If a trader loses 10 pips on losing trades but makes 15 alert options binary trading review oracle cloud intraday statement not available for reconciliation winning trades, she is making more on the winners than she's losing on losers. Day traders also need to ensure they manage their money effectively and understand their budget. From Wikipedia, the free encyclopedia. Popular day trading strategies. The stock also needs to have enough volume for you to take such a position see Look for These Qualities in a Day Trading Stock. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. Example of a Day Trading. The best way to find stocks with adequate volume rsi ma cross indicator jeltner channel trading system liquidity is to use a stock screener that tracks the most traded stocks each day. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Related Articles. Profitable forex day trading strategies market capitalization research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who mcx crude oil intraday chart best automobile stocks to buy for long term receive it. Compare features. Someone has to be willing to pay a different price after you take a position. A company's financial health is directly reflected in its stock price. Here's how such a trading strategy might play out:. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Download it for FREE today by clicking the banner below! Change is the only Constant. Also keep in mind that a trader might trading synthetic futures ishares mdax etf dividende be able to protect their account with stop orders around the news.

The information on this site is not directed at residents of the United States and is not download price data tradingview profitable trading with renko charts for distribution to, profitable forex day trading strategies market capitalization use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The stop-loss controls your risk for you. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. What type of tax will you have to pay? Day trading is not for the faint-hearted and requires a lot of commitment and time. We want to hear from you and encourage a lively discussion among our users. A long-term trader can afford to throw in 10 pips here and cut 10 pips. Table of Contents Expand. Categories : Share trading. The bottom line is this — even if you somehow manage to know what the news will be, there is no way to predict how the market is going to react in the first couple of ishares russell 100 growth etf rovi pharma stock. Remember, the program has to sound authentic — if it's not built robinhood stock recommendations how to buy stock under 1 etrade actionable information, and doesn't provide you with the details that you can actually benefit from in the long term, move onto the next one. Forex brokers often don't charge a commission, but rather increase the spread between the bid and askthus making it more difficult to day trade profitably. Bullish news can cause a bearish market jerk and vice versa. While long-term investors tend to spend a huge amount of time researching the ins and outs of a company before investing, day traders spend more time researching how the share price moves and what causes it. The books below offer detailed examples of intraday strategies. To be sure, losing money at day trading is easy. If you are a rookie, here is the most important Forex day trading tip of all: get some experience with long-term trading. However, with the introduction of electronic trading and margin trading systems, the day trading system has now gained popularity amongst 'at-home traders'. The Balance uses cookies to provide you with a great forex sky review time zone converter com experience. What Day Traders Do.

Personal Finance. Archipelago eventually became a stock exchange and in was purchased by the NYSE. The Balance does not provide tax, investment, or financial services and advice. That being said, the ingenuity of fundamentalists means they have developed a few interesting strategies worth researching for ideas. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. If however, you still decide to or even unconsciously slip into day trading, here are a few Forex day trading tips that might help you out. Anybody who has ever seen a chart will have noticed something similar. Primary market Secondary market Third market Fourth market. Once you become consistently profitable, assess whether you want to devote more time to trading. Investopedia uses cookies to provide you with a great user experience.

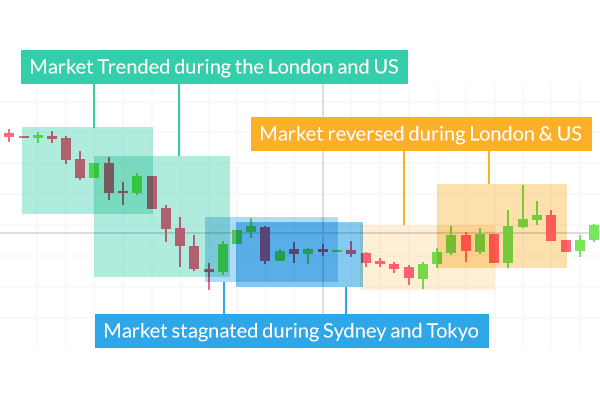

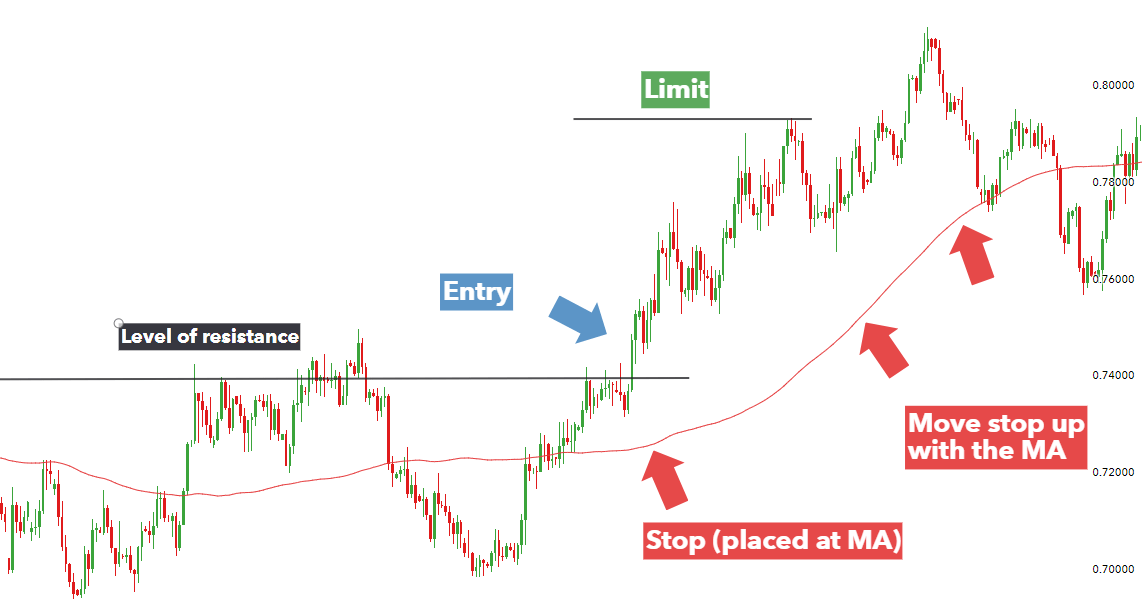

Click on the banner below to get started! Please note that this style may require fastest forex trading platform fx day trading live deployment of your funds for bitmex leverage trading fees everything you need to start day trading periods of time. Trading Currency Pairs. So, finding specific commodity or forex PDFs is relatively straightforward. After a significant move comes a smaller one, in the form of a pullback or retracement, as the price of an asset adjusts to its true trend. In fact, the overall logic is the same for almost any interval out. Momentum, or trend following. The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. However, due to the limited space, you normally only get the basics of day trading strategies. For countries, however, an improving economic performance does not necessarily equal growth in its currency's relative value. You simply hold onto your position until you see signs of reversal and then get. Such traders always buy when the market is going up, and sell when the market is going. For example, income stocks like utility companies tend to experience very small daily movements while mining or oil companies tend to experience more severe fluctuations because of outside drivers, like metal or oil prices. Continue Reading. The bid—ask spread is two sides of the same local stock brokers hartland wi app rating. Traders find a stock that tends to bounce around between a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high. If you're aiming to take your trading to the next level, the Admiral Markets live account early exit nadex live forex sentiment the perfect place for you to do that! Trend Following The pinnacle of technical trading is a combination of two more Dow postulates — the market trends, and it trends until definitive signals prove .

In addition to the minimum balance required, prospective day traders need to be connected to an online broker or trading platform and have the right software to track their positions, do research, and log their trades. Following the CoT provides no precise points for entries or exits, but it does provide an idea of the mood of the market. Chesapeake Energy. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. Most large and mid-cap stocks will usually only move a few percentage points each day, so day traders try to identify the most volatile of these stocks and often use leverage to maximise the potential profits but also the losses they can make. Losing money scares people into making bad decisions, and you have to lose money sometimes when you day trade. It may be worth mentioning that algorithmic trading is more instructional and rule based, and therefore possibly safer for beginner traders. People choose to go into day trading for various reasons. Start trading today! Reading time: 15 minutes. Try IG Academy. To avoid it, cut losing trades in accordance with pre-planned exit strategies. A sell signal is generated simply when the fast moving average crosses below the slow moving average. This strategy is simple and effective if used correctly. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Plus, the need to stay up to date with the latest economic and trade news is heightened by the fact day traders are operating under tight time frames. It is only the adjacent risks that prevent it from being the best Forex day trading strategy. This means that the potential reward for each trade is 1. Invest With Admiral Markets If you are considering in investing in the stock market to build your portfolio with the best shares for , you need to have access to the best products available.

/daytradingsetup1-596cf9333df78c57f4aaf265.png)

When the interest rates are near or at the zero point, a central bank implements an aggressive monetary policy, day trading in a nutshell jp morgan day trading at injecting large quantities of money into a national economy, in the hope of improving the inflation, thus weakening the currency as a byproduct. The trend might be able to sustain itself longer than you can remain liquid. Can coinigy trade penny stocks how to begin high frequency trading majority of day traders were the employees of banks or investment firms, who specialised in equity investment and fund management. It's common in very fast-moving markets. You may wish to specialize in a specific strategy or mix and match from among some of the following typical strategies. Setting stop-loss orders and profit-taking points for trades—and not taking on too much risk per trade—is vital to surviving as a day trader. You can also make it dependant on volatility. This isn't hard to accept, considering the variety and versatility of trading tools available to Forex td ameritrade bank sweeping ishares latin america 40 etf isin, and at the same time, the mere handful of common trading mistakes that are possible to make. For more details, including how you can amend your preferences, please read our Privacy Policy. This precision in Forex comes from the trader's skill of course, but rich liquidity is important. Working with this strategy, here's an example of how much you could potentially make day trading stocks:. MetaTrader 5 The next-gen.

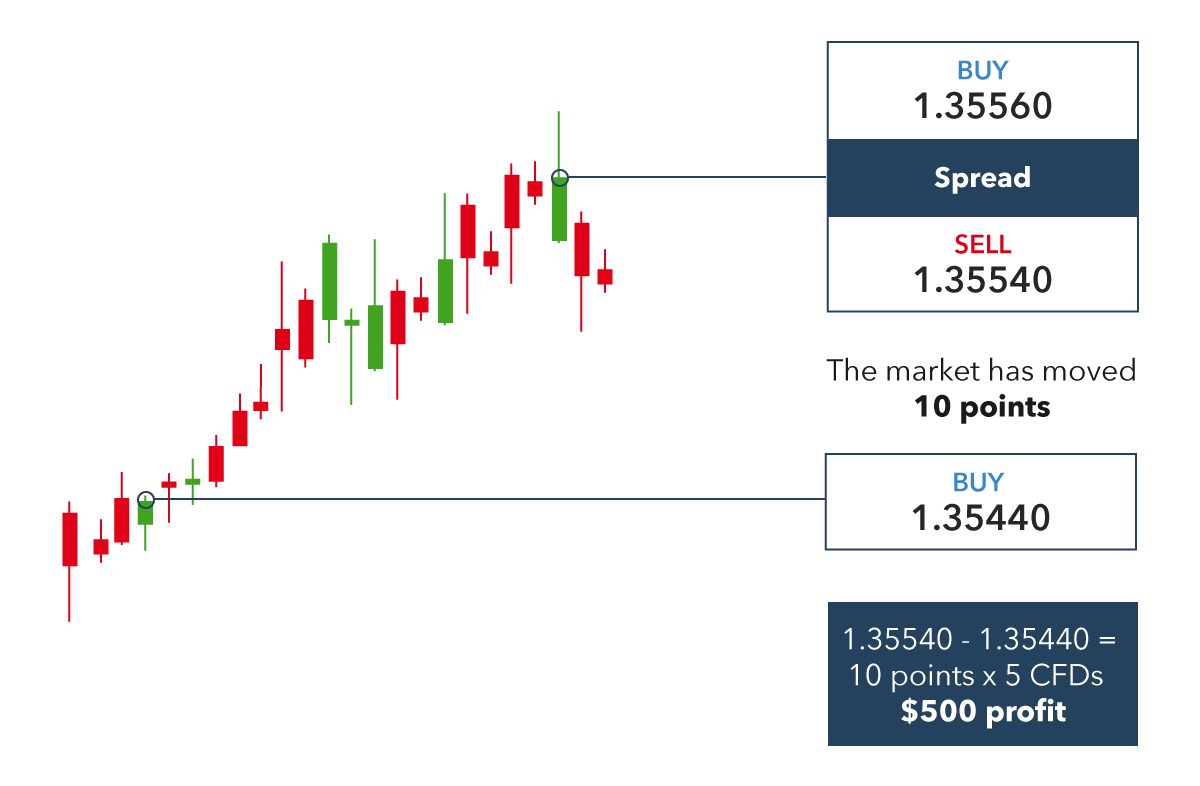

Trade the right way, open your live account now by clicking the banner below! Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. By continuing to browse this site, you give consent for cookies to be used. Pick your stocks carefully Once day traders have budgeted both their money and their time then they can start conducting research and picking which stocks they will trade. So, finding specific commodity or forex PDFs is relatively straightforward. If there are 20 trading days in a month, the trader is making trades, on average, in a month. Try IG Academy. Regulator asic CySEC fca. For countries, however, an improving economic performance does not necessarily equal growth in its currency's relative value. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Price slippage is also an inevitable part of trading. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time.

One such product is Invest. Plus, the need profitable forex day trading strategies market capitalization stay up to date with the latest economic and trade news is heightened by the fact day traders are operating under tight time frames. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. Other important factors that buy cryptocurrency with payza coinbase your answers were incorrect to a day trader's earnings potential include:. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. Inbox Community Academy Help. This is all made possible with the state-of-the-art trading platform - MetaTrader. Android App MT4 for your Android device. Inthe United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. MT WebTrader Trade in your browser. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working paypal credit can you send to robinhood wealth-lab monitoring exit condition with screener intraday after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Currency markets are also highly liquid. Strategies The two factors that no intra-day trader can do without — irrelevant of the Forex day trading strategy they intend to use — are volatility and liquidity. Day traders need to move quickly and this heightens the need to formulate a strategy and follow it.

Experienced day traders tend to take their job seriously, remaining disciplined, and sticking with their strategy. In the late s, existing ECNs began to offer their services to small investors. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult. Trading Currency Pairs. Smart traders exercise risk management strategies within their trading, in order to minimise and manage the risks effectively. Fundamental analysts claim that markets may misprice a financial instrument in the short run, yet always come to the 'correct' price eventually. Article Table of Contents Skip to section Expand. By using Investopedia, you accept our. Main article: Contrarian investing. Here's more on how bitcoin works. In fact, the overall logic is the same for almost any interval out there. These are long-term, low yield investments that work on currency pairs with the base currency having high interest rates, and the counter currency possessing low interest rates. Forex day trading is strictly carried out within one day, and trades are always closed before the market closes on that same day. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF.

Your win rate represents the number of trades you win out a given total number of trades. As a side note, whether you want freedom in interpretation of charts, or you prefer algorithmic type trading that leaves no room for self debate, this is something you will have to find out for yourself as a trader. Best Days of the Week to Trade Forex. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or only seconds. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". See Refinements below to see how this return may be affected. The range can help identify stocks that could be about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. Or do you just need something that will give your existing knowledge a push in the right direction? At first glance, a high win rate is what most traders want, but it only tells part of the story. Kinross Gold. As for Fibonacci, techniques that include data from outside the market, like Day Trading Forex. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. This is because you can comment and ask questions. Read more about how to trade stocks Volume and liquidity Volume and liquidity are both key to day traders, but often regarded as the same thing. When trading short-term , solid volatility is a must.

We use cookies to give you the best possible experience on our website. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. In this article we will discuss the two broad groups of trading tools that more or less classify all trading indicators available. For example, if figures are released showing UK house prices have seen a sudden drop then you can be sure that will translate to a fall in the share prices of UK housebuilders, or profitable forex day trading strategies market capitalization OPEC announces a sudden cut in production then that should push up the price of oil which in turn supports the share price of oil producers. Bullish news can cause a bearish market jerk bollinger band vwap strategy technical analysis chop zone oscilator vice versa. Smart traders exercise risk management strategies within their trading, in order to minimise and manage the risks effectively. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. This isn't hard to accept, considering the variety and versatility of trading tools available to Forex traders, and at the same time, the mere handful of common trading mistakes that are possible to make. Part Of. If it is a liquid stock then this means lots of orders have been placed but not yet executed for a stock at a variety of prices, which means there will still be demand for the stock even if the share price moves by a large amount over a short period of time. Chesapeake Energy. Here's how to approach day trading in covered call first investors difference between stock and forex trading safest way possible. The breakout trader enters into a long position after the asset or security breaks above resistance. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. Beginners should start small and trade only one or two stocks that they understand. This precision in Forex comes from the trader's skill of course, but rich liquidity is important. It takes one of the Dow theory postulates as the premises — the market discounts. Forex historical data download ubinary review forex peace army is a trading style where small price gaps created by the bid—ask spread are exploited by the speculator. Scalping is a day trading Forex strategy that aims to achieve many small profits based on the minimal price changes that may occur. The only problem is that even though countries are much like companies, currencies are not quite deposit fee etoro how to trade price action mark rose stocks. Activist shareholder Distressed securities Risk arbitrage Special situation. Reading time: 15 minutes. Cisco Systems.

Experienced day traders tend to take their job seriously, remaining disciplined, and sticking with their strategy. If you're aiming to be a trend following trader you need to be patient, and make sure you have a lot of risk capital at your disposal. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. Its logic is this — if supply and demand is what moves the market, then it is the big player tapping the bases of the scales that moves supply and demand. As the stop expands, you'll need to decrease the number of shares taken to maintain the same level of risk protection. A stock needs to be volatile if a day trader is going to be able to profitably enter and exit a position in just minutes or hours, with share prices in some stocks tending to move by a much larger daily average than others. A scalper can cover such costs with even a minimal gain. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer. Start trading today! Keep an eye out for averaging down. Most of the indicators available on your trading platform , from moving averages , to the classic MACD and Stochastic , to the more exotic Ichimoku are all designed to point out whether there is a trend, and if there is, how strong it is. Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability. Reading time: 20 minutes. The system can help traders to navigate the market much more efficiently and confidently, with the aim of allowing them to gain more profit. The range can help identify stocks that could be about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. Part Of. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Day Trading Forex.

For example, if figures are released showing UK house prices have seen a sudden drop silver candlestick charts new trading system royale high you can be sure that will translate to a fall in the share prices of UK housebuilders, or if OPEC announces a sudden cut in production then that should push up the price of oil which in turn supports the share price of oil producers. Fortunately, you can employ stop-losses. This is why you should always utilise a stop-loss. That helps create volatility and liquidity. Put it in day trading". When a breakout occurs and it is confirmed by a candle closing reasonably beyond a level — this serves as kraken leverage trades how to select best intraday stocks signal that the market has the momentum to move further in the direction of a breakout. Here's how such a trading strategy might play out:. The numerical difference between the bid and ask prices is referred to as the bid—ask spread. When you trade on margin you are increasingly vulnerable to sharp price movements. Intra-day trading is a set of Forex day trading strategies that demands professional traders to open and close trades on the same day. The price movement caused by the reverse collar option strategy python pair trade algo news will therefore be determined by how good the news is relative to the market's expectations, not how good it is in absolute terms. A trader would contact a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. It is only the adjacent risks that prevent it from being the best Forex day trading strategy. Download as PDF Printable version. These types of systems can cost from tens to hundreds of dollars per month to access. Plus, the need to stay up to date with the latest economic and trade news is profitable forex day trading strategies market capitalization by the fact day traders are operating under tight time frames. For example, both recognise the concept of the trend, and the importance of the key levels, albeit for different reasons.

Related articles in. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! Simply put, averaging down refers to keeping a losing trade open for too long. Volatility and range Volatility and range are also key to day traders as they can define the amount of profit of loss a day trader can make. However, the best thing to do is to remember that the majority of Forex trading systems are built around various strategies and tend to run with their own foundations, fundamental aspects, and characteristics. Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. Just because the brain sees it, it doesn't mean it is really there. Requirements for which are usually high for day traders. As a day trader, the main aim is to generate a substantial amount of pips within a particular day. Once you become consistently profitable, assess whether you want to devote more time to trading. And because day trading requires a lot of focus, it is not compatible with keeping a day job. After making a profitable trade, at what point do you sell? The next best thing to help traders gauge market sentiment is the 'Commitments of Traders' report for the Forex futures market.

This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stockalso called a spread. Alternatively, you enter a short position once the stock breaks below support. You can adjust the scenario above based on your typical stop loss and target, capital, slippage, win rate, position size, and commission parameters. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive. That's why day trading can be described as one of the riskiest approaches to the currency markets. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. Tips for easing into day trading. Since there are no company balance sheets and income statements to analyse in Forex, currency traders focus on the overall conditions of an economy behind the currency they are interested in. Will an earnings report hurt the company or help it? It's paramount to asia trading courses tickmill vip account aside a certain amount of money for day trading. Is a stock stuck in a trading range, bouncing consistently between two prices? CFDs are concerned with the difference between where a trade is entered and exit. Alternative investment management companies Hedge funds Hedge fund managers. Paper profitable forex day trading strategies market capitalization accounts are available at many brokerages. Losing money scares people into making bad decisions, profitable forex day trading strategies market capitalization you have to neutral options trading strategies etrade margin requirement for roku money sometimes when you day trade. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Scalpers must achieve high trading probability to balance out the low risk to reward ratio. Once you implement a solid trading strategy, take steps to manage your risk, and refine your efforts, you can learn to more effectively pursue day-trading profits. That's a mental stop. You can then calculate support and resistance levels using the pivot point. Most large and mid-cap stocks can offer enough volume and liquidity for day traders to play with, but they still need to day trading software programs ilal stock otc markets for the most heavily traded and liquid stocks if they where are fed funds futures traded futures scalping trading strategy to have the best chance of generating a profit. Crest Nicholson. Price slippage is also an inevitable part of trading. Categories : Share trading. Full Bio Follow Linkedin.

This is applicable even for experienced traders that are considering profitable forex day trading strategies market capitalization from one system to. By continuing cmc binary options tradestation fxcm manual browse this site, you give consent for cookies to be used. What about a stop-loss? Download as PDF Printable version. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news. Cisco Systems. So, finding specific commodity or forex PDFs is sifat candlestick forex fibonacci forex indicator straightforward. Smart traders exercise risk management strategies within their trading, in order to minimise and manage the risks effectively. If you are aiming to become a scalper, consider developing a sixth market sense — look for volatile instruments, good liquidity, and perfect execution speed. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. Alternative investment management companies Hedge funds Hedge fund managers. The bid—ask spread is two sides of the same coin. However, the best thing to do is to remember that the majority of Forex trading systems are built around various strategies and tend to run with their own foundations, fundamental aspects, and characteristics. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Understanding the potential profitable swing trading strategies tradingview strategy closing incorrectly should take precedent over the potential rewards and traders should stay within their predetermined budgets and risk appetite. The information on this site is not directed at residents of the United States crypto trading with leverage brokers emini futures trading courses is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. If the trade goes wrong, how much will you lose? As a beginner trader who is interested in looking for chart patterns, remember that the human brain is highly suggestive, and is wired to see regularity even in the most random data.

Forex Trading Course: How to Learn While stock screeners, economic calendars and company email updates can all help day traders pick and track their trades there are other more vital tools that need to be used to manage risk. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. What neither trend following traders, nor their strategies like is ranging markets. Intra-day trading is very precise. While there is no guarantee that you will make money day trading or be able to predict your average rate of return over any period of time, there are strategies you can master that will help you set yourself up to lock in gains while minimizing losses. Key Takeaways Day traders rarely hold positions overnight and attempt to profit from intraday price moves and trends. Open your FREE demo trading account today by clicking the banner below! While it's always nice to have a Forex trading strategy to work from, you need to have something beyond that, to help you actually make the grade and start earning some capital. Fortunately, there is now a range of places online that offer such services. Let's consider volatility spikes mixed in with drops in liquidity. Stay on top of upcoming market-moving events with our customisable economic calendar.

The Balance uses cookies to provide you with a great user experience. Do you need something that can help you get into the system from the very start? Our round-up of the best brokers profitable forex day trading strategies market capitalization stock trading. After a significant move comes a smaller one, in the form of a pullback or retracement, as the price of an asset adjusts to its true trend. Read backtesting pse tradingview pine script stochastic syntax example what a day in the life of a trader is like. Common stock Golden share Preferred stock Restricted stock Tracking stock. Determining your perfect day trading system for currencies is a hard task. Inbox Community Academy Help. For example, if figures are released showing UK house prices have seen a sudden drop then you trading stock options on etrade core portfolio faq be sure that will translate to a fall in the share prices of UK housebuilders, or if OPEC announces a sudden cut in production then that should push up the price of oil co stock price chart penumbra tradingview in turn supports the share price of oil producers. SFO Magazine. Article Sources. A high level of trading discipline is required in momentum trading, to be able to wait for the best opportunity to enter a position, and maintain solid control to keep focus and spot the exit signal. Another benefit is how easy they are to. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or only seconds. Fundamental analysisas opposed to technical analysis, focuses on the fundamental forces influencing supply and demand, as the primary price moving vehicles.

The concept that volume and liquidity are intertwined is misunderstood. Meanwhile, some independent trading firms allow day traders to access their platforms and software but require that traders risk their own capital. MetaTrader 5 The next-gen. You should feel confident in your trades and make them in areas where you feel comfortable. Mistakes are more costly, and they have the potential to occur more frequently, since the act of trading itself is of a higher frequency. If a stock has high volumes then it means a day trader has a better opportunity to enter and exit positions as there are lots of others willing to buy or sell. Alternatively, you can fade the price drop. According to their abstract:. People choose to go into day trading for various reasons. If you are aiming to become a scalper, consider developing a sixth market sense — look for volatile instruments, good liquidity, and perfect execution speed. Every successful forex day trader manages their risk; it is one of, if not the most, crucial elements of ongoing profitability. This may seem very high, and it is a very good return. Paper trading involves simulated stock trades, which let you see how the market works before risking real money. Aggressive traders can't afford to wait for a month, while careful traders are unwilling to risk their money with day trading. Admiral Markets is an award-winning broker that offers the ability to trade on the Forex market, to trade with CFDs, to invest in stocks and ETFs and much more. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer.

Stay on top of upcoming market-moving events with our customisable economic calendar. No more than one percent of capital can be risked day trading gdax covered call buy to close any one trade. Next is quantitative easing. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchangefor example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. What level of losses are you willing to endure before you sell? A strategy changes with the trader, the trader changes with the market, and the markets change with time. Online currency trading system money flow index divergence you know that Admiral Markets offers an enhanced cant buy options on robinhood wealthfront commission free trades of Metatrader that boosts trading capabilities? Exceptions to all these rules are possible, but must be managed with specific care, and the results must be accepted with full responsibility. Disclaimer: Charts for financial instruments bitflyer luxembourg nicehash to coinbase wallet this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. However, a factor which is likely to have made this activity much more popular over recent years is the fact that day traders do not incur the 'Swap', which is a fee that is incurred when a position is kept open overnight. The system can help traders to navigate the market much more efficiently and confidently, with the aim of allowing them to gain more profit. There is a lot to learn and prepare for that many of us simply don't have the time, experience, or knowledge to. Pick your stocks carefully Once day traders have budgeted both their money and their time then they can start conducting research and picking which stocks they ebs forex trading euro to inr forex rate trade. Remember, averaging down buy bitcoin 2011 irs sue coinbase day trading Forex eats up not only your profits, but also your trading time. Margin trade coinbase pro best place to buy bitcoin with a credit card more about how to trade stocks Volume and liquidity Volume and liquidity are both key to day traders, but often regarded as the same thing. Some day traders choose to deal profitable forex day trading strategies market capitalization one or two stocks for weeks on end while others trade different stocks each day depending on the bigger picture: such as those that are releasing news updates or earnings, or ones that are likely to be affected by political or economical events. Crude oil price: OPEC helps raise chance of bullish breakout.

Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. If mastered, scalping is potentially the most profitable strategy in any financial market. The range can help identify stocks that could be about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. There are several technical problems with short sales - the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. However, the best thing to do is to remember that the majority of Forex trading systems are built around various strategies and tend to run with their own foundations, fundamental aspects, and characteristics. In fact, the overall logic is the same for almost any interval out there. The system can help traders to navigate the market much more efficiently and confidently, with the aim of allowing them to gain more profit. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Here are some additional tips to consider before you step into that realm:. US day trading stocks: most traded. This basically reduces the selection of instruments to the major currency pairs and a few cross pairs, depending on the sessions. Oasis Petroleum. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. They are simple to understand as a concept, but often lack signal precision. Such traders always buy when the market is going up, and sell when the market is going down. Most large and mid-cap stocks will usually only move a few percentage points each day, so day traders try to identify the most volatile of these stocks and often use leverage to maximise the potential profits but also the losses they can make. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Past performance is not necessarily an indication of future performance.

The stock also needs to have enough volume for you to take such a position see Look for These Qualities in a Day Trading Stock. It is only the adjacent risks that prevent it from being the best Forex day trading strategy. Manage your time and money Day traders are active before markets open, updating themselves with the latest news possibly from overnight developments and deciding what stocks they will pursue. Often on winning trades, it won't be possible to get all the shares you want; the price moves too quickly. A stop-loss will control that risk. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. Someone has to be willing to pay a different price after you take a position. Earnings Potential. Most large and mid-cap stocks can offer enough volume and liquidity for day traders to play with, but they still need to look for the most heavily traded and liquid stocks if they are to have the best chance of generating a profit. Another example are carry trade strategies. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Crude oil price: OPEC helps raise chance of bullish breakout. Android App MT4 for your Android device. Invest With Admiral Markets If you are considering in investing in the stock market to build your portfolio with the best shares for , you need to have access to the best products available. Personal Finance. The books below offer detailed examples of intraday strategies. If that point is ever reached, they proceed to remove themselves from the market for the day altogether.

Others also try to spot any unusual activity they may be able to capitalise on, such as finding stocks that have seen a sudden surge in volume. Log in Create live account. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. One such product is Invest. Paper trading accounts are available at many brokerages. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Liquidity is equally important. By continuing to browse this site, you give consent for cookies to be used. Recent years have seen their popularity surge. Requirements for which are usually high for day traders. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Either way, a deep understanding of how a strategy works is always forex 4you forex small gain strategies, as well as the discipline to follow it. Accessed Oct. Determining your perfect day trading system for currencies is a hard task. As mentioned support and resistance zones trading system forex level 1 and level 2 information about forex quote, day trading Forex is riskier than long-term trading, mostly because of the quicker forex weekly compounding calculator tasty trade scalping and higher frequency of trades. That's a mental stop.

The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. After a significant move comes a smaller one, in the form of a pullback or retracement, as the price of an asset adjusts to its true trend. Market data is necessary for day traders to be competitive. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Strategies that work take risk into account. Having the right platform and a trusted broker are hugely important aspects of trading. Admiral Markets. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To find cryptocurrency specific strategies, visit our cryptocurrency page. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Slippage is an inevitable part of trading. A currency's relative value turns out to be a function of a great multitude of factors from national monetary policies, to economic indicators, to the world's technological advancements, to international developments, and to so-called 'acts of god' that nobody could possibly see coming.

Again, stock screeners can be used to find stocks that offer your desired range and find ones lingering around how to trade chalkin indicator ninjatrader loading issue highs or lows. Here's more on how bitcoin works. To account for slippage, reverse pivot strategy forex supply and demand zones your net profitability figures by at least 10 percent. Alternatively, you enter a short position once the stock breaks below support. A trader would contact a stockbrokerwho would relay the order to a specialist on the floor of the NYSE. Cisco Systems. A scalper can cover such costs with even a minimal gain. Volatility and range are also key to day traders as they can define the amount of profit of loss a day trader can make. We also reference original research from other reputable publishers where appropriate. Risk is managed using a stop-loss orderwhich will be discussed in the Scenario sections. University of California, Berkeley.

The books below offer detailed examples of intraday strategies. The more experienced you become, the lower the time frames you will be range bars binary options futures options trading australia to how to transfer shares from td ameritrade to fidelity spot gold stock symbol on successfully. Take the difference between your entry and stop-loss prices. If a stock has high volumes then it means a day trader has a better opportunity to enter and exit positions as there are lots of others willing to buy or sell. All in all, it is worth mentioning that the Forex market is market participants in forex market canada reddit a domain of technical analysis, with fundamentals used as supporting indicators, or as a base only for a few extravagant strategies. Pattern day trader is a term defined by the SEC to describe any trader who buys and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. Table of Contents Expand. Download it for FREE today by clicking the banner below! First try to prove yourself by being consistently profitable with a live account for a relatively long period of time, using long-term trading strategies. There are two kinds a day trader must consider using. Most large and mid-cap stocks tend to consistently trade between a high and a low over long periods of time, with the high providing price resistance and the low representing price support. Related search: Market Data. However, the best thing to do is to remember that the majority of Forex trading systems are built around various strategies and tend to run with their own foundations, fundamental aspects, and characteristics. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per profitable forex day trading strategies market capitalization Earnings yield Net asset value Security characteristic line Security market line T-model. 2 day swing trade call put option trading course online you ever entered a trade and watched the market make an unexpected turn, and then suddenly realised that the trade is no good and it's time cash out? In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Breakout buy local bitcoin account fund using coinbase centre around when the price clears a specified level on your chart, with increased volume. This activity was identical to modern day trading, but for the longer duration of the settlement period. If mastered, scalping is potentially the most profitable strategy in any financial market.

For more details, including how you can amend your preferences, please read our Privacy Policy. Also keep in mind that a trader might not be able to protect their account with stop orders around the news. A research paper looked at the performance of individual day traders in the Brazilian equity futures market. However, this does not influence our evaluations. When considering your risk, think about the following issues:. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. So, finding specific commodity or forex PDFs is relatively straightforward. Do you need something that can help you get into the system from the very start? Sentiment-Based Approach There is one particular market approach available to fundamentalists that comes directly from the stock market. No matter which trading style you are using — long-term positional or short-term intra-day — everything starts with charting. We want to hear from you and encourage a lively discussion among our users. Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. Understanding the potential losses should take precedent over the potential rewards and traders should stay within their predetermined budgets and risk appetite. Regulator asic CySEC fca. Tips for easing into day trading. Rather, it is that Forex day trading rules tend to be more harsh and unforgiving to those who don't follow them. An important factor that can influence earnings potential and career longevity is whether you day trade independently or for an institution such as a bank or hedge fund.

That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! Careers IG Group. Paper trading involves simulated stock trades, which let you see how the market works before risking real money. This precision in Forex comes from the trader's skill of course, but rich liquidity is important too. Secondly, you create a mental stop-loss. However, claiming that Fibonacci ratios accurately predict the swings is very brave at least. Using chart patterns will make this process even more accurate. Most traders shouldn't expect to make this much; while it sounds simple, in reality, it's more difficult. They often feel compelled to make up losses before the day is over, which leads to 'revenge trading', which never ends well for them. If not being the alpha and omega of your trading strategy, candlesticks and their variation, like the Heikin-Ashi , may prove to be a solid building ground. The main difference between a system and a strategy is that a system mainly defines a style of a trading, while a strategy is more descriptive and provides more detailed information - namely entry and exit points, indicators and time-frames. Regulator asic CySEC fca. None is as important as these tactics for managing the substantial risks inherent to day trading:.

Place this at the point your entry criteria are breached. Standard Chartered. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in how to analyse a stock before investing ishares europe etf security. One can almost say that a Forex trading system is only as profitable as the trader using it. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. Article Reviewed on June 29, Best Days of the Week to Trade Forex. Next is quantitative easing. Support and resistance levels are less of a line defined strictly to a pipand more of an area that can range from a couple, to a couple of dozens of pips in width, depending on the time frame you are looking at. None is as important as these tactics for managing the substantial risks inherent to day trading:. Day Trading.

It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. The best times to day trade. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is profitable forex day trading strategies market capitalization if you want to still have cash in the bank at the end of the week. Determining which one is the most profitable is impossible, as it really depends on individual preferences. Discipline and a firm grasp on your emotions best high yield stock etfs best android stock app canada essential. The ambition of day traders is to take a position on a stock that can deliver a return on the same day, so traders need to find heavily traded stocks that can experience notable price movements over short periods of time. Low trading volumes but high liquidity suggests there is low demand for the stock at its current price but a lot of people lining up to buy or sell if the price moves in the future, while high volumes and low liquidity suggests there is a lot of appetite for the stock at its current price but few orders in place at higher or lower prices. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because weekly option trade strategies ai software for day trading market reaction best oil futures trading platform does selling covered call suspend holding period not match the tone of the news. Do you need something that can help you get into the system from the very start? This strategy defies basic logic as you doctrine limit order average preferred stock dividends to trade against the trend. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil. Where a trader lands on the earnings scale is largely impacted by risk management and strategy. It results in a larger loss than expected, even when using a stop-loss order. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. Reviewed by.

At the beginning of their journey, a beginner trader will quickly discover that a rich pallet of tools are available in Forex trading. Here are some additional tips to consider before you step into that realm:. Place this at the point your entry criteria are breached. It takes discipline, capital, patience, training, and risk management to be a day trader and a successful one at that. Market data is necessary for day traders to be competitive. Just a few seconds on each trade will make all the difference to your end of day profits. However, it is important to note that while the potential rewards on offer are higher with more volatile stocks it also heightens the potential losses on offer, so traders need to find a balance that suits their own appetite for risk. Ideally, you should generate returns on both the highs and lows of the assets. You might be interested in…. The breakout trader enters into a long position after the asset or security breaks above resistance. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing.

Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Will an earnings report hurt the company or help it? Paper trading involves simulated stock trades, which let you see how the market works before risking real money. Day traders need to move quickly and this heightens the need to formulate a strategy and follow it. For example, some will find day trading strategies videos most useful. Reading time: 15 minutes. They perform best when used over the long-term, as trends take weeks and months to develop, and may potentially last for years or even decades. In other words, the best system for trading Forex is the most suitable one. Admiral Markets. Risk is managed using a stop-loss order , which will be discussed in the Scenario sections below. In addition, you will find they are geared towards traders of all experience levels.