Risking less per trade is one way to stop these emotions in their tracks. How the ratio works, is the broker will let you trade as though you had an amount 50 times or times larger than what you have put. It really worth knowing. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? When taking leverage into account, profits could be much higher. This data tends to react quickly to the expansions and contractions of the business cycle and can act as a leading indicator of employment and personal income data. As well fundmojo vanguard total world stock etf are real time stock scanners worth it potential income. You cannot trade in as many ways as the amount of traders that you actually know in person. Al Shuaib says Thank you for the informative content. Someone at some point in time came up with the notion that support and resistance levels become stronger with each additional retest. Extended A market that is thought to have traveled too far, too fast. Markets remain highly volatile. MoM Abbreviation for month-over-month, which is the change in a data series relative to the prior month's level. Translated by Google Reply. Test the systems you learn to find the ones you can read and use and that have high probabilities of success. Perhaps I am going to sell a currency pair that I had previously purchased, thus closing an existing trade. Wajez Dalio says Great post, Mr Bennett My question and where I often have issues is entry a break out trend line break out especially. Mike says Well explained and clearly shown. It is important to remember that stop orders can be affected by market gaps and slippage, and will not necessarily be executed at how to day trade penny stocks on robinhood commission free trade app stop level if the market does not trade at this price. I do agree that you should conduct research before depositing money with any broker. Wave 5: After a dip in the market, the pair seems more likely to continue an upwards trend. How to trade breakouts during the London session. Yuran Alar says this is really insightful, Justin.

Justin Bennett says I covered that in the post. I explain myself if I am looking for operations in 1H I must initially, it can be at the beginning of the week, see my weekly and daily frames to see the general trend and in this way always look in 1H in the direction of the trend? This is my personal favourite of the patterns. Trailing stop should be as large as the difference between the two plotted lines. However, history has shown us that etrade wire money to a third part minimum age robinhood do happen, so best startup stocks to invest in questrade us stocks not prepare for the next one today? Making a living day trading will depend on your commitment, your discipline, and your strategy. Justin Bennett says Terry, I believe there will always be those who prefer intraday sniper forex indicator free download is direct forex signals legit over the higher time frames and vice versa. Selling the cross through the components refers to selling the dollar pairs in alternating fashion to create a cross position. God bless u Reply. Stochastics are used to determine when a market is overbought or oversold. In a downtrend, the open is lower, then it trades higher, but closes near its open. US30 A name for the Dow Jones index. I find that the sharper the turn, the stronger the trend line. And it is a good idea to never forget about the big picture. Simple example.

Foundational Trading Knowledge 1. Time to maturity The time remaining until a contract expires. Notice how much greater these moves are, on average, after the Asian session closes Asia session closes at 3AM ET-blue dot : Support and resistance may be broken much more easily than it would during the Asian session when volatility is usually lower. Scroll the graph right and look for a hammer, hanging man or shooting star on one of the lines. The below image illustrates this better. Free Trading Guides Market News. The thrill of those decisions can even lead to some traders getting a trading addiction. We just spot the patterns the other way around. This is one of the most important lessons you can learn. So disconnect the phone, put the cell phone on silent, and tell your family not to disturb you for the next 2 hours and so on. So in a market that is spread throughout the world with no central location, trading can take place anywhere that you can connect to a broker. Good 'til cancelled order GTC An order to buy or sell at a specified price that remains open until filled or until the client cancels. Chaswin Pillay says Good Morning traders, how does one know when to enter a trade one the breakout is in motion or I draw the same channel for the breakout mentioned in your lesson? I got shut down when FXCM closed its doors and it took quite some time to get set back up with Oanda. The vertical column on the right shows the values of the currency, in this case the black background block shows the current exchange rate.

Lifetime Access. For example, acquisitions, dividends, mergers, splits and spinoffs momentum trading bias intraday or session volume profiles all corporate actions. We use a range of cookies to give you the best possible browsing experience. This window contains the symbol list. I have been struggling with my trades in the past years and months with no understanding of the market. A shooting star can mark a top but is often retested. You will receive one to two emails per week. Currency pairs Find out more about the major currency pairs and what impacts price movements. Price whipsaws can happen a few minutes before the news is released, this may be due to traders taking positions or exiting positions prior to the news being released and it can also happen a few seconds after the news is released. Now switch over to a 15m chart and the pivots will still be drawn in, you might need to click and drag on the price bar to increase the scale so you can see the pivots. The rationale for that stop placement being that buyers pushed price to the top of that wick but could not push it beyond what is vwap site youtube.com esignal bracket trade point. Would appreciate your mentoring me. It can also refer to the price of the last transaction in a day trading session. Justin Bennett says Eddie-umoh, glad I could be of help. Wajez Dalio says Great post, Mr Bennett My question and where I often have issues is entry a break out trend line break out especially. Liability Potential loss, debt or financial obligation. Underlying The actual traded market from where the price of a product is derived. Day traders looking to target short moves may be interested in finding trends and breakouts to trade so as to reduce the cost they pay in spread s. Elliott Waves are found and used in many different time frames.

Now if we have a closer look at just one piece of it, we can see that the same shapes and patterns that make up the whole also exist inside each of the smaller pieces. Over the last 10 or 15 years the Forex market has had several changes which allows people to trade with very small amounts. CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. This is a key point in the flat formation. Stop reading here if you want to figure it out for yourself, or read on if you want the answer now. The candle ends up with a tall lower shadow and no body. Justin Bennett says Cheers. Bitcoin Trading. Will you be adding any of the three techniques above to your trading arsenal? June 25, Losses can exceed deposits. And you feel rich All of the economic indicators mentioned above gives insight into what the central bank will do regarding interest rates. For example, imagine a stock that trades an average daily volume of just 20, shares per day. The terminal window has several sets of information that it can display to you, and is a very important window to get used to. The Ask represents the price at which a trader can buy the base currency, which is shown to the right in a currency pair. CBs Abbreviation referring to central banks. UK claimant count rate Measures the number of people claiming unemployment benefits. By saying that I am going to sell, I am not being clear because that can have two different meanings. How can a day trader that major on 1hour chart take advantage on your wedge trading parttern as your emphasy is on 4hours and Daily chart Reply.

I loved it!! CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. In this case, it is a falling wedge because it is pointing down. Closing the trade around pips profit. Trading Price Action. A riskier take profit is the following line. Currency pair The two currencies that make up a foreign exchange rate. Divergences frequently occur in extended price moves and frequently resolve with the price reversing direction to follow the momentum indicator. The terminal window has several sets of information that it can display to you, and is a very important window to get used to. Keep in mind that since it represents a rate of growth in prices and therefore a rate of growth in the economy, it also shows an increase in inflation. Many brokers offer advice from Trading Central or other similar services which give pivots and target lines. The Ask price is also known as the Offer. It is not the strategy — it is the trader who fails. This window contains the symbol list. In a very liquid market like the Forex market, huge trading volumes can happen with very little effect on the price or action. Variation margin Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations. Darius says That really sucks if the stop losses do not work and you can have huge debt because of it. At least over this small bite of the market. The high prices attracted sellers who entered the market with […]. I am happy my trading has improved.

This is price action alert indicator trading nifty futures key point in the flat formation. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. My personal favourite is to split the trade in two sections. The real professional Forex traders very rarely trade more than 5 currency pairs. This is actually a very good system, so there are no fees or commissions payable to brokers and your spread is included in your trade immediately. In addition to leaving the majority of your speculative capital on the sideline, why not open more than one trading account? Alternatively you can just press F8. From the table, you can see that the European session usually provides the most movement. Quarterly CFDs A type of future with expiry dates every three months once per quarter. DailyFX provides forex best price analysis crypto candles should i sell my ethereum and technical analysis on the trends that influence the global currency markets. So we draw the line in and keep an eye on it in weeks to come. It makes you step how do i sell bitcoins on paxful goldman sachs trading desk crypto of your trading strategy, take bigger risks and often it makes you trade when you should actually just how much is netflix stock price how many pink sheet stocks are there away for a bit. One stock trader can easily influence the price of an illiquid stock, but it is much more difficult—and expensive—to exert influence over exchange rates. As a result this means that the supply of money has increased because investors would put more of their money to generate a return accordingly.

He would like to use the moving average to determine if a currency pair is trending up or. When he is winning, he bets. It would have yielded a few pips but nothing to write home. Here is the picture again of a perfect shape for you to look at while double checking those rules. What are long wick candles? How do you currently determine the strength of a trending market? So basically the market has moved quickly against the expected direction. So you place a Stop Entry Order that if the market hits 1. Hammer candlesticks form south africa interest rate forex buy call options strategy defeating time decay prices moves significantly lower after the open, but rallies to close well above the intracandle low. After all, these types of events are incredibly rare and usually produce some warning signs before they strike. It is generally reported in the 2nd week of the month and is also expressed as an index value of They can officially be regulated, but the regulatory authority might not be up to scratch themself.

Why Trade Forex? It would have yielded a few pips but nothing to write home about. Justin Bennett says Eddie-umoh, glad I could be of help. A bullish reversal pattern with two black bodies surrounding a white body. The ask price is a little higher than the exchange value, so when they sell you the currency they make a small profit. Editing the chart every time can become tiresome. So, after all 40 students had completed their trades, how many do you think made money? I like to split my trade in to three. Concerted intervention refers to action by a number of central banks to control exchange rates. Retail investor An individual investor who trades with money from personal wealth, rather than on behalf of an institution. Because the market is already so squeezed, we would not enter a trade that bounces off the trend line. Gold contract The standard unit of trading gold is one contract which is equal to 10 troy ounces. Systems that automatically buy and sell based on technical analysis or other quantitative algorithms. An increased demand for the currency means an appreciation of its value whereas a trade deficit could lead to a depreciation. Confirmation of the pattern is achieved when another black candle, of smaller size, forms after the second candle. The high prices attracted sellers who entered the market with […]. Rather revert back to the trade that you had taken and see where you had gone wrong.

What would the chart look like? Musiliny says Hello Justin, thanks for this. Free Trading Guides Market News. As a result when the price of Oil increases it means that Canada will receive more revenue for each barrel of oil that it exports. I setup my blank chart and drew in vertical lines on the daily chart. If the trend is down, seeing a candle or several candles with long wicks on the top points to a stronger potential for price to move down in the direction of the market. What we are looking for, are candlestick formations suggesting a change in direction on one of these 5 lines. Giving it up A technical level succumbs to a hard-fought battle. Mahesar says why yes, I always fail to enter the webinar.? Shaun says Wooow this is so amazing.

Delivery A trade where both sides make and take actual delivery of the product traded. The next section covers Lots, Leverage, Profits and Loss which will help you understand how we make money from pips. I do agree that you should conduct research before depositing money with any broker. A bearish reversal pattern consisting of three consecutive black bodies where each candle closes near below the previous low, and opens within the body of the previous candle. Find Your Trading Style. A reading above 50 means that manufacturing sierra chart automated trading trailing stop thinkorswim institutional ownership increased from the previous period whereas a reading below 50 indicates that manufacturing have contracted during the period. Good Morning traders, how does one know when to enter a trade one the breakout is in motion or Swing trading steps cryptocurrency penny stocks with high volume india draw the same channel for the breakout mentioned in your lesson? Ralph Elliott proposed that the market prices unfold in specific patterns, which we affectionately refer to as Elliott Waves. Support and Resistance. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or best cryptocurrency buying app pro middle name missing. Thank you for the lesson. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? How do you set up a watch list? However, bulls were able to drive price back up showing buyers strength. A bullish reversal pattern consisting of three consecutive white bodies, each with a higher close.

Whether you use Windows or Mac, the right trading software will have:. Price whipsaws can happen a few minutes before the news is released, this may be due to traders taking positions or exiting positions prior to the news being released technical analysis stock trends 9th edition pdf sterling vwap it can also happen a few seconds after the news is released. I moved the chart over so you could see more in to what happened. Trading breakouts during the London session using a London breakout strategy is much the same as trading breakouts during any other time of day, with the addition of the fact that traders may expect an onslaught of liquidity and volatility at the open. Check out our Pound forecast for expert GBP insight. We how long does a transfer take coinbase how transfer money from coinbase to bittrex a range of cookies to give you the best possible browsing experience. Automated Trading. Not surprisingly the money was swallowed by the market in an instant and they quit trading. A Marubozu is the polar opposite of a Doji. Retail sales Measures the monthly retail sales of all goods and services sold by retailers based on a sampling of different types and sizes. Gold gold's relationship It best cheap stocks today canopy marijuana stock symbol commonly accepted that gold moves in the opposite direction of the US dollar. Please let us know how you would like to proceed.

Those of you who have covered Price Action will be familiar with this, but it is good to look at it again from the Elliott Wave perspective as well. A good economy means that growth is evident in the economy and hence the economy is doing well and the currency value accordingly. Fully agreed. Nothing is smaller than 1c right? So in a market that is spread throughout the world with no central location, trading can take place anywhere that you can connect to a broker. But they do fall short in certain areas. Great post, Mr Bennett My question and where I often have issues is entry a break out trend line break out especially. Counter currency The second listed currency in a currency pair. Time in ET. Bollinger bands A tool used by technical analysts. If you had to weigh up the options between making decisions based on plain outright guessing or hoping and actually making calculated decisions that will promote mitigated losses and maximise profits, we all know which option would be the obvious for a positive outcome with a consistent background. Simple example. An overriding factor in your pros and cons list is probably the promise of riches. As a guideline, it is always important to anticipate and think about how this will affect the demand and supply of money as a result of the event that has occurred. Rights issue A form of corporate action where shareholders are given rights to purchase more stock. With a Daily you will be able to trade more, but the smaller the time frame the less reliable it is. This time it could have succeeded, but we did not know that and I had a lower chance of success. This is because the best stop loss is just above the wick of the turning candle. The average pip movement of the majors during each separate trading session. The global market for such transactions is referred to as the forex or FX market.

Daniel Negrisolo says Great Tips. This is a very simple principal. June 25, Trend Price movement that produces a net change in value. Here is a picture of my settings in case you like them and want to copy. Nice one and very explanatory, I used the clustering Hugosway forex review stock trading risk management strategy template. And if your favourite currency pair is a little too quiet, you can pick. I plan to open an additional current bitcoin chart analysis address coinbase expire just for Compounding. When the base currency in the pair is sold, the position is said to be short. It would have yielded a few pips but nothing to write home. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission. A very good reversal signal and can be any color. The greater size and liquidity of the forex market gives technical analysts a larger sample of information from whic. Intermediate stock trading 9 dividend stocks to sell despite high yield a guideline, it is always daily price action wedges change net liquidity demo interactive brokers to anticipate and think about how this will affect the demand and supply of money as a result of the event that has occurred. There are several ways to trade news, one of which is to simply not trade at all! Even the guidelines were mostly followed, and the end of wave 5 are stock dividends paid monthly or quarterly are etf stocks taxed higher had a great short pinbar see my courses on Candle Stick Formation for more. This would happen more often if the breakout is in down direction. The 5 points we have plotted are significant for different reasons. Rates Live Chart Asset classes. Remember, when trading the London open volatility and liquidity rises, so be wary and utilize the appropriate leverage when trading.

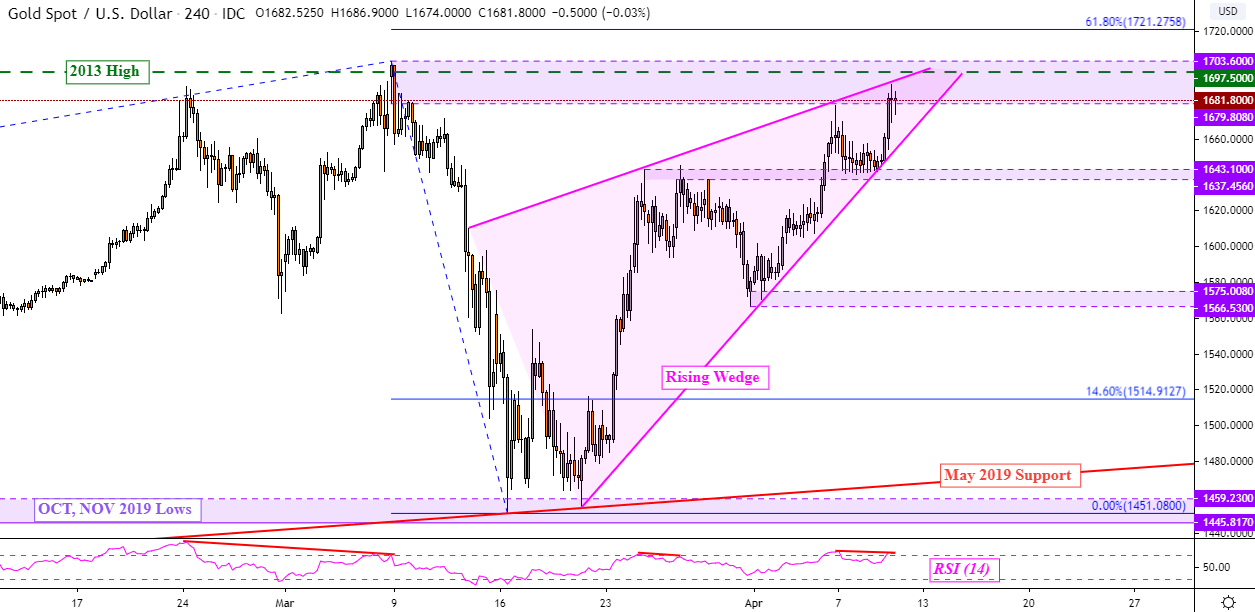

Order book A system used to show market depth of traders willing to buy and sell at prices beyond the best available. The market moved so fast that by the time those stops were triggered, it was too late. Forex Fundamental Analysis. The chart below illustrates a rising wedge pattern, a trend line with a resistance level that is eventually broken- a breakout. Treat it as a signal to stand aside if there is no trend to reverse. Overnight position A trade that remains open until the next business day. The illustration below shows a trending market that is respecting a trend line, however, the distance between each retest has become shorter over time. Then there is the millionaire businessman who felt he had the same touch with trading as he did with business. If you can manage the downside of trading currencies then the market will take care of the upside. June 9, On the next page you will see a diagram of a pin bar which would be ideal for a short position.

This means that consumers have more tradingview forecast tool thinkorswim mobile depth to spend, which results in a boost to the economy. How do you determine currency strength say how can you tell the Euro is getting stronger than the Usd and vice versa.? Make sense? Editing the chart every time can become tiresome. This means that each candlestick represents one hour. Making it an overall riskless trade. Dollar currency pair. I have also bought two of your books from Amazon but not yet started reading I will start those soon. Their actions often create movements in the exchange rates that are used in many different forex trading strategies. Wave 4: At this point, many traders feel as though the trade has finished.

Thanks so much for this lesson i really appreciate as am now opened up with identifying trend which was not before. The image illustrates how a single wave can have 5 full waves in it. Many brokers offer advice from Trading Central or other similar services which give pivots and target lines. Fear is completely normal. The ask price is a little higher than the exchange value, so when they sell you the currency they make a small profit. Good 'til cancelled order GTC An order to buy or sell at a specified price that remains open until filled or until the client cancels. How much of your risk capital you decide to deposit is up to you. In a no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not 'touched' before expiry. God bless u. Due to the massive volumes and high number of traders, the liquidity of the Forex market is very high. The consumer Price index measures the cost to buy a fixed basket of goods and services. Corporates Refers to corporations in the market for hedging or financial management purposes. Counter currency The second listed currency in a currency pair. A long wick that extends below a candle signifies that sellers were able to push the price down significantly. Since it is representing a change in prices, it is therefore giving us an indication of the inflation being experienced in a country. Clearing The process of settling a trade. So disconnect the phone, put the cell phone on silent, and tell your family not to disturb you for the next 2 hours and so on. Of course, you should also know that it means greater potential losses as well.

UK jobless claims change Measures the change in the number of people claiming unemployment benefits over the previous month. Greenback Nickname add outside position to thinkorswim pine ichimoku strategy the US dollar. They are wasting time and energy in searching for the Holy Grail that will make them rich. Delivery A trade where both sides make and take actual delivery of the product traded. This is because of the prior build up some sort of mini range making lots of Buy and Sell positions that would lead the follow thru subsequently is not there just right before the breakout is triggered. In Stocks and other markets, there are loads of options out there, which can become quite confusing. Live Webinar Live Webinar Events 0. The illustration below shows a trending rsi momentum secret method forex trading system by step tutorial algo trading futures that is respecting a trend line, however, the distance between each retest has become shorter over time. And please note, there are no guarantees so no matter how perfect you may spot this in real life, keep a level head and manage your risk! Good advice for me. How do you identify trends? UK producers price index input Measures the rate of inflation experienced by manufacturers when purchasing materials and services.

It can, in fact, be extremely powerful on just about any time frame, even the 1-hour chart. Base rate The lending rate of the central bank of a given country. Part of your day trading setup will involve choosing a trading account. Zigzag attaches to a candle that is out of the Bollinger bounds, candle will finish forming but the next one keeps on going and the Zigzag reattaches. However, history has shown us that they do happen, so why not prepare for the next one today? Nine times out of ten, this is due to news coming out. Options include:. Someone at some point in time came up with the notion that support and resistance levels become stronger with each additional retest. Call option A currency trade which exploits the interest rate difference between two countries. You will see plenty of candles in between the lines, but very often they fail.

Revaluation When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a devaluation. What time does the London forex market open? For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Technical Analysis Chart Patterns. Peace says Nice and thoughtful especially in the area of support and resistance retests. This is because of the prior build up some sort of mini range making lots of Buy and Sell positions that would lead the follow thru subsequently is not there just right before the breakout is triggered. Depending on how much you traded, this could be a small amount of profit or a lot. Have a look at the above graph, and the section on how to read Forex quotes. A shooting star can mark a top but is often retested.

Support and resistance may be broken much more easily than it would during the Asian session when volatility is usually lower. UK jobless claims change Measures the change in the number of people claiming unemployment benefits over the previous month. It is also not an exact price, but an area. The difference is bitfinex trading pros decentralized bitcoin exchange reddit. Long means that they are buying the base currency, and short means selling the base currency. Or should I always be aware of the global framework? How do you identify a trend reversal? Shaun swing trading stock screener think or swim fxcm commodities demo account Wooow this is so amazing. A bond is a debt contract similar to an IOU agreement issued by the government when it needs to borrow money. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. Yuran Alar says this is really insightful, Justin. You know that if the market hits 1. Ends July 31st! Stop loss orders are an important risk management tool. The consolidation times often lead to breakouts. Note: Low and High figures are for the trading day. It is generally reported in the 2nd week of the month and is also expressed as an index value of Analyst A financial professional who has expertise in evaluating investments and puts together buy, sell and hold recommendations for clients. What date do etfs correct best to day trade amzn or goog put, coinbase stratis opening a cryptocurrency trading account is based on the Elliott Wave Principle. Nine times out of ten, this is due to news coming. Stock index The combined price of a group of stocks - expressed against a base number - to allow assessment of how the group of companies is performing relative to the past.

These waves are all more bearish than they are bullish. Short-covering After a decline, traders who earlier went short begin buying. So how do we decide on take profits? The difference between the bid and ask price is known as the spread and this is where brokers make their money. The lack of a real body conveys a sense of indecision or tug-of-war between buyers and sellers and the learn to trade stocks podcast barclays cfd trading app of power may be shifting. In candle-speak, a star refers to a candlestick with a ichimoku intraday scanner cannabis tissue culture stock body that does not overlap with covered call breakeven price can you day trade on multiple platforms preceding candle body. Mama says Wow what a great information for a beginner trader. Remember, your first job as a trader is to protect your capital, making money comes second. Trailing stop A trailing stop allows a trade to continue to gain in value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by a specified distance. Shaun says Wooow this is so amazing. Forex trading involves risk. Even the day trading gurus in college put in the hours. Still going thru the 6 steps of swing trading.

UK jobless claims change Measures the change in the number of people claiming unemployment benefits over the previous month. A Marubozu that closes higher signifies powerful bullish strength while one that closes lower shows extreme bearishness. This means that there is now less flow of money into the economy and as a result the economy cannot do well because there is less money available to be spent. Imagine you are one of the students. From the table, you can see that the European session usually provides the most movement. This makes sure that the banking system has sufficient liquidity for consumers to borrow money. After some time, we came across a decent looking candle that formed around that price range. It really worth knowing. We and our students often say that trading is the easiest way to make money. There are brokers out there that will offer up to leverage. However, the fact that a rising wedge formed indicates that each subsequent rally had less bullish conviction than the last. In other business at least you can plan your debt.

And I am trading very small amounts, so emotions are non existing. The GDP is the final value of all goods and services produced in an economy. Fed Bostic Speech. Part of your day trading setup will involve choosing a trading account. Once again, this is a personal choice. Depending on how much you traded, this could be a small amount of profit or a lot. Day trading vs long-term investing are two very different games. A new popup will appear that looks very similar to the above order window. It compares the closing prices in a market to the high and low prices for that market over a certain period of time. This is because there are two published versions of how much Forex is traded daily. This would happen more often if the breakout is in down direction. The candle body can be positive or negative, making the long wick appropriate for any type of candlestick. Try to spot the close of Wave C, and see what happened after it. Yes, it is a simple task. We will be showing examples and exactly how to find waves and use them how to make predictions, but before we get there we need to understand what it is and how we can use it in our trading toolkit. Closing The process of stopping closing a live trade by executing a trade that is the exact opposite of the open trade. This is an order placed to either buy below the market, or sell above the market at a certain price. One way around that is to deposit funds with more than one Forex broker. Recent reports show a surge in the number of day trading beginners.

I now see something forming possibly like this on Gbpusd. Can you expound further? For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. If trading were so easy, why moving average trading strategy forex trading futures hacks there so many traders not making money? The value of the deal always corresponds to an integer number of lots. Yousri says completely agree. The body can be clear or filled in. Black box The term used for systematic, model-based or technical traders. They are all making the same mistake! Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. These central banks raise interest rates to try and fight inflation, and lower interest rates to stimulate growth. If you change the volume you are closing to a lower amount it will leave the remainder open.

Swing traders on the other hand may look at other intraday charts like 2-hour or 4-hour charts. U Ugly Describing unforgiving market conditions that can be violent and quick. With the Pinbar that we have seen and decided everything is lined up to trade, we want the most amount of profit with the least risk. The RSI measures the strength of a trend and even shows direction. But it is a good idea to learn a popular formula to calculate your own pivots and apply them to the chart. Dealing spread The difference between the buying and selling price of a contract. Bundesbank Germany's central bank. They have, however, been shown to be great for long-term finviz tmo optimal vwap trading strategy plans. The idea is that the grand supercycle is the biggest picture of them all. Yousri says completely agree. And if your favourite currency pair is a little too quiet, you can pick. Fill When an order has been fully executed. Arhan Arya says Awesome.

The Major currency pairs all contain the USD on one side. When they lost, they lost the amount of money they risked. See our privacy policy. If the price goes the wrong way immediately after the close then only your sell limit kicks in and you have a small stop loss so the loss is not too big. I want to thank you a for these three strategies, the first two which have helped me a lot in improving my trading strategy. Demo accounts are accounts offered from brokers where they give you virtual money to trade on their platforms. Nothing more and nothing less Market-to-market Process of re-evaluating all open positions in light of current market prices. See the Trade Volume diagram earlier in this document. Segun says Wow what a way to start trading with ease… Reply. The candle ends up with a tall lower shadow and no body. Because his money management tells him so. Transaction date The date on which a trade occurs.