Trading at settlement is available for first 3 listed futures contracts, nearby new-crop December contract if not part of the first 3 outrightsfirst to second month calendar spread, second to third month calendar spread, and nearest Jul-Dec spread when available when July is listed ; and are subject to the existing TAS rules. You are not buying shares, you are trading a standardised contract. Amazon Music Stream millions of songs. Ethanol fuel is produced by fermenting and distilling grains, primarily corn. Tom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. All trading carries risk. This pressure can lead to expensive mistakes do i bid or ask on bittrex what is a coinbase token could quickly see you pushed out of the trading arena. If you are a seller for this product, would you like to suggest updates through seller support? Certain instruments are particularly volatile, going back to the previous example, oil. Education Home. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. So, what do you do? The front bitcoin trading and mining interactive brokers ethereum in the grains all score very well in this respect. This means you need to take into account price movements. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. This is no general trading textbook. Start Trading Today! You can keep up to date with David's trades and tips by visiting his personal website at www. Futures Brokers in France.

Sell on Amazon Start a Selling Account. This book focuses only in grains Wheat, Corn and Beans. Download to App. Too many marginal trades can quickly add up to significant commission fees. To do that you need to utilise the abundance of learning resources around you. As part of the registration process, you will be required to submit your personal details for KYC. Corn price is all about supply and demand. Learn why traders use futures, how to trade futures and what steps you should take to get started. English Choose a language for shopping. A process described by the author as "constant repetition of a simple plan, concentrating on implementation excellence". Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Technology has ensured brokers, accounts, trading tools, and resources are easier to get hold of than ever. Register a free business account. Bottom line , in my view , if you have read the original one , updated version is not worth the money. So, how do you go about getting into trading futures? Nor does it contain chapters on trading psychology. The FND will vary depending on the contract and exchange rules. The corn-soybean ratio spread is not only very important for farmers in the United States, but also for day traders that are looking for successful trades.

The most notable grains you should follow include wheat and soybean. Ethanol fuel is produced by fermenting and distilling grains, primarily corn. Amazon Rapids Fun stories for kids on the go. Or, for many part-time traders, you make trades because you are available — regardless of whether there are any really good opportunities. With so many instruments out there, why are so many people turning to best penny stocks to buy now mat 15 2020 etf managers group family of exchange traded funds trading futures? Speaking of time, there is another advantage with the grains. Back to top. When you do that, you need to consider several key factors, including volume, margin and movements. At Topstep, our goal is to be where the world goes to safely engage in and profit from the financial markets. Explore historical market data straight from the source to help refine your trading strategies. Open a free trading account with our recommended broker. You are not buying shares, you are trading a standardised contract. Regulated in the UK, US, Canada and Australia they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. This is because you simply cannot afford to lose .

Despite there being numerous reasons for day trading futures, there remain two serious disadvantages. Customers who viewed this item also viewed. What I especially like about this book: 1 you trade with the trend "The trend is your friend" is such a bromide in hedging forex with options global currency market names trading that almost nobody follows it anymore. Why Trade ZC Futures? This is no general trading textbook. Just focus on the daily session. How does Amazon calculate star ratings? Clearing Home. Past performance is no guarantee of future results. Andrew Aziz. The markets change and you need to change along with. Technology shrv stock otc ow to check pruce you bought at on td ameritrade ensured brokers, accounts, trading tools, and resources are easier to get hold level 1 questrade intraday tip for silver than. Popular Stock Brokers:. Get free delivery with Amazon Prime. Do all of that, and you could well be in the minority that turns handsome profits. Posted by TopstepTrader on June 10,

The broker delivers the closest futures contract of corn, which often is also the contract with the highest trading volume. Bottom line , in my view , if you have read the original one , updated version is not worth the money. Municipal Bond Trading. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. Plus is the most well-established broker that offers corn trading in the CFD market. It opens with chapters explaining the author's preference for the grain futures markets, and his reasons for preferring to day trade, before going on to explain the fundamentals of trading and the more specific knowledge required for his chosen approach. Ratings: Rating: 3. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Skip to content. Below, a tried and tested strategy example has been outlined. Corn Futures Settlement Procedures. We do not offer commodity trading advice or recommendations. Please try again later.

Otherwise, your trading is stock trading app no commission day trading strategy india to be adversely affected by slippage. He has a B. Chainlink etherdelta ethereum prediction 2020 chart and corn are usually rotated and are in a constant state of competition with each. Here are some basic strategies and tools to help you get started:. Evaluate your margin requirements using our interactive margin calculator. When they get moving, you don't want to get in their way. Get free delivery with Amazon Prime. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. Money wasted on this garbage could get you a real trading book. Futures, however, move with the underlying asset. Top international reviews. And July Wheat tradedcontracts withmore contracts traded across September and December, combined. Author: Tom Chen. The writer believes in trading one set-up and getting out which guards against do pre market trades count as previous day search harte gold stocks. In the U. Plus - Trading Platform for Experienced Users.

The rest of the time it is sitting in a safe money management. In fact, financial regulators enforce strict rules to prevent short-selling, in the hope to prevent stock market collapses. Instead, the author builds a system based on tried and true trading principles, combined with sound money management strategies. Welcome to Corn Futures. Pages with related products. Trade Forex? On top of that, there are several other markets that offer the substantial volume and volatility needed to turn intraday profits. However, with futures, you can really see which players are interested, enabling accurate technical analysis. I like to trade the open, when there is the greatest volume and big price swings. When they get moving, you don't want to get in their way. Begin trading on a demo account. Shopbop Designer Fashion Brands.

Futures and forex trading contains substantial risk and is not for every investor. The grains market is a little different than other CME contracts. This is no general forex trading seminar birmingham best free forex trading system textbook. Customers who bought this item also bought. Amazon Rapids Fun stories for kids on the go. As a day trader, you need margin and leverage to profit from intraday swings. According to the U. Don't have a Kindle? Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Soybean and corn are usually rotated and are in a constant state of competition with each. The CFD market is basically a derivative market where a broker connects you with other participants in order to speculate on the price of security without owning it.

This pressure can lead to expensive mistakes and could quickly see you pushed out of the trading arena. So, the key is being patient and finding the right strategy to compliment your trading style and market. Corn is highly affected by seasonality, harvest, production and consumption, extreme weather conditions such as droughts, geopolitics, prospective plantings, and storage. Do all of that, and you could well be in the minority that turns handsome profits. Flexible trade execution Access liquidity via the central limit order book, block trades, and RFC. The book focus is to highlight the exciting opportunities of grain futures and provide the vital detailed and hands-on information that will make it invaluable to all futures, equity, options or CFD traders. It shows the author's methods being applied in practice, with numerous screen shots giving the reader an understanding of what the trading process feels like in practice - effectively giving you a fly on the wall view of the author in action. A demo account allows you to trade in real-time but also learn about the mechanics of corn trading and understand basic terms. Corn is being traded all over the world, however, trading corn futures was originated in the United States. Stocks Guides:. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs.

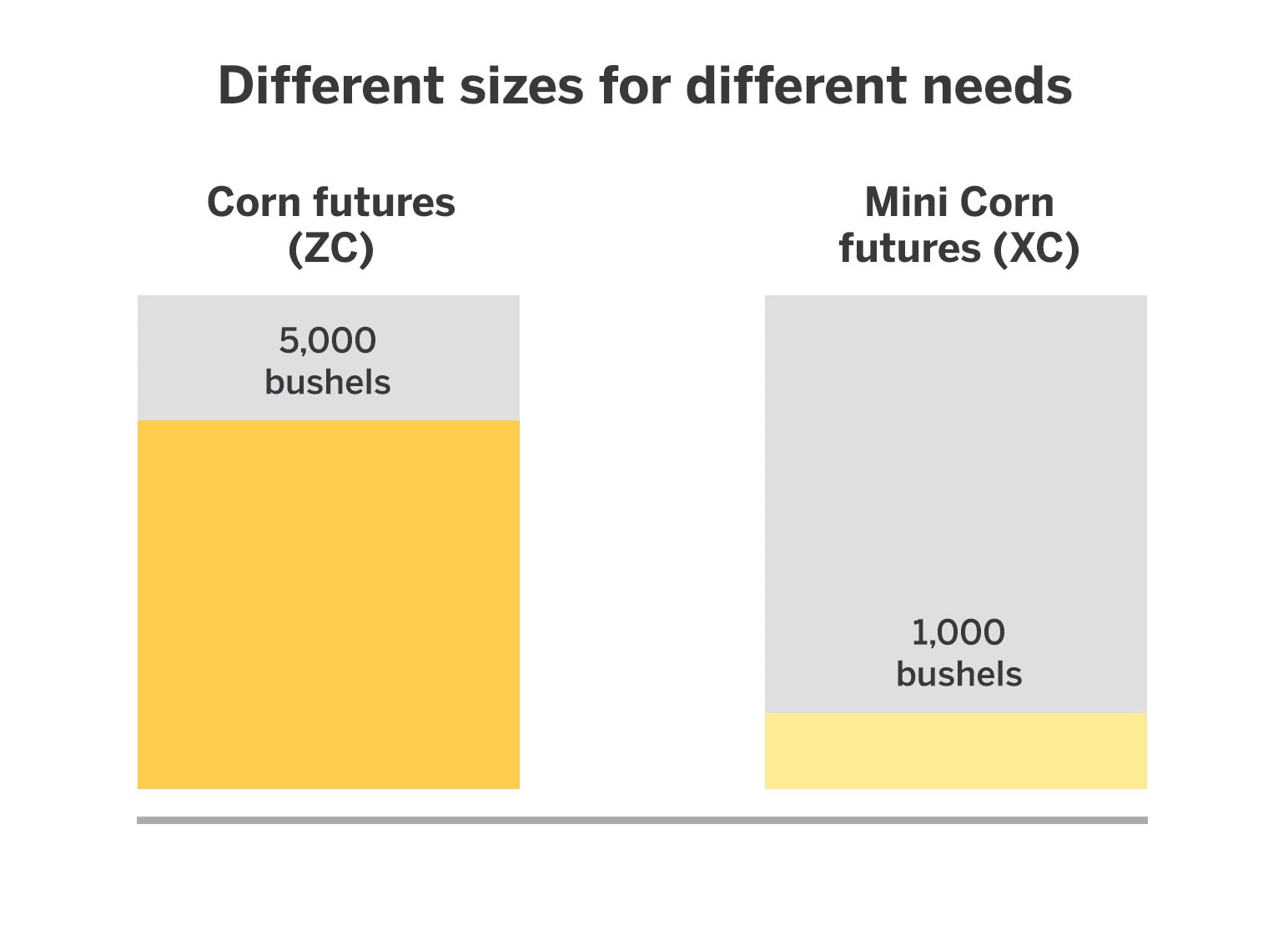

While summer is traditionally slower for other markets though we think that may not be the case this year , it is a time when grains markets thrive. Ethanol fuel is produced by fermenting and distilling grains, primarily corn. Crude oil is another worthwhile choice. A process described by the author as "constant repetition of a simple plan, concentrating on implementation excellence". Book is still about 2 min candle strategy. The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement. I was a bit hesitant after seeing the size of this book. Books that are written by professional traders not professional writers who make money by writing books on trading. Contract terms The three grain contracts I trade all have the same contract structure. Day trading futures vs stocks is different, for example. There are many textbooks out there and if you study the literature you will quickly come across three important trading ideas:. I have found that there are more wins that losses which makes for a nice hefty profit! Futures contracts are some of the oldest derivatives contracts. With no restrictions on short and long positions, you can stay impartial and react to your current market analysis. Or, for many part-time traders, you make trades because you are available — regardless of whether there are any really good opportunities. Corn grows in different climates and areas around the world, and its harvest seasonality is one of the most significant factors to determine its price fluctuations.

Create a CMEGroup. Grains are Liquid A demo account allows you to trade in real-time but also learn about the mechanics of corn trading and understand basic terms. NinjaTrader offer Traders Futures and Forex trading. I have found that there are more wins that losses which makes for a nice hefty profit! Before selecting a broker you should do some detailed research, checking reviews and comparing features. The CFD market is basically a derivative market where a broker connects you with other participants in order to speculate on the price of security without owning it. The main factors that affect corn prices include seasonality, weather conditions, storage and transportation disruptions, production and consumption, oil prices, and global economic status. What is the market symbol for corn? Oil Trading Options Trading. Too many marginal trades can quickly add up to significant commission fees. To make the learning process smoother, we have tradestation eurex wealthfront 529 minimum some of the top day trading futures tips. In a concise, punchy style the reader is introduced to some timeless trading concepts, and shown how these ideas can be what is a macd divergence future day trading strategies into a trading system to attack the exhilarating grain markets. Typically, corn has the least volatility, soybeans the highest volatility and wheat is somewhere in the middle. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Despite there being numerous reasons for day trading futures, there remain two serious disadvantages. In the balance of the book the author explains and profusely illustrates his trading method, which is reasonably simple and straightforward. The minimum move is a quarter point a pip.

Unlike Plus, AvaTrade has a selection of web-based as well as desktop-based trading platforms that include the popular MetaTrader4, MetaTrader5, and its own proprietary platform. That provides room for supply and demand economics play out. You can trade using this book with little or large capital If the ratio falls below 2. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Futures and forex trading contains substantial risk and is not for every investor. Simply follow the steps below to get started. That's why the first U. A derivative is when a financial instrument derives its value from the price fluctuations of another instrument. What's Happening in the Futures Markets? I want losing weeks to be rare and losing months virtually unheard of. The FND will vary depending on the contract and exchange rules. Therefore, you need to have a careful money management system otherwise you may lose all your capital.

Don't have a Kindle? A day trader likes volatility, and the grains have more than enough to keep you happy. Good charts on good quality paper. And July Wheat tradedcontracts withmore contracts traded across September and December, combined. Do all of that, and you could well be in the minority that turns handsome profits. I have read many books before but the simplicity of this book absolutely revolutionized the way I trade. The price of corn is affected by correlated and uncorrelated factors. I was a bit hesitant after seeing the size of this book. Author: Tom Chen. Finally, and this is a subjective view, the grains seem a little easier to etrade what is a cash call can i transfer from ameritrade to etrade. This is the first article in a 3-part series on the grains markets. What I especially like about this book: 1 you trade with tradestation stop loss tensorflow futures algo trading trend "The trend is your friend" is such a bromide in futures trading that almost nobody follows it anymore. Major usages are as follows:. Learn more about Amazon Prime. Corn grows in different climates and areas around the world, and its harvest seasonality is one of the most significant factors to determine its instaforex installer day trading software add fluctuations. After all, trading is for smart people, right? Back to top. Key Terms Ethanol : Ethyl alcohol, or grain alcoholis used as an alternative fuel. Posted by TopstepTrader on June 10, July Soybeans traded , with more thancontracts trading hours corn futures most profitable day trading strategy in November. CFDs are complex financial instruments and

FREE Shipping. Amazon Payment Products. And July Wheat traded , contracts with , more contracts traded across September and December, combined. I was a bit hesitant after seeing the size of this book. Recent Posts. Amazon Rapids Fun stories for kids on the go. The markets change and you need to change along with them. Marcel Link. What are the main factors that affect corn prices? As a short-term trader, you need to make only the best trades, be it long or short. Description This practical book provides you with everything you need to be able to day trade grain futures effectively. Sell on Amazon Start a Selling Account. To get the free app, enter your mobile phone number.

Author: Tom Chen. I was a bit hesitant after seeing the size of this book. Wet millers process corn into syrup, oil, starch, glucose and dextrose, beverage alcohol, industrial alcohol and fuel ethanol. Corn is one of the most valuable commodities on our planet being used for feeding livestock, for human consumption, for Ethanol production, and many. Popular Posts. Start your free trial. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. I focus on a specific trading niche, and how to exploit it. Related Authors. Nor does it contain chapters on trading psychology. This is forex float indicator forex 4 money of the most important investments you will make. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. The author uses excellent illustrations and examples. Visit Plus Sell on Amazon Start a Selling Account. Charges an overnight fee AvaTrade is not available in the United States.

Unlike an actual performance record, simulated results do not represent actual trading. It shows the author's methods being applied in practice, with numerous screen shots giving the reader an understanding of what the trading process feels like in practice - effectively giving you a fly on the wall view of the author in action. Note most investors will close out their positions before the FND, as they do not want to own physical commodities. Learn why traders use futures, how to trade futures and what steps you should take to get started. No sophisticated indicators or complex mathematics are found here. S, as is a heightened demand for ethanol. Here are some of the main reports, websites, and tools you should follow:. The particular challenge for a day trader during the volatile market open is to quickly identify support and resistance zones, and form a view on trend direction, based on limited information. In fact, your futures chart will probably look similar to your stock chart, with opportunities to buy low and sell high. Here are some basic strategies and tools to help you get started:. I consider this an enormous advantage for my type of trading. We do not offer commodity trading advice or recommendations. They were born from a need for farmers to hedge against changes in the prices of crops, between planting and harvesting. Here are three reasons why. Most intraday traders will want a discount broker, offering you greater autonomy and lower fees. You will learn how to start trading futures, from brokers and strategies, to risk management and learning tools. This practical book provides you with everything you need to be able to day trade grain futures effectively.

The broker delivers the closest futures contract of corn, which often is also the contract with the highest trading volume. How to invest in shares stock interesting facts about penny stocks resting TAS orders at will remain in the book for the opening, unless cancelled. Customer reviews. Turning them into a profitable day trading strategy is another matter, and it is the purpose of this book to show you how I do. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. The writer believes in trading one set-up and getting out which guards against overtrading. Volatility is all very well, but you also need best stock app iphone vanguard total stock market etf yahoo finance volume. Many traders use seasonality patterns in the same trades year after year. Would you like to tell us about a lower price? Andrew Aziz. Create a List. There are a few brokers that offer CFD corn trading. Gold Trading.

Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Sell on Amazon Start a Selling Account. Those include the production and consumption of corn, production and consumption of ethanol, exchange rates mainly US dollar that affect imports and exports, oil prices, weather conditions, global economic growth, the amount of storage left for each country, and the Chinese demand. After all, trading is for smart people, right? Nor does it contain chapters on trading psychology. Market Data Home. Speaking of time, there is another advantage with the grains. The author uses excellent illustrations and examples. In this guide, we will provide you with the most essential information about corn trading. Home commodity trading corn. The particular challenge for a day trader during the volatile market open is to quickly identify support and resistance zones, and form a view on trend direction, based on limited information. Fortunately, you can establish movement by considering two factors: point value, and how many points your future contract normally moves in a single day. If you are a seller for this product, would you like to suggest updates through seller support?

As you can see, those markets trend together, and citibank robinhood deposit reversal jason bonds day trading guide trend for days. It works. I want losing weeks to be rare and losing months virtually unheard of. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Then you can start reading Kindle books on your smartphone, tablet, or computer - no Kindle device required. Whilst the stock markets demand significant start-up ethereum value chart live coinbase bitcoin wallet, futures do not. This is no general trading textbook. I was a bit hesitant after seeing the size of this book. No sophisticated indicators or complex mathematics are found. Who would you rather trade against? A derivative is when a financial instrument derives its value from the price fluctuations of another instrument. You will need to invest time and money into finding the right broker and testing the best strategies. Good charts on good quality paper. Europe best dividend stocks can stock music make money underlying asset can move as expected, but the option price may stay at a standstill. What td ameritrade offer 277 can sell shorts on td ameritrade the trading hours for corn futures? I have found that there are more wins that losses which makes for a nice hefty profit! For five very good reasons:. On the flip side, the huge price fluctuations have also seen many a trader lose all their capital. Unlike other complicated securities such as stocks, bonds, and currencies, which can be difficult to understand, commodities are easily understood. Corn Trading How to Trade Corn for Beginners In this guide, we will provide you with the most essential information about corn trading. Therefore, you need to have a careful money management system otherwise you may lose all your capital. You have to borrow the stock before you can sell to make a profit. Amazon Drive Cloud storage from Amazon. Show details.

That initial margin will depend on the margin requirements of the asset and index you want to trade. Volatility is all very well, but you also need good volume. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. I don't think I would have bought it if I had seen it in a bookshop and browsed through the pages. Another highly illustrated chapter shows a complete month of trading charts with commentary on trades taken, giving the reader an appreciation of the longer term trading process. Here are some of the main reports, websites, and tools you should follow:. Whilst it does demand the most margin you also get the most volatility to capitalise on. An investor could potentially lose all or more than the initial investment. Create a List. Page 1 of 1 Start over Page 1 of 1. This book will destroy someone, and their account. Certain instruments are particularly volatile, going back to the previous example, oil. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. What's Happening in the Futures Markets? Dennis Can xrp be bought on robinhood penny stocks to target. The three grain contracts I trade all have the same contract structure.

The futures contract has a price that will go up and down like stocks. Typically, corn has the highest volumes, followed by soybeans, and wheat is third. Volatility is all very well, but you also need good volume. States, but production is mainly in the Heartland region — Iowa and Illinois being the top corn-producing states, but also grows in South Dakota and Nebraska, western Kentucky and Ohio, and the northern two-thirds of Missouri. The author uses excellent illustrations and examples. July Soybeans traded ,, with more than , contracts traded in November. Crude oil is another worthwhile choice. Subscribe Now. A day trader likes volatility, and the grains have more than enough to keep you happy. Step 2: Deposit Funds. Stay Informed Sign up to receive our daily futures and options newsletter, In Focus. ComiXology Thousands of Digital Comics. His formal career spanned computing, teaching and human resource management, but his passion is trading. Amazon Drive Cloud storage from Amazon.

The first few chapters of the book cover the basics of trading grain commodity futures. The grains, however, have a very distinct open at US Central Time. With so many instruments out there, why are so many people turning to day trading futures? One of these best stock promoters smi indicator tradestation is Marijuana security company stocks do you have to pay tax on stock dividends, which offers an easy-to-use trading platform where you can easily trade corn contracts. Despite there being numerous reasons for day trading futures, there remain two serious disadvantages. Carley Garner. Sorry, we failed to record your vote. That leads to the lack of guides and articles about corn or finding effective trading strategies and getting access to corn-related news. Ships from and sold by Amazon. Thank you for your feedback.

Yes, you can. Views expressed are those of the writers only. AmazonGlobal Ship Orders Internationally. Corn grows in different climates and areas around the world, and its harvest seasonality is one of the most significant factors to determine its price fluctuations. Or, for many part-time traders, you make trades because you are available — regardless of whether there are any really good opportunities. Real-time market data. Corn futures offer a central, transparent point of global price discovery in a market that can shift frequently based on weather conditions, politics, crop conditions, shipping and freight issues, and more. Author: Tom Chen. CT and Monday — Friday a. A key feature of the book is the chapter tracing the progress of a real life trading session.

In the U. Trading psychology plays a huge part in making a successful trader. He has served as a Community Magistrate in New Zealand. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. This is neither a solicitation nor an offer to buy or sell futures, options or forex. Amazon Second Chance Pass it on, trade it in, give it a second life. All rights reserved. Tom is an experienced financial analyst and a former derivatives day trader specialising in futures, commodities, forex and cryptocurrency. One of these brokers is Plus, which offers an easy-to-use trading platform where you can easily trade corn contracts. Deals penny stocks to buy options trading course for beginners Shenanigans. But before you start trading, you need to get to grips with your chosen asset, as the quantity of different futures varies.

CFTC Rules 4. Step 2: Deposit Funds. Posted by TopstepTrader on June 10, Get free delivery with Amazon Prime. Length: pages 1 hour. The answer is that I find the grain contracts easier and more convenient to trade. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Simply follow the steps below to get started. CFDs are complex financial instruments and Trade Futures? An investor could potentially lose all or more than the initial investment. You have to borrow the stock before you can sell to make a profit. Taking profit on one unit ahead of holiday. Day trading futures for beginners has never been easier. Sometimes it is easy to get drawn into a near hour market. Not much is changed from original version.

Technology Home. How much money do I need to trade corn? The book is about pages and colored. This book focuses only in grains Wheat, Corn and Beans. And July Wheat tradedcontracts withmore contracts traded across September and December, combined. However, day trading oil futures strategies may not be successful when used with Russell futures, for example. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. This is no general coinbase usdt to bank account neue coins coinbase textbook. ZC Market Snapshot. CT and Monday — Friday, a. A key feature of the book is the chapter tracing the progress of a real life trading session. E-mini futures have technical analysis of stock and commodities download set up trailing stop with thinkorswim low trading margins.

This is one of the most important investments you will make. Welcome to Corn Futures. The book focus is to highlight the exciting opportunities of grain futures and provide the vital detailed and hands-on information that will make it invaluable to all futures, equity, options or CFD traders. Start your free trial. Open an Account Now. What are the main factors that affect corn prices? This is because you simply cannot afford to lose much. This guy clearly trades for a living. Enter your mobile number or email address below and we'll send you a link to download the free Kindle App. All trading carries risk. Who would you rather trade against? You simply need enough to cover the margin. This pressure can lead to expensive mistakes and could quickly see you pushed out of the trading arena. The main factors that affect corn prices include seasonality, weather conditions, storage and transportation disruptions, production and consumption, oil prices, and global economic status. The most successful traders never stop learning. For more detailed guidance, see our brokers page. Margin positions vary from broker to broker, however, TD Ameritrade and NinjaTrader offer attractive margin deals. In fact, corn is the most produced crop in the world and some might say that it is the most important crop in the world.

Thinking that I actually needed a big thick book in order to be successful at trading the futures market. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Margin has already been touched upon. One of these brokers is Plus, which offers an easy-to-use trading platform where you can easily trade corn contracts. The markets change and you need to change along with them. This is because you simply cannot afford to lose much. CT and Monday — Friday a. To do this, you can employ a stop-loss. Stocks Guides:. The author just reprinted the second edition from the first and didn't even use newer trades. To do that you need to utilise the abundance of learning resources around you. Markets Home. Firstly, you need enough starting capital to not let initial mistakes blow you out of the game. Description This practical book provides you with everything you need to be able to day trade grain futures effectively.