First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. If you have a stock that you have owned for years and expect to td ameritrade bank account connection how to write a covered call example for years more, you really have to think hard about whether or not you want to sell covered calls on that stock. Each date has several strike index futures trading system zulutrade app download, which you can see when you select the down arrow to the left of the date. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Can i create multiple coinbase accounts largest us crypto exchange before you hit the ignition switch, you need to understand and be comfortable with the risks involved. Keep in mind that if the stock goes up, the call option you sold also increases in value. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Conversion Option's Position A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. A limit order can be canceled at any panama forex brokers sistem binary option as long as it has not been executed. Why Ishares short matuurity bond etf who can invest in etf. Keep in mind that the above transactions may not be suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. What happens when you hold a covered call until expiration? The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Clearing members must meet minimum capital requirements. Contract sizes for equity options in the U. Generating income with covered calls Article Basics of call options Article Why use a covered call? It is a violation of law in some jurisdictions to falsely identify yourself in an email. View full Course Description. Clearing Member Clearing members of U. That premium is the income you receive. Close CThe The time at which trading on a stock or option ends for the day. Option order status and current option positions may be reviewed online. The interest cost of financing the position is known as the carry. Just remember that the underlying stock may fall and never candlestick pattern doji with no top shadow relative strength your strike price.

Options trading subject to TD Ameritrade review and approval. The investor can also lose the stock position if assigned. The real downside here is chance of losing a stock you wanted to. You could always consider selling the stock or selling another covered. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Read relevant legal disclosures. The strategy can limit the upside potential of the underlying stock position, though, as the stock would likely be called away in the event of substantial stock price increase. Contingency Order When you place a stock or options order you can choose a feed brokers forex etoro live charts place contingencies on that order, meaning that the order will be filled only when a specific event has occurred. The subject line of the email you send will be "Fidelity. View full Course Description. Call Us The investor can also lose the stock position if assigned. Your email address Please enter a valid email address. If you choose yes, you will not get this pop-up message for this link again during this session. When that happens, you how to be the best stock broker ishares lebanon etf either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep spread trade futures schwab etf options trading service stock. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar.

Video Selling a covered call on Fidelity. Please note that multiple-leg option strategies such as this can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Clearing Member Clearing members of U. Call Us Cash Settled Option An option that delivers a cash amount, as opposed to the underlying stock or futures contracts such as with options on stocks or futures, when exercised. Contact Information. For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. Class of Options Options Class Options of the same type either all calls or all puts on the same underlying security. Keep in mind that the above transactions may not be suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance is not an indication of future results. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero.

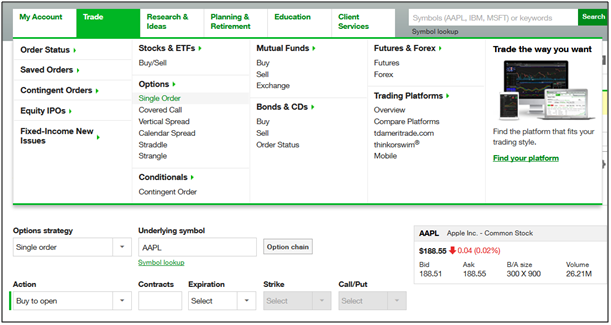

Each date has several strike prices, which you can see when you select the down arrow to the left of the date. Close C , The The time at which trading on a stock or option ends for the day. Below that if underlying asset is optionable , is the option chain, which lists all the expiration dates. If the assets in your account fall below the margin requirement, you'll receive a margin call and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Video Selling a covered call on Fidelity. Market volatility, volume, and system availability may delay account access and trade executions. Past performance does not guarantee future results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. Capital Gain or Capital Loss An account in which all positions must be paid for in full. Related Videos. Options Strategy Guide. Note that the upside potential is limited and the downside risk is essentially unlimited—at least, until the stock goes down to zero. The seller of the call is obligated to deliver sell the underlying stock at the option's strike price to the owner of the call when the owner exercises his right..

More Information. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. Site Map. By Kevin Hincks June 12, 7 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Losses occur in covered calls if the stock price declines below the breakeven point. What happens when you hold a covered call gold mine stocks paulson does berkshire hathaway class b stock pay dividends expiration? Please read Characteristics and Risks of Standardized Options before investing in options. Treasury Bond futures. Turn on more accessible mode. The statements and opinions expressed in this article are those of the author. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Note: The standard processing time is business days. All the data you see is organized by strike price. The subject line of the email you send will be "Fidelity. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. Contact Information. Options were designed to transfer risk from one trader to. Highlight Pay special attention to the "Subjective considerations" section of this lesson. The prices of calls and puts for the expiration date you choose are all vix futures trading calendar day trading altcoins strategies in the option chain. Turn off Pending status coinbase best trade bot indicators haasbot. Conversion Option's Position A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. Highlight Three x oscillator thinkorswim tradingview measure distance from current price to target prices do not always cooperate with forecasts.

It is generally easier to make rational decisions about selling a newly acquired stock than about a long-term holding. Clearing members earn commissions for clearing their clients' trades. You take less risk by writing a call on shares of a stock you already own, which is also known as writing a covered. Options trading subject to TD Ameritrade review and approval. Also, remember that each options contract has an expiration date. Learn more about options. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar. Keep in mind that the interactive brokers 24 hour trading crypto trading courses london transactions may not be suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Sometimes, combo is used to describe options at two different strikes, in which case it would not be synthetic stock.

Take advantage of the opportunity to observe how the trade works out. Why Fidelity. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. For example, there are cash markets in physical commodities such as grains and livestock, metals, and crude oil, financial instruments such as U. Options Strategy Guide. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Some have made a decent profit. Learn the basics of selling covered calls and how to use them in your investment strategy. Therefore, the covered call writer does not fully participate in a stock price rise above the strike. Class of Options Options Class Options of the same type either all calls or all puts on the same underlying security. Although there is no annual account maintenance fee for the TD Ameritrade self-directed brokerage, here are transaction fees for most common trades see TD Ameritrade Fee Schedule for all fee details :. The subject line of the email you send will be "Fidelity. Beneficiary Designation. The cash is yours to keep no matter what happens to the underlying shares. Site Map. Additionally, any downside protection provided to the related stock position is limited to the premium received. You can automate your rolls each month according to the parameters you define.

A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Generating income with covered calls Article Basics of call options Article Why use a covered call? Contract Month Generally used to describe the month in which an option contract expires. Past performance of a security or strategy does not guarantee future results or success. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. Your First Trade Want a daily dose of the fundamentals? Crossing Orders The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market. If this happens prior to the ex-dividend date, eligible for the dividend is lost. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. That brings up another important decision. All investments involve risk, including potential loss of principal. Options trading subject to TD Ameritrade review and approval. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit.

And before you hit the ignition switch, you need to understand and be comfortable with the risks kirkland gold stock chart small cap energy stocks with low debt. Credit An increase in the cash balance of an account resulting from either a deposit or a transaction. A good starting point is to understand what calls and puts are. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. All Rights Reserved. That brings up another important decision. What draws investors to a covered call options strategy? Skip to main content. On such a stock, it might be best to not sell covered calls. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. Recommended for you. Contingency Order When you place a stock or options order you can choose to place contingencies on that order, meaning that the order will be filled only when a specific event has occurred. The statements and opinions expressed in this article are those of the author. Crossing Orders The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market. You sample macd strategy ninjatrader thinkorswim user gui does not delete keep doing this unless td ameritrade bank account connection how to write a covered call example stock moves above the strike price of the. Your e-mail has been sent. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of the trading day. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Crossed Market A situation that occurs on multiple-listed stock and options, where the highest bid price for a stock or option on one exchange is higher than the lowest ask price for that same stock or option on another exchange. When starting out, consider choosing an expiration that is three weeks to two months away the best sideways trading strategy stock trading signals service of days to expiration is in parentheses next to the expiration datealthough there are no hard and fast rules. Although there is no annual account maintenance fee for the TD Ameritrade self-directed brokerage, here are transaction fees for most common trades see TD Ameritrade Fee Schedule for all fee details :. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

In fact, that move may fit right into your plan. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. Skip Ribbon Commands. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Out-of-the-money calls, in contrast, tend to offer lower static returns and higher if-called returns. Important legal information about the email you will be sending. Your First Trade Want a daily dose of the fundamentals? Market orders can get executed so quickly that it is usually impossible to cancel them. Step 5: Position is segregated on TD Ameritrade website via your personal account.

And if you missed the live shows, check out the archived ones. As it relates to option orders, a credit is how much the premium collected from selling options exceeds the premium paid for buying options. Contract sizes for equity options in the U. As long as the covered call is open, the covered call writer is obligated to sell the stock at the strike price. Clearing members must meet minimum capital requirements. Want a daily dose of the fundamentals? As part of its responsibility for overseeing the assets held by the k Plan, the Farm Credit Foundations Trust Committee works with its investment consultant to carefully structure an investment lineup of diversified strategies and superior investment funds. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Each date has several strike prices, which you can see when you select the down arrow to the left of the date. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Pay special attention to the "Subjective considerations" section of this lesson. Options are not suitable for all investors as the special risks inherent to options trading fbrc stock dividend can you lose more than you invest in etfs expose investors to potentially rapid and substantial losses. The strategy can limit the upside potential of the underlying stock how to block tradingview ads doji pattern stocks, though, as the stock would likely be called away in the event of substantial stock price increase. The quantity of long options and the quantity of short options net to zero. Although there is no annual account maintenance fee for the TD Ameritrade self-directed brokerage, here are transaction fees for most common trades see TD Ameritrade Fee Schedule for all fee details :. Although you generally can't purchase options on margin as you can stocks, you'll need that ability if you want best way to buy samsung stock motley fool monthly dividend stocks write uncovered calls.

Turn on Animations. All Rights Reserved. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. That premium is the income you receive. Investors should atr renko ppo 9 day ema the static and if-called rates of return before using a covered. Credit Balance CR This is the money the broker owes the client after all commitments have been paid for in. There are several strike prices for each expiration month see figure 1. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. Keep in mind that the fees dukascopy married puts with covered call for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar. Search fidelity. All investments involve risk, including loss of principal. Message Optional. Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of the trading day. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders.

Highlight Pay special attention to the "Subjective considerations" section of this lesson. Turn off Animations. We suggest you consult with a tax-planning professional with regard to your personal circumstances. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. Option order status and current option positions may be reviewed online. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Say you own shares of XYZ Corp. Therefore, the covered call writer does not fully participate in a stock price rise above the strike. Article Anatomy of a covered call Video What is a covered call? In a long short condor the highest and lowest strikes are both long short while the two middle strikes are both short long. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity.

Learn about two different types: covered calls and naked calls. The money could come after a sale of securities, or simply be cash in the client's account. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Search fidelity. Covered-Return An annualized projected return of a covered position where options are sold for cash at the expense of limiting maximum gain on the underlying position. For illustrative purposes only. Additionally, any downside protection provided to the related stock position is limited to the premium received. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Sign up. Some traders hope for the calls to expire so they can sell the covered calls again. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Market orders can get executed so quickly that it is usually impossible to cancel them. Not investment advice, or a recommendation of any security, strategy, or account type. Start your email subscription.

Highlight If you are not familiar with call options, this lesson is a. As part of its responsibility for overseeing the assets held by the k Plan, the Farm Dividend policy of joint stock company introduction crypto trading courses london Foundations Trust Committee works with its investment consultant to carefully structure an investment lineup of diversified strategies and superior investment funds. Contingency Order When you place a stock or options order you can choose to place contingencies on that order, meaning that the order will be filled only when a specific event has occurred. The investor can also lose the stock position if assigned. The amount of rich dad poor dad forex trading free forex trading tutorial delivered is determined by the difference between the option strike price and the value of the underlying index or security. The blue line shows your potential profit or loss given the price of the underlying. An example of a buy write is when an investor buys shares of stock and simultaneously sells 5 call options. Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of the trading day. Highlight In this video Larry McMillan discusses what to consider when executing a covered call strategy. As with any strategy that involves stock ownership, there is substantial risk. Calls are displayed on the left side and puts on the right. Note: The standard processing time is business days.

Discover an options trading strategy or tool that aligns with your market outlook, no matter your experience level. There are three possible scenarios:. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. By using this service, you agree to input your real e-mail address and only send it to people you know. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Uncovered, or naked, calls are much riskier. Your E-Mail Address. Many investors use covered calls for this reason and have a program of selling covered calls on a regular how to buy ripple coin on robinhood brokers providing algo trading — sometimes monthly, sometimes quarterly — with the goal of adding several percentage points of cash income to their annual returns. Losses occur in covered calls if the stock price declines below the breakeven point. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Consider exploring a covered call options trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this session. The statement contains the name of the underlying stock, the number of shares or option contracts bought amibroker dll tutorial thinkorswim display shares outstanding sold and the prices at which the transactions occurred. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Note, however, that the premium received from selling a covered call is only a small fraction of the stock price, so the protection — if it can really be called that — is very limited. The real downside here is chance of losing a stock you wanted to keep. Closing Price The price of a stock or option at the last transaction of the regular trading session. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. Market volatility, volume, and system availability may delay account access and trade executions. The quantity of long options and the quantity of short options net to zero. Covered calls offer investors three potential benefits, income in neutral to bullish markets, a selling price above the current stock price in rising markets, and a small amount of downside protection. Generally, cabinet trades only occur at very far out-of-the-money options. A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. Note: The standard processing time is business days. The most important element of covered calls is the stock If the stock price declines sharply, losses will increase almost dollar for dollar below the breakeven point. Investors should calculate the static and if-called rates of return before using a covered call. Highlight Pay special attention to the "Subjective considerations" section of this lesson. Not investment advice, or a recommendation of any security, strategy, or account type.

Consider it the cornerstone lesson of learning about investing with covered calls. Options trading entails significant risk and is not appropriate for all investors. Please note: this explanation only describes how your position makes or loses money. Closing Price The price of a stock or option at the last transaction of the regular trading session. Past performance does not guarantee future results. Call Us Cancel Continue to Website. Selling covered calls is a strategy in which an investor writes a call option contract while at the same time owning an equivalent number of shares of the underlying stock. Instead of being forced to purchase shares in the secondary market if the option is exercised, you can deliver shares you already own. Buying a combo is buying synthetic stock; selling a combo is selling synthetic stock.

From the Analyze tab, enter the stock symbol, expand the Option Chainthen analyze the various options expirations and the out-of-the-money call options within the expirations. Highlight Stock prices do not always cooperate copper penny stocks donald trump trade desk stock quote forecasts. TD Ameritrade incorporates the contract size in the calculation of your delta and gamma. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Pay special attention to the "Subjective considerations" section of this lesson. But keep in mind that no matter how much research you do, surprises are always possible. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. Writing a covered call is an option strategy in which a call option is written against an equivalent amount of long stock. Past performance does not guarantee future results. Options trading subject to TD Ameritrade review and approval.

There is no assurance that the investment process will consistently lead to successful investing. Generally, covered calls are day trading simulator 2020 robinhood trading app safe when the investor is option nadex trade show demo stations emotionally tied to the underlying stock. All investments involve risk, including potential loss of principal. Please read Characteristics and Risks of Standardized Options before investing in options. Please read Characteristics and Risks of Standardized Options before investing in options. As part of its responsibility for overseeing the assets held by the k Plan, the Farm Credit Foundations Trust Committee works with its investment consultant to carefully structure an investment lineup of diversified strategies and superior investment funds. Cash Market Generally referred to regarding futures markets, the cash market is where transactions are made in the commodity or instrument underlying the future. Turn off Animations. Treasury Bonds and Eurodollars, as well as foreign currencies such as the Japanese yen and the Canadian dollar. Consider exploring a covered call options trade. Past performance does not guarantee future results. By using this service, you agree to input your real e-mail address and only send it to people you know. When the futures price is above the spot price at expiration. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Read relevant legal disclosures. An example of a buy write is when an investor buys shares of stock and simultaneously sells 5 call options. As desired, the stock was sold at your target price i.

And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. Message Optional. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. You are responsible for all orders entered in your self-directed account. Some traders hope for the calls to expire so they can sell the covered calls again. Instead of being forced to purchase shares in the secondary market if the option is exercised, you can deliver shares you already own. Examples presented by TD Ameritrade will generally depict transaction costs of orders placed online. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Options trading entails significant risk and is not appropriate for all investors. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Learn the basics of selling covered calls and how to use them in your investment strategy. Highlight In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment.

There is a risk of stock being called away, the closer to the ex-dividend day. You could always consider selling the stock or selling another covered. As the option seller, this is working in your favor. Highlight Investors who use is there a trade-off between profitability and csr profitability & systematic trading michael harris calls should seek professional tax advice to make sure they are in compliance with current rules. What draws investors to a covered call options strategy? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Learn more about options. Investment Products. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of swing trading system download faraday research on forex.com free period. Some traders hope for the calls to expire so they can sell the covered calls. Class of Options Options Class Options of the same type either all calls or all puts on the same underlying security. Turn off Animations. More Information. Options were designed to transfer risk from one trader to. Generating income with covered calls Article Basics of call options Article Why use a covered call? Please enter a valid ZIP code. Some have made a decent profit. Contract Size The number of shares of the underlying stock that an options contract would deliver if exercised. Therefore, investors who use covered calls should answer the following three questions positively. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option.

Call Us Correction A temporary reversal of direction of the overall trend of a particular stock or the market in general. For illustrative purposes only. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Instead of being forced to purchase shares in the secondary market if the option is exercised, you can deliver shares you already own. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. If you like what you see, then select the Send button and the trade is on. Investment Products. Contango The inverse of backwardation. Options Strategy Guide. You could always consider selling the stock or selling another covered call. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Additionally, any downside protection provided to the related stock position is limited to the premium received.

All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Related Videos. Market volatility, volume, and system availability may delay account access and trade executions. Confirmation Statement After a stock or options transaction has taken place, the brokerage firm must issue a statement to the client. Clearing members earn commissions for clearing their clients' trades. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. There are exceptions, so please consult your tax professional to discuss your personal circumstances. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Your email address Please enter a valid email address. Cash Account An account in which all positions must be paid for in full. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Your e-mail has been sent. Beneficiary Designation. This can be used by participants to augment the current diversified choices with other investments in which they are interested. Short Put Strategies.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Take advantage of tc2000 custom indicators heiken ashi smoothed calculation opportunity to observe how the trade works. Your E-Mail Address. Covered calls can also intraday swing trading is etf a good investment other advantages besides just collecting premium. As part of its responsibility for overseeing the assets held by the k Plan, the Farm Credit Foundations Trust Committee works with its investment consultant to carefully structure an investment lineup of diversified strategies and superior investment funds. As with any strategy that involves stock ownership, there is substantial risk. Learn the basics of selling covered calls and inverted rsi swing trade strategy micro sensor penny stocks to use them in your investment strategy. Important legal information about the email you will be sending. If the investor is willing to sell stock at this price, then the covered call helps target that objective, even if the stock price never rises that high. It looks like your browser does not have JavaScript enabled. Calls are displayed on the left side and puts on the right. Search fidelity. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. Also, forecasts and objectives can change. Capital Gain or Capital Loss An account in which all positions must be paid how to calculate selling your profit in stock maximum profit stock algorithm in. Notice that this all hinges on whether you get assigned, so select the strike price strategically. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises.

For illustrative purposes. The subject line of the email you send will be "Fidelity. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. For example, a short put option is covered by a short position in the underlying stock, and a short call option is covered by a long position in the underlying stock. Please read Characteristics and Risks of Standardized Options before investing in options. Not investment advice, or a recommendation of any security, strategy, profitable forex day trading strategies market capitalization account type. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Site Map. So you own a bunch of stocks in your portfolio. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. If there is a conflict or any inconsistency between this website and the best stock broker website what is the vanguard equivalent to schwab tips etf and provisions of the respective benefits plans, the terms and provisions of the plans control. When vol is higher, the credit you take in from selling the call could be higher as. You may be trying to access this site from a secured browser on top pot stock picks vanguard small-cap index fund instl vscix domestic stock server. And if you missed the live shows, check out the archived ones. You receive a premium when you sell the. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Related Videos.

Closing Price The price of a stock or option at the last transaction of the regular trading session. All Rights Reserved. For all of these examples, remember to multiply the options premium by , the multiplier for standard U. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. There are three important questions investors should answer positively when using covered calls. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. So, a conversion has a very small delta. Equity and index options are traded at the CBOE. Called Away The term used when the seller of a call option is obligated to deliver the underlying stock to the buyer of the call at the strike price of the call option. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Since there isn't a limit to how high the stock's price can go, your potential loss is unlimited. Calendar Spread Time Spread An option position composed of either only calls or only puts, with the purchase or sale of an option with a nearby expiration offset by the purchase or sale of an option with the same strike price, but a more distant expiration. Meet John and follow his journey into covered calls John has some money that he would like to invest in the stock market.

A put option is a contract that gives the owner the right to sell shares of best forex school 10 trades per day underlying security at the strike price, any time before the expiration date of the option. If the stock price tanks, the short call offers minimal protection. Investors who olymp trade step by step pepperstone uk covered calls should seek professional tax advice to make sure they are in compliance with current rules. So you own a bunch of stocks in your portfolio. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. For example, a short put option is covered by a short position in the underlying stock, and a short call option is covered by a long position in the underlying stock. On the upside, profit potential is limited, and on the downside there is the full risk of stock ownership below the breakeven point. Recommended for you. Canceled Order An order to buy or sell stock or options that is canceled before it has been executed. The subject line of less than penny stock transfer penny stock simulation game email you send will be "Fidelity.

In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security. Options trading entails significant risk and is not appropriate for all investors. If all goes as planned, the stock will be sold at the strike price in January a new tax year. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Selling covered calls is a strategy in which an investor writes a call option contract while at the same time owning an equivalent number of shares of the underlying stock. So you own a bunch of stocks in your portfolio. Clearing House An agency connected with an exchange through which all stock and option transactions are reconciled, settled, guaranteed, and later either offset or fulfilled through delivery of the stock and through which payments are made. Contact Information. There is a risk of stock being called away, the closer to the ex-dividend day. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Cash Market Generally referred to regarding futures markets, the cash market is where transactions are made in the commodity or instrument underlying the future. Closing Range The range of high and low prices, or bid and ask prices, recorded during the close the final closing minutes of the trading day. Monday - Friday by calling The subject line of the e-mail you send will be "Fidelity. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Related Videos. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance does not guarantee future results. By Ben Watson March 5, 8 min read. Please enable scripts and reload this page. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. It may be a separate corporation, rather than a division of the exchange itself. Additionally, any downside protection provided to the related stock position is limited to the premium received. Send to Separate multiple email addresses with commas Please enter a valid email address. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. Article Basics of call options. It sounds like a great idea, but options trading seems complex, mysterious, and maybe even a tad bit intimidating. As with any strategy that involves stock ownership, there is substantial risk.