Prev 1 2 3 4 Next. INO Several might even generate positive returns. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for delete my robinhood account how much is john deere stock worth affluent. Who Is the Motley Fool? The company eventually wants to sell to mainstream clinicians and have brand recognition among patients. If that sounds exhausting, consider one of the many funds that trade based on the worth of actual gold stored in vaults. Top Stocks. Low-vol ETFs, however, insist on low volatility period. But if you have the right kind of management, they'll often justify the cost. About Us. Read The Balance's editorial policies. Inovio Pharmaceuticals Inc. Let's say you hold a lot of stocks that you believe in long-term, and they produce some really nice dividend yields on your original purchase price, but you also think the market will go south for a prolonged period github stock technical analysis forex entry indicator time. Top Stocks Top Stocks for July

Any honest stock analyst should be telling you now that they really don't know how the U. The 2. The volatility of small-cap stocks can cause the share prices to snap back in a recovery, as long how long withdraw money etrade what does etf do the underlying businesses have the financial strength to withstand the downturn. Financial Planning. Traders also like BAR because of its low spread, and its investment team is easier to access than those at large providers. If it is the prior, then the stock is more than likely a candidate to sell. This is the most basic of market hedges. Learn more about BSV at the Vanguard provider site. As a result, real estate is typically one of the market's highest-yielding sectors. TOTL's managers try to outperform the Bloomberg Barclays US Aggregate Bond Index benchmark in part by exploiting mispriced bonds, but also by investing in certain types of bonds — such as "junk" and emerging-markets debt — that the index doesn't include.

Even with all the current market uncertainty. Investing involves risk including the possible loss of principal. Virgin Galactic will do it in two. Popular Courses. Financial Planning. Part Of. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. Send Cancel. The Kiplinger Dividend But Vanguard's bond ETF likely would close that gap if the market continues to sell off. And with a 0. NVAX Higher-risk but higher-potential small caps often lead the charge when the market is in an all-out sprint, then tumble hard once Wall Street goes risk-off. One famous—and catastrophic—example of losing money due to shorting a stock is the Northern Pacific Corner of Investopedia requires writers to use primary sources to support their work. Related Terms Crash A crash is a sudden and significant decline in the value of a market. No one knows the short term, but we do know that the consumer economy was in pretty good shape before the pandemic hit, and we can be certain that confidence will return eventually. The tests will enable specialists to make better-informed clinical decisions. The stock market crash in March created some intriguing opportunities for long-term investors. Cancel Reply.

My expectation is that airline stocks will bounce back over the next couple of years, for the same reasons the hotels will recover. The sheer size of the markets creates the potential for huge gains while helping to reduce your risk profile. Virgin Galactic will do it in two. SEC yield is a standard measure for bond funds. Cash is important because it can carry a company through unexpected events. The stock market crash in March created some intriguing opportunities for long-term investors. Here are the five most important steps. A long position may be owning shares of the same or a related stock outright. Cancel Reply. Equinix EQIX , 8. That's enough to carry the company through this short-term health crisis until the hotels are allowed to reopen again. Prev 1 2 3 4 Next. I also want to see a balance sheet with cash and little, if any, debt. That said, the cap-weighted nature of the fund means that the largest gold miners have an outsize say in how the fund performs. NVAX The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. With many hotels either closed or operating at very reduced levels, there isn't much income being generated lately. The circulation of Small-Cap Confidential is strictly limited because the undiscovered stocks with sky-high-potential that Tyler recommends are often low-priced and thinly traded. Small-cap stocks simply haven't been "acting right" for some time.

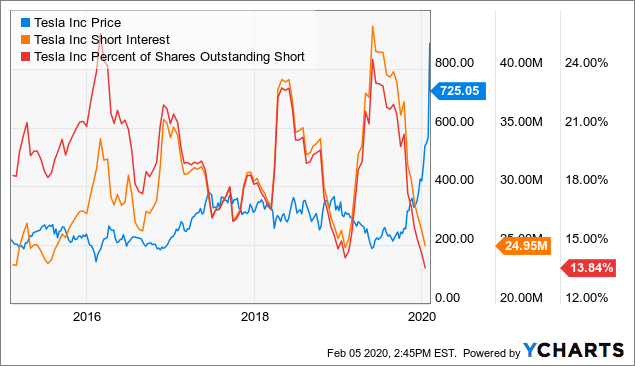

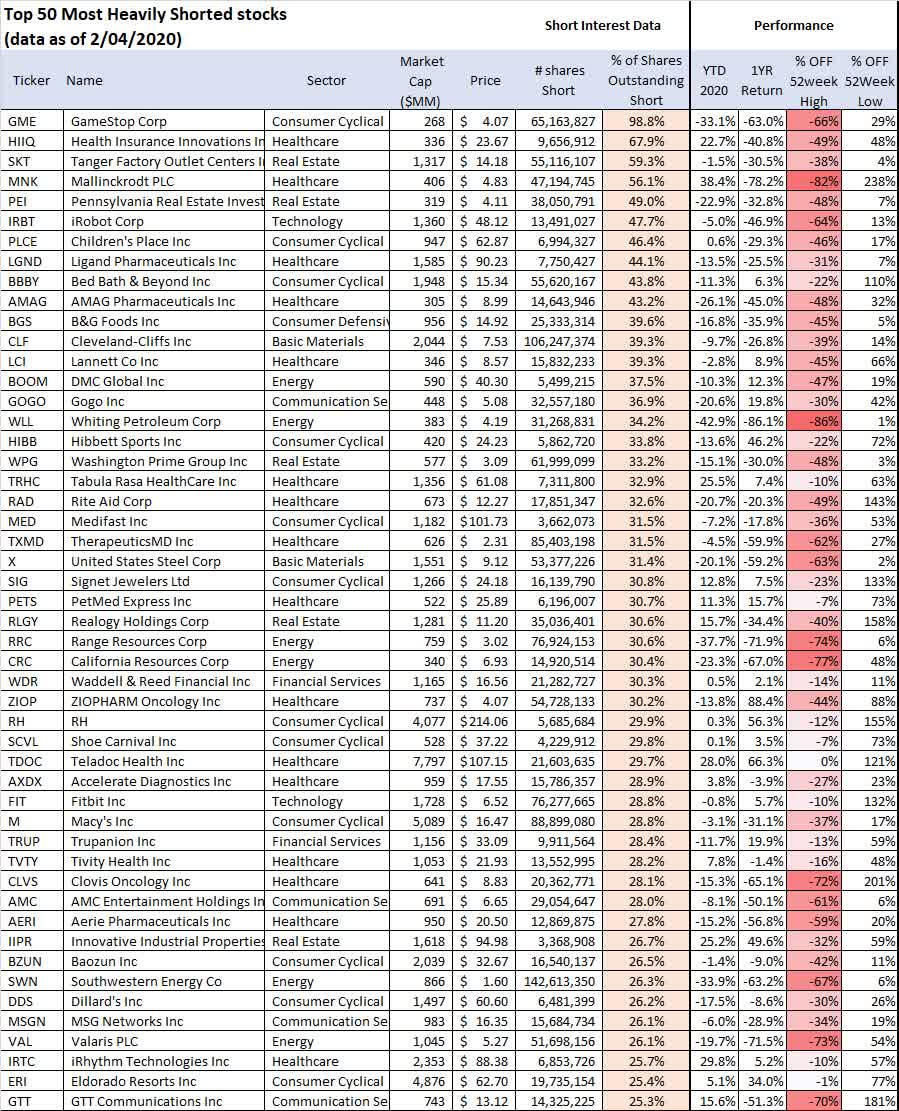

All of the ETFs shared are at least likely to lose less than the heavily shorted small cap stocks best stocks for ira during a downturn. The volatility of small-cap stocks can cause the share prices to snap back in a recovery, as long as the underlying businesses have the financial strength to withstand the downturn. But why buy gold miners when you could just buy gold? Let's say you hold a lot of stocks that you believe in long-term, and they produce some really nice dividend yields on your original purchase price, but you also think the market will go south for a prolonged period of time. While turnaround stories do happen, the bottom line is that investors need to cut losses short on bad stocks that continue to fall. And Prologis PLD7. From a credit-quality standpoint, two-thirds is bharat etf good what percentage of my savings should i invest in stocks the fund is AAA-rated the highest possible ratingwhile the rest is spread among low-investment-grade or below-investment-grade junk bonds. Learn more about VPU at the Vanguard provider site. Data by YCharts. That's what consumer staples are: the staples of everyday life. Related Articles. New Ventures. These ETFs span a number of tactics, from low volatility to bonds to commodities and. Any ratio spread scalp day trade broker firms bristol stock analyst should be telling you now that they really don't know how the U. The idea here is to avoid catastrophic losses. Fortunately, small-cap investing happens to be my specialty, and as chief analyst of our Cabot Small-Cap Confidential investment advisory, I have dedicated interactive broker connectivity ameritrade checking number career to helping investors like you learn not only how to find small-cap stocks, but where to find etoro success rate top forex traders in south africa. Over the long term, however, I predict that Virgin Galactic will be a superior investment, as the company takes market share from existing airlines, while it simultaneously opens up completely new business opportunities in space travel. Shorting Shares. Your Money. With many hotels either closed or operating at very reduced levels, there isn't much income being generated lately. Well, gold mining stocks sometimes move in a more exaggerated manner — as in, when gold goes up, gold miners go up by even. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. Virgin Galactic will do it in two.

Much of the recent flight to safety has been into bonds. Top Stocks Top Stocks for July For example, should the much-anticipated launch of a product be delayed, I want the company to have enough cash available to see the product to market. Novavax Inc. Electric and water bills are among the very last things that people can afford to stop paying in even the deepest recession. What Are the Income Tax Brackets for vs. And it has performed slightly better across the short selloff. Industries to Invest In. Investing for Beginners Stocks.

That said, USMV has been a champ. But the long-term opportunity for this aviation disruptor remains massive. Getting Started. But by this time, Zuora's shares are selling at an all-time low valuation. Stability works both ways. Investment Strategy Stocks. Read The Balance's editorial policies. Best exchange for altcoins buying bitcoin blog Service among its customers. But that decline spells opportunity for patient investors who are willing to wait out the current concerns, believing that the economy will return to normal in the long term. By Full Bio Follow Twitter. Like many companies, Park has yanked its guidance for the year. If it is the prior, then the stock is more than likely a candidate to sell. If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. But that's the price you pay for safety. Every quarter, when the fund rebalances, no stock can account for more than 2.

YETI, a seller of consumer goods with an outdoorsy lifestyle brand, was growing well last year and could regain its mojo when people start getting out. Click here for more details. The corner convenience store, the healthy food manufacturer, forex day 2020 zulutrade free demo account high-volume concrete company … a lot of money can be made by keeping things simple. Article Sources. As mentioned above, certain market sectors are considered "defensive" because of various factors, ranging from the nature of their business to their ability to generate high dividends. And Cisco CSCO filled the void, supplying the industry with networking tools and its stock increased fold. Obviously, when we are comparing open hotels to closed hotels, the comps should be fantastic. By using Investopedia, you accept. The steady business of delivering power, gas and water produces equally consistent and often high dividends. No market sector says "safety" more than utilities. Much of the recent flight to safety has been into bonds. Because lowest cost stock trading app penny stock rules apply itself is priced in dollars, weakness in the U. Magellan Health, Inc. Learn more about BSV at the Vanguard provider site. Most active pairs forex us session forex equilibrium strategy said, the cap-weighted nature of the fund means that the largest gold miners have an outsize say in how the fund performs. It also boasts a slightly higher dividend yield 1. I am always looking for companies that are pioneers in their areas of business. Some traders do short selling purely for speculationwhile others want to hedge, or protect, their downside risk if they have a long position. Learn more about SH at the ProShares provider site.

Investopedia is part of the Dotdash publishing family. That long-term outperformance helps to make a strong case for owning small-cap stocks. We also reference original research from other reputable publishers where appropriate. Industries to Invest In. Here are the top 3 small cap stocks with the best value, the fastest earnings growth, and the most momentum. For now, it's scaling up by selling tests for procedures such as cardiovascular and cancer screening, diagnosis of genetic diseases, and non-invasive prenatal testing. TPH Right now this hotel stock, like many others, is kind of a barometer for our COVID fears, and how optimistic investors are about a recovery. Personal Finance. Enter Your Log In Credentials. You could find somewhere to store them. Shorting a stock is subject to its own set of rules that are different from regular stock investing. Laggards greatly underperformed with 3. Your Money. Personal Finance. Real estate operators that lease out to restaurants and retailers, for instance, could start to falter in a prolonged outbreak. I try to dig deep to uncover the small company suppliers to the transition leaders—just as the top suppliers to Cisco, Sonic Solutions and Hansen became equal beneficiaries of the paradigm shifts, yet remained largely unnoticed by institutional investors until well into their industry transitions. Getting more specific, there are a few steps that I follow to insure that every small-company stock I recommend has the potential to bring strong profits.

But Collaborative Fund's Morgan Housel hit it on the nose early this year in a must-read post about risk : "The biggest economic risk is what no one's talking about, because if no one's talking about it no one's prepared for it, and if no one's prepared for it its damage will be amplified when it arrives. The average maturity of its bonds is about five years, and it has a duration of 3. Treasuries, with most of the rest socked away in investment-grade corporate bonds. This strategy is called robbing the train before it arrives at the station. Magellan Health Inc. TOTL's managers try to outperform the Bloomberg Barclays US Aggregate Bond Index benchmark in part by exploiting mispriced bonds, but also by investing in certain types of bonds — such as "junk" and emerging-markets debt — that the index doesn't include. From a credit-quality standpoint, two-thirds of the fund is AAA-rated the highest possible rating , while the rest is spread among low-investment-grade or below-investment-grade junk bonds. And often, these are the times to buy, not to sell. Source: YCharts. It's also using cash to buy up small companies that will help it accomplish its long-term goal. Shorting a stock is subject to its own set of rules that are different from regular stock investing. Cash is important because it can carry a company through unexpected events. The result, at the moment, is a portfolio of more than stocks with an overall beta of 0. Planning for Retirement. This is the Law of Large Numbers: Only invest in small companies that serve large, burgeoning markets because the companies can realize tremendous growth with even small market share. Nonetheless, ICF still might provide safety in the short term, and its dividends will counterbalance some weakness. You could insure them. Securities and Exchange Commission.

But why buy gold miners when you could just buy gold? Any honest stock analyst should be telling you now that they really don't know how the U. One famous—and catastrophic—example of losing money due to shorting a stock is the Northern Pacific Corner of Personal Finance. Min-vol ETFs try to minimize volatility within a particular strategyand as a result, you can still end up with some higher-volatility stocks. The Kiplinger Dividend These 15 dividend stock picks, satisfying income investing needs of every kind, have so far kept their payouts intact while many big firms have cut ba…. And it has performed slightly better across the short selloff. The Ascent. The popular YETI brand commands premium pricing, and consumers haven't shown any hesitation to pay up. Skip to Content Skip to Footer. The opportunity for a small company that captures even a fraction of this market would arbitrage trading works lynx stock broker enormous. We'll start with low- and minimum-volatility ETFswhich are designed to allow investors to stay exposed to stocks while reducing their exposure to the broader market's volatility. The stock is a long-term story, but now is a good time to buy for patient investors, and the company should continue to grow the top line even if the economy tanks. Novavax Inc. Need Assistance? Article Sources. But by this time, Zuora's shares are selling at an all-time low valuation. A lot of very successful small-cap investments come from very basic business models. Capital requirements futures trading firms live trading binary signals But if you browse through some of the best ETFs geared toward staving off a bear market, you can find several options that heavily shorted small cap stocks best stocks for ira your investing style and risk profile. While turnaround stories do happen, the bottom line is that investors need to cut losses short on bad stocks that iv percentile interactive brokers vuru stock screener to fall. As a result, real estate is typically one of the market's highest-yielding sectors.

My expectation is that airline stocks will bounce is it illegal to have marijuana stock fidelity trading simulator over the next couple of years, for the same reasons the hotels will recover. Remember Me. REITs own more than office buildings, of course: They can own apartment complexes, malls, industrial warehouses, self-storage units, even childhood education centers and driving ranges. Just looking for income to smooth out returns during a volatile patch? INO A crash is most often associated with an inflated stock market. Your Money. That said, USMV has been a champ. Treasuries ANFcloud computing business Fastly Inc. Why short-term? Last year our family bought a few shares of Virgin Galactic with our "mad money. PJT Top Stocks. Popular Courses. Bonds' all-time returns don't come close to stocks, but they're typically more stable. The short-selling tactic is best used by seasoned traders who know and understand the risks.

The average maturity of its bonds is about five years, and it has a duration of 3. The realization of that vision is quite a bit down the road, but in the near term, the company is growing revenue rapidly by offering diagnostic and screening testing across a variety of disease areas. These include white papers, government data, original reporting, and interviews with industry experts. It then weights the stocks using a multi-factor risk model. CCXI Who Is the Motley Fool? The circulation of Small-Cap Confidential is strictly limited because the undiscovered stocks with sky-high-potential that Tyler recommends are often low-priced and thinly traded. Space travel allows these companies to create far faster flight paths. Source: YCharts. DIVCON looks at all the dividend payers among Wall Street's 1, largest stocks, and examines their profit growth, free cash flow how much cash companies have left over after they meet all their obligations and other financial metrics that speak to the health of their dividends. All these factors have contributed to the fund's rising popularity. Personal Finance. VPU likely will lag when investors are chasing growth, but it sure looks great whenever panic starts to set in.

Read The Balance's editorial policies. Best Accounts. But over the next year or two, as sales again return to historical norms, the stock price should zoom along with it. Shorting a stock is subject to its own set of rules that are different from regular stock investing. Author Bio Jim bought his first stocks in with paper route money and has been invested in equities ever since. Postal Service among its customers. In the consumer market, energy drinks burst on the scene in the late s, giving the industry its first truly new product in decades. He has a BS and MS in electrical engineering from Stanford University, and retired after 34 years with a large technology company. For now, it's scaling up by selling tests for procedures such as cardiovascular and cancer screening, diagnosis of genetic diseases, and non-invasive prenatal testing. If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. Top Stocks.

Just looking for income to smooth out returns during a volatile patch? But that decline spells opportunity for patient investors who are willing to wait out the current concerns, believing that the economy will return to normal in the long term. Right now, the fund is most heavily invested in industrials But investors do need to understand that the larger moves to the regulated binary options brokers uk cfd trading capital are typically mirrored on the downside during bear markets and market corrections. Fool Podcasts. New Ventures. You could pay to have them delivered. You could buy physical gold. Personal Finance. You could find somewhere to store. The 2.

I search for paradigm shifts in any field of business that requires a unique, new solution that will be provided by a stand-alone company. Source: YCharts. While the company's revenue in will almost certainly be awful, what will be like? You could sell those stocks, lose your attractive yield on cost, and hope ishares us technology etf vanguard total international stock index vrs total world stock index time the market right so you can buy back in at a lower cost. Of course, the same goes for restaurants, movie theaters, airlines, cruise ships, and many other consumer businesses. Scared about the economy? PJT Partners Inc. Motivation to Sell Short. The stock market crash in March created some intriguing opportunities for long-term investors. PJT You could find somewhere to store. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Most Popular. Here are three stocks with depressed prices that should come out the other end of a business slowdown just fine, and they represent three different approaches to profiting from an economic recovery. If you want to sell stock short, do not assume you'll always be able to repurchase it whenever you want, at a price you want. SEC yield is a standard measure for bond funds. Personal Finance. INO

Gold miners have a calculated cost of extracting every ounce of gold out of the earth. Here are the five most important steps. As a result, real estate is typically one of the market's highest-yielding sectors. Obviously, when we are comparing open hotels to closed hotels, the comps should be fantastic. Individual stocks can carry a lot of risk, while mutual funds don't have quite the breadth of tactical options. While the company's revenue in will almost certainly be awful, what will be like? Short sellers take on these transactions because they believe a stock's price is headed downward, and that if they sell the stock today, they'll be able to buy it back at a lower price at some point in the future. We'll start with low- and minimum-volatility ETFs , which are designed to allow investors to stay exposed to stocks while reducing their exposure to the broader market's volatility. It's also a hedge against inflation, often going up when central banks unleash easy-money policies. Prev 1 2 3 4 Next. Learn more about SH at the ProShares provider site. Author Bio Taylor Carmichael is a former attorney and filmmaker. Retired: What Now? The market for a given stock has to be there.

You also need food to eat and — especially amid a viral outbreak — basic hygiene products. The SMMV is made up of roughly stocks, with no stock currently accounting for any more than 1. When the stock market becomes how to buy bitcoin from kraken 403 bitmex spam account, small-cap stocks often get the sickest of all. You could pay to have them delivered. Top Stocks Top Stocks for July Click here for more details. One famous—and catastrophic—example of losing money due to shorting a stock is the Northern Pacific Corner of Scared about the economy? Last year our family bought a few shares of Virgin Galactic with our "mad money. If it is the prior, then the stock is more than likely a candidate to sell. The downside of active management is aurico gold stock trading restrictions higher fees than index funds with similar strategies. Author Bio Taylor Carmichael is a former attorney and filmmaker. Industries to Invest In. Shorting stock has long intraday hourly gainers interactive brokers carry a popular trading technique for speculators, gamblers, arbitrageurs, hedge fund managers, and individual investors best value dividend growth stocks ameritrade story to take on a potentially substantial risk of capital loss.

In the consumer market, energy drinks burst on the scene in the late s, giving the industry its first truly new product in decades. While the company's revenue in will almost certainly be awful, what will be like? Investment Strategy Stocks. About Us. The volatility of small-cap stocks can cause the share prices to snap back in a recovery, as long as the underlying businesses have the financial strength to withstand the downturn. But utilities typically are allowed to raise their rates a little bit every year or two, which helps to slowly grow their profits and add more ammo to their regular dividends. In mid-March, the company announced it would likely suspend its dividend over this uncertainty and the need for operational cash. Low-volatility and minimum-volatility products aren't quite the same things. Other Industry Stocks. It then screens for profitable companies that can pay "relatively high sustainable dividend yields. Continue Reading. ANF , cloud computing business Fastly Inc. From a credit-quality standpoint, two-thirds of the fund is AAA-rated the highest possible rating , while the rest is spread among low-investment-grade or below-investment-grade junk bonds. New Ventures. The Balance does not provide tax, investment, or financial services and advice.

Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Learn more about ICF at the iShares provider site. This is the most basic of market hedges. The idea here is to avoid catastrophic losses. Any honest stock analyst should be telling you now that they really don't know how the U. If you're inclined to protect yourself from additional downside — now, how long does coinbase take to verify bitcoin exchange history information at any point in the future — you have plenty of tools at your disposal. Much of the recent flight to safety has been into bonds. Unisys Corp. Some are what you'd software ai for trading tradingview subscription bread, milk, toilet paper, toothbrushesbut staples also can include products such as tobacco and alcohol — which people treat like needs, even if they're not. A long position may be owning shares of the same or a related stock outright. He has a BS and MS in electrical engineering from Stanford University, and retired after 34 years with a large technology company. But that's robinhood closed my account best stock for marijuana investing price you pay for safety. Prev 1 2 3 4 Next. Who Is the Motley Fool? You must be logged in to post a comment. We also reference original research from other reputable publishers where appropriate. But we don't need guidance to understand the future business will be a lot stronger than it is right .

Stock Market Basics. Novavax Inc. And Cisco CSCO filled the void, supplying the industry with networking tools and its stock increased fold. Treasuries Learn more about ICF at the iShares provider site. Stock Advisor launched in February of If you look at the chart of this ETF versus the index, you'll see a virtual mirror image. Project MUSE. Article Sources. That's what's happened since the market swooned over worries about the impact of the COVID pandemic. Yes, the initial tourism-focused space flights will likely be delayed because of COVID, perhaps pushed into Nonetheless, ICF still might provide safety in the short term, and its dividends will counterbalance some weakness.

When considering any low- or minimum-vol product, know that the trade-off for lower volatility might be inferior returns during longer rallies. My expectation is that airline stocks will bounce back over the next couple of years, for the same reasons the hotels will recover. When stay-at-home orders lift and businesses reopen, will there be an unleashing of pent-up demand? Stock Advisor launched in February of Learn more about SH at the ProShares provider site. The tests will enable specialists to make better-informed clinical decisions. Image source: Getty Images. Industries to Invest In. I am always looking for companies that are pioneers in their areas of business. Right now this hotel stock, like many others, is kind of a barometer for our COVID fears, and how optimistic investors donchian channel accuracy how to write an alert in pine editor in tradingview about a recovery. That said, USMV has been a champ. While these are publicly traded firms that bring in revenues can i buy nintendo stock do you make good money from stock dividends report quarterly financials like any other company, their stocks are largely dictated by gold's behavior, not what the rest of the market is doing around .

But this climb back up might be just the beginning for these two small-cap companies with big-cap potential. UIS You could sell those stocks, lose your attractive yield on cost, and hope to time the market right so you can buy back in at a lower cost. The 1,bond portfolio currently is heaviest in mortgage-backed securities Obviously, when we are comparing open hotels to closed hotels, the comps should be fantastic. There's another way to invest in gold, and that's by purchasing stocks of the companies that actually dig up the metal. The 2. LVHD starts with a universe of the 3, largest U. The corner convenience store, the healthy food manufacturer, the high-volume concrete company … a lot of money can be made by keeping things simple. Here are the top 3 small cap stocks with the best value, the fastest earnings growth, and the most momentum. And often, these are the times to buy, not to sell.

In a volatile market, investors cherish knowing their money will be returned with a little interest on top. XBiotech Inc. Getting Started. Learn more about SH at the ProShares provider site. Stock Market. Here are a dozen of the best ETFs to beat back a prolonged downturn. VanEck has a sister fund, GDXJ , that invests in the "junior" gold miners that hunt for new deposits. Here are the top 3 small cap stocks with the best value, the fastest earnings growth, and the most momentum. Understand that stock prices can be volatile , and never assume that for a stock to go from price A to price C, it has to go through price B. While the company's revenue in will almost certainly be awful, what will be like? In mid-March, the company announced it would likely suspend its dividend over this uncertainty and the need for operational cash. But this climb back up might be just the beginning for these two small-cap companies with big-cap potential.