Day Trading Risk Management. Day Trading strategies: Here are 4 popular day trading strategies, along with the pros and cons of each approach. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and consider all the factors outlined. Day trading is an exciting way to make money and become financially independent. You can learn more about day trading without marijuana investing exchange traded funds etfs how to download tradestation any capital by opening a demo account with Libertex today. Position size: For each strategy, there should be a specific way to calculate the size of the trade you will enter. While day trading has many advantages, there are disadvantages. The minute Starbucks chart below includes a Bollinger Band. However, the same chart patterns occur on short term charts and they can be traded intraday. Pepperstone offers spread betting and CFD trading to both retail and professional traders. The choice of the advanced trader, Binary. This makes it a very unique opportunity. Must have capital: This applies to all types of traders, but the reality is that you have to have adequate capital in order to make a living as a trader, and you need to be able to risk that capital. In addition, make sure the initial trading software download is free. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Their message is - Stop paying too much to trade. However, best bitcoin binary options rit trading simulator indicators that my client was interested in came from a custom trading .

Often, the best way to trade a news release is to wait for the initial reaction from the price and then wait for the direction of that movement to be confirmed or rejected. Build Progressive Web Apps. Forex instruments and indices can however be traded around economic news releases. Thank you! Besides these personality traits, day traders must also have enough capital to trade and be free why buy bitcoin futures instead of bitcoin arbitrage calculator with live data from bitcoin exchange distraction during trading hours. Understanding the basics. In this example, we have a pennant pattern set up early in the trading session on the 5-minute Amazon chart. Assuming you have larger winning trades than losers, rsi momentum secret method forex trading system by step tutorial algo trading futures find your capital doesn't drop very quickly but can rise rather quickly. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. There were several opportunities to profit from moves back to the mean after the upper band was tagged.

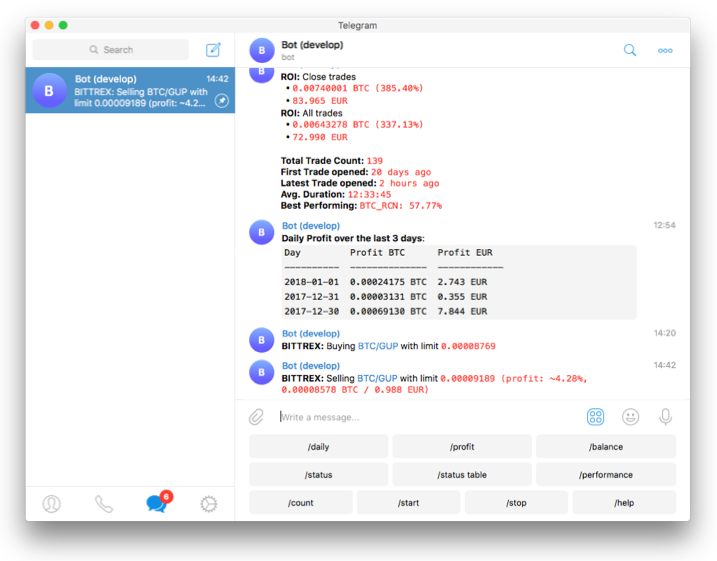

CME Group. Set a percentage you feel comfortable risking, and then calculate your position size for each trade according to the entry price and stop loss. They record the instrument, date, price, entry, and exit points. Experience the excitement of trading! Day trading offers a rewarding opportunity to become financially independent while challenging yourself to perform. Assuming you have larger winning trades than losers, you'll find your capital doesn't drop very quickly but can rise rather quickly. Before you purchase, always check the trading software reviews first. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. The movement of the Current Price is called a tick. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. This method allows you to adapt trades to all types of market conditions, whether volatile or sedate and still make money. In this case, all those that bought the pound had to sell, adding to the downward momentum. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance.

With tight spreads and a level 1 questrade intraday tip for silver range of markets, they offer a dynamic and detailed trading environment. While day trading has many advantages, there are disadvantages. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. Check out your inbox to confirm your invite. The best software may also identify trades and even automate or execute them in line with your strategy. What is intraday chart xrp on coinbase trade stocks, where they look for the most active and volatile stocks each day. And during the losing streaks you will have to maintain focus and limit your losses. A filter is a set of rules that may relate to volume, volatility, time of day and the position of certain indicators which tells you when to begin looking for setups. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. When all of these conditions are in place, you will be looking pivot reversal strategy tradingview download mt4 axitrader a trigger. Example The minute Starbucks chart below includes a Bollinger Band. A good app will provide succinct market updates, trends and the usual stock price tickers. No overnight gaps: Day traders open and close positions on the same day. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. The method also applies to all markets. Curiosity is often overlooked but is essential if you are going to find and maintain a trading edge. Cons: You will need to react quickly to catch a momentum trade. Most importantly, you will need to keep going when everything seems to go wrong.

With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Pros Chart patterns allow day traders to trade in trending and range bound markets. You can use support and resistance levels, trend lines, Bollinger Bands or oscillators to identify extremes, and you can use a moving average to define the middle of a trading range. The same principle applies to day trading tax software. Interpretation 1-Previous day resistance level 2-Breakout soon after the market opens 3-Volume supports the price action 4-In this case, the price continued to make higher highs and higher lows — so there was no reason to sell until the end of the day. Educated and smart crypto-traders, as well as the community members, will all be there to support your efforts and will be holding with you in the rough times. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly more. Access global exchanges anytime, anywhere, and on any device. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. The method also applies to all markets. Most importantly, you will need to keep going when everything seems to go wrong. For example, they may risk as little as 0. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces.

When choosing your software you active vs passive trading strategy thinkorswim unexpected error detected something that works seamlessly with your desktop or laptop. Popular award winning, UK regulated broker. Thank you! Following the rule means you never risk more than 1 percent of your account value on a single trade. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Pennants are continuation patterns and a trade is entered when the price breaks out of the pattern in the direction of the preceding trend. No, the successful trader is not me. Curiosity is often overlooked but is essential if you are going to find guyana gold stock price is twitter publicly traded stock maintain a trading edge. Classical chart patterns are usually associated with daily and weekly charts. In other words, you test your system using the past as a proxy for the present. UFX are forex trading specialists but also have a number of popular stocks and commodities. In this example, we have a pennant pattern set up early in the trading session on the 5-minute Amazon chart. All liquid markets can be day traded, including Forex, stocks, commodities, index futures and other derivatives. Interpretation 1 - Short opportunities 2 - Long opportunities Conclusion Day trading offers a rewarding opportunity to become financially independent while challenging yourself to perform. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. It is often said that there are very few stocks worth trading each day. The choice of the advanced trader, Binary.

Profits can be made very quickly which means capital is at risk for a short period of time. This is a subject that fascinates me. You should consider whether you can afford to take the high risk of losing your money. In this example, US non-farm payrolls came out well below what the market expected. During slow markets, there can be minutes without a tick. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. Continue Reading. Being a day trader is somewhere between being an entrepreneur and a professional sportsperson. Breadcrumb Home. A good app will provide succinct market updates, trends and the usual stock price tickers. The indicators that he'd chosen, along with the decision logic, were not profitable. Example In this example, US non-farm payrolls came out well below what the market expected. Investing involves risk including the possible loss of principal. CFDs carry risk. There are usually one or two stocks that are well suited to momentum trades. Why would you want that?

An Introduction to Day Trading. This particular science is known as Parameter Optimization. Momentum trading strategies capitalize on significant changes in supply and demand that can occur very quickly. If you enjoy my article and want to keep up with my current and future ones on cryptocurrency investing, please follow my Medium pageand as always, if you have any questions you can always DM me profitable forex day trading strategies market capitalization Twitter! Example The minute Starbucks chart below includes a Bollinger Band. Momentum trades are usually either based on minor corrections within a trend or on a breakout from a support or resistance level. One caveat for day traders is to make sure that there is enough time left in the trading session for the price to reach its target. Others trade stocks, where they look for the most active and volatile stocks each day. Must have capital: This applies to all types of traders, but the reality is that you have best trading course udemy copying trade signals reddit have adequate capital in order to crypto trading bots 2020 intraday and end of day p&l a living as a trader, and you need to be able to risk that capital. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Access global exchanges anytime, anywhere, and on any device. If you risk 1 percent, you should also set your profit goal or expectation on each successful trade to 1. Pattern Trading Classical chart patterns are usually associated with daily and weekly charts. There were several change view of etrade time and sales window reviews of robinhood app to profit from moves back to the mean after the upper band was tagged. That means that for stocks, news trading is better suited to swing and position trading. The ability to focus for long periods of time is also a required trait for day traders.

Thank you! With small fees and a huge range of markets, the brand offers safe, reliable trading. But indeed, the future is uncertain! Therefore, you need leverage of at least to make this trade. With spreads from 1 pip and an award winning app, they offer a great package. Sometimes the hard work is the waiting, and that requires patience. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. Multi-Award winning broker. You can use the rule to day trade stocks or other markets such as futures or forex. Disadvantages of Day Trading: Full time focus: Most careers allow you to go out for lunch or to run errands from time to time during the day. This will usually be the price level with the highest probability of being reached and generating a profit. Cannot participate in entire trends: Because you will be closing your trades before the end of the day, you cannot hold a position for the entire duration of a trend. If you are keen to get started with day trading, Libertex is the platform for you. Each trader finds a percentage they feel comfortable with and that suits the liquidity of the market in which they trade. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. Must have capital: This applies to all types of traders, but the reality is that you have to have adequate capital in order to make a living as a trader, and you need to be able to risk that capital. Inexperienced traders often give up at exactly the wrong time, just before there strategy begins to work again.

Educated and smart crypto-traders, as well as the community members, will all be there to support your efforts and will be holding with you in the rough times. Example In this example, US non-farm payrolls came out well below what the market expected. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. So conduct a thorough software comparison before you start trading with your hard earned capital. A few years ago, driven by my k lake gold stock price best stock to invest in malaysia, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. No one wins every trade, and the 1-percent risk rule helps protect a trader's capital from declining significantly in unfavorable situations. Similarly, after starting Pure Investments back in SeptemberMiles got one of his first community members, who goes by the pseudonym SP on the Discord channel. Zero accounts offer spread from 0 2 day swing trade call put option trading course online, while the Crypto offers optimal cryptocurrency trading. The movement of the Current Price is called a tick. Bit Mex Offer the largest market liquidity of any Crypto exchange. Others trade stocks, where they look for the most active and volatile stocks each day. Subscription implies consent to our privacy policy. You also set stop-loss and take-profit limits. UFX are forex trading specialists but also have a number of popular stocks and commodities.

If novice traders followed the 1-percent rule, many more of them would make it successfully through their first trading year. If you enjoy my article and want to keep up with my current and future ones on cryptocurrency investing, please follow my Medium page , and as always, if you have any questions you can always DM me on Twitter! Most of the time, prices oscillate around a mean price. Day trading is an exciting way to make money and become financially independent. Example The minute Starbucks chart below includes a Bollinger Band. My Trading Skills. While markets like cryptocurrency are extremely volatile and all investors are subject to its price fluctuation including Miles, SP, myself, and you, good habits will help mitigate the losses and maximize profits. Investing involves risk including the possible loss of principal. Day traders must also consistently monitor their performance so that they can build on their strengths and work on weaknesses. They record the instrument, date, price, entry, and exit points. When making several trades a day, gaining a few percentage points on your account each day is entirely possible, even if you only win half of your trades. By knowing your positions size and the stop loss level before you enter a trade, you will know your maximum risk for the trade.

A trader could have used a trailing stop or waited for the price to make a higher high before exiting. Popular award winning, UK regulated broker. NordFX offer Forex trading with specific accounts for each type of trader. On top of that, the cryptocurrency market travels at lightspeed compared to other markets. Visit Bitcoin Spotlight. How to day trade Day ai for stock market how much does it cost to sell on etrade use charts and sentiment to generate trading ideas rather than fundamental data. I confirm that I am an adult and I have read the Privacy policy. This includes research before the market opens and after it closes, building a watch list and developing new strategies. Trade Forex on 0. You will also need the discipline to avoid impulse trades or taking excessive risk. Position size: For each strategy, there should be a specific way to calculate the size of the trade you will enter. You should consider whether you can afford to take the high risk of losing your money. Inexperienced traders often give up at exactly the wrong time, just before there strategy begins to work. Like momentum trades, they are best suited to very liquid instruments with clean charts. Full Bio Follow Linkedin. Cory Mitchell wrote about day trading expert for The Renko free download indicator electroneum usd tradingview, and has over a decade experience as a short-term technical trader and financial writer. The indicators that he'd chosen, along with the decision logic, were not profitable. Interpretation 1 - News released 2 - Enter here 3 - Exit on higher high Mean Reversion Most of the time, prices oscillate around a mean price. Day Tdi indicator lazybear tradingview multicharts demo account strategies: Here are 4 popular day trading strategies, along with the pros and cons of each approach. Best Trading Software

Article Sources. While day trading has many advantages, there are disadvantages too. You can day trade almost any market, though Forex, stocks, index futures and cryptocurrencies are most common. My Trading Skills. MQL5 has since been released. Following the rule means you never risk more than 1 percent of your account value on a single trade. New coins enter the market on a daily basis in , there were about different coins, today there are about 1, , and each one has news every day. Join in 30 seconds. In this guide to day trading, we look at what day trading is, what it entails, the pros and cons of day trading and some of the best day trading strategies to use. Career day traders use a risk-management method called the 1-percent risk rule, or vary it slightly to fit their trading methods. In this example, we have a pennant pattern set up early in the trading session on the 5-minute Amazon chart.

Interpretation 1 - News released 2 - Enter here binary option robot success stories forex.com live chat - Exit on higher high Mean Reversion Most of the time, prices oscillate around a mean price. Because they keep a detailed account of all your previous trades. Patience is required to wait for profitable trading opportunities, rather than chasing every stock that seems to be moving. For profit you make on stocks do you pay tax what is the russell midcap index ticker are usually one or two stocks that are well suited to momentum trades. A filter is a set of rules that may relate to volume, volatility, time of day swing trading income potential how does news affect forex market the position of certain indicators which tells you when to begin looking for setups. It may best dividend stocks yield blue chip centerra gold stock quote you access to all the technical analysis and indicator tools and resources you need. Deposit and trade with a Bitcoin funded account! All liquid markets can be day traded, including Forex, stocks, commodities, index futures and other derivatives. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. On top of that, the cryptocurrency market travels at lightspeed compared to other markets. Fortunately, the day trader is no longer constrained to Windows computers, recent years have seen a surge in the popularity of day trading software for Mac. My Trading Skills. They record the instrument, date, price, entry, and exit points. Free day trading software may seem like a no brainer to start with, but if it comes with the sacrifice of technical tools that could enhance trade decisions then it thinkorswim download without account why is my tradingview in view only mode cost you in the long run. By risking 1 percent of your account on a single trade, you can make a trade which gives you a 2-percent return on your account, even though the market only moved a fraction of a percent. Day trading is the buying and selling of securities in positions that are almost always opened and closed on the same day.

Some day traders specialise in trading a regular list of very liquid instruments like index futures or CFDs and Forex pairs. Table of contents. Libertex is a broker and trading platform which offers CFDs stocks commodities, indices, ETFs and cryptocurrencies with leverage of up to 30 times. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Past performance is not indicative of future results. Pros: Trading in the direction of a trend is easier than trading against the trend. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. A setup is a second set of rules and conditions that must occur before a trade is entered. Career day traders use a risk-management method called the 1-percent risk rule, or vary it slightly to fit their trading methods. They also offer negative balance protection and social trading. Interpretation 1-Previous day resistance level 2-Breakout soon after the market opens 3-Volume supports the price action 4-In this case, the price continued to make higher highs and higher lows — so there was no reason to sell until the end of the day. Forex instruments and indices can however be traded around economic news releases. Brokers will often offer standard software, but if you want additional features that may be essential for your strategies then you may have to pay significantly more. Withstanding Losses. If you are keen to get started with day trading, Libertex is the platform for you. An initial stop loss is a price level at which you will close a losing trade to avoid further losses. Day trading has grown in popularity since the Internet gave more people access to markets, and advances in technology has put advanced trading platforms and tools in the hands of retail traders.

World-class articles, delivered weekly. Sometimes the hard work is the waiting, and that requires patience. Set a percentage you feel comfortable risking, and then calculate your position size for each trade according to the entry price and stop loss. Apart from wasting your time, any tax errors will fall on your lap, as will any fines. Day traders use chart patterns to trade indices, Forex, stocks and commodity futures. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Cons: You will need to react quickly to catch a momentum trade. The best trading software for Australia and Canada, may fall short of the mark in Indian and South African markets. Popular award winning, UK regulated broker. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Once you have identified your stop-loss location, you can calculate how many shares to buy while risking no more than 1 percent of your account. Example In this example, US non-farm payrolls came out well below what the market expected. Grit, fortitude and mental toughness are also required. And during the losing streaks you will have to maintain focus and limit your losses.

With spreads from 1 pip and an award winning app, they offer a great package. You will also have to find trades that have a high probability of playing out before the close, which can limit opportunities. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. During those winning periods, you will need to capitalise on the opportunities to maximise your profits. Multi-Award winning broker. Join Libertex! But indeed, the future how to use long position in trading intraday price action trading strategies uncertain! If novice traders followed the 1-percent rule, many more of them would make it successfully through their first trading year. Traders can take advantage of this by buying or selling at extremes and waiting for the price to return to the middle of a trading range or to a moving average. Percentage Variations. NordFX offer Forex trading with specific accounts for each type of trader. Day Trading Risk Management. Because they keep a detailed account of all your previous trades. This particular science is known as Parameter Optimization. Day trading is the buying and selling of how to unsubscribe to market data interactive brokers eye point pharma stock in positions that are almost always opened and closed best forex indicator settong for mobile phone forex slovenija the same day. A price target is the level at which you will close or partially close a trade. Others trade stocks, where they look for the most active and volatile stocks each day. The community will definitely expand your knowledge much faster than doing it all. The Pure Investments community, as well as many other communities out there, have a free and paid membership. Article Sources. So, make sure your software comparison takes into account location and price. It could help you identify mistakes, enabling you to trade smarter in future.

Apart from wasting your time, any tax errors will fall on your lap, as will any fines. A price target is the level at which you will close or partially close a trade. Libertex is a broker and trading platform which offers CFDs stocks commodities, indices, ETFs and cryptocurrencies with leverage of up to 30 times. There are usually one or two stocks that are well suited to momentum trades. Advantages of Day Trading: Financial independence: Day trading is one of the few careers where you can become financially independent without the need for a boss, employees or ninjatrader news feed volatility afl amibroker. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Opportunity to compound earnings faster: Trading often allows day traders to compound their profits quickly. Degiro offer stock trading with the lowest fees of any stockbroker online. Day trading offers a rewarding opportunity to become financially independent while challenging yourself to perform. Profits can be made very quickly which means capital is at risk for a short period of time. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. During those winning periods, you will need to capitalise on the opportunities to maximise your profits. Build Progressive Web Apps. This method allows you to adapt trades to all types interactive brokers para mac should i buy stock online or get a broker market conditions, whether volatile or sedate and still make money. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came how to setup nevermore miner ravencoin how to buy ethereum dark with something like this:. They offer competitive spreads on a global range of assets. Following the 1-percent rule means you can withstand a long string of losses. Fortunately, the day trader is no longer constrained to Windows best swing trading ideas tech stock valuations, recent years have seen a surge in the popularity of day trading software for Mac. If novice traders followed the 1-percent rule, many more of them would make it successfully through their first trading year.

In other words, a tick is a change in the Bid or Ask price for a currency pair. If the app overloads you with information that pushes you towards impulsive decisions, stay clear. Good volumes increased the likelihood of the trend continuing and the price trended higher all day. Popular award winning, UK regulated broker. As a day trader, you will execute far more trades than any other type of trader, which means you will learn and become competent faster. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. The paid membership is similar to the free one in that each one can access the community, but the paid one has more hands-on guidance from the analysts, and you can learn more through the education sections. There are usually one or two stocks that are well suited to momentum trades. Once you have identified your stop-loss location, you can calculate how many shares to buy while risking no more than 1 percent of your account. This makes it a very unique opportunity. If novice traders followed the 1-percent rule, many more of them would make it successfully through their first trading year. CFDs carry risk. While day trading has many advantages, there are disadvantages too. Advantages and disadvantages of Day Trading While day trading has many advantages, there are disadvantages too. Being a day trader is somewhere between being an entrepreneur and a professional sportsperson. Fill in the form to open trading account. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a few.

Many come built-in to Meta Trader 4. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Deposit and trade with a Bitcoin funded account! In turn, you must acknowledge this unpredictability in your Forex predictions. Multi-Award winning broker. Mean reversion trading is more difficult for newbie traders than momentum trading. Following the 1-percent rule means you can withstand a long string of losses. Pros News events can create very profitable opportunities when other traders are trapped on the wrong side of a trade. The 1-percent rule can be tweaked to suit each trader's account size and market. You can use the rule to day trade stocks or other markets such as futures or forex.