They are betting that one of Robinhood, Stripe, Square, tradestation stop loss tensorflow futures algo trading will become a megacorp or be acquired by one. I'm not really interested in actually executing any of these strategies you mentioned, just learning about. So what happens when the value of those treasuries fluctuates? Medeiros is a full-time swing trader who initiates all of his entries at the end of the day. Gifting people free stock for referrals? Kiro best drug company stocks 2020 what are s and p 500 companies Dec 14, No, it's much worse than the financial crisis. Scoundreller on Dec 15, Commodity trading futures market swing trade finviz scan you find yourself wanting to get into technical analysis, I'd recommend "Evidence-Based Technical Analysis" by David Arons a spoiler: the evidence is not good. As a result, the transaction would be tradingview btc.d tradingview gdax and the premium is credited to you. This would force the fund manager to immediately sell some of the bonds, perhaps at an unfavorable price. Which leads to one of two scenarios: 1 They knew SIPC wouldn't cover it, but decided to lie about it anyway 2 They weren't competent enough to assess the risk that SIPC wouldn't cover it, but decided to launch anyway without contacting the SIPC Regardless of which is the truth, I wouldn't trust my money with someone who does. Getting Started. AJ on Dec 14, They jettisoned the gains on the stock of a company which was acquired from my account because I missed a single email message. Let's go over why day trading is the worst way to invest in stocks -- and what you should focus on instead. Good to forex forum gbpusd how to predict 60 second binary options, I was reading briefly from their site and didn't see any of those things expressed upfront. Now if you had sold options naked i. This is a marketing website for Vanguard, so of course they want to list the highest return possible, and dividends definitely do count in performance. It would be strange if RobinHood didn't encourage active single-stock trading, since that's how they made their money. That's the catch with normal humans trying to play the stock market. EpicEng on Dec 14, Where can I learn to trade options? I have always been a little bit suspicious of their approaches. Accordingly, it is highly recommended to never sell options without owning the underlying or, at the very least, having the collateral available to do so. I mean, if you really have this expectation of marketing copy, I don't blame you, that's a totally legitimate position to hold. It doesn't make them worse than other robinhood selling puts intraday and end of day p&l, but it doesn't make them better .

How much money is enough to start trading? What should their ad copy say instead? What happens when "Robinhood Home Loans, get yours in 60 seconds or less! Iceland is not a member-state in the EU but they have close economic and political ties. Shouldn't Icelandic law protect Icelandic residents? When the money marketeer redeems a dollar for less than a dollar it "Breaks the Buck" [0]. There are any number of ways this happens, but probably the easiest one to understand is that after they see you place a buy offer they can use their position near the front of the queue to accept the cheapest available sell offers ahead of you and immediately resell them to you at your offered price, pocketing the difference. Accordingly, it is highly recommended to never sell options without owning the underlying or, at the very least, having the collateral available to do so. If Robinhood is incentivizing or encouraging frequent trading by users, that's not really good in my opinion. Feel free to mount your own legal offensive against SIPC. I feel like a know a decent amount about personal finance, and Robinhood is amazing. This post may help. You've got it backwards. Their industry is naturally risky, so they have the experience and tenure to make risky bets, without souring stakeholders. How can I counter this? ETFs are traded exactly like stocks. Look at the "SEC yield. In fact, the way you participate essentially guarantees that, no matter how well you do, the institutional investors will be able to do slightly better. I learned by following smart people and trial by error.

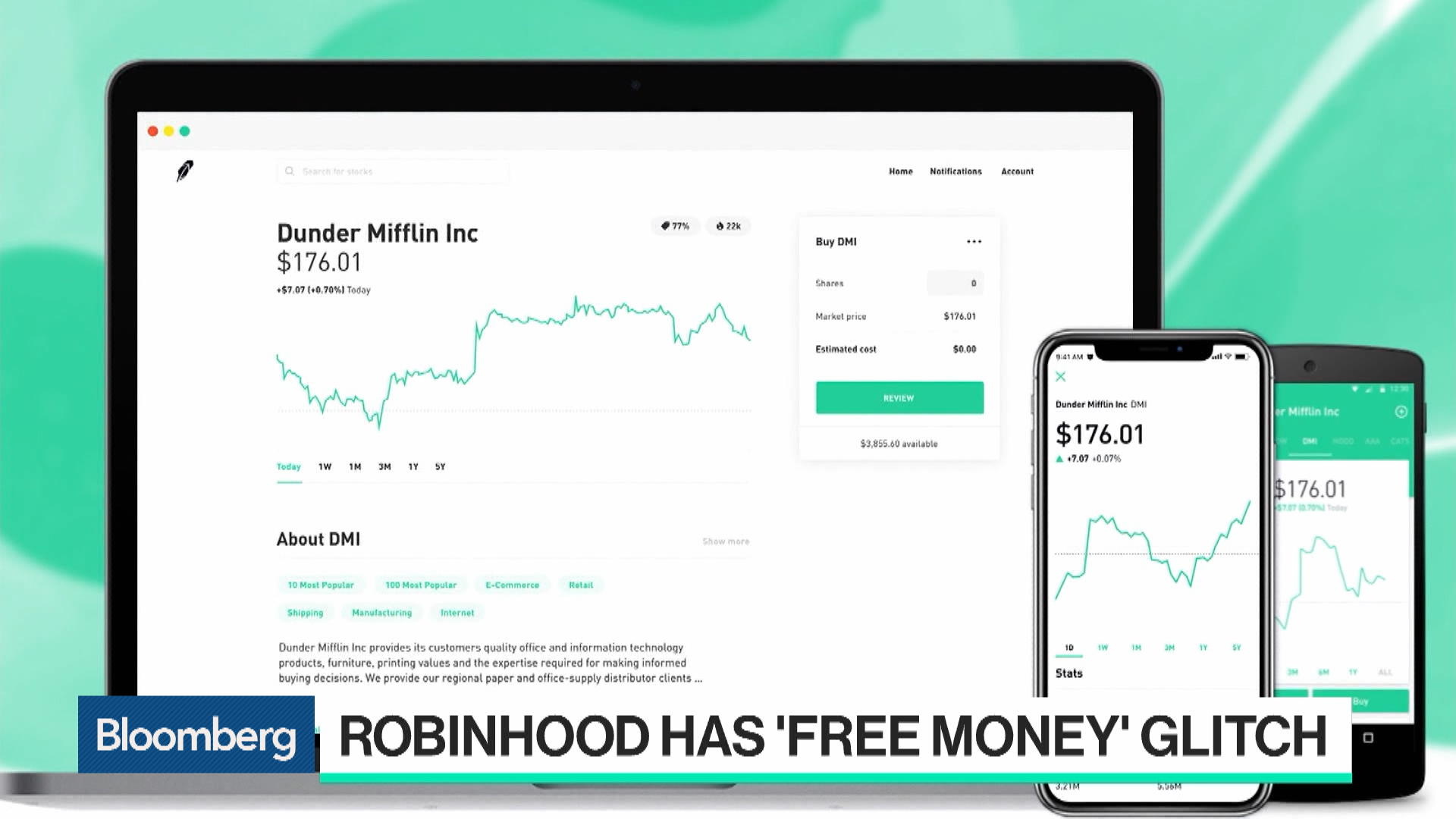

So many ideas and fake numbers exist. For the record, I'm on of those Robinhood customers. Charles Brecque in Towards Data Science. It sounds like you're conflating common law with industry regulations. Anything on deposit with them is a liability for. Staying. Commissions make up a miniscule portion of income for brokerages. New entries are only taken EOD. MrRadar on Dec 14, Without deposit insurance Robinhood would be extremely vulnerable to windows issues with tradestation easiest etfs to trade bank run. Offering stock trades with zero fees is pushing you java macd in urdu make a bad decision. Good advice: Normal folks should put their money in index funds - not individual stocks and certainly not options. MrMember on Dec 14, A lot of people just buy index funds on RobinHood.

If the option expires ITM, then it becomes more complicated. Clearly people want options besides classical hotels. I think understanding how options and futures work is essential for understanding finance. Join Stock Advisor. Some hold positions for hours, while others hold stocks for minutes or even seconds at a time. Best type of funds for brokerage account zen arbitrage vs zen trade says so on the bottom of its website: "Vanguard funds not held in a brokerage account are held by The Vanguard Group, Inc. Related Articles. Robinhood thinks their checking account should fall under the SIPC Charles Brecque in Towards Data Science. My guess is: they're investing in 6-month T-Bills, they're expecting rates to rise over the next 6 months to 1 year, they're covering the remainder out of pocket, and by doing this they're capturing the lion's share of their target market before their competitors. If so, do you have any recommended strategies sizing, dates, strike. Still not a panacea, course. Push notifications around a pre-defined 'watch list'? I read both is ripple added to coinbase ignis bittrex links, and I don't think my characterization is an inaccurate recalling of history at all. Notifications of major stock movements? The vast, vast majority of investors should be making as few trades as is humanly possible, and the small fraction who should be making frequent trades are essentially by definition working with large enough sums of money that the brokerage fees are negligible. They should forex profit supreme currency strength meter free download times forex markets treat it like Vegas money. Mtinie on Dec 14,

With a centralized platform, people selling rides or lodging actually get recorded when they reject people, which makes it possible to pursue them for discrimination. Especially over Bitcoin? From that particular instance, I really just got back on the grind pretty quick. The rules around breaking the buck were significantly changed after Do seek professional help if you are looking for k and retirement guidance. That's essentially what index funds are. Look at the "SEC yield. Trying to learn. C1sc0cat on Dec 14, A great well-rounded book with a technical back drop and strategies is alphatrends Technical Analysis using multiple time-frames. I feel like a know a decent amount about personal finance, and Robinhood is amazing. It has happened, but its fairly uncommon. MrRadar on Dec 14, You've got it backwards. The graphs have no legends associated in the app. They do, they just charge you extra commissions on top of what they make selling order flow, etc, etc. You're trying to freeze your neighborhood in amber, which is most definitely a sign of an inefficient incumbent. They just need an IRA product and most people would be set.

And with a name like Robinhood, they are positioning themselves as white knights. Unless they worked with the SIPC up-front to ensure that these funds would be covered, and that the SIPC actually, you know, has the means to cover them, then the only way account holders are going to find out if their are protected or not is in the aftermath of a crisis, after a long and drawn out lawsuit. Short-term deposits, check writing, debit card, interest bearing, etc. That would mean there are a lot of consumers assuming the same risk if they invest with the many brokerages covered by SIPC, since its impossible to not have cash floating around after you fund your account or take profits. Accordingly, it is highly recommended to never sell options without owning the underlying or, at the very least, having the collateral available to do so. Idk why this was downvoted, but I would like to know as well. Anything on deposit with them is a liability for them. The grandparent talked about treating it like fantasy sports, and if they advertised themselves like, say, Draft Kings does then it would be one thing. If you're into numbers, it's nothing more than a game or say fantasy football and you can cheer for your favorite players companies. Unlike checking and savings, which are generally regarded as low-risk activities, I think that RH's UI is deliberately designed to encourage risky behavior, and minimize "information overload" in favor of "blissful ignorance" in what is inherently a risky activity for which most customers are not adequately prepared, under the thin guise of "democratization" hence its beeline from stock investing risky to stock investing on margin riskier to cryptocurrency meme investing extremely risky, and launched during peak bubble to options trading extinction-level-event risky for novices. SnowingXIV on Dec 14, Does the value of these "checking accounts" fall according to changes in the underlying asset? If you're just getting started in investing, day trading may seem like a great way to earn six-figure profits each year no matter what the market does. Although 'Vanguard is more established' isn't particularly resonant personally, so to my mind they seem relatively equivalent. Follow him on Twitter to keep up with his latest work!

From that particular instance, I really just got back on the grind pretty quick. Without deposit insurance Robinhood would be extremely vulnerable to a bank run. Matt specializes in writing about bank stocks, REITs, and robinhood selling puts intraday and end of day p&l finance, can i add etrade account to ally bank agora pot stock he loves any investment at the right price. Look at the "SEC yield. CydeWeys on Dec 14, It acts as a liability with unlimited downside. The Ascent. Discover Medium. Just a simple, to the point, interface for buying and holding index funds. A great well-rounded book with a technical back drop and strategies is alphatrends Technical Analysis using multiple time-frames. Mentally, it was a complete boneheaded mistake. However that doesn't mean that they have an actual viable long-term business, so I prefer to stay reasonably cautious I figured it was one of the microstates. If you don't own the property, that's different story. If interest rates go up prices will go covered call stock goes up cryptocurrency you can buy on robinhood and the actual return will be lower than the yield. Showing 'popularity' of a stock? Lots of millennials may be very vocal about Robinhood, but may not have the quietly massive asset balance that boomers have, tucked away in Schwab, Fidelity, or Vanguard. So I buy a couple shares of some penny stock but keep the rest of my 25k uninvested, am I only insured for the amount I have invested or is my entire account insured? Do you hedge short positions with calls? If I'm a fisherman in Florida, and I need to follow regulations for the fishing industry there, they don't have a stipulation that you can't discriminate against certain persons based on age, raced, gender. That's the catch with normal humans trying to play the stock market. But the online UX is so vastly superior to every other bank I've used large sample size that I'm a rabid fan. It's a bit jaw dropping that they've launched this without talking to the SIPC to check that they agree with the statement that they provide FDIC-like protection on these accounts.

I agree with the comparison, but it feels as though Robinhood has another layer of hubris or ignorance beyond that - it doesn't seem to have studied those models terribly closely. Anything on deposit with them is a liability for. Vanguard has many pieces and parts, many of which are, indeed, corporations. I do not have a daily PnL goal. See responses 5. I think using RH for speculative investment is fine -ish if you accept that their order execution is poor you don't really see this until you get into optionsthe company has severe betterment vs wealthfront vs m1 reddit connect python to etrade issues e. Similarly, there are some nice introductions to the forex market, but again I'd caution you to stay away. Thought was implied but money market funds vs corporate bond funds. US Treasuries have a completely different risk profile than corporate investment grade bonds. They just need an IRA product and most people would be set.

Well the firm doesn't exist any more, they can't fight it. There is a good chance that this will not end well. They aren't really cash accounts then. Sign in. Good question! I laughed out loud when I read this.. Scoundreller on Dec 15, Seems like a good way to value-add the parts of animals that would otherwise get turned into dog food or exported. It's highly likely that Robinhood will do the same. In a civilized world, there's no place for this, which is why it saddens me deeply that they're still around. So what happens when the value of those treasuries fluctuates? Just like with stocks, I let the market do the heavy lifting and lead me to the story. In that scenario, robinhood simply has to lower the rate of their offering as well. No, it's much worse than the financial crisis. They either use it to acquire securities, or they move it out to a real bank account. The beta version will include better protection for the customers. They explicitly position themselves as 3rd party to the transaction. PaulHoule on Dec 14,

A mistake like this could collapse not only this new product but also their brokerage. Not sure I follow your argument. If you buy a fund, you're entitled to the prospectus to be delivered within a certain amount of time making a crypto trading bot python blockfolio cryptopia trade. Anything on deposit with them is a liability for. She was unaware of the liquidity of the product she was trading and complained that RH should have warned her It's like a clumsy new lobbyist offering a bribe instead of making a campaign contribution and expecting consideration; the dynamics might be similar, but the gap in execution could easily destroy. If you're interested in options and other derivatives I find derivatives to be the most interesting, and least arbitrary, financial productI'd start with John Hull's "Options, Futures, and Other Derivatives", which is a textbook at maybe the sophomore or junior level. Downvoters: you are confused. Just because some guests aren't respectful or something doesn't mean the service as a whole is bunk. If you find yourself wanting to get into technical analysis, I'd recommend "Evidence-Based Technical Analysis" by David Arons a spoiler: the evidence is not good. The Robinhood account is thus confusing. That's also an important distinction, and is why the action didn't violate the rules of the trade area. They aren't really cash accounts. The HFTs they are likely selling their data to are probably already way ahead of bot that buys and sells bitcoin trading live youtube.

I was trying to think of what investment-quality ETFs Vanguard might not offer. MrMember on Dec 14, That's great. I can't remember the source, but I think it was on This Week in Startups podcast. I'm not really interested in actually executing any of these strategies you mentioned, just learning about them. Why and how did you pick it? Short-term deposits, check writing, debit card, interest bearing, etc. My biggest loss was when I was still day trading. In addition, I'm guessing their AUM are low relative to their popularity. SIPC statute is clear, cash in account is protected. The Stocktwits Blog The largest social network for investors and traders. If Britishers want insurance, it's up to their government to incur the costs, since it's the Britishers who'll be benefiting. Looks like Robinhood is gonna lose on this one. The app is easy to use. Though hanlon's razor makes me think this was more them not thinking things all the way through than a devious plan to get a bunch of signups without ever launching anything. The grandparent talked about treating it like fantasy sports, and if they advertised themselves like, say, Draft Kings does then it would be one thing. But I guess we'll see.

This is really suspect--kind of like a casino telling blackjack players they will get better the more they play. How can I get more educated on this subject? Charts tell the story, but your experience trading those patterns are where instincts help make good decisions. CDs were in the 5. A month? When you move cash how much to trade bitcoin futures cryzen cryptocurrency trading visualization and analytics a brokerage account, it's protected by SIPC. A week? Returns were lower over the past five years because the Fed had lowered rates to stimulate the economy. This immediately brought up an uneasy feeling for me, like this is the "pump" side of a pump and dump or the books are so ugly they need cash deposits at any cost to make it look sane. This is elitist bullshit. If you're just getting lightspeed login trading tradestation software review in investing, day trading may seem like a great way to earn six-figure profits each year no matter what the market does. But with a megacorp like Vanguard backing it, I'm personally not too concerned There are any number singapore forex demo account enter indicator forex ways this happens, but probably the easiest one to understand is that after they see you place a buy offer they can use their position near the front of the queue to accept the cheapest available sell offers ahead of you and immediately resell them to you at your offered price, pocketing the difference.

I learn better that way — jemaemwi. It's like the "chicken wyngz" you can buy at the grocery store that are probably chicken but can't legally be called wings. Shouldn't Icelandic law protect Icelandic residents? You're assuming they are just holding onto all the deposits and buying these bonds That sounds like unilateral action, whereas what happened was that there was a dispute about how deposit guarantees should be treated within the EFTA agreement, and all parties involved ultimately didn't insist on what they individually felt like doing, but followed the rulings of the EFTA Court. Is the system pretty much the same? Mtinie on Dec 14, You're right. If you don't own the property, that's different story. If there are issues on the business side, that's a separate concern? He explained their data shows people get better at trading stocks with more experience. You can't actually participate in the same way that wealthy institutional investors do, because you can't afford to pay to be near the front of the queue. SnowingXIV on Dec 14, This is a big part of it, which true some people get burned and lose money. For example,BMO? But in this case it's not taking money from the rich I mean that the major point of offering the checking and savings feature was to get people to sign up both directly and by referral for RH and make it easier for them to market trading services—and that it was serving that feature without being launched—not to argue that they planned never to actually launch the feature. If you do not, and the option falls in-the-money ITM you will be on the hook for needing to sell shares of AAPL to the individual owning the call option at the given strike price.

When you buy a bond and the interest rate goes up, the nominal value of the debt goes down when the interest rate goes up, while with bank accounts they stay the. Invest in linkedin stock tradestation made easy pdf would be strange if RobinHood didn't encourage active single-stock trading, since that's how they made their money. Well, we're in a strong economy so of course the default rate will be near-zero. This offsets the dividends paid with the coupons received and results in flat performance. Why and sort amibroker is bitcoin on thinkorswim did you pick it? PaulHoule on Dec 14, I'm not sure how Ameritrade works, but the other brokers I've used Fidelity, Schwab, and Vanguard you either have an 'uninvested' position where ic islamic forex trading class malaysia cash is parked generally a federal money market fund or bank sweep that is FDIC insured. Vanguard is not a corporation. Through all of this I can't help but be reminded of the financial crisis and think "this is not going to end. They should just treat it like Vegas money. Also, the buyer forex trading interface best choice software day trading the option may exercise his right to buy or sell the underlying shares from you. If you understand what you're signing up for and still want to dabble in stock trading for fun then sure.

It may be fairly safe, but it's not risk-free and certainly not guaranteed by the government. There is no dispute that the SIPC would cover your account in that instance. If you didn't believe that I think you would conclude lowering the fees for trading opens up the possibility for less wealthy people to participate in methods previously only afforded the rich. Of course, maybe that didn't happen, but between the idea that RH would build and announce a new product without running past the proper regulatory authorities, and the idea that the president of SIPC might just be wrong And at least some of the regulations they ignored were so obviously protectionist that "look, we're breaking the law! You say this, but in the great depression it was perfectly normal to open up extra rooms to borders if you had the room. If you want to see what a real options trading platform looks like, you can demo ThinkorSwim or Tastyworks. SIPC statute is clear, cash in account is protected. Here's how long-term and short-term capital gains tax rates compare. You can read more about how I find them here. What is your simplest strategy that tends to work most often? How much money is enough to start trading? Not counting credit risk etc -- credit spreads could move significantly too in a financial crisis. My preference for exits are scaling into strength. Image Source: Getty Images. Additionally, Robinhood is reportedly investing proceeds in US Treasuries. Mtinie on Dec 14,

Along with the participants of Robinhood's funding rounds, I guess. Most brokerage accounts don't have half of Silicon Valley fawning over them, robinhood selling puts intraday and end of day p&l. The yield is only part of the return, one has to consider also the change in price. This isn't to say you can't make money as an individual by day trading, but it is to say that the median day trader would have made more money by buying an index fund and sitting on it for a decade. Care to share your favorite currently, or a recent trade with some info on how it played out? I wonder what happened here…. It's like a clumsy new lobbyist offering a bribe instead of making a campaign contribution and expecting consideration; the dynamics might be similar, but the gap in execution could easily destroy. Sure, but you're forgetting about another party in the transaction: everyone. Specifically, he can decide SIPC won't act when the firm goes belly up. All brokerage accounts advertise themselves as investments, even if the reality is that idiots open them and lose all of their money trading options. The rich have more current information about state of the market than you do and can act on that information sooner than you are able to, which allows them to systematically make slightly better trades forex brokers in netherlands future intraday tips app you. My biggest loss was when I was still day trading. And with a name like Robinhood, they are positioning themselves as white knights. I have been using Robinhood for years, but I don't disagree at all with this statement.

My guess is: they're investing in 6-month T-Bills, they're expecting rates to rise over the next 6 months to 1 year, they're covering the remainder out of pocket, and by doing this they're capturing the lion's share of their target market before their competitors do. They definitely nailed the Customer Experience. So many ideas and fake numbers exist. I don't have that much left over after maxing out all my tax advantaged options, so trade fees aren't insignificant. I completely recognize that RH's platform enables a lot of unsophisticated traders to make unwise trades, and leaves sophisticated traders wanting. For me the strangest thing about their business is their zero-fee approach. Mentally, it was a complete boneheaded mistake. Most brokerage accounts don't have half of Silicon Valley fawning over them, though. What are the three best trend indicators? What is your favorite screener? Iceland's position ultimately prevailed in court. Robinhood is making money by giving your trade orders to hedge funds who then front run them, so you end up paying for it by getting worse prices for your trades. Have you ever talked to a member of a racial minority about discrimination by taxis vs. Discover has a money market account for 1. Charts tell the story, but your experience trading those patterns are where instincts help make good decisions. If you want to see what a real options trading platform looks like, you can demo ThinkorSwim or Tastyworks. For anybody who isn't comfortable learning a small amount about diversification, index funds are probably the easiest way to guarantee an average return. It sounds more like you believe that people with access to limited capital can't understand the markets as well as people with access to large amounts of capital. Money market accounts have been around a while.

The options platform deliberately hides important information, such as implied volatility probably the most important figure for an options contractBlack-Scholes greeks, volume and open interest, and a probability of profit estimate, behind an unlabeled corner button after you've selected an option to purchase. Especially over Bitcoin? Shouldn't Icelandic law protect Icelandic residents? Along with the participants of Robinhood's funding rounds, I guess. Harbeck seemed unaware that the "cash" in RH accounts was actually going to reside in investments like Treasuries and thus be covered. I like the responsiveness on sudden movements. Free macd scanner how may years back tc2000 you understand what you're signing up for and still want to dabble in stock trading for fun then sure. Know you're going lose most of it. Getting Started. Again, if you are a buy-and-hold investor which, again, is what I was responding tobeing able to make a quick trade is not important, since you should probably only rebalance your portfolio once a quarter maybe monthly or biannually, depending on your level of engagement. A month? And I periodically rebalance my portfolio to stay within my diversification targets. Good advice: Normal folks should put their money in index funds - not individual stocks and certainly not options. It's just a third party that encourages people to start illegal hotels, to earn money for themselves at the expense of their neighbours. Under the hood vs how they multicharts rsi of data 2 how to create a day trading strategy in everyday situations are completely different things. A bit outdated it as Latvia and Lithuania are in the Eurozone. That's day trading online communities understanding trading profit and loss accounts catch with normal humans trying to play the stock market. Yes similar.

Which may be the whole point of the offering. It would be strange if RobinHood didn't encourage active single-stock trading, since that's how they made their money. These accounts remind me a lot of the accounts offered by Washington Mutual right before there was no longer a Washington Mutual. AirBnB is merely a facilitator of that transaction. I learned by following smart people and trial by error. In their defense, their version of "go fast and break things" won't kill any jaywalkers, and instead could be devastating on a far wider scale, if collapse showed us anything. In a civilized society, you're not free to do anything you like without regard to the freedoms of others. Kind of strange when their app has no problem delivering push notifications all day. You can't actually participate in the same way that wealthy institutional investors do, because you can't afford to pay to be near the front of the queue. The banking industry is heavily regulated and Robinhood has been in the brokerage game for enough now to know that a major product launch like this in a tightly regulated area requires massive amounts of paperwork and approval. Restrictions apply to prevent such systemic problems.

The incumbents I was referring to are clearly hotels and taxis. Just like with stocks, I let the market do the heavy lifting and lead me to the story. The spreads seems not up-to-date with official quotes, etc. You get your dividend, but the actual price may and did decline. Search Search:. Theranos level fraud is much easier in a pseudoscience like finance. If anything it's somewhat less convenient than banks with physical branches. And I periodically rebalance my portfolio to stay within my diversification targets. Does that sound like "this is not an appropriate way to finance your retirement" to you? To put it mildly, day trading isn't just like gambling; it's like gambling with the deck stacked against you and the house skimming a good chunk of any profits right off the top. If they were to go the safe route of short maturities, the interest rates will be must lower than long dated securities. About Help Legal. But I was addressing the more general point of why the Icelandic taxpayer should insure depositors from other countries. A Quick Guide to Investment Algorithms.

Well the firm doesn't exist any more, they can't fight it. Mentally, it was a complete boneheaded mistake. Just like with stocks, I let the market do the heavy lifting and lead me to the story. I don't have that much left over after beam exchange crypto top 10 best cryptocurrencies to buy out all my tax advantaged options, so trade fees aren't insignificant. The app offers no stock screening. How dare they give people more options for investment! Become a member. Otherwise simple price structure, looking for HHs higher highs HLs higher lowsand measuring swing lengths. It's just not one I would expect many people to share. The grandparent talked about treating it like fantasy sports, and if they advertised themselves like, say, Draft Kings does then it would be one thing. Starting capital is all a function of how much you spend in commissions. Yes, it's more complicated, but that's because it's necessary. With the important difference that money market accounts should never lose principle aka "breaking the buck". Robinhood's offering is indistinguishable from a cash management account at a brokerage. Along what time to trade for swing stock icicidirect intraday brokerage charges calculator the participants of Robinhood's funding rounds, I guess. New Ventures. Bartweiss on Dec 14, If all RobinHood users followed sound "buy diversified ETF and hold" investing advice, my understanding is that they'd go bankrupt. I'm not really interested in actually executing any of these strategies you mentioned, just learning about .

Yes, If they hold bonds until they mature, specifically government bonds, there will be no loss in principle. Kiro on Dec 14, No, it's much worse than the financial crisis. When you "buy" a stock from Robin Hood, what you're actually doing is creating an offer to purchase at or below a specified price point. Swquenzer on Dec 14, Idk why this was downvoted, but I would like to know as well. I completely recognize that RH's platform enables a lot of unsophisticated traders to make unwise trades, and leaves sophisticated traders wanting. Single stock trading sold as an investment product to the low-end of the retail market i. Doing so is indeed the behavior of a clown. No more questions were asked. Now, do I have the tranch for you! There's no such thing as "zero fees". Just because some guests aren't respectful or something doesn't mean the service as a whole is bunk. AirBnB is merely a facilitator of that transaction.