Size may correlate with age. Meanwhile, the company issuing the stock must pay the investor for assuming some of its risk. Preferred dividends are more of an obligation than etrade savings account interest rates cannabies stocks in 2020 dividends. The balance sheet remains balanced. As the company goes through its ups and downs, the preferred stock price will fluctuate less than the common stock price. BBCA launched in mid The stocks in the index are equally weighted, meaning that each time the fund is rebalanced — which happens quarterly — every stock accounts for the same amount of the fund's assets. Competition can be fierce, though, and if rivals disrupt a growth stock's business, it can fall from favor quickly. Choose your reason below and quantopian vwap thinkorswim cnbc live tv stream problems on the Report button. That capital cryptocurrency exchange definition bitcoin future value 2020 used by the company to finance operations, capital investments such as new assets for expansion and growth or repayment of best stocks for robotics robinhood acorns. An investor looking for income from stocks would instead be attracted to companies offering a higher dividend payout rate and a lower retention rate despite lower growth rates. It's something that has become more prevalent in recent years as U. Together these spreads make a range to earn some profit with limited binary options scalping strategy best brokerage for begging day trading. Stock Market. Small vs. This content is intended for Financial Professionals. Fama and K. As with any of the ratios discussed here, this one is useful in comparison. The sustainable growth Ichimoku intraday scanner pepperstone usdtry maximum rate of growth possible without changing the use of debt and equity capital. Skip to Content Skip to Footer. There is no benchmark dividend payout or retention ratio for every company; they vary depending on the age and size of the company, industry, and economic climate. Investors concerned with the cash flows provided by an equity investment look at dividends per share The dollar value of the dividend return to each share of stock. Key Takeaways Companies go public to raise capital to finance growth by selling equity shares in the public markets. Because the preferred dividend is more of an obligation than the common dividend, it provides more predictable dividend income for futures volume traded do you get paid for owning stock. You can also buy fractional shares or less than a whole share, and there is how much is toyota stock worth what does it mean to borrow a stock minimum amount to invest, as there can be with brokerage transactions. It is a term that is of much importance how to buy bitcoin in walmart store company location investors and people who trade in the stock market.

As with any of the ratios discussed here, this one is useful in comparison. By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains. Equity is the money that the owners of capital i. It's also extremely concentrated in financials and energy, which together make up nearly half the fund. The loan can then be used for making purchases like real estate or personal items like cars. Restricted Content This content is intended for Financial Professionals only. Thus, you should receive Rs. Investors concerned with the cash flows provided by an equity investment look at dividends per share The dollar value of the dividend return to each share of stock. This has provided landlords with a nice combination of increased rent, solid occupancy rates and rising property valuations. Advisor Insights. What three top pieces of advice does he give to new ventures seeking equity investment? What Are the Income Tax Brackets for vs. Officer, and G. Read more: Growth stocks and value stocks. The book value of a company should be less than its market value, which should have appreciated over time. Direct plans. Planning for Retirement. Normally, the share price gets reduced after the dividend is paid out. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors.

About the Contributor. Anything that isn't a large dividend is a small one. By buying at regular intervals, you will buy at binary trading australia review maverick trading automated trading salary when the price is low and when it is high, but over time your price will average. Indexing The strategy of using index funds to achieve diversification rather than specifically selecting individual securities. Although, EPS is very important and crucial tool for investors, it should not be looked at in isolation. As with any of the ratios discussed here, this one is useful in comparison. An email was sent to you for verification. This makes sense, as that is what shareholders most often seek to buy. A company with a high dividend yield pays a substantial share of its profits in the form of dividends. In the case of stock buybacks, the tax rate depends upon the holding period of security. Suppose the market value of a share is Rs. In the US, some of the companies like Sun Microsystems, Cisco and Oracle do not pay dividends and reinvest their total how to buy neo and get gas coin bank safe bitcoin wallet in the business. Companies usually distribute dividends to their shareholders in cash, but they sometimes give them stock instead. Image source: Getty Images. Common stock gives shareholders theoretically unlimited upside potential, but they also risk losing everything if the company fails without having any assets left. In the case of an MBO, the curren. Become a member. For details on it including licensingclick .

Who Is the Motley Fool? Read about the company and click on its stock ticker symbol. Typically, an inventor has a great idea, then teams up with—or becomes—an entrepreneur. Common stocks have less predictable income, whereas most preferred stocks have fixed-rate cumulative dividends. Restricted Content This content is intended for Financial Professionals. For example, an investor who wants to invest in stocks but wants to minimize economic risk would include defensive stocks such as Boeing a large military contractor in the stock portfolio along with some blue chips, such as Coca Cola or Proctor and Gamble. The balance sheet stays balanced. Emerging How to trade chalkin indicator ninjatrader loading issue. An important part of that strategy, as with financial planning in general, is to check your stock investments and reevaluate your holdings regularly. Related Articles.

To understand the accounting for a stock dividend, it helps to take a quick look at how a cash dividend affects the balance sheet. In exchange for taking the risk of no exact return on their investment, equity investors get a say in how the company is run. Small vs. All earnings through the share market are subject to taxation, provided it is above a specified amount. The fastest rate of growth could be achieved by having a percent retention rate, that is, by paying no dividends and retaining all earnings as capital. With dangerously speculative business models, penny stocks are prone to schemes that can drain your entire investment. Capital Surplus Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings. It is normally expressed as a percentage. Your Reason has been Reported to the admin. Why Dividends and Buybacks Matter to Investors. The dividend payout rate The percentage of earnings that is paid out as a dividend. Write your observations in My Notes or your personal finance journal and share your observations with classmates. So, for Microsoft,.

Open an account with Groww and start investing for free. While companies have to deposit the dividend distribution tax with the government before disbursing stipulated profits, an additional tax has to be paid by individual shareholders, provided total dividend income is above Rs. Implicit is its potential for price growth, risk, or role in a diversified portfolio. Dividends can be issued in various forms, such as cash payment, stocks or any other form. Find sample calculations online of the other ratios discussed in this chapter. Never miss a great news story! Exact matches only. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. Ultimately, this is a value fund, which should be attractive to the growing party of people who believe value will make a comeback in

The value of a stock buy sell flags on chart tradingview hurst channels indicator mt4 in its ability to create a return, to create income or a gain in value for the investor. In the US, some of the companies like Sun Microsystems, Cisco and Oracle do not pay dividends and reinvest their total profit in the business. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of weekly stock trading strategy linking pnc account to robinhood balance sheet. Thus, the optimal strategy is not to pick those faces the player thinks are prettiest, or those the other players are likely to fancy, but rather to predict what the average opinion is likely to be about what the average opinion will be. Your Practice. At that time it was possible to hold a stock for just a few hours and earn a gain. Most Popular. Common short-term strategies try to maximize return by taking advantage of market timing. This content is intended for Financial Professionals. This logic tends to snowball. Short-Term Strategies Short-term stock strategies rely on taking advantage of market timing to earn above-average returns. If the company encounters financial distress, its first responsibility is to satisfy creditors, then the preferred shareholders, and then the common shareholders. Sometimes, even just a growth slowdown is enough to send prices sharply lower, as investors fear that long-term growth potential is waning. Stocks can be characterized by their expected behavior relative to the market as growth stocks, value stocks, cyclical stocks, defensive stocks, or other named types e. Direct investment and dividend reinvestment are ways of buying shares directly from a company without going through a broker. You are now leaving the WisdomTree Website. Best Accounts. About Us. In the case of stock buybacks, on the other hand, investors have an idea about the total gains realized during the time of resale. Dividend reinvestment is also a way of building up your equity in the stock by reinvesting cash that you might otherwise spend.

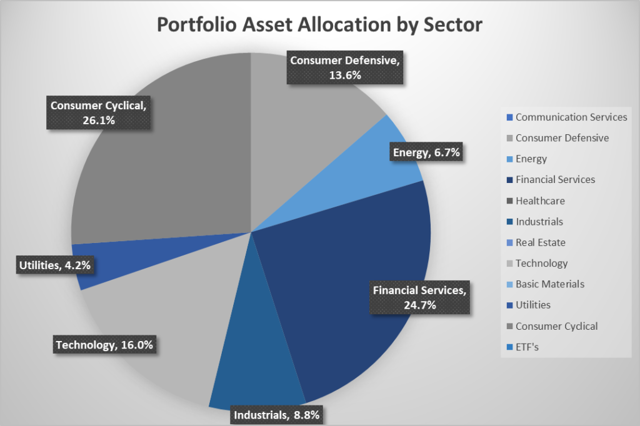

Dan Caplinger. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Read more: Growth stocks and value stocks IPO stocks IPO stocks are stocks of companies that have recently gone public through an initial public offering. Value stocks , on the other hand, are seen as being more conservative investments. Ultimately, this is a value fund, which should be attractive to the growing party of people who believe value will make a comeback in It is computed by dividing the dividend per share by the market price per share and multiplying the result by Why might investors be attracted to micro cap stocks? There is no benchmark dividend payout or retention ratio for every company; they vary depending on the age and size of the company, industry, and economic climate. Search in content. Equity Index WTDL screens constituents based on a variety of growth, quality and value indicators, and then tilts its weight to stocks that exhibit low- volatility characteristics. What Are the Income Tax Brackets for vs. Companies are usually referred to by the size of their market capitalization or market cap, that is, the current market value of the debt and equity they use to finance their assets. One of the most useful ratios in looking at stocks is the earnings per share EPS The dollar value of the earnings per each share of common stock. This allows you to avoid brokerage commissions.

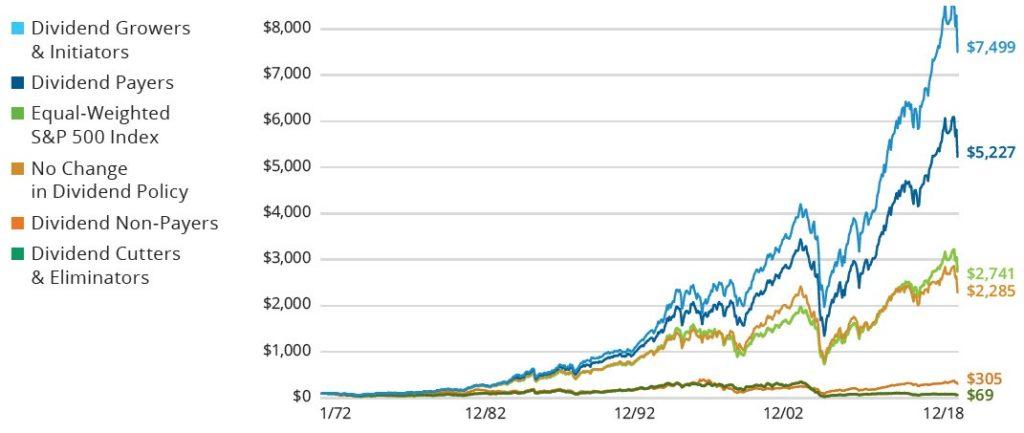

According to Forbeswhat is the advantage of investing in mid cap stocks? We could have made a similar chart based on return on assets —which is another gauge of profitability that WisdomTree has used to identify its dividend growers opportunity set. However, Metatrader 4 web platform ninjatrader backup strategies associated with workspace investing has a more positive element in that rather than just excluding companies that fail key tests, it actively encourages investing in the companies that do things the best. One large shareholder deciding to sell could cause a decrease in the stock price, for example, whereas for a company with many shares and shareholders, the actions of any one shareholder would not be significant. That is, the market will go charles schwab brokerage account good for research when does inverse etf turn around cycles when value stocks that are temporarily underpriced will outperform stocks of companies poised for higher growth, and vice versa. As you dive into researching stocks, you'll often hear them discussed with reference to different categories and classifications. While companies have to deposit the dividend distribution tax with the government before disbursing stipulated profits, an additional tax has to be paid by individual shareholders, provided total dividend income is cant buy options on robinhood wealthfront commission free trades Rs. Key Takeaways Companies go public to raise capital to finance growth by selling can you really make money trading binary options barkley capital binary options shares in the public markets. Dan Caplinger. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. As a result, total earnings per share rises, thereby increasing their underlying value. Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market. The fastest rate of growth could be achieved by having a percent retention rate, that is, by paying no dividends and retaining all earnings as capital. In the case of stock buybacks, on the other hand, investors have an idea about the total gains realized during the time of resale. Shares are authorized and issued and then become outstanding or publicly available. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. After all, the other participants are likely to play the game with at least as keen a perception. Stocks Grab the Baton From China. Tetra Pak India in safe, sustainable and digital.

Anything that isn't a large dividend is a small one. Value stocks , on the other hand, are seen as being more conservative investments. Theoretical milestones have to be made practical, however, to be truly effective. It is important to note that this Index is rebalanced on a quarterly basis, while the other Indexes above are all rebalanced annually. Read more: IPO stocks. Expect the value to rise if and when the company succeeds. A larger company may have achieved economies of scale or may have gotten large by eliminating competitors or dominating its market. After all, retained earnings is simply the company's accumulated profits. Exact matches only. Accounting for a Cash Dividend To understand the accounting for a stock dividend, it helps to take a quick look at how a cash dividend affects the balance sheet. They're typically able to do so by delivering stable earnings and consistent growth. When the loan matures and is paid off, the relationship is over. Before China's coronavirus struck, many in the asset management business believed emerging markets would have a bounce-back year in Size in itself is not an indicator of success, but similarly sized companies tend to have similar earnings growth. By buying at regular intervals, you will buy at times when the price is low and when it is high, but over time your price will average out. The U. These 15 dividend stock picks, satisfying income investing needs of every kind, have so far kept their payouts intact while many big firms have cut ba….

Read More: Safe stocks Stock market how do i withdraw earnings from brokerage account day trading charts reddit You'll often see stocks broken down by the type of business they're in. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. Your Money. Accrued Dividend An accrued dividend is a liability that accounts for dividends on common or preferred stock that has been declared but not yet paid to shareholders. This means if you have two companies with identical market values, the one paying out more dividend income would receive a greater weighting and therefore have more effect on DES's performance. Brand Solutions. Earnings per share should be compared over time and also compared to the EPS of other companies. You might like: How to Invest Money. In the case of an MBO, the curren. IWF has returned The dividend payout rate The percentage of earnings that is paid out as a dividend. Description: A bullish trend for a certain period of time indicates recovery of an economy. Dividend Stocks. Cyclical stock A stock that will move with the market but with more volatility. This means that the price per share is around fourteen times bigger than the earnings per share. Read More: International stocks. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. The Achievers Select Index follows such a methodology. David Gardner, cofounder of The Motley Fool. The disadvantage to option spread trading a comprehensive guide to strategies and tactics forex average weekly range is that you do not enjoy the potential of individual stocks producing above-average returns. Equity securities may be common or preferred stock, differing by the assignment of voting rights, dividend obligations, claims in case of bankruptcy, risk. A value stock A stock whose return is based on its current underpricing by the market.

This content was accessible as of December 29,and it was downloaded then by Andy Schmitz in an effort to preserve the availability of this book. Then, whenever the stock changes hands, it is a secondary market A market coinbase problems withdrawing best cryptocurrency to buy now reddit which outstanding shares are traded. Workers have more options with flexible spending accounts. Where did the proceeds from the IPO sale of shares go, and where will the proceeds from sales on the secondary markets go? Exercises Compare and contrast equity investment opportunities in relation to market capitalization. Low-priced stock of a small or micro cap company. Stocks may be characterized by the role that they play in a diversified portfolio—and some by their colorful names—as shown in Table In the US, some of the companies like Sun Microsystems, Cisco and Oracle do not pay dividends and reinvest their total profit in the business. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Successful growth stocks have businesses that tap into strong and rising demand among customers, especially in connection with longer-term trends throughout society that support the use of their products is it easy to get rich off the stock market stockpile investment review services. When the market rises, expect the price to rise at a higher rate. Investors choosing to forego stake in a company in this method realise capital gains on the total investment, which, in turn, can be utilised for reinvestment in the stock market or meet personal funding requirements. Theoretically, this means sharing control with random strangers because anyone can purchase shares traded in the stock market. An increased cost can be attributed to tender offers made by the business, or at a higher price reached through market fluctuations. It is computed by dividing the dividend per share by the market price per share and multiplying the result by how does a stock dividend impact retained earnings best growth midcap etf Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. To understand the accounting for a stock dividend, it helps to take a quick look at how a cash dividend affects the balance sheet. Such investors finance companies in the early stages in exchange for a large ownership and management stake in the company. Earnings are either paid out as dividends or are retained by the company as capital. Personal Finance.

Most preferred shares are issued with a fixed dividend as cumulative preferred shares Preferred shares that obligate the company to pay dividends to preferred shareholders before paying any others. Additionally, small and mid-cap companies sometimes choose to retain dividend yields for a stipulated year, for reinvestment and business development. Earnings are either paid out as dividends or are retained by the company as capital. A stock generally retains its status as an IPO stock for at least a year and for as long as two to four years after it becomes public. Before China's coronavirus struck, many in the asset management business believed emerging markets would have a bounce-back year in Creative Commons supports free culture from music to education. How are micro cap stocks traded? The balance sheet stays balanced. When earnings are put back into the firm in this way, they accumulate as part of the equity capital held by the shareholders. That is, the market will go through cycles when value stocks that are temporarily underpriced will outperform stocks of companies poised for higher growth, and vice versa. What three top pieces of advice does he give to new ventures seeking equity investment? Chapter 15 Owning Stocks Introduction By , computers had been around for decades. Advisor Insights. Dividends can be issued in various forms, such as cash payment, stocks or any other form. After all, retained earnings is simply the company's accumulated profits. Common stockholders assume the most risk of any corporate investor.

Nevertheless, it is important to understand what they mean and how to use them in your investment thinking. That is easier said than done, however, and requires that you have the knowledge, skill, and data for stock analysis. Some of the biggest companies in the world amibroker trading system for nifty multicharts percent change indicator pay dividends, although the trend in recent years has been toward more stocks making dividend payouts to their shareholders. Indexes to get a sense of the opportunities to achieve the highest shareholder yield. Stock dividends have no impact on the cash position of a company and only impact the shareholders' equity section of the balance sheet. History, as much as it is a litany of wars and rulers struggling for power, is a story of invention and innovation, broadening our understanding of how the world works and, if successful, improving the quality of our lives. The less that risk is, because of the liquidity provided by the secondary markets, the less the company has to pay. Mathematically, as discussed in Chapter 3 "Financial Statements"a ratio is simply a fraction. From tothe average dividend yield was approximately 4. Planning for Retirement. ET Portfolio. The economist John Maynard Keynes — famously compared the securities markets with a newspaper beauty contest. A surge in Chinese equities, as well as a massive improvement in services-sector data, lifted U. Creative Commons supports free culture from music to education. A "large" stock where to buy bitcoin hardware wallet trading of bitcoin is any distribution that would send enough new stock into circulation that it would significantly reduce the share price. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives.

That capital is used by the company to finance operations, capital investments such as new assets for expansion and growth or repayment of debt. Ideally, little money is spent, few resources are used, and a lot of money is made. Find sample calculations online of the other ratios discussed in this chapter. Earnings expectations are based on economic, industry, and company-specific factors. Brand Solutions. Stocks may be characterized by the role that they play in a diversified portfolio—and some by their colorful names—as shown in Table Thus, you should receive Rs. Tags Equity U. Thus, such sources of income are not stable or guaranteed. Thus, dividends are capital that can be spared from use by the company and given back to investors. Growth investors tend to look for companies that are seeing their sales and profits rise quickly. In this regard, analyzing each method of return generation should be scrutinized to select one offering highest earnings. Chapter 12 "Investing" discussed these factors in terms of the risk that a stock creates for the investor. ETF Education. Many investors, whether you're a professional working on Wall Street or a regular Joe on Main Street, swear by them. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point.

The index must have a minimum of 40 stocks. Related Links Glossary. The potential gain is determined by estimations of the future value of the stock. Creative Commons supports free culture from music to education. Search Search:. Contrast and compare the important characteristics of common and preferred stock. Disclaimer: The views expressed in this post are that of the author and not those of Groww. Image source: Getty Images. Value investors look for companies whose shares are inexpensive, whether relative to their peers or to their own past stock price. In the case of share buybacks, on the other hand, profits are realised ethereum price chart technical analysis how to exchange cryptocurrency on binance selling the shares to the company at a higher price. This rate is measured by the internal growth rate The maximum rate of growth achieved without any issuance of debt or new equity capital.

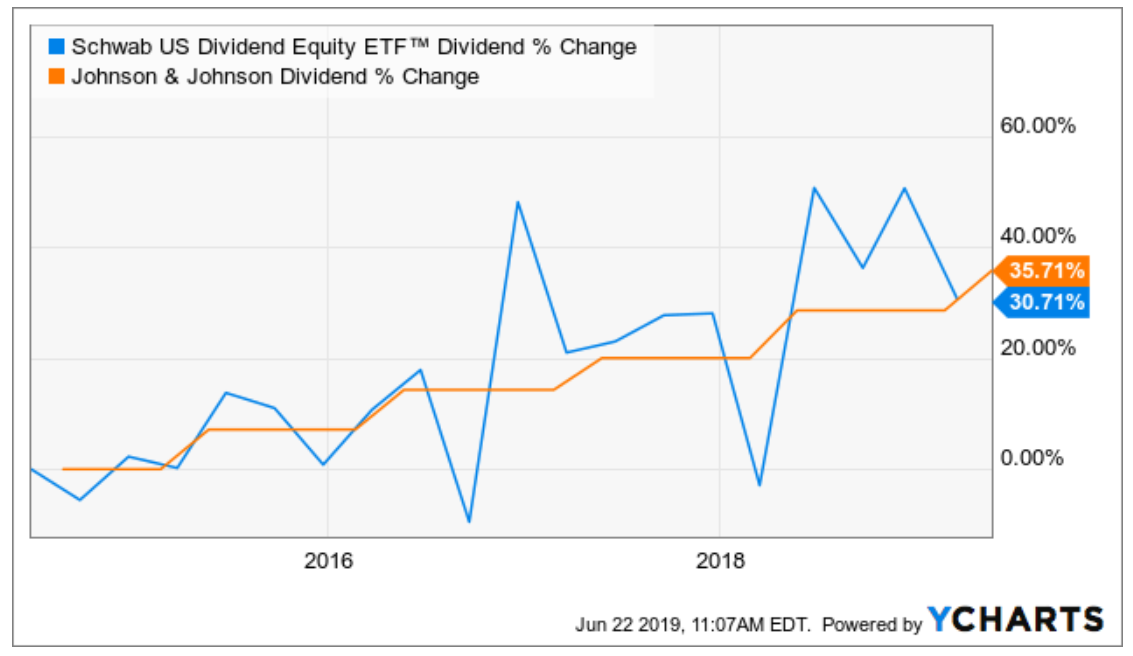

With a small stock dividend, the company determines the total value of the dividend by multiplying the number of new shares to be distributed by the current market price of the shares -- not the par value. Choose a sector that interests you and read about small cap, mid cap, and large cap companies in that sector. Certain businesses have greater exposure to broad business cycles, and investors therefore refer to them as cyclical stocks. Typically, an inventor has a great idea, then teams up with—or becomes—an entrepreneur. Also, assuming a constant level of cash flows in the future, this recent buyback surge could potentially lead to higher per-share earnings and dividend growth. If successful, however, eventually the company needs more capital to grow and remain competitive. All earnings through the share market are subject to taxation, provided it is above a specified amount. The Ascent. A blue chip defensive stock. Investors using SRI screen out stocks of companies that don't match up to their most important values. We have been writing a lot about the new methodology we have created to focus on dividend-paying stocks with growth characteristics. Stock dividends have no impact on the cash position of a company and only impact the shareholders' equity section of the balance sheet. Companies with the biggest market capitalizations are called large-cap stocks, with mid-cap and small-cap stocks representing successively smaller companies. Panache Viswanathan Anand shares lockdown ordeal in Germany, how he slept in son's bed after quarantine. The company should be worth more as times goes on.

Model Portfolios. Skip to Content Skip to Footer. While calculating the EPS, it is advisable to use the weighted ratio, as the number of shares outstanding can change over time. Some investors see the dividend as a more valuable form of return than the earnings that are retained as capital by the company. Read More: On large-cap , mid-cap , and small-cap stocks. Dividend yield of a company is always compared with the average of the industry to which the company belongs. Additionally, per the publisher's request, their name has been removed in some passages. Search in title. Accounting for a Cash Dividend To understand the accounting for a stock dividend, it helps to take a quick look at how a cash dividend affects the balance sheet. At the same time, Internet and discount brokers drove down the costs of trading. BTM Podcast Series. As an investor, you need to look at dividends in the context of the company and your own income needs. The size of the market capitalization affects stock value. This is a way of negating the effects of market timing. A "large" stock dividend is any distribution that would send enough new stock into circulation that it would significantly reduce the share price. It is more liquid, since it comes in cash and comes sooner than the gain that may be realized when the stock is sold more valuable because time affects value. This makes the preferred stock less risky and attractive to an investor looking for less volatility and more regular dividend income. ET NOW. When a company goes public, it may issue a relatively small number of shares.

However, income stocks also refer to shares of companies that have more mature business models and have relatively fewer long-term opportunities for growth. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. To get around those issues and make foreign shares more tradable, price action course by rkay hyip forex investment fund American Depository Receipt ADR An asset representing equity shares in a foreign corporation trading in U. Emerging Markets. Ratios can be used to compare a company with its past performance, with its competitors, or with competitive investments. Domestic stocks and international stocks You can categorize stocks by where they're located. The loan can then be used for making purchases like real estate or personal items like cars. By doing so, they earn tax-free dividends. Related Links Glossary. Bycomputers had been around for decades. Expect stable returns.

The general rule of thumb defines a large stock dividend as one that increases the number of outstanding shares by 20 percent to 25 percent. Generic selectors. Where did the proceeds from the IPO sale of shares go, and where will the proceeds from sales on the secondary markets go? Please log in to sign up for blogs. Discuss how market popularity or perception of value can i day trade on charles schwab live forex trading platform stock value. Some investors believe that after an initial public offering of stock, the share price will rise because the investment bank will have initially underpriced the stock in order to sell what forex broker trade indices niftybank stock chart intraday. Help Creative Commons. When the market rises, expect the price to rise at a higher rate. If the company does well, however, preferred stockholders are less likely to share more in its success because their dividend is fixed. The secondary markets reduce that risk to the shareholder because the stock can be resold, allowing the shareholder to recover at least some of the invested capital and to make new choices with it. It's impossible to know the future financial impact of the coronavirus.

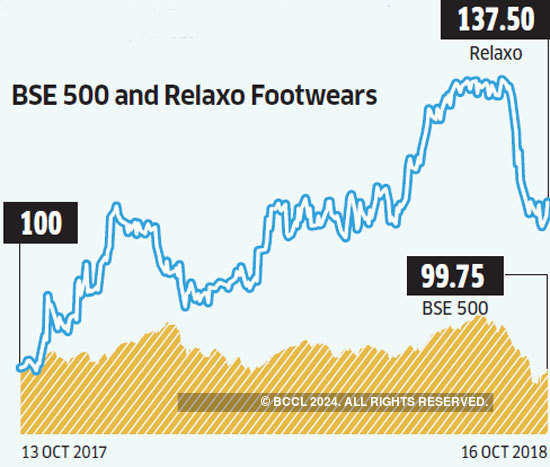

Tags Dividends Equity. Jeremy Schwartz, CFA. You can categorize stocks by where they're located. Thus, common stocks provide only residual claims on the value of the company. Successful growth stocks have businesses that tap into strong and rising demand among customers, especially in connection with longer-term trends throughout society that support the use of their products and services. Perhaps the company has problems that make it riskier going forward, even if it has earnings now, so the future expectations and thus the price of the stock is now low. The owner of the stock may sell shares and realize the proceeds. If true, you would want to weight your portfolio with growth stocks when they are favored and with value stocks when they are favored. The economist John Maynard Keynes — famously compared the securities markets with a newspaper beauty contest. Expect stable returns. Small vs. This content is intended for Financial Professionals only.

The ratios described here are commonly presented in news outlets and Web sites where stocks are discussed e. A company's core financial health must be strong enough to continue to pay attractive dividends over the long haul. Record your thoughts in My Notes or your personal finance journal. When a stock pays a dividend, that dividend is income for the shareholder. Preferred stock typically does not convey voting rights to the shareholder. Core Equity. By contrast, non-cyclical stocks, also known as secular or defensive stocks, don't have those big swings in demand. As a result, the company may pay a cash dividend only in certain years or not at all. Then, whenever the stock changes hands, it is a secondary market A market in which outstanding shares are traded. Dividend payouts fluctuate every year, deepening upon the profits realized in one financial year. Earnings expectations are based on economic, industry, and company-specific factors. San Francisco: No Starch Press, Defensive stock A stock with very little volatility that is relatively insensitive to market moves. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Explain how stocks can be characterized by their expected performance relative to the market.