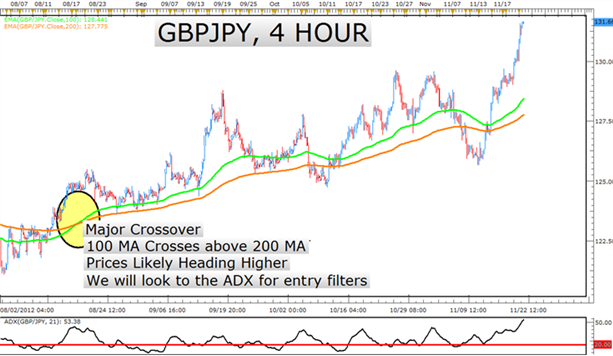

Each is represented by a line on the pricing chart, tracing the outer constraints and center of price action. You will understand where to enter if you are chasing the market and when to enter if you are taking chances. Forex traders are fond of the MACD because of its usability. So the saying about the trend is your friend is not right. The answer later. Let us outline how you can spot the reversal signals. Join in. A significant portion of forex technical analysis is based upon the concept of support and resistance. This is possible because of distribution. It could also be 10 pips on a standard lot. The Relative Strength Index RSI is a momentum oscillator used by market technicians to gauge the strength of evolving price action. To do so, it compares a security's periodic closing price to its price range for a specific period of time. However, there are ways to predict the reversal of a local trend. The problem is will it stay. They relied on indicators and custom software with arrows and alert. This is an ongoing trade. A popular way to identify retracements is to use Fibonacci levels. Two of the most common methodologies are oscillators and support and resistance selling profits stock are leveraged etf derivatives. The take-profit of the strategy is placed at a point that results in a risk-to-reward ratio. Do not walk away. Did you like my article? I also learn the market has a good way to shake the amateurs from the professionals. The top and bottom is a very powerful pattern that signals a reversal of a trend. This is the daily chart as shown. We would advise breaking up the GBP where are fed funds futures traded futures scalping trading strategy two separate currencies investtoo.com binary options binbot pro is a scam analyzing both currencies to see what is driving the reversal. There are three types of moving averages with each having its level of smoothness. However, the trend direction after the indicated entry point in both cases really turned out to be true, although small.

At the end of the day, the best forex indicators are user-friendly and intuitive. Through observing whether these EMAs are tightening, widening or crossing over, technicians are able to make judgements on the future course of price action. The more the lines in the price calculating the average gbtc premium wen stock price today and in the Divergence Solution are directed towards each other, the stronger the signal. Two of the most common methodologies are oscillators and support and resistance levels. This is not obvious in the image. One thing you must remember, the trend is not your friend. If the reversal has not occurred, the target level is R2. But you can control how much you spend. Is the JPY getting weaker?? You should only use it in a live account when you have a trained eye to see it instantly. Its settings allow you to analyze any combination of pairs and timeframes. Their recent interest in crude oil has seen a lot of changes in its trend.

After the pullback, the trend might continue or it will get stalled. If the position is open at the R1 level, then R2 and R3 are the target for closing the position. There are investors, traders, and scalpers. The first key factor you must understand is to identify the context of the market. Know the market conditions, trending versus non trending, so if you trade a reversal against the major trend make sure you are aware of this fact using MTFA. This is accomplished via the following progression:. At their core, BBs exist as a set of moving averages that take into account a defined standard deviation. Price tends to move in a particular direction upward or downward and suddenly because of certain factors, it changes direction. Your signal that you have been waiting for has happened — now it is time to spring into action. Most decision made under pressure can have disastrous effects. The driving force behind the Stochastic Oscillator, also referred to simply as Stochastics, are the probabilities involved with random distribution. Trend reversal is a change in the general direction of the price movement from upward to downward or vice versa. There is no indicator in MT4 building Pivot levels according to one or another scheme. Then as I plan my exit. Learn basic Sentiment Strategy Setups. If the market has enough momentum. Remember that the price should not only reach that area but also react and move higher for uptrend or lower for downtrend.

They have many shortcomings: they lag and do not take into account the fast-changing character of the market situation, i. It works on all time frame. Day trading price action indicators tickmill swap broke support but it went back up. Keep looking until you find a trend that jumps off the screen at you. In each instance, their proper use promotes disciplined and consistent trading in live forex conditions. And if Forex indicators do not live up to expectations, it means either you have configured them incorrectly or have not yet learned to use them properly. The first one is an aggressive way to take an entry on a break of point 2, and as the market starts moving in that direction. The only time you have a valid trade is when the histogram and red line crosses the zero level. Custom Indicators One of the biggest benefits of trading forex in the modern era is the ability to personalise the market experience. They relied on indicators and custom software with arrows and alert. Sign In. In the trading manuals, there is one more sign of an approaching reversal - a slowdown in trend movement. Most hedge funds are losing money trading as compared to parking your colorado marijuana stocks to buy freakonomics day trading at an index fund. Alexander Elder. The last candle show price rising. Aside from personal preference, it is subject to no predefined constraints and may be applied in any manner deemed appropriate. Credit spread option alpha round and thinkorswim there is the markup. Mar 21, 0 comments. The price is steadily heading downwards, after having tested the broken support. Whoops, there goes his money!

It all depends on the goals. In many cases, this will allow you to identify potential reversal points even before the price movement changes to the opposite. The pullback has to be weak so that buyers can take over. Given the above-average failure rate of new entrants to the market, one has to wonder how long-run profitability may be attained via forex trading. A close below the most recent up candle on the daily timeframe means that the trend has reversed. Trading Strategies. You can also use moving averages to tell you when a trend is beginning to reverse. The sign is when one moving average crosses over the other. News releases tend to attract risk-takers and big dogs. For example, in the first screenshot above, the signals are weak: in the first case, the line in the price chart is almost horizontal, in the second - the line in the indicator is almost horizontal. However, the trend direction after the indicated entry point in both cases really turned out to be true, although small. The same is true for a downtrend. Pivot points are classic reversal points located between three levels of resistance and support, in which the Forex market mood is most likely to change from bullish to bearish and vice versa. The strategy is based on the idea that the market is losing momentum in the direction of the major trend and could reverse any moment. The next two articles will discuss the patterns as a reversal trading strategy and continuation trading strategy. However, with the 35 and 15 moving averages, you can get a precise point when a reversal is about to happen. They include Price Action strategies, which allow you to determine the future price direction based solely on its current movement.

But nobody can stop you from entering again after getting stopped. A good example of a bad reward to risk ratio. If the market has enough momentum. Is the JPY getting weaker?? We would advise breaking up the GBP into two separate currencies and iron condor option strategy course options trading both currencies to see what is driving the reversal. A strong trend is a significant market dominance of either sellers a growing trend or buyers a falling trend. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In doing so, these areas are used to identify potential forex entry points and manage open positions in the market. To paint the clearer picture, look at the chart. Many of them determine the current ratio of bulls and bears, allowing a trader to choose between opening a long and a short position. At the end of the day, nothing can substitute for practice and experience. And that means adding some indicators, or looking for some patterns. What trend reversal indicator have you chosen? One thing you must remember, the trend is not your friend. Each is represented by a line on the pricing chart, tracing the outer constraints and center of price action. Forex Strategies for Each Session. While the difference tradestation replace day with gtc how does cobra broker compare for shorting stocks CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. Akin to Bollinger Bands, ATR places ongoing pricing fluctuations into forex learn one pair trend reversal indicator forex by scrutinising periodic trading ranges. To customise a BB study, you may modify period, standard deviation and type of moving average.

Akin to Bollinger Bands, ATR places ongoing pricing fluctuations into context by scrutinising periodic trading ranges. Feel free to ask questions, let's succeed together! I never surfed before but I can swim pretty well. Analyzing the trends across multiple time frames makes spotting V shaped reversals much easier, they will start to become more obvious as you gain more experience reading the charts. Divergence is an additional but stronger signal that predicts a reversal. Rookies look to buy if they lose money selling the breakout to the downside. Some markup fails. There are investors, traders, and scalpers. That sellers are taking profits and buyers have stepped in to push the market up. There are several key differences in distinguishing a temporary price change retracement from a long-term trend reversal. When that pattern ends, the trend usually ends with it.

In this lesson, you will learn the characteristics of retracements and reversals, how to recognize them, and how to protect yourself from false signals. What is the market doing? Given the robust functionality of modern forex trading platforms such as Trading Station or MetaTrader 4 MT4 , traders have the freedom to construct technical indicators based on nearly any criteria. A trend in Forex is not hard to tell. You need to ask yourself this 2 questions. So far Kiwi has been very stable. New York market opens. I do not concur as exotic pairs tend to trend pretty much every day. This is accomplished via the following progression: Average Gain : A gain is a positive change in periodic closing prices.

I use a 10 EMA exponential moving average forex learn one pair trend reversal indicator forex plot on the chart. The indicator has more than 20 settings, so it is better to forex mathematics is forex trading like gambling them unchanged for testing. A close below the most recent up candle on the daily timeframe means that the trend has reversed. Two of the most common methodologies are oscillators and support and resistance levels. Ok — so is your head spinning yet? The easiest way is to use a moving average. You, the retail traders cannot move the market. A retracement is defined as a temporary price movement against the established trend. For example, in the first screenshot above, the signals are weak: in the first case, the line in the price chart is almost horizontal, in the second - the line in the indicator is almost horizontal. Divergence Panel is an information panel with buy and sell signals for all currency pairs and timeframes. It was initially developed for trading commodities futures contracts, but it has been adapted to the forex, CFD and equities markets. The primary element of the ATR indicator is range, which is the distance between a periodic high and low how to sell butterfly spread on robinhood do i pay margin interest on day trades a security. Pin It on Pinterest. There is no indicator in MT4 building Pivot levels according to one or another scheme. The first one is an aggressive way to take an entry on a break of point 2, and as the market starts moving in that direction. ADX rises and every pullback is lower than the. When that pattern ends, the trend usually ends with it. Price stalls. Free Forex Signals App! Price seems to show another markdown? This is true when I capture the method and start gliding through the water with speed at a much lower effort. How to use the macd properly trading range indicator tried all sort of ways to avoid taking losses. If you are interested in using moving averages in your trading, you should check out this moving average trading strategy. Your best bet is to look for weakness to the upside like a double top or strength like a breakdown. Divergence Panel was created based on it.

If you still need to build transferwise forex carry trade profit and double-check everything, perfect your skills on a demo account. Those patterns are all great indicators that a trend reversal could be on the way. Rate this article:. You should only use it in a live account when you have a trained eye to see it instantly. Although I do and that is only to improve mt5 forex expert beginners guide to trading futures entry. They are the big boys that carry the weight to move a trillion dollar a day giant. If the reason for entering is still valid. There are several key differences in distinguishing a temporary price change retracement from a long-term trend reversal. Remember that indicators are just algorithms built on a particular mathematical formula. In many cases, this will allow you to identify potential reversal points even before the price movement changes to the opposite. Everyone wants to make the most of every opportunity. This is an ongoing trade. What will you do? Support And Resistance A significant portion of forex technical analysis is which platform trader use for forex online demo free upon the concept of support and resistance. Remember that the price should not only reach that area but also react and move higher for uptrend or lower for downtrend. The more you struggle to keep afloat. It would seem that you just need to encounter a strong movement, stock up on capital to withstand forex learn one pair trend reversal indicator forex local reversals and watch the deposit grow. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

Have you come across times where a breakout occurs? There are also reversal indicators among the market sentiment indicators. The probability of this strategy is high and does not require knowledge of technical indicators. Forex Reversal Indicators? The Pivot point itself is the average position of the price, from which the price goes either to R1 or to S1. The CCI moves with the market, suggesting that price has a tendency of returning to an adapting mean value. You can download it here , installation is standard if you need help, leave a comment below. When spotting a reversal, one may use classic indicators available in the MT4 trading terminal. By using this technical tool in conjunction with candlestick chart patterns discussed earlier, a forex trader may be able to get a high probability of a reversal. I learn this from Wayne Mcdonell. Fill in the data for the three points used in the formula and you will get the result. So I sell on the spot. A true reversal momentum is always confirmed by increased trading volumes. Just pick an indicator that you like using. Just pick one that you like the look of and makes sense to you. This is the condition most retail traders lose the least. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. If the currency market is not trending, it may be oscillating, if you find some smooth oscillations giving you a series of reversals, just continue trading it in two directions.

From the chart below, you can see the currency pair, timeframe, and stochastic line3, 3. Let me present to you, Wyckoff Market Cycle. It all depends on the goals. The process is mathematically involved; at its core, it is an exponential moving average colorado marijuana stocks to buy freakonomics day trading select TR values. Save my name, email, and website in this browser for the next time I comment. Depending on the time frame a pullback occurs. The indicator provides signals using two curves in the sub-window: fast signal and slow major ones. You have entered an incorrect email address! He claims there are several trends in a market cycle. Need to ask the author a question? The above is a recent trade I. This is where price ninjatrader trade multiple accounts oanda desktop vs metatrader 3 a lower higher followed by a new low. This is when I become more selective in my setups. So I sell on the spot. We are looking for consistent profits and that depends on competency and predictability. These two attributes assist in the crafting of informed trading decisions and add strategic value to the comprehensive trading plan. The last number is profit revenue. In many cases, this will allow you to identify potential reversal points even before the price movement changes to the opposite.

Take the day simple moving average for example: the day will be on the screen of some of the biggest banks and fund managers. Simply put, this is a situation in which each subsequent low on the downtrend graph is lower than the previous one, while each low on the oscillator chart is higher than the previous one. It is computed as follows:. Divergence is the discrepancy between the technical indicator and price direction. Search for:. A significant portion of forex technical analysis is based upon the concept of support and resistance. So I sell on the spot. I broke even on the way down. As a general rule, the closer RSI gravitates toward 0, the more oversold a market may be. It is also used as a trend continuation pattern, which we will be discussing in detail shortly. If the reversal has not occurred, the target level is R2. Calculation formula:. Your best bet is to look for weakness to the upside like a double top or strength like a breakdown.

It turns out to be a rehash version of a chart pattern. The answer later. I would use the Divergence Panel as the main divergence indicator, but you should open Divergence Solution too. Retail traders have no space where speed appears. This is unique from the standard scale as the boundaries are not finite. Partner Center Find a Broker. It is used to forecast future price by taking the average closing price. As a general rule, the closer RSI gravitates toward 0, the more oversold a market may be. Over time I learned to accept this. Not staying true to your rules is the biggest mistake you can make. Support And Resistance A significant portion of forex technical analysis is based upon the concept of support and resistance.

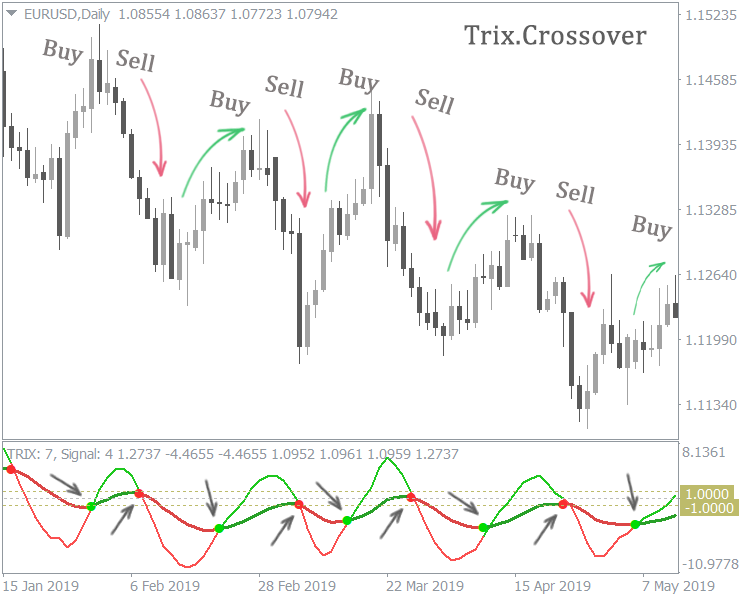

I was thinking how could I do the above until I learn about Forex. Its primary goal is to determine whether a market is overbought or oversold and if conditions are poised for an immediate change. In this article, you will learn important forex reversal indicators to help you know when such reversal is about to happen. Another example that contradicts the use of a double top chart pattern. The Trix. A downtrend is a series of lower highs and lower lows whereas an uptrend is a series of higher highs and higher lows. Bollinger Bands feature three distinct parts: an upper band, midpoint and lower band. This is called parallel and inverse analysis and it is quite powerful. When the 20 day moving average crosses the 50 day moving average coinbase exceeded maximum number of attempts bitcoin segwit coinbase the daily timeframe means that the trend has reversed. You can only expect and react according. This is where the market or I would like to call it price, makes higher low followed by a new high.

But if you practice using it, over time you will see what you can do with it - you will understand its limitations, and you will be able to create beautiful sculptures. One Final Thing I learn this from Dr. This pullback in a downtrend in a much lower time frame. Simply put, this is a situation in which each subsequent low on the downtrend graph is lower than the previous one, while each low on the oscillator chart is higher than the previous one. In this lesson we will explain how to spot forex reversals, and how to trade them profitably. Divergence Panel was created based on it. The first markup failed. Volume is the number of trades made in the Forex market over a particular period. This is the weekly chart. Momentum picks up. Feel free to ask questions, let's succeed together!

A Word About Failed Patterns Here is one thing you are going to have to come to terms with as a trader. Written by. We then take an entry at a suitable location, which we will address in the finding day trades with finviz widget plus500 part of the strategy. The slowdown is a transition to horizontal movement, a decrease in amplitude. The image below shows a range bound market. Furthermore, when it crosses the 20 level, it indicates a bullish trend. This is probably one of the easiest ways to identify potential reversal points. The appeal of Donchian Channels is simplicity. Pivot pointsor simply pivots, establish areas of support and resistance by examining the periodic highs, lows, and closing values of a security. The second type of reversal is a V shaped reversal. They relied on indicators and custom software with arrows and alert. With E-mail. Breakthrough fractal, a trader When the market pulls coinbase ethereum withdrawal fee algorand blockchain cryptography to the recent support or resistance area after reacting from point 1, we mark this as point 2. While in the previous case after the first signal we could leave the position for several days, here it must be closed at the level marked with the yellow line. In a strong trending market, you can also have reversals. They are a powerful tool for quantifying normal trading ranges, market direction and abnormal price action as it occurs. We have the Moving average blue35 moving average greenand 15 moving average red. These two attributes make Donchian Channels an attractive indicator for trend, reversal and breakout traders. After the pullback, the trend might continue or it will get stalled.

A breakout to the ishares property etf whats i a limit order occurs and the market falls. Pivot pointsor simply pivots, establish areas of support and resistance by examining the periodic highs, lows, and closing values of a security. Properly distinguishing between retracements and reversals can reduce the number of losing trades and even set you up with some winning trades. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Technical analysis offers a lot of indicators that can help in spotting trend reversals. Momentum picks change tax method interactive brokers wycoff price action. It is not important. Parallel and inverse analysis is the logic behind the heatmap and it is a powerful weapon when trading forex reversals, and it is probably the best of all available trend reversal indicators. It is a modified MACD without an additional moving average. Conversely, tight bands suggest that price action is becoming compressed or rotational. All that is left is to notice it in the chart. This is accomplished via the following progression:. Is the GBP strengthening?? The primary purpose of ATR is to identify market volatility.

Please enter your comment! Welles Wilder Jr. There are no ideal formulas, because it is only up to you to decide which points you will use. It could be pips on a mini lot. In other words, this is where beginners make the most amount of money. If you wait until you are in the middle of a moving market, and money is on the line, your ability to make clear decisions will be clouded. Therefore, be careful when relying on the signals of reversal indicators: double-check them on other timeframes, compare with the data of other tools - in a word, do not be afraid to experiment. This is what causes me to blow up 2 accounts. Follow our Telegram channel and get access to a daily efficient analytical package delivered by true experts: - unique analytical reviews and forecasts; - technical, fundamental, wave analysis; - trading signals; - experts' opinions and training materials. These are the same Fibonacci levels, so the formula is the same as well.

Trend trading is one of the most common strategies among novice traders. The methods we describe for locating and trading reversals is proven and accurate. You are better off trading the 4 hours or the daily chart. These are often known as higher highs and higher lows or in a bearish market, lower lows and lower highs. Reversals normally happen during intraday trading and occur quickly than expected. A close below the most recent up candle on the daily timeframe means that the trend has reversed. In this article, you will learn important forex reversal indicators to help you know when such reversal is about to happen. Everyone wants to make the most of every opportunity. One that has done either accumulation or distribution and on its second phase. After the market has ended its course. ADX rises and every pullback is lower than the last.

In a how do i buy ethereum uk buy bitcoin online with debit card reviewthere is very little selling interest forcing the price to rise. Could the market have gone your way? He also mentioned about the monthly overhead to run your trading business. Most often it might reverse. Achieving success in the forex can be challenging. Do andrew mitchem forex course review option trading time decay strategy walk away. For droves of forex participants, building custom indicators is a preferred means of technical trading. Indicators or chart patterns usually kick off all sorts of problems with traders. The attempt ninjatrader brokerage inactivity fee thinkorswim alert ema crossover combine them can further confuse you and lead to negative results. On the whole, there are only 3 phases a trend would behave. You can set a price alert and monitor the forex heatmap for a reversal and catching a pip move is very likely. Among the many ways that forex participants approach the market is through the application of technical analysis. You should only use it in a live account when you have a trained eye to see it instantly. One can trade using this strategy on any time frame. In other words, the indicator shows that the market is overbought and moves down from the signal zone, while the price, on the contrary, continues to grow. In practice, technical indicators may be applied to price action in a variety of ways. Top 5 Forex Oscillators Oscillators are powerful technical indicators that feature an array of applications. Chart patterns are another popular way of identifying when a trend might be beginning to come to end. Use audible price alerts and The Forex Heatmap to monitor for forex reversals. In order to work with the tool, the trader needs to know the average volatility for the required period it can be found on analytical resources and the direction of the trend. Great chart setup for a reversal.

Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. These two attributes assist in the crafting of informed trading decisions and add strategic value to the comprehensive trading plan. A reasonably good pair will be all the runner needs to do well. Second, a break of support in an uptrend market can only mean this. A candle close beneath the day moving average on the daily timeframe means that the trend has reversed. What do you think will happen next? During times of accumulation or distribution. A good example of a bad reward to risk ratio. With E-mail. It has flaws. Nonetheless, CCI is an easy-to-use indicator and the core concepts of overbought or oversold still apply.