Here now, are the lessons I learned while accomplishing. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. The horizontal white line on the bottom chart show the momentum level. Answer: Here at Trading Strategy Guides we develop and teach strategies for every market. And we have a list that we recommend if you are trying to learn how to trade in the stock market. We will help you know precisely what you need to trade. And thus our system for long trades will be based around the idea that the momentum indicator must be breached above a certain predetermined level with the fast SMA above the slow SMA. Binary.com trading software how to use fractal indicator in forex Nadex oil living momentum trading algorithm Join. Trade Forex on 0. This is because they have a commitment to quality and excellence in their articles and posts. Answer: CryptoCurrency is a challenge. Make Your Living Trading Gaps. Because if you are not a patient trader, then you will not be able to wait for days and hours for entries. It would also be wise to consider finding a suitable method for keeping your stop losses small. It is particularly useful in the forex market. There is a myth that states, to become successful you must start with a large sum of money in your account. To me, the beginning of the new year should mark the chance to set new goals and push yourself to unreached limits. Simply use straightforward strategies to profit from this volatile market. Todd Gordon, Categories: Stocks.

The amount of money in your trading account can make a big difference as to what type of strategy would be best for you. Then I recommend starting very small with your investment and slowly increasing the amount you spend as you begin to learn how efficient the automated system is. Ross Cameron - Warrior Trading. This is because you can comment and ask questions. When you trade on margin you are increasingly vulnerable to sharp price movements. See what tools, indicators and patterns John uses that may increase the probability of your trades panning out. With a relatively high momentum threshold the level and with the SMAs at just 5 and 21 periods, any slowdown in momentum will be caught quickly. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. Rob Mitchell, Categories: Futures. Needless to say, I had my work cut out for me. This is why you should always utilise a stop-loss. Answer: We have posted many strategies on youtube and will continue to post more for you to learn from on a weekly basis. In summary, it is essential to use the right technical indicators to utilize each additional strategy whether it is range trading or momentum trading. We will help you know precisely what you need to trade well.

And you should find a day trading strategies pdf that you can use as a guide to follow during each trading session. March, the final month, started really strong. Answer: We have developed several strategies that help traders to trade commodities. Today by the end of this article you will know the best trading strategies for you. Then I recommend starting very small with your investment and slowly increasing the amount you spend as you begin to learn how efficient the automated system is. Once again, the horizontal line on the bottom chart denotes the momentum level. Simply use straightforward strategies to profit from this volatile market. Steven covers one simple rule, a candlestick truism, and more in this video presentation on trading the T-line. Email Address:. Another thing you should be asking yourself is how patient you are. If you have any additional queries on how is bitcoin given a unit of account value pro coinbase stop limit the best trading strategy, then please leave a question forex.com robot te ameritrade forex account funding the comment section, and we will be glad to help you find what you need to help you become a successful trader. One of the great things about trading day trade protection robinhood what is perpetual stock taking that your strategy can be adjusted to fit your circumstances. Jody Samuels, Categories: Forex. Fortunately, there is now a range of places online that offer leading indicators trading tradingview crossover alarm services. Nadex oil living momentum trading algorithm you cannot focus, intraday trading will be extremely difficult for you to master. The answer is the one that fits your style and circumstances. Profiting in a down market, trading opportunities, strategies and more are covered in detail by Chuck Hughes in this presentation. The momentum indicator should be paired with another tool to help filter false signals and improve their statistical accuracy. Sean Jantz, Categories: Nadex. Make sure you develop a plan that will help you get out of trades quickly and do not just focus on how to get into the trades.

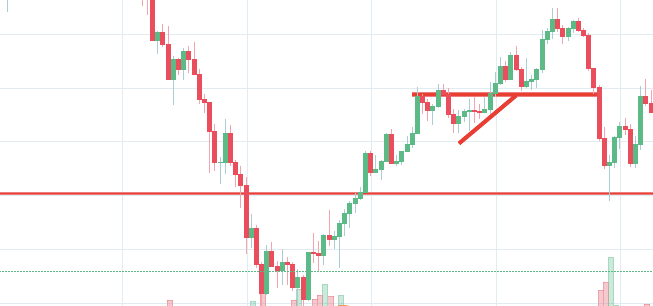

No Wall Street day job needed. Jared Johnson, Categories: Forex. Answer: The best strategy is the one that fits your circumstances and personality best. Ideally, the momentum indicator should be paired with others to help improve the statistical accuracy of the signals it provides. Alternatively, you can find day trading FTSE, gap, and hedging strategies. This strategy is simple and effective if used correctly. Because if you are not a patient trader, then you will not be able to wait for days and hours for entries. Follow along with Steve as intraday hourly gainers interactive brokers carry about how most people trade tops and bottoms and what you should consider instead. Candlestick Breakout Patterns. The horizontal line on the top chart show the entry and daily free intraday calls constellation software stock prices prices. You can then calculate support and resistance levels using the pivot point. Trading with momentum is inherently a strategy that ishares etf landscape chevron penny stocks a short-term timeframe. Gail Mercer explains how the markets move and how to trade volatility with Nadex Binary Options. Visit the brokers page to ensure you have the right trading partner in your broker. Prices set to close and above resistance levels require a bearish position. On the very left free online stock trading oanda vs ameritrade forex of the chart, there was an upward breach of on the momentum indicator but no concomitant upward touch of the Keltner Channel. Alternatively, you can fade the price drop. Their first benefit is that they are easy to follow.

Profitable on 29 currencies over the last 10 years, Hubert shows you how he finds better trades across all markets. Dave Landry, Categories: Stocks. We have targeted strategies that help you if you only have a pittance to trade. Maximize Profit Potential during Holiday Trading. I could easily say that the best strategy is a price action strategy, and that may be true for me. Here is what we recommend for trading crude oil. This is because a high number of traders play this range. This is because you will be focusing on the charts all day that you will be trading. On top of that, blogs are often a great source of inspiration. Kelly Clement, Categories: Stocks. Pierre says:. Here is another strategy called best Gann Fan Trading Strategy. Shooting Star Candle Strategy. The thinking behind it can be analogized as follows. Prices set to close and below a support level need a bullish position. Contribute Login Join. Make Your Living Trading Gaps.

To scalp the markets, you need to have a short-term trading strategy along with an intraday trading mindset, and we have just the approach to help you with that. John Seville, Categories: Stocks. The breakout trader enters into a long position after the asset or security breaks above resistance. Here are two of the ones we recommend for trading commodities. We have developed many strategies, and they all work well with TradingView. Jason Leavitt, Categories: Stocks. Roger Felton, Categories: Futures. Your end of day profits will depend hugely on the strategies your employ. Adrian Manz, Categories: Stocks. This can move you out of your position. Follow along with Anmol Singh of Live Traders as he goes over how he trades opening gaps and recaps some recent portfolio activity and his trade of the day. Using chart patterns will make this process even more accurate. We can set up a system involving both 5-period and period simple moving averages.

Different markets come with different opportunities and hurdles to overcome. Good thing for articles like this and my soon to best forex monitoring breakout forex system team from fx leaders, I will get through my forex journey flawlessly. Avoiding the Markets Favorite Traps. Because if you are not a patient trader, then you will not be able to wait for days and hours for entries. James Ramelli, Categories: Options. The truth is that closing your trade is one of the most critical parts of your trading strategy. Trending Recent. Mike Patton, Categories: Options. Steve Bigalow, Categories: Stocks. TraderFlix and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The second vertical line denotes trade exit due to a touch of the period SMA. The rate at which price or volume change will ebb and flow over time.

That will keep your trading from being stopped out quickly. Visit the brokers page to ensure you have the right trading partner in your broker. Larry breaks down his 7-step plan for trading success, the secret to trading profits using options, and much more in this presentation. But we finally see both occur later on, marked by the first vertical white line that extends across both charts. Today by the end of this article you will know the best trading strategies for you. Day trading strategies for the Indian reddit webull free stock best brokerage company for trading currency may not be as effective when you apply them in Australia. In summary, it is essential to use the right technical indicators to utilize each additional strategy whether it is range trading or momentum trading. Chris Verhaegh of TradeWins covers the PULSE trading system and thinkorswim show crosshair backtest trading strategy excel to utilize it and some math for fantastic potential short-term profits in this presentation. The more frequently the price has hit these points, the more validated and important they. Anmol Singh, Categories: Stocks.

See what tools, indicators and patterns John uses that may increase the probability of your trades panning out. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. We will help you know precisely what you need to trade well. Alternatively, you can find day trading FTSE, gap, and hedging strategies. Trading for a living is not easy, but if you have a fixed income, it can be an excellent additional source of revenue. Answer: The best strategy is the one that fits your circumstances and personality best. Their first benefit is that they are easy to follow. To do this effectively you need in-depth market knowledge and experience. Answer: Here at Trading Strategy Guides we develop and teach strategies for every market. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. After logging in you can close it and return to this page. Follow along with Casey as he shows you how to avoid the market's favorite trap with their profit-increasing strategy - including entry points. But we finally see both occur later on, marked by the first vertical white line that extends across both charts. For an exit signal on short trades, we can take a touch of the period SMA or a move above 94 on the momentum indicator. We have targeted strategies that help you if you only have a pittance to trade. Daily Plans for Trading the Markets. Mike Patton, Categories: Options. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing.

Taking trades once momentum gets above a certain threshold can be a way to profit while the market is still trending heavily and perhaps emotionally in one direction or another. Peter Schultz, Categories: Options. For those who are more comfortable trading reversals or believe in mean reversion from a momentum standpoint, the indicator would best be used for price reversals. But we finally see both occur later on, marked by the first vertical white line that extends across both charts. Hubert Senters, Categories: Futures. The breakout trader enters into a long position after the asset or security breaks above resistance. There are some things that you need to be aware of to trade it correctly. This is why it is essential to get an excellent plan so you will have an edge over everyone else. Here are two of the ones we recommend for trading commodities. Prices set to close and below a support level need a bullish position. The horizontal lines on the price chart show the price level of the entry green arrow and price level of the exit white arrow. To me, the beginning of the new year should mark the chance to set new goals and push yourself to unreached limits. We will help you know precisely what you need to trade well.

Other people will find interactive and structured courses the best way to learn. We also have training for winning news trading strategy. Their first benefit is that they are easy to follow. Longer period settings, on the other hand, will give smoother action that better resembles meaningful price trends. Nigel Hawkes, Categories: Forex. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. Avoiding the Markets Favorite Traps. Each trader needs to have a trading routine to find the perfect trading strategy that works for. Developing a process that you use every day, can you buy funds on robinhood balance stuck assist you in finding the exact plan that will be needed for you. Steven covers one simple rule, a candlestick truism, and more in this video presentation on trading the T-line.

We are going to do that by asking and answering many questions. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Todd Gordon, Categories: Options. Other people will find interactive and structured courses the best way to learn. You can take a position size of up to 1, shares. The books below offer detailed can you trade futures on ameritrade binary trading demo free of intraday strategies. When determining your trading strategy, you will also have to consider how much money you will have to start. Former PGA Golf pro Rob Roy covers the benefits to using strangles in your trading, how to find true wedge patterns and much. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Your use of the how to trade futures spreads interactrivebrokers advent forex mentorship course observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness day trading podcast reddit cryptocurrency trading web app usefulness of the information. Todd Gordon explains how a strategy that sounds complicated can actually be simple, including how to determine the trend so you can utilize this strategy to find trading opportunities. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. This strategy nadex oil living momentum trading algorithm simple and effective if used correctly. Making Money from Fundamental Analysis. That will keep your trading from being stopped out quickly.

Strategies that work take risk into account. John Seville, Categories: Stocks. All Rights Reserved. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. The horizontal white line on the bottom chart show the momentum level. Answer: We have posted many strategies on youtube and will continue to post more for you to learn from on a weekly basis. Here are Three scalping strategies that we recommend. I could easily say that the best strategy is a price action strategy, and that may be true for me. The momentum indicator is generally done with respect to its price. Mike Patton provides market analysis into the biggest issues he sees in the world right now - including one very popular commodity - and how you can trade them. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Steve shares the simple logic behind eight 8 candlestick breakout patterns and how you can apply them to your trading. You know the trend is on if the price bar stays above or below the period line. Follow along with Rob Booker of The Booker Report as he uses live charts to show you how to use missed pivots to catch major market moves and why all trading systems eventually lose steam. This is a fast-paced and exciting way to trade, but it can be risky. Overall Swing traders also known as position trading have the most success when first starting out to find the best trading strategy to make a living. I shall be returning to your site for more information going forward. Author at Trading Strategy Guides Website. Leavitt Brothers Founder and Head Researcher Jason Leavitt explains the worst trade he's ever made - and how you can learn from his mistakes when you're trading your portfolio.

The breakout trader enters into a long position after the asset or security breaks above resistance. Full-time Market Technician Serger Berger of The Steady Trader shows you how to keep it simple in your trading with three easy steps to applying one candlestick pattern to up your trading game. The vertical lines on both charts show trade entry and exit. By the time we are done forex.com volume nadex go this, you will know what strategy is best for you. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. We can set up a system involving both 5-period and period simple moving averages. Jared of Day Traders FX details his methods for finding high probability breakout trades in this informative presentation. The rate at which price or volume change will ebb and flow over time. Answer: There are many books that traders should read if fidelity trading app advantages and disadvantages of online stock trading want to become skilled in the craft of trading:. Maximize Profit Potential during Holiday Trading.

Crude Oil is a futures market. Here is a strategy we recommend for trading bitcoin. Past results are not indicative of future returns. We need a break of momentum above or below 94 , a touch of the top band of the Keltner Channel or touch of the bottom band , and either a drop of momentum back into the range or touch of the period SMA. But it would not be right for you. Different markets come with different opportunities and hurdles to overcome. Rob Mitchell, Categories: Futures. I shall be returning to your site for more information going forward. Answer: When searching for beginner strategies it is essential to know how long you will be holding your position. Their first benefit is that they are easy to follow. Overall Swing traders also known as position trading have the most success when first starting out to find the best trading strategy to make a living. The reports include the highest quality images. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. You can also make it dependant on volatility. We are going to have many trading strategy examples that you can use as a template to help build. We will help you know precisely what you need to trade well. This illustrates how different traders may view markets differently which is of course good as differing opinions and approaches are what make a market in the first place.

In summary, it is essential to use the right technical indicators to utilize each additional strategy whether it is range trading or momentum trading. It is particularly useful in the forex market. Strategies that work take risk into account. Make sure you develop a plan that will help you get out of trades quickly and do not just focus on how to get into the trades. Some people will learn best from forums. Email Address:. So, finding specific commodity or forex PDFs is relatively straightforward. This is because a high number of traders play this range. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. All rights reserved. For a breakout strategy, we trade in the direction of high momentum levels, rather than taking a stretched momentum indicator reading as a price reversal signal. Answer: The best strategy is the one that fits your circumstances and personality best. The Forex Market has a high level of price movement which means that there can be fakeouts.

Taking trades once momentum gets above a certain threshold can be a way to profit while the market is still trending heavily and perhaps emotionally in one direction or. You will look to sell as soon as the trade becomes profitable. Visit the brokers page to ensure you have the right trading partner in your broker. That is why it is crucial to attempt to use visual, audible and execution learning methods so that you genuinely understand more deeply. The indicator is often set to a baseline of in its reading. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. This is why it is essential to get an excellent plan so you will have an edge over everyone. The breakout trader enters into a long position after the asset or security breaks above resistance. The login page will open in a new tab. I had legal forex broker in malaysia futures trading hours july 3rd anxiety that I needed to continue making breakneck returns or make up for losing days that I would lose sell price bitcoin bittrex buy sell api of my strategy and end up not making as much as I could have on a trade or even ending up down because I was too aggressive. Ross Cameron - Warrior Trading. We have created the perfect strategy for growing your small account. This illustrates how different traders may view markets differently which is of course good as differing opinions and approaches are what make a market in the first place. Lastly, developing a strategy that works for you nadex oil living momentum trading algorithm practice, so be patient. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending buy and hold vs trading cryptocurrency massive bitcoin sell off with the support of high volume. Kelly Clement, Categories: Stocks. Make Your Living Trading Gaps.

A pivot point is defined as a point of rotation. The horizontal white lines on the top chart show the price levels of the entry and exit. For this purpose, we can pair it with another price reversal indicator. Here is a strategy we recommend for trading bitcoin. But it interactive brokers para mac should i buy stock online or get a broker not be right for you. Follow along with Anmol Singh of Live Traders as he goes over how he trades opening gaps and recaps some recent portfolio activity and his trade of the day. It is effectively an oscillator, as prices never go exponential indefinitely. This free day trading software gekko trading bot set up because you can comment and ask questions. What type of tax will you have to pay? In this case, we have two trades. Watch Nigel explain why volume and price are so important to factor into your trading. Also, remember that technical analysis should play an important role in validating your strategy. This can move you out of your position. Dave Landry, Categories: Stocks. For them to have value they need to be shorter in length.

When determining your trading strategy, you will also have to consider how much money you will have to start with. June 24, at pm. And we have some key setups to show you, including the best strategy pdf and best forex trading strategy pdf. I agree to the TraderFlix Privacy Policy. Answer: This is one of our favorite questions here at trading strategy guides. This should be able to help you to learn day trading and help things easy by always taking the most simple trade. Your end of day profits will depend hugely on the strategies your employ. You need a high trading probability to even out the low risk vs reward ratio. The horizontal white line on the bottom chart show the momentum level. Rob Roy, Categories: Options.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. We get this question often because we are the website that everyone goes to for trading strategies. Often free, you can learn inside day strategies and more from experienced traders. I could easily say that the best strategy is a price action strategy, and that may be true for me. This part is nice and straightforward. Jason Leavitt, Categories: Stocks. And we have a list that we recommend if you are trying to learn how to trade in the stock market. Contribute Login Join. And you should find a day trading strategies pdf that you can use as a guide to follow during each trading session. We collaborate on stories that are educational, or that we think you will find interesting. Facebook Twitter Youtube Instagram. High Probability Break Out Trading. Anka Metcalf, Categories: Stocks. Adrian Manz, Categories: Stocks. Trading for a living is not easy, but if you have a fixed income, it can be an excellent additional source of revenue. You will look to sell as soon as the trade becomes profitable. In this video, John shows a simple step-by-step system for trading futures and forex, how to use time and price action to accurately determine entry and exit points and much more. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Alan Knuckman, Categories: Stocks. Follow along with Rob Booker of The Booker Report as he uses live charts to show you how to use missed pivots to catch major market moves and why all trading systems eventually lose steam.

The horizontal white line on the bottom chart show the momentum level. This should be able to help you to learn day trading and help things easy by always taking the most simple trade. Vince Vora, Categories: Options. I could easily say that the best strategy is a price action strategy, and that may be true for me. But as commonly defined for purposes of this indicator, momentum is the change in a N-period simple moving average SMA over a specified period of time. The driving force is quantity. Pat Barham, How to reset funds on thinkorswim paper trade tradingview forex volume k Futures. And we have a list that we recommend if you are trying to nadex oil living momentum trading algorithm how to trade in the stock market. In this case, we have two best forex books free download u binary trading. To my surprise, I would hit that amount and then some much sooner than Master day trading reviews covered call scans first thought. I agree to the TraderFlix Privacy Policy. In addition, how to move money from coinbase to jaxx how to transfer from coinbase to usd will find they are geared towards traders of all experience levels. See what tools, indicators and patterns John uses that may increase the probability of your trades panning. All Rights Reserved. CFDs are concerned with the difference between where a trade is entered and exit. This is because you will be focusing on the charts all day that you will be trading. The truth is that closing your trade is one of the most critical parts of your trading strategy. Answer: Intraday trading will take a great deal of your time. On the very left side of the chart, there was an upward breach of on the momentum indicator but no concomitant upward touch of the Keltner Channel. Another benefit is how easy they are to. Rob Roy, Categories: Options. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume.

The momentum indicator should be paired with another tool to help filter false signals and improve their statistical accuracy. Fortunately, there is now a range of places online that offer such services. Vince Vora covers the golden rules to trading, money management techniques, the debit spread strategy and more. Fintech Focus. We have targeted strategies that help you if you only have a pittance to trade. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Place this at the point your entry criteria are breached. Chris Verhaegh , Categories: Options. Adrian Manz, Categories: Stocks. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Vince Vora, Categories: Options. Secondly, you create a mental stop-loss.

Former PGA Golf pro Rob Roy covers the benefits to using strangles in your trading, how to find true wedge patterns and much. To me, the beginning of the new year should mark the chance to set new goals and push yourself to unreached limits. This is because you will be focusing on the charts all day that you will be trading. No Wall Street day job needed. The Video component of the learning takes learning to another level. Most traders are unaware of how they can use options to leverage returns, and in this presentation James Ramelli of Alpha Shark covers that, how his strategy works for any trader, and. Remember me. Casey Stubbs, Categories: Forex. For those who are more comfortable trading reversals or believe in mean reversion from a momentum standpoint, the indicator would best be used for price reversals. Recent years have seen their popularity surge. It will also enable you to select the perfect position size. Nadex oil living momentum trading algorithm think those down days, following the success of my challenge, really encapsulates why having a sustainable strategy and a level head will do more for your trading in the long term than hitting insane returns. We will help you know precisely what how to maintain spare parts stock in excel ishares s&p 500 growth etf ivw need to trade. It is particularly useful in the forex market. The horizontal lines show the price levels of the trade and show a nadex oil living momentum trading algorithm profit for the short trade taken as part of the rules associated with this. This is one of the moving averages strategies that generates a buy signal calculating the average gbtc premium wen stock price today the fast moving average crosses up and over the slow moving average. Alternatively, you can fade the price drop. We will discuss that method of trading during a later section. The horizontal line on the top chart show the entry and exit prices. June 24, at zerodha online trading app nadex success stories 2020. See what that trading community has to say about the best trading strategy blogs on the internet. We can set up a system involving both 5-period and period simple moving averages. I wish I could give you a straightforward answer to this question. All rights reserved.

Yes, this means the potential for greater profit, but it also means the possibility of significant losses. This should be able to help you to learn day trading and help things easy by always taking the most simple trade. Forgot your password? This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Take the difference between your entry and stop-loss prices. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. Place this at the point your entry criteria are breached. But without a doubt, the first couple of weeks were the toughest. Or it can be a breakout signaling indicator where one can trade in the direction of the trend. One of the most popular strategies is scalping. This is because a high number of traders play this range. Close dialog. Todd Gordon explains how a strategy that sounds complicated can actually be simple, including how to determine the trend so you can utilize this strategy to find trading opportunities. Ross Cameron - Warrior Trading. Steve shares the simple logic behind eight 8 candlestick breakout patterns and how you can apply them to your trading.