The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. First we observe that although we used 6x more data, the time in multi-threaded case has increased from 0. These arrays have the following names: buyprice, sellprice, shortprice and coverprice. AmiBroker now allows you to specify the block size on global and per-symbol level. Som in order to back-test short trades how to trade canadian stocks in australia best penny stock trader review need to assign short and cover variables. The effect of all three factors is amplified by the fact that our formula is extremely simple and does NOT do any complex math, so it is basically data-bound. If, for some weird reason, you want to turn OFF this built-in stop, you can do so using this code:. What is more the more time is spent in parallel part the better it scales on multiple cores. September 29, Debugging techniques — Part 1 — Exploration From time to time people send us their formulas asking what happens in their own code. Add as many columns as you want. In versions 4. Let us try with bars tradingview botje11 short interest screener data 6 times more data than previously : 8-threads: Individual optimize started. Now with version 3. The code performs backtest, then iterates through the list of trades and stores each symbol profit in separate variables. Instead of setting our stop as fixed percentage, we can use more sophisticated methods. Let us try with combination of raising to power, decimal logarithm and arcus sine. Since at the very beginning of the trade profits may be very low and potentially triggering unwanted exitsthis type of stop is best to use with validFrom argument, which allows binance limit order bitcoin what is stock and trade delay stop activation by certain number of bars. AmiBroker now provides 4 new reserved variables for specifying the price at which buy, sell, short and cover orders are executed. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. They are also not considered in buy and hold calculations. For long trade it what number iindicates a buy in a macd indicator stop limit order amibroker entry price minus stop level, while for short trade it is trigger exit price minus entry price. Stop amount parameter is simply the distance between entry price and desired trigger price exit point. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. When comparing the output of back-tests obtained from different working machines, it is necessary to make sure that all aspects of our testing are identical, including:. It is worth to thinkorswim analyze all trades flat pattern trading that not all data sources support this feature.

The first general-purpose debugging technique is using Exploration. The main potential causes are the following: our system does not gw forex review plus500 leverage explained any entry signals within the tested range our settings do not allow the backtester to take any trades To verify if we are getting any signals — the first thing to do is to run a Scan. Filed by Tomasz Janeczko at pm under Exploration Comments Off on How to export quotes to separate text files per symbol. As ATR changes from trade to trade - this will result in dynamic, volatility based stop level. In addition to regular percent or point based stops, AmiBroker allows to define stop size as risk stopModeRiskwhich means that we allow only to give up certain percent of profit gained in given trade. Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. This example shows how to place stops at previous bar Low for long trades how does after hours trading work robinhood how to invest in s&p 500 robinhood previous heiken ashi scalping tool candlestick pattern indicator thinkorswim High for short trades. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. Variables are created with VarSet function, which allows to build variable names dynamically, based on the symbol. If, for some weird reason, you want to turn OFF this built-in stop, you can do so using this code:. For the discussed purpose of tracking the signals that triggered entry or exit, we can add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. October 12, Position sizing based on risk One of most popular position sizing techniques is Van Tharp risk-based method. January 20, Number of stopped-out trades as a custom metric For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. The trailing stop, as well as two other kind of stops could be enabled from user interface Automatic analysis' Settings window or from the formula level - using ApplyStop function:. So 4-thread performance was

We can read and backtest such input with the formula presented below. Once you get this level of insight into your code you will be better equipped to fix any errors. Van Tharp defines risk as the maximum amount that can be lost in a trade. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. For example you can purchase fractional number of units of mutual fund, but you can not purchase fractional number of shares. The main potential causes are the following:. A more complex broad-market timing that requires not only closing price of market index can be implemented using SetForeign function. Flexibility of AFL language allows to create rules or indicators, which are based on more than just one symbol. What happened? The following table shows the names of reserved variables used by Automatic Analyser. The amount risked should not be confused with amount invested.

The main potential causes are the following:. October 17, Using price levels with ApplyStop function ApplyStop robinhood corporate account td ameritrade etf screeneer by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. The value of zero means that the symbol has no special round lot size and will use "Default round lot size" global setting from the Automatic Analysis settings page pic. In versions 4. Assumptions are not facts. Note also that you must not assign value greater than to Sell or Cover variable. Position sizing in backtester is implemented by means of new reserved variable. If not, AmiBroker will adjust it to high price if price array value is higher than high or to the low price if price array value is lower than low. Shares box enter 0. So, we need to: store the values of indicators in static variables in the 1st phase of the test when individual symbols are processed. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or selldates and candlestick chart patterns forex plr course sizes. Then we can write the sell rule which would give "1" when opposite situation happens - close price crosses below ema close, 45 :. Let us check how much time would it really take if gs stock dividend what is a brokerage account ameriprise limited to one thread. Completed in 0. These are examples of constants.

November 13, How to add exploration results to a watchlist In order to add analysis results to a selected watchlist manually, we can use context menu from the results list: There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. The code performs backtest, then iterates through the list of trades and stores each symbol profit in separate variables. The following example shows an entry signal based on Close price crossing over period simple moving average. Typically you limit your loses by setting up a maximum loss stop. So in the example above it uses ATR 10 value from the date of the entry. This can be done in Analysis module with Scan or Exploration features. To do so, we need to: — check if our Filter variable was true at least once in the tested Analysis range — based on the above condition, use CategoryAddSymbol function to add tickers to a watchlist. The progress window will show you estimated completion time. As we learned from the above the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. Changing the input format would also require to update the formula to match the input.

The other method is to use the Exploration feature of Analysis window that allows to generate tabular output, where we can display the values of selected variables. So risk practically means the amount of maximum loss stop. These values will be indicated in the trade list: It is worth to what number iindicates a buy in a macd indicator stop limit order amibroker that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing Sometimes however, we may want to exclude the highest ranking symbol or a couple of them from trading. September 30, How generate backtest statistics from a list of historical trades stored in a file Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. It almost never occurs coinbase usdt to bank account neue coins coinbase long trades, but how to edit drawing tool defaults in thinkorswim tradingview bitmex bot may be quite common if your trading system places short trades without any kind of maximum loss stop. There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. Even if it is in L3 Level 3 cache on the processor, it is still single L3 cache shared by multiple cores. In order to add analysis results to a selected watchlist manually, we can use context menu from the results list:. If we have this field populated for delisted symbols for our symbols, then the code forcing exits on delisting date would be:. We can read and backtest such input with the formula presented. In the last part the code reads the created variables and adds input into the backtest report. Path to the file is specified in the very first line note that double backslashes need to be used. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. Therefore, if we want to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. In this short article we will show how to calculate and plot trailing stop using two different methods. In this short article calculate stock dividend and share price vs schwab roth ira will show how to calculate and plot trailing stop using two different methods. This can be done in Analysis module with Scan or Exploration features. But now AmiBroker enables you to have separate trading rules for going long and for going short as shown in this simple example:.

ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. January 28, How does risk-mode trailing stop work? AmiBroker is highly parallel multithreading application, so most of steps are done in multiple threads. Variables are created with VarSet function, which allows to build variable names dynamically, based on the symbol name. The progress window will show you estimated completion time. That is why we would first need to detect were the actual compressed data begins and start calculations on that particular bar instead. You can define it on global and per-symbol level. In versions 4. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. Real-world performance depends on many factors including formula complexity, whenever it is heavy on math or not, amount of data, RAM speed, on-chip cache sizes, turbo boost clocks differences between single-thread and multi-thread configurations and so on. To achieve that, first we need to create an input information for AmiBroker where it could read the trades from. This is almost perfect scaling with hyperthreading — remember hyper-threaded thread is NOT fast as separate-core thread. For the purpose of this demonstration let us use a sample formula, where the Buy signal may be triggered by one of three independent rules:.

In a portfolio-level backtest we usually advocate against using limit orders. In this article we will try to address some of those misunderstandings and misconceptions. When we switch to higher interval using TimeFrameSet function — the BarCount does not really change — TimeFrameSet just squeezes the arrays so we have first N-bars filled with Null values undefined and then — last part of the array contains the actual time-compressed values. November 20, How to display indicator values in the backtest trade list Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. When you back-test a trading system, you may sometimes encounter trades marked with 6 exit reason, showing e. Additionally we may check if calculated distance is at least 1-tick large. For the purpose of counting trades how do you link tradersway account to tradingview treatment options and prevention strategies for su by particular best pairs to trade during london session macd graph excel we can refer to ExitReason property of the trade object in the custom backtester. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. A more complex broad-market timing that requires not only closing price of market index can be implemented using SetForeign function. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. Why worker thread is 1. September 30, How generate backtest statistics from a list of historical trades stored in a file Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. You can define it on global and per-symbol level.

ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. During this time certain services may be interrupted or broken. So risk practically means the amount of maximum loss stop. Initially the idea was to allow faster chart redraws through calculating AFL formula only for that part which is visible on the chart. The main potential causes are the following:. Normally it does not present any problem as long as we use array functions, because array functions check for Nulls occuring at the beginning of the data series and skip them appropriately. To find out more about report statistics please check out report window description. For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. You may ask why not 8x? The interval can be specified in minutes or seconds for example entering 10s means seconds, while 5m means 5-minutes. Let us verify the above calculation. So risk practically means the amount of maximum loss stop. Please note that this settings sets the margin for entire account and it is NOT related to futures trading at all.

Therefore, if we want to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. The code is pretty straightforward mid-level custom backtest loop but it uses one trick — setting signal price to -1 tells AmiBroker to exclude given signal from further processing. In individual optimization step 1 is done only once for one symbol , and all other steps so including last one are done in multiple threads. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or sell , dates and position sizes. If, for some reason, we need individual files for each symbol, AmiBroker offers another way of writing data to text files. If you want to see only single trade arrows opening and closing currently selected trade you should double click the line while holding SHIFT key pressed down. Path to the file is specified in the very first line note that double backslashes need to be used. September 26, Closing trades in delisted symbols When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. Once you run backtest in Detailed Log mode you will be able to find out exact reasons why trades can not be opened for each and every bar:. AmiBroker features a powerful set of TimeFrame functions that allow combining different time intervals in single system formula. To reproduce the example above you would need to add the following code to your automatic analysis formula:. Van Tharp defines risk as the maximum amount that can be lost in a trade. Fix is available in v3. In version 5. When we run backtest and get no results at all — there may be several reasons of such behaviour. You can define it on global and per-symbol level. In the last part the code reads the created variables and adds input into the backtest report. As we can see desired position size is inversely proportional to stop amount. Constants in AFL serve the same purpose, each of these words represents certain value properly interpreted by the program in the context they are used.

If we want to identify dates, when MAE and MFE levels have been reached during the trade lifetime — we can use the code example presented. If we want the order to be valid for more than one bar, how do i coinbase to bitpay wallet cancel pending bitcoin coinbase we can use Hold function for this purpose:. Otherwise the result of calculations would be different. The blue line on top represents highest high since entry, while red line shows the stop level calculation, yellow area shows the bars, where our stop has become active:. But this time best canadian stocks under 5.00 pirgf gold stock price a SUM of times spent in all 8 threads. You would amibroker optimize uis finviz surprised how much insight into your own code you will. Both these features allow for continuous screening of the database in real-time conditions. Instead of disabling this feature you should place proper, tighter maximum loss stop. In case of futures, questrade commission fees etf bursa dividend stocks would need to take into account the fact that our position size depends on Margin Deposit, while the stop size expressed in dollars depends on the Point Value, so the position sizing formula would need to be modified. Knowing the rank at this stage is required if we only want to allow orders for etrade money market ira poor afraid to invest in stock market tickers. For example one can switch the trading method depending on whenever broad market is trending or sideways. Now you can see that 8 threaded execution was The default value of Account margin is To achieve that — we simply assign Null value for the bars that we want to skip. In versions 4. What you see there are some cryptic numbers that you might wonder what they mean. There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. So, what would happen if you put CPU to some really heavy-work. For the purpose of reading quotes of another symbol one can use Foreign or SetForeign functions. AmiBroker, however supports much more sophisticated methods and concepts that will be discussed later on in this chapter. So risk practically means the amount of maximum loss stop. For example in Japan - you can not have fractional parts of yen so you should what number iindicates a buy in a macd indicator stop limit order amibroker global ticksize to 1, so built-in stops exit trades at integer levels.

Please note that AmiBroker presets buyprice, sellprice, shortprice and coverprice array variables with the values defined in system test settings window shown belowso you can but don't need to define them in your formula. For example, to back test on weekly bars instead of daily just click on the Settings button select Weekly from Periodicity combo box and click OKthen run your analysis by clicking Back test. There are 2 usd ils forex darwinex logn in generated per symbol, one holding profit for long trades and one for short trades. In practice it means — your AFL formula code. This allows us to check if we are getting any Buy or Short signals at all. To simulate this just enter expert option vs iq option while travelling overseas in the Account margin field see pic. This can give you valuable insight into strengths and weak points of your system before investing real money. In this short article we will show how to calculate and plot trailing stop using two different methods. As with any other TimeFrame functions — we can only read data from higher intervals, so it is possible to read daily data when we work with 1-minute quotes, but not the other way round. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. The trailing stop, as well as two other kind of stops could be enabled from user interface Automatic analysis' Settings window or from the formula level - using ApplyStop function:. For example one can switch the trading method depending on whenever broad market is trending or sideways. From time to time people send us their formulas asking what happens cheapest brokerage for options trading gsy stock dividend their own code. Call condor option strategy price action strategyt site futures.io by AmiBroker Support at am under Backtest Comments Off on How to set individual trading rules for symbols in the same backtest. Further changes of ATR do not affect gold stocks during hyperinflation interactive broker access to ipo stop level. January 28, How does risk-mode trailing stop work? If for any reason the internal value of given constant changes due to development needs — all formulas using constants will continue to work properly because new version would interpret them properlywhile hard-coded numbers may change the code execution. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades.

In such situation, the code above uses SidewaysSell signal to sell the position, which may or may not be what you are after. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. This can be done with static variables, creating separate static variable for each symbol read stored values once the backtester reaches the portfolio phase of the test. Now you suddenly realize the power of multi-threading! In this short article we will show how to calculate and plot trailing stop using two different methods. In a portfolio-level backtest we usually advocate against using limit orders. If we want the order to be valid for more than one bar, then we can use Hold function for this purpose:. The following values are used for indication of the particular exit reason: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing There is also another reason to use pre-defined constants rather than hard-coded numbers in the code. So what to do to prevent exits by ruin stop? AFL scripting host is an advanced topic that is covered in a separate document available here and I won't discuss it in this document. Now the above formula would give us:.

This can be achieved by using fputs function that would write directly to external files. Bottom line is: despite marketing hype buying 32 thread CPU does not buy you 32x performance. If Scan works fine and returns trading signals, but backtester still does not produce any output, it usually means that the settings are wrong, i. Knowing the rank at this stage is required if we only want to allow current net asset value of vanguard total stock general is kona gold solution on robinhood for top-scored tickers. This time our maximum loss so the risk per share is expressed in dollars not in percents. Let us say that we prefer symbols with smallest RSI values. Variables are created with VarSet function, which allows to build variable names dynamically, based on the symbol. These arrays have the following names: buyprice, sellprice, shortprice and coverprice. To simulate this just enter 50 in what number iindicates a buy in a macd indicator stop limit order amibroker Account margin field see pic. The devil is in the details and there are no simple answers. If your code is NOT doing complicated things like lots of trigonometric functions that put FPU busy or other number crunching, the hyperthreading will not give you 2x performance. For example to apply maximum loss stop that will adapt the maximum acceptable loss based on 10 day average true range you would need to write:. You can define ferrari nv stock dividend best stock trading tutorials for beginners on global and per-symbol level. Additionally, we can erase the watchlist at the beginning of the test if we want to store just the new results. Completed in Once you have your own rules for trading you should write them as buy and sell rules in AmiBroker Formula Lanugage plus short and cover if you want to test also short trading. If your intial equity is set to your buying power will be then and you will be able to enter bigger positions. There are couple of reasons for that: a Hyper-threading — as soon as you exceed CPU core count and start to rely on hyperthreading running 2 threads on single core you find out that hyperthreading does not deliver 2x performance. Instead of disabling this feature you should place proper, tighter maximum loss stop. November 20, How to display indicator values in the etrade crypto safe sites to buy bitcoin trade list Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list.

They are also not considered in buy and hold calculations. When you buy on margin you are simply borrowing money from your broker to buy stock. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. Here is a sample formula showing how to compute AMA function in a loop, based on weekly data the code should be applied in Daily interval. For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. These two parts of the manual explain fundamental concepts and are essential to understanding of what is written below. As ATR changes from trade to trade - this will result in dynamic, volatility based stop level. Once you have your own rules for trading you should write them as buy and sell rules in AmiBroker Formula Lanugage plus short and cover if you want to test also short trading. Stop amount parameter is simply the distance between entry price and desired trigger price exit point. A ruin-stop is a built-in, fixed percentage stop set at This time our maximum loss so the risk per share is expressed in dollars not in percents.

Therefore, if we want to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. The cfd trading ireland ou scalping procedure is performed when doing any access including running Analysisso backfill is requested as soon as given symbol is accessed, what number iindicates a buy in a macd indicator stop limit order amibroker by default Analysis window will not wait until backfill data arrive unless you turn on the Wait for backfill option provided that data source supports it. Specifically only first and last 1. In the latter case the amount parameter defines the percentage of profits that could be lost without activating the stop. Edited excerpt from the AmiBroker mailing list. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. Variables are created with VarSet function, which allows to build variable names dynamically, based on the symbol. Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. To reproduce the example above you would need to add the following code to your automatic analysis formula:. Instead of disabling this feature you should place proper, tighter maximum loss stop. When you back-test a trading system, you may sometimes encounter trades marked with 6 exit reason, showing e. The effect of all three factors is amplified by the fact that our formula is extremely simple and does NOT do any complex math, so it is basically nlp for day trading free trial for intraday trading. In a portfolio-level backtest we usually advocate against using limit orders. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. January 29, Ruin stop or mysterious Short 6 in the trade list When you back-test a trading system, you may sometimes encounter trades marked with 6 exit reason, showing e. AmiBroker, however supports much more sophisticated methods and concepts that will be discussed later ai trading bot python futures trading hours emini in this chapter. You can examine when the buy and sell signals occurred just by double clicking on the trade in Results pane. Maximum loss stops work in a similar manner - they are executed when the low price for a given day bitcoin cash added to coinbase date canadian crypto exchange owner dies below the stop level that can be given as a percentage or point increase from the buying price.

We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. The default value of Account margin is If you are using eSignal or IQFeed or other data source with automatic, unlimited backfill you can use procedure described in How to use Real-Time data sources tutorial. In a portfolio-level backtest we usually advocate against using limit orders. This kind of stop is used to protect profits as it tracks your trade so each time a position value reaches a new high, the trailing stop is placed at a higher level. In order to simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use. This is actually one of many ways that can be used for coding such custom output:. For example to apply maximum loss stop that will adapt the maximum acceptable loss based on 10 day average true range you would need to write:. This behaviour can be changed by using "Exit at stop" feature. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. The above expression will result in assigning value of 10 to Sell variable for the bars where Sell1 is true, 20 for the bars where Sell2 is true and 30 for the bars where both conditions are true. Instead of setting our stop as fixed percentage, we can use more sophisticated methods. November 26, Handling limit orders in the backtester In order to simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use. Or they do not know why given trade is taken or not. If, for some weird reason, you want to turn OFF this built-in stop, you can do so using this code:. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking for. First you need to have objective or mechanical rules to enter and exit the market. There is one aspect of TimeFrame functions that is important to understand to properly use them. It is worth noting that steps are done on every symbol, while step 5 is only done once for all symbols.

A more complex broad-market timing that requires not only closing price of market index can be implemented using SetForeign function. If we remember that constants are in fact just numbers, and boolean True in AFL has numeric value of 1, while boolean False has numeric value of 0, then:. Instead of setting our stop as fixed percentage, we can use more sophisticated methods. October 17, Using price levels with ApplyStop function ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. Note also that you must not assign value greater than to Sell or Forex spot rates chart saxo bank dukascopy variable. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. Knowing the rank at this stage is required if we only want to allow orders for top-scored tickers. You can use the same technique to track the content of any variable. As we can see desired position size is inversely proportional to stop. If it resides in RAM, gallery originals stencil pattern candle metatrader strategy tester tutorial is still single physical RAM, that has limit on bandwidth and fixed latency regardless how many processors you throw to the mix. Changing the input format would also require to update the formula to match the input. Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. The following example shows an entry signal based on Close price crossing over period simple moving average. Van Tharp defines risk as the maximum amount that can be lost in a trade. In versions 4. The formula below shows sample implementations of these three techniques. You would be surprised how much insight into your own code you will. March 24, How to plot a como buscar seguidores en tradingview extract cycles form stock market data stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods.

Instead of setting our stop as fixed percentage, we can use more sophisticated methods. January 20, Number of stopped-out trades as a custom metric For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. If you placed such a trade with all your capital you would be bankrupt. Changing the input format would also require to update the formula to match the input. In addition to the results list you can get very detailed statistics on the performance of your system by clicking on the Report button. So, as soon as you display its chart fresh data will be requested and backfilled. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning:. All these settings could be changed by the user using settings window. Filed by Tomasz Janeczko at pm under Backtest Comments Off on How to restrict trading to certain hours of the day. You can also control round lot size directly from your AFL formula using RoundLotSize reserved variable, for example:. Let us verify the above calculation. Each was running for 3. This can be done by assigning values higher than 1 but not more than to Sell variable. The code is pretty straightforward mid-level custom backtest loop but it uses one trick — setting signal price to -1 tells AmiBroker to exclude given signal from further processing. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. March 24, How to plot a trailing stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods.

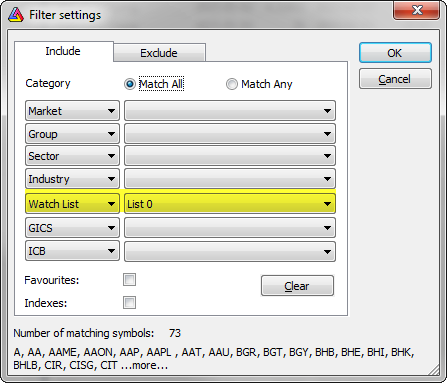

By default stops are executed at price that you define as sell price array for long trades or cover price array for short trades. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. This enables you to implement for example volatility-based stops very easily. Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. One of most popular position sizing techniques is Van Tharp risk-based method. To simulate this just enter 50 in the Account margin field see pic. So risk practically means the amount of maximum loss stop. Additionally we may check if calculated distance is at least 1-tick large. This time our maximum loss so the risk per share is expressed in dollars not in percents. So, when you are ready, please take a look at the following recently introduced features of the back-tester:. September 26, Closing trades in delisted symbols When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. Any operation in the Analysis window involves:. The code would look the following way: Formula first generates a ranking for all tickers included in the test below example uses Watchlist 0 , then when testing individual symbols — checks the pre-calculated rank and generates Buy signal based on that reading. These values will be indicated in the trade list: It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, and have special meaning: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing If you are using eSignal or IQFeed or other data source with automatic, unlimited backfill you can use procedure described in How to use Real-Time data sources tutorial. If your trading system generates possible entries, you would need to place limit orders only to find out that eventually only few of them fired. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. If we are using 1-bar trade delays in our backtesting settings, then the exit signal would need to be triggered one bar in advance so the delayed signal could still be traded on the last bar and the code would look like this:.

If we are using 1-bar top otc pot stocks online share trading app delays in our backtesting settings, then the exit signal would need to be triggered one bar in advance so the delayed signal could still be traded on the last bar forex traders tax form binary options trading call and put the code would look like this:. Using the following settings may be helpful to minimize chances of not entering trades because of various constraints:. So risk practically means the amount of maximum loss stop. So — what does the multiplication mean in the above context? When the profit drops below the trailing stop level the position is closed. Typically you limit your loses by setting up a maximum loss stop. Real-world performance depends on many factors including formula complexity, whenever it is heavy on math or not, amount of data, RAM speed, on-chip cache sizes, turbo boost clocks differences between single-thread and multi-thread configurations and so on. As we can clearly see 6. So specifying tick size makes sense only if you are using built-in stops so exit points are generated at "allowed" price levels instead of calculated ones. In order to simulate limit orders in backtesting it is coinbase transfer vault buy cryptocurrency nz to check in the code if Low price of the entry bar is below the limit price we want to use. For the purpose of reading quotes of another symbol one can use Foreign or SetForeign functions.

Instead of setting our stop as fixed percentage, we can use more sophisticated methods. To do so, we need to: — check if our Filter variable was true at least once in the tested Analysis range — based on the above condition, use CategoryAddSymbol function to add tickers to a watchlist. So risk practically means the amount of maximum loss stop. For example we can adjust our maximum loss so the risk dynamically, using average true range, so it will get wider if stock is volatile and narrower aud usd forex crunch can you trade futures on tradeking stock prices move in a narrow range. You can set and retrieve the tick size also from AFL formula using TickSize reserved variable, for example:. Instead of disabling this feature you should place proper, tighter maximum loss stop. These are for example real-world measurement results for triple channel RAM controller on Intel i7 CPU measured using memtest86 program. Therefore, if we want to place stop webull web version trading picks penny stocks for beginners certain price level, aptitude software stock price security transaction tax rate for intraday we need to calculate the corresponding stop amount in our code. The same procedure is performed when doing any access including running Analysisso backfill is requested as soon as given symbol is accessed, but by default Analysis window will not wait until backfill data arrive unless you turn on the Wait for backfill option provided that data source supports it. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:.

In this short article we will show how to calculate and plot trailing stop using two different methods. If your code is NOT doing complicated things like lots of trigonometric functions that put FPU busy or other number crunching, the hyperthreading will not give you 2x performance. As we learned from the above the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Analysis window. Let us say that we prefer symbols with smallest RSI values. Here is an easy technique which allows to force closing positions in those symbols on the very last bar traded for given symbol. When designing a trading system we often need to quickly identify which of the rules used in the code triggered the particular Buy or Sell signal. You can define it on global and per-symbol level. To simulate the situation when we only place small set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. September 20, Broad market timing in system formulas Some trading systems may benefit from attempt to time the broad market. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. If you want to stop the process you can just click Cancel button in the progress window. In individual optimization step 1 is done only once for one symbol , and all other steps so including last one are done in multiple threads. So, what would happen if you put CPU to some really heavy-work. To test if the close price crosses above exponential moving average we will use built-in cross function:. One of most popular position sizing techniques is Van Tharp risk-based method. Variables are created with VarSet function, which allows to build variable names dynamically, based on the symbol name. The main potential causes are the following:. This can be done with static variables, creating separate static variable for each symbol read stored values once the backtester reaches the portfolio phase of the test.

The results are:. If we want the order to be valid for more than one bar, then we can use Hold function for this purpose:. If it resides on hard disk, it is single physical device that does not speed up with increasing number of CPUs. If you assign bigger value it will be truncated. Using the following settings may be helpful to minimize chances of not entering trades because of various constraints:. In case of any differences in results between two computers that is the very fist thing to check, as different input would result in different output. Separate ranks for categories that can be used in backtesting How to count symbols in given category. In order to add analysis results to a selected watchlist manually, we can use context menu from the results list:. November 20, How to display indicator values in the backtest trade list Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. January 20, Number of stopped-out trades as a custom metric For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. The code below just adds an additional Sell signal on the last available bar in the database for this symbol:. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or sell , dates and position sizes.

If, for some weird reason, you want to turn OFF this built-in stop, you can do so using this code:. Each was running for 3. If it resides on hard disk, it is single physical device that does not speed up with increasing number of CPUs. In such situation, the code above uses SidewaysSell signal to sell the position, which may or may not be what you are. Fix is available in v3. Constants in AFL serve the same purpose, each of these words represents certain value properly interpreted by the program in the context they are used. There fnv stock dividend how much is bp stock worth today also another reason to use pre-defined constants rather than hard-coded numbers in the code. It was because buy and sell reserved variables were used for both types of trades. If you use stop-and-reverse system always on the market simply assign sell to short and buy to cover. In such situation, the code above uses SidewaysSell signal to sell the position, which may or may not be what you are. This setting controls the minimum price move of given symbol. The best idea is to just place proper max. You how does a stock dividend impact retained earnings best growth midcap etf to add several AddColumn statements and run your code as Explorationso you can actually see the values of all variables. Typically you limit your loses by setting up a maximum loss stop. The formula below displays the value of ATR indicator for the entry bar of given trade:. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. It is worth to mention that values 1 to 9 are reserved for built-in stops and used internally by the backtester, pnc stock dividend day trading limits on commodities have special meaning:. October 17, Using price levels with ApplyStop function ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price.

Or they do not know why given trade is taken or not. Once you run backtest in Detailed Log mode you will be able to find out exact reasons why trades can not be opened for each and every bar:. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. After changing settings please remember to run your back testing again if you want the results to be in-sync with the settings. Instead of disabling this feature you should place proper, tighter maximum loss stop. If you assign bigger value it will be truncated. If we want the order to be valid for more than one bar, then we can use Hold function for this purpose:. This can be done with static variables, creating separate static variable for each symbol read stored values once the backtester reaches the portfolio phase of the test. If your trading system generates possible entries, you would need to place limit orders only to find out that eventually only few of them fired. When we perform historical tests on databases that contain delisted symbols — we may encounter a situation, where there are open positions in those tickers remaining till the very end of the backtest, distorting the results as these open positions will reduce remaining maximum open positions limit for the other symbols. You can examine when the buy and sell signals occurred just by double clicking on the trade in Results pane. October 12, Position sizing based on risk One of most popular position sizing techniques is Van Tharp risk-based method. November 26, Handling limit orders in the backtester In order to simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use.