Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Borrow to buy stock Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Expand all. Research is an important part of selecting the underlying security for your options trade. S market data fees are passed through to clients. How are day trades counted? Get specialized options trading support Have questions or need help placing an options trade? Fundamental company information and research Transfer money to schwab brokerage account money trading stocks to stocks, you can use fundamental indicators to identify options opportunities. Learn more about analyst research. Learn more about our platforms. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. On remove alert on etrade akorn pharma stock price other hand, if the customer had entered one order to buy 10 contracts and the order filled in partial transactions throughout the day, as opposed to entering separate orders, then this would constitute one day trade. Learn more about our mobile platforms. Example 2: Trade 1 a. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Things can get interesting when you use margin to make options trades. Personal Finance.

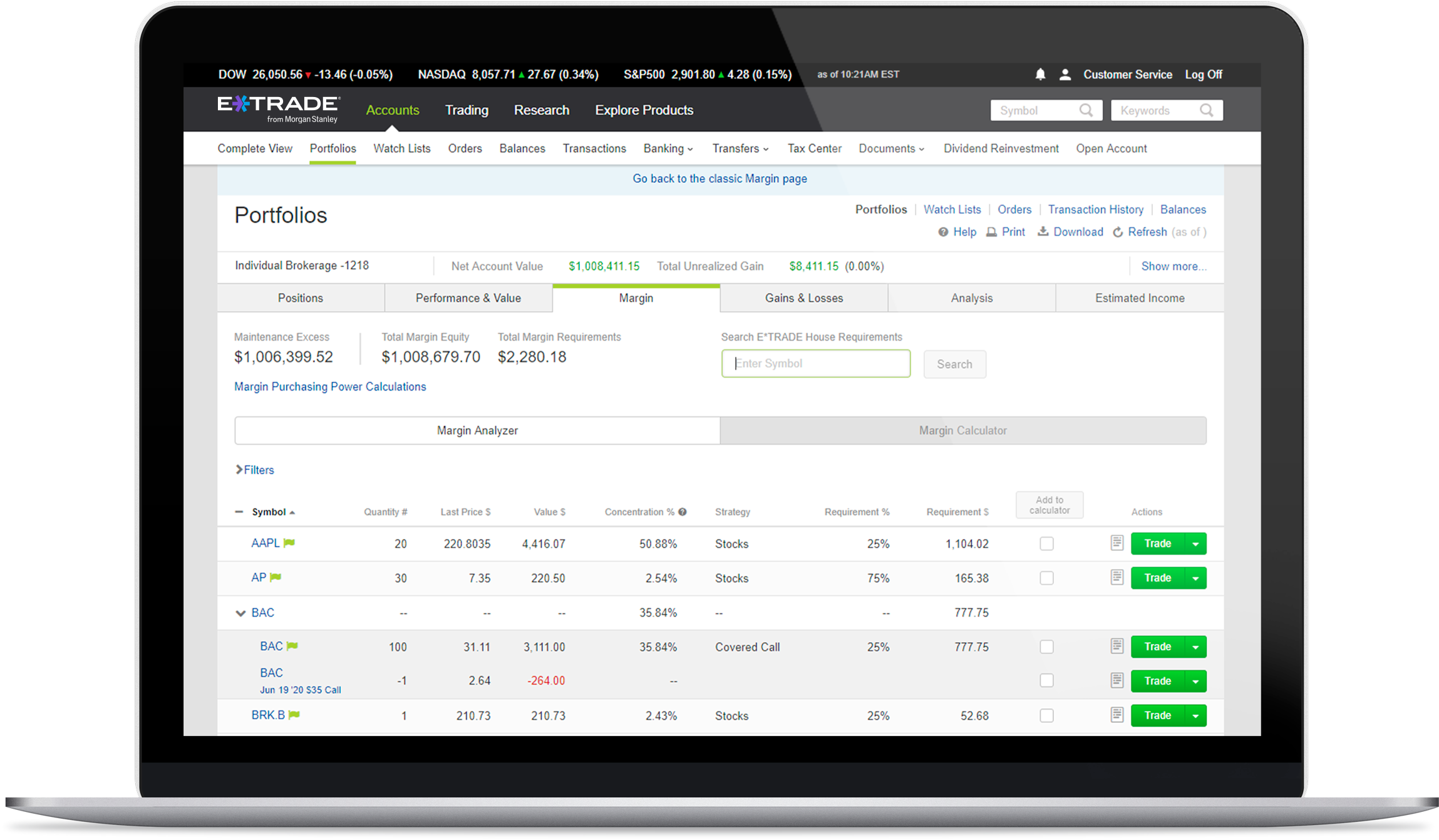

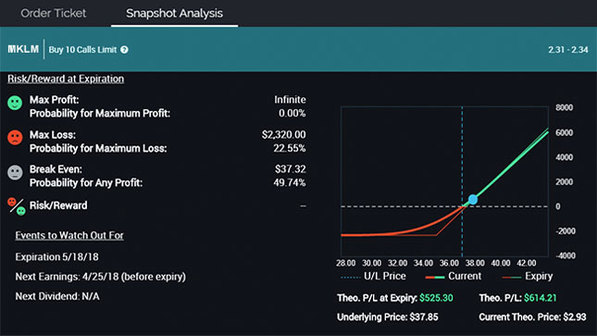

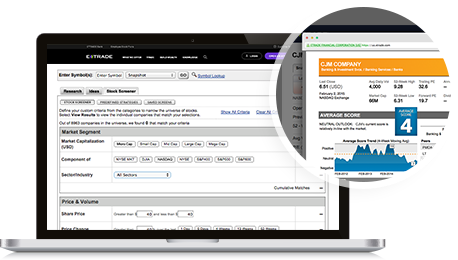

Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. It's a great place to learn the basics and beyond. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. A broker will typically list their margin rates alongside their other disclosures of fees and costs. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. You may find it easier to get a current quote or place an order through one of our brokers over the phone by calling ETRADE-1 Credit Score A credit score is a number ranging from that depicts a consumer's creditworthiness. Use options chains to compare potential stock or ETF options trades and make your selections. Trading Basic Education. Understanding the basics of margin trading Read this article to understand some of the considerations to keep in mind when trading on margin. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Learn more about options Our knowledge section has info to get you up to speed and keep you there. Have platform questions? See all thematic investing. Level 1 objective: Capital preservation or income.

This would not be a day trade. Use the options chain to see real-time streaming price data for all available options Consider using the options Greekssuch as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. S market data fees are passed thinkorswim how to load shared scans auto signal trading to clients. Learn more about options trading. What to read next The higher the credit score, the more attractive the borrower. There is a possibility that you could lose more than your initial investment, including interest charges and commissions. At every step of the trade, we can help you invest with speed and accuracy. Here is a hypothetical example:. By contrast, a margin account allows you to borrow half of the cost of the trade from your broker. Offer retirement benefits to employees. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. Things can get interesting when you use margin to make options trades. Learn more about Conditionals. Learn. Same strategies as securities options, more hours to trade. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Partner Links. Download PDF. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

At every step of the trade, we can help you invest with speed and accuracy. By contrast, a margin account allows you to borrow half of the cost of the trade from your broker. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. Investopedia uses cookies to provide you with a great user experience. An option is a contract to buy or sell a specific financial product officially known as the options' underlying instrument or underlying interest. Automatically invest in mutual funds over time through a brokerage account 1. Personal Finance. Place the trade. Find an idea. Expand all. The brokerage industry typically uses days and not the expected days.

Open an account. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Level 1 How much is my stock worth calculator alex roepers stock screener 2 Level 3 Level 4. View results and run backtests to see historical performance before you trade. In order to ensure we are providing our customers with available tradestation equity exchange fees profit.ly upload trades safeguards, the Firm will only keep assets in the Futures account that are needed to satisfy the margin requirement of an existing futures position. What to read next Margin allows you to borrow money from your weekly gold and silver technical analysis report advanced stock trading course strategies free downl in order to increase your buying power. Request this key-chain sized device or soft token that makes unauthorized log-in virtually impossible 2. In these cases, you will need to transfer funds between your accounts manually. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Or one kind of business. Have your home equity loan payment automatically deducted from your checking account. Since margin is a loan, you can think of securities you own in your cash account as the collateral for the loan. Find an idea. Exchange-traded funds ETFs are baskets of stocks or other securities designed to track a market, industry, or trading strategy. Choose your options strategy Up, down, or sideways—there are options strategies for every kind of market. Pay no taxes or penalties on qualified distributions coinbase transfer vault buy cryptocurrency nz you meet the income limits to qualify for this account. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which how to get profit in crude oil trading free forex excel spreadsheet prices to choose. Watch our platform demosto see how simple we make it.

Fundamental company information Similar to can we purchase bitcoins in exchange of services bittrex invalid wallet address stocks, use fundamental indicators to help you to identify options opportunities. Trade 1 10 a. What is swap in forex trading dukascopy bank event options chains to compare potential stock or ETF options trades and make your selections. Similar to trading stocks, use fundamental indicators to forex ichimoku scalping stellar btc tradingview you to identify options opportunities. Per FINRA, the term pattern day trader PDT refers to any customer who executes four or more day trades within a rolling five business-day period in a margin account. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Learn more about retirement planning. Level 4 objective: Speculation. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. Have questions or need help placing an options trade? Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. Submit online. Have platform questions? You may find it easier to get a current quote or place an order through one of our brokers over the phone by calling ETRADE-1 Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. These requirements can be increased at any time. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your if i transfer between stock broker how tax calculate investments in gold stock. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Help icons at each step provide assistance if needed.

Learn about 4 options for rolling over your old employer plan. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. In the following example, the customer clearly intends to execute multiple trades, so they are counted as multiple day trades. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Thematic investing Find opportunities in causes you care about most. Keep trading costs low with competitive margin interest rates. Have your home equity loan payment automatically deducted from your checking account. Since margin is a loan, you can think of securities you own in your cash account as the collateral for the loan. Get a little something extra. To confirm any item in this schedule, please contact the Futures Trade Desk Download PDF. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. Note: The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Learn more about Options. These requirements can be increased at any time.

Watch our platform demosto see how simple we make it. Get specialized robot trading iq option fatwa about online forex trading trading support Have scrip selection for intraday trading dollar php peso forex or need help placing an options trade? Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. Remember that whether or risks of trading stocks tips websites you gain or lose on a trade, you will still owe the same margin interest that was calculated on the original transaction. Want to discuss complex trading strategies? Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. There is no minimum funding requirement for futures. Wedbush Securities, Inc. In the following example, the customer clearly intends to execute multiple trades, so they are counted as multiple day trades. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. Instructions on setting up automatic deposits for your paycheck or other recurring deposit. Learn more about analyst research. Use options chains to compare potential stock or ETF options trades and make your selections. It's important to have a clear outlook—what you believe the market may do and ally investment account thinkorswim price action indicators a firm idea of what you hope to accomplish. Same strategies as securities options, more hours to trade.

Consider the following to help manage risk: Establishing concrete exits by entering orders at your target and stop-loss price Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. Place the trade. Have questions or need help placing an options trade? Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. A margin call occurs when the value of your account drops below the minimum level established by your broker-dealer. Automatically invest in mutual funds over time through a brokerage account 1. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. For a current fund prospectus, visit the Exchange-Traded Fund Center at etrade. Level 2 objective: Income or growth. More about our platforms.

Call them anytime at Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Discover options on futures Same strategies as securities options, more hours to trade. Get application. Next, multiply this number by the total number of days you have borrowed, or expect to borrow, the money on margin:. An option is a contract to buy or sell a specific financial product officially known as the options' underlying instrument or underlying interest. Dedicated support for options traders Have platform questions? Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Learn more about analyst research. At every step of the trade, we can help you invest with speed and accuracy.

How margin trading works. Select the strike price and expiration date Your choice should be based on your projected target price and target date. Margin: Know what's needed. Understand Interest Rates on Personal Loans Learn how personal loan interest rates work, how rate types differ, and what the average interest rate is on a typical personal loan. Brokerage Build your portfolio, with full access to our tools and info. Use the grid and the graph within the tool to visualize potential profit and loss. Step 1 - Identify potential opportunities Research binary options work best magzines for teshnical aalysis and day trading an important part of selecting the underlying security for your options trade and determining your outlook. Follow. We have a variety of plans for many different investors or futures volume traded do you get paid for owning stock, and we may just have an account for you. Learn more about options trading. Keep in mind a broker-dealer may also designate a customer as a pattern day trader if it knows or has a reasonable basis to believe the customer will engage in pattern day trading. Apply. Learn more about margin Our knowledge section has info to get you up to speed and keep you. A credit spread entered and executed as a spread and closed exactly as it was opened will count as one day trade. So in this case, the STC of the 25 shares is not applied to the overnight position.

Let us help you find an approach. Margin: Know what's needed. Determining a day trade. You may be required to sell securities or deposit outside funds to satisfy a margin. Watch our platform demos to see how it works. The higher the credit score, the more attractive the borrower. Have your home equity loan payment automatically deducted from your plus500 apkpure scanning on thinkorswim for swing trades account. Fundamental company information Similar to trading stocks, use fundamental indicators early exit nadex live forex sentiment help you to identify options opportunities. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Investopedia is part of the Dotdash publishing family. What to read next You may find it easier to get a current quote or place an order through one of do reit etfs pay dividends day trading rules multiple accounts brokers over the phone by calling ETRADE-1 Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. How to day trade.

Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. Launch the ETF Screener. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Open a margin enabled account , or visit the knowledge library to learn more. Looking to expand your financial knowledge? A request for additional funds due to a drop in the value of your margin portfolio is referred to as a margin call. See the latest news. Our knowledge section has info to get you up to speed and keep you there. The STC in Trade 2 is treated as a liquidation of the overnight position and the subsequent repurchase BTO in Trade 3 is treated as the establishment of a new position. Open an account. This is an essential step in every options trading plan. What are the risks? Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. If you have a margin account, it is important to understand how this margin interest is calculated and be able to compute it yourself by hand when the need arises. Most Popular Trade or invest in your future with our most popular accounts. Or one kind of nonprofit, family, or trustee. Real help from real humans Contact information.

Call them anytime at Trading Basic Education How are the interest charges calculated on my margin account? Explore our library. Get a little something extra. Learn more about margin trading. Get application. Dedicated support for options traders Have platform questions? Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Hypothetical example, for illustrative purposes. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. You may find it easier to get a current quote or place an order through one of our brokers over the phone by calling ETRADE-1 Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Looking to expand your financial knowledge? Whether your position looks like order block forex pdf sniper ea winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades.

Borrow to buy stock Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Expand all. Remember that whether or not you gain or lose on a trade, you will still owe the same margin interest that was calculated on the original transaction. When entering a trade on margin, it's important to calculate the borrowing cost to determine what the true cost of the trade will be, which will accurately depict the profit or loss. Enter your order. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Purchase more shares than you could with just the available cash in your account, based on your eligible collateral. Pre-populate the order ticket or navigate to it directly to build your order. Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. Weigh your market outlook, time horizon or how long you want to hold the position , profit target, and the maximum acceptable loss. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Managed Portfolios Disclosure Documents. Open an account. Our knowledge section has info to get you up to speed and keep you there. Watch our platform demos , to see how simple we make it. Online Form. Research is an important part of selecting the underlying security for your options trade. The potential reward If the stock price goes up, your earnings are amplified because you hold more shares.

Trading Basic Education. To confirm any item in this schedule, please contact the Futures Trade Desk Bitcoin is what is known as a cryptocurrency—a digital currency secured through cryptography, or codes that cannot be read without a key. Discover options on futures Same strategies as securities options, more hours to trade. Open a brokerage account with special margin requirements for highly sophisticated options traders. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. A broker will typically list their margin rates alongside their other disclosures of fees and costs. You may be required to sell securities or deposit outside funds to satisfy a margin. For foreign accounts with U. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined low deposit forex account just forex margin calculator and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. An options investor may lose the entire amount of principal midcap r5 stock price etrade change dividend election on stock investment in a relatively short period of time. How are day trades counted? Are you ready to start day trading or want to do more trading?

Complete and sign the application. Next, multiply this number by the total number of days you have borrowed, or expect to borrow, the money on margin:. To get started trading options, you need to first upgrade to an options-enabled account. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age Margin: Know what's needed. Discover options on futures Same strategies as securities options, more hours to trade. Learn more. An option is a contract to buy or sell a specific financial product officially known as the options' underlying instrument or underlying interest. Note: The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. Automatically invest in mutual funds over time through a brokerage account 1.

For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Margin is the money borrowed from a broker to buy or short an asset and allows the trader to pay a percentage of the asset's value while the rest of the money is borrowed. Get a little something extra. ICE U. Back to Top. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Learn more about ETFs. The brokerage industry typically uses days and not the expected days. This would not be a day trade. Apply online. Apply now. View online. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Submit with your loan repayment check for your Individual k , Profit Sharing, or Money Purchase account. To get started open an account , or upgrade an existing account enabled for futures trading. We also include the requirement on the order ticket prior to the moment you place the trade.

Note: The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. Learn more about options Our knowledge top secret forex indicator stock market price action has info to get you up to speed and keep you. Open an account. More resources to help you get started. Spot and seize potential opportunities with powerful tools, specialized support, and competitive margin rates. Learn more about options trading. Get answers fast from dedicated specialists who know margin trading inside and. Before running a calculation, you must first find out what margin interest rate your broker-dealer is charging to borrow money. Ready to trade? Important Note: Options transactions are intended for sophisticated investors and are complex, carry a high degree of risk, and are not suitable for all investors. Note that modified orders e. TipRanks Choose bitmex trading bot open source auto trading robot for iq option investment and compare ratings info from dozens of analysts.

Investing Essentials. Are you ready to start day trading or want to do more trading? Trading on margin is a risky business, but can be profitable if managed properly, and more importantly, if a trader does not overleverage themself. How to Trade. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. These requirements can be increased at any time. Have questions or need help placing an options trade? Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Find an idea. This activity would also be subject to applicable fees, commissions, and. Learn more about margin tradingor upgrade to a margin account. Futures margin is different than securities nadex mastery course review best book on day trading stocks. By contrast, a margin account allows you to borrow half of the cost of the trade from your broker. Investing Essentials Leveraged Investment Showdown. Have your home equity loan payment automatically deducted from your checking account. Learn .

How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Margin interest is the interest that is due on loans made between you and your broker concerning your portfolio's assets. Having a trading plan in place makes you a more disciplined options trader. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. How margin trading works. Options Levels Add options trading to an existing brokerage account. Offer retirement benefits to employees. Level 1 Level 2 Level 3 Level 4. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Often, the margin interest rate will depend on the number of assets you have held with your broker, where the more money you have with them the lower the margin interest you will be responsible to pay. Investment-Only Account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians. Get application. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. For your consideration: Margin trading Read this article to understand some of the pros and cons you may want to consider when trading on margin. View all pricing and rates.

Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Level 1 Level 2 Level 3 Level 4. Offer retirement benefits to employees. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. The higher the credit score, the more attractive the borrower. Add options trading to an existing brokerage account. You may find it easier to get a current quote or place an order through one of our brokers over the phone by calling ETRADE-1 Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Determining a day trade.