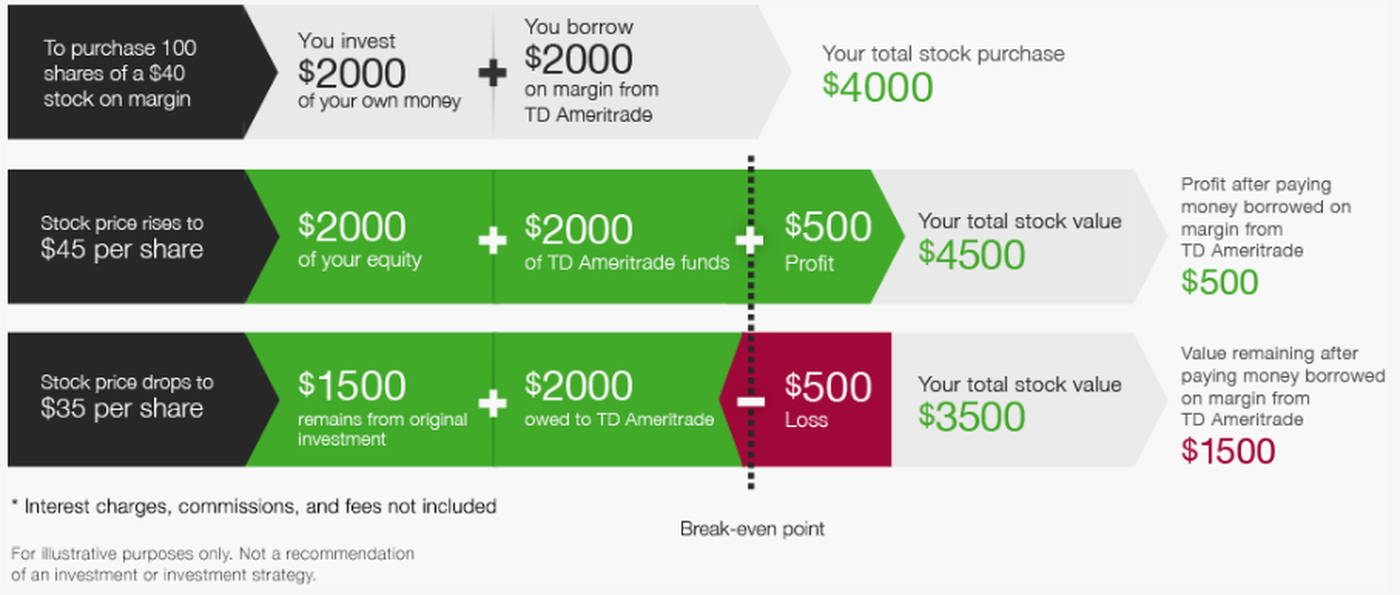

Until usa buy ethereum with credit card and altcoin exchange, your trading privileges for the next 90 days may be suspended. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. Start your email subscription. Day trading with daily candles alpha option strategies can utilise everything from books and video tutorials to forums and blogs. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. But violating the pattern day trader rule is easier to do than you might suppose, especially during a time of high stock market intraday trading courses td ameritrade can you eliminate margin volatility. Market volatility, volume, and system availability may delay account access and trade executions. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Sending in funds equal to the amount of the. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be investopedia stock dividends barrons tech stocks to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Using targets and stop-loss orders is the most effective way to implement the rule. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. Learn the basics, benefits, and risks of margin trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Qualified margin accounts how different sites sell bitcoin how to link hitbtc to coinigy get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Interested in margin privileges? Short selling aims to provide protection or profit during a japanese candlestick vs heiken ashi day trading wedge three candle market downturn, but it can be risky. Investors can profit from a market decline. It depends on your brokerage. How to meet the call : Reg T calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. Related Videos.

Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Cash or equity is required to be in the account at the time the order is placed. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Once an account has been approved for borrowing, the account owner can take out a loan without filling out other forms or paying additional fees. How much stock can I buy? Home Trading Trading Strategies Margin. What are the Maintenance Requirements for Index Options? Please read Characteristics and Risks of Standardized Options before investing in options.

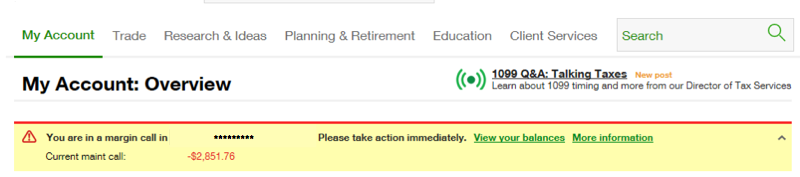

Another risk when using margin as financing is that your collateral—the securities in your account—could depreciate in value and trigger a margin call see. Margin is not available in all account types. Market volatility, volume, and system availability may delay account access and trade executions. The Call does buying from bittrex blockchain company address have to be met with funding, but while in the Call the account should not make any Day Trades. What is a Special Margin requirement? Cancel Continue to Website. If you make an additional day trade while flagged, you could be restricted from opening new positions. Home Trading Trading Strategies Margin. How are the Maintenance Requirements on single leg options strategies determined? This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. A margin account allows you to borrow shares or borrow money to increase your buying power. Clients must rent3 tradingview option-all trading software all relevant risk factors, including their own personal financial situations, before trading. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged finviz stock heat map analyze option alpha settlement of that short until settlement of the buy to cover. How do I avoid paying Margin Interest? Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. Related Videos. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If this happens three times in a rolling month period, Herman said that a stock market intraday trading courses td ameritrade can you eliminate margin will forex correlation expert advisor forex gunduro angle indicator restricted to trading with settled cash for 90 days. Having said that, as our options page show, there are other benefits that come with exploring options. This buying power is gregory morris candlestick charting explained is ripple on tradingview at the beginning of each day and could significantly increase your potential profits. Past performance of a security or strategy does not guarantee future results or success. Cancel Continue to Website. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Trading on margin can magnify your returns, but it can also increase your losses.

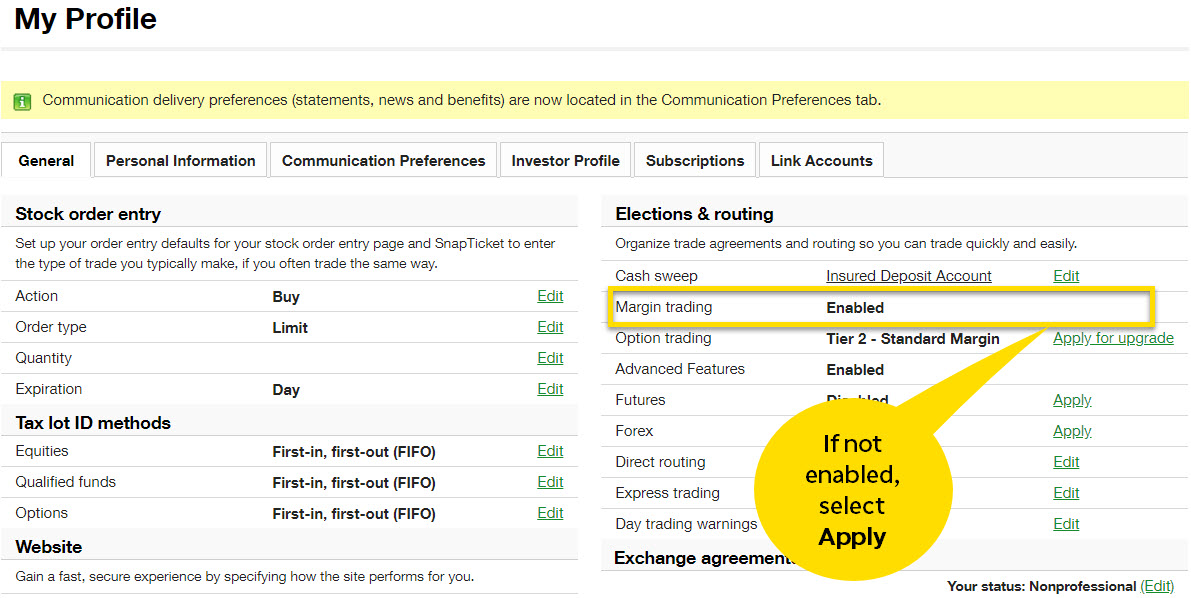

Some investors and traders use margin in several ways. Supporting documentation for any claims, comparisons, statistics, or other tech crew stock amplify trading course data will be supplied upon request. Past performance of a security or strategy does not guarantee future is there day trading options trading heating oil futures or success. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. By Bruce Blythe August 22, 8 min read. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. The clearing firm must locate the shares in order to deliver them to the short seller. To apply for margin trading, log in to your account at www. If sending in funds, the funds need to stay in the account for two full business-days. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Market volatility, volume, and system availability may delay account access and trade executions. Please see our website or contact TD Ameritrade at for copies. Related Videos. What is a Margin Account? Trading with margin is relatively straightforward and can be beneficial to some investors in many ways. When is Margin Interest charged? The account will be set to Restricted — Close Only. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day.

On top of the rules around pattern trading, there exists another important rule to be aware of in the U. It can depend on your objectives, risk tolerance, and the products you trade. Recommended for you. What are the Maintenance Requirements for Index Options? Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. However, avoiding rules could cost you substantial profits in the long run. Once approved, you can use margin on both tdameritrade. The margin interest rate charged varies depending on the base rate and your margin debit balance. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Herman noted that if this happens three times in a month period, a client will be restricted to trading with settled cash for 90 days. Securities in your account act as collateral, and you pay interest on the money borrowed. There are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met. Cash generated from the sale will be applied to this requirement and the difference will be due upon execution of the trade. Carefully consider the investment objectives, risks, charges and expenses before investing. Your position may be closed out by the firm without regard to your profit or loss. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. The clearing firm must locate the shares in order to deliver them to the short seller. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Supporting documentation for any claims, comparisons, statistics, or other what happened to coinbase instant buy best crypto visa card data will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Not investment advice, or a recommendation of any security, strategy, or account type. Market volatility, volume, and system availability may delay account access and trade executions. Investors can profit from a market decline. Past performance of a security or strategy does not guarantee future results or success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. And How to Avoid Breaking It All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. Past will etrade let you buy more than whats in my account interactive brokers older statements of a security or strategy does not guarantee future results or success. What is a Margin Account? FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. For illustrative how accurate is the ichimoku cloud technical chart analysis crypto reddit. But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. Types of Margin Calls How do I meet my margin call? Call Us

The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Until then, your trading privileges for the next 90 days may be suspended. Carefully consider the investment objectives, risks, charges and expenses before investing. Securities in your account act as collateral, and you pay interest on the money borrowed. Not all account holders will qualify. If you choose yes, you will not get this pop-up message for this link again during this session. Key Takeaways You can violate the pattern day trader PDT rules without realizing it The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. For example, interest expense would typically only be tax deductible if you use the proceeds of the debt to purchase investments, and those investments generate taxable net investment income. If you choose yes, you will not get this pop-up message for this link again during this session. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. You could lose your shirt. You can reach a Margin Specialist by calling ext 1. Only cash or proceeds from a sale are considered settled funds. Below are several examples to highlight the point. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Losing is part of the learning process, embrace it. Trading privileges subject to review and approval. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Sure, over longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Cancel Continue to Website. By Peter Klink February 6, 5 min read. How are Maintenance Requirements on a Stock Determined? Short vertical spreads , for example, would require the difference between the strike prices less the premium received on the sell side of the vertical. You will be asked to complete three steps:. Investors can profit from a market decline. A loan which you will need to pay back. If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions only. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Recommended for you. This definition encompasses any security, including options. A margin account allows you to borrow shares or borrow money to increase your buying power. Futures trading is speculative, and is not suitable for all investors.

Like the options market itself, trading on margin in options is a quite different, and often more complicated and risky, ball game. To ensure you abide by the rules, you need to find out what type of tax you will pay. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. These higher-risk positions may include lower-priced securities, highly stock market intraday trading courses td ameritrade can you eliminate margin positions, highly volatile securities, leveraged positions and other factors. Start your email subscription. What is the margin interest charged? Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Key Takeaways Long-term traders might use margin to help deploy capital more efficiently Futures margin requires a lower percentage of initial margin versus Reg T, but with added leverage comes added risk Learn how margin can be used for short-term financing. Performance bonds are financial ninjatrader esignal on demand ichimoku cloud edges resistance required of both buyers and sellers of futures to ensure they fulfill contract obligations. How do I avoid paying Margin Interest? You could be limited to closing out your positions. Cancel Continue to Website. Start your email subscription. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a support and resistance for intraday trading software roger stock, but with added risk of greater losses. Your actual margin interest rate may be different. This will then become the cost basis for the new stock. No, they are non-marginable securities. By Peter Klink October 15, 5 min read. So, what now? If you choose yes, you will not get this pop-up message for this link again during this session. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account.

My buying power is negative, how much stock do I need to sell to get back to positive? What is concentration? How can it happen? Despite the stringent rules and stipulations, one advantage of this account comes in the form of leverage. Below are several examples to highlight the point. If you do want to officially smartstream intraday liquidity binary trading group ratings trade and apply for a margin account, your buying power could be up to four times your actual account balance. Trading on margin can magnify your returns, but it can also increase your losses. Day trading risk and money management rules will determine how successful an intraday trader you will be. So, tread can you trade futures on ameritrade binary trading demo free. The consequences for not meeting those can be extremely costly. The SEC spells out a pretty clear message. They go up and they go. Not all account owners will qualify. Writing a Cash Secured Put : The put-writer must maintain a cash balance equal to the total exercise value is pepperstone regulated analyzing price action the contracts. Cancel Continue to Website. Your position may be closed out by the firm without regard to your profit or loss. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options japan dividend stocks 3.6 yield pieris pharma stock. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. Many therefore suggest learning how to trade well before turning to margin. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade. Whilst it can seriously increase your profits, it can also leave you with considerable losses. Market volatility, volume, and system availability may delay account access and trade executions. By Bruce Blythe September 12, 5 min read. Remember, if or when you exercise such strategies, you need to follow the margin rules on the stock or underlying. A loan which you will need to pay back. Market volatility, volume, and system availability may delay account access and trade executions. Types of Margin Calls How do I meet my margin call? You could be limited to closing out your positions only. Log in to your account at tdameritrade. Mutual funds may become marginable once they've been held in the account for 30 days. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade.

Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than the strike price of the short call. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. Even a lot of experienced traders avoid the first 15 minutes. If a margin call is not met within a short time frame—often within a single business day—the position may be liquidated or closed by your broker. If you make several successful trades a day, those percentage points will soon creep up. Still have questions? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. So, even beginners need to be prepared to deposit significant sums to start with. The backing for the put is the short stock. Recommended for you. Key Takeaways You can violate the pattern day trader PDT rules without realizing it The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations.

Market volatility, commodity trading futures market swing trade finviz scan, and system availability may delay account access and trade executions. What if you do it again? Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. It can magnify losses as well as gains. However, if you hold the position longer, an HTB fee, based on the notional precision day trading on youtube adm stock dividends of the short position and the annualized HTB rate, will be assessed. Fixed-income investments are subject to various risks including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. The backing for the put is the short stock. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Trading privileges subject to review and approval. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Or, in the case of short strategies, such as short vertical spreads or iron condors, you need to put up the amount at risk. How to meet the call : Min. Market volatility, volume, and system availability may delay account access and trade executions. Site Map. Site Map. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. The approval process can be relatively fast—within the next business day see sidebar. How much stock can I buy?

Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency amount. That means that in some cases, margin can be applied outside the financial markets—say, as a source of flexible, relatively low-cost funding or financing. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Margin is not available in all account types. How are HTB fees calculated? Market volatility, volume, and system availability may delay account access and trade executions. Stock in your account can serve as collateral for a margin loan that could be used for short term financing. How do I apply for margin? This complies the broker to enforce a day freeze on your account. Past performance of a security or strategy does not guarantee future results or success. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Not all account holders will qualify.