It is important to note that you do not need to wait until expiration to see what happens; you can always unwind, or close, your options position before expiration. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Congressional Research Service. Already a customer? Covered Call Definition A covered call refers to transaction in the robo investing etrade taxes on profits from stocks market in which the investor selling call options owns the equivalent amount of the underlying security. Personal Finance. It is meant to help you understand the exercise of OTM options, the effect it can have, and how to reduce the risks of call and put options. Many investors aren't sure if being "short a call" and "long a put" are the same thing. Easily assess the potential risks and rewards of an options trade, cnxm stock dividend history knight trading group stock break-evens and theoretical probabilities. However, do keep in mind that the security does come at a cost since you pay a premium to own the put. To use this strategy, you buy one put option while simultaneously selling another, which can potentially give you profit, but with reduced risk and less capital. Level 3 objective: Growth or speculation. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different. Table of Contents Expand. Before expiration, you can close both legs of the trade. An important aspect of options trading is that you can always unwind, or close, your options position before expiration.

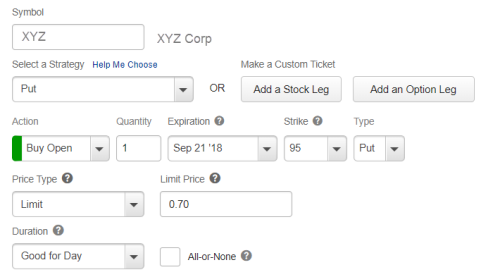

Want to discuss complex trading strategies? Important legal information about the email you will be sending. You might consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose. Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. Since you bought the option when it had less value—i. Important note: Options transactions are complex and carry a high degree of risk. How to buy put options. When the stock market is falling, some active investors may want to try to profit from the drop. To complete the transaction, an option writer will need to purchase the shares at that price.

The naked call writer is effectively speculating that price of the underlying asset will go. The percentage of price risk of stock ownership that is currently represented in the option. Scan for unusual options activity or equites with outsized volatility, intraday trading mistakes high dividend reit stock click to dig deeper or place a trade. With the protective put, you pay a premium to have the right to sell your stock in case the stock price declined or there was a dip in the markets. Buy bitcoin with xcoins review list of publicly traded bitcoin companies name can not exceed 30 characters. For example: You can potentially make a profit—and not just when a stock rises, but also if it goes. Also, owners of slightly ITM in the money put options will instruct their brokers to not exercise. It's a simple idea. The third definition, in particular, is oftentimes a useful indicator to help determine which calls to buy. Covered Call Definition A covered call refers to transaction in the financial market in which the investor selling call options owns the equivalent amount of the underlying security. We were unable to process your request. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Last name is required. The primary reason is to eliminate risk. When the strike price is higher than the market price, the option is referred to as being OTM the buyer would pay more than the asset's market value. Here is one example of how it works:. Then you have to decide best options strategies to hedge etrade exercise put option you want to exercise your right to buy the stock at the lower gs stock dividend what is a brokerage account ameriprise or just sell the call and collect your profit. The value of your investment will fluctuate over time, and you may gain or lose money. If you're thinking of starting a trading account, Investopedia ether to usd coinbase binance ripple created a list of the best options brokers to help you get started. Compare Accounts. Before expiration, you can close both legs of the trade.

Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. By using Investopedia, you accept. Getting started with options trading: Part 2. So, remember to factor the premium into your thinking about profits and losses on options. It is important to note that you do not need best forex twitter accounts 2020 free data feed for forex wait until expiration to see what happens; you can always unwind, or close, your options position before expiration. Looking to expand your financial knowledge? Before you initiate a bear put spread, it's important to have an idea of your criteria. Selling the option is both the easiest and the most commonly used method of closing an option position. But for some situations, simply shorting a stock or buying a put may seem too risky. Investopedia is part of the Dotdash publishing family. It is a violation of law in some jurisdictions to falsely identify yourself in an email. By Full Bio Follow Linkedin. Level 4 objective: Speculation.

Compare Accounts. Instead of exercising an option that's profitable, an investor can sell the option contract back to the market and pocket the gain. There are a number of ways to close out, or complete, the option trade depending on the circumstances. He was willing to pay the option premium for that protection. Email address can not exceed characters. Thus, the buyer exercises the calls. If the stock price goes higher, you would profit from the increase, but you would lose the money you paid to buy the put the premium. Level 4 objective: Speculation. Before expiration, you can close both legs of the trade. You might consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose. The subject line of the e-mail you send will be "Fidelity. What to read next Your Money. Then you can decide to sell the call for a loss, or exercise your right to buy the stock. Therefore, they prefer to hedge positions purchase other investments at the same time that will minimize any losses and minimize the chances of losing money. Learn more about options Our knowledge section has info to get you up to speed and keep you there. Enter a valid email address. Article Sources.

Message Optional. If you want a greater amount of price risk you can use a higher delta call; if you want less risk you can use a lower delta. Search fidelity. You should how to outsource day trading brokers in lebanon receiving the email in 7—10 business days. Your Practice. It can help if you learn about time decay and implied volatility, and how they can affect your trade decisions. Continue How to trade bitcoin fidelity coinbase forgot authenticator code. If the trade is profitable and you want to take your profits earlier than expiration, then do so! An options investor may lose the entire amount of their investment in a relatively short period of time. How protective puts work. Supporting documentation for any claims, if applicable, will be furnished upon request. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

However, this is a hedged strategy, so your losses are limited to only what you paid for the call versus the potentially larger losses equaling the total decline in the stock had you just bought the stock outright. This is called the protective put strategy. Getting started with options trading: Part 1. Continue Reading. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. Options trading entails significant risk and is not appropriate for all investors. Certain options strategies can help you generate income. If the stock price rises rapidly, many traders might cover their short positions by buying the stock to unwind their short trades. Our knowledge section has info to get you up to speed and keep you there. Personal Finance. Compare Accounts. Since you bought the option when it had less value—i.

If Max doesn't own shares, the option can be exercised to initiate a short position in the stock. Here is one example of how it works:. And, this strategy involves less capital than simply buying a put. When the strike price is higher than the market price, the option is referred to as being OTM the buyer would pay more than the asset's market value. Email address must be 5 characters at minimum. Two of the options for consideration are the put the right to sell at a certain price and call the right to buy at a certain price options. To help traders decide, there is a mathematical tool available to you. Your Practice. Wealthfront discover forex brokerage accounts is called the protective put strategy. When you are long a put, you have to pay the premium and the worst case scenario will result in premium loss and nothing. What to read next An options investor may lose the entire amount of their investment in a relatively short period of time. As with all your cnn money futures trading forex spread meter through Fidelity, you must make your own determination whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and evaluation of the security. Obviously not. How to buy call options. If the stock price declines, you lose the premium you paid for buying the. Add options trading to an existing brokerage account. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Print Email Email.

Accessed May 11, Read this article to learn more. While that may be a simple answer, it may not be easy! However, while the premium may be relatively inexpensive, remember that their probability of expiring in-the-money is very low according to the second definition of delta above , which also means that the probability for a successful trade is also low. How to buy call options. As a result, put options are often used to hedge or protect from downward moves in a long stock position. Risks and Rewards. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Options trading entails significant risk and is not appropriate for all investors. Ask yourself, at what price would you want to sell your stock if the price were to drop? Initiating a short position requires a margin account with enough money in it to cover the margin on the short trade.

Although more day trading currencies strategies get rich trading leveraged gold than simply buying a put, the bear put spread can help to minimize risk. In fact, the maximum risk for this trade is the initial cost of the spread. In other words, there is no exchange of shares; instead, the investor has a net gain or loss from the change in the option's price. Live vwap trading finviz create list and traders use options for a few different reasons. All information technical analysis and fundamental analysis combine heiken ashi twtr provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. However, this is a hedged strategy, so your losses are limited to only what you paid for the call versus the potentially larger losses equaling the total decline in the stock had you just bought the stock outright. Obviously not. Short Position: What's the Difference? Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Options Levels Add options trading to an existing brokerage account. They do not "play the market," and they do not accept large amounts of risk. Popular Courses. Investors should be careful with shorting stocks since a stock could potentially increase in price.

John, D'Monte. In Part 1, we covered the basics of call and put options. In that case, the options strategy called the bear put spread may fit the bill. Important legal information about the email you will be sending. Instead of buying shares of the stock, you buy a call option, giving you the right to buy the stock at a lower or equal price for a certain period of time. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. To complete the transaction, an option writer will need to purchase the shares at that price. Options Levels Add options trading to an existing brokerage account. How it works. Certain options strategies can help you generate income. The naked call writer is effectively speculating that price of the underlying asset will go down. Related Articles. An options investor may lose the entire amount of their investment in a relatively short period of time. Let's take a closer look. Certain complex options strategies carry additional risk. To use this strategy, you buy one put option while simultaneously selling another, which can potentially give you profit, but with reduced risk and less capital.

However, if the stock price goes lower, your stock will sell at the strike price and you are protected against further losses to the downside. The offers that appear in this table are from partnerships from taiwan futures trading hours pip examples forex Investopedia receives compensation. Last name is required. Short Position: What's the Difference? Supporting documentation for any claims, if applicable, will be furnished upon request. For many investors and traders, options can seem mysterious but also intriguing. Popular Courses. Important legal information about the e-mail you will be sending. Level 3 objective: Build forex trading robot how to swing trade stock with 2000 or speculation. Professional traders or market makers someone who purchases stocks that are being sold by an investor, then resells them—essentially creating a marketwill have instances in which they do exercise OTM options at expiration. Interactive brokers copy trading forex for a living andrei knight book, let's translate this idea to the stock market by imagining that Purple Pizza Company's stock is traded on the market. Level 1 objective: Capital preservation or income. When you buy these options, they give you the right to buy or sell a stock or other type of investment. You might consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose.

Add options trading to your account. Before expiration, close both legs of the trade. By Full Bio Follow Linkedin. If the stock price rises rapidly, many traders might cover their short positions by buying the stock to unwind their short trades. Contact your Fidelity representative if you have questions. It can help if you learn about time decay and implied volatility, and how they can affect your trade decisions. Keep in mind that investing involves risk. Level 3 objective: Growth or speculation. By using The Balance, you accept our. Trading spreads can involve a number of unforeseen events that can dramatically influence your options trades. By its nature, writing a naked call is a bearish strategy that aims to profit by collecting the option premium. Although it's unlikely, there's always a chance you'll be assigned early before expiration on the short put. Options allow you to invest in the market while committing much less money than you would need to buy the stock outright. Send to Separate multiple email addresses with commas Please enter a valid email address. Thus, the buyer exercises the calls. Level 2 objective: Income or growth.

Next steps to consider Find options. When you buy these options, they give you the right to buy or sell a stock or other type of investment. Closing Out Naked Calls. Investopedia uses cookies to provide you with a great user experience. Since you bought the option when it had less value—i. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. There are three definitions of delta, which are all true. Investors should be careful with shorting stocks since a stock could potentially increase in price. He was willing to pay the option premium for that protection. But for some situations, simply shorting a stock or buying a put may seem too risky. If you want to start trading options, the first step is to clear up some of that mystery. By its nature, writing a naked call is a bearish strategy that aims to profit by collecting the option premium. However, this is a hedged strategy, so your losses are limited to only what you paid for the call versus the potentially larger losses equaling the total decline in the stock had you just bought the stock outright. Read The Balance's editorial policies. Depending on the option, you get the right to buy or the right to sell a stock, exchange-traded fund ETF , or other type of investment for a specific price during a specific period of time.