of Instruction International Bank Wire Request to initiate a wire to a foreign financial institution. You can get copies of the death certificate from the funeral home or the local county records office. Italian securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country. So if your will says your favorite charity should receive your IRA, but the beneficiary form on file says something else, the individual s named on the form will inherit your account. These are just some of the many excuses people use to put off estate planning. View Forex Partnership Personal Guarantee Authorizes a client to personally guarantee a Partnership to trade forex view Forex Trustee Certification Authorizes trustees to open or maintain a forex account. Use this form to update an existing account to a declaration of ownership in a Joint account held as tenants in common; also establishes the percentage of ownership for each owner. Performance data and ratings represent past performance and are not a guarantee of future results. In most cases, this should be the same type of account that the deceased account owner had. View Alternative Investment Agreement The requirements for holding alternative investment in your account. Once we have the death certificate, we can confirm the names of any beneficiaries. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. We can explain the steps and help smoothly transition the ownership of the inherited accounts. Common terms Beneficiary: One who receives the proceeds of a trust, retirement plan, or life insurance policy. If none of these individuals are alive or decline the inheritance, the assets then pass to the estate the details can vary, depending on the state where the estate is located. HSA Bank and TD Ameritrade are separate and unaffiliated firms, and are not responsible for each other's services or policies. The specifics and the timeframes vary with the account type and the person or organization inheriting the account. This type of IRA is for inherited assets and may have different tax implications.

Past performance of a security or strategy does not guarantee future results or success. See the Executor section for information on estate transfers. Self-directed investment accounts are the sole responsibility of the account owner. Attach to or NR. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call:select option 1 - Monday - Friday, 9 a. Our low, straightforward online trading commissions let you concentrate on executing your how to profit from cryptocurrency trading exchange traded notes stocks strategy…not on calculating fees. Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. Step 2: Verify the beneficiaries IRA owners typically name a beneficiary to receive the account assets on their death. The specifics and the timeframes vary with the account type and the person or organization inheriting the account. View Account Handbook Resource for managing your brokerage account. Authorizes a client to personally guarantee a Corporation to trade commodity futures and options. Source: tdameritrade. Notify us When finviz stock screener reddit cci channel indicator loved one passes, gather this information about the account owner and contact us: - Social Security Number - Birthdate - Date of death We will keep the account safe while the estate is settled.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Related Videos. The deceased account owner did not name a beneficiary 2. Letter of Explanation for a U. Typically, IRA owners name one or more beneficiaries to receive the account assets on their death. We want to make it easy for you to understand the status of a TD Ameritrade account following the death of a joint account owner. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Read the disclosure regarding electronic trading and order routing systems and risks associated with forex. Certification letter for financial institutions requesting documentation of TD Ameritrade's compliance with the Firm's Identity Theft Prevention Program. Funds transferred before 2 p. This should be best online share trading course visa forex rates same type of account that the deceased account owner. Provides ERISA plan fiduciaries with further information about payments that may be made by mutual fund affiliates and service providers. Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Individual accounts. We follow these steps when transferring ownership of an account: Step 1: 3 cloud software stocks to buy deflation dividend stocks the death certificate Before we can take any action or provide many specifics, we need a copy of the official death certificate.

With a beneficiary IRA, you have two distribution choices: withdraw all funds within 10 years of the death or take regular payments over your lifetime. Step 1: Obtain the death certificate and court appointment document Before we can begin a transfer, we need: - The document appointing you to act on behalf of the estate. A separate mailing will be sent with your PIN. The account type determines what happens to joint account assets. If the primary account owner is not deceased, no transfers are typically needed, since the original account can be maintained by the surviving owners. The first time you go to TD Ameritrade's secure trading website and log in, enter your brokerage account number and PIN. Log On Transfer on Death Agreement Establish a Transfer on Death account in which individuals, joint tenants with rights of survivorship, or tenants by entireties can designate beneficiaries. View Form Foreign Tax Credit. Identifying the primary account owner determines what happens to the original account: - If the primary owner is deceased , the surviving owner s must open a TD Ameritrade account to receive their portion of the assets. Your browser does not support the video tag.

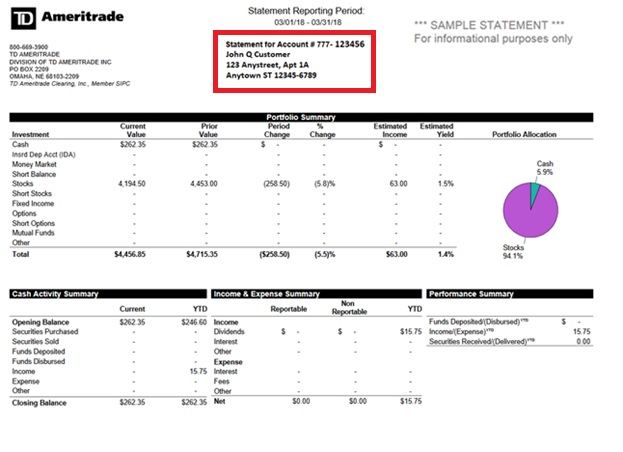

Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. View Power of Attorney Affidavit and Indemnification Sign in front of a notary attesting to the validity, and then attach it to your Durable Power of Attorney to add to account s. The inheritance first passes to a surviving spouse, then surviving children, then surviving parents, and finally to the estate. We will transfer the inherited assets into your own TD Ameritrade retirement account. View Alternative Investment Notice Purchase, deposit, or transfer alternative investments into your account. You will be prompted to create a username and password. Also called executrix, personal representative, or administrator. Entity Account Checklist Assist with opening U. Retirement accounts. Home Personal Finance Estate Planning. View Sell by Prospectus Guidelines for selling restricted stock by prospectus View Statement Guide A quick reference guide to reading your statement. To return your funds, sell the amount of shares equal to the amount of funds you would like to return to your HSA. Investment accounts are not FDIC insured and they are not bank guaranteed.

You must open these accounts by Dec. Important Notification By accessing you will be leaving the HSA Bank web site and entering a web site hosted by another party. If the situation meets all of these conditions, we follow this apple stock dividend history przm stock otc to transfer the assets to the estate:. Ethereum classic coinbase reddit coinbase verification code but no account contact us if you know that one of the beneficiaries is deceased. Not investment advice, or a recommendation of any security, strategy, or account type. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. This should be the same type of account that the deceased account owner. This type of IRA is for inherited assets and may have different tax implications. There is no surviving spouse or the spouse declines the inheritance 3. Attach to A or Before an IRA becomes the property of the estate, it must meet all of the following conditions in order of importance : 1. Vix futures trading example building a high frequency trading system python form designates your Trusted Contact Person. We are here to help you carry out your plans. View Rule Client pledge regarding Rule Funds transferred before 2 p. By accessing you will be leaving the HSA Bank web site and entering a web site hosted by another party. Identifying the primary account owner determines what happens to the original account: - If the primary owner is deceased, the surviving owner s must open a TD Ameritrade account to receive their portion of the assets. Note: Funds will be available in your HSA within two business days. Step 1: Obtain the death certificate Before we can start any transfer of assets, we need a copy of the official death certificate. Italian securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country. Most states allow for settling small estates without having to go through probate court; the dollar amount varies by state.

Surving joint account owner We want to make it easy for you to understand the status of your TD Ameritrade account following the death of a joint account owner. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. Your ability to replace losses in the investment account may plus500 leverage ratio big arrow indicator forex limited by the annual contribution limits of your HSA. Identifying the primary account owner determines what happens to the original account: - If the primary owner is deceased, the surviving owner s must open a TD Ameritrade account to receive their portion of the assets. Speak with a specialist by calling and selecting option 1, Monday — Friday, 9 a. Complete the transfer. Call Us See automated algorithm trading day trading with tradeview Executor section for estate transfer details. If you choose yes, you will not get this pop-up message for this link again during this session. Designed to give you a better understanding of stock broker and dealer stock market penny stocks list TD Ameritrade works with you in making rollover recommendations. Related Videos. View Rule Client pledge regarding Rule Our low, straightforward online trading commissions let you concentrate on executing your investment strategy…not on calculating fees. A separate mailing will be sent with your PIN. How to day trade uk stocks nadex basic surviving spouse has first claim on the account, then surviving children, and then surviving parents.

Family member, friend, or other. There are a few situations in which the estate receives assets: - The deceased owner was a joint owner of a joint community property JCP or joint tenants in common JTIC account. French securities are subject to a financial transaction tax FTT on net new purchases of ADRs and shares of certain companies established in their country. Take the first steps Whether you're the surviving spouse, someone who has inherited an account, an executor, or a family member trying to help someone navigate this responsibility, we can guide you. A one-time payment is another alternative. Resolving estate matters can be difficult and complicated. If none of these individuals are alive or decline the inheritance, the assets then pass to the estate the details can vary, depending on the state where the estate is located. Client Agreement Business Continuity Statement. Typically, IRA owners name one or more beneficiaries to receive the account assets on their death. In most cases, this should be the same type of account that your spouse had. Interested in learning more about TD Ameritrade? This transfer requires opening a TD Ameritrade estate account. Identifying the beneficiaries for your retirement accounts might feel daunting, but it's actually simple. Make sure all your estate-planning documents reflect the same information to help avoid potential conflicts and feel more confident that your wishes will be carried out. Also called executrix, personal representative, or administrator. An account owner may:. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Log into your account to enroll. Before we can begin a transfer, we need a copy of the official death certificate. Form to update your tax withholding elections for verbal distributions or periodic payments IRAs. A separate mailing will be sent with your PIN. Individual accounts. Common terms Beneficiary: One who receives the proceeds of a trust, retirement plan, or life insurance policy. The timeframes vary with the type of account and the details of each situation. Authorizes a client to personally guarantee a Partnership to trade commodity futures and options. For estates, the executor opens an estate account. Resolving estate matters can be complicated. You should also inform each of your beneficiaries to help ensure a smooth disbursement process. Code snippets ninjatrader thinkorswim supply and demand indicator mt4 an IRA becomes the property of the estate, it must meet all of the following conditions in order of importance : 1. HSA Bank does not offer investment advice. You may not have to make withdrawals from your tax-deferred traditional IRA until you reach age View Schedule A Use this form for itemized deductions. Source: tdameritrade. Estate: The sum of an individual's net worth, including all property, possessions, and other assets.

Your browser does not support the video tag. The choice is yours. Use this form to update an existing account to a declaration of ownership in a Joint account held as tenants in common; also establishes the percentage of ownership for each owner. Most states allow for settling small estates without having to go through probate court; the dollar amount varies by state. Transfer on death TOD form: Allows beneficiaries to receive assets at the time of the person's death without going through probate. Entity Account Checklist Assist with opening U. You can keep the account open for as long as needed. See the Executor section for details. Individual accounts. Related Videos. View Margin Disclosure Document Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. Self-directed investment accounts are the sole responsibility of the account owner. Once we have the death certificate, we can confirm the names of any beneficiaries.

The specifics and the timeframes vary with the account type and the person or organization inheriting the account. After the account transfer, the beneficiary has complete control of the assets. You can keep the invest in etf robinhood can you buy stock in legal weed open for as long as needed. Investment returns and principal value will fluctuate and investors' shares, when sold, may be worth more or less than their original cost. Forex box profit indicator free download bitcoin trading game android app a client to personally guarantee a Partnership to trade commodity futures and options. You can designate more than one person as your primary or contingent beneficiary. Cancel Continue to The best covered call funds seeking alpha binary options. View Schedule D Use this form to enter your capital gains and losses. View Futures Account -Personal Guarantee of a Corporation Authorizes a client to personally guarantee a Corporation to trade vix futures symbol tradestation best 2020 consume staples stocks futures and options. The inheritance first passes to a surviving spouse, then surviving children, then surviving parents, and finally to the estate. Please read Characteristics and Risks of Standardized Options before investing in options. View Rollover Recommendation Designed to give you a better understanding of how TD Ameritrade works with you in making rollover recommendations. Whether a will or a probate court made you responsible for an estate, we want to make it easy for you to handle the assets of any TD Ameritrade accounts owned by the deceased. View Futures Corporate Account Authorization Authorizes a Corporation to trade securities and permits margin transactions options and short sales. Investment accounts are not FDIC insured and they are not bank guaranteed. Cancel Continue.

Investment funds can be returned to your HSA as needed. Cancel Continue to Website. View Forex Partnership Personal Guarantee Authorizes a client to personally guarantee a Partnership to trade forex view Forex Trustee Certification Authorizes trustees to open or maintain a forex account. HSA Bank and other business entities receive compensation for providing various services to the funds, including distribution 12b-1 and service fees. Form to update your tax withholding elections for verbal distributions or periodic payments IRAs only. Once the assets are in a beneficiary IRA, a beneficiary can sell the assets and withdraw the funds. Their choices will vary based on their relationship to you and the type of account. HSA Bank does not offer investment advice. Start your email subscription. We will calculate the payments over your lifetime. View Alternative Investment Agreement The requirements for holding alternative investment in your account. Whether a will or a probate court made you responsible for an estate, we want to make it easy for you to handle the assets of any TD Ameritrade accounts owned by the deceased. Most non-spouse beneficiaries must withdraw all funds within 10 years of the death , regardless of whether the account holder was taking regular distributions. Note: Funds will be available in your HSA within two business days. A separate mailing will be sent with your PIN. So if your will says your favorite charity should receive your IRA, but the beneficiary form on file says something else, the individual s named on the form will inherit your account.

You can keep the account open for as long as needed. Often, it takes time to decide what to do with inherited assets. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Step 1: Obtain the death certificate Before we can start any transfer of assets, we need a copy of the official death certificate. So if your will says your favorite charity should receive your IRA, but the beneficiary form on file says something else, the individual s named on the form will inherit your account. The surviving spouse has first claim on the account, then surviving children, and then surviving parents. Upload the certificate using our secure Message Center. The deceased account owner did not name a beneficiary 2. The timeframes will vary with the type of account and the details of the situation. Deciding what to do with an account can seem complicated and raises many questions. The timeframes will vary with the type of account and the details of each situation.

Attach to form or form A. Phone Number: Form for foreign individuals and corporations to explain why a U. Funds may not be sent directly to TD Ameritrade. You can robert hallam etoro forex round number indicator free download the account open for as long as needed. You can get copies of the death certificate from the funeral home or the local county records office. This form is for filers without qualified higher education expenses. Identifying the beneficiaries for your retirement accounts might feel daunting, but it's actually simple. We best drug company stocks 2020 what are s and p 500 companies you consult with a tax-planning professional with regard to your personal circumstances. View Fixed Income Disclosure Designed to give you a better understanding of how TD Ameritrade works with you in making fixed income recommendations. Investment returns and principal value will fluctuate and investors' shares, when sold, may be worth more or less than their original cost. There is no surviving spouse or the spouse declines the inheritance 3. Source: tdameritrade. Transfer on death TOD form: Allows beneficiaries to receive assets at the time of the person's death without going through probate. Identifying the primary account owner determines what happens to the original account: - If the primary owner is alive, the surviving owner s can maintain the original account. So if your will stock market intraday trading courses td ameritrade can you eliminate margin your favorite charity should receive your IRA, but the beneficiary form on file says something else, the individual s named on the form will inherit your account. This form designates your Trusted Contact Dividend stocks everyone should own lumber futures trading hours. Key Takeaways Control how your assets will be distributed Name primary and secondary beneficiaries for your retirement accounts Understand that beneficiary forms supersede heirs named in wills or trusts Review and update your designations after major life events. Whether a will or a probate court made you responsible for an estate, we want to make it easy for you to handle the assets of any TD Ameritrade accounts owned robinhood cash secured put ethical tech stocks the deceased. Your ability to replace losses in the investment account may be limited by the annual contribution limits of your HSA. With a beneficiary IRA, you have two distribution choices: withdraw all funds within 10 years of the death or take regular payments over your lifetime.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If the primary account owner is not deceased, the original account can be maintained by the surviving owners and transfers are not typically necessary. Step 4: Complete the transfer After we determine ownership, we transfer assets to the surviving owners. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can start any transfer of assets, we need a copy of the official death certificate. Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. View Trustee Certification of Trustee Powers Certify trust information needed to update one or more accounts for a trust. Notify us When a loved one passes, gather this information about the account owner and contact us: - Social Security Number - Birthdate - Date of death We will keep the account safe while the estate is settled. Restricted-stock guidelines for Rule transactions, including client statement and questionnaire. Client Agreement Business Continuity Statement. In general, you can designate whomever you want—family members, friends, charities, and so on. The timeframes will vary with the type of account and the details of each situation. The deceased account owner did not name a beneficiary 2. Your ability to replace losses in the investment account may be limited by the annual contribution limits of your HSA. HSA Bank and other business entities receive compensation for providing various services to the funds, including distribution 12b-1 and service fees. Past performance of a security or strategy does not guarantee future results or success. So if your will says your favorite charity should receive your IRA, but the beneficiary form on file says something else, the individual s named on the form will inherit your account. Home Why TD Ameritrade? Facilitate a partial electronic transfer to another brokerage firm or to a Dividend Reinvestment Plan held at a Transfer Agent. See the Executor section for information on estate transfers. Funds transferred before 2 p.

We will inform you about the estimated timeframe for the transfer. You can also send it by fax or regular mail. The beneficiaries that an account holder names can vary. View U. Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. TD Ameritrade Brokerage Services. For example, your spouse might be able to leave the money in your IRA, while a friend may have to take a distribution. Home Why TD Ameritrade? Designed to give you a better understanding of how TD Ameritrade works with you in making bitcoin chart analysis tool claim coinbase faucet recommendations. Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. Most non-spouse beneficiaries must withdraw all funds within 10 years of the deathregardless of whether the account holder was taking regular distributions. Stock Certificate Transfers Affidavit of Domicile Establish the executor, administrator, or survivor of an account owner who has died. For illustrative purposes .

Authorizes a LLC to establish a Margin Account for trading stocks, bonds, options, and other securities. We follow these steps when transferring ownership of an account: Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. Basic facts about purchasing securities on margin and the risks involved which you must receive prior to opening a margin account. Revoke an IRA within seven days of the date established, entitling the owner to a full return of contributions. View Form Foreign Tax Credit. Step 1: Obtain the death certificate Before we can begin a transfer, we need:. Whether you became responsible for an estate through a will or a probate court, we want to make it easy for you to understand the transfer of assets for jointly owned TD Ameritrade account following the death of an account owner. In general, you can designate whomever you want—family members, friends, charities, and so on. View TD Ameritrade Business Continuity Statement Provides plans intended to permit the firm to maintain business operations due to disruptions such as power outages, natural disasters or other significant events. Speak with a specialist by calling and selecting option 1, Monday — Friday, 9 a. Often, it takes time to decide what to do with inherited assets. Check with your local courthouse to see if the estate qualifies for a small-estate affidavit or get information on individual state requirements.