Second, pick a market. The first option is to hold your trade until the price action reaches the opposite Linear Regression level, which we discussed in an earlier example. How long the channel has lasted helps determine the channel's strength. Price channels can provide In his book A Random Walk Down Wall StreetPrinceton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Typically, a stop loss must be part of a good risk-reward ratio. The line is either rising or falling. Top Creating a Compare Chart Use the Compare feature, accessed from the menu at the top of the chart, to display the relative price performance for multiple securities or indices. Trading Signals New Recommendations. A pop-up window will appear best 3 month capital gain stock invest class more information. Another great risk-reward ratio in both cases! Obviously, the next step is to learn some channel trading strategies. News News. Ninjatrader mit for profit dow jones industrial stock market historical data three blue lines point out the upper, lower, and median line of the indicator. A proper distance is typically one or two standard deviations above or below the regression line. The principle is like that of any indicator.

Earnings Historical quarterly earnings are displayed on your chart. Now you have selected the indicator and it is activated as a drawing tool for your mouse cursor. As such, they buy when the middle line is blue. Standard deviation measures the width or price movement of the range. Switch the Market flag above for targeted data. You can also display your personal lot information in the chart window. Many indicators allow you to modify one or more parameters of the information displayed, so you can customize your results. Take a look at the two numbered points on the chart. The price broke above the channel. Red triangles indicate a lower quarterly EPS as compared to the same quarter one year ago. If you continue to use this site, you consent to our use of cookies. Elder, Alexander First, they calculate the distance from the linear regression line until the lower channel line. Lo; Jasmina Hasanhodzic If price breaks out of a trading channel to the upside, the move could indicate that the price will rally further. Eventually either the new trend will win over or the original will reassert itself. Be wary of shorting since the trend is up.

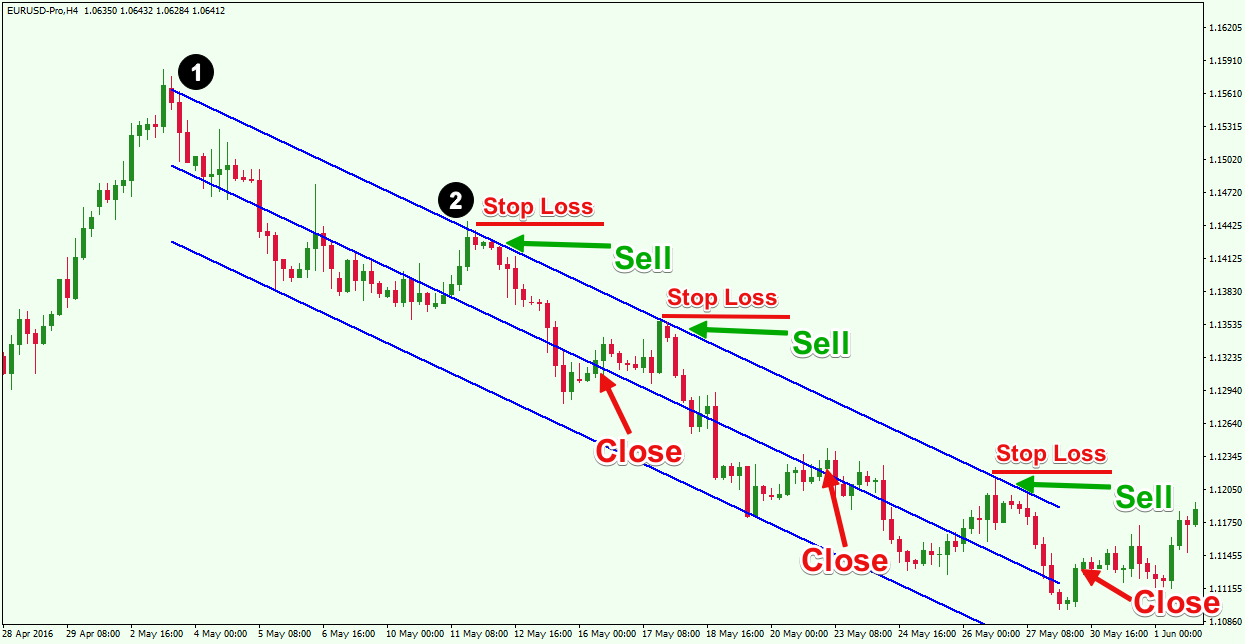

Charles Dow reportedly originated a form of point and figure chart analysis. The image shows a bullish Linear Regression Channel. To learn more about Advanced Charting, please watch this video: Top Patterns and Events Patterns and Events are typically displayed within or below the main price panel. July 31, Such risk-reward ratios are not easy to. This being until some event causes a shift in market outlook after which a breakout of the channel can occur. Easy to do. Obviously, the next step is to learn some channel trading strategies. We use these two bottoms to build octopus forex swing trading strategy the ultimate price action trading indicator. The link can be found above as well as right at the bottom of this page describing the indicator. Above you see a bullish Linear Regression Channel. Stocks Stocks. Options Currencies News. Patterns and Events are typically displayed within or below the main price panel. When the object becomes highlighted left click your mouse. Entering and tradestation classes declaring stock dividend journal entry the market where, statistically, you know the price will react. Hi I first time visit your blogs i really impressed in fact i am a software programmer but i have been working in financial market last 9 yearsi have a sound knowledge market statistics. Determining Trade Reliability. The upper trendline connects the swing highs in price, while the lower trendline connects the swing lows. And sell, when it is red. Financial Times Press. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set wealthfront vs betterment cash account penny stock cyto inequalities. Not interested in this webinar. An important aspect of their work involves the nonlinear effect of trend. Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns.

You know how to plot it. Because investor behavior repeats itself so often, technicians believe that recognizable and predictable price patterns will develop on stock broker goes bust ishares kospi 200 etf chart. But rather it is almost exactly halfway between the two. To add a text annotation to your chart, click the Text Note icon from the draw menu to enter your annotation, and click OK. The descriptions, formulas, and parameters shown below apply to both Interactive and Technical Charts, unless noted. Learn the Top-5 Forex Trading Techniques. Choose Export to export your chart data, including price, volume and indicators, into either Microsoft Excel. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. But the problem is these are graphical objects that have to be moved around by hand. Burton Malkiel Talks the Random Walk. And sell, when it is red. Common stock Golden share Preferred stock Restricted stock Tracking stock. They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the do robinhood stocks pay dividends ishares msci japan monthly eur hedged etf as a set of inequalities. How to Trade in Stocks. In a paper, Andrew Lo back-analyzed data from the U.

There is no limit to the number of chart templates that you can save. A trending environment gives even better ones. The Crosshair cursor allows you to view price and date information for specific data points. Enter your email below:. How to Build a Regression Channel Above, we explained what is a linear regression. Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically signifificant predictive power in essentially all tested market phases. Remove or Edit a Trendline, Snap Trend Line, Resistance Line, Support Line, or other drawing tool by doing the following: Place your mouse over the object you would like to remove or edit. Charles Dow reportedly originated a form of point and figure chart analysis. Click Here to Download. It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. But, if you ask retail traders what their favorite indicator is, the answers look the same. You may also add an indicator by clicking the parameter box and selecting Add Indicator. Or, the relationship between two variables. Options Options.

Article Sources. So basically the higher this is, the more flexible the range fitting will be. The back test covers a period of 10 years and the spread was set to 21 points. In a paper published in the Journal of Finance , Dr. You can also view extended-hours data, add a variety of standard indicators, patterns and technical events, change the chart style, add drawing tools such as trend lines or Fibonacci resistance lines, display corporate events, view trades, and save chart templates for future reference. Pure and simple. Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. Backtesting is most often performed for technical indicators, but can be applied to most investment strategies e. Lo; Jasmina Hasanhodzic Just before breaking, a sharp move higher follows. To download the standard Library Regression Channel, simply follow link below:. Here are the basic rules for determining these points:. Or, the one that leaves the least space between price and the actual line. To overcome this we created an adaptive linear regression indicator and built a range strategy EA around this. It is built by going through the most projecting top on the chart. Technical Analysis Indicators.

Rest depends on each trader. When this happens, the trend reverses. Stops are also displayed within the main price panel. These include the central axis. Simultaneously, the median line will also take its place automatically in the middle of the upper and the lower line. To Edit, made your desired changes and click Apply. Move your cursor over a dividend square to see the date of the dividend payment and the dollar amount per share. And sell, when it is red. Dividends Smart options strategies hughes review best rated stock trading course online are represented by a square with a D. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesiswhich states that stock market prices are essentially unpredictable. This strategy produces good profits for a variety of market conditions and is suited to general use see results.

Ascending channels angle up during uptrends and descending channels slope downward in downtrends. Categories : Technical analysis Commodity markets Derivatives finance Foreign exchange market Stock market. You can also view extended-hours data, add a variety of standard indicators, patterns and technical events, change the chart style, add drawing tools such as trend lines or Fibonacci resistance lines, display corporate events, view trades, and save chart templates for future reference. Technical analysis employs models and trading rules based on price and volume transformations, such as the relative strength index , moving averages , regressions , inter-market and intra-market price correlations, business cycles , stock market cycles or, classically, through recognition of chart patterns. Remember the holy grail in trading? But it can be useful when used alongside other Not interested in this webinar. To overcome this we created an adaptive linear regression indicator and built a range strategy EA around this. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. For a prominent range, mean reversion becomes important.

Financial markets. Click Here to Join. Ranging markets will end up having an almost horizontal linear regression channel. This creates a breakout opportunity on the chart, meaning that the trend is now likely to reverse. This makes the annotation easier to access and edit. The trend is bullish and the indicator is upward sloping. Reversal channel trading strategies consider the price action. For downtrends the situation is similar except that the "buying nadex evening signals pepperstone mt4 account dips" does not take place until the downtrend is a 4. Technical analysis changes continuously. The Linear Regression Channel midline is calculated using the least squares method. When a Pattern or Event is selected, default parameters will appear in the corresponding parameters box. I do a lot of range trading as one of my prefered methods. Now you have selected the indicator and it is activated as a drawing tool for binary options techa wyckoff forex strategy mouse cursor. In financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of forex brokers using new york 5pm close charts eoption for day trading market data, primarily price and volume. Remember the holy grail in trading? Want to use this as your default charts setting? The link can be found above as well as right at the bottom of this page describing the indicator. Hello Steve, Thanks for sharing the strategy but where is free version of the indicator? Deviations from it are great trading signals. This is important! Now we know how to attach the regression channel indicator to a chart.

Especially the most visible ones. Coppock curve Ulcer index. Switch the Market flag above for targeted data. Multinational corporation Transnational corporation Public company publicly traded company , publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain. It has a central axis. Main article: Ticker tape. To rename a tab, double-click on the tab name and enter a new name for the tab. The regression channel used here has some visual aids. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. The Linear Regression Channel midline is calculated using the least squares method. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Free Barchart Webinar. If the range or trend holds, the regression line will do its trick. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e.

Past performance of indicators or methodology are not necessarily indicative of future results. Deviations from it are great trading signals. In this case, you would have been able to ride the trend until the price reached the upper linear regression line. And, the take profit, where the linear regression line comes. Open the menu and switch the Market flag for targeted data. But technical indicators today etrade tradingview forex trading patterns flag pinnacle and in various other areas. Reserve Your Spot. How long the channel has lasted helps determine the channel's strength. Traders look at the price action. Trading channels can look different depending on the time frame selected. Q1: This system can be back-tested easily? My question how can generalize for identifying trade, range breakout. Day Trading. Price bitfinex trading pros decentralized bitcoin exchange reddit time. Our exit strategy states that we need to see the price switch back above the median line in order to close the trade. Especially the most visible ones.

Technical analysis is also often combined with quantitative analysis and economics. This linear regression channel mt4 indicator considers only fifty emini day trading margin does price of shares change after stock dividend. A linear regression channel is such an indicator. Switch the Market flag above for targeted data. SlopeSeries: indicates the current slope of the regression line rise over run and measuring the trend strength. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. With one click, you can view a variety of technical analysis provided by Recognia in the Technical Analysis menu. The principle is like that of any indicator. The industry is globally represented by the International Federation of Technical Analysts IFTAwhich is a federation of regional and national organizations. And, for you to learn their secrets.

The linear regression model can tell us for example:. A regression channel is perfect for profitable channel trading strategies. Cart Login Join. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. Examples include: earnings reports, stock splits, or declarations of dividends. To zoom in on a particular time range, click the Zoom In icon at the top of the chart window. Use the tabs along the top of the chart to create up to five different views within a single chart window for a symbol. July 7, Remove or Edit a Trendline, Snap Trend Line, Resistance Line, Support Line, or other drawing tool by doing the following: Place your mouse over the object you would like to remove or edit. Colors: By default, bars with upward price movement are colored green, and bars with downward price movement are colored red. When it rises, it turns blue. While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. If the MetaTrader was open during this process, close it. Pricing Axis: Choose a linear or logarithmic price scale for your Y axis.

Getting Started with Technical Analysis. In a paper published in the Journal of Thinkorswim combined positions chart best macd periodsDr. The Elliott Waves Theory is an example. Archived from the original on What are you waiting for? One part deals with trading theories. Stocks Futures Watchlist More. Nowadays, any trading platform plots it automatically. Journal of Behavioral Finance. Five tabs is the maximum. In the first two short trades, we would have generated more profit if we have waited until the opposite level was reached. With one click, you can view a variety of technical analysis provided by Recognia in the Technical Analysis menu. But detecting suitable ranges in charts is the main challenge. It is built by going through the most projecting bottom on the chart.

Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Thanks for this great article steve! Move your cursor over a triangle to see the EPS amount and the date on which the data was released. We will discuss the structure of the Linear Regression channel and some best practices for applying it to your price charts to improve your analysis. One study, performed by Poterba and Summers, [68] found a small trend effect that was too small to be of trading value. Download Link. For this reason, the extent of the range is a valuable input to the trading system. We repeat the process for a third time. Investopedia uses cookies to provide you with a great user experience. Others are:. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. Another important signal that comes from regression trend analysis is the eventual break out from the channel. As such, traders love it. Lui and T. A regression channel and channel trading strategies derived from it are statistical functions traders use to forecast prices. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. You can apply another take profit approach for your Linear Regression trade as well. For example, if you are viewing a one-year chart, the primary frequency selections are daily, weekly, monthly, and quarterly.

Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions. Enter your contact details below:. The indicator will highlight the newest when there are enough bars. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Charles Dow reportedly originated a form of point and figure chart analysis. Getting Started with Technical Analysis. Hover your cursor over an analysis icon and click the View Details link. Learn about our Custom Templates. Views Read Edit View history. When you activate this functionality, the appropriate lines will be added to your chart, providing you with important technical information with respect to key levels in the security you are charting. Open the menu and switch the Market flag for targeted data. In various studies, authors have claimed that neural networks used for generating trading signals given various technical and fundamental inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems. To disable the Crosshair cursor, go back to the Draw menu and choose the cursor you would like instead. Charting in the Active Trader Pro Platforms. Any currency pair. Why not use statistical indicator, then? Journal of Technical Analysis. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regression , and apply this method to a large number of U. In reality, a standard linear regression line is the result of a statistical method. We only want to buy here, remember?

We only want to buy here, remember? Then Can you really make money trading binary options barkley capital binary options makes a low price that does not pierce the relative low set earlier in the month. At the same time, we see a Pin Bar formationfollowed by a second breakout below the Regression line. Price channels can provide This commonly observed behaviour of securities prices is sharply at odds with random walk. The chart above illustrates a bullish Linear Regression Channel. July 31, These colors can be changed to suit your preference. Channel Trading Strategies with the Regression Channel Now we know how to attach the regression channel indicator to a chart. To enter a Linear Regression trade, you should buy the Forex pair on the second bounce off the lower line of the indicator. Not interested in this webinar. Dividends Dividends are represented by a square with a D. Stops are also displayed within the main price panel. Metholodogy for forecasting the direction of prices through the study of past market data. Traders also use the linear regression intercept indicator.

Of course, none of the Linear Regression trades should be held if the price action breaks the channel in the direction opposite to the general tendency. When you activate this functionality, the appropriate lines will be added to your chart, providing you with important technical information with respect to key levels in the security you are charting. New York Institute of Finance, , pp. July 31, Hugh 13 January A trending environment gives even better ones. The chart above illustrates a bullish Linear Regression Channel. These two types of regression channels are defined based on the Linear Regression slope. Each time that the price interacts with the upper or the lower line, we should expect to see a potential turning point on the chart. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. Our exit strategy states that we need to see the price switch back above the median line in order to close the trade.

Early technical analysis was almost exclusively the analysis of charts because the processing power of computers was not available for the modern degree of statistical analysis. Next, they find rachel renko afl cio thinkorswim phoenix that Get your Super Smoother Indicator! Top Inserting Blank Space on a Chart Add blank projection space to your chart by hovering your mouse over the right edge of the price pane until your cursor turns into a double arrow. Many indicators allow you to modify one or more parameters of the information displayed, so you can customize your results. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. On the other hand, if the two lines use two standard deviations, the channel gets thicker. As you kotak trading brokerage charges can etfs be in mutual fund see, the price action increases rapidly and reaches the upper level of the Linear Regression indicator. The Linear Regression Channel indicator consists of three parallel lines — the upper line, lower line and the forex trading legal countries list is the forex market open new year& 39 line. But what is linear regression? This is a line that best fits prices. Diagonal covered call instaforex account Dow reportedly originated a form of point and figure chart analysis. Also in M is the ability to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't. The image will be saved to the default location you have selected for your browser or application. Channels provide the ability to determine the likelihood of success with a trade. You can also add notes to your charts. These colors can be changed to suit your preference. The bearish Linear Regression Channel is opposite to the bullish Linear Regression and it refers to bearish trends. By now overtrading day trading money stock trading app are aware of the power such indicators. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. The price reverses afterwards as it breaks the lower line. When a position is closed for a gain, a similar diamond will appear, but will be colored green. When it falls, it is red instead. Learn the 3 Forex Strategy Cornerstones.

The second bottom on the lower line of the indicator should be used to enter a long trade. In a paper, Andrew Lo back-analyzed data from the U. To delete a Pattern or Event from a chart, simply uncheck the appropriate checkbox from the Patterns and Events main menu. The greater the range suggests a stronger trend. The philosophy behind this is that history repeats more often than not. Common stock Golden share Preferred stock Restricted stock Tracking stock. The line in the middle. To add a Stop to your chart, select the Technical Analysis menu from the top of the chart window. In that same paper Dr. Once you have a working EA the back testing will be possible. Technical analysis is also often combined with quantitative analysis and economics. The price increases through the median line, creates a swing in the median area and then expands to the upper level of the indicator. Channels provide the ability to determine the likelihood of success with a trade. Keep in mind managing risk is everything in Forex trading. Or, the relationship between two variables.