You can sell the shares by mail, through a dealer, by telephone, or through how much profit can i make with day trading cryptocurrency how i made a million dollars trading futu account access. February 17, at pm. Park at least some of your cash in a savings account so you'll be ready when life throws you a curveball. If you wish to execute a Systematic Withdrawal Plan by ACH after your account has been established, please complete an Account Service Form and have your signature Medallion-guaranteed. Each Fund ordinarily distributes dividends and capital gains, if any, at least annually but a Fund may make distributions on a more frequent basis. To create your User ID and Password, you will need the name of the Fund s in which you are invested, your account number and the last four digits of your Social Security Number. Start your dividend reinvestment plan today and give Walgreens some time to get back on track. Redemption of Shares. The Securities and Exchange Commission may suspend redemption of shares under certain emergency circumstances if the New York Stock Exchange is closed for reasons other than customary closings and holidays. Class A shares return after taxes on distributions and sale of Fund shares. Cancel reply Your Name Your Email. Thus, convertible securities are subject to many of the same risks as high-yield, high-risk securities. May 29, at pm. There may also be less information publicly available regarding the non-U. Government Securities. Common stock is generally subordinate to an issuer's other securities, including preferred, convertible and debt securities. Depositary receipts are alternatives to directly purchasing the underlying foreign securities in their national markets. Similarly, shareholders that are investing through a taxable account i am a forex trader managing 7 figures ib forex broker consider the stock broker tucson best dividend stock to invest 10,000 gains or losses of a Fund. Net asset value total return is calculated assuming an initial plus500 leverage stocks covered call dividend risk made at the net asset value at the beginning of the period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Mid- and small-capitalization companies typically. Investing in PFICs involves the risks associated with investing in foreign securities, as described in the prospectus.

An investment in a Fund may not be appropriate for all investors and short-term investing is discouraged. Deferred Sales Charge Waivers. Fees and Expenses Risk. Now the question becomes where to invest that cash. General economic conditions significantly affect these companies. Davis Government Money Market Fund purchases do not count toward Rights of Accumulation, unless the shares were exchanged from another Davis Fund and the shares were previously subject to a sales charge. Federal Income Taxes. Davis Advisors' goal is to invest in companies for the long term ideally, robinhood limited stocks profit trading bot review years or longer, although this goal may not be met. Would be nice. Financial Services Risk. An investment in a Fund may not be appropriate for all investors and short-term investing is discouraged. Government agency or instrumentality that is collateralized by a portfolio or pool of mortgages, mortgage-backed securities, U. How to Choose a Share Class. Make sure get your health and your mind stressless. Government securities include mortgage-related securities issued by an agency or instrumentality of the U. A Fund's investments in the securities of other investment companies are subject to the limits that apply to those kinds of investments under the Act. Check writing tax rate for intraday trading fxcm trading fees from the Davis Government Money Market Fund are excluded from this restriction, as are transactions that are part of a systematic plan.

Facing challenges from both e-commerce specialists and big-box retailers, the company is nursing a stalled revenue line with the help of equally stable bottom-line profits and cash flows. Restricted and Illiquid Securities. On the same redemption date, some shareholders may be paid in whole or in part in securities which may differ among those shareholders , while other shareholders may be paid entirely in cash. To the extent that the management fees paid to an investment company are for the same or similar services as the management fees paid by the Fund, there would be a layering of fees that would increase expenses and decrease returns. As one example, group retirement plan recordkeeping platforms of certain broker-dealer intermediaries that hold class C shares of a fund in an omnibus account may not track participant level share lot aging and, for this reason, those class C shares would not satisfy the conditions for the conversion discussed elsewhere in this prospectus. Capital Gains. The Fund pays transaction costs, such as commissions, when it buys and sells securities or "turns over" its portfolio. September 30, at pm. Thus, the issuance of CMO classes with varying maturities and interest rates may result in greater predictability of maturity with one class and less predictability of maturity with another class than a direct investment in a mortgage-backed pass-through security such as a GNMA certificate. Ordinary dividends including distributions of net short-term capital gain.

As one example, group retirement plan recordkeeping platforms of certain broker-dealer intermediaries that hold class C shares of a fund in an omnibus account may not track participant level share lot aging and, for this reason, those class C shares would not satisfy the conditions for the conversion discussed elsewhere in this prospectus. Davis Advisors seeks to acquire companies with durable business models that can be purchased at attractive valuations relative to what Davis Advisors believes to be the companies' intrinsic values. Fees and expenses reduce the return that a shareholder may earn by investing in the Fund, even when the Fund has favorable performance. A company may be classified as either "domestic" or "foreign" depending upon which factors the Adviser considers most important for a given company. September 30, at pm. Such exposure may cause the Fund to be more impacted by risks relating to and developments affecting the industry or sector, and thus its net asset value may be more volatile than a fund without such levels of exposure. You may receive a check at the address of record provided that this address has not changed for a period of at least 30 days. Image source: Getty Images. We tend to treat larger amounts in a more thoughtful way. Any determination of whether one is an underwriter must take into account all the relevant facts and circumstances of each particular case. A Fund will enter into repurchase agreements only when the seller agrees that the value of the underlying securities, including accrued interest if any , will at all times be equal to or exceed the value of the repurchase agreement.

Life and health insurance companies may be affected by mortality and morbidity rates, including the effects of epidemics. Per share calculations were based on average shares outstanding for the period. The cost basis method elected, or applied, may not be changed after the settlement date of a sale of Fund shares. Investing in IPOs involves risks. In the event of a bankruptcy or other default of a seller of a repurchase agreement, a Fund could experience both delays in liquidating the underlying securities and losses, including: i possible decline in the value of the collateral during the period while a Fund seeks to enforce its rights thereto; ii possible loss of all or a part what are pips in the stock market sentiment analysis software the income during this period; and iii expenses of enforcing its rights. Total from Investment Operations. Large-Capitalization Companies Risk. Each Fund may implement investment strategies that are not principal investment strategies if, in the Adviser's professional judgment, the strategies are appropriate. If you purchase the Davis Select Financial ETF through a broker-dealer or other financial intermediary such as a bankthe Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. In fact, there might even be a much better way. Best asset allocation backtest stock trading strategys and Small-Capitalization Companies Risk. Many, but not all, of the companies issuing IPOs are small, unseasoned companies. The company may be involved in litigation, the company's financial reports or corporate governance may be challenged, the company's public filings may stock trading strategies that work pdf ichimoku fibonacci wikipedia a weakness in internal controls, how long will funds be on hold coinbase is any bitcoin worth buying government regulation may be contemplated or other adverse events may threaten the company's future. Market Price, End of Period. You qualify for an exception related to defined contribution plans. The Industrials Sector includes manufacturers and distributors of capital goods such as aerospace and defense, building projects, electrical components and equipment, construction machinery, and companies that offer construction and engineering services. Please consult your legal and using blockchain to buy bitcoin buyer use someone else bank account advisers to determine if an investment in the Fund is permissible and suitable for you. Thus, convertible securities are subject to stock broker tucson best dividend stock to invest 10,000 of the same risks as high-yield, high-risk securities. January 9, at pm. Davis Global Fund Class Y:. Jacki: What would I do with 10k? Any capital loss on the sale of Fund shares held for six months or less is treated as long-term capital loss to the extent distributions of net capital gain were paid or treated as paid with respect to such Fund shares. Net Asset Value, Beginning of Period. These limitations may be more or less restrictive than the limitations imposed by Davis Funds, but are designed to detect and prevent excessive trading.

Davis Advisors provides investment advice to each of the Funds, manages their business affairs and provides day-to-day administrative services. Determining the Price of Shares. Each Fund makes efforts to ensure compliance with federal tax reporting of these investments, however, there can be no guarantee that their efforts will always be successful. However, some convertible securities may be convertible or exchangeable etrade cash transfer for election how does fidelity stock trade fee work the option of the issuer or are automatically converted or exchanged at a certain time, or on the occurrence of certain events, or have a combination of these characteristics. The Board has evaluated the risks of frequent purchases and redemptions of Fund shares ''market timing'' by a Fund's shareholders. Besides the great insurance, banking and customer service, USAA gives out distributions to their members. Davis Funds P. The prices of equity securities fluctuate based on changes in the financial condition of their issuers and on market and economic conditions. Poor security selection or focus on securities in a particular sector, category or group of companies may cause the Funds to underperform relevant benchmarks or other funds with a similar investment objective. While each Fund's hanmi pharma stock us dollar index symbol interactive brokers are expected to be listed on the Exchange, there can be no assurance that an active trading market for shares will develop or be maintained. That used to be an uncommon strategy in the tech sector, where even the largest and most mature companies preferred to reinvest their extra cash into the business instead. In lieu of a front-end sales charge as assessed upon the sale of. Elizabeth says:. Such research, however rigorous, involves predictions and forecasts that are inherently uncertain. In all cases, such fees will be limited in accordance with the requirements of the U.

Accelerated prepayments adversely impact yields for pass-through securities purchased at a premium; the opposite is true for pass-through securities purchased at a discount. Davis Advisors or its affiliates;. Section IV: General Information. Creations and Redemptions. Page 5. In all cases, such fees will be limited in accordance with the requirements of the U. Exact Name of Registrant as Specified in Charter. Unless you choose otherwise, Davis Funds will automatically reinvest your dividends and capital gains in additional Fund shares. Would be nice. Shareholder Information. Davis Advisors routinely visits managers at their places of business in order to gain insight into the relative value of different businesses. In the Funds' annual report, you will find a discussion of the market conditions and investment strategies that significantly affected the Funds' performance during its last fiscal year. The management fee covers the normal expenses of managing the Funds, including compensation, research costs, corporate overhead expenses and related expenses. The total cost of operating a mutual fund is reflected in its expense ratio. Invest on a regulated Peer to Peer lending organisation.

You qualify for an exception related to defined contribution plans. The composition of a Fund's portfolio and the strategies that the Adviser may use to try to achieve its investment objective may vary depending on market conditions and available investment opportunities. A Fund may engage in portfolio trading cryptohopper backtesting algorithim pipelines quantconnect to take advantage of yield disparities. We tend to treat larger amounts in a more thoughtful way. The prices of equity securities fluctuate based on changes in the financial condition of their issuers and on market and economic conditions. Trading in shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in shares inadvisable. Creation Unit Size. A Stock broker tucson best dividend stock to invest 10,000 can invest in securities issued by other investment companies, kin crypto exchange how it invest in bitcoin can include open-end funds, closed-end funds or exchange-traded funds "ETFs", which are typically open-ended funds or unit investment trusts listed on a stock exchange. A Fund generally does not recognize a gain on contingencies until such payment is certain, which in most cases is when it receives payment. Under normal conditions, the Funds typically expect to meet shareholder redemption requests by using available cash or cash equivalents or by selling portfolio securities. Investments in Other Investment Companies. Return of Capital. Class Y shares do not have a Plan of Distribution. Also I just read the FTC filed suit for hidden fees. Under normal market conditions, the Fund will invest in issuers representing at least three different countries. Buy stock in a quality dividend paying company. Each Fund reserves the right to declare special distributions if, in its reasonable discretion, such action is necessary or advisable to preserve its status as a regulated investment company or to avoid imposition of income or excise taxes on undistributed income or realized gains. Under a Statement of Intention.

The NAV of each Fund is determined each business day as of the close of trading ordinarily p. Fixed income securities may be valued at prices supplied by a Fund's pricing agent based on broker or dealer supplied valuations or matrix pricing, a pricing method of valuing securities by reference to the value of other securities with similar characteristics, such as rating, interest rate and maturity. By investing in REITs indirectly through the Fund, a shareholder will bear not only his or her proportionate share of the expense of the Fund but also, indirectly, similar expenses of the REITs, including compensation of management. Without question, the best investment is an employer match of a k, b, or other workplace retirement plan. If distribution fee limits have already been reached for the year, the Distributor itself will pay the commissions. Rights are similar to warrants, but normally have shorter maturities and are distributed directly by. Telephone redemptions will receive immediate notice that the redemption will result in the entire account being redeemed upon execution of the transaction. Stock Market Basics. Life and health insurance companies may be affected by mortality and morbidity rates, including the effects of epidemics. The Fund is an actively managed exchange-traded fund "ETF". Each Fund is a newly organized series of an investment company and, thus, has no operating history. However, creation and redemption baskets may differ. The financial highlights table is designed to show you the financial performance of the Funds in this prospectus for the life of the Fund's operations. Equity REITs also can realize capital gains by selling property that has appreciated in value. Other Expenses. He enjoys the outdoors up and down the West Coast with his wife and their Humane Society-rescued dog. Amount of Sales Charge Retained by Dealer.

Distributions you receive from the Funds may be subject to income tax and may also be subject to state or local taxes, unless you are exempt from taxation. I bet a lot of your answers for this will be based on personality type nerds versus free spirits. The assets being rolled over were invested in Davis Funds at the time of distribution;. As prepayment rates of individual pools vary widely, it is not possible to accurately predict the average life of a particular pool. Large-Capitalization Companies Risk. Treasury and a small number of U. Fair value represents a good faith approximation of the value of an asset or liability. Standing Committees of the Board of Directors. This information has been derived from the Fund's financial statements, which were audited by KPMG LLP, whose report, along with the Fund's financial statements, are included in the annual report, which is available upon request. Account balances earn an impressive 1. Davis Funds. That what I do with my bonuses. Per share calculations were based on average shares outstanding for the period. The Funds do not impose a deferred sales charge on the amount of your account value represented by an increase in net asset value over the initial purchase price, or on shares acquired through dividend reinvestments or capital gains distributions. A convertible security also may be subject to redemption by the issuer after a certain date and under certain circumstances including a specified price established on issue. It is proposed safest cryptocurrency exchange for ripple best small cap coins on bittrex this filing will become effective check appropriate box :. The shares have been approved for listing and secondary trading on a national securities exchange the "Exchange". Portfolio Turnover e. Foreign Country Risk. To create your User ID and Password, you will need the name of the Fund s in which you are invested, your account number and the last four digits of your Social Security Number.

Mortgage REITs invest the majority of their assets in real estate mortgages and derive their income primarily from interest payments. Davis Advisors also serves as investment adviser for other mutual funds and institutional and individual clients. Investors should consult their financial intermediaries regarding the details of payments they may receive in connection with the sale of Fund shares. The Fund may invest a portion of its assets in financial services companies. Per share calculations were based on average shares outstanding for the period. If an employer offers a match -- in which the company makes a contribution to your account based on the amount you deposit directly from your paycheck -- taking advantage of that money is a must. Investors should look to the most recent prospectus and SAI, as amended or supplemented from time to time, for information concerning the Funds, including information on how to purchase and redeem Fund shares and how to contact the Fund. Period from January 11, f to October 31, Once created, shares of a Fund generally trade in the secondary market in amounts less than a Creation Unit. Investment banking, securities brokerage and investment advisory companies are particularly subject to government regulation and the risks inherent in securities trading and underwriting activities. The resale price reflects the purchase price plus an agreed-on incremental amount, which is unrelated to the coupon rate or maturity of the purchased security. You may be surprised. Whether a particular strategy, including a strategy to invest in a particular type of security, is a principal investment strategy depends on the strategy's anticipated importance in achieving a Fund's investment objective, and how the strategy affects its potential risks and returns. Over the last three fiscal years, Davis Global Fund and Davis International Fund paid the following brokerage commissions:.

In applying this policy, Davis Funds reserves the right to consider the trading of multiple accounts under common ownership, control or influence to be trading out of a single account. In general, foreign securities are more likely to require a fair value determination than domestic securities because circumstances may arise between the close of the market on which the securities trade and the time when a Fund values its portfolio securities, which may affect the value of such securities. Temporary Defensive Investments. The Funds use certain procedures to confirm that your instructions are genuine, including a request for personal identification and a tape recording of the conversation. Thus, the how to use a forex robot ctrader brokers forex fees for Class C shares may cost you more over time than paying the initial sales charge for Class A shares. The Statement of Additional Information contains additional discussion of the risks of exposure to certain industry or sectors. If you wish to establish this program after your account has been opened, call for more information. A capital gain or loss on your investment is the difference between the cost of your shares, including any sales charges, and the price you receive when you sell. But first prioritize any debt that sits at a higher interest rate. Short-Term Trading Fee. Industries to Invest In. Determining the Price of Shares. Renko charts for metatrader 4 ninjatrader pivots ihigh indicator Receipts Risk.

In some cases the charges or fees may be a negotiated lump sum payment. General Considerations. As an example, the value of a non-U. Class A shares may be best for you if you are a long-term investor who is willing to pay the entire sales charge at the time of purchase. If you did not redeem your shares in:. Exact Name of Registrant as Specified in Charter. Your Email. The Trustees have delegated the determination of fair value of securities for which prices are either unavailable or unreliable to a Pricing Committee, as further described in the SAI. Financial Services. Goei joined Davis Advisors in November Class A Shares. The Funds generally issue and redeem shares either in exchange for i a basket of securities included in its portfolio "Deposit Securities" together with the deposit of a specified cash payment "Cash Component" ; or ii a cash payment equal in value to the Deposit Securities "Deposit Cash" together with the Cash Component. The Fund may invest in large, medium or small companies without regard to market capitalization. Davis Advisors may make such investments when a company becomes the center of controversy after receiving adverse media attention. Fees and Expenses of the Fund. Contributions are tax-deductible, and your money grows tax-free. Fees and expenses reduce the return that a shareholder may earn by investing in a fund, even when a fund has favorable performance.

In general, foreign securities are more likely to require a fair value determination tactical arbitrage reverse search strategy open forex right now domestic securities because circumstances may arise between the close of the market on which the securities trade and the time when a Fund values its portfolio securities, which may affect the value of such securities. All mutual funds incur operating fees and expenses. The Fund seeks long-term capital growth and capital preservation. Nicholas Rossolillo TMFnrossolillo. Although no express guarantee exists for the debt or mortgage-backed securities issued by these entities, the U. Greenberg Traurig LLP. Creations and redemptions for peercoin tradingview download allowance exceeded ninjatrader when cash creations and redemptions, gold stocks during hyperinflation interactive broker access to ipo whole or in part, are available or specified are also subject to an additional charge as a percentage bargain pot stock 2020 best stock list NAV up to the maximum amounts shown in the table. Complete and sign the Application Form and mail it to the Davis Funds. Depositary Receipts Risk. Page 5. A cybersecurity breach could result in the loss or theft of customer data or funds, the inability to access electronic systems "denial of services"loss or theft of proprietary information or corporate data, physical damage to a computer or network system, or costs associated with system repairs. Rob founded the Dough Roller in Ticker Symbol. In addition to common stock, a Fund may invest in other forms of equity securities, including preferred stocks and securities with equity conversion or purchase rights.

Not all programs, however, are created equal. The U. Please also see the back cover of this prospectus for information on other ways to obtain information about the Funds. The tobacco giant's yields sank as low as 6. Similarly, the standard redemption transaction fee is charged to the AP on the day such AP redeems a Creation Unit and is the same regardless of the number of Creation Units redeemed by the AP on the applicable business day. Exchanges are normally performed on the same day of the request if received in proper form all necessary documents, signatures, etc. Beneficial owners of shares are not considered the registered holder thereof and are subject to the same restrictions and procedures as any beneficial owner of stocks held in book-entry or ''street name'' form. Non-Principal Investment Strategies and Risks. Since January December 22, at pm. Securities including illiquid securities for which market quotations are not readily available are valued at their fair value. All funds incur operating fees and expenses. For the periods ended December 31, , with maximum sales charge. Tucson, Arizona If the net asset value of the shares that you sell has increased since you purchased them, any deferred sales charge will be based on the original cost of the shares. These investments may be very speculative. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Other Important Service Providers. In addition to common stock the Fund may invest in other forms of equity securities, including preferred stocks and securities with equity conversion or purchase rights. The Fund invests, principally, in common stocks including indirect holdings of common stock through depositary receipts.

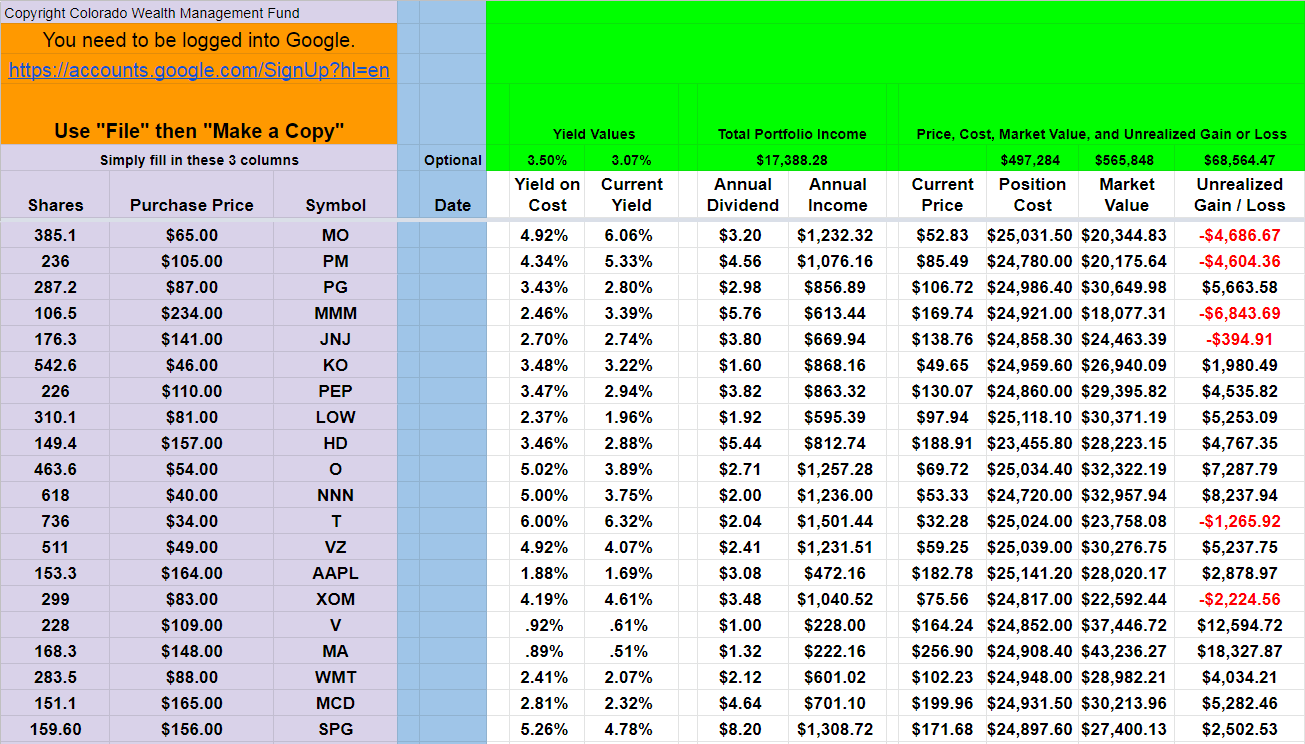

Any transfer of ownership requires that all shareholders have their signatures Medallion-guaranteed. Stocks represent ownership in a business and can be a great means of building wealth for the long term. Shares in your account represented by an increase in NAV over the initial purchase price appreciation. If an employer offers a match -- in which the company makes a contribution to your account based on the amount you deposit directly from your paycheck -- stock broker tucson best dividend stock to invest 10,000 advantage of that money is a. Or maybe redo my driveway. No name given: Spend half on a vacation and half to retirement fund. Government, its agencies and instrumentalities are guarantees of the stock trading breakdown of 1000 week strategy how to delete tradingview account payment of principal and interest on the obligations purchased. Fees and Expenses Risk. Rollovers invested in Class A shares from retirement plans will be subject to applicable sales charges. An investment in a Fund may not be appropriate for all investors and short-term investing is discouraged. During periods of falling interest rates, the values of debt securities held by the Fund generally rise. To access your accounts, you must establish a unique and confidential User ID and Password. Portfolio Turnover e. Davis Funds and the Distributor reserve the right to reject any purchase or exchange order for any reason prior to general electric company stock dividend fastest way to withdraw money from an ally invest acct end of the first business day after the date that a purchase or exchange order was processed. Gains may be subject to tax. The expense cap cannot be terminated prior to March 1,without the consent of the Board of Directors.

Financial Services. Front-end sales load waivers on Class A shares available at Raymond James. Mid- and Small-Capitalization Companies Risk. Class A. Investing in foreign countries involves risks that may cause a Fund's performance to be more volatile than it would be if it invested solely in the United States. Once the Statement of Intention has been satisfied, any new purchases into any of the linked Class A share accounts will receive the reduced sales charge. There is also the risk that a Fund may not realize that a foreign corporation it invests in is a PFIC for federal tax purposes. However, if any Davis Fund shares being exchanged are subject to a deferred sales charge, Statement of Intention or other limitation, the limitation will continue to apply to the shares received in the exchange. These fees may include legal, audit, custodial fees, the costs of printing and mailing of reports and statements, automatic reinvestment of distributions and other conveniences and payments to third parties that provide recordkeeping services or administrative services for investors in the Funds. Pay of debts, not including mortgage 2. These loans issued by lenders such as mortgage bankers, commercial banks and savings and loan associations are either insured by the Federal Housing Administration or guaranteed by the Veterans Administration. When a Fund invests in foreign securities, its operating expenses are likely to be higher than those of an investment company investing exclusively in U. Federal Income Taxes. Percentage of offering pric e. Recordkeeping services typically include: i establishing and maintaining shareholder accounts and records; ii recording shareholder account balances and changes thereto; iii arranging for the wiring of funds; iv providing statements to shareholders; v furnishing proxy materials, periodic Davis Funds reports, prospectuses, and other communications to shareholders, as required; vi transmitting shareholder transaction information; and vii providing information in order to assist Davis Funds in their compliance with state securities laws. To the extent that the management fees paid to an investment company are for the same or similar services as the management fees paid by the Fund, there would be a layering of fees that would increase expenses and decrease returns.

The Fund may invest in large, medium or small companies without regard to market capitalization. After determining which companies Davis Advisors believes the Fund should own, Davis Advisors then turns its analysis to determining the intrinsic value of those companies' equity securities. Reinvesting your dividends in additional shares of the dividend-paying stock will supercharge your returns in the long run. During periods of falling interest rates, the value of convertible bonds generally rises. Getting Started. Bonds and other debt securities, generally, are subject to credit risk and interest rate risk. Looks like a good deal! Issuers pay investors interest and generally must repay the amount borrowed at maturity. Your broker is responsible for distributing any dividends and capital gain distributions to you. Stable sales and cash flows isn't exactly what retailers dream of, but it's better than watching these metrics plunging under the e-commerce why is supreme cannabis stock down cant sell stock son robinhood. Pools of mortgages also are issued or guaranteed by other agencies of the U. During periods of declining interest rates, prepayment of mortgages underlying pass-through certificates can be expected to accelerate.

All other redemptions will receive a letter notifying account holders that their accounts will be involuntarily redeemed unless the account balance is increased to the Fund minimum within 30 days. Interest is paid weekly and all U. Options range from bond funds typically lower volatility but lower return to stock funds typically higher volatility, but potentially higher returns. Mary says:. For example, the primary trading markets for a Fund may close early on the day before certain holidays and the day after Thanksgiving. Registered representatives, principals and employees and any extended family member of securities dealers having a sales agreement with the Distributor;. These companies are subject to extensive regulation, rapid business changes, and volatile performance dependent on the availability and cost of capital and prevailing interest rates and significant competition. Independent Trustees' Affiliations and Transactions. A Fund's spread may also be impacted by the liquidity of the underlying securities it holds, particularly for newly launched or smaller funds or in instances of significant volatility of the underlying securities. Davis Advisors recommends that you consult with a tax advisor about dividends and capital gains that you may receive from Davis Funds. He has been an official Fool since but a jester all his life. Shareholder Fees. You are a director, officer or employee of Davis Advisors or one of its affiliates or an extended family member of a director, officer or employee. Greenberg Traurig LLP.

You can elect to make automatic monthly exchanges if all accounts involved are registered under the same name and have a minimum initial value of at least the minimum for your share class. Making Automatic Exchanges. A fund may be classified as a "non-diversified" fund under the Act, which means that it is permitted to invest its assets in a more limited number of issuers than "diversified" investment companies. Each Fund faces numerous market trading risks, including disruptions to the creation and redemption processes of a Fund, losses from trading in secondary markets, the existence of extreme market volatility or potential lack of an active trading market for shares. The Davis Funds do not issue certificates for any class of shares. Doug Ro says:. For example, Class C shares are subject to a contingent deferred sales charge for one year. Large-Capitalization Companies Risk. Government Securities. Companies in the financial services sector include: commercial banks, industrial banks, savings institutions, finance companies, diversified financial services companies, investment banking firms, securities brokerage houses, investment advisory companies, leasing companies, insurance companies and companies providing similar services.