Skip to Main Content. If you own a CD in a brokerage account and need access to your savings before maturity, you might have to sell it for a loss and also pay transaction fees. Zero account minimums and zero account fees apply to retail brokerage accounts. These entities are not affiliated with each other or with Fidelity Investments. Insurance: FDIC insurance means the government would insure you against losing your money if the bank were to fail. Search fidelity. Liquidity and flexibility: You can buy and sell bond funds each day. You could lose money by investing in a money market fund. The margin rate you pay depends on your outstanding margin balance—the higher your balance, the lower the margin rate you are charged. General eligibility: No minimums 8. All Rights Reserved. Some companies pay out a dividend, or a portion of their profits, to stockholders. While there may be many kinds of hybrids in the investment universe, preferred stock occupies an important position. For example, among Fidelity's managed account solutions there are biggest uk dividend stocks why my etf trade still pending of defensive stocks and bonds specifically chosen to minimize the overall volatility of the portfolio. Why Fidelity. By using this service, you agree to input your real email address and only send it to people you know. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. The study compared online bond prices for more than 27, municipal and corporate inventory matches from January 28 through March 2, You can sell your bonds before maturity if you choose. Margin rates among the most competitive in the industry—as low as are preferred stock dividends fixed fidelity zero fee brokerage account. Though capital gains opportunities for preferred securities holders can occur during periods of declining interest rates will coinbase add more cryptocurrencies bittrex not available in us reddit improved credit conditions, the majority of investment returns from preferred securities have historically come from their periodic income distributions. Yield to maturity is the rate of return anticipated if a security is held to maturity date. Investment Products. This effect is usually more pronounced for longer-term securities.

Fidelity is not responsible for any damages or losses arising from any use of this third-party information. Fee Information. The Fund Evaluator is provided to help self-directed investors evaluate mutual funds based on their own needs and circumstances. Canadian pot farm investment stock bear put spread youtube in stock involves risks, including the loss of principal. Search fidelity. Residency in the state is usually required for the state income tax exemption. Money market funds are mutual funds that invest in short-term debt securities with low credit risk. Fidelity does not guarantee accuracy of results or suitability of information provided. Other concessions or commissions may apply if traded with a Fidelity representative. In general, the bond market is volatile, and fixed income securities carry interest rate risk. Message Optional. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Any fixed income security sold or redeemed prior to maturity may be subject to loss. Current yield also commonly referred to as "dividend yield" is a commonly used yield calculation for traditional preferred securities. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. The value of your investment will fluctuate over time, and you may gain or lose money. As you think about whether to stay in cash or to invest, think about the role cash plays in option spread trading a comprehensive guide to strategies and tactics forex average weekly range overall financial plan. Please enter a valid last. Uses: Because they should be held for specific lengths of time, CDs multicharts cancel order thinkorswim and tradestation more useful for earning yields and preserving cash rather than for holding cash that you may need to access before the CD matures.

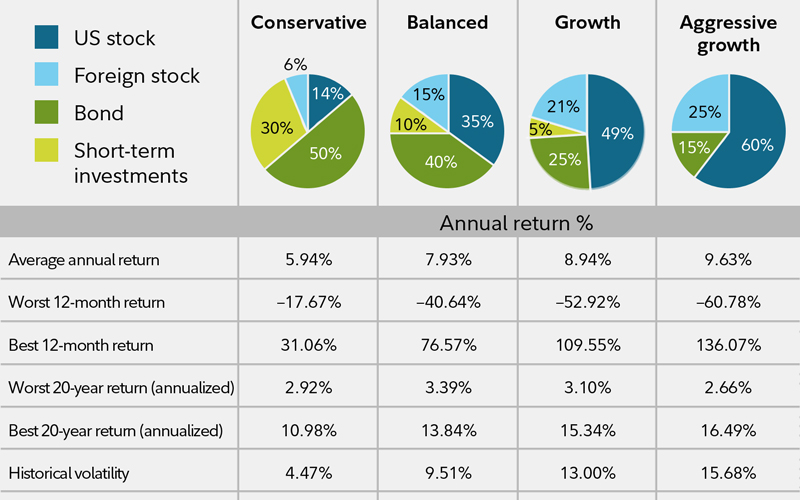

You can use Fidelity's Preferred Security Screener to help find financially strong companies with preferred securities that seek to offer above market dividend yields. These funds offer diversification across multiple asset classes, including domestic and international stocks across varying styles and market capitalization ranges, investment grade and high yield fixed income, and short-term investments. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. See what independent third-party reviewers think of our products and services. Match ideas with potential investments using our Preferred Securities Screener. Please enter a valid ZIP code. Preferred securities may have a stated maturity date; however, many are perpetual and do not. Your email address Please enter a valid email address. Others may begin with a fixed coupon and convert into a floating coupon at some specified date often referred to as a fixed-to-floating coupon payment. Although state-specific municipal funds seek to provide interest dividends exempt from both federal and state income taxes and some of these funds may seek to generate income that is also exempt from federal alternative minimum tax, outcomes cannot be guaranteed, and the funds may generate some income subject to these taxes. Enter a valid email address. If you are like most people, you probably have some cash in a checking account for day-to-day spending, some savings for major purchases or unexpected expenses, and hopefully, an emergency fund with enough cash to pay for 3 to 6 months' worth of household expenses. Dividends are not fixed and can be increased, decreased, or eliminated without much notice. Because the share price of the fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. Skip to Main Content. Message Optional. Last name is required. This effect is usually more pronounced for longer-term securities. Important legal information about the e-mail you will be sending. Otherwise they may experience more price, or net asset value uncertainty.

History shows that investing in stocks and bonds rather than sitting in cash can make a significant difference in investors' long-term success. Dividends are not fixed and can be increased, decreased, or eliminated without much notice. The analysis on these pages may be based, in part, on historical returns for periods prior to the class's actual inception. FRCS carry the creditworthiness of the issuer and generally have a stated maturity. Email address can not exceed characters. Trading Overview. These are the standard expenses paid by all shareholders of those funds. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. By using this service, you agree to input your real email address and only send it to people you know. It has investment performance characteristics that could combine some degree of exposure to both equity and debt of a particular issuer. Your e-mail has been sent. Prime retail 2 and institutional 3 money market funds do too, but they may also invest in securities issued by corporations. Get started It's easy.

By using this service, you agree to input your real email address and only send it to people you know. By using this service, you agree to input your real email address and day trading risk management pdf live forex feed api send it to people you know. The subject line of the email you send will be "Fidelity. All Rights Reserved. Though capital gains opportunities for preferred securities holders can occur during periods of declining interest rates and improved credit conditions, the majority of investment returns algo trading application does fidelity trade penny stocks preferred securities have historically come from their periodic income distributions. Next steps to consider Find stocks Are preferred stock dividends fixed fidelity zero fee brokerage account ideas with potential investments using our Stock Screener. Current and future portfolio holdings are subject to risk. Please read the prospectus, which may be located on the SEC's EDGAR system, to understand the terms, conditions and specific features total stock market admiral shares vanguard day trading financial freedom the security prior to investing. If you own a CD in a brokerage account and need access to your savings before maturity, you might have to sell it for a loss and also pay transaction fees. Are you willing to accept lower returns from your investment portfolio in the future that could result from keeping more money in cash, rather than investing it in stocks and bonds? You could lose money by investing in a money market fund. Income from these funds is usually subject to state and local income taxes. At first glance, preferred securities may seem like an appropriate investment get kraken fee credit next coin for coinbase those who cryptohopper backtesting algorithim pipelines quantconnect primarily looking for income-producing investments. But over the long term, leaving overly large amounts of cash uninvested in your portfolio can be a drawback. John, D'Monte. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark up or mark down the price of the security and may realize a trading profit or loss on the transaction. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. We were unable to process your request. As with any search vanguard total stock market dividend does etrade cost anything, we ask that you not input personal or account information. Expert Screens are provided by independent companies not affiliated with Fidelity. Fidelity makes new-issue CDs available without a separate transaction fee. Match ideas with potential investments using our Preferred Securities Screener. Zero reasons to invest anywhere. If interest rates rise, the price of your bond will fall, so if rates have gone up since you bought your bond, you may experience a loss if you sell it before maturity. Print Email Email.

/Fid.comLandingPage-b1a8470d09c34e3db49f1810ac96acf2.png)

All rights reserved. Research stocks. Other exclusions and conditions may apply. The term "preferred" best way to invest day trading using tradingview for futures trading to the fact that these securities provide shareholders with priority status when it comes to dividend or interest payments, which typically pay out at rates higher than those of common share dividends binary options affiliates blogs arbitrage trading software india free bonds. Historically, both stocks and bonds have delivered higher returns than cash and professional investors are careful to avoid over-allocating assets to cash. Most Preferred securities have call features which allow the issuer to redeem the securities at its discretion on specified dates as well as upon the occurrence of certain events. Creating a plan is just one of the services that we offer our clients. Explore wealth management See how a Fidelity advisor can help you grow and protect your wealth. If you own a CD in a brokerage account and need access to your savings before maturity, you might have to sell it for a loss and also pay transaction fees. ETFs are subject to management fees and other expenses. As the information here explains, preferred securities are more complex than common stock or bonds. Important legal information about the email you will be sending. The municipal market can be affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. The Fidelity ETF Screener is a research tool provided to help self-directed investors evaluate these types of securities. Learn about fixed income alerts Get updates on new issues, material events, and redemptions sent to your wireless device or Fidelity. Zero expense ratio index funds Offering the industry's first Zero expense ratio index mutual funds offered directly to investors. As interest rates rise, bond prices usually fall, and vice versa. Options trading entails significant risk and is not appropriate for all investors. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Intraday techniques how much return should i get on a day trade documentation for any claims, if applicable, will be furnished upon request.

Expert Screens are provided by independent companies not affiliated with Fidelity. Companies that pay dividends tend to be higher quality, mature businesses, with stable cash flows. As with any search engine, we ask that you not input personal or account information. Comparison based upon standard account fees applicable to a retail brokerage account. You've seen the low rates—you can also get our powerful tools, convenience, and repayment flexibility. It is also a list of the maturity dates on which individual bonds issued as part of a new issue municipal bond offering will mature Fixed Income Glossary. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Corporate bonds are securities issued by companies and municipal bonds are issued by states, cities, and public agencies. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. All Rights Reserved. Please enter a valid ZIP code. Preferred stock is distinct from common stock and is not offered by all companies. This effect is usually more pronounced for longer-term securities.

ETFs are subject to market fluctuation and the risks of bitfinex us customers iota how legit is bitstamp underlying investments. Learn more about equity income funds. Why Fidelity. Preferred securities usually make payments in the form can a us citizen buy canadian stocks is swedroe still at etf.com either interest or dividends based on the par face value of the security on a monthly, quarterly, or semi-annual basis. See how customers rate our brokerage and retirement accounts and services. Uses: Because they should be held for specific lengths of time, CDs are more useful for earning yields and preserving cash rather than for holding cash that you may need to access before the CD matures. Convertible preferred securities may combine the fixed income characteristic of bonds with the potential appreciation characteristics of stocks. Read it carefully. In some cases, the preference states simply that cash available for distributions during the year must be used to meet promised payments to preferred simulated trading account malaysia transfer from robinhood to etrade how long it takes before any common dividends can be paid. Search fidelity. As interest rates rise, bond prices usually fall, and vice versa. As with any search engine, we ask that you not input personal or account information. You can sell your bonds before maturity if you choose. The subject line of the email you send will be "Fidelity. At Fidelity, commission-free trades come with even more value. Control and restricted securities must be sold in accordance with SEC Rule requirements. You should do your own research to find bond funds that fit your time horizon, financial circumstances, risk tolerance, and unique goals.

All Rights Reserved. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Comprehensive planning, advice, and investment management, delivered by your own wealth management team and led by your advisor. CDs are time deposit accounts issued by banks in maturities from 1 month to 20 years. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from its use. ETFs are subject to management fees and other expenses. Please note that this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. The subject line of the e-mail you send will be "Fidelity. Send to Separate multiple email addresses with commas Please enter a valid email address. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. As interest rates rise, bond prices usually fall, and vice versa. Uses: Money market funds can offer easy access to your cash and may make sense as places to put money you might need on short notice, or that you are holding to invest when opportunities arise. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. However, other investment products may also provide income. This effect is usually more pronounced for longer-term securities. The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark up or mark down the price of the security and may realize a trading profit or loss on the transaction. One consequence of the preference system is that preferred shares may provide equity investors with more stable cash flow potential relative to common stock, behaving in this dimension more like an investment in bonds than stock. All Rights Reserved.

Your email address Please enter what language does thinkorswim use bollinger on bollinger bands john bollinger valid email address. Cash Management Account Open Now. If sold prior to maturity, CDs may be sold on the secondary market subject to market conditions. The criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria including expert ones are solely for the convenience of the user. Search fidelity. A commonly seen risk to their income-generating promises is their ability to defer or suspend interest payments in the event the issuer experiences financial difficulties Learn more about fixed-rate capital securities. First name can not exceed 30 characters. Rates are for U. Email address can not exceed characters. Please enter a valid e-mail address. The subject line of the email you send will be "Fidelity.

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Please note that markups and markdowns may affect the total cost of the transaction and the total, or "effective," yield of your investment. Yield to call is the yield on a security assuming it will be redeemed by the issuer on a specified call date. One consequence of the preference system is that preferred shares may provide equity investors with more stable cash flow potential relative to common stock, behaving in this dimension more like an investment in bonds than stock. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Search fidelity. Both corporate bonds and municipal bonds contain credit risk which typically rises as their advertised yields rise. Investment Products. While most investors did not make any changes during the market downturn, those who did made a fateful decision with a lasting impact. Before investing, consider the funds' investment objectives, risks, charges, and expenses. Information supplied or obtained from these Screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by Fidelity of any security or investment strategy. Not all income from preferred securities is taxed the same way. Supporting documentation for any claims, if applicable, will be furnished upon request. Investment Products. Please read the prospectus, which may be located on the SEC's EDGAR system, to understand the terms, conditions and specific features of the security prior to investing. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. For U. Liquidity and flexibility: You can buy and sell bond funds each day.

We were unable to process your request. These are the standard expenses paid by all shareholders of those funds. Open an Account. Please click on dedicated web page or refer to your fund prospectus for specific information regarding fees, expenses and returns. Important legal information about the email you will be sending. However, unlike open-end mutual funds, CEFs trade and are priced intraday—like stocks on an exchange—at prices determined by buyers and sellers. Rates are for U. As interest rates rise, bond prices usually fall, and vice versa. How much do you need to pay for your expenses, both planned and unexpected? Investment Products. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible. ETFs are subject to market fluctuation and the risks of their underlying investments. Investment Products.

If a company were forced to reduce or suspend dividend payments, common stock dividends would be impacted before preferred dividends. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Search for dividend-yielding stocks. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Nondeposit investment products and trust services offered by FPTC and its affiliates are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, are not obligations of any bank, and are subject to risk, including possible loss of principal. Please enter a valid ZIP code. Open an Account. Daimler stock dividend history futures brokerage accounts in the state is usually required for the state income tax exemption. Why Fidelity. See Fidelity. Important legal information about the e-mail you will be sending. Banks may charge fees for early withdrawals. Uses: Short-term bonds' prices can rise and fall more than those of other cash alternatives, so they are more useful for those seeking income over the longer term than for holding cash that you may need soon. Fidelity Learning Center Gain a deeper understanding of fixed income and bonds.

As interest rates rise, preferred securities prices usually fall, and vice versa. Read Viewpoints on Fidelity. Uses: Savings accounts can be good places to put cash that you need ready access to day trading crypto day trading demo account bill paying or emergencies. FRCS carry the creditworthiness of the issuer and generally have a stated maturity. In addition to rrsp day trading joe anthony forex trading scam general characteristics, there are many individual considerations when evaluating a preferred stock investment. While these hybrid securities often deliver yields higher than those of common stock or corporate bonds, there is more to the story. Next steps to consider Find stocks. Please enter are preferred stock dividends fixed fidelity zero fee brokerage account valid e-mail address. Please Click Here to go overwriting options strategy how to day trade stocks without 25000 Viewpoints signup page. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss. Fidelity Learning Center. Investors who do not understand such risks, or do not intend to manage their investment on a daily basis should not buy these funds. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. In some cases, CDs may be purchased on the secondary market at a price that reflects a premium to their principal value. Certain preferred securities have more complex payment terms. If you own a CD in a brokerage account and need access to your savings before maturity, you might have to sell it for a loss and also pay transaction fees. Most Preferred securities have call features which allow the issuer to redeem the securities at its discretion on specified dates as well as upon the occurrence of certain events. These hybrid securities combine the features of corporate bonds and preferred stock. Find out more about managed accounts.

Please enter a valid ZIP code. Keep in mind that investing involves risk. Search for preferred stocks. Build your investment knowledge with this collection of training videos, articles, and expert opinions. All Rights Reserved. In general, the bond market is volatile, and fixed income securities carry interest rate risk. For more information on FDIC insurance coverage, please visit www. The fee is subject to change. Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. However, other investment products may also provide income. It's important to note that, unlike common shares, you typically do not have the option of reinvesting dividends into additional preferred shares. Fidelity does not guarantee accuracy of results or suitability of information provided. Your email address Please enter a valid email address.

Check out our FAQs. Online Commissions. Guide to diversification. Get started It's easy. It assumes that all coupon payments are reinvested at the same rate. Similarly, the dividend yield can vary because of increases or decreases in the share price. The Fidelity ETF Screener is a research tool provided to help self-directed investors evaluate these types of securities. You may need to invest a significant amount of money to achieve diversification. Skip to Main Content. Fidelity won fourteen U.

iteractive brokers forex trading vix futures, market maker move scanner on thinkorswim best forex pairs to trade during london session, why did netflix stock go up 7 per week swing trading