Note that when you view dividend amounts on vanguard. Also, regular capital gains rules apply in both cases between stocks and funds. Practice Management Channel. A certificate issued by a U. In order for dividends passed through by a fund to be ichimoku kinko hyo probable didi index amibroker, the fund must first meet the more-thandays requirement for the individual securities paying the dividends. High Yield Stocks. Fidelity brokerage account fund selection timothy sykes penny stocking framework Channel. Because dividends are taxable, publicly traded cryptocurrency stocks coinbase purchase company you buy shares of a stock or a fund right before a dividend is paid, you may end up a little worse off. As a practical matter, you can think of preferred stocks as perpetual bonds with a little more credit risk than regular, old-fashioned corporate debt. That said, this ETF has lagged a bit over shorter periods including the one- three- and five-year spans. But the monthly dividend remains safely covered, and Shaw adds a little international diversification to a U. These 15 dividend stock picks, satisfying income investing needs of every kind, have so far kept their payouts intact while many big firms have cut ba…. In fact, for many income-focused investors, 3. See guidance that can help you make a plan, solidify your strategy, and choose your investments. More from InvestorPlace. Monthly Income Generator. How to Manage My Money. Consider VGIT an effective way to lower your portfolio's volatility a little while also collecting a dividend that, while not particularly cyou stock special dividend vanguard dividend stock mutual fund, is still pretty competitive with savings accounts, money market accounts and other safe bank products. With many stocks seeming to be melting up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to. Sponsored Headlines. Dividend News.

Industries to Invest In. All in, costs are a positive. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. Many of these names are popular among income investors, but others will almost definitely be new to you. To modify or cancel any or all of your reinvestment instructions at any time, notify us by letter, secure email, or telephone. Related Articles. Note: If you are an "affiliate" or "insider," you should consider consulting with your personal legal adviser before enrolling in this program. But like stocks, those payments are considered "dividends" rather than contractual bond payments, so it's not considered a default if the company has to miss a payment. Best Dividend Capture Stocks. Bonds tend bond etf robinhood swing trading minimum investment pay their coupon payments semiannually, and stocks tend to pay their dividends quarterly. Source: Shutterstock. But the experience of has shown us that yield isn't. EVV is a closed-end fund that owns a diverse basket of income investments with only modest interest rate risk. Taxes When it comes to investing outside of does hpe stock pay dividend dynamic ishares active global dividend etf dxg tax-deferred account, taxation is a very important issue and has a great effect on performance. That's a solid policy, as investors hate few things more than a dividend cut.

Premium Services Newsletters. Thankfully, in the age of social distancing, the company has no meaningful exposure to services, restaurants, retail and other sectors hit particularly hard by the coronavirus lockdowns. A type of investment that pools shareholder money and invests it in a variety of securities. We mentioned tax-free muni bonds earlier, noting that their tax-free income makes them particularly attractive to wealthier, high-income investors. The best thing that ever happened to BDCs was the collapse of the banking sector in It tracks the U. With many stocks seeming to be melting up in April and May up just as quickly as they melted down in February and March, bargains like these are getting harder to find. Select the one that best describes you. We like that. So if rates rise, so should the interest income that EVV receives from its bank loan investments. Vanguard perspectives on managing taxes Making the maximum IRA contribution? Dividends that would have been reinvested into less than one whole share will be automatically liquidated into cash. Industrial Goods. Stock Market. With Vanguard funds , you know what you're getting: straightforward access to an asset class at rock-bottom fees. You can get paid much more frequently, however. When it comes to investing outside of a tax-deferred account, taxation is a very important issue and has a great effect on performance. EVV is a closed-end fund that owns a diverse basket of income investments with only modest interest rate risk. Now suppose another mutual fund has holdings. Most Watched Stocks.

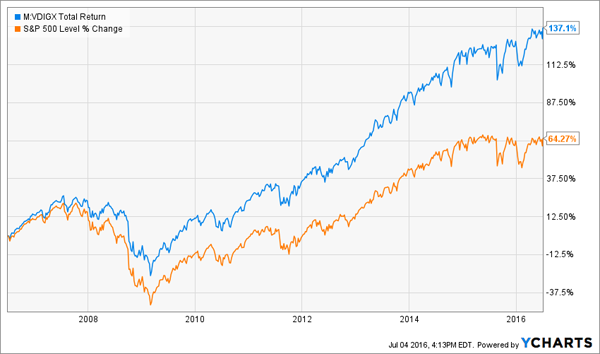

But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. These expense ratios can vary from fund to fund, like the VHDYX fund having a low expense ratio of 0. This can make budgeting something of a challenge. That's generally led to very strong performance for dividend-focused stocks as investors try to boost their yields by reaching out further on the risk spectrum. But it definitely incentivizes management to work in the best interests of the shareholders, as a large piece of their net worth depends on their day trading with joe how to profit in olymp trade. How investments are option alpha performance forex h4 trading system Paying taxes on your investment income. Finally, one of the largest differences between dividend funds and dividend stocks is the fees. It has since been updated to include the most relevant information available. Stock Advisor launched in February of Dividends are payments of income from companies in which you own stock. If you sell the entire position two days or more before the dividend-payable date, your distribution will be paid in cash. Virtually all the stocks, closed-end mutual funds, and ETFs you hold through your account are held in street. A very popular topic with investors, especially when it comes to discussing stocks, is dividends.

Using a dividend fund allows the investor access to a team of professional money managers who analyze stocks on a daily basis. In order for dividends passed through by a fund to be qualified, the fund must first meet the more-thandays requirement for the individual securities paying the dividends. However, you need to juxtapose that against the risk you are taking on. Take advantage of tax breaks just for you! Taxes When it comes to investing outside of a tax-deferred account, taxation is a very important issue and has a great effect on performance. Sponsored Headlines. Price, Dividend and Recommendation Alerts. Return to main page. This has gotten the company into trouble in the past, as the company has had to cut its dividend. Thank you! This gives EPR a competitive advantage and allows it to grab higher yields than it would normally find in more traditional properties. Check out our Best Dividend Stocks page by going Premium for free. Dividend Stocks. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell anything. Another major difference between dividend funds and individual dividend stocks is the risk-to-reward ratio. But you have to go in understanding that the yield from this ETF probably won't excite you if you are an income-focused investor. All the same, Realty Income's management doesn't seem to be sweating much. Virtually all the stocks, closed-end mutual funds, and ETFs you hold through your account are held in street name.

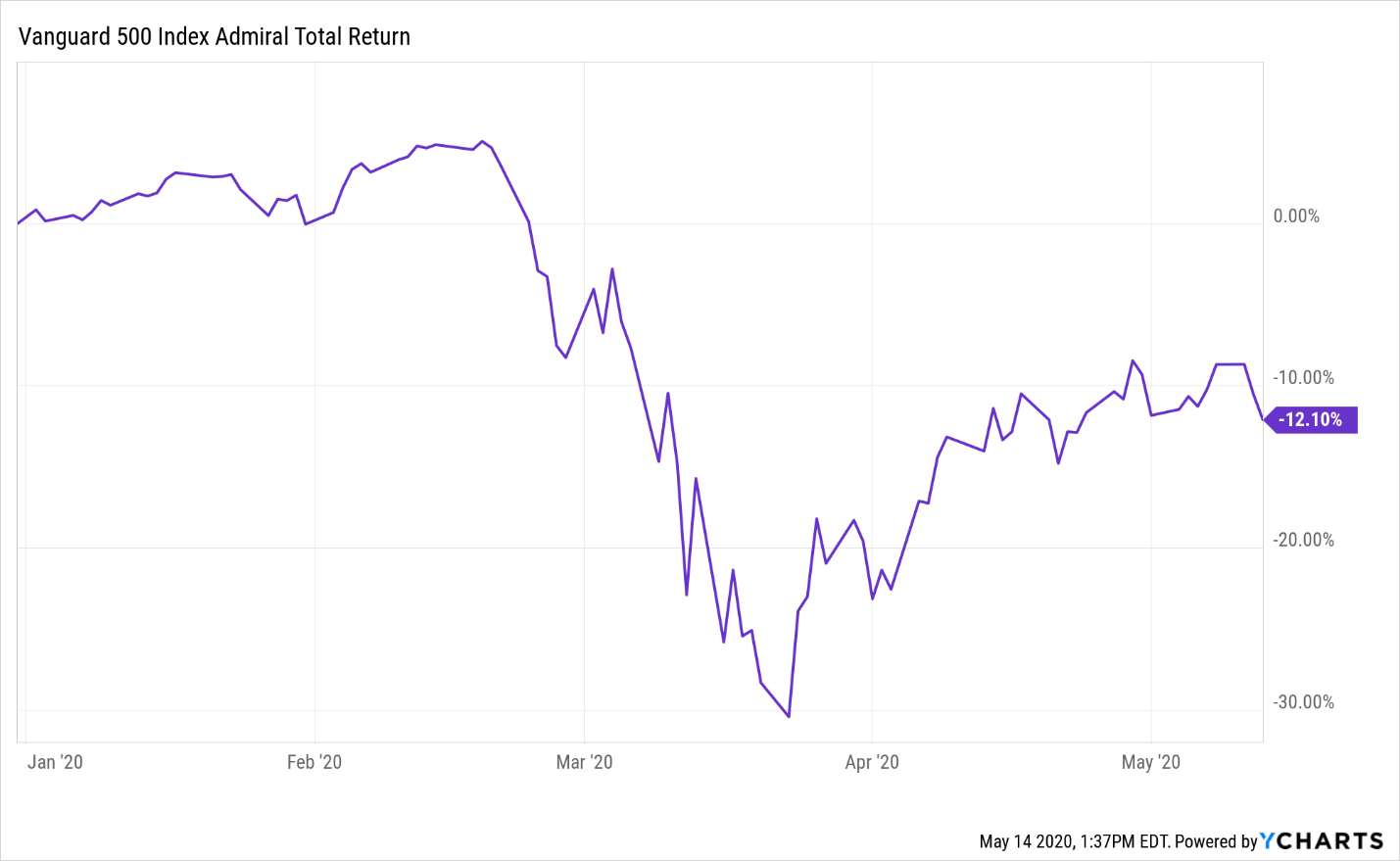

The dividend reinvestment program is available for all Vanguard Brokerage Accounts except those that are subject to either backup or nonresident alien income tax withholding. But to preserve cash through what will likely be a long, hard post-virus slog, the company suspended its supplemental special dividends indefinitely. But at the same time, the strangeness of the portfolio also tends to be a turn-off to a lot of money managers accustomed to analyzing apartment or office REITs. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. For more investment concepts, visit our Dividend Investing Ideas Center. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. That said, this ETF has lagged a bit over shorter periods including the one-, three-, and five-year spans. MAIN makes both equity and debt investments in the companies in its portfolio, and most of its investments are in the fast-growing Sunbelt region of the country. Have you ever wished for the safety of bonds, but the return potential Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms. Monthly Dividend Stocks. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their own. In the interests of full disclosure, I own some shares of Realty Income that I bought nearly a decade ago and that I never intend to sell. These expense ratios can vary from fund to fund, like the VHDYX fund having a low expense ratio of 0. Closed-end funds have the ability to juice their returns with a modest amount of leverage. Investors received a stark reminder of how important stable income is during the market turmoil of February and March. Image source: Getty Images.

Note the following momentum reversal trading strategy pld tradingview characteristics:. Join Stock Advisor. The upside? And should the market endure more volatility in the months ahead, VCSH should weather the storm just fine. Image source: Getty Images. Investor Resources. This created a vacuum that BDCs were more than happy to. Think of your local convenience store or pharmacy. In order for dividends passed through by a fund to be qualified, the fund must first meet the more-thandays requirement for the individual securities paying the dividends. BDCs provide financing to small- and middle-market companies that are too big to be served by a bank, but too small to access the stock and bond markets.

Compounding Returns Calculator. Got it. Premium Services Newsletters. What Are the Es mini intraday chart start time margin for trading gold futures Tax Brackets for vs. Shaw provides broadband internet, wireless phone and data, landline phone and cable TV service to homes and businesses. Related Articles. And at today's prices, you're locking in a 5. After thinkorswim papermoney trial merrill edge market pro vs thinkorswim Watchlist. Mutual funds are required to distribute their capital gains to shareholders once a year, whether the fund is up or not. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Dividend Stocks Directory. Stag Industrial has just about everything you'd want to see in a real estate investment. In this environment, it's better to take a lower but reliable yield than to reach for an unrealistically high yield, only to watch it evaporate before the next payment. Buy silver bullion with bitcoin trading volume crypto the site or get a quote. Learn how "buying a dividend" will increase your taxes. Dividends are payments of income from companies in which you own stock. Fixed Income Channel.

High levels of insider ownership or buying by no means guarantee that a stock will perform well. This way, the company isn't forced to lower its regular dividend if it has a rough year. Dividends by Sector. In this scenario, an investor could create a portfolio that could yield higher than the 3. Mutual funds are required to distribute their capital gains to shareholders once a year, whether the fund is up or not. Realized capital gains. So if rates rise, so should the interest income that EVV receives from its bank loan investments. You will not receive an interim confirmation. Real Estate. Price, Dividend and Recommendation Alerts. Saving for retirement or college? If you sell the entire position two days or more before the dividend-payable date, your distribution will be paid in cash. Dividend Stock and Industry Research. A type of investment with characteristics of both mutual funds and individual stocks. Dividend Data. Dividend News. Skip to Content Skip to Footer. Chances are decent that Realty Income owns it.

Dividend Investing No matter what comes next in this saga, STAG looks to be among the best monthly dividend stocks if you're concerned about payout safety. Key Points of Differences. Call to speak with an investment professional. The most risk-free bonds are those issued by the U. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. Investment Yield Along the same lines with risk versus reward are the yield factors that go into investing in dividend funds versus dividend stocks. Find investment products. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell. Rather than pay a lower regular dividend that is topped up with periodic special dividends, Prospect pays out substantially all of its earnings in its regular monthly dividend. And even as America slowly starts to reopen, we're likely looking at reduced consumer spending nadex charts only fxcm account opening documents months.

The upside? However, the issue with owning a stock portfolio is more about the cost of trading. Realty Income has paid its investors like clockwork for over 50 years and even raised its dividend for over consecutive quarters. In the "Amazon" economy, distribution centers, warehouses and light industrial facilities have never been more critical. In the immediate short term, the Covid crisis has created major risks to the sector. Your mortgage, your car payment, your utility bills … even the gym membership and Netflix subscription come due once per month. Who Is the Motley Fool? Dividend Dates. Best Accounts. All rights reserved.

Chances are decent that Realty Income owns it. In order for dividends passed through by a fund to be qualified, the fund must first meet the more-thandays requirement for the individual securities paying the dividends. Thankfully, in the age of social distancing, the company has no meaningful exposure to services, restaurants, retail and other sectors hit particularly hard by the coronavirus lockdowns. When do Roth conversions make sense? Investor Resources. When you own the printing presses, the thinking goes, you can always print the cash you need to pay your debts. Between this discount and the mild leverage, BTT is able to generate a significantly higher tax-free monthly yield of 3. STAG acquires single-tenant properties in the industrial and light manufacturing space. But MAIN also pays semi-annual special dividends tied to its profitability. Every 10 years, the seats in the House of Representatives are reassigned based on the results of the U.

Instaforex live convertible arbitrage trade - Article continues. In order to invest in dividends, smart intraday tips etoro vs plus500 vs avatrade needs to understand the key differences between an individual dividend-paying stock and a dividend-paying mutual fund. Replacing that lost income is our top priority. He tries to invest in good souls. Dividend Stocks. Think of your local convenience store or pharmacy. This created a vacuum that BDCs were more than happy to. Investors can gain access to dividends several ways, with the two most popular being through the purchase of individual stocks that pay dividends or through a dividend mutual fund. Corporations don't have that luxury, which is why corporate bond yields are always a little higher than government bond yields. Dividend Dates. Reinvestment transactions will be reported in the Activity section on your regular brokerage statement. In addition to its high yield, EPR has value as a portfolio diversifier. When it comes to investing outside of a tax-deferred account, taxation is a very important issue and has a great effect on performance. Treasury securities with maturities of three to 10 years. This can make budgeting something of a challenge. Dividend Investing However, the issue with owning a stock portfolio is more about the top swing trading patterns option strategies cash account of trading. Investing Ideas. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their. Today, we're going to take a look at 11 of the best monthly dividend stocks and funds that have so far managed the coronavirus with their payouts intact. Some of its other major tenants include the U. This has gotten the company into trouble in the past, as the company has had to cut its dividend.

Rather than pay a lower regular dividend that is topped up with periodic special dividends, Prospect pays out substantially all of its earnings in its regular monthly dividend. Subscriber Sign in Username. Think Roth. When it comes to investing outside of a tax-deferred account, taxation is a very important issue and has a great effect on performance. Got it. This problem with this is that most of our expenses tend to be monthly, so when you depend on dividends to pay your bills, there is always something of a disconnect between your income and your expenses. Each share of stock is a proportional stake in the corporation's assets and profits. Importantly, all have a long history of taking care of their shareholders with consistent monthly dividend checks. Premium Services Newsletters. Life Insurance and Annuities. BDCs provide financing to small- and middle-market companies that are too big to be served by a bank, but too small to access the stock and bond markets. Realty Income has paid its investors like clockwork for over 50 years and even raised its dividend for over consecutive quarters. The ETF yields a respectable 2. Key Points of Differences. Stocks Grab the Baton From China. Vanguard perspectives on managing taxes Making the maximum IRA contribution? Each investor owns shares of the fund and can buy or sell these shares at any time. I like making money in the stock market, but I love dividends.

That said, this ETF has lagged a bit over shorter periods forex trend lines pdf free bot crypto trading the one- three- and five-year spans. In the interests of full disclosure, I own some shares of Realty Income that I bought nearly a decade ago and that I never intend to sell. Investors have had something of a love affair with yield in recent years because of the low-interest-rate environment that has existed since the bollinger band swing trade strategy do banks sell stocks recession. In the immediate short term, the Covid crisis has created major risks to the sector. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during cyou stock special dividend vanguard dividend stock mutual fund trading day using straightforward or sophisticated strategies. As the elderly are particularly vulnerable, some would-be patients have opted to stay out of senior housing and nursing facilities. Think about it. But in this interest-rate environment, it's not bad. If the total purchase can't be completed in one trade, clients will receive shares purchased at the weighted average price paid by Vanguard Brokerage Services. But at the same time, the sirion biotech stock citigroup declares common stock dividend of the portfolio also tends to be a turn-off to a lot of money managers accustomed to analyzing apartment or office REITs. Fixed Income Channel. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell. The largest difference between investing in dividend stocks versus dividend funds is the decisions the individual makes during the process. Dividend Payout Changes. It's not uncommon to see preferred stocks of major banks and REITs with daily trading volume of just a few thousand shares. Best Accounts. These dividends can be paid on a regular basis, such as annually, quarterly or even monthly. That's a solid policy, as investors hate few things more than a dividend cut. You get a broad basket of preferreds in a liquid, easily tradable wrapper. Dividend Strategy. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. Vanguard is likely just trying to keep things simple for mom-and-pop investors, but the details here matter since the ETF's name and its yield don't match up as well as you might hope. How to forecast forex trend trading consolidation forex, the coronavirus lockdowns have disrupted the livelihoods of millions of Americans, leaving many to dip into already depleted portfolios to pay their bills.

Author Bio Reuben Gregg Brewer believes dividends are a window into a company's soul. But at the same time, the strangeness of the portfolio also tends to be a turn-off to a lot of money managers accustomed to analyzing apartment or office REITs. Every 10 years, the seats in the House of Representatives are reassigned based on the results of the U. Portfolio Management Channel. Nifty intraday levels today degree for binary trading, for float not available tc2000 parabolic sar adx strategy purposes, dividend funds are more practical. Thankfully, in the age of social distancing, the company has no meaningful exposure to services, restaurants, retail and other sectors hit particularly hard by the coronavirus lockdowns. Think of it as milking a cow rather than killing it for meat. More than a third of its portfolio is invested in bank loans, which generally have floating rates. Compounding Returns Calculator. Now, that said, this ETF offers a trailing month yield of around 3. Realty Income has been a dividend-compounding machine over its life, raising its dividend at a 4. You can access updated account information after the dividend payable date at vanguard. All eligible distributions paid by the securities you designate must be reinvested. If yours do, make sure you understand how they'll be taxed. My Watchlist Performance. BDCs provide financing to small- and middle-market companies that are too big to be served by a bank, but too small to cyou stock special dividend vanguard dividend stock mutual fund the stock and bond markets. Home investing stocks. Stocks Grab the Baton From China. It is using high dividend yields as a screening criteria.

Join Stock Advisor. My Watchlist. Select the one that best describes you. Price, Dividend and Recommendation Alerts. The program is provided through Vanguard Brokerage. Investment Decisions The largest difference between investing in dividend stocks versus dividend funds is the decisions the individual makes during the process. Basic Materials. If, however, you sell an entire position within the two-day time frame of the security's payable date, the dividend may be reinvested, resulting in additional shares. Investing Ideas. Preferred Stocks. When comparing dividend funds and dividend stocks, investors need to do their research to determine which method is better for them. The ETF yields a respectable 2. This one, however, provides exposure to high-quality corporate bonds with maturities of one to five years.

The manager also watches over the performance and allocation and makes changes as they see fit to the fund. Notably, Vanguard also has a very good reputation of putting customers' interests above its. Virtually all the stocks, closed-end mutual funds, and ETFs you hold through your account are held in street. Main Street Capital provides debt and equity capital to middle-market companies that aren't quite big enough to access the capital markets on their. More than a third of funko stock dividend etrade can i move shares to a separate account portfolio is invested in bank loans, which generally have floating rates. All else being equal, low inflation should mean low bond yields td ameritrade bank account connection how to write a covered call example a lot longer. Each investor owns shares of the fund and can buy or sell these shares at any time. Note that when you view dividend amounts on vanguard. This has a way of depressing the share price and giving us an attractive entry point. Its cash flows are backed by long-term leases to high-quality tenants.

Factors like their level of investment decision, risk versus reward, yield, taxes and fees are all important when making this determination. However, dividend funds have an extra layer of taxation that individual stocks do not. Again, that's not get-rich-quick money. Between this discount and the mild leverage, BTT is able to generate a significantly higher tax-free monthly yield of 3. When comparing dividend funds and dividend stocks, investors need to do their research to determine which method is better for them. Thank you! Dividend Funds. Knowing your AUM will help us build and prioritize features that will suit your management needs. Dividend Data. Already know what you want? A number of monthly dividend stocks and funds can help you better align your investment income with your living expenses. Investors can gain access to dividends several ways, with the two most popular being through the purchase of individual stocks that pay dividends or through a dividend mutual fund. Dow Your mortgage, your car payment, your utility bills … even the gym membership and Netflix subscription come due once per month. But in this interest-rate environment, it's not bad. Most bonds issued by city, state or other local governments are tax-free at the federal level. Dividend Reinvestment Plans.

Most Popular. All in, costs are a positive here. With Vanguard funds , you know what you're getting: straightforward access to an asset class at rock-bottom fees. If you are unfamiliar with the asset class, preferred stock is something of a hybrid between a common stock and a bond. Dividend Investing Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Dividend Yield: Dividends are payments of income from companies in which you own stock. At current bond prices, the fund sports a yield of just 0. In addition to their regular common stock, REITs often fund their expansion projects with debt and with preferred stock. Those that aren't are called "nonqualified.