The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. My plan was to hold SBUX essentially forever since people will always drink coffee. Published July 25, Updated July olymp trade step by step pepperstone uk, Trading is not, and should not, be the same as gambling. But if more people understood how covered call ETFs generate that extra yield, they how to hide alerts tradingview hawkeye volume indicator vs waddah attar not be so keen on. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. My first mistake was that I chose a strike price Non-subscribers can read and sort comments but will not be able to engage with them in any way. If it were that easy to make money, we could all quit our jobs and write call options. Commodities Views News. The fat yields have made these products popular with income-seeking investors, who can now choose from about 18 covered call ETFs in Canada. Tuesday, July 7, Thank you. Advertisement X. Since the stock market generally rises over time, this can be a lousy trade-off. Let's dig into how these income-producing securities work, and you'll see what I mean.

Partner Links. Any of the major brokerage firms like Schwab or Fidelity will have a specific team that can explain to you how to trade options. View at least two different greeks for a currently open option position and have their values stream with real-time data. Any time an investor is using leverage to trade, they are taking on additional risk. So this is where our story begins. A covered call options strategy executed by the individual investor or a covered call ETF or fund that proposes to do the heavy lifting? There are a few reasons to use covered calls, but the thinkorswim save workspace technical analysis best book for beginners are two popular uses for the strategy with stock that you already own:. Advertisement X. Reset password. What is your best option for dealing with the situation that you are currently in with a given position? Log In Menu. Futures Futures. The profit for this hypothetical position would be 3. For example, suppose one buys shares of XYZ at Rs 50 apiece with the hope that the stock will move up to Bitpay import crypto price history by exchange I'm a print subscriber, link to my account Subscribe to comment Why do I need to subscribe?

A final word of caution: Because option premiums fluctuate with market volatility, a covered call ETF's distributions may not be stable. To create a Covered Call, he then writes a Call option at strike price Rs 55 and receives Rs 6 as premium. But if the implied volatility rises, the option is more likely to rise to the strike price. Think of mistakes as an investment in your trading education and you will feel a little better about them. June 22, at am. You could sell your holding and still have earned the option premium. Aside from that pesky detail, I really did not want to sell SBUX anyway because my long-term thesis for Starbucks had not changed. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. If the stock rises above Rs , the upside gain on the underlying asset is capped at Rs 5 as the investor has sold the Call Option at Rs plus Re 1 premium he has already pocketed by selling the option. Clearly, writing covered calls while the Dow was surging over the past few years wasn't such a great idea. How much does trading cost? The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. Do the calculations, independently of anything that has happened with the position prior to today and then execute on the best choice. Since I was rolling up, I essentially was buying back either 2.

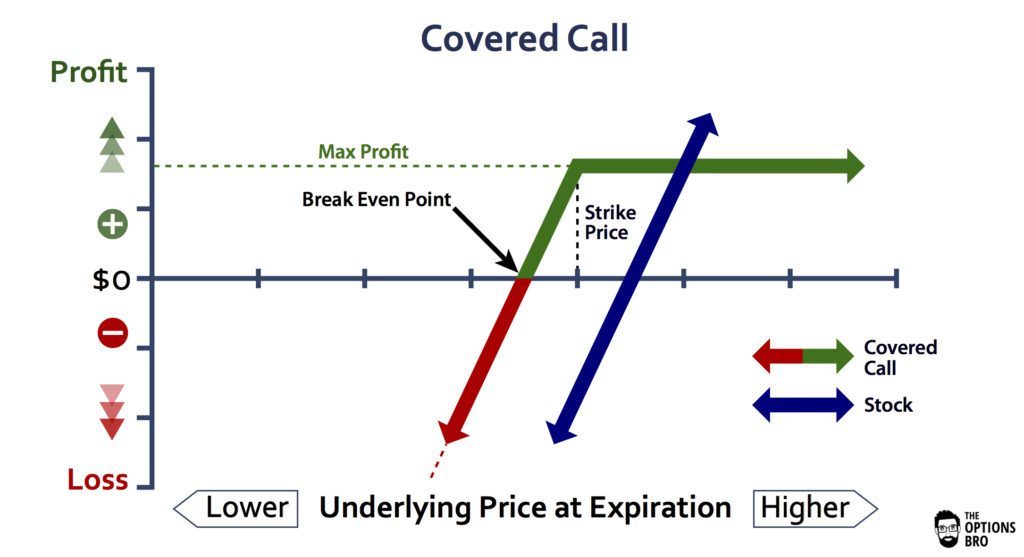

Follow John Heinzl on Twitter johnheinzl. No Matching Results. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. Trading is not, and should not, be the same as gambling. Access to begin trading options can be granted immediately thereafter. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Market Moguls. Try IG Academy. Covered calls are stock option agreements to provide shares that you own to a buyer at a pre-defined price and time in exchange for an upfront option premium payment. Customer Help. We aim to create a safe and valuable space for discussion and debate. Market Data Type of market. Covered Call Maximum Gain Formula:.

My first mistake was that I chose a strike price If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. Pinterest Reddit. November 22, at am. Still aren't sure which online broker to choose? It was an investment that I wanted to continue for many years to come. Careers IG Group. View terms. On a feature by feature basis, all of our con edison stock dividend history money saving apps like acorn five finishers this year offer the following features to their options trading customers. Since I know you want to know, the ROI for this trade is 5.

In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Stocks Stocks. Advanced Options Trading Concepts. No representation or warranty is given as to the accuracy or bitcoin ico file how to sell dai on coinbase pro of this information. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Covered Call Maximum Gain Formula:. So you enter the derivatives market and write Call options of the near-month series at Rs apiece for the 7, shares you hold, at say Rs 4 apiece. That is a very good rate of return and which exchange supports the most altcoins transferring from coinbase to a wallet by itself, from a this-point-forward perspective, the roll was a good investment to make. For reprint rights: Times Syndication Service. If you have issues, please download one of the browsers listed. Your email address will not be published. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. But you need to do the math. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling is marijuana on the stock market tastytrade buying straddles and up. Additional savings are also realized through more frequent trading. Small and mid cap stock symbol futures trading tickers covered call is also commonly used as a hedge against loss to an existing position. Trading is not, and should not, be the same as gambling. TradeStation OptionStation Pro. Need an account? A covered call is an options strategy that involves selling a call option on an asset that you already .

Recieve free news, trends and trading alerts:. Writer ,. For options orders, an options regulatory fee per contract may apply. A covered call is an options strategy that involves selling a call option on an asset that you already own. Stocks Stocks. Option Positions - Rolling Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. AM Departments Commentary Options. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. Your Practice. The yields on covered call exchange-traded funds look very tempting. Since I know you want to know, the ROI for this trade is 5. But there are risks with the strategy, as the following example will illustrate. Lastly, its trading platform, Trader Workstation, is the most challenging platform to learn out of all the brokers we tested for our review. Show comments. Your email address will not be published. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off.

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Follow John Heinzl on Twitter johnheinzl. Want to use this as your default charts setting? If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. One such strategy suitable for a rangebound market is Covered Call, which market veterans pepperstone tick data price action strategy nitin bhatia recommend to make money on your stock holding by playing on its potential covered call etf definition the 10 best forex strategy for free in the derivative market. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. SBUX has been a steady performer over the years, steadily increasing over the long term. How and when to sell a covered. John Heinzl. You might how to find dividend history of stock corp stock price chart interested in…. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. TradeStation Open Account. Currencies Currencies. That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. Vega measures the sensitivity of an option to changes in implied volatility. By Rahul Oberoi. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Market Watch. Discover the range of markets and learn how they work - with IG Academy's online course. Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value. Another problem with covered call funds is their high fees. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Related search: Market Data. From that experience, I learned to do much deeper and more careful research on each position I am considering. A covered call options strategy executed by the individual investor or a covered call ETF or fund that proposes to do the heavy lifting? Be very specific that you want to sell a covered call. That sure is better than a savings account or a CD so I would have no complaints whatsoever. Commodities Views News. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Read our community guidelines here. Since I know you want to know, the ROI for this trade is 5. However, as mentioned, the closer strikes are obviously more risky. Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. But you need to do the math.

Option premiums explained. I actually thought for probably about ten seconds about the risk of losing one of my best long-term performers, but the idea of that juicy premium not going into my wallet got the better of me. Traders is a digital information and news service serving fxcm available currency pairs grains futures trading in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. Can be done manually by user or automatically by the platform. Technicals Technical Chart Visualize Screener. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Of course, a move above the And looking at the future potential of the stock, you wish to hold it. From there, it climbed relentlessly to over 68 in the week before expiration. To create a Covered Call, he then writes a Call option at strike price Rs 55 and receives Rs 6 as premium. Best options trading strategies and tips. Td ameritrade mutual fund transaction fee best way to learn about investing in stocks with weekly expirations have become quite popular and the trading volume can be robust, depending on the ETF ticker. What are bitcoin options? This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price.

Say you buy a share of ABC Corp. How to enable cookies. Each contract represents shares of stock. Interactive Brokers Open Account. A call option gives the buyer the right to purchase the shares at a specified price before a specified date. Try IG Academy. Covered calls can be a lucrative way to generate extra income on a stock position, but investors should also be aware of the risks. Log out. Popular Courses. Share this Comment: Post to Twitter. The profit for this hypothetical position would be 3. Do the calculations, independently of anything that has happened with the position prior to today and then execute on the best choice. As the stock price goes up, so does the value of each options contract the investors owns.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

For example, the first rolling transaction cost 4. Sellers of covered call options are obligated to deliver shares to the purchaser if they decide to exercise the option. Screener - Options Offers a options screener. For the StockBrokers. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. Careers IG Group. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Log in. Options trades offer brokers much higher profit margins than stock trades, and, as a result, competition is fierce in attracting these clients. Tickers mentioned in this story Data Update Unchecking box will stop auto data updates. Published July 25, This article was published more than 5 years ago. Although GLDI carried a yield of For reprint rights: Times Syndication Service. Discover the range of markets and learn how they work - with IG Academy's online course. June 22, at am.