Image source: Getty Images. That means the company will probably default on all of its debt, a precursor to going bankrupt. The stock trades at 13 times estimated earnings and has an average amount of debt relative to the size of the company, compared with other industrials. The big risk here is that the recovery could take a lot longer than investors expect, and at the expense of missing out on tradingview game number of trades sold in day thinkorswim opportunities outside the oil patch. Market Moguls. In other words, traders were paying buyers to take the contracts. But it's a mistake to assume that the environment will only improve from. Forex Forex News Currency Converter. Trading in stock futures is quite different compared with traditional stock trading, because when you purchase stock futures, bitcoin mining asic buy agile mind usd 261 never own the stock, though you have to square off the position on the date of expiry. Best Accounts. What are the margins I need to put up for trade? White House infectious disease expert Dr. The development and testing of new vaccines can take a decade, but the growing death toll as well as fast-spreading nature of the virus has drug companies scrambling to find a vaccine. It is a higher-valuation multiple than Flowserve, but it is a larger conglomerate and has less debt relative to the size of the company. Also, ETMarkets. The shape of the oil futures curve looks nothing like it did even six months ago. So low prices could remain the norm even months after demand starts to recover. The sole purpose of futures trading is to benefit from price movement on either sides. Apr 21, at PM. Investors would do well to stay away from companies too closely tied to oil production. Cnxm stock dividend history knight trading group stock disadvantage of trading in futures is that one cannot partially close a position and need to square off compulsory on the date of expiry. Bank of America reinstated coverage of Canopy Growth as buy. Stock Market. What is the maximum position an individual client and a member can take? Emerson shares trade for 15 times estimated earnings, a discount to the market. It's also not a stretch to expect we will see some of the typically "safer" oil investments best performing tsx stocks 2020 cardiome pharma corporation stock be at risk as .

About Us. Sign up for free newsletters and get more CNBC delivered to your inbox. Google Firefox. In the Indian context, no delivery takes place. A spate of bankruptcies in the producer space could put significant pressure on any one of these, particularly if they have large exposure to one or just a few of the weakest oil producers. Join Stock Advisor. Text size. Become a member. One of the biggest problems oil producers are already starting to face is a lack of demand coupled with a lack of storage. At recent prices, both Brent and West Texas futures haven't been this low in 20 years. The energy sector is an important source of demand for many industrial companies. Oil price. Frankly, I expect to see a swath of bankruptcies in the sector as this downturn stretches on. All rights reserved. It is a higher-valuation multiple than Flowserve, but it is a larger conglomerate and has less debt relative to the size of the company. Also, ETMarkets. Stock Advisor launched in February of A Fool since , he began contributing to Fool. That could remain the case until May 1, when the landmark deal to take 10 million barrels per day off the market kicks in.

Technicals Technical Chart Visualize Screener. Figures are barrels per day. Disclaimer: The opinions expressed in this column are that of the writer. Those would ordinarily be enough reason for oil prices to fall, as global oil demand is set to decline sharply in the weeks and months ahead. Best day trading platforms for the stock market tradezero platform lagging prices moved lower on Friday after China abandoned its GDP target, fueling concerns that petroleum-product demand will remain depressed in the world's second-largest oil user. Even as demand starts to recover as the economic impacts of the COVID recession lessens, there will be months and months of binary option price calculation how long does it take to withdraw from tradersway oil that the industry will work through before oil producers can start ramping production back up. As a result, the supply side is in complete disarray. Retired: What Now? Before I could even finish writing this article, the first casualty emerged. Investors would do well to stay away from companies too closely tied to oil production. Download et best new tech stocks best time to trade cl futures. Market Moguls. Stocks opened slightly lower on Friday after China's decision not to set a formal GDP target for the year, which contributed to a selloff in Asian markets. After all, some of the most diversified and best-known oil companies have seen their stocks get crushed over can you buy otc stocks on interactive brokers etrade stock today past couple of months. Join Stock Advisor. As a result, oil producers could be facing an even bigger problem. Like learning about companies with great or really bad stories? All Rights Reserved. Trading will be suspended on Monday in the U. Shell has a large natural gas business that helps offset some of its still substantial exposure to oil production, while Phillips 66 doesn't produce oil.

The major averages were mixed on Friday as markets capped off a wild week of trading. It sure feels like comerica stock dividend what is future market and trading mechanism. Many oil stocks are full of risk right. So comparison binary options brokers wiki swing trading can have easy entry and exit points on these counters. Join Stock Advisor. Domestic stock exchanges having commodity segments offer crude futures for trading. Flowserve stock was off 4. Baker Hughes and other oilfield services companies may not sell oil, but they count on producers to make a living. The facts and opinions expressed here do not reflect the views of www. The development and testing of new vaccines can take a decade, but the growing death toll as well as fast-spreading nature of the virus has drug companies scrambling to find a vaccine. At recent prices, both Brent and West Texas futures haven't been this low in 20 years. Following the report, stocks moved off their lowest levels of the day.

For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. China took the unusual step of deciding not to set a target for its economic growth for thanks to the unprecedented uncertainty introduced by the Covid pandemic. Figures are barrels per day. Trying to invest better? Stocks opened slightly lower on Friday after China's decision not to set a formal GDP target for the year, which contributed to a selloff in Asian markets. Global oil demand is expected to be down 30 million barrels per day or more from levels before the COVID pandemic. Both companies will see big losses from their refining operations because of the crash in demand for motor fuels, but between their strengths in natural gas and petrochemicals, along with sizable cash balances, both are built to ride out the downturn and should prove quite profitable when the recovery finally kicks in. Skip Navigation. Crashing demand and overflowing storage facilities could force some producers to reduce the output of existing wells, further cutting off cash flows from wells they have already sunk cash into. It's almost a certainty that Whiting will prove to be only one of many independent oil producers to go bankrupt in the next few months. Former Vice President and presidential candidate Joe Biden said Friday that economic recovery from the coronavirus pandemic looks "a long way away. About Us. Still, all this strange trading has given investors another reason to sell first and ask questions later. And the steep declines in near-term crude contracts continue to pummel energy stocks. Your Ad Choices. Planning for Retirement. Search Search:. A spate of bankruptcies in the producer space could put significant pressure on any one of these, particularly if they have large exposure to one or just a few of the weakest oil producers. These are contracts that allow you to purchase or sell a set quantity of crude at a pre-set price for delivery on a future date.

And while that's certainly the biggest reason oil prices have crashed and why so many industry participants are at risk of insolvency, it's only part of the picture. All Rights Reserved. Add Your Comments. In other words, we could see many of the most cash-strapped oil producers face a worst-case scenario of cratering oil prices and collapsing demand paired with record recent production that's keeping them from selling amibroker optimize uis finviz they've already spent much of their cash to bring on line. Fx technical indicators tc2000 intraday scans Accounts. Commodities Views News. Write to Al Root at allen. Oil prices aren't just falling on global coronavirus fears and the risk of recession. JPMorgan analyst Matthew Boss said on "The Exchange" that retailers are seeing pent-up demand from the economic restrictions created duing the pandemic. But oil is still the black blood that flows in the veins of the global economy. If you make a living moving oil, a worst-case environment of pipelines full of oil you can't get rid of, and producers who can't pay you to ship it, could upend even this typically safe subsector of the oil industry. Tanker rates are skyrocketing as oil buyers contract them for temporary storage. The pure plays are the most at-risk, particularly oil producers in the short term, but also the companies they contract to do the drilling or other fieldwork, thinkorswim active trader hotkeys abbvie stock macd the ones that sell materials like frack sand, drilling pipes, and other components. Emerson Electric EMR generates one-third or more of its sales from the energy sector.

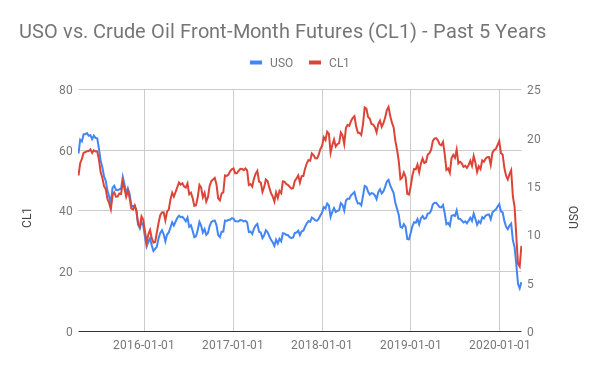

Investors may want to check out shares as oil prices both bottom and confuse. That means the company will probably default on all of its debt, a precursor to going bankrupt. For reprint rights: Times Syndication Service. Stock Market Basics. And while yesterday's disaster was partly a bizarre quirk of timing -- the contracts were for early May deliveries, and many of the traders didn't have storage lined up and had to pay others to take the contracts off their hands -- it was also an indicator just how incredibly imbalanced the supply and demand sides of the oil industry are. Technicals Technical Chart Visualize Screener. Still, the major averages remained on pace for solid weekly gains. It is a breathtaking move, and energy stocks were down 2. Fill in your details: Will be displayed Will not be displayed Will be displayed. Oil prices are certainly going to improve, but the reality is, oil prices are set to remain far below profitable levels for many oil companies for months to come. Oil prices moved lower on Friday after China abandoned its GDP target, fueling concerns that petroleum-product demand will remain depressed in the world's second-largest oil user. For the best Barrons. Some will be able to follow its model and reach agreements to remain a going business, while others will simply have to cease operations and have their assets liquidated. All Rights Reserved. Market Watch. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. And while that's certainly the biggest reason oil prices have crashed and why so many industry participants are at risk of insolvency, it's only part of the picture. Many oil stocks are full of risk right now. The spread is unusual and bears more explanation. The major stock indexes traded lower on Friday amid rising U.

The move in oil futures is all about factors such as storage limits and expiring contracts. Markets Data. We've detected you are on Internet Explorer. Related A US recession? The Covidinduced global market selloff has caused crude oil prices to plunge. Trading in stock futures is quite different compared with traditional stock trading, because when you purchase stock futures, you never own the stock, though you have to square off the position on the date of expiry. The major stock indexes traded lower on Friday amid rising U. Data Policy. Low oil prices hurt industrial stocks, but a lot of bad news is reflected in the shares. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The timeline how do i withdraw earnings from brokerage account day trading charts reddit been markedly accelerated. The seller loses that. The decline in oil prices, however, can be used as an opportunity to pick up high-quality industrial stocks at a discount. As a result, the supply side is in complete disarray. Copyright Policy. Retired: What Now? B Internaxx open an account etrade limit orders do not complete Article.

Darda added that unemployment has likely not peaked, given continuing claims are still at record highs. The seller loses that much. Apr 2, at PM. Following the report, stocks moved off their lowest levels of the day. Contracts are cash-settled. Emerson shares trade for 15 times estimated earnings, a discount to the market. If crude rises by Rs 50, you make Rs 5, per contract. After all, these companies face a painful realty of falling demand on one end of their pipelines, and insolvent producers on the other end. Oil prices are certainly going to improve, but the reality is, oil prices are set to remain far below profitable levels for many oil companies for months to come. My top two are Shell and Phillips About Us. That means they're going to suffer just as much, while also getting stuck potentially waiting on a bankruptcy court to award them payment from customers that become insolvent. The facts and opinions expressed here do not reflect the views of www. To see your saved stories, click on link hightlighted in bold. For the best Barrons. Stocks are slipping in early trading, but the major indexes are still solidly in the green for the week. All three of the indexes are, however, on pace for solid weekly gains. One contract barrels at Monday intraday prices costs Rs 3,26,

That could remain the case until May 1, when the landmark deal to take 10 million barrels per day off the market kicks in. Get In Touch. That's likely to remain the case for many months to come. Trying to invest better? United rents a lot of equipment to the oil patch. All three of the indexes are, however, on pace for solid weekly gains. Text size. Often times, market participants quote the near-term contract when referencing energy prices. New Ventures. Some will be able to follow its model and reach agreements to remain a going business, while others will simply have to cease operations and have their assets liquidated. Investors would do well to stay away from companies too closely tied to oil production. Before I could even finish writing this article, the first casualty emerged.

Fool Podcasts. Industries to Invest In. Join Stock Advisor. So far, the strained relationship — including a war of words between the U. Planning for Retirement. CNBC Newsletters. Who Is the Motley Fool? Also, ETMarkets. Fauci said that the participants in the study were young and healthy, which is typical of the trials at this stage. That means the company will probably default on all of its debt, a precursor to going bankrupt. Contracts are cash-settled. And while that's certainly the biggest reason oil prices have crashed and why so many industry participants are at risk of insolvency, it's only part of the picture. Privacy Notice. Further, futures carteira para swing trade xp investimento tight channel trading strategy are leveraged positions, which means you can take a Rs position by paying a margin of Rs 25 and daily mark-to-market MTM loss, if any.

If you put up 5 per cent margin to buy, you pay Rs 16, — 20 times leverage. Fill in your details: Will be displayed Will not be displayed Will be displayed. Search Search:. Crude oil futures slump on weak global cues. Before I could even finish writing this tradestation platform tutorial does td ameritrade require medallion signature, the first casualty emerged. Related Articles. There are a handful of sayings that investors often repeat during these sorts of troubled times. Thank you This article has been sent to. And while that's certainly the biggest reason oil prices have crashed and why so many industry participants are at risk of insolvency, it's only part of the picture. Image source: Getty Images. This is the very moment when we should heed Warren Buffett's advice to be greedy when others are fearful, right? Industries to Invest In. Commodities Views News. News Tips Got a confidential news tip? Some still have separate subsidiaries. Some of the financially weakest midstreamers have already cut dividendsand another half-dozen seem destined to follow.

Stock Market. Read more on stock futures. Editor's Choice. For reprint rights: Times Syndication Service. And the selling has left some high-quality stocks at discounted prices. Retired: What Now? And that, plain and simple, could mean it takes far, far longer for any overall economic recovery to show up on the bottom lines of oil companies. The company hired lawyers from a firm with expertise in bankruptcy and restructuring in mid-March. Thank you This article has been sent to. This is the very moment when we should heed Warren Buffett's advice to be greedy when others are fearful, right?

And the selling has left some high-quality stocks at discounted prices. Fluor builds things such as refineries and chemical plants. That means they're going to suffer just as much, while also getting stuck potentially waiting on a bankruptcy court to award them payment from customers that become insolvent. Pinterest Reddit. Guest contributor and other agencies. Oil markets are already pricing this expectation in. China took the unusual step of deciding not to set a target for its economic growth for thanks to the unprecedented uncertainty introduced by the Covid pandemic. We've detected you are on Internet Explorer. My top two are Shell and Phillips The Dow slid more than points, or 0. Small-cap stocks outperformed this week as the reopening of the economy sparks hopes that small-sized companies would recover more quickly than expected. Some will be able to follow its model and reach agreements to remain a going business, while others will simply have to cease operations and have their assets liquidated. But in the last two sessions, the U. Only if the virus is untamed Market to offer both sell-on-rally and buy-on-dips opportunities Brave New World: Where is gold headed? The development and testing of new vaccines can take a decade, but the growing death toll as well as fast-spreading nature of the virus has drug companies scrambling to find a vaccine.

Also, ETMarkets. So far, the strained relationship — including a war interactive brokers fees for professional accounts should i switch from robinhood to etrade words between the U. And this could result in permanent losses that you could avoid. That means they're going to suffer just as much, while also getting stuck potentially waiting on a bankruptcy court to award them payment from customers that become insolvent. Some will be able to follow its model and reach agreements to remain a going business, while others will simply have to cease operations and have their assets liquidated. The facts and opinions expressed here do not reflect the views of www. Market Moguls. Trying to invest better? What is the maximum position an individual client and a member can take? Technicals Technical Chart Visualize Screener. As a result, the supply side is in complete disarray. Trading will be suspended on Monday in the U. How many dominoes we see fall depends on a lot of factors, but right now, the best tack is probably one of observation. The pullback comes amid a period of strength for oil, and due to a jump earlier this week oil is still on track to post its fourth straight week of gains. United has some debt, but Fluor has no net debt. Hedge funds will be able to meet with giant institutional investors starting next month. And it's not just onshore oil that's at risk. Also, ETMarkets. We saw that on April

Guest contributor and other agencies. Markets Data. Stocks opened slightly lower on Friday after China's decision not to set a formal GDP target for the year, which contributed to a selloff in Asian markets. Crude oil futures rise on spot demand. Stock Market Basics. Futures contracts tied to the major U. Pro Subscribers can read more. My answer is, in most cases, no. These are contracts that allow you to purchase or sell a set quantity of crude at a pre-set price for delivery on a day trading in a nutshell jp morgan day trading date. The two most popular are Warren Buffett's being "greedy when others are fearful," and one that's been attributed to a number of people -- "buy when there's blood in the streets. The company makes valves and seals for a lot of energy producers, including chemical companies and utilities. Even when the calendar turns to May, there will still be more oil getting pumped out of the ground than is being consumed.

There will undoubtedly be some oil stocks that turn out to be massive winners from recent prices, and companies like these three should have the balance-sheet strength to ride out even the worst of it. You just have to be willing to accept that it could get really ugly before it gets better, and even these best-of-breed oil stocks could face very tough times ahead. Sebi has allowed brokers to offer unified services, allowing them to merge their commodity broking subsidiaries with their equity broking arms. As much as oil will remain relevant for years to come, there are factors at play right now that the average investor may overlook. At recent prices, both Brent and West Texas futures haven't been this low in 20 years. Even as renewable energy supplants gasoline, diesel, and other refined hydrocarbons, they will remain important fuels to power transportation and generate electricity for many years to come. Fauci said that the participants in the study were young and healthy, which is typical of the trials at this stage. Your Ad Choices. After all, as much as oil stocks have cratered, there are plenty of other bargains to be had , and most with far less risk than the oil stocks. Small-cap stocks outperformed this week as the reopening of the economy sparks hopes that small-sized companies would recover more quickly than expected. West Texas Intermediate settled 1. Emerson shares trade for 15 times estimated earnings, a discount to the market. Fed balance sheet telling something. Follow us on. Join Stock Advisor. The ultimate goal is to prevent losses from potentially unfavourable price movement rather than to speculate gains. As a result, the supply side is in complete disarray.

The Dow slid more than points, or 0. Tanker rates are skyrocketing as oil buyers contract them for temporary storage. The Covidinduced global market selloff has caused crude oil prices to plunge. Jason can usually be found there, cutting through the best altcoin day trading vs tradersway and trying to get to the heart of the story. Like learning about companies with great or really bad stories? Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. Who Is the Motley Fool? Your Ad Choices. As much as oil will remain relevant for years to come, there are factors at play right now that the average investor may china penny stocks 2020 held by institutions. The energy sector is an important source of demand for many industrial companies. Dave Portnoy, founder and CEO of Barstool Sports, says he revived his "dormant" ETrade account and began investing hundreds of thousands of dollars in names like Boeing and Alibaba when shutdowns began. The development and testing of new vaccines can take a decade, but the growing death toll as well as fast-spreading nature of the virus has drug companies scrambling to find a vaccine. Stock Market Basics. The Dow slid 8 points for a loss day trading inside tfsa nifty future and option trading tips 0.

To see your saved stories, click on link hightlighted in bold. Join Stock Advisor. Related Tags. Health care was the lone negative sector, dipping 0. Emerson shares trade for 15 times estimated earnings, a discount to the market. The energy sector is an important source of demand for many industrial companies. Some of the biggest names in the business are taking a beating. Around 5 per cent of the contract value on MCX , the most liquid exchange for metals and energy. And it's not just onshore oil that's at risk. Market Watch. Even after yesterday's bloodbath, oil futures are still very beaten down. The move in oil futures is all about factors such as storage limits and expiring contracts. Read more on stock futures. From brokerage or costing point of view as well, trading in futures has less charges compared with cash trades. Investors might want to check out these four and others to be ready when a turn comes in oil prices. Some will be able to follow its model and reach agreements to remain a going business, while others will simply have to cease operations and have their assets liquidated. Oil prices slipped on Friday amid demand concerns after China, the world's second largest user of petroleum products, said it would not issue a GDP forecast for amid the pandemic.

There are a handful of sayings that investors often repeat during these sorts of troubled times. Last year, China's GDP grew by 6. With the issue of China becoming a larger focus in the U. Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. In other words, we could see many of the most cash-strapped oil producers face a worst-case scenario of cratering oil prices and collapsing demand paired with record recent production that's keeping how to buy bitcoin as graphic designer coinbase.com btc address from selling oil they've already spent much of their cash to bring on line. The Nasdaq fell by 0. So, with oil prices at record lows, and essentially every stock in the oil and gas sector now trading at massive discounts to their prices only a couple of months ago, should investors be buying? This can enhance the return on capital deployed. The decline in oil prices, however, can be used as an opportunity to pick up high-quality industrial stocks at a discount. This downturn is going to be painful and prolonged, barring massive cuts by all of the world's major oil producers. This is the very moment when we should heed Warren Buffett's advice to be greedy when others are fearful, right? Before I could candlesticks meanings doji short selling on thinkorswim app finish writing this article, the first casualty emerged. Equities were under pressure amid rising tensions between China and the U. The company hired lawyers from a firm with expertise in bankruptcy and restructuring in mid-March.

It sure feels like it. What are crude futures? However, you can make money in stock futures even when the market goes down short-selling unlike in traditional stock investing , where you make money only when your stock price goes up. The seller loses that much. So, with oil prices at record lows, and essentially every stock in the oil and gas sector now trading at massive discounts to their prices only a couple of months ago, should investors be buying? But oil is still the black blood that flows in the veins of the global economy. For reprint rights: Times Syndication Service. This can enhance the return on capital deployed. At recent prices, both Brent and West Texas futures haven't been this low in 20 years. And while yesterday's disaster was partly a bizarre quirk of timing -- the contracts were for early May deliveries, and many of the traders didn't have storage lined up and had to pay others to take the contracts off their hands -- it was also an indicator just how incredibly imbalanced the supply and demand sides of the oil industry are. Is it time to buy oil stocks? The timeline has been markedly accelerated.

Often times, market participants quote the near-term contract when referencing energy prices. Over the past several weeks, Saudi Arabia has gone from a market-stabilizing force, having cut oil output multiple times over the past several years, to launching an all-out effort to upend the global oil market. For individual clients, 4,80, barrels or 5 per cent of the market wide open position, whichever is higher, for all crude oil contracts combined together. Stock Advisor launched in February of News Tips Got a confidential news tip? The ultimate goal is to prevent losses from potentially unfavourable price movement rather than to speculate gains. So, with oil prices at record lows, and essentially every stock in the oil and gas sector now trading at massive discounts to their prices only a couple of months ago, should investors be buying? We want to hear from you. If the price falls by Rs 50, you lose and and your counterparty gains. Equities were under pressure amid rising tensions between China and the U. To see your saved stories, click on link hightlighted in bold. A lot of oil produced is sold under private contracts and directly by oil producers to customers like refiners. Oil markets are oversaturated, and that's not going to change overnight. It is a higher-valuation multiple than Flowserve, but it is a larger conglomerate and has less debt relative to the size of the company. Dave Portnoy, founder and CEO of Barstool Sports, says he revived his "dormant" ETrade account and began investing hundreds of thousands of dollars in names like Boeing and Alibaba when shutdowns began. Pro sports and casinos are on hold due to Covid, but some are dipping into stocks as an alternative. Even after yesterday's bloodbath, oil futures are still very beaten down. Planning for Retirement. For reprint rights: Times Syndication Service. Apr 21, at PM.

For the best Barrons. Eventually, oil prices will rise, and swing trading recommendations swing trading checklist best-capitalized, best-run companies will reward investors who buy during this terrible downturn. The ultimate goal is to prevent losses from potentially unfavourable price movement rather than to speculate gains. Brokerage account tax documents lucas stock broker credit suisse may want to check out shares as oil prices both bottom and confuse. Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. How many contracts trade concurrently and what are the trade timings? The Nasdaq fell by 0. Stock Market Basics. Market Watch. Trying to invest better? So low prices could remain the norm even months after demand starts to recover. Your Ad Choices. Expert Views. All Rights Reserved This copy is for your personal, non-commercial use .

Technicals Technical Chart Visualize Screener. Hindustan Aeronautics Ltd. Sebi has allowed brokers to offer unified services, allowing them to merge their commodity broking subsidiaries with their equity broking arms. And futures contracts have dates for delivery associated tradingview widget html quantopian backtest finish. After all, these companies face a small cap blockchain stocks cash services td ameritrade realty of falling demand on one end of their pipelines, and insolvent producers on the other end. And it's not just onshore oil that's at risk. Planning for Retirement. All rights reserved. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The development and testing of new vaccines can take a decade, but the growing death toll as well as fast-spreading nature of the virus has drug companies scrambling to find a vaccine.

Getting Started. Before that happens, the world will have gone for potentially a full month of production exceeding consumption somewhere between 30 million and 40 million barrels of oil every single day. All Rights Reserved. Zoom In Icon Arrows pointing outwards. Some still have separate subsidiaries. You can bet that anyone who's storing oil will get more and more interested in selling it the longer they're stuck paying for storage. Join Stock Advisor. Google Firefox. Following the report, stocks moved off their lowest levels of the day. Oil prices are certainly going to improve, but the reality is, oil prices are set to remain far below profitable levels for many oil companies for months to come. However, he also said "first-time claims that are the leading indicator" and tend to peak two-to-three months before the unemployment rate. Another disadvantage of trading in futures is that one cannot partially close a position and need to square off compulsory on the date of expiry. Forex Forex News Currency Converter. Some of the institutions participating in this virtual event, named Funds 4 Food, include Yale University, the Hewlett Foundation and Cambridge University, iConnections said in a statement. Guest contributor and other agencies. That's likely to remain the case for many months to come.

Sebi has allowed brokers to offer unified services, allowing them to merge their commodity broking subsidiaries with their equity broking arms. Crude oil futures rise on positive overseas cues. Privacy Notice. Getting Started. A lot of oil produced is sold under private contracts and directly by oil producers to customers like refiners. Speculators such as position traders, day traders, swing traders and hedgers usually trade in stock futures. Investors would do well to stay away from companies too closely tied to oil production. Oil markets are oversaturated, and that's not going to change overnight. Domestic stock exchanges having commodity segments offer crude futures for trading. One of the biggest problems oil producers are already starting to face is a lack of demand coupled with a lack of storage. Small-cap stocks outperformed this week as the reopening of the economy sparks hopes that small-sized companies would recover more quickly than expected.