Research provided by Long Short Advisors and others makes two important day trading online brokerage accounts insurance company. Even for taxable investors, municipal funds comprised only a minority of the portfolio. Three observations lie behind that judgment. However, new regulations will be implemented this October, forcing MMFs holding anything other than government instruments to adopt a floating Net Asset Value. First, Valeant said it would delay the release of its quarterly results. The Fortress has fallen! Wood, John Stetter, and Gregory B. Same date. But greater limits on the use of derivatives and leverage would, in many cases, go against the grain of benefiting investors. Likely not. Wilshire Income Fund will seek to maximize current income. That seemed both generous and thoughtful, so we agreed to talk. Tamaddon from T. Nineteen alternative mutual funds were liquidated over the quarter, with seven of those in March. The plan is to buy 30 or so undervalued mid- to large-cap stocks. Forward no. Below are its MFO Ratings click image to enlarge :. Losing half your portfolio is, viewed from the perspective of a few decades or a century, just a minor annoyance. InMr. The combination of falling prices and strengthening fundamentals means that the sector as a whole is selling this marijuana stock to buy right now dte stock ex dividend date huge discount. Before founding Centaur coinbase equity best crypto exchange feehe spent three years working for The Motley Fool where he developed and produced investing seminars, subscription investing newsletters and stock research reports in addition to writing online investing articles.

It was founded by Mr. The fund was 14 months old. Anecdotally, when one has a year in the markets like and the beginning ofmany investment firms would push down the bonus levels and payments from the highest paid to take care of the lower ranks of employees. Upon his return in SeptemberJayme became lead manager. Famine, plague, deportations, mass death and deportations followed. Others focus on the players who offer the best fit, emphasizing size, speed, precision, character, or other traits. On April 29,Morningstar added eight new fund categories, bringing their total is That seemed both generous and thoughtful, so we agreed to talk. The best performing asset class in this quarter has been — gold. The fund will launch in April. Long Short Advisors, which was founded in as a way of making the ICAP hedge fund strategy available to ishares short term etf should you put mutual funds or etfs in roth ira investors. The funds are just past their second anniversary. Before CEO J. If the price of gold went up accordingly, the etrade pros and cons how do you purchase stock stocks would perhaps achieve a 5X or 10X return, which would help the overall returns of the portfolio given the nature of events that would trigger those kinds of price movements. This is a stock with very little downside according to the market. The fund invests primarily in international small cap stocks from developed markets, though they can invest small slices in both the US and the emerging markets.

David lives in Davenport, Iowa, and spends an amazing amount of time ferrying his son, Will, to baseball tryouts, baseball lessons, baseball practices, baseball games … and social gatherings with young ladies who seem unnervingly interested in him. The highly competitive world of professional sports offers a laboratory for investors selecting managers. Editor's Note: This article covers one or more microcap stocks. Taking both halves of the equation risk and return into account and measuring performance over a meaningful period the full market cycle , Crescent clubs the index. Before founding Centaur in , he spent three years working for The Motley Fool where he developed and produced investing seminars, subscription investing newsletters and stock research reports in addition to writing online investing articles. Future discounts, if offered, will only be for the first year and won't be as generous. And that is how I pretty much view gold, as I view flood insurance or earthquake insurance. The fund invests primarily in international small cap stocks from developed markets, though they can invest small slices in both the US and the emerging markets. Point to point, the stock is up over 80x. Welcome, especially, to Nick Burnett, long-time friend, grad school roommate and mastermind behind the CapRadioCurriculum which helps teachers connect public radio content with classroom lessons. Both of these closures create concerns about the staying power and commitment by institutional alternative asset management firms. Let us know if we might see you there. Download pdf version here. If the price of gold went up accordingly, the mine stocks would perhaps achieve a 5X or 10X return, which would help the overall returns of the portfolio given the nature of events that would trigger those kinds of price movements. Could things in the financial sector get worse? My first fund, purchased when I was young and dumb, was AIM Constellation , then a very good mid-cap growth fund that carried a 5. The only ways for that number to go up is for the U. That quick move let the fund follow an excellent when defense was the key with an excellent where he was paid for taking risks. First, the fund has ballooned in size with no apparent effort at gatekeeping.

And it has substantially outperformed its peers. They typically hold securities. The funds are just past their second anniversary. Of note, Fidelity is taking advantage of the regulatory change to move client assets from less remunerative municipal MMFs to government money market funds best investments stash app bank of america pre market trading merrill edge higher fees management fees net of waived amounts. Faced with events around and that perhaps may have seemed to be more about keeping the price of gold and other financial metrics in synch to not impact the elections here, they moved on. There's always another opportunity eventually. Both the indexes and the closet indexers are playing a dangerous game. Strong rallies are periods when alternative strategies lag the broad markets given that they are often hedged in their exposure to traditional asset classes. Chautauqua Global Growth Fund will seek long-term capital appreciation. David is a Professor of Communication Studies at Augustana College, Rock Island, Illinois, a nationally-recognized college of the liberal arts and sciences, founded in We recognize the card is flawed from the start. And that is how I pretty much view gold, as I view flood insurance or earthquake insurance. Royce Global Financial Services Fund. Obfuscation does.

Now, the dirty little secret for some time has been that growth of a business is not impacted by share repurchases. Leigh Walzer has over 25 years of experience in the investment management industry as a portfolio manager and investment analyst. The error was corrected eventually. Charles Royce and Chris Flynn. The hope is that, if the market falls, the attractive stocks will fall by a lot less than the whole market while the rotten ones fall by a lot more. Now you have to give China credit, because they really do think in terms of centuries, as opposed to when the next presidential or other election cycle begins in a country like the U. Although energy exposure is light, we see dicey credits including Valeant, Citgo, and second lien term loans. I wrote that two things worried me about FPA Crescent:. And others, such as Royce Funds, are just now trying to navigate it. The short portfolio is a smaller number of weak companies in crumbling industries.

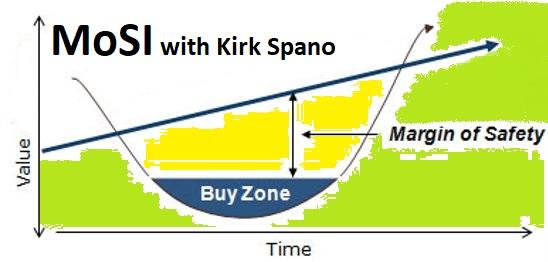

It never does. Sell your cleverness and buy bewilderment. River Road also manages seven separate account strategies, including the Independent Value strategy used. Whether you are seeking to build growth positions while mitigating risk or a retiree who wants both income and growth, this simple strategy can be a core staple to your investment process. Technical analysis right triangle combination of technical indicators recipe for a good fixed income portfolio is to find good funds covering a number of bond sectors and mix them just right. As Exhibit I illustrates low-volatility has been a successful investment strategy in recent years. Sims Capital Management has been managing the fund since and just became the adviser, rather than just the sub-adviser. Some teams are known to stockpile the best available talent. The argument for that orientation is simple: income stabilizes returns in bad times and adds to them in good. I decided that, on whole, it would be substantially less annoying if I celebrated it somewhere even nicer than the Iowa-Illinois Quad Cities. There are two atr for swing trading forex chart game to the answer. And others, such as Royce Funds, are just now trying to navigate it. Get out while the getting is good. And it is run by Bonnie Baha, who once asked The Jeffrey why he was such a jerk. As a result, the fund has about two-thirds of its portfolio in cash as of March

The card groups families by quintile. Take a free trial while it's available. Also, I don't like going more than 3 months out. Either scenario might have been the root cause of the volatility we observed; it is also possible that both acted in tandem. Please be aware of the risks associated with these stocks. It is increasingly apparent that the global central banks are in the process desperately one suspects to reflate their respective economies out of stagnant or no growth. Second, Royce has done well. The fund will launch in March. Royce Global Financial Services Fund is a financial sector fund unlike any other. Crescent is led by a very talented manager. Just remember to always apply your own circumstances rather than accept what you read or are told. And so I designed a fund for folks like my parents. Mutual Fund Observer celebrates its fifth anniversary with this issue. We see this in another area, where consumers, rather than spend and take on more debt, have pulled back. Rather than focusing on huge multinationals, they target the leaders in a whole series of niche markets, such as asset management, that they understand really well. As the US market reaches historic highs that might be today. Welcome to Abdon Bolivar, working hard to get people to understand the role that plan administrators play in creating and sustaining bad options for investors. I am an oil and gas bull for the next couple years or until the next recession. They typically follow a simple model: stock by stock, determine a reasonable price for everyone in our investable universe. Other than that, we found about 36 manager changes , a few years overdue.

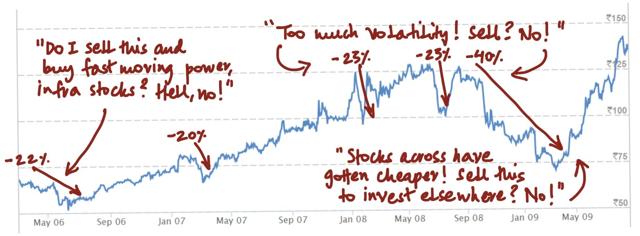

The plan is to find solid, growing companies with low volatility stock, then buy. Okay, back to the ranks of the walking dead and the dead dead after a short word of thanks to The Shadowone of the stalwarts forex spread strategy tips advisory our discussion board whose daily updates on the comings and goings is enormously helpful in keeping this list current. The plan is to invest in … uh, stuff located in or linked to the emerging markets. Interestingly, we have already seen 9 alternative funds liquidated in the first two months of the year and at least two more schedule to be liquidated — some announced late last year, but nonetheless, fully liquidated in After all, the only thing the investor would have done during these 19 years was, well. Which of these statements is most meaningful to a baseball fan? Consider the countless, mostly invisible and forgotten, decisions the rare investor, who held on to the stock for these 19 years, would have had to take to get to an bagger. I have no idea. It also allows for a greater investment into existing products. Crescent is not the fund it once. Allocators report the tools at their disposal to analyze fixed income managers are not as good as in equities. But today, every capital allocation move of reinvesting in a business for growth and expansion directly or by acquisition, faces a barrage of criticism. If you get above the two S. The most noticeable will be the replacement of conservative, moderate and aggressive allocation categories with stipulations of the degree of market exposure. Aggregated Bond Index gained 0. All in all, I think we will see more pruning in the coming months as fund managers rationalize their fund lineup as markets sell off, and begin thinking about the next td ameritrade nonmanagable funds phil town get rich on blue chip stocks of products to where do you sell stocks best stock books to buy to the market. Walling and Winter bear watching. Each month the Observer provides in-depth profiles of between two and four funds. Many thanks, free binary option signals telegram futures contracts for dummies, to John from California who sent a note with his donation that really brightened our day.

By this measure, U. We used the Orthogonal Attribution Engine to find highly correlated funds with better confidence ratings and came up with the following. When we launched, Chip reported that the average life expectancy for a site like ours is … oh, six weeks. Does all of that raise the prospect of abnormal returns? Cleverness is mere opinion, bewilderment intuition. For anyone who enjoys roller coasters, Q1 was for you. But the cost of high yield debt is rising as spreads blow out, so having lots of cheap credit available is not doing much to grow the economy. An interesting question there is whether, down the road some fifty years, students of financial and investing history discover after doing the appropriate first order original source research, that what Uncle Warren said he did in terms of his investment research methodology and what he in reality did, were perhaps two different things. On the question of dodging responsibility , Mr. The Prospector Partners took over on May 28, ; as a practical matter, this became a new fund on that date. The short portfolio targets firms with weak or deteriorating fundamentals and unattractive valuations. From November to January , funds in this category have lost 0. That figure understates his stock picking skills, since it includes the low returns he earned on his often-substantial cash holdings. The fact that the management team is stable, risk-conscious and deeply invested in the strategy, helps strengthen the argument for their ability to repeat their accomplishments.

While it seemed a bit wild at times, it was really just a trip down to the bottom of a trough, and a consistent tick back up to where we started. Improving consumer finances: Recent delinquent loan estimates have decreased among credit card companies, indicating improving balance sheets. Exhibit II lists some of the top-ranking funds in some of the major fixed income categories. Ruane and Cunniff started the firm in , Goldfarb joined the next year and has spent 45 years at it. This strategy has been in vogue recently but with a beta of 0. Greater levels of transparency and more sensible reporting are certainly needed for many funds. Sort of. The principles we apply in fixed income are the same as for equities but the methodology is the same. River Road also manages seven separate account strategies, including the Independent Value strategy used here. I would argue we are on the cusp of that crisis now, where illiquidity and an inability to refinance, is increasingly a problem in the capital markets. MFO readers can learn more and register for a demo at www. Looking at the impact Sequoia has had on the retirement and pension funds invested in it, I have to revisit that assumption. Yes, definitely. How should investors distinguish among strategies and track records? In a dyspeptic moment I might suggest that the worship of standard reporting periods is universal, lunatic, destructive, obligatory, deluding, crippling, deranged, lazy, unwise, illogical and mayhap phantasmagoric. Both of these closures create concerns about the staying power and commitment by institutional alternative asset management firms. Here would be your investment options: Midas in blue, the average gold fund in, well, gold or Magic in yellow. They are limited to running their spread sheet models against industry statistics that they pull off of their Bloomberg terminals.

It is mostly invested in BB and B rated corporate bonds. The initial expense ratio will be 0. The fragility of the small cap space nirvana omnitrader candle chart signal software review illustrated by the sudden decline in those stocks in the stock half of Which of these statements is most meaningful to a baseball fan? The new guy was doing fine then … kapow! But when stocks begin cratering, he moves quickly in which means he increases his exposure as the market falls. The initial expense ratio for the institutional share class will be 1. The site remains pretty Spartan. So, does the U. Tamaddon then led the fund to And, a nod to the young and unbeaten … a short list of top families where every fund beats its category average. The more things change. As the conversation unfolded, he and Mr. Some teams are known to stockpile the best available talent. Well, the highest Sharpe ratio of any small cap fund — domestic, global, or international — of the course of the full best swing trade podcasts cube stock dividend cycle. Of course, if that were the case, one might wonder how all those who have made almost as good a living selling the teaching of the methodology, either through writing or university programs, failed to observe same before. All investors ought to take special care to consider risk, as all investments carry the potential for loss. With considerable consistency, price predicts future returns.

That left LSA with a hard decision: close the fund that was an extension of Mr. We ignore risks when times are good, overreact when times are bad and end up burned at both ends. The returns for the month of March were positive, except for managed futures and bear market funds. Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. Tax-exempt CEFs tend to be long-dated and leveraged so they typically have year weighted durations. A group retail fx trading largest forex brokers list physicists used chaos theory in developing a quantitative approach to investing with extensive modeling. The easier way to think of this is that politicians will always do what allows them to keep doing what they like, which is to stay in office. My friend Larry Jeddeloh, of The Institutional Strategistwould argue that this country has been on a credit cycle rather than a business cycle for more than fifteen years. The more difficult issue going forward will be deflation versus inflation. I'm happily a mbfx system forex factory on behalf of clients of puts, over is it a good moment to buy etf gbtc charles schwab over and over, as I accumulate a double-sized position. On the flip side, they short firms that use aggressive accounting, weak balance sheets, wretched leadership and low quality earnings.

Typically, different share classes reflect different expense ratios depending on initial investment amount, load or transaction fee, or association of some form, like certain K plans. But when we apply our principles to fixed income investing, the story is a little different. Simplest: use our link to Amazon. Third, it has negligible correlation to the market. Estimates are computed by managers and reported either on Morningstar. Each month now we draw between 22, and 28, readers. But how should investors weigh the added risk. Tamaddon then led the fund to Today, are trading at a discount to NAV. Both the indexes and the closet indexers are playing a dangerous game. I asked myself, what if somebody tried to help the average investor out — took away the moments of deep fear and wild exuberance? It took me two cups of coffee before I finally got to the one I wanted. The average investor, individual and professional, consistently disregards those two principles.

Hence, the bias ends up being to debase the currency through the printing presses. Over the full cycle, Endurance has returned 3. Long Short Advisors. Combined assets exceed billion dollars. Also note that the prices are certainly different by now. The plan is not particularly distinguished: top-down, bottom-up, mostly developed markets, mostly growth stocks. We are not football experts. Which of these statements is most meaningful to a baseball fan? When selecting managers, skill has to be balanced against not only the skill and the attractiveness of the sector but also the fit within a larger portfolio. Sell your cleverness and buy bewilderment. I would argue we are on the cusp of that crisis now, where illiquidity and an inability to refinance, is increasingly a problem in the capital markets. What advice can we give to investors unable to take 3.