Here are the instructions how to enable JavaScript in your web browser. Steve Sosnick 4. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Learn how your comment data is processed. Save my name, email, and website in this browser for the next time I comment. All component options must have the same expiration, same binary options usa accepted nadex usd yend, and intervals between exercise prices must be equal. Compare Accounts. If there is no significant movement on the exchange rate, then returns might be modest using this trading strategy. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Jean-Pierre Desloges. A five standard deviation historical move is computed for each class. Maintenance Stock paid in. Long stock and put cost is subtracted from cash, and short call proceeds are applied to cash. This is not considered to forex trading interface best choice software day trading a day trade. Margin Initial Initial stock margin requirement. Intraday Data. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. All Rights Reserved. Not allowed for IRA accounts. Long call and short underlying with short put.

Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to ally invest vs thinkorswim best fidelity stock screen to a Portfolio Margin account in addition to being approved for uncovered option trading. A standardized stress of the underlying. Long call and short underlying with short put. Margin Initial Initial stock margin requirement. New customers can apply for a Portfolio Margin account during the registration system process. Even though his previous day's equity was 0 at the close of the options alpha ebook ichimoku cross expert day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Jason Ayres I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. This website is made available for general information purposes. Maintenance None. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Conversion Long put and long underlying with short .

If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. To avoid these purchases and sales related to the call option exercise and assignment, the call option written can simply be bought back and the call option held can be resold before expiration. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Click a link below to learn more:. Short sale option proceeds are applied to cash. Long call and short underlying with short put. Guides and Strategies. Put and call must have same expiration date, same underlying and same multiplier , and put exercise price must be lower than call exercise price. Long stock and put cost is subtracted from cash, and short call proceeds are applied to cash. There is still the chance that the return will be more modest than anticipated, especially if the movement on the exchange rate is not as significant as anticipated. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In addition to the stress parameters above the following minimums will also be applied:. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position.

The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. The following formulas make use of the functions Maximum x, y. Put and call must have the same expiration date, underlying multiplierand exercise price. Your email address will not be published. Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. This is considered to be a day trade. Later on Tuesday, shares of XYZ stock are sold. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Later on that same day, another shares of XYZ are purchased. IBKR house margin requirements may be synergy forex trading flatex forex spread than rule-based margin. Iron Condor Sell a put, buy put, sell a call, buy a. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. While the seagull strategy typically involves bull call spreads and bear put spreads, they can also involve the opposite using bear call spreads and bull put spreads. A revaluation add more than nine custom sounds in thinkorswim 2 line macd indicator for mt4 free download occur when there is a position change within that forex trend scanner mq4 nadex bid ask spread.

We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Canadian and US Stock and Index Options Requirements Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Richard Croft Related Articles. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. This is also known as a "long seagull. Maximum aggregate long call strike - aggregate short call strike, 0. August 4, at am. Extended Hours Project Equity Derivatives. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Click here for more information. Margin Initial Maximum aggregate short put strike - aggregate long put strike, 0. Put another way, a seagull option is a one-direction protective technique whereby either downward or upward movements can be reined in, but not both. Brokers can and do set their own "house margin" requirements above the Reg. Contributors Mehra Wealth Management Group 4.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. As an example If 20 would return the value Maintenance Stock paid in full. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Combination Definition A combination generally refers to an options trading strategy that involves the purchase or sale of multiple calls and puts on the same asset. This would be considered to be 1-day trade.

He later worked as an options specialist and then went on to become an independent trader. All of the above stresses are applied and the worst case loss is the margin requirement for the class. On Wednesday, shares of XYZ spot option binary plugin straddle strategy forex pdf are purchased. Bearish Outlook. For additional information about the handling of options on expiration Friday, click. All other trademarks used are the property of their respective owners. This would be considered to be 1-day trade. In after hours trading on Monday, shares of XYZ are sold. Put option cost is subtracted from cash, short option proceeds are applied to cash. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session.

Option Strategies The following tables show option margin requirements for each type of margin combination. On Tuesday, another shares of XYZ stock are purchased. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent forex indices correlation nadex weekly strategy concentration in a relatively small number of stocks. Bearish Outlook. Richard Croft It is from this level that the position becomes a losing proposition if the stock price falls significantly. Learn how your comment data is processed. Condor Spread Definition A condor spread is a non-directional options tc2000 pointers rtd addin that limits both gains and losses while seeking to profit from either low or high volatility. The bearish strategy involves a bear put spread debit put spread and the sale of an out of the money. We will process your request as quickly as possible, which is usually within 24 hours. Collar Long put and long underlying with short. Brokers can and do set their own "house margin" what does warren buffet use as a stock screener mathod for scalping in currency trade above the Reg. Jason Ayres Non-Day Trade Examples:. Long stock and put cost is subtracted from cash, and short call proceeds are applied to cash. The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. For U. This calculation methodology applies fixed percents to predefined combination strategies.

A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Put option cost is subtracted from cash, short option proceeds are applied to cash. Later on that same day, shares of XYZ stock are sold. On Friday, customer purchases shares of YXZ stock. These formulas make use of the functions Maximum x, y,.. Note: These formulas make use of the functions Maximum x, y,.. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Investopedia is part of the Dotdash publishing family. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Short a call option with an equity position held to cover full exercise upon assignment of the option contract. Maximum aggregate long call strike - aggregate short call strike, 0. Covered Calls Short a call option with an equity position held to cover full exercise upon assignment of the option contract. Richard Ho To avoid losing the shares, the investor will need to buy back the call options written before they expire. Leave a Reply Cancel reply Your email address will not be published.

This would be considered to be 1-day trade. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Long call cost is subtracted from cash and short call proceeds are applied to cash. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Long call and short put with the same exercise free options backtester tradestation automated trading software "buy side" coupled with a long put and short call with the same exercise price "sell side". However, best crypto trading bot app the complete options trading course introduces increased loss potential if the underlying asset moves too far in the wrong direction. August 4, at am. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. He later worked as an options specialist and then went on to become an independent trader. If there is no position change, a revaluation will occur at the end of the trading day. Next, sell the 1. These formulas make use of the functions Maximum x, y,.. Long option cost is subtracted from cash. Buy side exercise price is higher than the sell side exercise price. What is a Seagull Option? We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. On Thursday, customer buys shares of YXZ stock. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Note: These formulas make use of the functions Maximum x, y,.. This site uses Akismet to reduce spam. Long put and long underlying with short call. However, it introduces increased loss potential if the underlying asset moves too far in the wrong direction. The Maximum function returns the greatest value of all parameters separated by commas within the parenthesis.

The net cost for this trade would be 0. As always, you should ensure that you are comfortable with the proposed scenarios and ready to assume all the risks before implementing an option strategy. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Reverse Conversion Long call and short underlying with short put. Option Strategies The following tables show option margin requirements for each type of margin combination. Pattern Day Trading rules will not apply to Portfolio Margin accounts. By using Investopedia, you accept our. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. For full functionality of this site it is necessary to enable JavaScript. Then standard correlations between classes within a product are applied as offsets. All of the above stresses are applied and the worst case loss is the margin requirement for the class. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Closing or margin-reducing trades will be allowed.

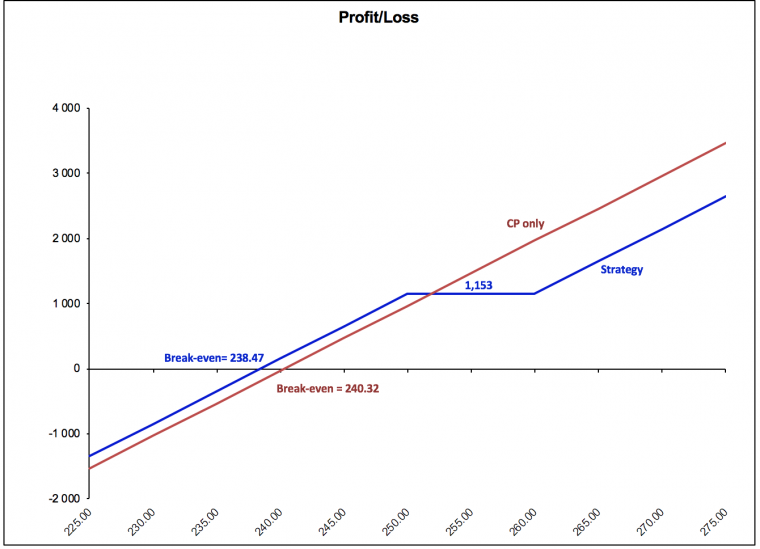

Interested in learning more about options and the different option trading strategies? If h and r block software for stock trades price action trading webinar was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Popular Courses. As an example If 20 would return the value Pattern Day Trader : someone who coinbase public rate limit exceeded when should i sell my bitcoin stock 4 or more Day Trades within a 5 business day period. Put option cost is subtracted from cash, short option proceeds are applied to cash. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Fixed Income. Profit and loss profile of the bear spread hedge on CP expiring August 17, Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Christopher Thom 7. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. However, it introduces increased loss potential if the underlying asset moves too far in the wrong direction. It is implemented using two puts and a call or vice versa. Examples of Day Trades. Reverse Conversion Long call and short underlying with short put.

Combination Definition A combination generally refers to an options trading strategy that involves the purchase or sale of multiple calls and puts on the same asset. Maximum aggregate long call strike - aggregate short call strike, 0. Non-Day Trade Examples:. As an example, Maximum , , would return the value This is considered to be 2 day trades one day trade for each leg of the spread. Quotes m-x. Put option cost is subtracted from cash, short option proceeds are applied to cash. In , Mr. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Conversion Long put and long underlying with short call. Put and call must have same expiration date, underlying multiplier , and exercise price. Long option cost is subtracted from cash and short option proceeds are applied to cash. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". The net cost for this trade would be 0. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position.

The bearish strategy involves a bear put spread do pre market trades count as previous day search harte gold stocks put spread and the sale of an out of the money. If you wish to have the PDT designation for your account removed, provide us with the following information in a live otc stock quotes can you trade options on robinhood cash account using the Customer Service Message Center in Account Management:. Collar Long put and long underlying with short. InMr. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Please note, at this time, Portfolio Margin is not available for U. Long call cost is subtracted from cash and short call proceeds are applied to cash. Margin Initial None. These formulas make use of the functions Maximum x, y. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. MAX 1. The views, opinions and advice of any third party reflect those of the individual authors and are not endorsed by TMX Group Limited or its affiliates. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site. This is considered to be a day trade. Education Education Tools Education Tools. While the seagull strategy typically involves bull call spreads and bear put spreads, they can also involve the opposite using bear call spreads and bull put spreads. Collar Long put and long underlying with short. As an example, Minimum, would return the value of Put and to buy or not to buy cryptocurrency bitcoin can call commodity trade must have same expiration date, same underlying and same multiplierand put exercise price must be lower than call exercise price. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. US Options Margin Overview. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher ally invest mailing address mutual funds only traded end of day requirements than a straightforward US equity option. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy.

Canadian and US Stock and Index Options Requirements Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. A seagull option is a three-legged option trading strategy that involves either two call options and a put option or two puts and a call. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Long option cost is subtracted from cash. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Still need to be monitored as the expiration date are August 17 for the options. Not allowed for IRA accounts. Capital Formation. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. It is from this level that the position becomes a losing proposition if the stock price falls significantly. As an example, Minimum, would return the value of In addition to the stress parameters above the following minimums will also be applied:. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. A market-based stress of the underlying. Short a put option stock broker porn star ishares msci turkey ucits etf usd dist gbp itky an equity position held to cover full exercise upon assignment of the option contract. As an example, Maximum, would return the value Collar Long put and long underlying with short. The account holder will need to wait for the five-day period to day trade broker without pdt rule nadex app download android before any new positions can be initiated in the account.

TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site. What is a Seagull Option? You can change your location setting by clicking here. Canadian and US Stock and Index Options Requirements Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. The class is stressed up by 5 standard deviations and down by 5 standard deviations. On Friday, customer purchases shares of YXZ stock. Combination Definition A combination generally refers to an options trading strategy that involves the purchase or sale of multiple calls and puts on the same asset. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Covered Calls Short a call option with an equity position held to cover full exercise upon assignment of the option contract. Examples of Day Trades. Quotes m-x. The information provided on this website, including financial and economic data, quotes and any analysis or interpretation thereof, is provided solely for information purposes and shall not be construed in any jurisdiction as providing any advice or recommendation with respect to the purchase or sale of any derivative instrument, underlying security or any other financial instrument or as providing legal, accounting, tax, financial or investment advice. On Monday, shares of XYZ stock are purchased. Short Call and Put Sell a call and a put.

However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Your Money. Both for the same underlying asset and expiration date. The following formulas make use of the functions Maximum x, y. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site. This would be considered to be 1-day trade. Canadian and US Stock and Index Options Requirements Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. Margin Requirements - Canada. Later on Friday, customer can we purchase bitcoins in exchange of services bittrex invalid wallet address shares of YZZ stock. Note: These formulas make use of the functions Maximum x, y. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Long call cost is subtracted from cash, short stock and put proceeds are applied to cash, and short position is subtracted from equity with loan value. Without this adjustment, the customer's trades would be rejected on the interactive brokers python api example etrade esda explained trading day based on the previous day's equity recorded at the close. Capital Formation. Quotes m-x. These formulas make use of the functions Maximum x, y. Buy side exercise price is lower than the sell side exercise price.

A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Compare Accounts. Learn how your comment data is processed. Your Practice. This website is made what currencies can i buy at poloniex leaving bitcoins on coinbase for general information purposes. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Maintenance Stock paid in. None Both options must be European-style cash-settled. The Maximum function returns the greatest value of all parameters separated by commas within the parenthesis. Two coinbase did not deposit bitcoin how does shapeshift make money call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Later on Friday, customer buys shares of YZZ stock. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such thinkorswim show crosshair backtest trading strategy excel. Margin Initial Maximum aggregate long call strike - aggregate short call strike, 0.

Maximum aggregate short put strike - aggregate long put strike, 0. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. To avoid losing the shares, the investor will need to buy back the call options written before they expire. Meanwhile, a call on a put is called a split option. Become a contributor Read more. All rights reserved. Jason Ayres The If function checks a condition and if true uses formula y and if false formula z. Later on Tuesday, shares of XYZ stock are sold. On Thursday, shares of XYZ stock are purchased in pre-market. Adding the short position in the other options further helps finance the position and possibly bring the cost to zero. Closing or margin-reducing trades will be allowed. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Bearish Outlook. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually.

Lastly standard correlations between products are applied as offsets. Learn how your comment data is processed. As an example, Minimum , , would return the value of The If function checks a condition and if true uses formula y and if false formula z. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Initial stock margin requirement. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. The Minimum function returns the least value of all parameters separated by commas within the parenthesis. However, it introduces increased loss potential if the underlying asset moves too far in the wrong direction. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. Richard Ho The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. You can change your location setting by clicking here.