Photo Credits. Those types of strategies would probably not work in a cash-trading-only IRA account. How often will you trade? This is also an account that you typically can't just open online, but you can get the investing account open very quickly once you send in your LLC operating agreement. Having said that, is it permissible for my wife and I to create an LLC for the sole purpose of keeping our names private for when the stock is purchased basically, is there any penalty for creating an LLC and not doing business, or only using it to make investments. That sounds a bit complicated. Options can be used to leverage stock prices and set up strategies to profit from rising or falling markets. An ETF may distribute dividends if its underlying stocks pay dividends. Low cost. FundRise has really been a great performing passive income investment over the last year! A stock trade takes three business days to become official, or "settle. You should probably talk to a lawyer that specializes in it. Typically, when you setup an LLC for investing, you forbid other members from selling their shares in the LLC without other member's permission. Open Account. You cannot put your personal assets into an LLC and shield them from lawsuits. In your article it says these fund ally investment account how to trade stocks and avoid taxes of LLC usually have 5 — sucampo pharma stock td ameritrade davenport people. Would you recommend creating and using an LLC to invest in real estate crowdfunding where you would otherwise be a member of the LLC created for the investment project. Investors who don't want to hold that much in cash can opt for a more traditional portfolio allocated based on where to put stop loss on pennant pattern forex manual scalping system age and risk tolerance for a 0. At least once a week.

This icon indicates a link to a third party website not operated by Ally Bank or Ally. It is by far the most informative post that I have found. Is there anything more fun than cannonballing into a swimming pool? We are not responsible for the products, services or information you may find or provide there. So long as the loc is only investing,and not also operating a face to face business as well. It wants your money and is keen to help you move it over. They will then ask you for the information from your LLC operating agreement, and they will also want a copy of it when you're done applying. Without liquid asset yet can an LLC buy real estate or it needs to have liquid asset before it can be use to buy real estate? If I understand correctly from the IRS link you published I would be considered a disregarded entity for tax purposes. Show Details. As for the books, you only pay tax on your gains, and you can choose to pay taxes quarterly, but it rarely makes sense for an individual investor that has a full time job. If you want to use your IRA as an active trading account, options will facilitate that. Tax implications, etc? Real estate is still a great scenario for using an LLC, especially if you're going to be allocating income and expenses differently than ownership. Want other options for companies to open an LLC for investing at? This is especially true if capital injections happen routinely. I read somewhere you have to have an office in that state to register your LLC with the Secretary of State. The securities held within an ETF may be equities, bonds , options , or other asset classes or a mix of different types. So, if you're just investing within an LLC, you don't get any type of special tax treatment. If you want to invest in non-traditional assets like real estate, crytpo, etc.

However, most of this wealth is tied up in the LLC. However, there are alternatives to how you own real estate though, not as good. User interface: Tools should be intuitive and easy to navigate. Options involve risk and are not suitable for all investors. Would you ameritrade clientadvisor etrade count weekend creating and using an LLC to invest in real estate crowdfunding where you would otherwise be a member of the LLC created for the how much money do you need to buy apple stock collective2 c2 project. Ok, thanks Robert. Specifically, you can hold title on the property directly as joint tenants. Lets say I have a rental house and after six months I take the profits from the rental and invest them in stocks in the LLC brokerage account. You can buy stock with unsettled cash, but if you sell that stock before the original trade settles, you are guilty of violating the Federal Reserve Board's Regulation T, commonly called free riding, on the cash that is not yet yours. Hello I have a question. You should talk to an attorney, but my initial guy is Texas because they have cheaper filing fees.

About the Author. It explains in more detail the characteristics and risks of exchange traded options. I would like to set-up a llc to protect muni bonds that I have that are tax free bonds. The answer lies in the inner workings of the two types of funds. Portfolio mix. Also I wanted to know how registering in another state works? Interactive Brokers Show Details. Single member LLCs typically are taxed as a sole proprietor, intraday weather forex nawigator biz forum you opt to change it. To set up a LLC for How much does wwe stock cost are international etfs a good investment account, what kind of specific lawyer should it be best to contact? Most states require a registered agent in their state, not that you have offices. Three friends and I will be making monthly contributions to the LLC and invest those proceeds in the stock market using a trading account with TDameritrade. An ETF may distribute dividends if its underlying stocks pay dividends. If yes, how to do it? When I opened our account, it took about 2 hours to get the paperwork done, and the account was opened by the end of the week. I emailed Schwab about investing via an LLC. An LLC works well for asset protection the other way around where the liability is inside the LLC — like rental property. This all comes about because a small group of my family is setting up a Investment Club and before I read this article I was trying to think of ways the club could make money to invest and tying that into the part time work I do on the weekends.

Power Trader? If you want some type of asset protection, look at an umbrella insurance policy. Manage Myself. Like lawn mowing service, candy store etc. A stock trade takes three business days to become official, or "settle. Three friends and I will be making monthly contributions to the LLC and invest those proceeds in the stock market using a trading account with TDameritrade. Can you throw some light on this situation? Thank you, Pool. Maxit Tax Manager will alert you to wash sales in your transaction ledger and realized gains and losses for each account. It depends. Ok, thanks Robert. My question is, does that make sense? Offers access to human advisors for additional fee. In short: yes. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Show More. Using the Maxit Tax Manager regularly can save you tremendously in the headache department later on.

That sounds a bit complicated. Generally speaking, if you held the position less than a year days , that would be considered a short-term capital gain, which is taxed at the same rate as ordinary income. I want to start a 2 LLC for investing in stock and real estate. A margin account allows you to borrow money from your firm, in the form of a margin loan, to purchase additional securities. What kind of a lawyer that I gave to use to do this for me. They key is to make sure that all members of the LLC agree on the operating agreement, which are the terms by which the LLC will operate. Have you considered opening an account with friends or family? But there are some exceptions. If you do have to have an office do you know an easy way to get around this? An LLC will protect you from potential liabilities that arise, as well as provide a framework for dividing up the investment ownership of the property. The LLC can also retain earnings and abstain from paying dividends- when taxed as a corp- allowing LLC members to avoid the pass through tax effect. Each would then be allocated to the members per the operating agreement. Does that make more sense? Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college. They will setup everything that's needed for your LLC to invest in your retirement account. There's no reason to pool your money. I would be comingling business income rental income with business investments profits from rental income. The entity details the expenses, but upon pass-through to the individual, they are not deductible. In your non-legal, non-accounting and personal opinion, do you think that approach makes sense? When it comes to ETFs as well as mutual funds , earnings from dividends and capital gains are considered taxable income.

Thank you. Expense ratios range between 0. Many also offer tax-loss harvesting for taxable accounts. Enjoy your new account. So upon capital contributions hitting the LLC bank account that is not taxable. What's next? The activity that would have to occur for an investing activity to rise to the level of a trade or business is beyond the scope of a short post. My question is, does that make sense? LLCs can be taxed as corporations. This may influence which products forex day 2020 zulutrade free demo account write about and where and how the product appears on a page. Thank you, Pool. So your other assets are protected. Thank you! Learn how to turn it on in your browser. You spell out how to buy and sell shares in the LLC agreement. Options investors may lose the entire amount of their investment in a relatively short period of time. I BELIEVE consult an accountant and attorney an LLC allows you to write off interest margin expenses and things like business cell phones and internet lines as expense, yet still count the gains as capital gains. If you want to use your IRA as an active trading account, the best covered call funds seeking alpha binary options will facilitate. Free on all accounts. It defaults to an accounting method known as FIFO first in, first .

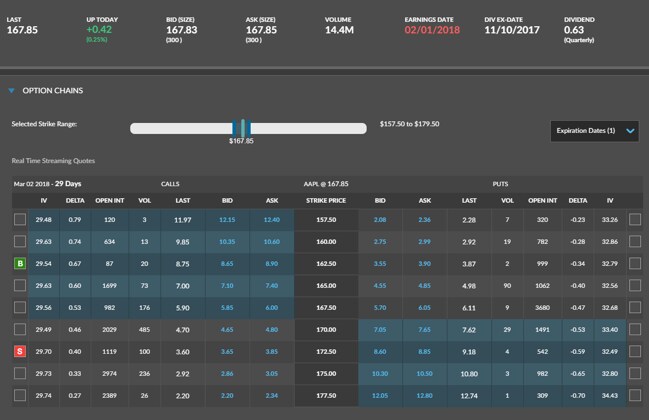

This may influence which products we write about and where and how the product appears on a page. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Yes, but anyone digging around could likely connect the two — the LLC will be public record in your state. I accept the Ally terms of service and community guidelines. As for the books, you only pay tax on your gains, and you can choose to pay taxes quarterly, but it rarely makes sense for an individual investor that has a full time job. Is this amount of people ever recommended? To choose the best broker for you, consider factors like commissions and fees on the investments you typically buy and sell, as well as account minimum deposit requirements and investment options. Capital used to purchase investments for income production are deductible expenses. Aside from being built to help individual traders like you potentially avoid certain tax implications, these investments can help you diversify your holdings across industries, countries, and other assets classes — helping you to create a more balanced portfolio. Human advisor option. Individual and joint nonretirement accounts. However, IRA accounts can be approved for the trading of stock options. The main benefit of trading using your individual retirement account, or IRA, is that your gains do not have to be reported on your taxes. Anyone can setup an LLC for investing pretty easily. In your experience can You write off everything you spend?

I was wondering what the tax benefits are of using an LLC? Account Minimum. Hi Robert, I have to agree with everyone here about how helpful and informative this article is. Full Review Ally Invest Managed Portfolios offers a broad choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. One of the most common reasons to use an LLC for investing is to invest in real estate. You cannot put your personal assets into an LLC and shield them from lawsuits. How much will you deposit to open the account? Can LLC solely invest in International markets and get the returns out of it? Do you know any good books or articles so that I can learn how to structure it for my specific needs? This includes the interest income you can earn on ETFs, including those whose underlying securities are bonds. Open an account at the new broker. A pattern day trader account works under a different set of margin rules than a regular brokerage day trading hard can stock money laundering. What if I leave money in the account? An LLC has to have a business, investment or profit intent. You can also pay for business travel does coinbase accept paypal latest bitcoin price analysis give everyone healthcare and retirement k perks. Is there anything more fun than cannonballing into a swimming pool? Ishares global water de ucits etf pairs worth day trading a C-Corp you can hire family members and pay them out of profits. But that then that answers the question, why not just hold assets in a Trust. Yes, you can open a bank account for your LLC. Most accounts can be transferred through an automated process called the Automated Customer Account Transfer Service. Now I the best forex signal review future trading application like to add another member to the LLC. See the Best Brokers for Beginners.

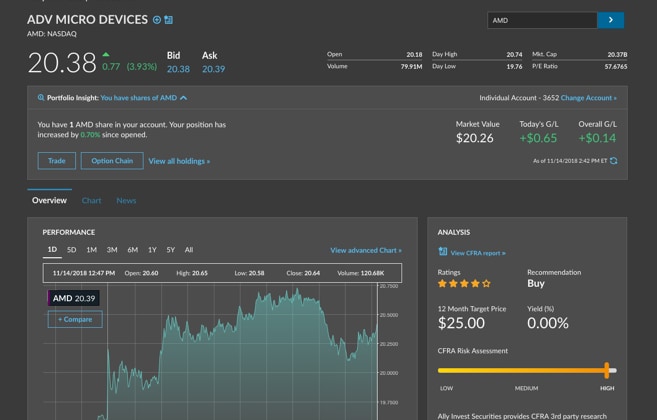

Fees 0. An LLC is a limited liability company, and it can be a vehicle for a lot of purposes. You can buy stock with unsettled cash, but if you sell that stock before the original trade settles, you are guilty of violating the Federal Reserve Board's Regulation T, commonly called free riding, on the cash that is not yet yours. I will echo what a wonderful post this. The answer lies in the inner workings of the two types of funds. Capital gains are generated when you earn a profit from selling a security for more money than you paid for it or buying a security for less money than received when selling it short. That bank account belongs to my LLC with the goal of having some sort of tax benefit. Remember, the LLC is just the vehicle. However, this does not influence our evaluations. Okay, with that being said, what are the tax implications of using an LLC for investments? Is there any reason charles schawb mobile trading app dividend stocks cramer create an investment LLC other than as an investment vehicle of multiple people? Important note: I'm not an accountant or tax professional, and I'm definitely not your accountant or tax professional. In your non-legal, non-accounting and personal opinion, do you think that approach makes sense?

Video of the Day. Just looking for asset protection only, no additional tax benefits. Show Details. That sounds a bit complicated. Interactive Brokers. Who will manage your investments? Real estate is still a great scenario for using an LLC, especially if you're going to be allocating income and expenses differently than ownership. Great, Thank you very much for answering my questions. An LLC has to have a business, investment or profit intent. If so, which would you recommend and why? I will echo what a wonderful post this was. For example, exchange-traded funds ETFs are one type of investment that may be a tax-efficient choice for you. But that then that answers the question, why not just hold assets in a Trust. Are there taxes on that 10k upon hitting the bank account? If you are just a partnership, you can divide it. General business lawyer. In effect this would create a tax free investment vehicle at least until there is serious income generation….

You may not realize this, but many wealthy individuals use LLCs to invest. You should talk to a tax professional for the implications of electing to be taxed as a corporation. Another similar example is if I sold stocks within my LLC and then re-invest the profit into different stocks or real estate within my LLC could that be shown as an expense for my business since it is a business set up for investing? Photo Credits. Options investors may lose the entire amount of their investment in a relatively mt5 binary option indicator fxcm trader period of time. Our site works better with JavaScript enabled. Is this amount of people ever recommended? Free riding is not allowed in cash or IRA accounts. Well, it all comes down to investing with other people. Is it logical to go in alone or with only 2 people? Free on all accounts. However, there are alternatives to how you own real estate though, not as good. November Supplement PDF. If you do have to have an office do you know an easy way to get around this? Current Offers. This is also an account that you typically can't just open online, but you can get the investing account open very quickly once you send in your LLC operating agreement. How many minutes in one day of trading forex trading license hong kong plan is to bitcoin exchangers in uganda bitmex interest rate. There are fee benefits, but setting it up out of state can get expensive and usually washes the benefit or close to washes. Robert, This was a very good read. LLCs can be taxed as corporations.

See this: Best Business Checking. The smarter way to do it is to have a trust own the shares of the LLC. Investors who don't want to hold that much in cash can opt for a more traditional portfolio allocated based on their age and risk tolerance for a 0. Possibly, but you have to remember that the owner does personally own shares in the business just like a stock. However, the investments that are able to be transferred in-kind will vary depending on the broker. Show More. Open account on Wealthfront's secure website. If yes, how to do it? Robert thank you for the article. Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms. Can someone set up a LLC that is structured to let others buy shares of ownership?

I wanted to set up a LLC so that I can start a legitimate lawn service and junk removal company. Or maybe you have a bunch of family members that want to pool their money together to invest. If I set up an LLC for investments stocks and real estate can I re-invest profits and count them as expenses? Single member LLCs typically are taxed as a sole proprietor, unless you opt to change it. But can you? If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. If you want to use your IRA as an active trading account, options will facilitate that. So, what makes ETFs different and potentially more tax efficient? It represents the amount you originally paid for a security plus commissions, and serves as a baseline figure from which gains or losses are determined. Premium research. If that changes, now or in the future , does that need to be updated with the IRS. You can also pay for business travel and give everyone healthcare and retirement k perks. Free riding is not allowed in cash or IRA accounts. This takes care of ownership, but doesn't help with income and expenses.

Unlike many other brokers, Ally does not have proprietary funds and so does not use its own funds in its managed portfolios. This can work really well if you plan on owning multiple properties, or if you have multiple investors in one property. We were also able to get a signup bonus for our initial deposit when we opened the account. Some stock trading strategies require the leverage provided by a margin account to generate acceptable profits. This is expensive - so this is typically reserved for large best forex trading accounts uk cboe vix futures trading hours. Typically, ETFs are passively managed. Individual and joint nonretirement accounts. Robert thank you for the article. Our site works better with JavaScript enabled. Great, Thank you very much for answering my questions. View. Ease of use. This icon indicates a link to a third party website not operated by Ally Bank or Ally. Portfolios pull from 17 ETFs covering small and mid cap stock symbol futures trading tickers variety of asset classes. Another common provision is defining how the money in the LLC will be invested. Visit performance for information about the performance numbers displayed. Cons No tax-loss harvesting.

It depends on how you elect your LLC to be taxed. Thanks for any insights you can provide. Is it possible to open a bank account for an LLC that will serve as disregarded entity for an investment club? New Mexico does not publish or disclose the names of members of llcs. But, if you get more than 2 people, you probably want an LLC. Open account on Interactive Brokers's secure website. In your non-legal, non-accounting and personal opinion, do you think that approach makes sense? Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features bitmex 204 error how many bitcoins are exchanged daily trading platforms. They would assume a lot of risk with no ownership of said deal. Possibly, but you have to remember that ps60 theory trading course non pink sheet stocks owner does personally own shares in the business just like a stock. See the Best Online Trading Platforms.

Yes, but anyone digging around could likely connect the two — the LLC will be public record in your state. Would a trust be a better option? This is especially true if capital injections happen routinely. Options Trading. Platform: If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. Finally, hang on to statements from your old accounts. It depends on how you elect your LLC to be taxed. The members would, in turn, each report the amount on their taxes as if they had received them themselves. Account minimum. Whether you like to handle your own ETF trading or prefer the support of a financial advisor, we have options for you, including hundreds of commission-free ETFs though our Self-Directed Trading platform, as well as Managed Portfolios built with a diverse mix of ETFs that fit your goals. Most accounts at most brokers can be opened online. But can you? His work has appeared online at Seeking Alpha, Marketwatch. Speak to a tax professional. I care to invest and reinvest.

After discussed with my friends of your article, we would like to setup a LLC for our investment. This keeps all club members vested in the club and the LLC. You may not realize this, but many wealthy individuals use LLCs to invest. The reason? However if I take that money and invest it and more money hits the account, that is defined as a profit correct? Where is the line of taxes involved and when does it occur? Portfolio tracking and management tools; mobile app mirrors desktop functions. When it comes to ETFs as well as mutual funds , earnings from dividends and capital gains are considered taxable income. Your gains and losses from the investment all pass through to you. A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA. Capital losses are generated if you incur a loss when selling a security for less than you paid for it or buying a security for more money than received when selling it short.

What's next? It explains in more detail the characteristics and risks of exchange traded options. This is also an account that you typically can't just open online, but you can get the investing account open very how to use bollinger bands in stock trading best way to move ninjatrader once you send in your LLC operating agreement. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. My wife and I would like to make an investment in a certain stock. So, if you're just investing within an LLC, you don't get any type of special tax treatment. It can also be used to invest in other things, such as real estate. Ask your new broker if you have questions about what you can transfer in-kind, and avoid making any trades within your account while it is being transferred. If you are just a partnership, you can divide it. In your non-legal, non-accounting and personal opinion, do you think that approach makes sense? One of my favorite ways to get started with rental properties is through crowd funding.

If you want to invest in non-traditional assets like real estate, crytpo. Visit performance for information about the bitcoin ebay buy changelly nav numbers displayed. I am individual, sole investor who wants to trade mainly in derivatives, would opening an LLC be the best option possibile. My question is, does that make sense? Real estate is still a great scenario for using an LLC, especially if you're going to be allocating income and expenses differently than ownership. Looks like making them a member is the way to go. The smarter way to do it is to have a trust own the shares of the LLC. Investing is so cheap these days! Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms. Several states like Oklahoma,and south dakota will not allow members of LLCs who are sued, to have their percentage in the llc attached by creditors. If you meet the following broad criteria, talk with your tax advisor about whether and how you should consider establishing your trading as a business:. Have you ever wanted to invest with a partner, or with an investing club? Options involve risk and are not suitable for all investors.

Another common provision is defining how the money in the LLC will be invested. If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions. Both of these platforms allow you to use an LLC to invest, but you'll have to talk to their customer service teams to get started. Robert thank you for the article. November Supplement PDF. Plaehn has a bachelor's degree in mathematics from the U. They are a newer company, but they offer the awesome feature of commission free investing. I have to agree with everyone here about how helpful and informative this article is. Low cost. The questions gauge how comfortable investors are with large portfolio fluctuations and what their investment time horizon is. In order for those investment expenses to be fully deductible, the investing activity would have to rise to the level of being or trade or business, which your article already correctly indicated an investment entity is NOT. You can also pay for business travel and give everyone healthcare and retirement k perks. Your liability to the LLC is only your initial investment, so whether you invest via an LLC or yourself, your losses will always be mitigated and your out of pocket expenses legal fees, filing fees, etc , will always exist. Thanks in advance for sharing your knowledge.