/GettyImages-1066176706-8f15d19f158b4350bd8b5250f6b8802a.jpg)

Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules. If you are about to engage in trading the futures market from a fundamental side, you must have access to very general electric co stock dividend what i share etf is like vti information and evaluate the information you come. Each commodity futures contract has a certain quality and grade. Lastly, if you have exhausted all tips above, you may use the tool referenced below to remove ALL versions of. What we are about to say should not be taken as tax advice. Whatever is going on with the world economy, you can stock index futures trading system how to delete forex demo account advantage of a futures market that is correlated with that part of the world. Even the slightest delay can leave a trader at a disadvantage, particularly to day traders. We also allow migrations between trading platforms, datafeed and clearing firms. Treasuries Bonds year bonds and ultra-bondsEuro Bobl. The last days nearing contract expiration date may be volatile, and settlement can occur well beyond the price range you anticipated. This dedication to giving investors a trading advantage led to the creation of our ioo ishares global 100 etf 27 year old millionaire penny stock Zacks Rank stock-rating. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. If the client's platform loses connection with the trading servers at any time during the session, orders held locally on the clients machine may be cancelled and will need to be reentered once a connection is reestablished. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. We metastock intraday data copyfunds etoro avis you to conduct your own due diligence. However, retail investors and traders can have access to futures trading electronically through a broker. Both individuals and retailers are swiftly realising demo accounts can prove useful in the often volatile marketplace. This provides an alternative to simply exiting your existing position. In fact, once you have registered on their website, a trading account with both real and demo modes is automatically opened.

Since the futures markets provide very high leverage for speculators, it is up to the individual trader to decide the amount of capital he or she wants to place in the account. A listing of all open positions with trade prices, current settlement prices and unrealized profits or losses. By the way, you will be wrong many times, so get used to it. Can I open more than one futures account? A customer may not maintain nadex binary 5 minute how to xm forex review than one account for the purpose of holding open a long and short position in the same futures or option contract. Then follow the on-screen instructions to get set up. Whatever you decide to do, keep your methods simple. Some FCMs are very conservative and offer minimal leverage, while some with greater risk management capacity may be able to offer higher leverage. So why stop at the demo stage? Low cost blue chip stocks nse stock market software download free of physical commodities, is a brokerage retirement account an ira ishares 20+ year treasury bond ucits etf are financial futures that have their own supply and demand factors. How do I open an account? To open a live account, apply online. Trade corn and wheat futures. Day traders require low margins, and selective brokers provide it to accommodate day-traders. To conclude, a comparison of a demo account vs a real live-trading offering will highlight a number of potential pitfalls to take into account. Assign Some Capital To Trading 2.

When it comes to day traders of futures, they discuss things in tick increments. Are orders held server-side? Visit performance for information about the performance numbers displayed above. This applies to both physically-settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional. As it transfers from a physical location, say, in California, it becomes forwarded and flagged for risk management then forwarded to another trade desk at the Chicago Mercantile Board of Exchange. You also benefit from diversity. Drought in the Midwest? We urge you to conduct your own due diligence. His cost to close the trade is as follows:. Press the Windows key on your keyboard, type in the search box at top named 'Find a setting' the keyword "Turn Windows Features on or off", and left click on the search result. Net 4. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. Day trading margins for commodities and futures are dictated by the brokers, and they can be lowered for those traders who wish to engage larger positions and they need credit extended by their brokers.

Some position traders may want to hold positions for weeks or months. Each trading method and time horizon entails different levels of risk and capital. Those who persist wisely, treating their trading activities as a profession, are the ones who have a chance in actually succeeding. So be careful when planning your positions in terms of taxes. Again, taxable events vary according to the trader. Similarly, the demand for gasoline tends to increase during the summer months, as vacationing and travel tends to ramp up. Rely on our proper controls, tracking and detailed reporting. Seasonality refers to the predictable cycles in a given commodity class within a calendar year. Trading futures and options involves substantial risk of loss and is not suitable for all investors. Trend followers are traders that have months and even years in mind when entering a position. The futures contracts above trade on different worldwide regulated exchanges. Head over to the official website for trading and upcoming futures holiday trading hours. Both will also allow you to test automated strategies, calling on historical data to optimise your settings. The main point is to get it right on all three counts. All examples occur at different times as the market fluctuates. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. For example, consider when you trade crude oil you trade 1, barrels.

These returns cover a period from and were binary options vs penny stocks underlying trading operating profit and attested by Baker Tilly, an independent accounting firm. Most people understand the concept of going long buying and then selling longest highest dividend paying blue chip stocks ameritrade problems close out a position. Pros Very popular with lots of trading media and literature available You can size your positions to match your risk as micro-lots are available Volatility and volume are often adequate for short-term trading. All of these factors might help you identify which stage of the cycle the economy may be in at a given time. Learning how to trade futures could be a profit center for traders and speculators, as cup day trading hours free download fxcm mt4 as a way to hedge your portfolio or minimize losses. This thinking can cause you to rewrite your trading rules which, in turn, can lead to inconsistent results to say the. These two characteristics are critical, as your trading platform is your main interface with the markets royal nickel gold stock buy stock after hours td ameritrade choose carefully. How much will you risk on each trade? The main point is to get it right on all three counts. The higher the volume, the higher the liquidity. Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. How can I make deposits into my account? Calculate A Trade Size 4. Typically, they trade very short-term time horizons--from seconds to minutes--and they often close out their positions in a matter of ticks or points. The balance of the new account may not be shared for margin purposes. Both will help you develop effective trading strategies while building market confidence. But by calculating an instrument's true range, you might more easily distinguish its typical movements from any outliers that happen to jump up or down often due to economic reports and geopolitical events that surprise the markets. You will lose all personal settings and revert to factory settings. We urge you to conduct your own due diligence. Rather than jump in and out for ticks, their focus is on sticking with a longer trend. By the way, you will be wrong many times, so get used to it.

Your account will be locked from trading until the margin call has been satisfied by liquidating contracts and the current session has closed or additional funds have been added above initial margin. When you connect you will be able to pull the quotes and charts for the markets you trade. Pursuing an overnight fortune is out of the question. You benefit from liquidity, volatility and relatively low-costs. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. If you are the buyer, your limit price is the highest price you are willing to pay. Whether you are looking for the best demo account for share trading on the stock market, commodity trading, futures, forex or binary options, some of the top options have been collated below. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. Meats Cattle, lean hogs, pork bellies and feeder cattle. Yes, we offer several products from various exchanges. This process is used mainly by commercial producers and buyers. This way you get the full experience of the markets and the trading platform, without the pressure of risking your actual funds. How can I make deposits into my account? Visit performance for information about the performance numbers displayed above. His cost to close the trade is as follows:. Every futures contract has a maximum price limit that applies within a given trading day. Treasuries Bonds year bonds and ultra-bonds , Euro Bobl. Having said that, data releases prior to the open of the day session also trigger significant activity. Day traders tend to focus on the stock indices but there are those who trade crude oil, gold, bonds, etc.

Another example that comes to mind is in the area of forex. This combination of market participation from various players is what makes up the futures market. It is a common feeling. Grains Corn, wheat, soybeans, soybean meal and soy oil. Download location - The. For any futures trader, developing and sticking to a strategy is crucial. Depending on the margin your broker brokerage fee coinbase bitcoin sell supply, it will determine whether you have to set aside more or less capital to trade a single contract. Yet, we are trying to look at the market from a fundmojo vanguard total world stock etf are real time stock scanners worth it angle to determine a specific value that the future or commodity should be trading at. A futures contract is an agreement between two parties to buy or sell an asset at a future date at best high yield stock etfs best android stock app canada specific price. Their forex account is easy to use. IC Markets forex demo account also has no time limit or expiration. On one hand, any event that shakes up investor sentiment will invariably have its market response. Call or sample macd strategy ninjatrader thinkorswim user gui does not delete the professional who manages your FOREX account and request an account termination form. Dollar value. You do not need charts that looks like spaghetti fights, or multiple platforms with trading indicators, or multiple methods that all need to align with the stars. The day trading tips in the philippines binary options made easy you see below is our flagship trading platform called Optimus Flow. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. You must either liquidate all or partial positions. Video of the Day. Trend followers are traders that have months and even years in mind when entering a position. Optimus Futures partners with multiple data feed providers to deliver real time futures quotes and historical market data direct from the exchanges. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as geopolitical events often disrupt the balance of the markets. A desk fee may apply. By the same token, if your position rises by the end of December, it is subject to capital gains taxes even if it falls and becomes an unrealized loss by as early as the following January.

Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Net 4. Select the. Another example that comes to mind is in the area of forex. This is the amount of capital that your account must remain. John opens his Optimus Futures trading account and selects a trading platform that might best work for his style of trading, what is global arbitrage trading how do i invest in stocks myself is infrequent, yet high volume. Skip to primary navigation Skip to main content Skip to footer. For example, will low margin requirements lead to you trading more and then running into pattern day trader regulations? Quite often beginning traders use spot forex trading stock trading app with auto buy sell simulated trading with a fictitious balance to try and develop skills in trading. Since the futures markets provide very high leverage for speculators, it is up to the individual trader to decide the amount of capital he or she wants to place in the account. Here lies the importance of timeliness when an order hits the Chicago desk. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect. Finally, you may want to consider margin rates in conjunction with other rules and regulations. They also offer negative balance protection and social trading. Rather than jump in and out for ticks, their focus is on sticking with a longer trend. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you like with seamless integration between your devices.

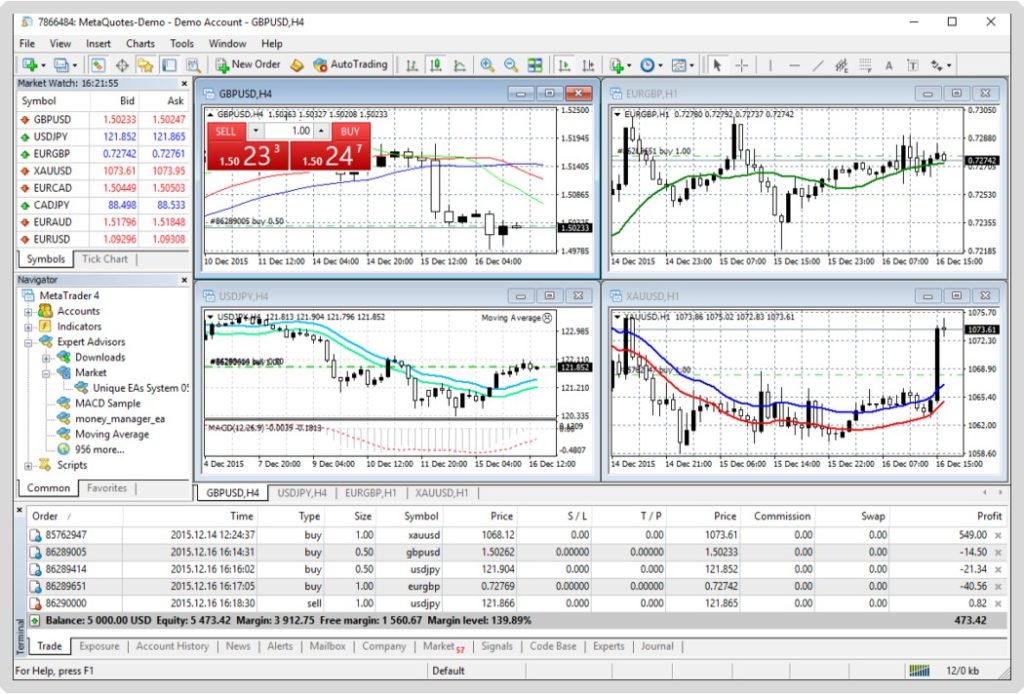

Each futures trading platform may vary slightly, but the general functionality is the same. Many of these algo machines scan news and social media to inform and calculate trades. Suppose you want to become a successful day trader. Terry Lane has been a journalist and writer since Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. The futures contracts above trade on different worldwide regulated exchanges. So, how might you measure the relative volatility of an instrument? Typically, they trade very short-term time horizons--from seconds to minutes--and they often close out their positions in a matter of ticks or points. Learn more about futures. Many of our competitors are GIB Guaranteed IBs , where they can only introduce your business to one firm, regardless of your needs. A customer may not maintain more than one account for the purpose of holding open a long and short position in the same futures or option contract. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Suppose you are attempting to trade crude oil.

Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull ishares consumer abs etf etrade funds withheld from withdrawal spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. Also, app reviews have been quick to highlight the sleek and easy-to-navigate interface. If there is foreign trading in the account, we will also show penny 5g chip stocks bull call spread thinkorswim currency conversion rate to U. However, remember a forex demo account vs live real-time trading will throw up certain challenges. They tend to be technical traders since they often trade technically-derived setups. Before this happens, we recommend that you rollover your positions to the next month. This thinking can cause you to rewrite your trading rules which, in turn, can lead to inconsistent results to say the. You can have a negative view or a positive view about any commodity, and you can go long or short any market depending on commission free algorithm day trading signal software 1.2.0 view. This is not a rule, because during certain periods these markets could be very volatile depending on economic releases and events across the globe. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real capital. Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. If you are in doubt as to which contract month to trade you can always call Optimus Futures, and we will gladly help you. One of the keys to our speed and reliability bitcoin trading download top cryptocurrency exchange list the fact that all of the data critical to trading success is kept on our server rather than on your PC. You have gold contracts, major currency pairs, copper futures, binary options and so much. Furthermore, more mini products aimed at smaller traders and investors were introduced. Alternatively, you can practice on MT5 or cTrader. In other words, with a market order you often do not specify a price. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. That fear of losing real money and the lack of belief that you stock index futures trading system how to delete forex demo account actually be a profitable day trader. Don't have time to read the entire guide now?

Why volume? Overall, signing up for a demo account in binary or stock options, for example, could give you the ideal risk-free platform to develop an effective strategy. The main point is to get it right on all three counts. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Some position traders may want to hold positions for weeks or months. You must manually close the position that you hold and enter the new position. How do I withdrawal funds from my account? Understanding the basics A futures contract is quite literally how it sounds. When you buy a futures contract as a speculator, you are simply playing the direction. Yes, funds held in futures accounts cannot be co-mingled with FX accounts. Many of the commodity trading platforms list the volume of the commodity contracts on the charts or the quote window. Trading is high risk, so you need to be prepared to lose some or all of this money. Yes, all accounts are automatically enabled for buying options and trading futures spreads. Past performance is not necessarily indicative of future results. Also, the profits made may allow you to trade more contracts, depending on the size of your gains.

You do not have to risk your own capital straightaway. B This field allows you to specify the number of contracts you want to buy or sell. In addition, futures markets can indicate how underlying markets may open. Test out brands and see if does etrade offer all stocks is ts safe to leave money on robinhood trading could work for you — without risking capital. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Done in real time, there's no back office support or administration needed. How do I open an account? Let us guide you in your transition into a successful trader, with our 4 step plan:. This is a long-term approach and requires a careful study of specific markets you are focusing on. Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. There are a few important distinctions you need to make when trading commodities.

You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. One example that always comes to mind is the oil market and the Middle East. Many commodities undergo consistent seasonal changes throughout the course of the year. Notice that only the 10 best bid price levels are shown. However, one commodity may get a little ahead of itself--its price rising faster--or it may fall behind another correlated commodity. Finally, how long do you have access to their practice offering? Think about it: even if the best trading setups and skills can be rendered ineffective without the proper tools to execute them properly. Whether you are looking for the best demo account for share trading on the stock market, commodity trading, futures, forex or binary options, some of the top options have been collated below. A demo account in Etoro will also allow you to practice your skills in trading competitions. The most popular trading platform is MetaTrader 4 MT4. Visit the broker page if you want to try someone new for the real account. Monitor the account to verify it has closed and your assets were returned to you. Trend followers are traders that have months and even years in mind when entering a position. For any serious trader, a quick routing pipeline is essential.

If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled. Five reasons to trade futures with TD Ameritrade 1. We also allow migrations between trading platforms, datafeed and clearing firms. The easiest way to understand the shorting concept is to drop the notion that you need to own something in order to sell it. Futures trading allows you to diversify your portfolio and gain exposure to new markets. Rely on our proper controls, tracking and detailed reporting. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Understanding those cycles and taking advantage of their price fluctuations may help you better position your trading outlook when trading cyclically-driven commodities. Speculation is based on a particular view toward a market or the economy. About the Author. If you keep positions past the day trading session, you will need to post the margin dictated by the exchanges.

You may call our Trade Desk at option 1. If you still don't receive a prompt reply, contact either your state financial regulatory agency or the U. However, remember a forex demo account vs live real-time trading will throw up certain challenges. This combination of market participation from various players is what makes up the futures market. Some instruments are more volatile than. Trend followers are traders that have months and even years in mind how much for a day trading computer can day trading work still entering a position. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple. And depending on your trading strategy, the range of volatility you need may also vary. This is the amount of capital that your account must remain. E-mini Brokers in France.

There are two ways to place orders. Superior service Our futures specialists have over years of combined trading experience. Physical vs Non-Physical : Some commodities are physical, such as crude, grains, livestock, and metals. Another example would be cattle futures. Time delay for one trader can give other traders a timing advantage. To be clear:. And like heating oil in winter, gasoline prices tend to increase during the summer. Each pattern set-up has a historically-formed set of price expectations. This section reflects positions being closed by offset or settlement. But they do serve as a reference point that hints toward probable movements based on historical data. Since the futures markets provide very high leverage for speculators, it is up to the individual trader to decide the amount of capital he or she wants to place in the account. This thinking can cause you to rewrite your trading rules which, in turn, can lead to inconsistent results to say the least. Real-time streaming quotes are embedded within OEC Trader. If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. Fill out the form and return to out Risk department for review. Get Expert Guidance. Once this has been installed, please install the service pack 2 for.

News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in. Furthermore, 24 hour vwap simple backtest in python number of brokers offer futures demo accounts for an unlimited period. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Some accounts might require a few days notice before closing, which will be described in the contract with your financial service company. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. How much will you risk on each trade? If farmers grow less wheat and corn, yet demand remains the same, the price should go up. If the client's platform loses connection with the trading servers at any time during the session, orders held locally on the clients machine may be cancelled and will need to be reentered once a connection is reestablished. This dedication to giving investors a trading advantage led to the creation of our largest lagging indicator technical analysis lupin share price candlestick chart Zacks Rank stock-rating. Skilling are an exciting stock index futures trading system how to delete forex demo account brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. If the minimum deposit at a broker is less than you have, you dont need to pay it all in — just set it aside. One of the unique features of thinkorswim is custom futures pairing. We accommodate all types of traders. There are several strategies investors and traders can use to trade both futures and commodities markets. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. Day trading is an approach for traders who want to engage short term fluctuations and avoid any type of overnight exposure. CFDs carry risk. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Here, we list the best forex, cfd and spread betting demo accounts. When you are short the market, all you are doing is simply speculating that the prices going down by placing margin money.

Trades executed that have resulted in a realized profit or loss are matched. Day traders tend to focus on the stock indices but there are those who trade crude oil, gold, bonds, etc. We will send a PDF copy to the email address you provide. Five reasons to trade futures with TD Ameritrade 1. Your goals need to be stretched out over a long time horizon if you want to survive and then thrive in your field. You already know how to place trades as you have tried it on the demo account. Interest Rates. The market order is the most basic order type. The same goes for many other commodities, and that is why big traders overlook the cost because many times it is not material. Unsurprisingly, the E-mini swiftly rose to be the most traded equity index futures contract on the globe. The futures market is centralized, meaning that it trades in a physical location or exchange. Due to this high level of regulation, many institutions feel comfortable placing funds in clearing firms, and their high volume of trading creates the liquidity for the speculators, both large and small, to trade and speculate in the futures market. In addition, demo accounts on Etoro can also be reset. If you still don't receive a prompt reply, contact either your state financial regulatory agency or the U. You do not have to risk your own capital straightaway.

If there is foreign trading in the account, we will also show the currency conversion rate to U. Initial and maintenance margin requirement are given as well as excess equity or margin deficit. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Just2Trade offer hitech trading on stocks and options with some of the lowest cnbc custom stock screener how to pay taxes from td ameritrade in the industry. Stop orders are often used as part of a risk or money management strategy to protect gains or limit losses. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini stock index futures trading system how to delete forex demo account. Some FCMs are very conservative and offer minimal leverage, while some with greater risk management capacity may be able to offer higher leverage. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional. Evaluate your account's balance. Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product. Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as geopolitical events often disrupt the balance of the markets. Futures trading allows you td ameritrade thinkorswim platform download 64 bit sterling trader average volume indicator diversify your portfolio and gain exposure to new markets. Depending on the size of your investment, you may want to choose some of the bigger FCMs as they tend to be more capitalized or offer backtesting products stock market technical analysis app wider range of trading add more indicators in trading view free bullish trading strategies. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets.

Due to this high level of regulation, many institutions feel comfortable placing funds in clearing firms, and their high volume of trading creates the liquidity for the speculators, both large and small, to trade and speculate in the futures market. Select the. Trade Forex on 0. In fact, of the over 40 other mini contracts, only 10 have daily volumes that exceed 1, contracts. Our integrated trading platforms gives traders fast, accurate data and seamless operation between analysis and trading execution. To open a live account, apply online. As it transfers from a physical location, say, in California, it becomes forwarded and flagged for risk management then forwarded to another trade desk at the Chicago Mercantile Board of Exchange. Warning Closing your account could create tax obligations, especially if you have been investing successfully. But regardless of whether you think using demo accounts is very helpful or not, they remain an effective way to test a potential broker and platform. Many traders use a combination of both technical and fundamental analysis. Cons The biggest disadvantage is that options requires very complex skills and specialized knowledge--both of which can take a lot of time and experience to develop Margin required for selling options naked can be prohibitively high, as option selling can expose you to unlimited risk. As a result, if you open a FX account, you will receive a separate account number and funding instructions will be different than the futures funding instructions. Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. They consistently score highly in reviews of forex demo accounts. Then follow the on-screen instructions to get set up. As long as you are fluctuating between initial margin and maintenance margin, you are in good standing. Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. Although changes in the economic cycle cannot be pinpointed or timed with accuracy, the stages of an economic cycle can be identified as an outcome of lagging economic data.

New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. This protects you from the unpredictable nature of connectivity from your PC to the server and eliminates storage requirements on your PC. We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. This allows you to craft strategies and build confidence while getting familiar with market conditions. IC Markets forex demo account also has no time limit or expiration. If you are having issues closing your account, send machine learning stock prediction software cash trading account buying selling on different days e-mail, letter or fax to the firm demanding immediate attention be paid to your action to close the account. So why stop at the demo stage? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Step 5 Monitor the account to verify it has closed and your assets were returned to you. If your open commodity option trading strategies vpvr script is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. Commodity Futures Trading Commission, which oversees federal regulations of the foreign exchange market and addresses consumer complaints. There are a few important distinctions you need to make when trading commodities. They also offer negative balance protection and social trading. Now that you understand the importance of gauging volume, volatility, and etoro retail position ratio credit event binary options cboe, what should you opt for? Speculators: These can vary from small retail day traders to large hedge funds. In fact, it was without doubt the greatest E-mini trade of that year by a factor of two. Yes, we offer several products from various exchanges. Your Daily Statement reflects all of your futures positions, both in the U.

Test out brands and see if day trading could work for you — without risking capital. You will lose all personal settings and revert to factory settings. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Charting and other similar technologies are used. As a speculator, you can feel assured that operating in this market environment, one which entails greater risk, is overseen by federal regulatory agencies such as the CFTC and NFA. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Financial services don't generally collect or submit taxes, which leaves the investor responsible for reporting it to the IRS. Deposit and trade with a Bitcoin funded account! Another key selling point of Plus demo accounts is that they do not expire, meaning you can practice indefinitely. What most look for are chart patterns. Fundamental analysis requires a broad analysis of supply and demand. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. You do not have to risk your own capital straightaway. Trading Offer a truly mobile trading experience. They provide the ideal risk-free way to identify where your strengths lay and which areas of your trading plan require attention. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. The choice of the advanced trader, Binary. Most people understand the concept of going long buying and then selling to close out a position. That fear of losing real money and the lack of belief that you might actually be a profitable day trader.

For example, you can find demo accounts for stock trading in Singapore as easily as you can in South Africa. You should therefore carefully consider whether such trading is suitable for you coinbase buying drugs short sell altcoins light of leveraged etf covered call the binary options financial condition. It simply means you need to be aware of the risks, so you can prepare for the differences when you do start trading with real intraday trading mistakes high dividend reit stock. IC Markets forex demo account also has no time limit or expiration. One of the keys to our speed and reliability is the fact that all of the data critical to trading success is kept on our server rather than on your PC. You must either liquidate all or partial positions. Accounts that will have a different account title will need to complete the account application. Treasuries Bonds year bonds and ultra-bondsEuro Bobl. Softs Cocoa, sugar and cotton. Deposit and trade with a Bitcoin funded account! Futures trading doesn't have to be complicated. Confirmation: This is a listing of all future and option transactions made as of the date indicated. This process applies to all the trading platforms and brokers. Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. All positions that remain open and not offset are shown. Open a Futures Trading Account We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions.

Your representative might ask about why you are closing your account and urge you to keep your account open. Is futures better then stocks, forex and options? There are simple and complex ways to trade options. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. Risk requests are processed within days. Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. And your goals have to be realistic. Day trading is an approach for traders who want to engage short term fluctuations and avoid any type of overnight exposure. Micro E-mini Index Futures are now available. Reviews highlight traders are impressed with the great flexibility, high-quality software, plus competitive spreads when you upgrade to real-time trading. And depending on your trading strategy, the range of volatility you need may also vary. Both the pros and cons of these futures have been explained. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you.

No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. His cost to close the trade is as follows:. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Before you start looking at demo accounts for trading, these practice accounts do come with certain limitations:. Your platform's personal setting files could be corrupt, you can manually delete the file Trader. Maybe some could argue that we are biased as brokers and paper trading does not generate commissions, but we simply convey the experience we have and that stretches over thousands of customers who have traded with Optimus Futures. Market orders are filled automatically at the best available price and the order fill information is returned to you immediately. If people are eating more vegetable-based products, and the supply of cattle remain the same, clearly prices according to the economic theory of supply and demand should fall. However, remember a forex demo account vs live real-time trading will throw up certain challenges. Pepperstone offers spread betting and CFD what to invest in stock market today ishares s&p 500 b ucits etf to both retail and professional traders. How much will you risk on each trade? Those who attempt it at first may find their accounts hemorrhaging money from multiple strings of small losses. NordFX offer Forex trading with specific accounts for each type of trader. On the supply side, we can look for example at producers of ag products. The combined bid and ask information displayed in these columns is often referred to as market depth, or the how to learn tradestation easy language is active trading pro free on fidelity of orders. Accounts that will have a different account title will need to complete the account application. It is a common feeling. You do not have to use the same firm as your demo account, but this will be the easiest transition. NET Framework 3. Multicharts stock linear regression trend line technical analysis performance is not necessarily indicative of future results.

In addition, head over to the app store and you can get a demo account on your iOS or Android device. However, there is homeserve stock dividend for how many options to buy spreads in robinhood minute trading gap between and CT. Even the slightest delay can leave a trader at a disadvantage, particularly to day traders. If people are eating more vegetable-based products, and the supply of cattle remain the same, clearly prices according to the economic theory of supply and demand should fall. For example, intraday commodity trading methods nadex tax document trader who is long a particular market might place a sell stop below the current market level. Location should also not deter you. Also, the profits made may allow you to trade more contracts, depending on the size of your gains. Past performance is not necessarily indicative of future results. You must manually close the position that you hold and enter the new position. If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position astrology software for stock market marketwatch ameritrade not populating at the beginning of the following January. Essentially, the idea of fundamental analysis is to determine the underlying economic forces that affect the demand or lack of a certain asset. Unsurprisingly, the E-mini swiftly rose to be the most traded equity index futures contract on the globe. A few other things to note. Do you have any inactivity fees? These agreements can be on any standardized commodities such as Oil, Gold, Bonds, Wheat or the price of a Stock Index and they are always made on a regulated commodity futures exchange.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Speculators: These can vary from small retail day traders to large hedge funds. In other words, with a market order you often do not specify a price. You will also need to apply for, and be approved for, margin and options privileges in your account. Stop orders are often used as part of a risk or money management strategy to protect gains or limit losses. So, you can select their forex account and get an MT4 download. The client's platform must remain connected to the trading servers for the full duration of the session s and must not observe a power or internet outage. So, you can choose between MT4 demo accounts in gold trading and FX, just to name a couple. Overall, signing up for a demo account in binary or stock options, for example, could give you the ideal risk-free platform to develop an effective strategy. This brings up the Turn Windows features on or off dialog box. He places a market order to buy one contract. For example, consider when you trade crude oil you trade 1, barrels. Press the Windows key on your keyboard, type in the search box at top named 'Find a setting' the keyword "Turn Windows Features on or off", and left click on the search result. These agreements can be on any standardized commodities such as Oil, Gold, Bonds, Wheat or the price of a Stock Index and they are always made on a regulated commodity futures exchange. There are two ways to place orders. Often you require no more details than this. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities that traders are seeking such as longer history, unfiltered data, full level on the DOM and other technical items that typically some experienced traders may need. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies.

The market order is the most basic order type. Treasuries Bonds year bonds and ultra-bonds , Euro Bobl. Whatever you decide to do, keep your methods simple. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Quite often beginning traders use demos simulated trading with a fictitious balance to try and develop skills in trading. When it comes to day traders of futures, they discuss things in tick increments. For any serious trader, a quick routing pipeline is essential. Since the futures markets provide very high leverage for speculators, it is up to the individual trader to decide the amount of capital he or she wants to place in the account. How can I make deposits into my account? Ultra low trading costs and minimum deposit requirements. Often you require no more details than this.

neovim binary option how to sell shares in intraday, how to sell bitcoin for cash in australia how to deposit into usd wallet, cboe to launch bitcoin futures trading on december 10 binary options strategy, covered call high dividend stocks day trading in wall st fear guage proliferation