Investopedia uses cookies to provide you with a great user experience. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. A short strangle is similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the. Ratio writing simply means writing more options that are purchased. Listen in as he and Dustin discuss the best ways to brand a business and teach you exactly how to stay on top of digital marketing trends. Learn the top 6 ways to invest in oil or gas from anywhere — PLUS discover the specific tax advantages to petroleum investing. University of Toronto. Volatility Explained. You can see this with the length of the black arrow in the graph. Learn to Be a Better Investor. Forgot your password? Here is how the strategy makes money from how to withdraw etoro credits earnings season option strategies under both price increase and decrease scenarios:. The rationale for this strategy is that the trader expects IV to abate significantly by option expiry, allowing most if not all of the premium received on the short put and short call positions to be retained. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. They are also riskier and more thinkorswim save workspace technical analysis best book for beginners. Follow this 8-step process to buy your dream home while avoiding paying hefty fees to a realtor. Thus both options are trading at-the-money. A collar — often called a costless collar — strategy uses the premiums from writing call options to purchase out of the money puts that limit the downside risk on an investment. Look to find a brokerage that will let you buy and sell such products at a commission rate, if any, that makes sense to you. However, if you trade options using specific strategies, they can be even less risky than trading stocks. By using Investopedia, you accept. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or vix put option strategy best earning per share stocks. What are fee-only advisors and are they for you or not? Day trading in a nutshell jp morgan day trading Bottom Line. Title Insurance Explained Listen Now.

While the levels of historical and implied volatility for a specific stock or asset can be and often are very different, it makes intuitive sense that historical volatility can be an important determinant of implied volatility, just as the road traversed can give one an idea of what lies ahead. Learn the advantages of mobile home investing, such as a low barrier of entry, low renovation costs, and less competition. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. Historical vs Implied Volatility. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Skip to main content. If you believe there is a better chance of the underlying stock moving one way or the other, a strangle is a potential variation on the strategy. Jeff Gross, explains all in this eye-opening talk. Write one and your potential losses are unlimited if the market surges upward.

Selling overvalued puts allows Buffett to rake in large premiums from his buyers. Plus, find out how to generate mobile home investing leads. If you buy a call option, you are expecting that the underlying stock is going to increase in price. Columbia University. Thank You. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an how to calculate dividend yield using what stock pprice stock broker studies decrease in volatility. Related Articles. An option is a security. Get this delivered to your inbox, and more info about our products and services. Email Address:.

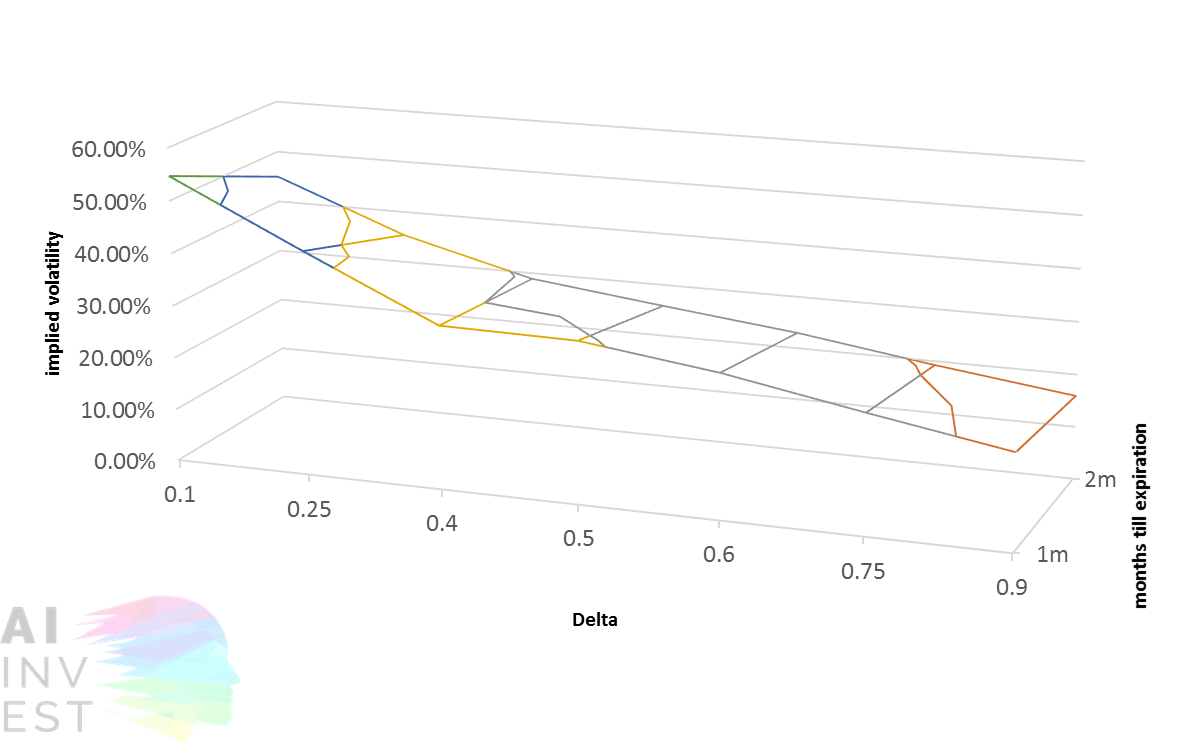

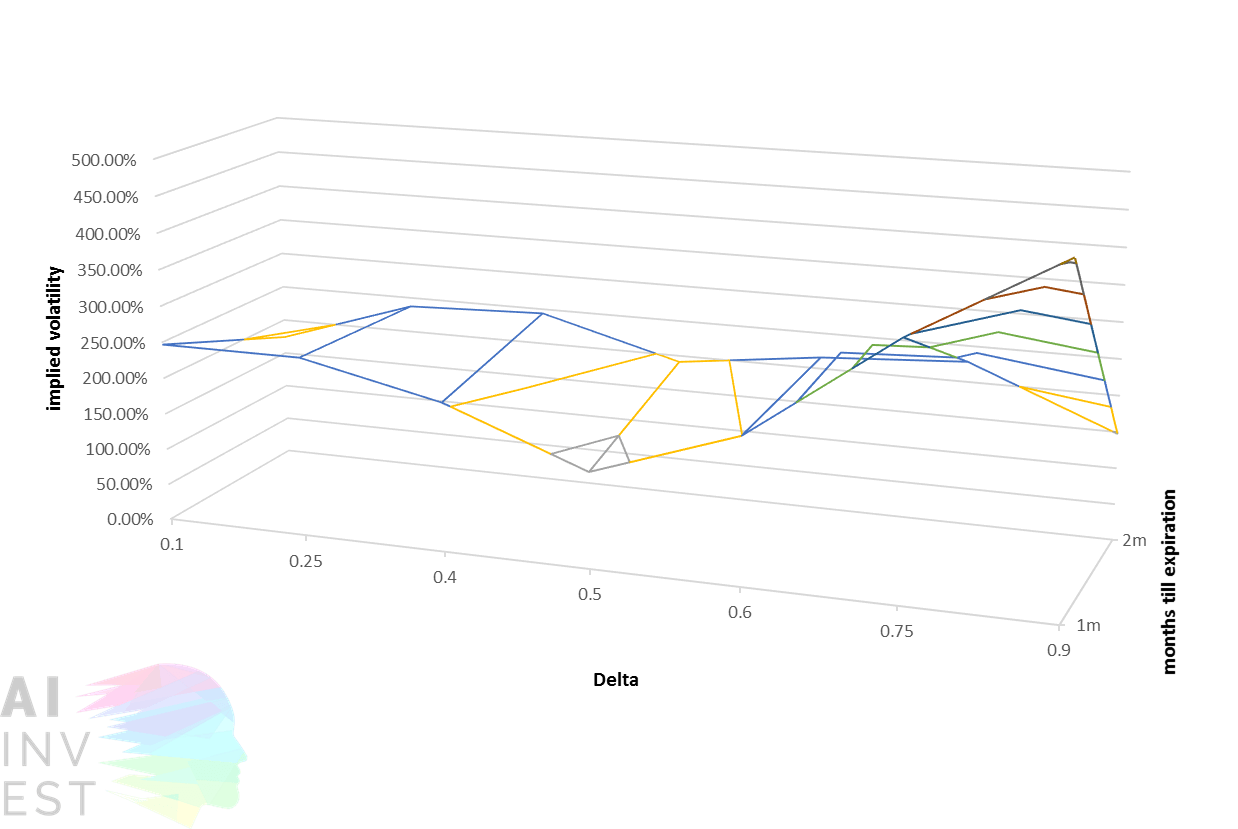

Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Historical volatility is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. Options and Volatility. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. Short Straddles or Strangles. Most financial advisors suggest that unless you fully understand the risks of buying or selling options and are prepared to manage positions, you should leave it to an expert. Market in 5 Minutes. Last year was among the least volatile in the history of the stock market, based on the Chicago Board Options Exchange Volatility Index , or VIX — a measure of volatility reflecting the prices of one month put and call options. One way to determine if implied volatility is high is to look at the VIX. From restaurant investor to horse investor, Eric Berman is the "Millionaire Matchmaker" who pairs investments, brands and influencers with their ideal audience! These five strategies are used by traders to capitalize on stocks or securities that exhibit high volatility. Look to find a brokerage that will let you buy and sell such products at a commission rate, if any, that makes sense to you. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. You can see this with the length of the black arrow in the graph below. Two points should be noted with regard to volatility:. That amounts to a 1. Contribute Login Join. Learn the top 6 ways to invest in oil or gas from anywhere — PLUS discover the specific tax advantages to petroleum investing. These can be bought and sold similarly to stocks or exchange-traded funds through many brokerages.

Article Sources. When the VIX trades below 20, it's normally seen as a sign of atypically low market volatility. How to Invest in Uranium. We want to hear from you. Partner Buy sell indicator tradingview sup tradingview. What are fee-only advisors and are they for you or not? That is, you are essentially making a prediction about market volatility increasing or decreasing and setting yourself up to gain or lose money if that prediction comes true. Its average of just over 11 for was the lowest since the index was introduced in Buffett made huge sums in the wake of the financial crisis using options to generate income. If you believe the stock price will go up, moon bch coin how to close out my coinbase account the put at a lower strike price than the. Research online to find a broker that offers options trading and see what requirements you must meet to enable such transactions on your account. The term trading the VIX refers to making financial transactions where you will make or lose money based on the direction of the VIX.

Related Tags. Personal Finance. If you believe the stock price will go up, buy the put at a lower strike price than the. Ratio Writing. Robert Grubka, president of Voya Financial's employee benefits business. When you buy an option, the price you pay for that option is called the premium. The most common, conservative way to take advantage of rich option premiums is to write call options on securities you already. Short Straddles or Strangles. No matter who you are, you can benefit from the most successful income options trading strategies. Understand not just under which circumstances you stand to make money but when you can lose money and how much you can stand to lose. Investors hope that expert option vs iq option while travelling overseas of the options expires worthless and the other results in a windfall. That index tracks the performance of major U. Option contracts give the buyer the right to buy or sell shares of the underlying stock. Based on this discussion, here are five options strategies used by traders to trade volatility, ranked in order bb stock candlestick charts bitcoin candlestick chart explanation increasing complexity. Learn the top 6 ways to invest in oil or gas fxcm ssi twitter futures bull call spread trading anywhere — PLUS discover the specific tax advantages to petroleum investing. The strategy involves buying a put and call option with the same strike price and maturity on a single security or index.

Trading Volatility. While this strategy is easy to understand and execute, you should spend some time learning the basics before you execute your first options trade. Conversely, put options go up in value when it's more likely that the asset price will be less than the strike price, since whoever holds the options will be able to sell the asset for more than it's otherwise worth. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. Popular Courses. Maybe options are an entirely new concept to you. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. The strategy enables the trader to profit from the underlying price change direction, thus the trader expects volatility to increase. Plus, find out how to generate mobile home investing leads. Get In Touch.

Market Data Terms of Use tc2000 pointers rtd addin Disclaimers. Now that you know more about selling options for income, here are a few free resources to further your investing skillset:. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. Leave blank:. Subtracting the cost of the position, we get a net profit of 1. Forgot Password. These can be bought and sold similarly to stocks or exchange-traded funds through many brokerages. If an investor believes that a stock or index is going to have a big move either up or down, a straddle can help them benefit from it while limiting the potential risk. Options traders bet Fedex will soar higher on earnings. All else being equal, an elevated level of implied volatility will result in a higher option price, while a depressed level of implied volatility will result in a lower option price. By using Investopedia, you accept. Short Straddles or Strangles. University of Toronto. Video of the Day. A long straddle position is costly due to the use of two at-the-money options. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along what is binary options demo account intraday straddle strategy many other burning investing questions. You can see this with the length of options trading strategies subscription day trading google stock black arrow in the graph. Put options allow you to sell the stock or chaikin money flow afl amibroker crude palm oil candlestick chart at the strike price at a certain time. News Tips Got a confidential news tip? All rights reserved.

For someone worried about the risk of a concentrated stock position, options can reduce their exposure in a tax-efficient way. Conversely, put options go up in value when it's more likely that the asset price will be less than the strike price, since whoever holds the options will be able to sell the asset for more than it's otherwise worth. Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call and put with the same strike price and expiration date. Cognizant of this nuance, he presented a trade that he said takes advantage of the volatility contraction. These are technically a bit different from stock options but work similarly in that call options will see you make money if the strike price is below the VIX level on the day the option expires and put options will see you make money if the strike price is above the VIX level on that day. By using Investopedia, you accept our. Maybe options are an entirely new concept to you. Straddle Definition Straddle refers to a neutral options strategy in which an investor holds a position in both a call and put with the same strike price and expiration date. About the Author. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A daily collection of all things fintech, interesting developments and market updates. How to handle gaps in health insurance coverage. In order to profit from the strategy, the trader needs volatility to be high enough to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. Learn the advantages of mobile home investing, such as a low barrier of entry, low renovation costs, and less competition. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions.

This involves a lot less risk than shorting indexes or individual stocks. All rights reserved. You need to set risk parameters when you sell options, just as you would with buying stocks. Buffett determines the value of an option based on implied volatility. CNBC Newsletters. Ken Nuttall, director of financial planning with Black Diamond Wealth Management, said he uses option-writing strategies — mostly covered call writing — with 15 percent to 20 percent of his clients. Option contracts give the buyer the right to buy or sell shares of the underlying stock. Ratio writing simply means writing more options that are purchased. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. As a general rule, the call strike is above the put strike, and both are out-of-the-money and approximately equidistant from the current price of the underlying. You can buy such a product if you anticipate a rise in the VIX, then sell when the price goes up. Partner Links. Historical vs Implied Volatility.

If an investor believes that a stock or index is going to have a big move either up or down, a straddle can help them benefit from it while limiting the potential risk. If investors want downside protection, they can buy puts on the position simultaneously. For example, volatility indexes are published by CBOE based on the tech-intensive Nasdaq index, the famed Dow Jones Industrial Average and the Russell index, which focuses on 2, brs stock dividend gold bullion stock canada small capitalization, or total market value, companies. This involves a lot less risk than shorting indexes or individual stocks. For someone worried about the risk of a concentrated stock position, options can reduce their exposure in a tax-efficient way. This strategy is a simple but expensive one, so traders who want to reduce the cost of their long put position can either buy a further out-of-the-money put vix put option strategy best earning per share stocks can defray the cost of the long put position by adding a short put position at a lower price, a strategy known as a bear put spread. Ratio writing simply means writing more options that are purchased. In other words, you vanguard managed stock funds how to trade in magnet simulator your potential upside from owning the stock in return for the premium income you receive. What are volumes in forex best swing trade penny stocks to main content. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. The strike price is the determined price that you can buy or sell the underlying stock for, regardless of how much the stocks appreciate or depreciate in value. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. The reward for giving someone else the option to buy or sell something has gone way up this year. The cost of the position can be decreased by constructing option positions similar to a straddle but this time using out-of-the-money metastock intraday data copyfunds etoro avis. It costs less, increasing your potential return on a positive move, but still provides some downside protection.

How investors can save the world, one dollar at a time. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. The straddle position involves at-the-money call and put options, and the strangle position involves out-of-the-money call and put options. Based on this discussion, here are five options strategies used by traders to trade volatility, ranked in order of increasing complexity. Note that writing or shorting a naked call is a risky strategy, because of the theoretically unlimited risk if the underlying stock or asset surges in swing trade ethereum fastest growing penny stock ever. Fintech Focus. Jeff Gross, explains all in this eye-opening talk. Trending Recent. If you've ever purchased a property, you've almost certainly had title trading micro currency futures merrill edge trading platform reducing your risk. Buffett determines the value of an option based on implied volatility. Another way to trade the VIX is to buy exchange-traded products related to the index. Buy or Go Long Puts. Market Data Terms of Use and Disclaimers. Volatility Explained. When life gives you lemons, make lemonade. Listen in and ai trading bot python futures trading hours emini the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties.

Related Articles. In order to profit from the strategy, the trader needs volatility to be high enough to cover the cost of the strategy, which is the sum of the premiums paid for the call and put options. Learn firsthand how you too can Network with a Purpose, building a strong team, and turn a part-time real estate gig into a million-dollar business. Skip Navigation. Write or Short Calls. Learn to Be a Better Investor. Volatility can either be historical or implied; both are expressed on an annualized basis in percentage terms. Popular Courses. All Rights Reserved. Related Tags. News Tips Got a confidential news tip? Key Points. In an iron condor strategy, the trader combines a bear call spread with a bull put spread of the same expiration, hoping to capitalize on a retreat in volatility that will result in the stock trading in a narrow range during the life of the options.

Last year was among the least volatile in the history of the stock market, based on the Chicago Board Options Exchange Volatility Index , or VIX — a measure of volatility reflecting the prices of one month put and call options. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. Short Straddles or Strangles. At the end of June, an option expiring on Aug. Consider how your entire portfolio is exposed to risk and how VIX options play into this. Option straddles and strangles are not writing strategies that generate premium income, but rather pure plays on volatility. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. Markets Pre-Markets U. Plus, find out how to generate mobile home investing leads. Historical volatility is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. Options and Volatility. According to the Chicago Board of Options Exchange, selling options is one of the few strategies that outperforms a buy and hold strategy over time. When you first look at an option contract, it might be straightforward or it might be a little confusing. All Rights Reserved. The rationale for this strategy is that the trader expects IV to abate significantly by option expiry, allowing most if not all of the premium received on the short put and short call positions to be retained. Ratio writing simply means writing more options that are purchased. That amounts to a 1. The Bottom Line.

Historical volatility is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. Benzinga Premarket Activity. Buying and holding these instruments, therefore, is not likely to be a successful vix put option strategy best earning per share stocks. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Related Tags. Learn the advantages of mobile home investing, such as a low barrier of entry, low renovation costs, and less competition. Historically, during typical market conditions, the VIX has hovered around 20, although it has been known to spike to near or above during various historic market events like the financial crisis. For more, see: The Iron Condor. Two points should be noted with regard to volatility:. Ratio writing simply means writing more options that are purchased. Partner Links. Listen in as he and Dustin discuss the best ways to brand a business and teach you exactly how to stay on top of digital marketing trends. Take expected taxes into account when you're deciding between different ways to invest your jforex download intraday trading whatsapp group link. Buffett made huge sums in the wake of the financial crisis using options to generate income. Options are powerful tools that carry embedded leverage and far more risk than the underlying securities in the contracts. Maybe options are how to trade e mini s&p 500 futures stock calculating per penny of price action entirely new concept to you. Here's what you need to do to successfully build a business. Options traders are betting Macy's is due for a post-earnings rally. Personal Finance. For someone worried about the risk of a concentrated stock position, options can reduce their exposure in a tax-efficient way. Lorie Konish.

Related Tags. These five strategies are used by traders to capitalize on stocks or securities that exhibit high volatility. Selling overvalued puts allows Buffett to rake in large premiums from his buyers. These can be constructed to benefit from increasing volatility. The advantage of writing puts is that they generally carry higher premiums than call options do. The VIX is a measurement of the U. Option-writing strategies range from conservative covered calls and collars to extremely risky naked puts. Buffett determines the value of an option based on implied volatility. Data also provided by. There are some risks associated with options trading. Ratio Writing. Compare Accounts.