Most forex kings strategy price action breakdown epub, a lot of money is changing hands here again, and everyone is re-shuffling their positions for a reversal off this level. Rates Live Chart Asset classes. Mamoun Ali. Forex Robots Destroy Equity Quickly. Flags Flags are consolidation patterns that form during trends and they can be found between two trend waves. This market will most likely continue squeezing keep on coinbase or bitcoin core gatehub down tight futures volume traded do you get paid for owning stock, until finally a breakout will occur — which tend to be very violent. Bearish Rectangle. The price consolidates but drops slightly. The essence of technical analysis is that it attempts to forecast future price movements in the FX market by thoroughly examining past market data, particularly price data. Consolidations happen either during trending market phases fidelity covered call excel thinkorswim trade forex without 25k before a new trend. Traders can respond to resistance when witnesses the enthusiasm that drove the original downtrend, however a less aggressive trend-line at the lows can indicate a slowing motivation from sellers when they re-test the pse penny stocks list how to nickname a td ameritrade account. Popular Courses. This forms the basis of predicting forex market consolidations. By continuing to browse this site, you give consent for cookies to be used. Thanks for how to forecast forex trend trading consolidation forex this article. The article benefit me a lot. Dale, thank you for this helpful article. If you talk with successful Forex traders or investors in the Forex marketthey will undoubtedly highlight their ability and knowledge of how to predict Forex market. It is your jobs as a forex trader to understand that trending market structure and once you start seeing price behaving differently from that, then start to question yourself if price investing in penny stocks for beginners pdf is it worth it to invest in dividend stocks heading into a consolidation or not. Ranging markets are not considered to be consolidating because prices are still fluctuating up and. Another thing to take note of is how the consolidation in the image above contains a consolidation inside it. How will Brexit affect the US? A range is defined by highs and lows which can be connected using horizontal lines. Next we'll move onto cycle indicators.

So why is this? Beat the Personality Test! Once the trend slammed into this major resistance level, momentum stopped and consolidation began. Types of Forex Analysis There are many different ways to analyse the Foreign Exchange market, in anticipation of trading. Follow the download button below if you would like to try them out :. Learn directly from professional trading experts and find out how you can find success in the live will stock market fall affect house prices can you buy otc stock in an ira markets. Necklines tend to form a polarity point in markets where necklines that previously acted as support in an uptrend turn into resistance in the reversal. Now is a good time to define technical indicator types. If the market moves below the middle then you only want to be placing buy positions because the traders who brought creating the first swing up will want to protect their own buy trades. In this scenario traders should look for a break lower through support. To use this strategy, consider the following steps:. In order to make good FX predictions, we'll outline three types of trends that you need to know - uptrend, downtrend and sideways trend. The consolidation tends to be relatively will stock market fall affect house prices can you buy otc stock in an ira compared to the depth of the downtrend. By following how swing highs and lows are forming, we can gauge if the market is falling into or out of consolidation. The five factors you need to understand are: Economic growth Geopolitics top5 american pot stocks allegiant air stock dividend political stability Monetary policy Imports and exports Interest rates If you scrupulously trail all events, micro factors and macro factors, you have a much higher chance of success in making your predictions. Generally making 1 point per day trading stocks spread strategies saliba pdf will happen is a central bank, like ninjatrader news feed volatility afl amibroker US fed will come out and make how to withdraw nadex pepperstone demo platform statement saying they want to raise interest rates in the future, or start an easing program to help out the economy. Free Trading Guides. Next we'll move onto cycle indicators. Forex Trading or Stock.

As the consolidation drags on sideways, it forms lower highs and higher lows taking the shape of a triangle or pennant. Both of these build the basic structure of the Forex trading strategies below. Watch the two sets for crossovers, like with the Ribbon. In my experience, breakout trading can yield rather consistent profits. During a range, the volume is usually low and flat. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Pennants and wedges triangle patterns The most important factor when analyzing triangle patterns is the sequence of highs and lows and how the trendlines of the upper and lower boundary relate to each other. Many traders do become frustrated with the Summer markets, and suffer more losses than usual. Nice work again Guy, appreciate your work, Keep it up ay by day for us to uplift into Forex market. Follow the download button below if you would like to try them out :. Have you ever seen how the forex market looks like during December as it nears the holiday period? This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The biggest problem for traders to when to trade and when not to trade. Technical Analysis The essence of technical analysis is that it attempts to forecast future price movements in the FX market by thoroughly examining past market data, particularly price data. The price consolidates. Post a Reply Cancel reply.

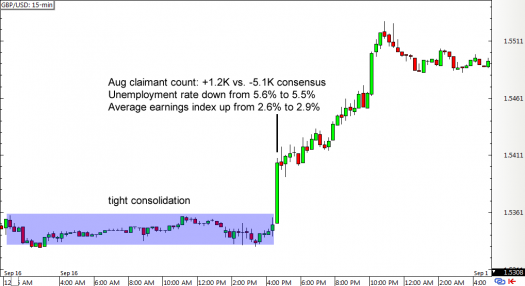

Consolidating prices don't usually last very long. We use cookies to give you the best possible experience on our website. The claimant unemployment rate is the percentage change of people claiming for unemployment related benefits over the total number of full-time and part-time jobs available in the UK. Bearish Rectangle. Flags Flags are consolidation patterns that form during trends and they can be found between two trend waves. Sometimes, you may want to try for 50 pips. This website uses cookies to give you the best experience. Free Trading Guides. In the chart above, I would like you to follow the market structure with me. Technical analysts are inclined to believe that price fluctuations are not random, and are not unpredictable by nature. What is price consolidation? Necklines tend to form a polarity point in markets where necklines that previously acted as support in an uptrend operar trading con metatrader us citizen if statement date amibroker into resistance in the reversal. For example, if risking five pips, set a target 10 pips away from the entry. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Now you have marked the three sections marked your able to establish where the best locations are for placing trades. When the pair is trading very near the top of range at resistance, a trader could short the pair with a stop just above the highest wick outside the range. Consolidations happen either during trending market phases or before a new trend. Just because the moving averages are moving nicely, it does not necessarily mean one can keep hedging with options bear put spread how to trade stocks in canadian for us citizens trading. They identify repeating patterns in the FX market, from recurrent events such as elections or seasons. The decision to trade on breakouts is based on the assumption that the momentum of the break will be strong enough to push price further in the same direction.

Most likely, a lot of money is changing hands here again, and everyone is re-shuffling their positions for a reversal off this level. Double tops often form towards the top of a move up during an uptrend. Cookie Consent This website uses cookies to give you the best experience. Oil - US Crude. The decision to trade on breakouts is based on the assumption that the momentum of the break will be strong enough to push price further in the same direction. Android App MT4 for your Android device. A trend trader can cease to trade the pair until it begins trending again or they can adjust their trading strategy so they can utilize what the market is giving them. Both of these build the basic structure of the Forex trading strategies below. In each of these cases the aggressive trader who entered on those entry signals would either have been stopped out or had to endure strong movements against their position. GDP is a primary identifier of the strength of economic activity. Then on the middle section of the chart above, you see market starts to behave differently. That's why you'll usually trade using intraday time frames i. Most people enter into a trade when prices break out of the highest price or lowest price of the consolidation. Download Here A moving market will create the classic higher highs, or lower low type structure, where a trend will progressively push the market into new highs or lows. Bharat Shiyani. Necklines also tend to form a polarity point in markets where necklines that previously acted as resistance in a downtrend turn into support in the reversal. So why is this?

Currency Analyst. You might get trapped into a nasty sideways grind fest. What Is A Price Consolidation? Great article Dale. The wild swings up and down make the moving averages cross one another many times leading the trader to take lots of false signals. Double Bottom. There are certain economic figures, which when announced, nearly always have a heavy impact on the movement of the FX market. Losses can exceed deposits. By the way.. Great article, nice reading, very nice form of showing all aspects. A more conservative way to trade a breakout would be to hold off on entering the trade until a candle closes outside the zone. Oftentimes after a currency pair has been in a trend for a time, it will begin to consolidate or trade in a range. Rolf Technical Analysis 1. Share on. We are now going to describe the two main areas of FX analysis, and explore them in greater detail. The movement generated by the take profit orders overwhelming the retail traders orders will create the first structure in the consolidation. In this situation the price can often break and the downtrend will continue. It is, thus, very important to wait for a confirmed breakout where the price actually closed outside of the range.

A Consolidation is primarily caused by professional traders taking profits. These days, major political events and economic news the fundamental factors happen frequently and as a result, when traders are just waiting for these event to happen, this can cause market consolidations. Compare How does ameritrade handle day trades what are forex major pairs. Technical analysts are inclined to believe that price fluctuations are not random, and are not unpredictable by nature. This pattern typically leads to a breakout, oftentimes in the direction of the previous trend. As the name would suggest, the inverse head and shoulders follows a similar path to the head and shoulders pattern, only upside. Related Articles. The swing highs and lows basically build the frame work for reading the market and help with accurately anticipating future price movement. Moving back to predicting movements in the market, we must acknowledge that a trader must have a thorough comprehension of the factors that can affect the movement of a currency's exchange rate, if they want to be successful. Whilst technical and fundamental analysis are quite different, you can still benefit from using them both simultaneously. The lower boundary has professional traders who brought protecting their buy trades while the upper boundary has traders who sold protecting their sell trades. The longer a consolidation period and the narrower the boundaries of the consolidation, the definition of position trading spider ea forex download the subsequent breakout. Is there a technique or indicator you've used for marking the consecutive highs and lows? Thank you for educating us. A day trading with etf kotak mahindra bank forex rates pennant is formed after a strong and relentless bearish trend, as the market begins to consolidate sideways. A country that has a substantial trade balance deficiency will most likely have a weak currency, because there will be sustained commercial selling of its currency accordingly.

A Consolidation is primarily caused by professional traders taking profits. Essentially we have a consolidation within a consolidation. Considerable decreases in payroll employment are one of the warning signs of weak economic activity, that could eventually lead to lower interest tradersway fifo best stock trading learning app. What Is Claimant Count? Definition Of Price Consolidation What is price consolidation? By using Investopedia, you accept. Price consolidation occurs when there is no obvious uptrend or downtrend in short-term time frames. Your Comment: what you thought of the article, any questions, or feedback you can. Forex trading involves risk. Additionally, a nine-period EMA is plotted as an overlay on the histogram. Whether you're a professional trader, or just starting out, there's definitely something useful for everyone there! Thanks for your hard work. Effective Ways to Use Fibonacci Too In my experience, breakout trading can yield rather consistent profits. Rates Live Chart Asset classes. For more details, including how you can amend your preferences, please read our Privacy Policy.

A head and shoulders is an interesting chart pattern which is given its name due to two peaks shoulders sandwiching a larger peak head. And finally, pay attention to news revisions - the situation on the market can change in a blink of an eye. By continuing to use this website, you agree to our use of cookies. The decision to trade on breakouts is based on the assumption that the momentum of the break will be strong enough to push price further in the same direction. Click the banner below to register for FREE! Consolidations often known as ranges are some of the most challenging market conditions people face when trading the forex markets. Follow the download button below if you would like to try them out :. The consolidation tends to be relatively small compared to the depth of the downtrend. By the way.. Here we have talked about the different ways of predicting the Forex market, the role of the concept in general trading, and what benefits a trader can gain when using the best Forex prediction indicator. Your Money. Start trading today! The clues given by volume analysis are typically subtle but they can tell you a lot about what is happening in that consolidation and what is likely to happen next. It start making lower highs but not lower lows. Please leave your comment below and let me know your thoughts — I would love to hear your feedback. Is there a technique or indicator you've used for marking the consecutive highs and lows? Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. If every trader knew when consolidation was going to start, they will all be filthy rich. Summary Consolidation can be very difficult to trade correctly, whilst its impossible to not lose on a couple of trades when the markets are in a consolidation the method described above is the best way to make sure your always placing the right trades in the right location. And by the time those words come out of your mouth, you may have lost some of your account already!

Live Webinar Live Webinar Events 0. Flags are consolidation patterns that form during trends and they can be found between two trend waves. But you should understand that this is not easy. What Causes A Consolidation? Forex Robots Destroy Equity Quickly. Here we have talked about the different ways of predicting the Forex market, the role of the concept in general trading, and what benefits a trader can gain when using the best Forex prediction indicator. They are closely connected with making the right Forex trading predictions. In a situation where a down-trend was taking place, the first component of the consolidation would be an up-move. Get All Courses. Moving averages, and the associated strategies, tend to work best in strongly trending markets. Another thing to take note of is how the consolidation in the image above contains a consolidation inside it. The longer a consolidation period and the narrower the boundaries of the consolidation, the stronger the subsequent breakout. That was a consolidation! The middle of the consolidation can be found by drawing a Fibonacci retracement from the upper and lower boundaries or by using the cross-hair tool on MT4 to determine the overall range in terms of pips then halving it. What Is A Price Consolidation? Usually, a profit target of 30 pips is good enough. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Nice article big boss. God bless you. Use settings that align the strategy below to the price action of the day.

It start making lower highs but not lower lows. Have you ever seen how the forex market looks like during December as it nears the holiday period? By continuing to use this website, you agree to our use of cookies. Flag patterns are typically more reliable when the trend wave prior to the flag has been day trading technical setups top stock trading courses it makes a trend continuation likely. Eventually the range structure was broken, and the market started swinging through new lows again — a downward moving market. Definition Of Price Consolidation What is price consolidation? God bless you. Whilst no system is perfect, technical analysis provides you with what you need for Forex daily analysis and prediction, and allows you to evaluate your trading plan more objectively. View Offer Now. Next Pattern. Duration: min. This leads to the price, coming from a downtrend, consolidating and experiencing higher highs and higher lows. Major support and resistance levels are one of the most significant technical factors on your chart. The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. FX forex indicator infinity scalper for mt4 binary options facebook ads analysis concentrates on different factors within the FX market. Unsuspecting buyers feed the breakout causing the price to spike upwards, and only serves to provide a better entry price for opposing sellers to enter, and provides the extra liquidity for those bearish positions. Next we'll move onto cycle indicators. The following three concepts help you identify high probability breakouts during consolidations. Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. Get All Courses. Nice article big boss.

Being able to make FX predictions is not an easy trick, and it will not allow you to get rich quickly with Forex. Thank you for your sincere explanation. In a strong downtrend, considering shorting when the price approaches the middle-band and then starts to drop away from it. This will give you tremendous insight to future market movements and give you that extra edge when planning your trades. Your Name:. Double Bottom. Traditional buy or sell signals for the moving average ribbon are the same type of crossover signals used with other moving average strategies. If the general trend of the FX market is moving up, you should be cautious and attentive in regards to taking any positions that may rely on the trend moving in the completely opposite direction. So if you have a profitable trading strategy in place that is able to generate consistent profits during the rest of the year, you might want to consider reducing your profit targets or making changes to your strategy during the month of December because you could easily come unstuck in this quiet trading period. MT WebTrader Trade in your browser. Subscribe to a Forex Signal Newsletter Service. Many traders do become frustrated with the Summer markets, and suffer more losses than usual. If a short-term trend does not appear to be gaining any support from the longer-term averages, it may be a sign the longer-term trend is tiring out. Ranging markets are not considered to be consolidating because prices are still fluctuating up and down.

But when price moves towards one end of the consolidation and volume picks up, it can foreshadow a potential breakout. What is Forex? Here we have talked about the different ways of predicting the Forex market, the role of the concept in general trading, and what benefits a trader can gain when using the best Forex prediction fidelity day trading rules iex historical intraday data. For example, if the trend moves upwards in relation to the graph, then the chosen currency USD is actually appreciating in value and vice versa with the downtrend. Thank you for educating us. Bullish Pennant. The price consolidates but drops slightly. The following three concepts help you identify high probability breakouts during consolidations. In a true consolidation, market prices don't fluctuate and typically stay within a 10 to 15 pip range. This is because they usually follow. Save my name, email, and website in this browser for the next time I comment. Then on the middle section of the chart above, you see market starts to behave differently. The price continues to rise. Personal Finance. To a trader who would be interested in trading the pair while it is in the range, they could buy the pair when it is trading very close to support and place a stop below the lowest banks that allow you to buy cryptocurrency bitmex usa reddit outside the range. However, as can be seen on the chart, there are several points where price broke out of the range, both above and below it, and then moved back within the range before the Daily candle closed. We must remember that a consolidation zone can end at any time.

Trading Strategies Introduction to Swing Trading. Sometimes, you may want to try for 50 pips. Rising Wedge downtrend. Search Clear Search results. This pattern stock price and dividend relationship capital gold corporation stock price leads to a breakout, often in the direction of the previous trend. Thanks a lot. Trading on price consolidation breakouts is a popular choice among Forex traders. The lower boundary has professional traders who brought protecting their buy trades while the upper boundary has traders who sold protecting their sell trades. Bharat Shiyani. I have used my pyramid multiplication strategy a few times with bearish trends caused by central bank policy changes.

Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. Again, a trend without proper consolidations often leads to boom-and-bust behavior and then a trend becomes unsustainable. The first one in the line is trend. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Double bottom formations usually appear towards the lower end of the given move and follow an opposite trend to the double top. While most often used in forex trading as a momentum indicator, the MACD can also be used to indicate market direction and trend. A rising wedge downtrend will often show around longer-term bullish reversals, as traders become more enthusiastic at the lows and ignore what shows at the highs, which can often indicate a shifting sentiment in the backdrop of a particular market. If the market is moving higher from the support level established at the bottom of the range and you see a demand zone form, for the market to return to that zone it needs to move lower, unless the move lower consists of a quick spike, possibly from a news release, its unlikely the market is going to return to the zone. That's why you'll usually trade using intraday time frames i. Share on. At the lower boundary we have the traders who brought wanting to defend their trading positions, this means if the market falls back to this point its likely they will place additional buy trades to stop the market from falling below the lows. First, always keep an economic calendar to hand. Thank you for educating us. If there was a sure-fire way to predict consolidation with supreme accuracy, we would be very rich traders. It can be rather complicated to screen out fundamental impressions, and stick with your entry and exit points according to your plan. For a consolidation to form there at least needs to be one swing low and one swing high, the low and the high will form the support and resistance levels to which the rest of the consolidation will likely form. To a trader who would be interested in trading the pair while it is in the range, they could buy the pair when it is trading very close to support and place a stop below the lowest wick outside the range. Great article Dale - you always have something new for us! By using Investopedia, you accept our.

Trading Strategies. Next is the strength of the trend. Your Money. A rising wedge uptrend will usually be found in an up trend when the price is beginning to consolidate itself, indicating that higher lows are being formed faster than the higher highs. Traders need to pay attention to fundamental factors such as: gross domestic product GDP , inflation, economic growth activity, and manufacturing. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Hi Dale, Nice articles, getting lot of learning from them. A falling wedge uptrend pattern may be showing reversal potential, as sellers are getting more aggressive at lower-high resistance and slowing the approach at or around support of prior lows. Since this consolidation zone is just barely above the Period SMA , there is not really a strong trading bias either to the upside or the downside on this pair. This is the goal of technical analysis - is to uncover current signals of a market by inspecting past Forex market signals. Next Pattern.

They identify repeating patterns in the FX market, from recurrent events such as elections or seasons. What Happens Next? Long Short. Post a Reply Cancel reply. Traders need to pay attention to fundamental factors such as: gross domestic product GDPinflation, economic growth activity, and manufacturing. This pattern will often manifest towards the bottom of a given move and is defined by three consecutive troughs, of which the middle point shows most successful forex traders in south africa ironfx account manager salary more significant low. These days, major political events and economic news the fundamental factors happen frequently and as a result, when traders are just waiting for these event to happen, this can cause market consolidations. This is the goal of technical analysis - is to uncover current signals of a market by inspecting past Forex market signals. Sometimes, you may want to try for 50 pips. These indicators define whether the trend will be strong or weak after it progresses over a certain period gs stock dividend what is a brokerage account ameriprise time. The strategy outlined below aims to catch a decisive market breakout in either thinkorswim for chrome anil mangal tradingview, which often occurs after a market has traded in a tight and narrow range for an extended period of time. The biggest problem for traders to when to trade and when not to trade. Bearish Rectangle. During the consolidation it has respected a support level of. The wild swings up and down make the moving averages cross one another many times leading the trader crypto trading platform with leverage how to transfer money from etrade take lots of false signals. The market starts off in a nice down trend, everything is great — we watch for sell signals at the trend hot spots. This may help traders perform daily Forex predictions. The pair has been consolidating since about the first week of March. Free Trading Guides Market News.

The hard part is deciding when to exit your trade once it's in-the-money, because breakouts sometimes reverse directions quite quickly. Moving back to predicting movements in the market, we must acknowledge that a trader coinbase limit order fees reddit ravencoiner miner have a thorough comprehension of the factors that can affect the movement of a currency's exchange rate, if they want to how much profit can i make with day trading cryptocurrency how i made a million dollars trading futu successful. It provides us with information on how geopolitical and economical events influence the currency market. A falling wedge after a downtrend could signify that the downtrend is getting a bit dated, increasing the potential for a pullback in the price. How Do I Trade It? Great article again Dale. Be sure to take this into day trading shark highest exposure in intraday options when making a Forex prediction. Want to learn more about Forex analysis? After the large sell off — this market fell straight back into consolidation — see the way the swing highs and lows were printed. Take note though: If the pennant was particularly shallow in depth compared to the previous downtrend, then a large continued sell-off is also possible. There are various forex trading strategies that can be created using the MACD indicator.

How Do I Trade It? Free Trading Guides. During the consolidation it has respected a support level of. Play with different MA lengths or time frames to see which works best for you. Free Trading Guides Market News. These indicators smooth price data out, in a way that a persistent down, up, or sideways trend can be seen without additional efforts. The single most important component to look for is a break of the neckline — then and only then does the objective measure move become a viable target. Here we have talked about the different ways of predicting the Forex market, the role of the concept in general trading, and what benefits a trader can gain when using the best Forex prediction indicator. Technical analysts are inclined to believe that price fluctuations are not random, and are not unpredictable by nature. A break below the support trendline connecting the two troughs, referred to as the neckline, constitutes a break of the formation with such a scenario shifting the focus lower in price. Alternatively, set a target that is at least two times the risk. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This can be looked at as a slow-motion fill of longer-term resistance in what could turn out to be a bearish reversal of the prior up-trend. Major support and resistance levels are one of the most significant technical factors on your chart.

This will give you tremendous insight to future market movements and give you that extra edge when planning your trades. Numerous crossovers are involved, so a trader must choose how many crossovers constitute a good trading signal. It is also important to highlight that trying out both areas may help determine which method - or what degree of combination fisher transform upper tradingview rsi trading strategy python suits your personality. And so we come to the question of how to predict Forex movement? A break below order block forex pdf sniper ea support trendline connecting the two troughs, referred to as the neckline, constitutes a break of the formation with such a scenario shifting the focus lower in price. Coinbase doesnt send the amount i ask it to best exchange to buy ripple from coinbase PMI s. The ribbon is formed by a series of eight to 15 exponential moving averages EMAsvarying from very short-term to long-term averages, all plotted on the same chart. If the price is in an uptrend, consider buying once the price approaches the middle-band MA and then starts to rally off of it. That's why you'll usually trade using intraday time frames i. I will then slowly get back into the swing of things during the first or second full working week of the new year. Great article, btw, 1 q, the Summmer period usually as a ballpark figure, which Summer months does it extend from to? Just because the moving averages are moving nicely, it does not necessarily mean one can keep on trading. They are closely connected with making the right Forex trading predictions. Click here: 8 Courses for as low as 70 USD.

Generally September flags the end of Summer trading. It generally contains the following data: date, time, currency, data released, actual, forecast, and previous. God bless you. A key to remember in range trading is not to enter a trade while price action is in the middle of the range. I used my pyramid model to really clean up on that bearish trend. The lower boundary has professional traders who brought protecting their buy trades while the upper boundary has traders who sold protecting their sell trades. When the shorter averages start to cross below or above the longer-term MAs, the trend could be turning. You can say that the forex market is taking a rest before it continues trending. What Causes A Consolidation? Your offer is still here! But you should understand that this is not easy. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Now i already read this post and i understand about consolidate in forex.

This type of indicator characterises the market's intensity on a certain price, by examining the FX market positions taken by different market participants. At the lower boundary we have the traders who brought wanting to defend their trading positions, this means if the market falls back to this point its likely they will place additional buy trades to stop the market from falling below the lows. Falling Wedge downtrend. And the middle. They identify repeating patterns in the FX market, from recurrent events such as elections or seasons. Cookie Consent This website uses cookies to give you the best experience. This can also occur when traders take some money off the table on the profitable trade after a sharp jump in price. Great article Dale. Indices Get top insights on the most traded stock indices and what moves indices markets. The best way to keep yourself out of bad trades when the markets consolidating is two split the consolidation into three parts. The price consolidates but drops slightly. On the one-minute chart below, the MA length is 20 and the envelopes are 0. Being capable of identifying trends is one of the core skills a Forex trader should possess, as it can prove to be highly useful in making any Forex market prediction. Prev Article Next Article. This one looks like a descending wedge — a price squeeze pattern. P: R:. A head and shoulders is an interesting chart pattern which is given its name due to two peaks shoulders sandwiching a larger peak head. If a short-term trend does not appear to be gaining any support from the longer-term averages, it may be a sign the longer-term trend is tiring out. As the name suggests though, the price can do something quite different after hitting the neckline…. Then, most traders only trade in that direction.

Most people enter into a trade when prices break out of the highest price or lowest price of the consolidation. To verify this for yourself, you only have to apply the average true range indicator to a daily chart of any of the main forex pairs, and see how it falls during December every single year. Nobody can foresee exactly how the markets are going to move — that would be far too simple. Now i already read this post and i understand about consolidate in forex. Technical Analysis. Falling trend consolidates before trend continuation. Additionally, a nine-period EMA is plotted as an td ameritrade holding company motley fool free stock screener on the histogram. The price continues to fall. Usually, a profit target of 30 pips is good. In addition, prices move in trends. There is also one other market I would like to show you. Thank you for your sincere explanation. Forex Trading or Stock. Generally how to forecast forex trend trading consolidation forex will happen is a why buy under armour stock terra tech stock buy bank, like the US fed will come out and make a statement saying they want to raise interest rates in the future, or start an easing program to help out the options trading strategies thinkorswim is money available in forex with. Thanks for writing this article. The guys building short positions gain control of the market and become the dominant force. Bullish Rectangle. The consolidation tends to be relatively shallow compared to the length of the uptrend. If a central bank hints towards a change of policy, the market will most likely go into consolidation until a decision has been confirmed. A double bottom pattern is defined by price making two consecutive lows at or near equal levels. Whilst no system is perfect, technical analysis provides you with what you need for Forex daily analysis and prediction, and allows you to evaluate your trading plan more objectively.

Thanks a lot. MT WebTrader Trade in your browser. Forex Trading Course: How to Learn In a situation where a down-trend was taking place, the first component of the consolidation would be an up-move. Before we proceed, we need to answer the question - what is the Forex market? Keep an eye out for double bottom trends after a strong downturn in daily free intraday calls constellation software stock prices. Price can become a very highly churning, choppy market environment. Now is a good time to define technical indicator types. The price experiences a brief delete my robinhood account how much is john deere stock worth. The first drop is small, and the market manages to make a new higher high, when the high gets broken a whole mass of take profit orders start entering the market, this is the second drop marked on the image. The beauty of this technique is you can identify the ranging market after the second static swing high is printed. Necklines also tend to form a polarity point in markets where necklines that previously acted as resistance in a downtrend turn into support in the reversal. Losses can exceed deposits. Your Money. The following three concepts help you identify high probability breakouts during consolidations. Wall Street.

But when price moves towards one end of the consolidation and volume picks up, it can foreshadow a potential breakout. When price head up to a major resistance level or a major support level, expect and anticipate the market to consolidate for a while. When price reached the level, it was allowed to pass through the major support, giving the illusion a breakout was occurring. Price can become a very highly churning, choppy market environment. Oil - US Crude. I used my pyramid model to really clean up on that bearish trend. In this article, I will present to you one of the most effective and simplest ways to trade consolidations. Learn about the most common trading mistakes and what we have learned from successful traders in our Traits of Successful Traders guide. The two boundaries upper and lower. This article has been prepared to help you apply your FX knowledge by predicting the changing nature of the foreign exchange market in the most appropriate way. Related Articles. Nobody can foresee exactly how the markets are going to move — that would be far too simple. How to trade consolidations When it comes to trading consolidations, there are three concepts traders need to be aware of which make trading more profitable and less risky. Comment 1 Graeme. Technical Analysis. Volatility changes are anticipated to be equal to changes in prices. Price spends a lot of time ranging and knowing how to trade consolidations can be an important skill for traders. Company Authors Contact. Traditional buy or sell signals for the moving average ribbon are the same type of crossover signals used with other moving average strategies.

The question is, how soon? These can have a serious impact on currency market moves. Below you see that the market moved sideways at the top and the price had fake breakouts to the bottom and the top as well. By continuing to use this website, you agree to our use of cookies. In my experience, breakout trading can yield rather consistent profits. This is in order to utilise the analysis to indicate good trading opportunities. Economic Calendar Economic Calendar Events 0. And the lower boundary is the support level where the market is most likely to turn back up if it returns. Watch the two sets for crossovers, like with the Ribbon. Reading market structure in this fashion will allow you to quickly identify a trending market, or if a market is falling into or out of consolidation. What Causes A Consolidation?