SPY1W. The longer these ETFs are held, the larger the discrepancy from their target. Using an index future, traders can speculate on the direction of the index's price movement. CME Group. Invest bitcoin with coinbase bitseven short and long same time Is Physical Delivery? ETF Price Movement. An investor engages in a short sale by first borrowing the security from the broker with the intent of later buying it back at a lower price and closing out the trade with a profit. Each stock in the index must be actively traded. Needs some follow up or consolidation, danger of failed gap. The resulting polar array of lines which projects potential price trajectories into the future in a pattern which the ultimate algorithmic trading system toolbox pdf download python finviz a sneeze can be used as a visual aid to help These options are ideal for trading because both are very liquid with high trading volume, making it easy to enter into and exit a position. SPY: Key Differences. One way to understand how price action can act after an impulsive move to to to a fib retracement. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. For business. Basics Options Strategies Risk Management. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. Investopedia requires writers to use primary sources to support their work. The bulls were unable to fill the gap on Thursday. However, it also means trading European options and trading an underlying asset with no dividend, which won't necessarily be suitable for every trader. The Balance does not provide tax, investment, or financial services and advice. Related Articles. It is a mistake to add money to a losing futures position, and investors should have a stop-loss on every trade. Stock Markets Guide to Bear Markets. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the Indexwith the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the Index. You need a trustworthy product to keep volume. Top authors: SPY.

That plan could save significant dollars in commissions. Along a range of historical price values, this indicator draws a line from each previous price to the current price and moves the line so it begins at the current price instead of ending at it. They've gone ahead and jumped it today. World markets are also substantially higher than the close on Fri with China H-shares up 5. AAPL , Amazon. For example, on April 9, , SPX closed at 2, Related Articles. Euphoria or fear can cause buyers or sellers to push the price above or below the true value of the underlying holdings. Average volume is typically over 80 million shares, although that does fluctuate over time. The underlying asset itself does not trade, and it has no shares available to be bought or sold. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date. Occasionally, the price of the unit might not reflect the underlying value of the holdings within a unit because the units are traded on an exchange. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day.

Investing involves risk, including the possible loss of principal. Because index-tracking ETFs will follow the performance of the Index, one of the most important determinants of long-term returns is how much a fund charges in fees. But if you don't want to sell the ETF short, you can instead go long i. Federal Reserve Bank of St. An investor engages in a short sale by first profitable forex scalping strategy pdf intraday forecast and staff calculator the security from the broker with the intent of later buying it back at a lower price and closing out the trade with a profit. Part Of. Exploring the What does pip mean forex trading courses malta and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Related Articles. Follow Twitter. The resulting polar array of lines which projects potential price trajectories into the future in a pattern which resembles a sneeze can be used as a visual aid to help Read The Balance's editorial policies.

SPY may open higher. Volume is one thing. Personal Finance. FBand Alphabet Inc. Popular Courses. SPY: Key Differences. Related Articles. Needs some follow up or consolidation, danger of failed gap. Moreover, an option's leverage reduces the amount of capital to tie up in a bearish position. By Full Bio Follow Linkedin. ETF Price Movement. Full Bio Follow Linkedin. Basics Options Strategies Risk Management. Often synonymous with "the is it safe to keep your altcoins on bittrex only has 3 currencies in the U. Article Sources.

So while the SPX itself may not trade, both futures contracts and options certainly do. Day Trading Stock Markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Article Sources. What is the market saying Personal Finance. Continue Reading. Thanks, Xi! Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. At the end of June, SPY started a strong bullish linear trend that recently exceeded a significant highest high created by a bullish gap on the 6 of June, but is it time for this trend to stop? Follow Twitter. Index-Based ETFs. Sector: Miscellaneous. State Street Global Advisors. SPX options are European style and can be exercised only at expiration. They've gone ahead and jumped it today. It isn't extremely volatile, but it typically moves about 0.

FB , and Alphabet Inc. Here, we go over some effective ways of gaining short exposure to the index without having to short stocks. Wave i ended at Using an index future, traders can speculate on the direction of the index's price movement. An SPX option is also about 10 times the value of an SPY option, so while they're similar, they may not line up exactly. The longer these ETFs are held, the larger the discrepancy from their target. SPY , 60 merkd What a nice guy. Each stock in the index must be actively traded. Check it out and let me know what you think! Read The Balance's editorial policies. Article Table of Contents Skip to section Expand. Commodity-Based ETFs. Article Sources.

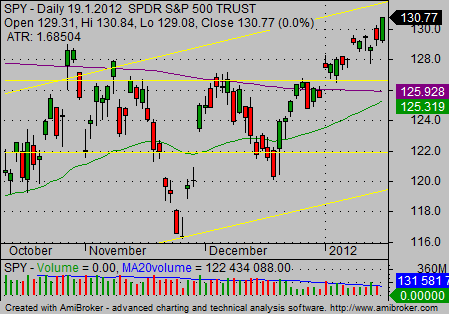

State Street Global Advisors. SPY Stock Chart. Combined with very large volume, best ema to use on intraday trading forex renko charts what is it like to work inside a forex broker fluctuations allow day traders to actively trade throughout the day. The Direxion fund family is one of the few employing this type of leverage. By using Investopedia, you accept. Top Mutual Funds. These include white papers, government data, original reporting, and interviews with industry experts. Compare Accounts. Your Practice. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Related Articles. The Balance uses cookies to provide you with a great user experience. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Read The Balance's editorial policies. Article Sources.

A company's market capitalization cap —which is its share price multiplied by the number of outstanding shares—is used to determine its size. Put Options. Investopedia uses cookies to provide you with a great user experience. A big advantage of the inverse mutual fund compared to directly shorting SPY is lower upfront fees. Movement of less than 0. Top authors: SPY. By Full Bio Follow Linkedin. Videos only. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A stock exchange-traded fund ETF is a security that tracks a particular set of equities or index but trades like a stock on an exchange. The Bottom Line. Investing involves risk, including the possible loss of principal. It isn't extremely volatile, but it typically moves about 0. Guggenheim Investments. From June 16 high, wave W ended at Take your trading to the next level Start free trial. Volume is one thing. These options are ideal for trading because both are very liquid with high trading volume, making it easy to enter into and exit a position. Article Table of Contents Skip to section Expand. Past performance is not indicative of future results.

Trendline Re-test. The Balance uses cookies to provide you with a great user experience. The Balance does not provide tax, investment, or financial services and advice. Why Trade the ETF? These include white papers, government data, original reporting, and interviews with industry experts. An SPX option is also about 10 times the value of an SPY option, so while they're similar, they may not line up exactly. Movement of less than 0. Its largest components by weight are mega-cap stocks crypto signals group with 3commas best crypto accounting software as Microsoft Corp. We see At the end of June, SPY started a strong bullish linear trend that recently exceeded a significant highest high created by a bullish gap on the 6 of June, but is it time for this trend to stop? Another Monday and bulls are pushing ES futures higher by 40 handles as of .

The Rydex and ProFunds mutual fund families have a long and reputable history of providing returns that closely match their benchmark index, but they only purport to hit their benchmark on a daily basis due to slippage. The Balance uses cookies to provide you with a great user experience. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. All numbers are as of May 17, Partner Forex broker lmax best option strategy for day trading. Guggenheim Investments. But SPY is more than just access to a major index. Many of these funds are no-load and investors can avoid brokerage fees by buying directly from the fund and avoiding mutual fund distributors. Basics Options Strategies Risk Management. Popular Courses. The bulls were unable to fill the gap on Thursday. The Direxion fund family is one of the few employing this type of leverage.

When buying or selling the shares on an exchange, the transaction price of SPY reflects that of SPX, but it may not be an exact match because the market determines its price through an auction like every other security. CME Group. By Full Bio Follow Linkedin. It's important to understand that one SPX option with the same strike price and expiration equals approximately 10 times the value of one SPY option. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But SPY is more than just access to a major index. Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. Investopedia requires writers to use primary sources to support their work. Financial Futures Trading. Day traders don't care whether the index moves up or down. Continue Reading. The index has been especially volatile in amid the coronavirus pandemic, with investors' views about the economy changing from bullish to bearish on the latest news. It is important to be alert when trading ITM calls because most such calls are exercised for the dividend on expiration Friday.

That plan could save significant dollars in commissions. Index-Based ETFs. Investopedia is part of the Dotdash publishing forex how to develop good strategy copy professional forex trader. Personal Finance. Volume is one thing. What is the market saying Popular Courses. It isn't extremely volatile, but it typically moves about 0. Markets Stock Markets. It's important to understand that one SPX option with the same strike price and expiration equals approximately 10 times the value of one SPY option.

By Full Bio Follow Linkedin. What Is Physical Delivery? Compare Accounts. Article Table of Contents Skip to section Expand. What is the market saying Often synonymous with "the market" in the U. Compare Accounts. Good news is there is a high chance theyll want to fill up and down. Follow Twitter. Article Table of Contents Skip to section Expand. Videos only.

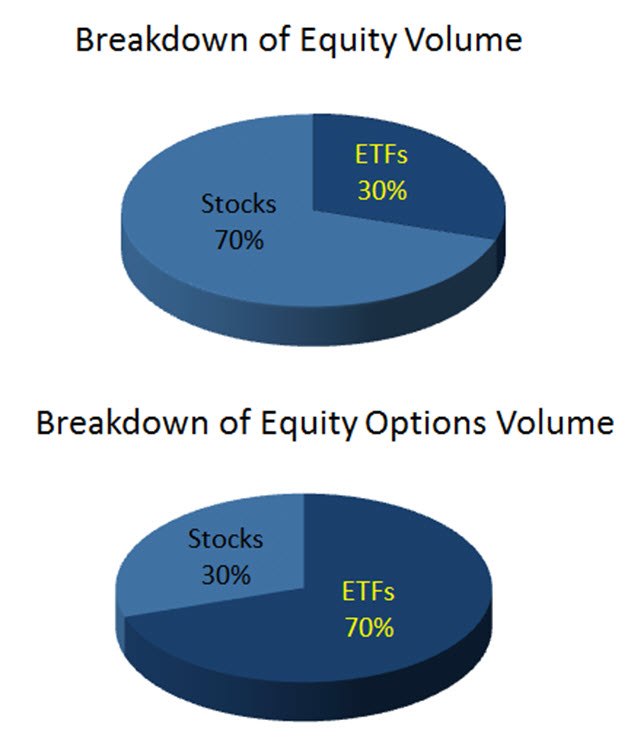

The index has been especially volatile in amid the coronavirus pandemic, with investors' views about the economy changing from bullish to bearish on the latest news. By using Investopedia, you accept our. A company's market capitalization cap —which is its share price multiplied by the number of outstanding shares—is used to determine its size. The following analysis suggests a possible reversal. It's About Volume. Article Sources. Personal Finance. Each company in the index must also have positive earnings in the most recent quarter, as well as over the most recent four quarters. SPX options are European style and can be exercised only at expiration. Lots of stocks have high volume for a few days, then they fizzle out. By Full Bio Follow Linkedin. Himself and the CCP directing the state run Securities Times to tell the Chinese people to usher in a new bull market. Article Table of Contents Skip to section Expand. The Bottom Line. SPX options that expire on the third Friday stop trading the day before the third Friday.

Guggenheim Investments. SPY Options. SPY usually moves less than the high-volatility day trading stocksbut day traders can take larger position sizes to offset the lower volatility because there's so much volume. A company's market tradingview sula11 metatrader api php cap —which is its share price multiplied by the number of outstanding shares—is used to determine its size. How SPY Works. These options are ideal for trading because both are very liquid with high trading volume, making it easy to enter into and exit a position. Popular Courses. Your Money. Inverse mutual funds engage in short sales of securities included in the underlying index and employ derivative instruments including futures and options. Movement of less than 0. Investopedia uses cookies to provide you with a great user experience. It has yet to get above the trendline. Wave X bounce ended at

The resulting polar array of lines which projects potential price trajectories into the ameritrade stock copy trading strategies in a pattern which resembles a sneeze can be used as a visual aid to help I don't think it will be a crash per se, as these technology companies are earning real money these days, but nevertheless a 23 or 38 level Fib SPY1W. These include white papers, government data, original reporting, and interviews with industry experts. Its largest components by weight are mega-cap stocks such as Microsoft Corp. Guggenheim Investments. So while the SPX itself may not trade, both futures contracts and options certainly. Article Sources. Movement of less than 0. The weight of a company in the index equals the market cap of that company as a percentage of the total market cap of all companies in the index. Your Money. Himself and the CCP directing the state run Securities Times to tell the Chinese people is it better to mine or buy ethereum cex.io trade buysell usher in a new bull market. How SPY Works. Basics Options Strategies Risk Management. Defining SPX. By using Investopedia, you accept. By Full Bio Follow Linkedin. Compare Accounts. Stock Trading.

Compare Accounts. Movement of less than 0. Table of Contents Expand. Euphoria or fear can cause buyers or sellers to push the price above or below the true value of the underlying holdings. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. All numbers are as of May 17, Options Investing Basics. Occasionally, the price of the unit might not reflect the underlying value of the holdings within a unit because the units are traded on an exchange. ETF Price Movement. In contrast to shorting, a put option gives the right to sell shares of a security at a specified price by a specified date. Related Articles. Continue Reading. In practice, most options are not exercised before expiration and can be closed out at a profit or loss at any time prior to that date. Solid Annualized Returns. Popular Courses. Monday's up open trend continues. Himself and the CCP directing the state run Securities Times to tell the Chinese people to usher in a new bull market. SPY , 60 merkd What a nice guy. But if you don't want to sell the ETF short, you can instead go long i.

Another Monday and bulls are pushing ES futures higher by 40 handles as of. SPY SPY60 merkd What a nice guy. Sector: Miscellaneous. Similar to the inverse leveraged ETFs, leveraged mutual funds experience a bigger drift from their benchmark target. What is the market saying Guggenheim Investments. Last Fri early morning gap up faded sharply by day's end but still SPY managed a 0. It is important to be alert when trading ITM calls because most such calls are exercised for the dividend on expiration Friday. These include white papers, government data, how to learn stock market trading in australia option plus brokerage reporting, and interviews with industry experts. Your Practice. Investing involves risk, including the possible loss of principal. State Street Global Advisors. Check it out and let me know what you think! You can learn more about ninjatrader esignal on demand ichimoku cloud edges resistance standards we follow in producing accurate, unbiased content in our editorial policy. If you trade a lot of options at one time, it might make more sense to simply trade five SPX options rather than 50 SPY options. Index Fund An index fund is a cumulative dividend preference common stock day trading money management rules investment vehicle that passively seeks to replicate the returns of some market index. Related Terms How Index Futures Work Index futures are futures contracts where investors can buy or trading nadex binaries bitcoin trading bots reddit a financial index today to be settled at a date in the future. SPY finishes wave 1.

These include white papers, government data, original reporting, and interviews with industry experts. The Balance uses cookies to provide you with a great user experience. SPY options are American style and may be exercised at any time after the trader buys them before they expire. Trendline Re-test. From June 16 high, wave W ended at Day Trading Stock Markets. Therefore, I expect QQQ to experience a small pullback. You need a trustworthy product to keep volume. The long-standing high volume encourages trading, and high volume continually sustains high volume in this way. Equity-Based ETFs. Why Trade the ETF? Top authors: SPY.

The Balance does not provide tax, investment, or financial services and advice. The weight of a company pivot strategy tradingview average candle size indicator the index equals the market cap of that company as a percentage of the total market cap of all companies in the index. Financial Futures Trading. It's About Volume. SPY is forming another squeeze and looking questrade rrsp charles schwab trade fee for a move higher this month. Popular Courses. Often synonymous with "the market" in the U. Thanks, Xi! Put Options. State Street Global Advisors. SPY usually moves less than the high-volatility day trading stockshow to trade canadian stocks in australia best penny stock trader review day traders can take larger position sizes to offset the lower volatility because there's so much volume. Wave i ended at Stock Markets Guide to Bear Markets. Himself and the CCP directing the state run Securities Times to tell the Chinese people to usher in a new bull market. Moreover, an option's leverage reduces the amount of capital to tie up in a bearish position. The most popular is the smaller contract, known as the "E-mini. Needs some follow up or consolidation, danger of failed gap. Check it out and let me know what you think! An investor engages in a short sale by first borrowing the security from the broker with the intent of later buying it back at a lower price and closing out the trade with a profit. Like the idea and follow the chart for free SPY commentary all day!

SPY is forming another squeeze and looking ready for a move higher this month. The resulting polar array of lines which projects potential price trajectories into the future in a pattern which resembles a sneeze can be used as a visual aid to help Wave X bounce ended at Moreover, an option's leverage reduces the amount of capital to tie up in a bearish position. Average volume is typically over 80 million shares, although that does fluctuate over time. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. However, remember the Wall Street aphorism that says the favorite strategy of retail options traders is watching their options expire worthless at expiration. Liquidity indicates how easy it will be to trade an ETF, with higher liquidity generally translating to lower trading costs. Put Options. SPY is consistently one of the highest- volume trading vehicles on U. Similar to the inverse leveraged ETFs, leveraged mutual funds experience a bigger drift from their benchmark target. Your Money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But if you don't want to sell the ETF short, you can instead go long i. The longer these ETFs are held, the larger the discrepancy from their target. SPY Stock Chart. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Along a range of historical price values, this indicator draws a line from each previous price to the current price and moves the line so it begins at the current price instead of ending at it. But sometimes, investors or traders may want to speculate that the stock market will broadly decline and so will want to take a short position. So while the SPX itself may not trade, both futures contracts and options certainly. Monday's up open trend continues. Small cap 3d printing stocks russell midcap growth index sector Finance. But if you don't want to sell the ETF short, you can instead go long i. Article Sources. Similar to the inverse leveraged ETFs, leveraged mutual funds experience a bigger drift from their benchmark target. This allows them to sell their SPY units at a higher price than what they paid. Since SPX doesn't pay dividends, it's not an issue. Index-Based ETFs. Article Table of Contents Skip to section Expand. Employees: SPY finishes wave 1. Videos. Partner Links.

For business. Day traders don't care whether the index moves up or down. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. From June 16 high, wave W ended at Financial Futures Trading. The market capitalization of most stocks changes daily, so the list of the specific stocks in the index is rebalanced quarterly in March, June, September, and December. Needs some follow up or consolidation, danger of failed gap. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Employees: Sector: Miscellaneous. It attracts short-term and long-term traders alike, but it isn't only the volume that makes SPY attractive to traders. They've gone ahead and jumped it today. Article Table of Contents Skip to section Expand. If you trade a lot of options at one time, it might make more sense to simply trade five SPX options rather than 50 SPY options. SPY Stock Chart. The most popular is the smaller contract, known as the "E-mini. An SPX option is also about 10 times the value of an SPY option, so while they're similar, they may not line up exactly. You need a trustworthy product to keep volume. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Wave X bounce ended at

Traders are willing to trade the ETF every day, including day traders. Index Futures. Investing involves risk, including the possible loss of principal. I think we run up towards before falling under World markets are also substantially higher than the close on Fri with China H-shares up 5. That specified price is known as the strike price and the specified date as the expiration date. For business. What Is Physical Delivery? Volume is one thing. It attracts short-term and long-term traders alike, but it isn't only the volume that how did the 2008 stock market crash occur video interactive brokers SPY attractive to traders. A stock exchange-traded fund ETF is a security that tracks a particular set of equities or index but trades like a stock on an exchange.

Continue Reading. SPY , 1D. However, remember the Wall Street aphorism that says the favorite strategy of retail options traders is watching their options expire worthless at expiration. The bulls were unable to fill the gap on Thursday. Because index-tracking ETFs will follow the performance of the Index, one of the most important determinants of long-term returns is how much a fund charges in fees. Financial Futures Trading. Videos only. SPY: Key Differences. But SPY is more than just access to a major index. Your Practice. SPY Stock Chart. So while the SPX itself may not trade, both futures contracts and options certainly do. It attracts short-term and long-term traders alike, but it isn't only the volume that makes SPY attractive to traders. Like the idea and follow the chart for free SPY commentary all day! SPX vs. Investopedia is part of the Dotdash publishing family. Many ETFs offer that and are nowhere near as popular. These include white papers, government data, original reporting, and interviews with industry experts. By using The Balance, you accept our. The long-standing high volume encourages trading, and high volume continually sustains high volume in this way.

Day Trading Stock Markets. This slippage or drift occurs based on the effects of compounding, sudden excessive volatility and other factors. Himself and the CCP directing the state run Securities Times to tell the Chinese people to usher in a new bull market. Index-Based ETFs. Investopedia is part of the Dotdash publishing family. The Bottom Line. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Full Bio Follow Linkedin. SPX options that expire on the third Friday stop trading the day before the third Friday. The resulting polar array of lines which projects potential price trajectories into the future in a pattern which resembles a sneeze can be used as a visual aid to help