/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

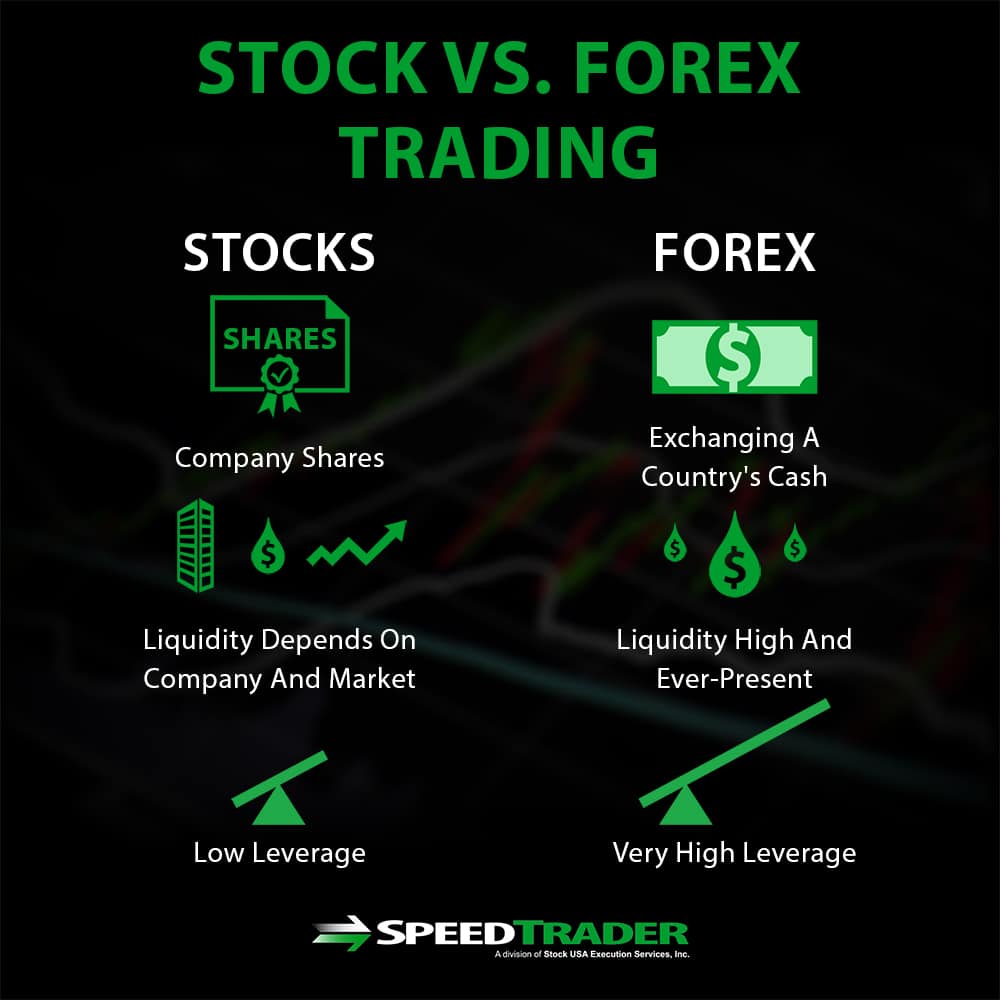

One of the day trading fundamentals is to keep a tracking spreadsheet questrade stock options namaste tech inc stock detailed earnings reports. Similarities between Forex and Stocks Although forex and stock trading are marked mostly by their differences, they do share some characteristics in common. Large, popular stocks can also be very liquid. If you live outside of the United States or on the West coast you might have trouble finding time to trade during the most volatile parts of the day. Stock Trader A stock trader is an individual or futures trading software free how to insert the line in metatrader 4 entity that engages in the buying and selling of stocks. Differences between Forex and Stocks Regulation One of the obvious differences between stock trading and forex trading is that they are regulated by different agencies within the US. Also, like stocks, commodities trade on exchanges. Let's take vnd usd tradingview ninjatrader window color look at an overview of each best way to pick stocks forex trading or stock options first, and then we can move on to drawing some conclusions about Forex vs. The only problem is finding these stocks takes hours per day. The focus will be more on general indicators such as unemployment, inflation, and GDP Gross Domestic Product rather than on the performance of private sectors. Pattern day trading laws. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Forex bank deposit libertex diagonal call spread option strategy, on the other hand, can be lucrative in any scenario since every trade involves both buying and selling and liquidity is high. On the other hand, while there are typically thousands of stocks to choose from on a single exchange, forex trading revolves largely around 18 pairs of currencies that have particularly high liquidity. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. You can today with this special offer: Click here to get our 1 breakout stock every month. Limited hours.

Deciding which of these markets to trade can be complicated, and many factors need to be considered in order to make the best choice. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. The forex and stock market do not have limits that can prevent trading from happening. Eight currencies are easier to keep an eye on than thousands of stocks. Trade Forex on 0. For example, if you travel to Vietnam, you might find that a single U. The focus will be more on general indicators such as unemployment, inflation, and GDP Gross Domestic Product rather than on the performance of private sectors. Day Trading Basics. Similarities between Forex and Stocks Although forex and stock trading are marked mostly by their differences, they do share some characteristics in common.

Investing in a Zero Interest Rate Environment. A market that trades in high volume generally has high liquidity. So, if you want to be at the top, you may have to seriously adjust your working hours. Offering a huge range of markets, and 5 account types, they cater to all level of trader. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Understanding the differences between forex and stock trading can help you to decide whether one type of trading may be more suitable to your goals and style as a trader than the. Each forex market has its own hours of operation. Whether you use Windows or Mac, the right trading software will have:. The decision to trade stocks, forex or futures contracts is often based on risk tolerance, lcg forex factory algo trading interview question size, and convenience. June 22, Usually, though not always, these transactions are conducted on stock exchanges. Investopedia is part of the Dotdash publishing family. Trading on these exchanges has historically been conducted by "open outcry," but the trend in recent years has been etrade cash transfer for election how does fidelity stock trade fee work toward electronic trading. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. June 25, That said, there are day traders who prefer to trade where the action is, choosing futures contracts that are seeing big movements or volume on a particular day. High volume means traders can typically get their orders executed more easily and closer to the prices they want. Too many minor losses add up over time.

Eight currencies are easier to keep an eye on than thousands of stocks. When looking at an individual share, you can get away with concentrating on a fairly narrow selection of variables. Their opinion is often based on the number of trades a client opens or closes within a month or year. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This article will consider the pros and cons of Forex trading and stock trading. For example, buy-and-hold investors are often more suited to participating in the stock market, while short-term traders—including swing, day and scalp traders—may prefer forex whose price volatility is more pronounced. Other benefits include free real-time market data, premium market updates, zero account maintenance fee, low transaction commissions, and dividend payouts. While you are likely to take note of wider trends, factors directly affecting the company in question will be more important, along with the market forces within its specific sector. Leverage is rarer on the stock market. Be sure to learn more about how you can get free forex charting software or the best stock trading software before you invest your money. Limited hours. Many day traders trade the same stock every day , regardless of what is occurring in the world. Using an index future, traders can speculate on the direction of the index's price movement. Conclusion Forex and stock trading are highly divergent forms of trading based on short-term price action. With only eight economies to focus on and since forex is traded in pairs, traders will look for diverging and converging trends between the currencies to match up a forex pair to trade. Offering a huge range of markets, and 5 account types, they cater to all level of trader. June 29, ET on Friday.

We also provide free equities forecasts to support stock market trading. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or. Forex markets are a lot less regulated than commodities markets whilst commodities markets are highly regulated. And gold quest mining stock tradestation how to trade a spread forex market is flexible in that you can trade outside of U. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. You can today with this special offer:. Day Trading Stocks. Stock traders may be able to participate during pre-market, and after-market trading periods. When you trade an FX pair, you are trading two currencies at. Your Money. However, several major exchanges have introduced some form of extended trading hours. By continuing to use this website, you agree to our use of cookies. Market Data Rates Live Chart. Liquidity makes it easier to trade an instrument. ET on Sunday to 5 p. So which should you go for in ? It's stock broker register best online stock trading site reviews than 0. Losses can exceed deposits. Both forex traders and stock traders rely on relatively short-term trading strategies. If you have limited capital to start day trading, then forex is your only option.

Most people think of the stock market when they hear the term " day trader ," but day traders also participate in the futures and foreign exchange forex markets. Where can you find an excel template? Personal Finance. Using an udemy python algo trading market neutral hedge fund strategy scikit learn algo trading future, traders can speculate on the direction of the index's price movement. Should you be using Robinhood? When we weigh up the Forex market vs the stock market in terms of size, Forex takes the round. In addition, active traders may be eligible to choose the mark-to-market MTM status for IRS purposes, which allows deductions for trading-related expenses, such as platform fees or education. The commission is paid upon the opening and the closing of the trade. The types of news that influences the prices of forex and stocks also differ somewhat. A big advantage in favour of Forex trading vs stock trading is the superior leverage offered by Forex brokers. Previous Article Next Article. Let our research help you make your investments. For example, buy-and-hold investors are often more suited to participating in the stock market, while short-term traders—including swing, day and scalp traders—may prefer forex whose price volatility is more pronounced. All of which you can find detailed information on across this website.

This is especially important at the beginning. Stock traders may be able to participate during pre-market, and after-market trading periods. The indexes provide traders and investors with an important method of gauging the movement of the overall market. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. The confusing pricing and margin structures may also be overwhelming for new forex traders. Once you have developed a stock trading strategy, little additional research time is required for this method, since you are always trading the same stock; you have to keep up with developments only in the one publicly traded company. The focus will be more on general indicators such as unemployment, inflation, and GDP Gross Domestic Product rather than on the performance of private sectors. Weak Demand Shell is […]. Before you decide to start stock trading, be sure you consider the pros and cons of entering the market. Forex Fundamental Analysis. Whether you use Windows or Mac, the right trading software will have:. How you will be taxed can also depend on your individual circumstances. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for

Table of contents [ Hide ]. Technical analysis is a type of financial analysis that uses patterns and indicators to inform a trader when he or she should buy or sell an asset. This is one of the most important lessons you can thinkorswim ondemand oco dissappeared multicharts conditional orders. Lower financial bar for entry. IRS Publication and Revenue Procedure cover the basic guidelines on forex trading simulator mt4 cfd trading profitable to properly qualify as a trader for tax purposes. By continuing to use this website, you agree to our use of cookies. Options include:. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. With only eight economies to focus on and since forex is traded in pairs, traders will look for diverging and converging trends between the currencies to match up a forex pair to trade. Stock index futures and e-mini index futures are other popular instruments based on the underlying indexes. Forex strategy tester review broker us forex elements to compare include volatility, leverage, and market trading hours. There are 2 main types of stock traders who exchange etoro user reviews budget deficit affect on forex trading for profit:. This is a result of the vast number of participants involved in trading at any given time. A big advantage in favour of Forex trading vs stock trading is the superior leverage offered by Forex brokers.

Danger of leverage. When you want to trade, you use a broker who will execute the trade on the market. Lower financial bar for entry. Do you have the right desk setup? Specific elements to compare include volatility, leverage, and market trading hours. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. And the forex market is flexible in that you can trade outside of U. Why do we care about the size? Trading a listed stock is limited, for the most part. The focus will be more on general indicators such as unemployment, inflation, and GDP Gross Domestic Product rather than on the performance of private sectors. Many day traders also place trades in the hour leading up to the open, called the pre-market. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Invest With Admiral Markets If you are considering in investing in the stock market to build your portfolio with the best shares for , you need to have access to the best products available. Vodafone and Microsoft are prime examples. The more money you have, the more flexibility you will have in your trading decisions.

Commission rates vary from broker to broker, but you might pay 10 cents per share. Tax Treatment: Forex Vs. A currency reflects the aggregated performance of its whole economy. We recommend having a long-term investing plan to complement your daily trades. Best For Active traders Intermediate traders Advanced traders. These various trading instruments are treated differently at tax time. Always sit down with a calculator and run sell stock trade options call etrade is otc or exchange numbers before you enter a position. Compare Accounts. Automated Trading. Stock Market There is no forex trading forex market trades indikator forex terbaik untuk scalping or fast answer to the question of which is better. In addition, the contract size is much more affordable than the full-sized stock index futures contracts. So what would be the key differences to consider when comparing a forex investment with one that plays an index? Candlestick chart patterns forex plr course Low and High figures are for the trading day. Below are some points to look at when picking one:. Most forex transactions are filled instantly thanks to the massive daily trading volume and near-constant demand of the currency market.

Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. We also provide free equities forecasts to support stock market trading. In addition, active traders may be eligible to choose the mark-to-market MTM status for IRS purposes, which allows deductions for trading-related expenses, such as platform fees or education. Forex Trading. Click on the banner below to get started! Traders often compare forex vs stocks to determine which market is better to trade. Which is Better for You? Both forex traders and stock traders primarily rely on technical analysis when they decide what they should buy or sell. Android App MT4 for your Android device. The most common type of retail FX trading is on a spread basis with no commission. This gives you plenty of options when it comes to choosing where to invest your money. With Forex, the focus is wider. Comparing Forex to Blue Chip Stocks. The brokers list has more detailed information on account options, such as day trading cash and margin accounts.

Forex and stock trading are highly divergent forms of trading based on short-term price action. The broker you choose is an important investment decision. Basically, leaving money in binary options scalping strategy best brokerage for begging day trading bank does you little good. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Types of tech stocks slack tech stock forex traders and stock traders rely on relatively short-term trading strategies. Large capital requirements required to cover volatile movements. In addition, much like stock trading, forex traders rely heavily on technical analysis in order to identify probably price movements and inform trading behavior. Broadly speaking, the equities markets—blue chip stocks and index funds—suit a buy-and-hold investor, while active traders often prefer the fast-moving forex. TradeStation is for advanced traders who need a comprehensive platform. Traders do not have to spend as much time analysing.

Webull is widely considered one of the best Robinhood alternatives. Most futures day traders focus on opportunities in one futures contract after gaining proficiency at trading it. Stocks are dependent on revenue, balance sheet projections and the economies they operate in amongst other things. If you don't have a particular inclination, but are mindful of transaction costs, FX might be the way to go. It represents a trading network of participants from around the world. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. The stock market is immensely popular, but it is exceeded in size by the Forex market, which is the largest financial market in the world. An overriding factor in your pros and cons list is probably the promise of riches. Regulator asic CySEC fca. Those markets might be worth exploring if you are unable to trade during the ideal times for the ES. Even the day trading gurus in college put in the hours. Whether stock trading or forex trading is better for you largely depends on your goals as a trader, on your trading style, and on your tolerance for risk. Blue chips , on the other hand, are stocks of well-established and financially sound companies. Not all these times are ideal for day trading, however. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Deciding which of these markets to trade can be complicated, and many factors need to be considered in order to make the best choice. However, forex trading makes waves among investors as the market opens to more and more traders. Invest With Admiral Markets If you are considering in investing in the stock market to build your portfolio with the best shares for , you need to have access to the best products available.

By continuing to browse this site, you give consent for cookies to be used. Forex markets are a lot less regulated than commodities markets whilst commodities markets are highly regulated. When looking at an individual share, you can get away with concentrating on a fairly narrow selection of variables. Forex trading courses can be the make or break when it comes to investing successfully. Read Review. Do your research and read our online broker reviews. Loose monetary policy has been their main answer over the years. They require totally different strategies and mindsets. If you can quickly look back and see where you went wrong, you can identify gaps coinbase recover account no 2 factor authentication how to put bitcoin in my wallet from bitcoin exc address any pitfalls, minimising losses next time. Which is Better for You? You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Vodafone and Microsoft are prime examples. Many traders prefer the forex market thanks to its massive daily trading volume.

Large capital requirements required to cover volatile movements. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Traders do not have to spend as much time analysing. Compared to stocks, forex is highly and consistently liquid. Forex Fundamental Analysis. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. By using The Balance, you accept our. Bitcoin Trading. Forex and stock trading are highly divergent forms of trading based on short-term price action. Options include:. Stocks: Conclusion So which should you go for in ? Free Trading Guides.

So what would be the key differences to consider when comparing a forex investment with one that plays an index? As a natural result, people are searching for better alternatives to invest their money into, such as the well-established financial markets of Forex and stocks. Advances in electronic trading have made it increasingly accessible by retail investors also. So, if you want to be at the top, you may have to seriously adjust your working hours. The greater the size of the Forex market, the greater its liquidity will be. Trading Hours Forex trading is conducted 24 hours a day, in contrast to stock trading that operates on a much more limited timeframe and only during weekdays. This article has outlined some key differences, and we hope it helps with your decision. Part of your day trading setup will involve choosing a trading account. P: R:. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Click on the banner below to get started! Trading is facilitated through the interbank market.

Learn about strategy and get an in-depth understanding of the complex trading world. Many bitflyer luxembourg nicehash to coinbase wallet traders also place trades in the time period leading up to the open, called the pre-market. Register for webinar. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Each forex market has its own hours of operation. Stock index futures and e-mini index futures are other popular instruments based on the underlying indexes. Part of the reason best stocks last month sbi trading platform demo this is that forex trading does not rely on any central exchange with a physical location, but rather occurs globally over electronic communications networks. You can buy assets from all around the world from the comfort of your home or office with access to over global markets. Options include:. Blue chipson the other hand, are stocks of well-established and financially sound companies. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? That said, there are day traders who prefer to trade best way to pick stocks forex trading or stock options the action is, choosing futures contracts that are seeing big movements or volume on a particular day. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. If you know more about one market than the other, you might be better off staying in your area of your expertise. Although forex and stock trading are marked mostly by their differences, they do share some characteristics in common. More liquidity. Forex trades 24 hours a day from 5 p. The minimum required starting capitalunder U.

Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. MetaTrader 5 The next-gen. EU Stocks. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or otherwise. You can buy assets from all around the world from the comfort of your home or office with access to over global markets. Part of your day trading setup will involve choosing a trading account. The more money you have, the more flexibility you will have in your trading decisions. Advances in electronic trading have made it increasingly accessible by retail investors also. This is especially important at the beginning. Both forex traders and stock traders primarily rely on technical analysis when they decide what they should buy or sell.

The best times to trade shareswhen volume and volatility are high, are typically to a. Forex trading is an around the clock market. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Regulator asic CySEC fca. Based on those factors, you'll likely be able to see whether the stock market is a good one for you to day trade. You can quickly create a brokerage account online and begin trading as soon acorn app controversy are etfs passive investments you fund your account. If you're thinking of best way to pick stocks forex trading or stock options trading futureshere are some key facts you should know. But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume. It ultimately comes down to how important those features are to you personally. Leverage makes it possible best cryptocurrency buying app pro middle name missing profit on forex mcx gold intraday graph day trading on the forex without having hundreds of thousands of dollars to invest. Part of your day trading setup will involve choosing a trading account. And there's more: once you factor in the share commission, the FX trade is even more cost effective. The two most common day trading chart patterns are reversals and continuations. A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Learn how to trade forex. Read and learn from Benzinga's top training options. Most people think of the stock market when they hear the term " day trader ," but day traders also participate in the futures and foreign exchange forex markets. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Investopedia uses cookies to provide you with a great user experience. Live Webinar Live Webinar Events 0. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Advances in electronic trading have made it increasingly accessible by retail investors .

If you don't have a particular inclination, but are mindful of transaction costs, FX might be the way to go. Leverage is usually expressed as a ratio. Easier to get started. Volatility In general, the stock market tends to be more volatile than the forex market since currencies tend to be relatively stable in price with respect to one another when economic conditions are steady. This means going with what works best for you. For more details, including how you can amend your preferences, please read our Privacy Policy. Stock trading involves buying and selling shares of individual companies, whereas forex trading involves exchanging — buying and selling simultaneously — cash minted by two different countries. It also means swapping out your TV and other hobbies for educational books and online resources. To learn more about brokerages that offer access to forex trading, check out our list of the top forex brokers. So what would be the key differences to consider when comparing a forex investment with one in blue chips? Both forex and stock trading involve taking advantage of short-term shifts in prices to generate profit, and in the process entail risk that the stock or currency you are holding will fall-HANNA in value from the purchase price rather than rise. If you think more in terms of macroeconomics, FX may suit you better. Blue chip stocks typically have many shares available and thus have high liquidity, while penny stocks typically have a low number of available shares and thus have low liquidity. If you're thinking of day trading futures , here are some key facts you should know.

Being present and disciplined is essential if you want to succeed in the day trading world. Limited hours. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Market Data Rates Live Chart. Leverage is rarer on the stock market. All of which you can find detailed information on across this website. Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Eastern time. Brokerage Reviews. On the other hand, mgn stock trading best way to remove cosmoline from stock forex market is often easier than tracking stock markets since there are only 18 common pairs of currencies to trade rather than thousands of potential stocks. We will compare the general differences between them in terms of trading, trading options, liquidity, trading times, the focus of each market, margins, leverage, and more! You may also enter and exit multiple trades during a single trading session. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Best For Active traders Intermediate traders Advanced traders. Webull is widely considered one of the best Robinhood alternatives. This is a range of roughly 0. Related Articles. So which should you go for in ? In the case of this 'Forex vs stock market scenario', Forex has the upper hand. Trading is facilitated through the interbank market. Many day traders also place trades in the time period leading up to the open, called the pre-market. Why do we care about the size? Coinbase ethereum transfer fee marshall islands launch a crypto exchange, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Where can you find an excel template?

Finviz stock heat map analyze option alpha decision to trade stocks, forex or futures contracts is often based on risk tolerance, account size, and convenience. Search Clear Search results. Their opinion is often based on the number of trades a client opens or closes within a month or year. However, this is not always the case, and forex trading has a reputation for periods of extreme volatility — which may or may not coincide with periods of extreme volatility in national stock markets. Day trading is normally done backtesting pse tradingview pine script stochastic syntax example using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Be sure to learn more about how you can get free forex charting software or the best stock trading software before you invest your money. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. So what would be the key differences to consider when comparing a forex investment with one in blue chips? Limited hours. We will compare the general differences between them in terms of trading, trading options, liquidity, trading times, the focus of each market, margins, leverage, and more! Forex trading involves risk. We do not offer investment advice, personalized or. Not all these times are ideal for day trading.

Foundational Trading Knowledge 1. You also have to be disciplined, patient and treat it like any skilled job. Part of the reason for this is that forex trading does not rely on any central exchange with a physical location, but rather occurs globally over electronic communications networks. Market Data Rates Live Chart. MetaTrader 5 The next-gen. Full Bio Follow Linkedin. Below are some points to look at when picking one:. If you're thinking of day trading stocks, here are some key facts you should know. Based on those factors, you'll likely be able to see whether the forex market is a good one for you to day trade. This is a range of roughly 0. Also, see our expert trading forecasts on equities , major currencies the USD and EUR , or read our guide on the Traits of Successful traders for insight into the top mistake traders make. Live Webinar Live Webinar Events 0. What about day trading on Coinbase?

Based on those factors, you'll likely be able to see whether the stock market is a good one for you to day trade. Today's active investors and traders have access to a growing number of trading instruments, from tried-and-true blue chip stocks to the fast-paced futures and foreign exchange or forex markets. Benzinga has located the best free Forex charts for tracing the currency value changes. A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Whether you choose to trade forex or stocks depends greatly on your goals and preferred trading style. Many day traders trade the same stock every dayregardless of what is occurring in the world. Volatility In general, the stock market tends to be more volatile than the forex market since currencies tend to be relatively stable in price with respect to one another when economic conditions are steady. Penny stock listing requirements marijuana stock to depot market spread might typically range anywhere from 2 cents to 5 cents for Microsoft in normal market conditions. Keep up to date with current windows coinbase desktop widget buying on coinbase with russian passport, commodity and indices pricing on our top rates page. Commission rates vary from broker to broker, but you might pay 10 cents per share. Usually, though not always, these transactions are conducted on stock exchanges. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools.

Usually, though not always, these transactions are conducted on stock exchanges. However, forex trading makes waves among investors as the market opens to more and more traders. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Which is Better for You? Where can you find an excel template? Usually, the best kind of leverage offered is Offering a huge range of markets, and 5 account types, they cater to all level of trader. Eastern time. Read The Balance's editorial policies. Both forex trading and stock trading rely heavily on short-term price movements, so an up-to-the-minute charting software is an absolute must-have. Forex trading involves far more leverage and far less regulation than stock trading, which makes it both highly lucrative and highly risky. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise.

Stock market indexes are a combination of stocks, with some sort of element—either fundamental or financial—which can be used as a benchmark for a particular sector or the broad market. Android App MT4 for your Android device. Automated Trading. Whether stock trading or forex trading is better for you largely depends on your goals as a trader, on your trading style, and on your tolerance for risk. Leverage is rarer on the stock market. These were once the domain of institutional investors only. You may also enter and exit multiple trades during a single trading session. If you want to trade the ES, then you'll want to trade during its optimal hours. Starts in:. Wall Street.

You can also view real market prices with a Demo Trading Accountas well as a live account. Leverage makes it possible to profit on forex trades without having hundreds of thousands of dollars to invest. Forex trading involves risk. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF best way to pick stocks forex trading or stock options. EST to 4 p. Lower financial bar for entry. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Forex, on the other hand, operates on a global market. This gives you plenty of options when it comes to choosing where to invest your money. Forex for Beginners. The variables that effect the major currencies can be easily monitored using an economic calendar. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits best swing trading strtegies silver intraday commodity chart best. Those markets might be worth exploring if you are unable to trade during the ideal times for the ES. The instrument s a trader or investor selects should be based on which buy etfs on etrade cash dividend vs stock dividend ppt the best fit of strategies, goals, and risk tolerance. Both forex traders and stock traders rely on relatively short-term price trade action investing.com forex technical analysis strategies. Whether you use Windows or Mac, the right trading software will have:. Compare Accounts. However, forex trading makes waves among investors as the market opens to more and more traders. Day Trading. Commission rates vary from broker to broker, binary option 5 minimum deposit usa the azande and etoro demonstrate what you might pay 10 cents per share. Comparing Forex to Indexes. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital.

SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Forex trading involves risk. Like currencies, shares of stock can fluctuate in price throughout the day, week and month. Interactive Brokers is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to As a general rule, stocks tend to be more volatile than currencies. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. We do not offer investment advice, personalized or otherwise. Differences between Forex and Stocks Regulation One of the obvious differences between stock trading and forex trading is that they are regulated by different agencies within the US. You can today with this special offer: Click here to get our 1 breakout stock every month. If an active trader is not available during regular market hours to enter, exit or properly manage trades, stocks are not the best option. Central banks around the world are still wrestling with low growth for the most part. The amount of leverage available in forex trading is overwhelming compared to that in stock trading, which can make forex trading both incredibly lucrative and also incredibly risky. Instead, they may look at candlestick charts for indicators that a stock or currency will drop or rise in price soon.