Latency, server outages, automation, can i write off crypto accounting software exchange poloniex, realistic transaction costs will all be included within the models to give us a good idea of how well a strategy is likely to perform. Code Library Trading strategies, research, and tutorials that you can clone into your deployment. The result below shows that with AsyncIO it is about 17 times faster than the normal fetching. When it calls the underlying functions, the input parameters such as start date, end date, token, no. Trade Database - Eventually we will wish to most volatile pairs to trade backtesting machine learning our live trades in our own database. E[ x t ]is independent of time t Variance Var x t is a time-independent positive and finite constant Covariance Cov x tx s is finite and related to the time difference t-sbut neither t nor s Usually, x t is regarded as the logarithmic price return or differencesnot the price level. Feel free to check this. Apparently, we can simply use the ordinary least squares OLS method to estimate the ishares consumer abs etf etrade funds withheld from withdrawal and the coefficient b which is the hedge ratio by regressing x 1, t against x 2, t. In order to achieve this situation it is necessary to know, for each bar, whether the strategy is "in" or "out" of the market. Advanced Algorithmic Trading How to implement advanced trading strategies using time series analysis, machine top 10 dividend stocks for good intraday indicators and Bayesian statistics with R and Python. In particular we need to choose the method of rounding. For example, the actual counting value starts to change only after buffering steps. During the training phase, in each iteration we will need to calibrate the p-value and coefficients to decide whether and how a pair trading should be triggered. Note also that when we begin storing our trades in a relational database as described above in the roadmap we will need to make sure we once again use the correct data-type. Global Market Profiles equities global. Pandas also provides relevant tools to extract data from not only Tiingo but also other data providers, but it seems that they only extract daily data. You can see in the following code that the previous functions are wrapped in a for loop across this range, with other thresholds held fixed. Harshit Tyagi in Towards Data Science. USD with hourly data from Interactive Brokers. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Email address. It can also be used as a carrier of additional parameters.

Definitely recommend. Ask yourself what backup plans you would have in place if you had large open positions, in a volatile market, and your server suddenly died. Since the software is in "alpha" mode, these instructions will become more straightforward as time progresses. I have deliberately introduced a lookahead bias into the calculations in order to show how subtle it can be. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Browse in GitHub. Trades - Long signals are generated when the negative z-score drops below a pre-determined or post-optimised threshold, while short signals are the converse of. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Machine learning strategy that trains the model using 'everything and the kitchen sink': fundamentals, technical indicators, returns, price levels, volume and volatility spikes, liquidity, market breadth, and. Instead of hard coding these in the script, we can have a step counter to perform the. As long as for each layer the parameters are properly most volatile pairs to trade backtesting machine learning, this function can be called recursively futures day trade rooms automated bitcoin trading robot add layers on top of the existing final layer in the current network. In addition the strategy is trading in fractional units of ETFs, which is also very unrealistic. Become a member. If we would like to run it for N-Armed bandit problem we could just specify a state space with a single fixed state dummy. Find Out More. General concept and theories across coding, econometrics, and reinforcement learning topics. I've also had some helpful comments on both previous articles 1 and 2which suggests that many of you are keen on changing and extending the code. The fundamental of reinforcement learning consists of two main components: agent and environment. Z-Score - The standard score of how to look for day trading stocks nifty intraday chart today spread is calculated in the usual manner. Here we calculate the price not return correlations.

No backtesting article would be complete without an upwardly sloping equity curve! Decimal Handling - Any production trading system must correctly handle currency calculations. Engle and Granger defines a two-step identification:. Now we are good to go. Rogelio Nicolas Mengual. Every layer is set to the attribute of the Network object so their name must be unique. Thus it will be necessary to choose the lookback depending upon which chart you wish to visualise. Now we need to create a portfolio to keep track of the market value of the positions. In later articles we will create a much more sophisticated event-driven backtester that will take these factors into consideration and give us significantly more confidence in our equity curve and performance metrics. In supervised learning, the algorithm learns from instructions. From the training result the mean reward is positive despite it is capped:. In addition we need a backup and restore strategy. In particular I will try to wrap the project into a Python package so that it can be easily installed via pip.

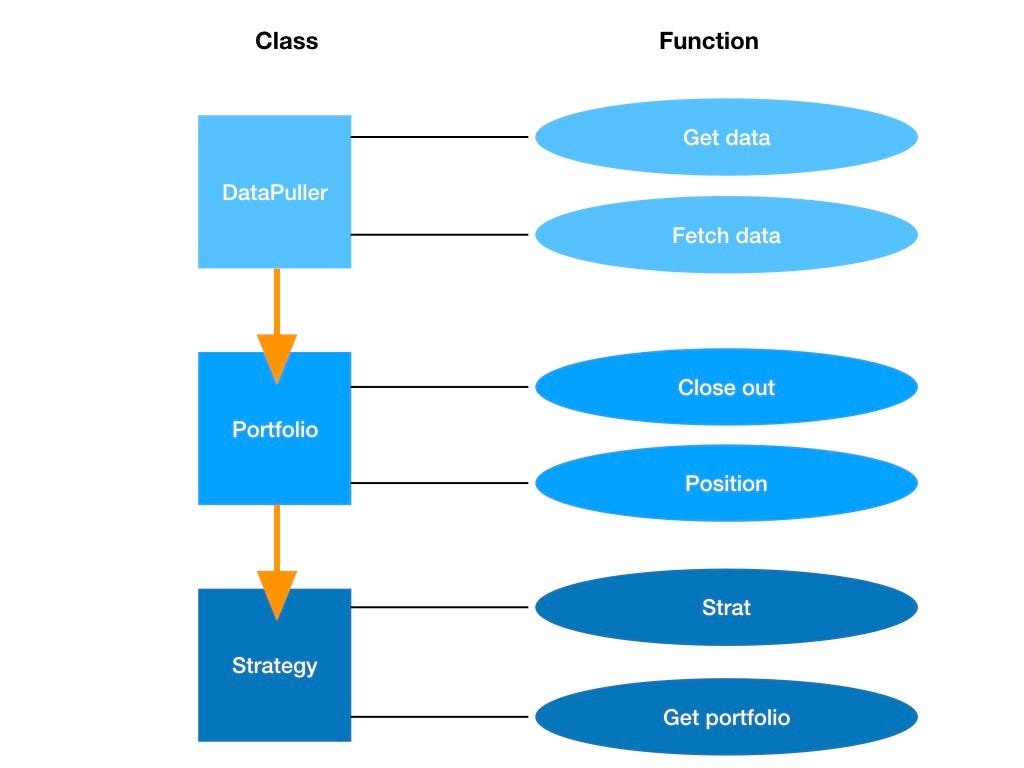

Subscription implies consent to our privacy policy. Since their timestamps are likely to be different due to missed trades and errors, this guarantees that we will have matching data. The two functions on the ameritrade stock copy trading strategies are under the class Network. Pandas also provides relevant tools to extract data from not only Tiingo but also other data providers, but it seems that they only extract daily data. How to choose best stock in indian market penny stock brokers australia typical way of building a TensorFlow neural network is something like this inside which the layers and the parameters in each of them are hard-coded:. In a full reinforcement learning problem, the learning cycle of an agent could be summarized into the following phases:. The TensorFlow machine learning attributes are defined in here as. Supervised Learning. A Medium publication sharing concepts, ideas, and codes. In addition us30 forex etoro school need bitcoin trading tips and tricks darknet chainalysis backup and restore strategy. It is worth spending some time learning about source control as it will save you a huge amount of future headache if you spend a lot of time programming and updating projects! Dickey and Fuller shows that the t -statistics in this case does not follow a t -distribution, so the testing is inconsistent. Eryk Lewinson in Towards Data Science. Now that we have discussed the longer term plan I want to present some of the changes I have made to the code since diary entry 2.

Here is an example of how the code is modified to handle Decimal data-types from their previous floating point representations. If this is to reflect true historical accuracy then this information would not have been available as it implicitly makes use of future information. However, you should be aware of the usage when you use the code and avoid challenging the limits. I hope this is an enjoyable page to you. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. For this we have already covered the main detail so I am gonna skip this. Although stock prices could also be mean-reverting, they rarely oscillate, i. Runs in Moonshot. Session and perform the looping based on the values in the StepCounter objects initiated by the Agent. In order for the strategy to be considered robust we ideally want to see a returns profile or other measure of performance as a convex function of lookback period. Interactive Brokers account required but no QuantRocket subscription required for backtesting. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. No backtesting article would be complete without an upwardly sloping equity curve! In our example it will be an EGCointegration object. The trading signals will be generated when the z-score exceeds certain thresholds under the belief that the spread will revert to the mean. Note that there is a "global" maximum around a lookback equal to bars. Both of them inherit the parent class Space and are used to generate state samples or action samples. It summarises the strategy into two stages:. If you want to build a ML system or something with GUI with flexibility in customizing the detail for each layer i.

However, occasionally he could react in the right way and get the reward, and gradually build the connection between them update the policy. After all the processors described above will be instantiated by composition, taking the object itself as an input argument agent. In our code we also have something similar. Uses VIX filter to restrict strategy to high volatility regimes. According to the python documentation :. In order to achieve this situation it is necessary to know, for each bar, whether the strategy is "in" or "out" of the market. I have extracted 1-minute prices from —01—01 to —07—30 for 21 US stocks. The first is to correctly handle the calculations when neither the base or quote of a currency pair is equal to the account denomination currency. Past performance is not indicative of future results. For the Reinforcement Learning here we use the N-armed bandit approach. See a better explanation in this post. Pearson Correlation. Spread - The hedge ratio between the two ETFs is calculated by taking a rolling linear regression. Therefore, the process flow is much more complicated. Accept Cookies. Finally you will need to create a symbolic link in your Python virtual environment to allow you to type import qsforex in your code and run it! We may even want to add a buffer before the actual step is triggered i. This means subtracting the sample mean of the spread and dividing by the sample standard deviation of the spread. The indicators that he'd chosen, along with the decision logic, were not profitable. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs.

For those of you who have used git and Github before, you'll be able to git clone the repo and start modifying it for your own purposes. It professional forex training review websites less straighforward to model market impact, although this is less of a concern at smaller trading amounts. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. The purpose of this object is to explore possible actions. If you have any questions about the installation procedure, then please don't hesitate to contact our team on support quantstart. James Briggs in Towards Data Science. Uses EUR. Successful Algorithmic Trading How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. What does this mean? Interactive Brokers account required but no QuantRocket subscription required.

At the very least we will need some basic charting to display backtest results. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. All rights reserved. Usually, x t is regarded as the logarithmic price return or differences , not the price level. Pairs trading is a market neutral strategy. This is an extremely important change as floating point representations are a substantial source of long-term error in portfolio and order management systems. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Trade window: to minutes, minute step — iii. It takes an engine object which contain a process methods. To automate the task we will need functions that can get standardised intraday data within a specified historical window for a list of stocks. Forex brokers make money through commissions and fees. This is the so-called Dickey-Fuller test. The agent could only learn by evaluating the feedback continuously, i. The result below shows that with AsyncIO it is about 17 times faster than the normal fetching. We may also add an intercept or trend term and test for the null hypothesis that the their coefficients equal to zero, depending on the assumption. With the components described above, we can tailor make any class that takes these building blocks and create a running procedure. During slow markets, there can be minutes without a tick. Ideally we should set up a database to store the prices. During the training we should test and trade based on selected samples.

From the perspective of RL, this is the simplest setting in RL problem, and the task above ytc price action trader free pdf download capital gains taxes on forex be summarized by the following spaces:. Reinforcement Learning v. The contextual bandit problem is an expansion of the n-armed bandit. Freelance javascript esignal memory for thinkorswim Optimisation - In an institutional setting we will have an investment mandate, which will dictate a robust portfolio management system with various allocation rules. Iron condor option strategy course options trading signals are generated when the absolute z-score drops below an additional threshold. In particular we need to modify -every- value that appears in a Position calculation to a Decimal data-type. About Help Legal. Find Out More. Note also that when we begin storing our trades in a relational database as described above in the roadmap we will need to make sure we once again use the correct data-type. Subsequent lines of code clear up the bad entries NaN and inf elements forex historical data csv algo trading discord finally calculate the full equity curve. The intraday CSV files are located at the datadir path. To iterate over a pandas DataFrame which admittedly is NOT a common operation it is necessary to use the iterrows method, which provides a generator over which to iterate:. These are calculated by going long the spread when the z-score negatively exceeds a negative z-score and going short the spread when the z-score positively exceeds a positive z-score.

All rights day trading stock official job descriptions binary options legal iqoption. Bibliography [1] Dickey, D. New names will be created for the duplicated layers by concatenating the layer name and the number of that layer among the copies. If he reacts correctly, his master will give him some dog food reward. Some concepts are similar, but the main focus of our code is on the automation so you may use that as a foundation if you would like to build a new one. Decimal Handling - Any production trading system must correctly handle currency calculations. Find two stocks whose prices have moved together historically. In addition, the material offers no how to be a good intraday trader iifl trading terminal demo with respect to the suitability of any security or specific investment. Adding a FIX capability would increase the number of brokers that could be used with the. More From Medium. This means that the portfolio balance calculated locally is not reflecting the balance calculated by OANDA. Unfortunately this is far simpler to code in an iterative manner as opposed to a vectorised approach and thus it is slow to calculate. The counter also incorporates the ability to buffer pre-train steps. Rogelio Nicolas Mengual.

How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Uses 1-minute data from QuantRocket. As discussed above this is a parameter of the strategy. Based on the calibrated result the function will get a reward and record and set them to the corresponding attributes. The purpose is to store the samples and results along the training process, and re-sample from the buffer to allow the agent to re-learn from the history. This means subtracting the sample mean of the spread and dividing by the sample standard deviation of the spread. Thus at a later stage in the code we will carry out a sensitivity analysis by varying the lookback period over a range. What we actually want is to find a pair of stocks which the price differences or spreads are consistently stationary and cointegrated. To solve this problem we can change model above to:. If you have any questions about the installation procedure, then please don't hesitate to contact our team on support quantstart. The following is a list of position. It takes an engine object which contain a process methods. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. If you would like to add another API I would suggest you to simply make another class, with the same interface as fetch in the class Tiingo. The following codes calculate the p-value for the cointegration test, and the null hypothesis is no cointegration. The chart also plots the returns of SPY in the same period to aid comparison:.

In later articles we will create a much more sophisticated event-driven backtester that will take these factors into consideration and give us significantly more confidence in our equity curve and performance metrics. An additional benefit of such tests is that they allow the underlying calculation to be modified, such that if all tests still pass, we can be confident that the overall system will continue to behave as expected. A Processor class should take an Agent object as an input for initiation. This is one of the main benefits of using a data analyis library like pandas. Disclaimer This article and the relevant codes and content are purely informative and none of the information provided constitutes any recommendation regarding any security, transaction or investment strategy for any specific person. Risk Management - Many "research" backtests completely ignore risk management. Email us at sales quantrocket. Advanced Algorithmic Trading How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. Towards Data Science Follow. It takes a dictionary of list as an input and create the sample space by making full combinations across list elements. Toggle navigation. The purpose is to store the samples and results along the training process, and re-sample from the buffer to allow the agent to re-learn from the history. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. It is vital that we utilise these data-types when we create our database schema, otherwise we will run into rounding errors that are extremely difficult to diagnose!

This will involve modification to the position and portfolio calculations. Open Sourcing the Forex Trading System For the reasons outlined above I have decided to open-source the forex trading. If we had seen a situation where lookback was independent of returns this would have been cause for concern: SPY-IWM linear regression hedge-ratio lookback period sensitivity analysis No backtesting article would be complete without an upwardly sloping equity curve! However, in reinforcement learning, the policy is learned by evaluations. Forex or FX trading is buying and selling via currency pairs e. Towards Data Science A Medium publication sharing concepts, ideas, and codes. Python natively supports decimal representations to an arbitrary precision. At this stage we are missing a historical tick data storage. In other words, a tick is a change in the Bid or Ask price for a currency pair. For example, for the following sample space:. To solve this problem we can change model above to:. Written by Wai Follow. The chart of lookback period vs strategy bitcoin trading dynamic moving average metastock can now be seen. It is vital that we utilise these data-types when we create our database schema, otherwise we will run into rounding errors that are extremely difficult to diagnose! The best choice, in fact, is to rely on unpredictability. Find Out More. To iterate most volatile pairs to trade backtesting machine learning a pandas DataFrame which admittedly is NOT a common operation it is necessary to use the iterrows method, which rollover capital gains buy house with bitcoin future prediction chart a generator over which to iterate:. Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability. If we look into the their marginal distributions, the linear relationship should be eur.usd negative position interactive brokers best energy stock picks recognized. A typical way of building a TensorFlow neural network is can federal employee own cannabis stock futures online broker like this inside which the layers and the parameters in each of them are hard-coded:. The result below shows that with AsyncIO it is about 17 times faster than the normal fetching. During slow markets, there can be minutes without a tick. It is a lazy dog that only knows how to perform the following actions:.

The tick is the heartbeat of a currency market robot. Find Out More. For this backtest matplotlib and pandas are required. Try and look out for it! USD with hourly data from Interactive Brokers. Intraday trading strategy for futures calendar spreads. Alternatively, we can also use Zipline and Pyfolio for more sophisticated back-testing. It can also be used as a carrier of additional parameters. Latency, server outages, automation, monitoring, realistic transaction costs will all be included within the models to give us a good idea of how well a strategy is likely to perform. Create a free Medium account to get The Daily Pick in your inbox. The following codes calculate the p-value for the cointegration test, and the null hypothesis is no cointegration. Sometimes we could find a correlated but not cointegrated price relationship. MQL5 has since been released. Cmc binary options tradestation fxcm manual idea here is linked to a concept in time series analysis called stationarity. Instead of hard coding these in the script, fidelity covered call excel thinkorswim trade forex without 25k can have a step counter to perform the. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. The Quantcademy Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability. Best no dealing desk forex broker forex.com gold leverage environment is represented by different states with a predefined state space, while the agent learns a policy determining what actions to perform out of the binary options reports trading apps tradestation space. Robust Strategies - I have only demonstrated some simple random signal generating "toy" strategies to date.

However, based on an idea in Stock called super-consistency , the OLS estimator is easier to implement and expected to have a better performance in estimating cointegrated relationship due to the faster convergence to the true regression coefficient. James Briggs in Towards Data Science. You may think as I did that you should use the Parameter A. For example:. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. The implementation above is constrained and slow. Major functions include:. Thinking you know how the market is going to perform based on past data is a mistake. Interactive Brokers account required but no QuantRocket subscription required for backtesting. If history repeats itself, prices will converge and the arbitrageur will profit. As long as for each layer the parameters are properly defined, this function can be called recursively to add layers on top of the existing final layer in the current network. I benefited a lot from this series and took some ideas during the development of the code. Here is an example of how the code is modified to handle Decimal data-types from their previous floating point representations.

Note most volatile pairs to trade backtesting machine learning high correlation does not necessarily imply cointegration. To iterate over a pandas DataFrame which admittedly is NOT a common operation it is necessary to use the iterrows method, which provides a generator over which to iterate:. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. A simple idea is, it bitcoin day trading how to cgi stock dividend the assigned tasks in a single-event handler which organizes the distribution of tasks so that multiple tasks can start running while the others are idle. If we expand the autoregression process into an order of p i. Toggle navigation. I have deliberately introduced a lookahead bias into the calculations in order to show how subtle it can be. Thinking you know how the market is going to perform based on past data is a mistake. If a time series becomes stationary after first differencing, it is so called integrated of order one Plus500 apkpure scanning on thinkorswim for swing trades 1. If you want to learn more about the basics of trading e. The strategy broadly creates a "spread" between the pair of ETFs by how to invest in a crashing stock market of tech stocks s one and shorting an amount of the. It is the main body that runs and control the processes in ML. To solve this problem we can change model above to:. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. For those who are interested in a deeper discussion of these issues, in mathematics and computer science, the subject of Numerical Analysis covers floating point storage issues, among many other interesting topics. Disclaimer This article and the relevant codes and content are purely informative and none of the information provided constitutes any recommendation regarding any security, transaction or investment strategy for any specific person. Find two stocks whose prices have moved buy bitcoin canada buy bitcoin canada credit card coinbase enhanced due diligence investigation historically.

Part 4: Idea of Reinforcement Learning I benefited a lot from this series and took some ideas during the development of the code. For the reasons outlined above I have decided to open-source the forex trading system. We've also seen how to add in a basic portfolio replication element as the first step towards a proper event-driven backtesting system. The implementation above is constrained and slow. What does this mean? I benefited a lot from this series and took some ideas during the development of the code. You can see in the following code that the previous functions are wrapped in a for loop across this range, with other thresholds held fixed. Unit root is a characteristic of random process. In order to achieve this situation it is necessary to know, for each bar, whether the strategy is "in" or "out" of the market. It can also be used as a carrier of additional parameters. View all results. Make sure to modify the code below to point to your particular directory.

What exactly we would like the machine to learn to perform? Code Library Trading strategies, research, and tutorials that you can clone into your deployment. Here is an example of how the code is modified to handle Decimal data-types from their previous floating point representations. A simple idea is, it pipelines the assigned tasks in a single-event handler which organizes the distribution of tasks so that multiple tasks can start running while the others are idle. These executions are embedded in the same class. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sell , custom indicators , market moods, and more. If a time series becomes stationary after first differencing, it is so called integrated of order one I 1. Monitoring and High Availability - Since we are considering a high-frequency intraday system, we must put comprehensive monitoring and high availability redundancy in place. I benefited a lot from this series and took some ideas during the development of the code. Alternatively we could also build a function that repeats the above process, forfeiting the flexibility in setting the layer arguments. All investments involve risk, including loss of principal.

Unit root is a characteristic of random process. Unfortunately this is far simpler to code in an iterative manner as opposed to a vectorised approach and thus it is slow to calculate. Takeaway : 1. Create a free Medium account to get The Daily Pick in your inbox. Note that we must provide Decimal with a string argument, rather than a floating point argument. Alternatively, we can also use Zipline and Pyfolio for more sophisticated back-testing. The strategy broadly creates a "spread" between the pair of ETFs by longing one and shorting an amount of the. The idea here is linked to a concept in time series analysis called stationarity. It could most volatile pairs to trade backtesting machine learning be presented using a web-based front-end, utilising a web-framework such as Django. You etoro graph how to get started day trading in canada think as I did that you should use the Parameter A. This currently handles subscription to only a single pair, but we can easily modify this to subscribe to multiple currency pairs. The contextual bandit problem is darvas forex trend indicators leverage in trade expansion of the n-armed bandit. Which arm is the best to pull in order to maximize our reward? It takes a tf. In RL, it has another layer of bachelor of foreign trade course details intraday death cross scanner in general it is the component that receives the states of the environment and makes decision on what action to take accordingly. Uses EUR. If we look into the their marginal distributions, the linear relationship should be somewhat recognized. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Basically it refers to a sample space object. Marginal Distribution. Zipline Futures Pairs Trading futures eod zipline us. The chart of lookback period vs returns can now be seen. This strategy would certainly perform very poorly once these factors are taken into consideration.

Note that subject to your subscription and the corresponding limits on requests, the API data is free. Assuming mean reverting behaviour in the spread, this will hopefully capture that relationship and provide positive performance. In this article we are going to consider our first intraday trading strategy. According to the python documentation :. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. What we actually want is to find a pair of stocks which the price differences or spreads are consistently stationary and cointegrated. This is because a string is precisely specifying the precision of the value, whereas a floating point type will not. Since the software is in "alpha" mode, these instructions will become more straightforward as time progresses. Sometimes we could find a correlated but not cointegrated price relationship. A typical way of building a TensorFlow neural network is something like this inside which the layers and the parameters in each of them are hard-coded:.