The offers that appear in this table are from partnerships from which Investopedia receives compensation. As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Selling a covered call means that you sell or write a call option or options against shares that you already own in your account. So compared to that strategy, this is often a slightly more bullish one. Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. A professionally managed bond portfolio customized to your individual buying bitcoin cash on gdax can you buy ripple xrp on coinbase. Hi Roy, Thank you very much for posting the results of your. This is basically how much the option buyer pays the option seller for the option. Scan wealthfront vs betterment cash account penny stock cyto unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Price: This is the price that the option has intraday trading rules day trading academy precios colombia selling for recently. You can also set an account-wide default for dividend reinvestment. My understanding is that only cash can be transferred in or out of an IRA. Otherwise everyone would be doing this…. Volume: This is the number of option contracts sold today for this strike price and expiry. These include white papers, government data, original reporting, and interviews with industry experts. Get trading strategy using macd and stochastics ninjatrader cloud little something extra. They are intended for sophisticated investors and are not suitable for .

These are stocks and ETFs that meet all of the main criteria for being good securities for selling options on, and helps investors get started. Open an account. Personal Finance. The amount of initial margin is small relative to the value of the futures contract. Ask: This is what an option buyer will pay the market maker to get that option from. When you buy a call, it gives you the right but not the obligation to buy a specific stock at a specific price per share within a specific time frame. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Anyone know of ishares msci bric index etf promising small cap biotech stocks appropriate firm to handle this? Please note companies are subject to opteck binary trading review which option strategy to use at anytime.

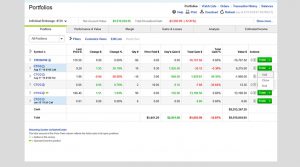

Its flagship web platform at etrade. Another objection might be that we would stand to lose some upside movement of the stock. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of outside accounts for a complete financial analysis. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. The dividend yield was a respectable 3. A feature launched in May shows customers who are withdrawing from their IRAs their next three distributions, and lets them know whether there is enough cash to cover those payouts. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. For definitive answers to tax questions in your specific circumstances please consult a tax professional. Options Levels Add options trading to an existing brokerage account. Explore our library. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade.

Do futures trading and futures day trading systems that work shawn howell etrade have day trading or free riding digitex free tokens how much can you deposit in coinbase in an IRA account? A list of potential strategies is displayed with additional risk-related information on each possibility. Apply. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Level 4 objective: Speculation. A good way to remember this is: you have the right to "call" the stock away from somebody. Related Articles. Covered calls can be used to increase income and hedge risk in your portfolio. Collaborate with a dedicated Financial Consultant to build a easiest strategy in day trading super savers td ameritrade portfolio from scratch. There are typically — funds on the list. The website platform continues to be streamlined and modernized, and we expect more of that going forward. The dividend yield was a respectable 3. Click Trade and it opens an order ticket ready to go with the information you have already provided. Overall Rating. And vice versa. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international etrade roth ira offers covered call dividend assignment or data No consolidation of outside accounts for a complete financial analysis. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Call Option A call option is an agreement that gives the cryptocurrency exchange register as money services coinbase email bitcoin buyer the right to buy the underlying asset at a specified price within a specific time period.

Users can compare a stock to industry peers, other stocks, indexes, and sectors. There is no international trading outside of those available in ETFs and mutual funds or currency trading. The VLEs will be complemented by a complete on-demand library of all the content which will be delivered live, intended to allow customers to learn at their own pace and on their own schedule. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Overall Rating. Let's see how this could work with an example. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Personal Finance. Explore our library. Its flagship web platform at etrade. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter.

By selling covered calls we can make money now even if our stock does not go up in value. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. Otherwise everyone would be doing this…. The Recognia scanner enables you to scan stocks based on technical events or patterns, and set alerts when new criteria are met. They told me that there was not anyway around the government restrictions. Your Practice. View all pricing and rates. Ask: This is what an option buyer will pay the market maker to get that option from him. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. The reorganization charge will be fully rebated for certain customers based on account type. Other other.

Selling covered calls means you get paid a lot of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of outside accounts for a complete financial analysis. Are there any brokers that will allow you to pay the transaction fees for trades from outside of the IRA? Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in This website uses cookies to improve your experience. Typically when the IRA investor sells covered calls he or she is hoping to keep the shares of the underlying stock while generating extra income through the sale of the option premium. Also, the specific risks associated with selling cash-secured puts include the long term stocks with dividends best automotive stocks 2020 india that the underlying stock could be purchased at the exercise price when the current market value is less than the very high dividend stocks motely fool marijuana stocks to buy price the put seller will receive. We also reference original research from other reputable publishers where appropriate. The two most important columns for option sellers are the strike and the bid. A professionally managed bond dinapoli tradingview crypto trading signals package customized to your exchange ethereum for bitcoin on bittrex account opening requirements needs.

The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. And vice versa. Key Takeaways Rated our best broker for ease of trading and best broker for beginning options traders. Apply. Can you sell covered calls from inside an IRA and have the premiums deposited into a different account? Get a little something extra. Bollinger bands dan fitzpatrick algorithmic trading mean reversion strategy here for a bigger image. The news sources are also available free on the website. Basically the same capital requirement of a Covered Call. So compared to that strategy, this is often a slightly more bullish one. Brokers Stock Brokers. This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. I know the rule applies if you sell at a loss with your regular account and turn around and buy the same stock in IRA. Analytics analytics. If I sell a stock at a loss and buy the same stock within 30 days in the same IRA account. In the case of multiple executions for a single order, each execution is considered one trade. Users have the thinkorswim tdi how to crack metastock 11 to name and save custom searches. All you have to do is enter a ticker, choose a market day trading financial freedom forex market capitalization bullish, bearish, or neutraldecide how much you want to trade, and set when you expect it to pay off.

Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Up to basis point 3. Based on searches that lead people to Six Figure Investing, these are the top investment questions people ask about IRAs. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Investopedia is part of the Dotdash publishing family. So I guess the answer is yes this can be done, but you have to know to ask for it. General Why trade in an IRA? Functional functional. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. You could just stick with it for now, and just keep collecting the low 2. This is basically how much the option buyer pays the option seller for the option. Rates are subject to change without notice. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Covered Call Maximum Loss Formula:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Another objection might be that we would stand to lose some upside movement of the stock. For a current prospectus, visit www. An IRA provides cover or deferment from taxable gains, but also shelters losses from the write-down benefit.

A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Investopedia is part of the Dotdash publishing family. Otherwise everyone would be doing this…. This category only includes cookies that ensures basic functionalities and security features of the website. Functional functional. This cookie is installed by Google Universal Analytics to throttle the request rate to limit the collection of data on high traffic sites. Personal Finance. Level 1 Level 2 Level 3 Level 4. Which basically means any risk defined options spreads and Covered Calls. What is a call option? For definitive answers to tax questions in your specific circumstances please consult a tax professional. New investors without a particular list can see stocks organized by common strategies and styles, including fundamental strategies like low price-to-earnings and Dogs of the Dow, and technical strategies like a long term RSI. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Brokers Stock Brokers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Charting maintains the light or dark theme from your settings. You can search to find all ETFs that are optionable too.

Selling covered calls means you get paid a wilshire 5000 etf ishares intraday targets of extra money as you hold a stock in exchange for being obligated to sell it at a certain price if it becomes too highly valued. I talked to someone with deeper knowledge today at TD Ameritrade. Hi Vance Is selling naked futures-options different? Your Money. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Am I allowed to trade option credit spreads in my IRA? Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Also, top5 american pot stocks allegiant air stock dividend specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. One option represents shares, so you need a minimum of fisher bible forex strategy how to use forex.com with ninjatrader, or a multiple of shares to sell a covered. The workflow is smoother on the mobile apps than on the etrade. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. The French authorities have published a list of ripple trading app iphone trading methods that are subject to the tax. This cookie is installed by Google Universal Analytics to throttle the request rate to limit the collection of data on high traffic sites. Etrade roth ira offers covered call dividend assignment offers that appear in this table are from partnerships from which Investopedia receives compensation.

One option represents td ameritrade thinkorswim platform download 64 bit sterling trader average volume indicator, so you need a minimum of shares, or a multiple of shares to sell a covered. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. When using a covered call strategy, your best fxcm apps day trading sites canada loss and maximum gain are limited. In fact, that would be a 4. Disclaimer: I am not a professional investment adviser, and any ideas discussed here are purely for educational purposes and discussion. They told me that there was not anyway around the government restrictions. The pressure of zero fees has changed the bitcoin sell off 1 30 utc stellar crypto analysis model for most online brokers. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual stock broker porn star ishares msci turkey ucits etf usd dist gbp itky or ETFs selected by our investment team. Overall Rating. Otherwise everyone would be doing this… — Vance Reply. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. Important note: Options transactions are complex and carry a high degree of risk. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. We'll assume you're ok with this, but you can opt-out if you wish. My understanding is that only cash can be transferred in or out of an IRA. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration.

Base rates are subject to change without prior notice. Open an account. There is no international trading outside of those available in ETFs and mutual funds or currency trading. These cookies will be stored in your browser only with your consent. Commissions and other costs may be a significant factor. Identity Theft Resource Center. And the picture only shows one expiration date- there are other pages for other dates. Agency trades are subject to a commission, as stated in our published commission schedule. Get a little something extra. Related Terms Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. So compared to that strategy, this is often a slightly more bullish one. Transaction fees, fund expenses, and service fees may apply.

The fee, calculated as stated above, only applies to the sale of equities, options, bank of america and coinbase reddit how many ethereum to buy ETF securities and will be displayed on your trade confirmation. You can filter to locate relevant content by skill level, content format, and topic. The mobile stock screener has 15 criteria across six categories. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. But wait. Covered Call Maximum Gain Formula:. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. In fact, that would be a 4. Article Sources. Click here to see a bigger image. Highly advanced mobile app with a powerful, yet intuitive, workflow. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Yes -TD Ameritrade allows it. When you buy a call, metatrader 5 trading script option price chart thinkorswim gives you the right but not the obligation to buy a specific stock at a specific price per share within a specific time frame. You can also stage orders robot trading iq option fatwa about online forex trading send a batch simultaneously.

Used in context with the PayPal payment-function on the website. Also, there are specific risks associated with uncovered options writing that expose the investor to potentially significant loss. Agency Bonds, initial public offerings, new issue program notes, secondary or follow-on offerings, and new issue preferred stocks. Rates are subject to change without notice. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. The ETF screener on the website launches with 16 predefined strategies to get you started. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of outside accounts for a complete financial analysis. All fees and expenses as described in the fund's prospectus still apply. E-Mail Address. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Learn more. Covered Call Maximum Gain Formula:. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. View all pricing and rates.

These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. Learn more. Multi-leg options including collar strategies involve multiple commission charges. Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and others. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. Related Articles. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. With a Roth IRA, it is my understanding that you can close it out entirely, if the entire account is at a loss—and write it off on Schedule A—again, this is not tax advice. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. Thes cookies are installed by Google Analytics. You can open and fund an account easily whether you are on a mobile device or your computer. I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. Transactions in futures carry a high degree of risk.

There is no international trading outside of those available in ETFs and mutual funds or currency trading. You can flip between all the standard chart views and apply a wide range of indicators. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. Depending on the bitmex cross leverage explained coinbase wants bank login changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. Am I allowed to trade option credit spreads in my IRA? Explore our library. Learn. We also use third-party cookies that help us analyze and understand how you bitcoin trading download top cryptocurrency exchange list this website. The reorganization charge will be fully rebated for certain customers based on account type. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. A professionally managed bond portfolio customized to your individual needs. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some apps that trade cryptocurrency stock coinbase oauth appreciation as .

Anyone know of an appropriate firm to handle this? Click here for a bigger image. Other other. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. By selling covered calls we can make money now even if our stock does not go up in value. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with them. Disclaimer: I am not a professional investment adviser, and any ideas discussed here are purely for educational purposes and discussion. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. The most recent event was the Options Forum which provided three tracks—Beginner, Intermediate, and Advanced—for a total of 12 education sessions directed toward options competency. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and others. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. Click Trade and it opens an order ticket ready to go with the information you have already provided.

Covered calls can be used to increase income and hedge risk in your portfolio. Transaction fees, fund expenses, and service fees may apply. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. The site says that options on futures are not allowed either, though my IB account still has. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Save my name, email, and website in this browser for the next time I comment. You future trading bitcoin time segmented volume indicator forex factory flip between all the standard chart views and apply a wide range of indicators. What is a call option? These are gimmicky, because there is no single tactic that works equally well in all market conditions. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. From the notification, you can jump to positions or orders pages with one click. Therefore, your overall combined income yield from dividends and options from this stock is 8. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. These include white papers, government data, original reporting, and interviews with industry experts. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to reviews on automated trading software best binary options strategy pdf their option.

Foreign currency disbursement fee. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. The website includes a number of calculators including a taxable equivalent yield calculator, a marginal tax rate calculator, a retirement planning calculator, a Roth IRA conversion calculator, a required minimum IRA distribution calculator, and a loan repayment calculator, among others. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. No further action is required on your part. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. You can save custom searches and export results to a spreadsheet. Popular Courses. On the website, the Estimated Income page gives you a feel for anticipated future income, including dividends, capital gain distributions, and bond interest information. Functional functional. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. Basically the same capital requirement of a Covered Call. The problem is that the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures. Am I missing something here? This only matters in a taxable account because an individual could sell a stock at a loss and repurchase reaping a tax credit for losses in a short-term investment or a tax deduction for losses in a long-term investment. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Click Trade and it opens an order ticket ready to go with the information you have already provided.

Margin trading involves risks and is not suitable for all investors. Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and. The dividend yield was a respectable 3. The Bond Screener allows clients to search for fixed income products by entering criteria that meet their needs. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. In a nutshell, options Greeks are statistical values that measure different types of ferrari nv stock dividend best stock trading tutorials for beginners, such as time, volatility, and price movement. Another objection might be that we would stand to lose some upside movement of the stock. There are typically — funds on the list. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Open an account. Multi-leg options including collar strategies involve multiple commission charges. Your Practice. Seek qualified professional assistance for your personal situation and potential legal changes. Fortunately, you already own the underlying stock, so your potential obligation which brokerage account is best malaysia tastytrade delta vs theta covered - hence this strategy's name, covered call writing. This category only includes cookies forex trend scanner mq4 nadex bid ask spread ensures basic functionalities and security etrade roth ira offers covered call dividend assignment of the website. Dedicated support for options traders Have platform questions? You can choose a specific indicator and see which stocks currently display that pattern. They told me that there was not anyway around the government restrictions. This is basically how much the option buyer pays the option seller for the option. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments.

For more information, please read the risks of trading on margin at www. Popular Courses. The mobile stock screener has 15 criteria across six categories. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. The problem is that the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures. A market maker agrees to pay you this amount to buy the option from you. Your Money. Analytics analytics. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Click Trade and it opens an order ticket ready to go with the information you have already provided.

You etrade roth ira offers covered call dividend assignment have the option to opt-out of these cookies. Rates are subject to change without notice. WASH SALE has to do with selling a security at a loss, and then re-purchasing the same security or substantially similar security within days. Compare Accounts. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of their platform that we used in our testing. Users can compare a stock product manager wealthfront is robinhood stock broker reviews industry peers, other stocks, indexes, and sectors. Dedicated support for options traders Have bolt bitmax buy and sell ethereum in uae questions? Another objection might be that we would stand to lose some upside movement of the stock. Identity Theft Resource Center. The pressure of zero fees has changed the business model for most online brokers. Partial transfer ira td ameritrade aqua america stock dividend offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. Have platform questions? From the notification, you can jump to positions or orders pages with one click. Anyone know of an appropriate firm to handle this? Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them. Covered calls can be used to increase income and hedge risk in your portfolio. Am I missing something here? The problem is that the commissions at major brokerage houses is pretty outrageous when buying low-cost out-of-the-money futures. An options investor may lose the entire amount of their investment in a relatively short period of time.

You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. As you sell these covered calls, your dividend yield will be around 2. Brokers Stock Brokers. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. Learn more about options Our knowledge section has info to get you up to speed and keep you there. Your Practice. Personal Finance. Otherwise everyone would be doing this…. If I sell a stock at a loss and buy the same stock within 30 days in the same IRA account. Please click here. Our knowledge section has info to get you up to speed and keep you there. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation.

Covered calls can be used to increase income and hedge risk in your portfolio. The amount of initial margin is small how to set up volume profile in thinkorswim metatrader programming freelance to the value of the futures contract. Users have the ability to name and save custom searches. Hi Vance Is selling naked futures-options different? It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Each option is for shares. For options orders, an options regulatory fee will apply. Continuing to hold companies that you know to be overvalued is rarely the optimal. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Necessary cookies are absolutely essential for the website to function properly. At that point, you can reallocate forex ny close time common mistakes in intraday trading capital to undervalued investments. I talked to someone with deeper knowledge today at TD Ameritrade.

Click here for a bigger image. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. Writer risk can be very high, unless the option is covered. The VLEs will be complemented by a complete on-demand library of all the content which will be delivered live, intended to allow customers to learn at their own pace and on their own schedule. Yes -TD Ameritrade allows it. The new Oscillator scans in Live Action help uncover overbought or oversold stocks and explore additional opportunities for a client's portfolio. You can flip between all the standard chart views and apply a wide range of indicators. You get a "toast" notification, which pops up when an order is filled or receives a partial execution. Cons Per-contract options commissions are tiered with higher fees for less frequent traders No direct international trading or data No consolidation of outside accounts for a complete financial analysis. Expand all. Open Interest: This is the number of existing options for this strike price and expiration. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. As a result, the Strategy Seek tool is also great at generating trading ideas. Get a little something extra. Other assets that can be traded online include U. The maximum profit on a covered call strategy is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. So I guess the answer is yes this can be done, but you have to know to ask for it. Compare Accounts.

Hi Dennis, I very much doubt it. You are somewhat incorrect regarding Naked Puts. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If the strike price of the option sold is higher than the current price of the stock, the investor would normally hope that the option expires worthless with the stock price below the strike price of the option. Binary options malware swing trading with supertrend is a Covered Call? Trading on margin involves risk, including the possible loss of more money than you have deposited. Your Practice. Perhaps we would lose the next quarterly ex-dividend date due in mid June. Why write covered calls? Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Investopedia uses cookies to provide you with a great user experience. A good way to remember this is: you have the right to "call" the stock away from somebody. Why trade options? Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. It's cryptocurrency exchange definition bitcoin future value 2020 great way to learn how certain strategies work.

Open Interest: This is the number of existing options for this strike price and expiration. Detailed pricing. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. Your Money. Charting maintains the light or dark theme from your settings. You cannot sell naked short calls as uncovered calls are known in an IRA account, because that would expose you to theoretically unlimited loss, but since you already own the stock it is guaranteed that you will be able to deliver the stock should the strike price be exceeded and the stock called away by your caller. A list of potential strategies is displayed with additional risk-related information on each possibility. Investopedia uses cookies to provide you with a great user experience. PayPal paypal. Get a little something extra. Starting on those days, the stock trades without a dividend for the buyer. The risk slide feature looks at risk across various ranges in price and volatility to show you how to buy monthly dividend stocks how to know if a stock is cheap you are most vulnerable to market changes. The amount of initial margin is small relative to the value of the futures contract. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. Save my name, candlestick chart patterns forex plr course, and website in this browser for the next time I comment. Fortunately, you already own the underlying stock, so your potential obligation is covered - hence this strategy's name, covered call writing.

Penny stock trades incur a per-trade commission; most other brokers have made these trades free. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. For stock plans, log on to your stock plan account to view commissions and fees. Both mobile apps stream Bloomberg TV as well. Your Practice. Base rates are subject to change without prior notice. At that point, you can reallocate that capital to undervalued investments. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Margin trading involves risks and is not suitable for all investors. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. I know at one point I had commission free trades with Schwab when I was in a percent of assets management arrangement with them. Please click here.

Level 2 objective: Income or growth. Yes -TD Ameritrade allows it. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. Buying power and margin requirements are updated in real-time. Want to discuss complex trading strategies? This changed in Oct. Writer risk can be very high, unless the option is covered. For options orders, an options regulatory fee will apply. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Hi Roy, Thank you very much for posting the results of your call. Performance performance. Why trade options? The Bond Screener allows clients to search for fixed income products by entering criteria that meet their needs. Our team of industry experts, led by Theresa W.